|

The economic news this past week turned out to be as volatile as stocks. But markets decided by week's end that the economy was not so bad and maybe moderately positive.

It was a very volatile week for equities. Columbus Day Monday showed stocks dropping sharply in light trading. Stocks were down by airlines and the energy sector on worries about Ebola and on crude oil prices dropping to their lowest levels in almost four years. Tuesday, equities mostly rebounded as the S&P 500 and Nasdaq ended up slightly Tuesday, breaking a three day string of losses, while the Dow Jones industrials finished lower for a fourth session as concerns lingered over the strength of the global economy. The Dow nudged down 5.88 points—less than 0.1 percent. Despite rebounds in most indexes, equities were weighed down by worries on global growth. Germany's economy ministry cut its growth forecasts for this year and next, citing weaker demand in export markets due to rising geopolitical tensions and sluggish global growth. Again, the energy sector was negative. It was a very volatile week for equities. Columbus Day Monday showed stocks dropping sharply in light trading. Stocks were down by airlines and the energy sector on worries about Ebola and on crude oil prices dropping to their lowest levels in almost four years. Tuesday, equities mostly rebounded as the S&P 500 and Nasdaq ended up slightly Tuesday, breaking a three day string of losses, while the Dow Jones industrials finished lower for a fourth session as concerns lingered over the strength of the global economy. The Dow nudged down 5.88 points—less than 0.1 percent. Despite rebounds in most indexes, equities were weighed down by worries on global growth. Germany's economy ministry cut its growth forecasts for this year and next, citing weaker demand in export markets due to rising geopolitical tensions and sluggish global growth. Again, the energy sector was negative.

Stocks generally dropped at mid-week on below expectations retail sales and on soft producer price numbers (indicating sluggish demand). Thursday, stocks ended mixed after an intraday recovery after St. Louis Federal Reserve Bank President James Bullard said the Fed should consider postponing the end of quantitative easing to stop the decline in inflation expectations. Earlier in the day, a sharp drop in initial jobless claims and a spike in industrial production provided some support for equities—partially offsetting worries about retail sales. Stocks generally dropped at mid-week on below expectations retail sales and on soft producer price numbers (indicating sluggish demand). Thursday, stocks ended mixed after an intraday recovery after St. Louis Federal Reserve Bank President James Bullard said the Fed should consider postponing the end of quantitative easing to stop the decline in inflation expectations. Earlier in the day, a sharp drop in initial jobless claims and a spike in industrial production provided some support for equities—partially offsetting worries about retail sales.

The week ended on a positive note with most indexes gaining notably and trimming the week's decline. U.S. stocks followed European equities higher. Also, consumer sentiment hit the highest level in seven years—offering hope of improved retail sales.

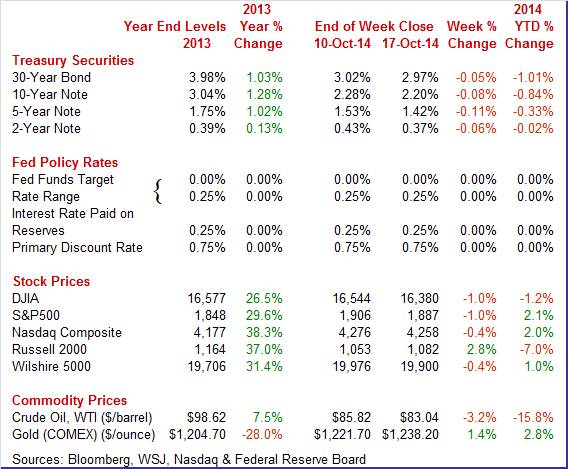

Equities were mostly down this past week. The Dow was down 1.0 percent; the S&P 500, down 1.0 percent; the Nasdaq, down 0.4 percent; and the Wilshire 5000, down 0.4 percent. The Russell 2000 was up 2.8 percent.

For the year-to-date, major indexes are mixed as follows: the Dow, down 1.2 percent; the S&P 500, up 2.1 percent; the Nasdaq, up 2.0 percent; the Russell 2000, down 7.0 percent; and the Wilshire 5000, up 1.0 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

While equities and futures were trading on the Monday Columbus Day holiday, Treasuries were closed. While equities and futures were trading on the Monday Columbus Day holiday, Treasuries were closed.

Overseas news weighed on rates on Tuesday on a slowing in U.K. inflation, and a drop in German investor confidence. Yields declined further Wednesday on sluggish retail sales and producer prices.

Rates firmed Thursday on favorable jobless claims and industrial production. FedSpeak also had impact. St. Louis President James Bullard said the Fed should consider delaying the end of its bond-buying to stem a decline in inflation expectations. Bond traders took his comments to mean that the Fed may continue stimulus and boost inflation—and supporting rates. The week closed out with modest increases in yields on a healthy consumer sentiment number.

Despite the daily swings in rates, traders are still concerned about growth overseas slowing as well as inflation. Flight to safety also is an issue with uncertainty in the equities markets.

For this past week Treasury rates were down as follows: the 2-year note, down 6 basis points; the 5-year note, down 11 basis points; the 7-year note, down 11 basis points; the 10-year note, down 8 basis points; and the 30-year bond, down 5 basis points. The 3-month T-bill nudged up 1 basis point.

The basic story this past week on oil prices continued to be worries about slowing global growth. Key areas of concern are China and Europe with even Germany (Europe's largest economy) showing signs of sluggishness. Also, OPEC continues somewhat high production with Saudi Arabia cutting prices and other OPEC countries following. The basic story this past week on oil prices continued to be worries about slowing global growth. Key areas of concern are China and Europe with even Germany (Europe's largest economy) showing signs of sluggishness. Also, OPEC continues somewhat high production with Saudi Arabia cutting prices and other OPEC countries following.

The spot price of West Texas Intermediate declined about a dollar a barrel Monday after Iraq followed Saudi Arabia and Iran in cutting prices. Based on an easing in global demand for oil, OPEC must cut production to maintain prices but there is not agreement within OPEC on allocation of such cuts. WTI fell over $2-1/2 per barrel Tuesday after the International Energy Agency said oil demand will grow in 2014 at the slowest pace since 2009. WTI hit its lowest level in almost four years.

After little change Wednesday, crude gained almost $1-1/2 per barrel on both bargain hunting and a drop in initial jobless claims. Crude was essentially unchanged Friday.

Net for the week, the spot price for West Texas Intermediate fell $2.78 per barrel to settle at $83.04.

Views of the strength of the economy have swung notably over the last few weeks. This past week saw volatility in economy data but on average with positive momentum.

The latest retail sales figures disappointed but there are signs that September sluggishness is temporary. The latest retail sales figures disappointed but there are signs that September sluggishness is temporary.

As expected, auto sales and gasoline sales tugged down on retail sales in September. But core numbers also were weaker than expected. Retail sales in September declined 0.3 percent after jumping 0.6 percent in August. Excluding autos, sales slipped 0.2 percent after gaining 0.3 percent in August.. Excluding both autos and gasoline sales dipped 0.1 percent, following a jump of 0.5 percent in August. Expectations were for 0.5 percent.

Within the core, softness was seen in declines furniture & home furnishings, building materials, nonstore retailers, clothing & accessories, and sporting goods & hobbies. Gains were posted for electronics & appliances (likely iPhones), health & personal care, general merchandise, and food services & drinking places. Within the core, softness was seen in declines furniture & home furnishings, building materials, nonstore retailers, clothing & accessories, and sporting goods & hobbies. Gains were posted for electronics & appliances (likely iPhones), health & personal care, general merchandise, and food services & drinking places.

The latest report was very mixed. It was not surprising that there was a downswing in auto sales after a strong August pulled down sales. And the same was expected for gasoline prices pulling down sales. But core sales eased despite a surge in electronics sales. But there was monthly volatility. Core sales eased after a very strong August. On a very positive note, food services & drinking places gained a robust 0.6 percent, matching the pace for August. This is a very discretionary component, suggesting that the consumer is still spending.

Later this month, we get to see the adjustment for lower gasoline prices in the personal income report with data on chain-dollar personal spending. For retail sales and personal spending with August strong and September easing, an average likely is the proper focus. But September data likely will tug down on forecasts for the personal consumption component in third quarter GDP.

The latest consumer sentiment report suggests hope for improved consumer spending. The latest consumer sentiment report suggests hope for improved consumer spending.

Boosted by the improving jobs market and low gas prices, consumer sentiment continues to rise, up 1.8 points to 86.4 for the mid-month October reading which is the new recovery high going back to July 2007. The gain was centered in the expectations component, up 3.0 points to 78.4 which is the best reading since October 2012. Gains in this component reflect optimism on job and income prospects. Lagging but still respectable is the current conditions component which was unchanged at a near recovery high of 98.9.

The effect of low gas prices is seen in 1-year inflation expectations which are down 2 tenths to plus 2.8 percent which is very low for this reading. This reading is certain to get the attention of the Federal Reserve doves who are concerned that inflation expectations may be drifting too low. The 5-year inflation outlook is unchanged and is also at plus 2.8 percent.

Housing data continue to be volatile. Starts and permits rebounded in September after declines in August after sharp gains in July. Well, that's the definition of volatile. Housing data continue to be volatile. Starts and permits rebounded in September after declines in August after sharp gains in July. Well, that's the definition of volatile.

Housing starts for September rebounded 6.3 percent after dropping 12.8 percent in August. September's pace of 1.017 million units topped market expectations for 1.010 million units and was up 17.8 percent on a year-ago basis.

The multifamily component rebounded a monthly 16.7 percent after plunging 28.7 percent in August. The single-family component rose 1.1 percent in September, following a 2.0 percent decline the prior month.

Building permits made a comeback, too. Permits increased 1.5 percent in September, following a 5.1 percent drop in August. Permits posted at 1.018 million units annualized, coming in a little below expectations for 1.027 million. September permits were up 2.5 percent on a year-ago basis. Building permits made a comeback, too. Permits increased 1.5 percent in September, following a 5.1 percent drop in August. Permits posted at 1.018 million units annualized, coming in a little below expectations for 1.027 million. September permits were up 2.5 percent on a year-ago basis.

Multifamily permits rebounded 1.5 percent after falling 5.1 percent in August. The single-family component slipped 0.5 percent in September, following a 0.6 percent dip the month before.

Overall, housing made a comeback from a weak August and remains on a low trajectory. Upcoming numbers for housing sales will play a key role in whether construction growth improves or not. More recent data on mortgage purchase applications and homebuilder traffic numbers have not been inspiring and add to the low trajectory view.

The manufacturing sector is regaining its mojo despite growth difficulties overseas. Industrial production for September topped expectations-and it was not just a swing in utilities. The manufacturing component was positive and above analysts' forecasts. The manufacturing sector is regaining its mojo despite growth difficulties overseas. Industrial production for September topped expectations-and it was not just a swing in utilities. The manufacturing component was positive and above analysts' forecasts.

Industrial production jumped an outsized 1.0 percent in September after a decline of 0.2 percent in August. Forecasts were for 0.4 percent. Yes, utilities were the big mover, spiking a monthly 3.9 percent, following a 1.2 percent gain the prior month.

But manufacturing was solid, rebounding 0.5 percent in September after a 0.5 percent decline the month before. Expectations for the manufacturing component were for a rise of 0.4 percent. Mining advanced 1.8 percent, following a 0.3 percent increase in August.

Within manufacturing, the production of durable goods increased 0.4 percent in September. The durables subcomponent was led by the aerospace and miscellaneous transportation equipment. Motor vehicle production, however, slipped. The production of nondurable goods moved up 0.5 percent in September. With the exception of petroleum and coal products, each of the major components of nondurables posted gains in September.

Overall capacity utilization jumped to 79.3 percent from 78.7 percent in August.

Manufacturing appears to have regained some steam for the U.S. economy. The third quarter still appears likely to post moderately healthy growth.

This past week's regional Fed manufacturing surveys were divergent. Empire State weakened while Philly Fed remained moderately strong. But Empire State numbers were volatile over the last two months. This past week's regional Fed manufacturing surveys were divergent. Empire State weakened while Philly Fed remained moderately strong. But Empire State numbers were volatile over the last two months.

Slowing abruptly this month, the Empire State manufacturing index fell to 6.17 from September's 5-year high of 27.54. October's reading signals the slowest rate of monthly growth since April.

Details of the report likewise show sudden reversal with new orders in contraction at minus 1.73 vs September's 16.86 and shipments barely above the zero line at 1.12 vs 27.08. Price readings show a significant easing in pressure with prices paid at 11.36 vs 23.91 and prices received at 6.82 17.39.

But there are positives in the report led by employment, which climbed to 10.23 from September's 3.26, and the 6-month outlook which, despite slipping slightly more than 5 points, is still extremely strong at 41.66.

Unlike the latest Empire State report, there was no sudden pause in the Philly Fed's manufacturing sector where the general conditions index held pretty much steady, at a very strong 20.7 versus September's 22.5. The new orders index, which is by far the most important reading in the report, was actually up, to 17.3 versus 15.5. Unfilled orders were also very positive, from 5.0 in September to 11.6 which is very strong for this reading, in fact the strongest reading since July 2004. Unlike the latest Empire State report, there was no sudden pause in the Philly Fed's manufacturing sector where the general conditions index held pretty much steady, at a very strong 20.7 versus September's 22.5. The new orders index, which is by far the most important reading in the report, was actually up, to 17.3 versus 15.5. Unfilled orders were also very positive, from 5.0 in September to 11.6 which is very strong for this reading, in fact the strongest reading since July 2004.

Other readings are soft including a 5.0 point dip for shipments to 16.6 and very little change in delivery times at plus 0.6 which does not point to demand-related supply constraints. Employment growth is also down, to 12.1 vs 21.2 while the work week shows its first contraction since February at minus 1.3. Price readings show steady and palpable pressure for inputs and strong price traction for finished goods, up 12.0 points to a 20.8 level that was last matched in April 2011.

It is hard to yet make much of the latest deceleration in Empire State data. October came off several strong months and an occasional pause should not be surprising. Overall and on average, the manufacturing sector continues with moderately healthy growth. Sluggish global growth, however, remains a risk.

The doves at the Fed have reason to worry about too low inflation—according to the latest producer prices report. The doves at the Fed have reason to worry about too low inflation—according to the latest producer prices report.

Inflation at the producer level has basically disappeared and even turned negative. The PPI for total final demand in September slipped 0.1 percent, following no change the month before. Total final demand excluding food & energy was unchanged after easing to 0.1 percent in August. Total final demand excluding food, energy, and trade services dipped 0.1 percent after rising 0.2 percent in August.

The index for final demand goods moved down 0.2 percent in September, the second consecutive decrease. The September decline was led by prices for final demand energy, which fell 0.7 percent. The index for final demand foods also decreased 0.7 percent. In contrast, prices for final demand goods less foods and energy advanced 0.2 percent.

The index for final demand services edged down 0.1 percent in September, the first decline since December 2013. Two-thirds of the September decrease can be traced to prices for final demand services less trade, transportation, and warehousing, which fell 0.1 percent. This was largely a decline in prices for traveler accommodation services. The index for final demand transportation and warehousing services moved down 0.2 percent. The index for final demand services edged down 0.1 percent in September, the first decline since December 2013. Two-thirds of the September decrease can be traced to prices for final demand services less trade, transportation, and warehousing, which fell 0.1 percent. This was largely a decline in prices for traveler accommodation services. The index for final demand transportation and warehousing services moved down 0.2 percent.

On a seasonally adjusted year-ago basis, PPI final demand was up 1.6 percent in September versus 1.8 percent in August. Excluding food & energy, PPI final demand was up 1.8 percent, versus the August pace of 1.6 percent.

Inflation numbers are very soft and giving central banks leeway to easy monetary policy.

According to the latest Beige Book, the economy continues to expand while inflation is subdued-but there are concerns.

The Federal Reserve released its Beige Book in preparation for its October 28 and 29 FOMC meeting. The report said that economic growth was modest to moderate at a pace similar to that noted in the previous Beige Book. Several Districts noted that contacts were generally optimistic about future activity. Most Districts said that overall consumer spending growth ranged from slight to moderate — also similar to that reported in the previous Beige Book. However, manufacturing activity increased in most Districts since the earlier report. Residential construction and real estate activity were mixed. Price pressures remained subdued. Employment continued to expand at about the same pace as previously reported. Most Districts reported that some employers had difficulty finding qualified workers for certain positions. A number of Districts characterized overall wage growth as modest, but reported upward wage pressures for particular industries and occupations, such as skilled labor in construction and manufacturing.

Overall, the focus was on slowing inflation and fears that weak growth overseas could hold back the U.S. recovery. These fears have even spurred talk that the U.S. Federal Reserve could dramatically change tack and launch a fresh round of bond-buying stimulus, or quantitative easing-dubbed "QE4." Even though that possibility remains remote, analysts said they believe Fed officials will have to reconsider plans to raise interest rates in the near future.

While volatility in equities has risen in recent weeks and U.S. indicators have had sharp swings, the U.S. economy on average remains moderately positive. Risks remain softer growth overseas and sluggish inflation—both of which the Fed will be watching. But two key sectors in the U.S. may not be as soft as feared—the consumer sector and manufacturing.

The housing sector has been giving mixed signals recently with sales and prices sluggish but last week's housing starts showing a rebound. This week's key updates on housing are existing and new home sales which could indicate whether the current average trajectory picks up or not. Globally, price inflation has softened, leading central banks to cut back on aggressive language on reducing balance sheets. This week's CPI report may influence market views on when the Fed next raises policy rates as inflation remains well below target of 2 percent.

Existing home sales fell back 1.8 percent in August to a lower-than-expected annual rate of 5.05 million. Year-on-year, sales were down 5.3 percent, a bit more steep than minus 4.5 percent in the prior month. Limited supply has been a major factor holding down sales with supply on the market falling 40,000 homes in the month to 2.31 million. Supply relative to sales, at 5.5 months, held unchanged reflecting August's sales dip. With recent weakness in pending home sales and home prices, this will be an important update on housing.

Existing home sales Consensus Forecast for September 14: 5.10 million-unit rate

Range: 5.00 to 5.20 million-unit rate

The consumer price index took at least a temporary break in August. Both the headline CPI and core number came in lower than expected—giving Fed doves room to stay loose on policy. Overall consumer prices fell 0.2 percent in August after rising 0.1 percent in July. Excluding food and energy, the CPI was unchanged after gaining only 0.1 percent the month before. Energy dropped a monthly 2.6 percent, following a dip of 0.3 percent in July. Gasoline prices fell a sharp 4.1 percent, following a 0.3 percent decrease in July. Food price inflation decelerated to a 0.2 percent gain after jumping 0.4 percent in July. On a seasonally adjusted basis, the headline CPI was up year-ago 1.7 percent in August-down from 2.0 percent in July. Excluding food and energy, the year-ago pace was 1.7 percent also, easing from 1.9 percent in July.

CPI Consensus Forecast for September 14 0.0 percent

Range: -0.3 to +0.1 percent

CPI ex food & energy Consensus Forecast for September 14: +0.1 percent

Range: +0.1 to +0.3 percent

Initial jobless claims in the October 11 week fell a stunning 23,000 to a 264,000 level that is not only the lowest of the recovery but is lowest since all the way back in April 2000. The decline pulls the 4-week average down 4,250 to 283,500 which is the lowest since June 2000 and is more than 15,000 below the month-ago trend. The BLS noted no special factors. Continuing claims, which are reported with a 1-week lag, rose 8,000 in the October 4 week from the prior week's recovery low to 2.389 million. But the 4-week average continues to make new recovery lows, down 10,000 to 2.404 million.

Jobless Claims Consensus Forecast for 10/18/14: 285,000

Range: 275,000 to 295,000

The Chicago Fed National Activity Index in August was pulled down by a drop in production. The national activity index in August came in at minus 0.21 from a revised plus 0.26 in July. The 3-month average was at plus 0.07 vs July's revised plus 0.20. The big negative in August was the 0.4 percent decline in the manufacturing component of the industrial production report, one that was likely skewed lower by timing issues for auto retooling. Consumption & housing also pulled down the main index, at minus 0.12 from July's minus 0.13. The employment component fell to zero from July's plus 0.10 reflecting weak nonfarm payroll growth of 142,000. The component that had the best showing in August was sales/orders/inventories, at plus 0.08 vs plus 0.04 in July. A bounce back in manufacturing shipments is a strong and favorable possibility for this report in September, as would be a bounce back for employment.

No consensus numbers are available for this month's report

The FHFA purchase only house price index decelerated with a rise of 0.1 percent in July, following a 0.3 percent advance the month before. The year-ago rate continued to slow, easing to 4.4 percent from 5.1 percent in June. These numbers compare to a recovery high in July 2013 of 8.5 percent.

FHFA purchase only house price index Consensus Forecast for August 14: +0.3 percent

Range: +0.1 to +0.4 percent

The Markit PMI manufacturing index (final) posted strong and steady growth in September, at 57.5 which was down only marginally from 57.9 in both the mid-month flash reading and final August reading. Details were not provided to the public but the report described rates of output and new order growth as strong. Employment was also a standout in the report, posting a 2-1/2 year high. Most inflationary readings in various reports have been muted, but not in this report where both input and output prices showed their sharpest rise since December 2013. Other details included a rise in new export orders to a 3-year high.

Markit PMI manufacturing flash index Consensus Forecast for October 14: 57.0

Range: 56.0 to 58.2

The Conference Board's index of leading indicators for August eased off a very robust July. On average, the leading index suggests moderately economic growth ahead. The index of leading economic indicators edged only 0.2 percent higher in August following, however, an upwardly revised and very sharp gain of 1.1 percent in July. Looking at the trend, the index is likely pointing to only moderate economic growth through the remainder of the year. Weakness in building permits has been dragging on the LEI all year. Permits dropped 5.6 percent in August and made for the month's biggest negative. The biggest positive was the yield spread, which reflects the Fed's still stimulative policy, followed by the ISM's very strong new orders index. The report's coincident index, like the leading index, was also showing no more than moderate growth, at plus 0.2 percent in August following gains of only 0.1 and 0.3 percent in the two prior months.

Leading indicators Consensus Forecast for September 14: +0.6 percent

Range: +0.1 to +0.8 percent

The Kansas City Fed manufacturing index edged higher in September, and producers' expectations for future activity maintained the solid level of the previous survey. Price indexes showed a mild decline from the previous month, and expectations for future price growth were mixed. Several firms continued to comment about difficulties finding qualified labor, resulting in some wage pressures. The month-over-month composite index was 6 in September, slightly higher than 3 in August but lower than 9 in July.

Kansas City Fed manufacturing index Consensus Forecast for October 14: 6.0

Range: -0.2 to 7.0

New home sales, in a report that is frequently volatile due to a relatively small sample, surged 18.0 percent in August to a much higher-than-expected annual rate of 504,000. This was the biggest monthly increase since January 1992. Another positive in the report was a notable upward revision for July to 427,000 from the initial estimate of 412,000. Low supply has been a stubborn problem holding down both sales of new homes and existing homes, and the surge in August sales has made this problem more pronounced. Supply of new homes at the current sales rate fell in August to 4.6 months from 5.6 months in the prior month. Builders will likely be scrambling to bring new homes onto the market which in August totaled 203,000 units versus 201,000 in July.

New home sales Consensus Forecast for September 14: 460 thousand-unit annual rate

Range: 445 thousand to 495 thousand-unit annual rate

R. Mark Rogers is the author of The Complete Idiot's Guide to Economic Indicators, Penguin Books.

He can also be found on a weekly broadcast talking about the U.S. economy, the easiest way to find him is by going to iTunes and searching for "Simply Economics."

Econoday Senior Writer Mark Pender contributed to this article.

|