|

GDP data filled Econoday’s calendar in the week, coming in mostly flat in Europe though showing surprises in spots. The week’s monetary news also offered few surprises, steady policy for the US Federal Reserve and Bank of England with no promises yet for rate cuts from the former though a possible dovish tilt for the latter. The week’s big and major surprise was the US employment report where not only payroll growth surged but wages as well, the latter upsetting what had been a consistent run of moderating price pressures across global economies.

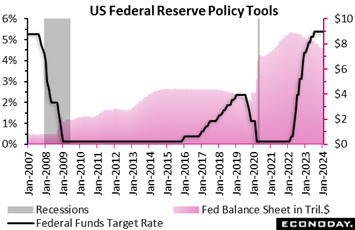

The Federal Reserve kept its policy rate unchanged at a target rate of 5.25 to 5.50 percent. The accompanying statement was quite hawkish in tone, probably to discourage market expectations that a rate cut is in the immediate future, or to stress that when rate cuts start they will be undertaken with caution. There wasn’t much change to the assessment of economic conditions: activity was downgraded slightly from "strong" to "solid", while job gains continued to be called "strong" and the unemployment rate "low". As for inflation, it "has eased over the past year but remains elevated." Wording on risks to the US banking system, which surfaced early last year, was dropped. The Federal Reserve kept its policy rate unchanged at a target rate of 5.25 to 5.50 percent. The accompanying statement was quite hawkish in tone, probably to discourage market expectations that a rate cut is in the immediate future, or to stress that when rate cuts start they will be undertaken with caution. There wasn’t much change to the assessment of economic conditions: activity was downgraded slightly from "strong" to "solid", while job gains continued to be called "strong" and the unemployment rate "low". As for inflation, it "has eased over the past year but remains elevated." Wording on risks to the US banking system, which surfaced early last year, was dropped.

Building the case for patience at his press conference, Jerome Powell stressed that inflation is "still too high" and that the path forward to the Federal Reserve's policy goal is "still uncertain" and "not assured". Noting that the PCE price index has slowed to 2.6 percent, the Fed chair nevertheless said FOMC members will need to see continuing evidence of improvement in order to "build confidence" that inflation is returning to the 2.0 percent objective.

On the question of when policy will begin to ease, Powell said it would "likely" be appropriate to begin dialing back prior rate hikes "sometime this year". He warned that cutting rates too soon could feed an acceleration in inflation and trigger a policy "reversal" that would require a return to rate hikes. Powell said the Fed is prepared to hold rates where they are "for longer if appropriate". He said there was no proposal at the meeting to cut rates.

Powell had to strike a balance between a "good" economy offset by an “uncertain” outlook. He said several times that while Fed policymakers are seeing meaningful improvement in inflation, they also want "greater confidence" that this trend will be sustained. Powell reiterated that the FOMC is making its decisions on a meeting-by-meeting basis and looking for a "continuation of the good data we have seen". In question is if the data are "sending us a true signal that we are on a sustainable path" of inflation reduction.

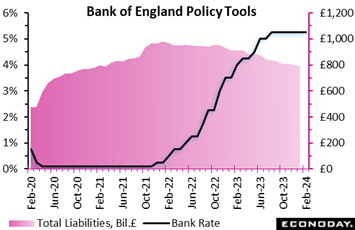

The Bank of England’s first meeting of the year produced few surprises. Bank Rate was again left at the 5.25 percent level to which it was raised back in August last year, matching a strong market consensus. However, the voting pattern will boost speculation that interest rates will be cut sooner rather than later. In December, Jonathan Haskell, Catherine Mann and Megan Greene all wanted another 25 basis point tightening but this time not only did Megan Greene follow the majority but the main dove, Swati Dhingra, wanted a 25 basis point ease. The Bank of England’s first meeting of the year produced few surprises. Bank Rate was again left at the 5.25 percent level to which it was raised back in August last year, matching a strong market consensus. However, the voting pattern will boost speculation that interest rates will be cut sooner rather than later. In December, Jonathan Haskell, Catherine Mann and Megan Greene all wanted another 25 basis point tightening but this time not only did Megan Greene follow the majority but the main dove, Swati Dhingra, wanted a 25 basis point ease.

For most members, policy was thought to have been restrictive enough and leading to a looser labour market. Risks to the bank's new inflation forecast were seen better balanced than in November albeit still on the upside over the first half of the projection period. However, although service prices and wage growth had fallen more than had been expected, key indicators of inflation remained elevated. Indeed, two members thought underlying inflationary pressures were still strong, particularly from wages where growth was still well above levels compatible with meeting the two percent CPI target.

Against this backdrop and representing a subtle shift, the committee judged that monetary policy would need to remain restrictive for sufficiently long to return inflation to target sustainably in the medium term. The view since last autumn had been that monetary policy needed to be restrictive for an extended period of time until the risk of inflation becoming embedded above target dissipated.

In sum, the latest statement and minutes underline a still very high level of uncertainty about the inflation outlook meaning that for policy, data dependency will remain key. In particular, there remain significant concerns about inflation persistence. However, overall there appears to have been a slight dovish shift that should leave investors expecting the first cut in Bank Rate next quarter.

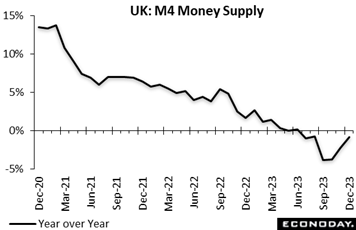

Pointing to stabilisation in overall economic activity and bolstering the case for no change in Bank Rate is money supply.  Broad money in the UK rose 0.5 percent on the month in December, lifting the annual rate from minus 2.3 percent to minus 0.9 percent, a 4-month high. M4 lending was more subdued but a 0.1 percent monthly increase was the third advance in as many months. Excluding intermediate other financial institutions, M4 grew 0.7 percent versus November, only its second gain since last April. Similarly-adjusted lending was up 0.3 percent. Broad money in the UK rose 0.5 percent on the month in December, lifting the annual rate from minus 2.3 percent to minus 0.9 percent, a 4-month high. M4 lending was more subdued but a 0.1 percent monthly increase was the third advance in as many months. Excluding intermediate other financial institutions, M4 grew 0.7 percent versus November, only its second gain since last April. Similarly-adjusted lending was up 0.3 percent.

Elsewhere the financial data were again mixed. In the housing market, mortgage approvals climbed from 49,313 to 50,459, their third successive rise and 6-month peak. However, net lending to individuals increased just £0.4 billion after a £2.0 billion jump in November while the increase in total consumer credit eased to £1.20 billion from £2.06 billion.

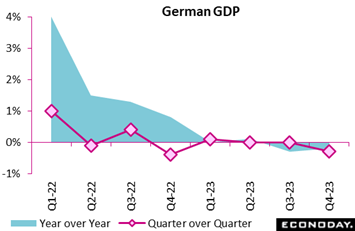

Germany just avoided falling into recession at the end of 2023, but only due to a small upward revision to the third quarter data. A 0.3 percent quarterly fall in total output was in line with Econoday’s consensus (and the first decline since the fourth quarter of 2022) but followed a flat reading in the previous period, revised up from the 0.1 percent fall reported earlier. Annual workday adjusted growth edged up from minus 0.3 percent to minus 0.2 percent while unadjusted, Germany just avoided falling into recession at the end of 2023, but only due to a small upward revision to the third quarter data. A 0.3 percent quarterly fall in total output was in line with Econoday’s consensus (and the first decline since the fourth quarter of 2022) but followed a flat reading in the previous period, revised up from the 0.1 percent fall reported earlier. Annual workday adjusted growth edged up from minus 0.3 percent to minus 0.2 percent while unadjusted,

As usual, no GDP expenditure components were released in the first estimate but the Federal Statistical Office did indicate that there was sharp contraction in both construction and investment in machinery and equipment.

The fourth quarter data confirm a weak 2023 ending for the German economy. Manufacturing has been in the doldrums for some time and, with new orders still trending down, any near-term bounce looks unlikely. Services have also been struggling and with consumer confidence very weak, will face a difficult start to 2024 too. Consequently, first quarter GDP growth will do well to keep its head above water meaning that recession remains a very real possibility.

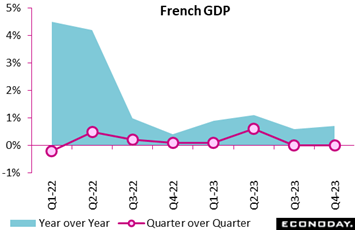

Real GDP in France was marginally firmer than expected at the end of 2023. No change versus the previous quarter was a tick stronger than the consensus and followed a revised flat reading in the September quarter. Accordingly, the economy avoided falling into recession in 2023 but only just in what was still a generally disappointing year. Annual growth was 0.7 percent, up from 0.6 percent. Real GDP in France was marginally firmer than expected at the end of 2023. No change versus the previous quarter was a tick stronger than the consensus and followed a revised flat reading in the September quarter. Accordingly, the economy avoided falling into recession in 2023 but only just in what was still a generally disappointing year. Annual growth was 0.7 percent, up from 0.6 percent.

In fact, quarterly stagnation masked a 0.1 percent hit from final domestic demand as household consumption also dipped 0.1 percent and gross fixed capital formation fell 0.7 percent. Within the latter, business investment was down 0.6 percent and residential investment a further 1.4 percent. Government consumption rose 0.3 percent but inventories subtracted a sizeable 1.1 percentage points.

Consequently, quarterly growth would have been negative but for net foreign trade which added some 1.2 percentage points as a 3.1 percent slump in imports easily more than offset a 0.1 percent drop in exports.

The fourth quarter GDP data mean that the French economy will begin 2024 lacking any real momentum and with soft domestic demand a clear issue for policymakers. To make matters worse, early business and consumer surveys warn that the current period may not be much better ─ although that at least should bolster the chances of getting inflation back on track.

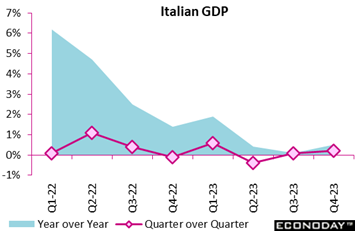

The Italian economy held up a good deal better than expected at the end of 2023. GDP provisionally expanded a quarterly 0.2 percent, well above the consensus and the strongest showing since the first quarter of the year. Following a 0.1 percent increase in the previous period, this lifted year-over-year growth from also 0.1 percent to 0.5 percent. The Italian economy held up a good deal better than expected at the end of 2023. GDP provisionally expanded a quarterly 0.2 percent, well above the consensus and the strongest showing since the first quarter of the year. Following a 0.1 percent increase in the previous period, this lifted year-over-year growth from also 0.1 percent to 0.5 percent.

In terms of output, the only other information provided by the Italian National Institute of Statistics indicated that quarterly growth was attributable to gains in both the goods producing and service sectors. Advances here more than offset a decline in agriculture, forestry and fishing. However, domestic demand subtracted leaving the expansion dependent upon a positive impact from net exports.

The fourth-quarter update means that the Italian economy will begin 2024 on a rather firmer footing than previously expected. Still, domestic demand remains soft so unless global activity continues to provide support, the first quarter could yet disappoint.

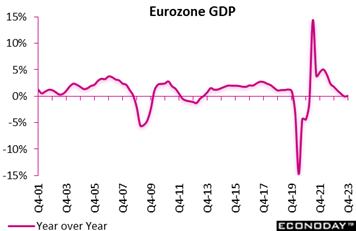

The preliminary flash data proved just strong enough for the Eurozone to avoid recession at the end of last year. A zero quarterly change was marginally stronger than the consensus and followed a 0.1 percent decline in the previous period. Even so, year-over-year growth was up only a tick at 0.1 percent. The preliminary flash data proved just strong enough for the Eurozone to avoid recession at the end of last year. A zero quarterly change was marginally stronger than the consensus and followed a 0.1 percent decline in the previous period. Even so, year-over-year growth was up only a tick at 0.1 percent.

Overall quarterly stagnation masked some sharp divergences between the individual member states. Ireland (already in recession) contracted 0.7 percent while Portugal advanced 0.8 percent and Spain advanced 0.6 percent. As we’ve seen, Germany declined 0.3 percent, France was only flat, while Italy expanded 0.2 percent.

In sum, the limited fourth quarter data confirm an uninspiring end to 2023 by the Eurozone economy. Moreover, most leading indicators currently point to little better at the start of 2024. Still, the ECB will not be too disappointed as it will see sluggish demand as helping it to achieve its 2 percent inflation target.

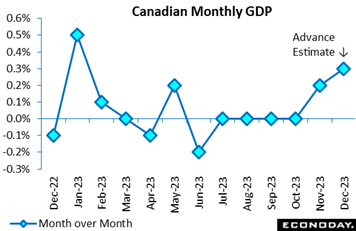

Marking the first increase since May 2023, Canada's economic activity recovered 0.2 percent in November, slightly more than the consensus expectation of a 0.1 percent increase in Econoday’s survey. The advance estimate for December points to a further 0.3 monthly percent increase that would put the fourth quarter at a quarterly 0.3 percent rise and the 2023 growth rate at 1.5 percent. Marking the first increase since May 2023, Canada's economic activity recovered 0.2 percent in November, slightly more than the consensus expectation of a 0.1 percent increase in Econoday’s survey. The advance estimate for December points to a further 0.3 monthly percent increase that would put the fourth quarter at a quarterly 0.3 percent rise and the 2023 growth rate at 1.5 percent.

The Bank of Canada projected economic activity to stall in the fourth quarter, for 1.0 percent growth in 2023 as a whole, down from 3.8 percent in 2022. The central bank expects real GDP to expand at an annualized pace of 0.5 percent in the first quarter of this year.

In November, 13 of 20 industrial sectors increased, with the monthly recovery led by a 0.6 percent gain in goods-producing industries, which matched January 2023 growth rate but which had not been surpassed since June 2022, when the monthly growth rate was 0.7 percent. Except for a 0.2 percent gain in September, activity in goods-producing industries had been contracting every month since April 2023.

Manufacturing was up 0.9 percent in November, with non-durables up 1.2 percent, twice as much as durables. Utilities expanded 1.4 percent, agriculture, forestry, fishing and hunting 2.4 percent, and mining, quarrying, and oil and gas extraction 0.3 percent. Overall, energy increased 1.4 percent on the month. Construction was the only sector to see its activity contract in November, by 0.2 percent. Industrial production recovered 0.8 percent in November after retreating 0.3 percent in October and stalling in September. Advance indicators point to a further advance in manufacturing and mining, quarrying and oil and gas extraction, while construction further contracted in December.

Services edged up 0.1 percent in November, the same as in October. While the monthly pace was muted relative to goods-producing industries, it occurred against the backdrop of strikes that started in the Quebec public sector. A 0.7 percent gain in wholesale trade supported services in November and transportation and warehousing rebounded 0.8 percent. On the downside, a 0.3 percent drop in educational activities weighed on public sector growth, which was flat on the month amid strikes in Quebec. Elsewhere, retail trade contracted 0.1 percent after rising 0.9 percent in October. Advance indicators suggest that transportation and warehousing, as well as educational services declined in December, while real estate and rental and leasing increased further after edging up 0.1 percent in November.

While the Bank of Canada has been on hold, the stronger-than-expected updates are more likely to keep the bias on the tightening side than not. In its January Monetary Policy Report, the BoC said it remained "particularly concerned about the upside risks."

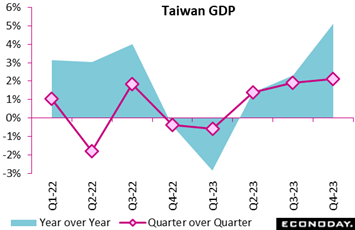

Advance estimates for Taiwan GDP show the economy grew 2.13 percent on the quarter in the fourth quarter after an increase of 1.90 percent in the third quarter. GDP growth also picked up in year-over-year terms, increasing 5.12 percent on the year after growth of 2.32 percent the September quarter. Year-over-year growth was largely driven by a rebound in exports; the positive contribution from domestic demand, in contrast, weakened further, with growth in consumer spending slowing and investment spending again falling. Advance estimates for Taiwan GDP show the economy grew 2.13 percent on the quarter in the fourth quarter after an increase of 1.90 percent in the third quarter. GDP growth also picked up in year-over-year terms, increasing 5.12 percent on the year after growth of 2.32 percent the September quarter. Year-over-year growth was largely driven by a rebound in exports; the positive contribution from domestic demand, in contrast, weakened further, with growth in consumer spending slowing and investment spending again falling.

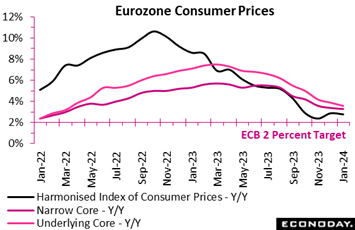

Following a year-end bounce, Eurozone inflation decelerated at the start of 2024. At 2.8 percent, down from December's final 2.9 percent, the flash annual rate was in line with Econoday’s consensus and now only 0.8 percentage points above its two percent target. However, the January print was just a two-month low having only dented the 0.5 percentage point gain in the previous period. Following a year-end bounce, Eurozone inflation decelerated at the start of 2024. At 2.8 percent, down from December's final 2.9 percent, the flash annual rate was in line with Econoday’s consensus and now only 0.8 percentage points above its two percent target. However, the January print was just a two-month low having only dented the 0.5 percentage point gain in the previous period.

Still, crucially too, core inflation continued to fall. The narrowest measure was down 0.1 percentage point at 3.3 percent, again matching the consensus and its lowest post since March 2022. Excluding just energy and unprocessed food, the rate dropped a steeper 0.3 percentage points to 3.6 percent. Elsewhere, inflation in non-energy industrial goods decreased from 2.5 percent to 2.0 percent and also declined in food, alcohol and tobacco (5.7 percent after 6.1 percent). Against that, energy (minus 6.3 percent after minus 6.7 percent) provided a small boost and, importantly, services were again only flat (4.0 percent).

Regionally, inflation was lower in most member states, notably France (3.4 percent after 4.1 percent) and Germany (3.1 percent after 3.8 percent). However, Spain (3.5 percent after 3.3 percent) showed a climb as did Italy (0.9 percent after 0.5 percent) though this country’s rate remains very low.

The flash January data should come as little surprise to the ECB and will probably do nothing to impact the Governing Council's expected profile to key interest rates in 2024. The declines in both headline and, more significantly, core inflation leave open the door for a cut in rates later but the stickiness of prices in services very probably rules out a move as soon as March.

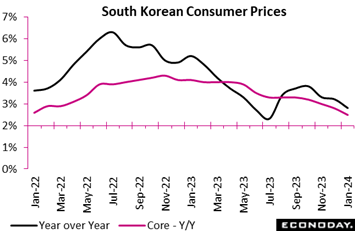

South Korea's headline consumer price index rose 2.8 percent on the year in January, decelerating further from an increase of 3.2 percent in December. Headline inflation has now fallen for four consecutive months from its recent peak of 3.7 percent, getting closer to the Bank of Korea's two percent target. South Korea's headline consumer price index rose 2.8 percent on the year in January, decelerating further from an increase of 3.2 percent in December. Headline inflation has now fallen for four consecutive months from its recent peak of 3.7 percent, getting closer to the Bank of Korea's two percent target.

Underlying price pressures also moderated in January. Core CPI, excluding food and energy, rose 2.5 percent on the year, down from 2.8 percent in December, and advanced 0.4 percent on the month after a previous increase of 0.2 percent.

The decline in headline inflation was broad-based across categories of spending. Food inflation moderated from 6.2 percent in December to 5.9 percent in January, the year-over-year increase in housing and utilities costs slowed from 2.7 percent to 1.8 percent, while transport costs fell at a slightly more pronounced pace, down 0.3 percent on the year after a previous decline of 0.2 percent.

At their most recent policy meeting, held last month, officials at the BoK left policy rates on hold at 3.50 percent, as they have since the start of 2023. This decision reflected officials' assessment that "inflation is projected to maintain its slowing trend". Officials also expressed confidence about the outlook for growth in 2024.

Monthly CPI data show that headline inflation in Australia cooled substantially from 4.3 percent in November to 3.4 percent in December, a fall sharper than the consensus forecast for a decline to 3.6 percent. After rising in August and September, monthly headline inflation has now fallen for three consecutive months, resuming the downward trend seen earlier in 2023 and moving closer to the Reserve Bank of Australia's target range of two percent to three percent. Monthly CPI data show that headline inflation in Australia cooled substantially from 4.3 percent in November to 3.4 percent in December, a fall sharper than the consensus forecast for a decline to 3.6 percent. After rising in August and September, monthly headline inflation has now fallen for three consecutive months, resuming the downward trend seen earlier in 2023 and moving closer to the Reserve Bank of Australia's target range of two percent to three percent.

December’s cooling was largely driven by smaller increases in food prices and housing costs. Food prices rose 4.0 percent on the year in December after advancing 4.6 percent in November, while the year-over-year increase in housing costs fell from 6.6 percent to 5.2 percent. Fuel prices, however, grew at a faster pace, up 5.3 percent on the year after a previous increase of 2.3 percent.

Evidence of moderating price pressures will likely convince the Reserve Bank of Australia to leave policy rates on hold. For the fourth quarter as a whole, the CPI rose 0.6 percent compared to the third quarter for a 4.1 percent year-over-year rate, both lower than expected.

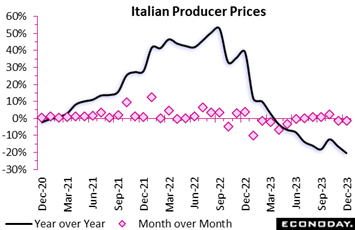

While consumer prices in the global data are clearly moderating, producer price inflation is falling substantially. Italian producer prices fell sharply again in December. A 1.2 percent monthly decline followed November's 1.4 percent drop and steepened the yearly decrease from minus 16.5 percent to fully minus 20.5 percent. While consumer prices in the global data are clearly moderating, producer price inflation is falling substantially. Italian producer prices fell sharply again in December. A 1.2 percent monthly decline followed November's 1.4 percent drop and steepened the yearly decrease from minus 16.5 percent to fully minus 20.5 percent.

Not surprisingly, energy prices did most of the work, slumping 3.4 percent versus November. Even so, excluding this category, core prices were down 0.1 percent on the month, putting the underlying yearly rate at minus 1.5 percent. Elsewhere, consumer goods also dipped a monthly 0.1 percent and intermediates 0.2 percent while capital goods rose 0.1 percent.

The December data again underscore the absence of any underlying pipeline price pressures in manufacturing, consistent with a sector where Italian output has contracted in at least four of the last five quarters.

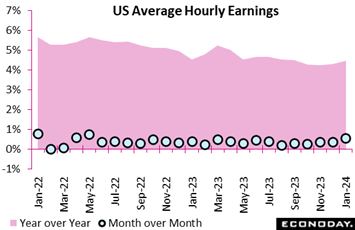

Employment costs in the US were thought to have been cooling that is until the surprising – if not shocking – strength of the January employment report. Average hourly earnings doubled expectations at an unusually hot 0.6 percent monthly increase with the annual rate going in the wrong direction, rising from a sharply upward revised 4.3 percent and back up to 4.5 percent. These results were not indicated by the employment cost index which, in data released on Wednesday, slowed from 4.3 and 4.5 percent in the prior two quarters to 4.2 percent in the fourth quarter and which set the stage for Friday’s mistakenly sanguine expectations. Employment costs in the US were thought to have been cooling that is until the surprising – if not shocking – strength of the January employment report. Average hourly earnings doubled expectations at an unusually hot 0.6 percent monthly increase with the annual rate going in the wrong direction, rising from a sharply upward revised 4.3 percent and back up to 4.5 percent. These results were not indicated by the employment cost index which, in data released on Wednesday, slowed from 4.3 and 4.5 percent in the prior two quarters to 4.2 percent in the fourth quarter and which set the stage for Friday’s mistakenly sanguine expectations.

Also setting the stage for the surprise was ADP’s private-payroll employment number which, in data also released on Wednesday, fell sharply to a much lower-than-expected 107,000. Actual private payrolls as it turned out climbed sharply to 317,000 while the nonfarm headline rose to 353,000 for the largest increase since January last year. Yes, base-effect distortions were at play given strong revisions to the establishment part of the report, but the results nevertheless dial back what the Federal Reserve is looking at: a labor market where supply (still limited) and demand (still strong) are not rebalancing as much as expected.

Adding to the overheating was another downtick in the unemployment rate from 3.8 to 3.7 percent. Payroll details included a 289,000 jump in the services sector that showed gains across all major categories led by health care and social assistance. Retail, up 45,200, was also surprisingly strong and a reminder that consumer spending has been driving the ongoing strength in GDP.

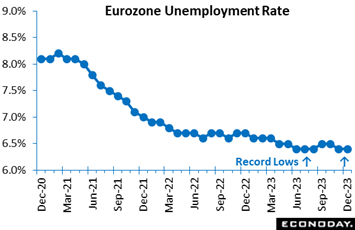

Europe’s labour market also proved surprisingly robust. Unemployment unexpectedly fell again, this time by 17,000 in December following a 99,000 drop in November. The latest decrease left the headline jobless rate at 6.4 percent, a tick below the market consensus and still matching its record low. Europe’s labour market also proved surprisingly robust. Unemployment unexpectedly fell again, this time by 17,000 in December following a 99,000 drop in November. The latest decrease left the headline jobless rate at 6.4 percent, a tick below the market consensus and still matching its record low.

The stable overall rate reflected no change in both France (7.3 percent) and Germany (3.1 percent) but masked falls in Italy (7.2 percent after 7.4 percent) and Spain (11.7 percent after 11.8 percent).

The ongoing tightness of the Eurozone labour market will worry the ECB's hawks, especially with key wage negotiations currently taking place across much of the region. To this end, December’s update further reduces the likelihood of a cut in the central bank's interest rates next month.

German retailers had a surprisingly poor end to 2023. Volumes sales fell a further 1.6 percent on the month, much steeper than the market consensus and their worst performance since October 2022. November's drop was at least trimmed to 0.8 percent but unadjusted annual growth slumped from minus 1.2 percent to minus 4.4 percent and purchases stood at their lowest level since February 2021, in the midst of the Covid lockdown. Purchases of food were down 2.8 percent versus November while non-food was off 1.6 percent. German retailers had a surprisingly poor end to 2023. Volumes sales fell a further 1.6 percent on the month, much steeper than the market consensus and their worst performance since October 2022. November's drop was at least trimmed to 0.8 percent but unadjusted annual growth slumped from minus 1.2 percent to minus 4.4 percent and purchases stood at their lowest level since February 2021, in the midst of the Covid lockdown. Purchases of food were down 2.8 percent versus November while non-food was off 1.6 percent.

Overall sales have now declined in six of the last seven months, leaving fourth quarter volumes 0.4 percent weaker than in the July-September period. Accordingly, the sector weighed on GDP growth though details have yet to published.

Inflation is falling but with consumer confidence still very weak, prospects for the current period look poor. Recession could easily arrive by the end of March.

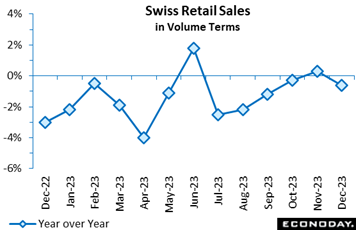

Swiss retail sales fell 0.6 percent on the month at year-end. The decline followed a downwardly revised 0.3 percent increase in November and left volumes at their lowest level since last April. However, with base effects positive, annual workday adjusted contraction still eased from minus 1.5 percent to minus 0.8 percent, a 6-month high but much lower than expectations for 1.1 percent growth. Swiss retail sales fell 0.6 percent on the month at year-end. The decline followed a downwardly revised 0.3 percent increase in November and left volumes at their lowest level since last April. However, with base effects positive, annual workday adjusted contraction still eased from minus 1.5 percent to minus 0.8 percent, a 6-month high but much lower than expectations for 1.1 percent growth.

The monthly headline drop reflected losses in both food, alcohol and tobacco (1.4 percent) and in discretionary spending (0.8 percent). Indeed, the overall decrease would have been steeper but for a 1.0 percent rise in auto fuel.

The surprisingly soft December update leaves fourth quarter sales 0.3 percent below their third quarter level, implying a modest hit from the retail sector on GDP growth.

Japanese retail sales turned weaker in December, rising just 2.1 percent on the year, below the consensus forecast of a 5.3 percent rise and slowing from a revised 5.4 percent gain in November, as demand for clothing plunged, vehicle sales slowed and easing inflation put a damper on values of foodstuffs and fuels. Japanese retail sales turned weaker in December, rising just 2.1 percent on the year, below the consensus forecast of a 5.3 percent rise and slowing from a revised 5.4 percent gain in November, as demand for clothing plunged, vehicle sales slowed and easing inflation put a damper on values of foodstuffs and fuels.

On the month, retail sales plummeted a seasonally adjusted 2.9 percent, versus the median forecast of a 0.5 percent dip, after rebounding a revised 1.1 percent in November and slumping 1.7 percent in October. Demand for winter clothing stabilized after a jump in the previous month, when a cold snap replaced months of warm weather.

The number of visitors from other countries has recovered to pre-Covid level, generally supporting the retail and tourism industries but the year-over-year increase in department stores has decelerated.

The Ministry of Economy, Trade and Industry downgraded its assessment, saying retail sales are "taking one step forward and one step back." Previously, it had said sales were "on an uptrend." The three-month moving average in seasonally adjusted retail sales slumped 1.2 percent on the month in December for a third straight drop.

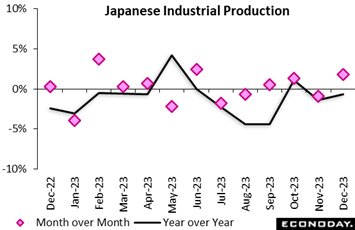

Japan's industrial production rebounded by a solid but lower-than-expected 1.8 percent on the month in December, led by demand for conveyors, cosmetics and chip-making equipment and recovering from a 0.9 percent drop in November. Econoday’s median forecast was a 2.5 percent gain. From a year earlier, factory output unexpectedly marked a second consecutive decline, down 0.7 percent, following a 1.4 percent dip and coming in weaker than the consensus call of a 0.1 percent rise. Japan's industrial production rebounded by a solid but lower-than-expected 1.8 percent on the month in December, led by demand for conveyors, cosmetics and chip-making equipment and recovering from a 0.9 percent drop in November. Econoday’s median forecast was a 2.5 percent gain. From a year earlier, factory output unexpectedly marked a second consecutive decline, down 0.7 percent, following a 1.4 percent dip and coming in weaker than the consensus call of a 0.1 percent rise.

A survey of producers conducted by the Ministry of Economy, Trade and Industry (METI) indicated that output is expected to plunge 10.5 percent in January before recovering a comparatively modest 2.2 percent in February. The downturn is due to suspension of all domestic production by Toyota Motor group firm Daihatsu over a vehicle safety scandal; the suspension began in late December and is due to extend to mid-February and appears to be having widespread impact beyond the auto industry.

METI maintained its assessment saying industrial output is "taking one step forward and one step back." The government agency said it will keep a close watch on the effects of global economic growth and suspended automobile production. It dropped its reference to price risks as domestic inflation has been easing.

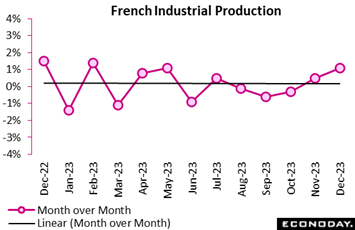

The French industrial production had a surprisingly good December. A 1.1 percent monthly rise in production was the best performance since last May and easily beat the consensus. This was the fourth advance in the last six months and steep enough to leave output at its highest level since January 2021. That said, production was still some 3.7 percent below its pre-pandemic level in February 2020 and the National Institute for Statistics and Economic Studies (INSEE) warned that problems with their seasonal adjustment programme due to unusual holiday timings might have artificially boosted the December data. The French industrial production had a surprisingly good December. A 1.1 percent monthly rise in production was the best performance since last May and easily beat the consensus. This was the fourth advance in the last six months and steep enough to leave output at its highest level since January 2021. That said, production was still some 3.7 percent below its pre-pandemic level in February 2020 and the National Institute for Statistics and Economic Studies (INSEE) warned that problems with their seasonal adjustment programme due to unusual holiday timings might have artificially boosted the December data.

Manufacturing output fared even better, posting a 1.2 monthly gain following a 0.2 percent increase previously. Within this, transport equipment (1.6 percent), food (1.5 percent) and the other manufacturing category (2.1 percent) all saw healthy rises but machinery and equipment (minus 2.4) and coke and refined petroleum products (minus 1.7 percent) fell sharply. Elsewhere, mining and quarrying, energy, water supply and waste management edged 0.2 percent firmer while construction was up fully 3.0 percent, its first increase since September.

Despite December's jump, fourth quarter industrial production was still 0.2 percent below its level in the third quarter so the sector was a drag on GDP growth. Looking ahead, recent sector PMIs have been particularly weak (January just 43.1) suggesting no meaningful recovery this quarter but these underestimated production in much of 2023 and INSEE's own manufacturing surveys have been much less pessimistic. In any event with France’s Relative Performance Indexes both above zero (RPI at 18 and RPI-P at 4), overall economic activity is at least running a little hotter than expected (See Bottom Line for further details).

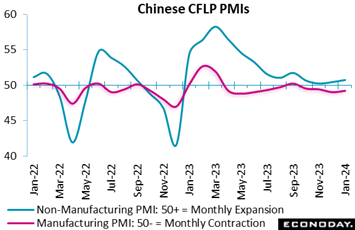

Official Chinese PMI survey data show no more than the most modest improvement in China's aggregate economy in January, with the data showing a smaller contraction in the manufacturing sector and slightly stronger growth in the non-manufacturing sector. January’s data suggest China's economy remains weighed down by weakness in the property market despite recent measures aimed at improving liquidity conditions. Official Chinese PMI survey data show no more than the most modest improvement in China's aggregate economy in January, with the data showing a smaller contraction in the manufacturing sector and slightly stronger growth in the non-manufacturing sector. January’s data suggest China's economy remains weighed down by weakness in the property market despite recent measures aimed at improving liquidity conditions.

The headline index for the CFLP manufacturing PMI rose from 49.0 in December to 49.2 in January, just below the consensus forecast of 49.3 and indicating contraction in the sector for the ninth time in the last ten months. The CFLP non-manufacturing PMI survey's headline index rose slightly from 50.4 to 50.7, just above the consensus forecast of 50.5. The composite index covering the entire economy rose from 50.3 in December to a four-month high of 50.9 in January.

Global economic data on net are coming in very near Econoday’s consensus forecasts and very near the breakeven line for the Relative Performance Index (RPI), at minus 5 overall and minus 6 when excluding prices (RPI-P).

Eurozone economic activity continues to perform much as expected despite an ongoing downside bias to the German data (RPI minus 36). The region’s RPI and RPI-P ended last week at 4 and 5 respectively. Crucially, there were no surprises in the January inflation update, probably meaning that next month is too soon for the first ECB interest rate cut of the year.

In the UK, the latest data have tended to undershoot forecasts and are reflected in sub-zero readings on both the RPI (minus 14) and RPI-P (minus 25). However, underperformance in the second half of January only offset outperformance in the first half and so cleared the way for the Bank of England to leave Bank Rate unchanged at 5.25 percent.

Recent upside and downside surprises in Swiss data have all but cancelled each other out. At 3 and minus 5 respectively, the RPI and RPI-P show overall economic activity largely matching expectations, potentially leaving the Swiss National Bank to focus more on a very strong Swiss franc.

In Japan, surprisingly soft consumer demand combined with weaker-than-expected industrial production to leave the RPI at minus 21 and the RPI-P at minus 10. This warns of some downside risk to fourth quarter GDP growth, due on February 13.

Survey data for January in China were mixed but at minus 14, both the RPI and RPI-P show economic activity in general lagging a little behind expectations. The latest readings are not deep in negative surprise territory but will do nothing to bolster a very nervous stock market.

Canada’s economy proved stronger than expected in November to lift the both RPI and RPI-P to 4. Overall economic activity is now performing much as expected but only after a run of disappointingly soft readings in January. Accordingly, a Bank of Canda rate cut is likely not very far away.

Much of last week’s data from the US ─ with the major exception of the much stronger-than-expected employment report ─ have been coming in near or just below Econoday's consensus, reflected in the RPI which is holding near the breakeven zero line, at 2 overall and 4 when excluding inflation data. Readings near zero in this case imply no change in Federal Reserve policy.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Australian International Trade in Goods for December (Mon 0030 GMT; Mon 1130 AEDT; Sun 1930 EST)

Consensus Forecast, Balance: A$10.9 billion

Consensus for international trade in goods in December is a surplus of A$10.9 billion versus November’s higher-than-expected A$11.4 billion surplus that saw monthly imports fall sharply and monthly exports rise.

China: S&P PMI Composite for January (Mon 0945 CST; Mon 0145 GMT; Sun 2045 EST)

Services Index, Consensus Forecast: 53.0

S&P's services PMI in January is expected to come in little changed at 53.0 versus December’s 52.9 and November’s 51.5.

German Merchandise Trade for December (Mon 0800 CET; Mon 0700 GMT; Mon 0200 EST)

Consensus Forecast, Balance: +€17.5 billion

December’s goods balance is expected to narrow to a €17.5 billion surplus versus a surplus of €20.4 billion in November.

Eurozone PPI for December (Mon 1100 CET; Mon 1000 GMT; Mon 0500 EST)

Consensus Forecast, Year over Year: -10.2%

Producer prices are expected to fall 10.2 percent on the year in December which would compare with 8.8 percent contraction in November.

Japanese Household Spending for December (Mon 2330 GMT; Tue 0830 JST; Mon 1830 EST)

Consensus Forecast , Month over Month: -0.3%

Consensus Forecast , Year over Year: -2.1%

Real household spending in December is expected to decline 2.1 percent on the year versus deeper-than-expected contraction in November of 2.9 percent as consumers remained frugal amid elevated costs for daily necessities.

Reserve Bank of Australia Announcement (Tue 1430 AEDT; Tue 0330 GMT; Mon 2230 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 4.35%

Saying “inflation is continuing to moderate”, the Reserve Bank of Australia kept its policy rate steady at 4.35 percent in December after raising this rate by 25 basis points at its November meeting. The RBA is expected to once again hold policy steady at its February meeting.

German Manufacturing Orders for December (Tue 0800 CET; Tue 0700 GMT; Tue 0200 EST)

Consensus Forecast, Month over Month: -0.1%

Manufacturing orders are expected to decrease 0.1 percent on the month in December versus November’s disappointing 0.3 percent rise that followed a 3.8 percent slump in October.

Eurozone Retail Sales for December (Tue 1100 CET; Tue 1000 GMT; Tue 0500 EST)

Consensus Forecast, Month over Month: -1.0%

Consensus Forecast, Year over Year: -1.1%

Retail sales volumes in December are expected to fall 1.0 percent on the month following a 0.3 percent decrease in November that left volumes down 1.1 percent on the year.

German Industrial Production for December (Wed 0800 CET; Wed 0700 GMT; Wed 0200 EST)

Consensus Forecast, Month over Month: 0.0%

Consensus Forecast, Year over Year: -3.5%

Industrial production in December is expected to remain unchanged on the month after falling a steeper-than-expected 0.7 percent in November, the sixth straight decline. The year-over-year comparison is seen decreasing 3.5 percent following 4.9 percent contraction in November.

Canada Merchandise Trade Balance for December (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast: C$1.2 billion

December’s trade balance is seen in surplus of C$1.2 billion versus November’s surplus of C$1.6 billion that was held down by a jump in imports and a fall in exports.

Chinese CPI for January (Thu 0930 CST; Thu 0130 GMT; Wed 2030 EST)

Consensus Forecast, Year over Year: -0.5%

After as-expected contraction of 0.3 percent in December, January’s year-over-year rate is expected to decrease to 0.5 percent. China’s CPI last peaked in January last year at 2.1 percent.

Chinese PPI for January (Thu 0930 CST; Thu 0130 GMT; Wed 2030 EST)

Consensus Forecast, Year over Year: -2.6%

Producer prices have been in long annual contraction. January’s consensus is minus 2.6 percent on the year versus December’s as-expected contraction of minus 2.7 percent.

Reserve Bank of India Announcement (Thu 0530 GMT; Thu 1000 IST; Wed 2330 EST)

Consensus Change: 0 basis points

Consensus Level: 6.50%

Despite rising inflation and robust economic growth, the Reserve Bank of India has left policy unchanged at their last five meeting. Expectations for are for no change once again.

Italian Industrial Production for December (Fri 1000 CET; Fri 0900 GMT; Fri 0400 EST)

Consensus Forecast, Month over Month: 0.7%

With a 3.4 percent surge needed just to keep fourth-quarter output flat, production in December is expected to rise 0.7 percent on the month following a sharper-than-expected fall of 1.5 percent in November.

Canadian Labour Force Survey for January (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast: Employment Change: 15,000

Consensus Forecast: Unemployment Rate: 5.8%

Employment in January is expected to rise 15,000 versus December’s marginal 100 increase that compared with expectations for a gain of 10,000. January’s unemployment rate is expected to hold unchanged at 5.8 percent.

|