|

Corporate news was uninspiring this past week—especially after 2013 finished strongly. Economic news was mixed with manufacturing taking the lead back while housing wavered. And the consumer sector was mixed.

This past week was mixed but mostly up for stocks as economic news and corporate news wavered.

The week got off to a negative start as stocks declined as investors continued to evaluate the disappointing December employment report and fret about pending earnings reports for the fourth quarter. Monday posted the largest drop in the S&P 500 in two months. However, on Tuesday stocks reversed course and erased most of Monday's losses as better than expected earnings and strong retail sales numbers for December boosted trader views of the economy. The week got off to a negative start as stocks declined as investors continued to evaluate the disappointing December employment report and fret about pending earnings reports for the fourth quarter. Monday posted the largest drop in the S&P 500 in two months. However, on Tuesday stocks reversed course and erased most of Monday's losses as better than expected earnings and strong retail sales numbers for December boosted trader views of the economy.

Wednesday saw a solid gain in equities, lifted by both corporate news and indicators. Banks led equities with favorable news from Bank of America, JP Morgan Chase, and Wells Fargo. Manufacturing got an upgrade from the Empire State survey and the Fed’s Beige Book indicated that the economy continued to grow at a moderate pace. The S&P 500 hit a record close. Wednesday saw a solid gain in equities, lifted by both corporate news and indicators. Banks led equities with favorable news from Bank of America, JP Morgan Chase, and Wells Fargo. Manufacturing got an upgrade from the Empire State survey and the Fed’s Beige Book indicated that the economy continued to grow at a moderate pace. The S&P 500 hit a record close.

Stocks were mixed Thursday—this time with financials tugging down. Citigroup and Goldman Sachs disappointed. At week’s close, equities were mostly down. Disappointing earnings numbers offset better-than-expected data on manufacturing and housing. Also, consumer sentiment came in below expectations. For company news, UPS declined, Intel dipped, Best Buy fell, Morgan Stanley gained, and GE declined.

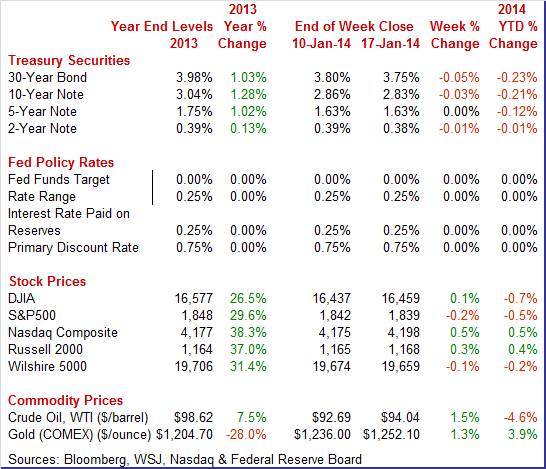

Equities were mixed this past week. The Dow was up 0.1 percent; the S&P 500, down 0.2 percent; the Nasdaq, up 0.5 percent; the Russell 2000, up 0.3 percent; and the Wilshire 5000, down 0.1 percent.

For the year-to-date, major indexes are mixed as follows: the Dow, down 0.7 percent; the S&P 500, down 0.5 percent; the Nasdaq, up 0.5 percent; the Russell 2000, up 0.4 percent; and the Wilshire 5000, down 0.2 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields generally were down modestly this past week. Treasury yields generally were down modestly this past week.

Bond yields eased at the start of the week on trader concerns that Tuesday’s report on December retail sales would be soft. But rates firmed Tuesday as retail sales growth exceeded expectations. Rates nudged up again on Wednesday as the Fed’s Beige Book was seen as somewhat positive—with economic growth being described as “moderate.”

Treasury yields declined Thursday—largely on the December CPI report which showed a year-ago pace of 1.5 percent. This is well below the Fed’s goal of 2.0 percent and suggested that taper of Fed bond purchases will be slow. Rates slipped again on Friday on mixed economic news and FedSpeak. Housing starts declined while industrial production gained. Fed Bank of Richmond President Jeffrey Lacker stated that he expected GDP growth of 2 percent for 2014—notably below most economists’ forecasts.

For this past week Treasury rates were down as follows: 3-month T-bill, down 1 basis point; the 2-year note, down 1 basis point; the 7-year note, down 2 basis points; the 10-year note, down 3 basis points; and the 30-year bond, down 5 basis points. The 5-year note was unchanged.

Oil prices firmed somewhat this past week. Oil prices firmed somewhat this past week.

However, the spot price for West Texas Intermediate eased a little over a dollar a barrel at the start of the week on news that Iran agreed to curtail its nuclear program beginning January 20, easing some sanctions on the oil producer. WTI bumped up almost a dollar a barrel Tuesday on a strong retail sales report.

At mid-week, crude rose two dollars a barrel after the weekly petroleum inventory report showed the lowest inventories in almost 22 months. The positive report on manufacturing from the Empire State survey also supported WTI. Prices were little changed Thursday and Friday.

Net for the week, the spot price for West Texas Intermediate increased $1.35 per barrel to settle at $94.04.

The economy was mostly positive this past week although there were some question marks. Housing wavered, manufacturing continued to improve, consumers spent more than expected, and core inflation is tame.

Housing is sputtering but it is hard to tell in what direction—this is a volatile time of year with large seasonal factors for winter months. Housing is sputtering but it is hard to tell in what direction—this is a volatile time of year with large seasonal factors for winter months.

Housing starts declined in December but the decrease was after a surge in November. Housing starts decreased 9.8 percent after spiking 23.1 percent in November. The December starts annualized level of 0.999 million units came in a little higher than expectations for 0.985 million units and was up 1.6 percent on a year-ago basis.

The drop in starts was led by the multifamily component which fell 14.9 percent after jumping 30.4 percent in November. The single-family slipped 7.0 percent, following a 19.5 percent boost the prior month.

Permits suggest temporary slippage in the housing sector. Overall permits decreased 3.0 percent, following a 2.1 percent dip in November. The 0.986 million unit pace was up 4.6 percent on the year. On the month, the decrease was led by a 4.8 percent decline in single-family permits while the multifamily component was unchanged. Permits suggest temporary slippage in the housing sector. Overall permits decreased 3.0 percent, following a 2.1 percent dip in November. The 0.986 million unit pace was up 4.6 percent on the year. On the month, the decrease was led by a 4.8 percent decline in single-family permits while the multifamily component was unchanged.

Atypically adverse winter weather may have played a role in slippage for starts and permits for December. In a plus, starts and permit did top the completions pace of 0.744 million units in December. Completions were down 10.8 percent in December after a 2.5 percent rise in November. The positive gap between permits and completions indicates that construction activity in the housing sector is still positive but the level of permits suggests deceleration.

The manufacturing sector is showing some momentum. Industrial production in December continued to rise following a healthy gain in November. Overall industrial production increased 0.3 percent after a gain of 1.0 percent in November. The December figure matched expectations for a 0.3 percent rise. The manufacturing sector is showing some momentum. Industrial production in December continued to rise following a healthy gain in November. Overall industrial production increased 0.3 percent after a gain of 1.0 percent in November. The December figure matched expectations for a 0.3 percent rise.

Turning to major components, manufacturing posted a 0.4 percent increase, following a jump of 0.6 percent the month before. Analysts expected a 0.3 percent advance. The December gain in manufacturing was its fifth consecutive increase. Motor vehicles advanced 1.6 percent in December after jumping 3.6 percent in November. Still, manufacturing was healthy outside of this sector. Excluding motor vehicles, manufacturing posted a 0.4 percent boost, following an increase of 0.4 in November.

Total industrial production in December was 3.7 percent above its year-earlier level and 0.9 percent above its pre-recession peak in December 2007.

The output of utilities declined 1.4 percent, following a 3.0 percent spike in November. Mining activity expanded 0.8 percent after a 1.9 percent boost in November.

Capacity utilization for total industry improved to 79.2 percent from 79.1 percent in November. The median market forecast was for 79.1 percent. Capacity utilization for total industry improved to 79.2 percent from 79.1 percent in November. The median market forecast was for 79.1 percent.

Manufacturing continues to gain moderately strong momentum. Recent industrial production numbers point to a notable gain in fourth quarter GDP. Industrial production rose an annualized 7.0 percent in the fourth quarter after rising 2.2 percent the prior quarter. The manufacturing component gained 6.3 percent annualized after rising 1.4 percent in the third quarter. While employment numbers have been mixed, healthy production numbers suggest that the Fed may continue its taper strategy later this month.

Manufacturing for New York State was solidly positive for January, but the Philly Fed region may have lost a little momentum. Manufacturing for New York State was solidly positive for January, but the Philly Fed region may have lost a little momentum.

New York manufacturing had been lagging other regions of the U.S. until this month with the Empire State index jumping to 12.51 from December's revised 2.22 to indicate significant month-to-month improvement in general business conditions.

And the improvement included new orders which were at 10.98 from December's minus 1.69. The gain points to upcoming strength for shipments and other readings including employment. Employment is already on the rise, opening the year with a big jump to 12.20 from zero in December. And the improvement included new orders which were at 10.98 from December's minus 1.69. The gain points to upcoming strength for shipments and other readings including employment. Employment is already on the rise, opening the year with a big jump to 12.20 from zero in December.

The latest Philly Fed report was mostly positive—with new orders being an exception. Growth in general conditions improved in January in the mid-Atlantic manufacturing sector but, unfortunately, not growth in new orders. The headline index rose to 9.4 from a revised 6.4 in December but new orders slowed to 5.1 from December's 12.9 and November's stand-out reading of 14.0.

But a big plus in the report was a 5.6 point gain in employment to 10.0 in what hints that manufacturers, who are always reluctant to hire, are confident enough in their order pipeline to expand their workforces.

Shipments, at 12.1, were healthy and offer a near-term explanation for the gain in employment. A big draw in inventories was another indication of strong production activity as are rising costs for raw materials with prices paid up 2.3 points to 18.7.

Taking out autos and gasoline, consumer spending was actually strong in December. The latest retail sales report suggests a moderately healthy consumer sector—somewhat in contrast to the December employment report. Overall retail sales in December rose 0.2 percent, following a gain of 0.4 percent the month before. Taking out autos and gasoline, consumer spending was actually strong in December. The latest retail sales report suggests a moderately healthy consumer sector—somewhat in contrast to the December employment report. Overall retail sales in December rose 0.2 percent, following a gain of 0.4 percent the month before.

As expected, autos tugged down sharply on sales. Motor vehicle & parts dropped 1.8 percent after a 1.9 percent increase in November. Excluding autos, sales posted a 0.7 percent boost after a November rise of 0.1 percent. Gas station sales rebounded 1.6 percent, following a 1.5 percent decline the month before. Excluding both autos and gasoline, sales advanced a healthy 0.6 percent in December, following a 0.3 percent gain in November. As expected, autos tugged down sharply on sales. Motor vehicle & parts dropped 1.8 percent after a 1.9 percent increase in November. Excluding autos, sales posted a 0.7 percent boost after a November rise of 0.1 percent. Gas station sales rebounded 1.6 percent, following a 1.5 percent decline the month before. Excluding both autos and gasoline, sales advanced a healthy 0.6 percent in December, following a 0.3 percent gain in November.

In the core, strength was seen in food & beverage stores, health & personal care, clothing, nonstore retailers, and food services & drinking places.

The December retail sales report points to a strong Q4 for GDP. The Fed will weigh these numbers against the employment report.

The new year may not be getting off to a good start from the consumer perspective. But the best interpretation of the consumer mood may simply be one of uncertainty. The new year may not be getting off to a good start from the consumer perspective. But the best interpretation of the consumer mood may simply be one of uncertainty.

According to Reuters/University of Michigan, consumer sentiment was down 2.1 points to 80.4 for the mid-January reading. The current conditions component, which offers an indication on December-to-January activity, was down 3.4 points to 95.2. This suggests that consumer spending, which was solid in December based on retail sales, may not be adding to December's gain.

The expectations component of the report was also down, 1.2 points lower to 70.9. This reading has been flat for nearly two years, often hovering in the high 60s area and unable approach 80 which is a level consistent with strong economic growth.

Gas prices are tame and so are 1-year inflation expectations which are unchanged at 3.0 percent. Expectations for inflation 5 years out are at 2.9 percent, right in trend.

The heavy weather that hit much of the country early this year may be behind the dip in this report, or it may be an effect from the weak jobs report early in the month.

The labor market continues to slowly mend, according to the BLS’s JOLTS (Job Openings and Labor Turnover Survey) report. There were 4.001 million job openings on the last business day of November, up slightly from 3.931 million in October. The November figure is the first to top 4 million since March 2008. The hires rate (3.3 percent) and separations rate (3.1 percent) were unchanged in November. The labor market continues to slowly mend, according to the BLS’s JOLTS (Job Openings and Labor Turnover Survey) report. There were 4.001 million job openings on the last business day of November, up slightly from 3.931 million in October. The November figure is the first to top 4 million since March 2008. The hires rate (3.3 percent) and separations rate (3.1 percent) were unchanged in November.

There were 4.494 million hires in November, compared to 4.484 million in October. The number of hires was essentially unchanged for total private and government. The number of hires was also essentially unchanged in all industries and in all four regions.

There were 4.258 million total separations in November versus 4.205 million in October. The number of total separations was essentially unchanged for total private and government.

In November, the quits rate was little changed at 1.8 percent for total nonfarm. The rate was unchanged for total private (2.0 percent) and for government (0.6 percent). The quits rate was essentially unchanged over the month for all industries and all four regions.

While the JOLTS data lag the employment situation by one month, the numbers are modestly favorable. The numbers may allow the Fed to continue taper—but at a moderate pace.

Other than energy, consumer price inflation was largely tame in December. Headline CPI inflation in December warmed up to a 0.3 percent gain after a flat reading in November. The CPI excluding food and energy softened to a 0.1 percent gain, following a rise of 0.2 percent the month before. Other than energy, consumer price inflation was largely tame in December. Headline CPI inflation in December warmed up to a 0.3 percent gain after a flat reading in November. The CPI excluding food and energy softened to a 0.1 percent gain, following a rise of 0.2 percent the month before.

The energy component rebounded to 2.1 percent, following a decline of 1.0 percent in November. Gasoline increased 3.1 percent after a drop of 1.6 percent the prior month. Food price inflation held steady with a 0.1 percent month rise.

Within the core, the shelter index rose 0.2 percent in December after a 0.3 percent increase in November. The rent index increased 0.3 percent, while the index for owners' equivalent rent rose 0.2 percent. The index for lodging away from home fell 0.3 percent after rising in November. The apparel index rose 0.9 percent in December but followed significant declines in each of the three previous months.

The tobacco index rose 0.6 percent and the personal care index increased 0.3 percent. The new vehicles index was unchanged in December, as was the medical care index. The index for medical care services rose 0.3 percent, but the index for medical care commodities fell 0.8 percent, as the prescription drugs index declined 0.9 percent. The airline fares index declined sharply in December, falling 4.7 percent after increasing in recent months. The indexes for recreation, for household furnishings and operations, and for used cars and trucks also fell in December. The tobacco index rose 0.6 percent and the personal care index increased 0.3 percent. The new vehicles index was unchanged in December, as was the medical care index. The index for medical care services rose 0.3 percent, but the index for medical care commodities fell 0.8 percent, as the prescription drugs index declined 0.9 percent. The airline fares index declined sharply in December, falling 4.7 percent after increasing in recent months. The indexes for recreation, for household furnishings and operations, and for used cars and trucks also fell in December.

Year-on-year, overall CPI inflation came in at 1.5 percent in December, compared to 1.2 percent in November (seasonally adjusted). The core rate stood at 1.7 percent year-on-year, matching the November pace. For December, NSA year-ago percent changes for total and core CPI are 1.5 percent and 1.7 percent, respectively.

Inflation remains subdued and is still below the Fed's long-term target of 2 percent. Some recent FedSpeak has argued that the Fed should focus on bringing inflation up rather than bringing unemployment down. Either way, Fed taper is likely to be on a slow path with the next FOMC decision scheduled for January 29.

December producer price index was up 0.4 percent as expected and was up 1.2 percent from December 2012. However, core PPI (excludes food and energy) was up a greater than anticipated 0.3 percent and 1.4 percent on the year. December producer price index was up 0.4 percent as expected and was up 1.2 percent from December 2012. However, core PPI (excludes food and energy) was up a greater than anticipated 0.3 percent and 1.4 percent on the year.

Food prices dropped 0.6 percent on the month thanks to lower prices for both vegetables and meat. However, energy prices jumped 1.6 percent. Gasoline prices were up 2.2 percent, the biggest jump since August.

Among the sub-categories influencing December's increase in the core PPI were tobacco prices (up 3.6 percent), pharmaceuticals (up 0.5 percent) and light trucks (up 0.5 percent). Among the sub-categories influencing December's increase in the core PPI were tobacco prices (up 3.6 percent), pharmaceuticals (up 0.5 percent) and light trucks (up 0.5 percent).

This is the last release of the PPI in its current format. Beginning with the January 2014 report which will be released in mid-February, it will include intermediate and final demand classifications dominated by services, weighting traditional core less. Seasonal adjustments and relative importance factors also will be recalculated at that time.

Taking into account severe winter weather in December, the economy appears to be moderately healthy. Growth is somewhat positive and possibly moderately strong for the fourth quarter. The recovery likely can withstand the Fed continuing to taper at a slow pace.

This week’s focus is on housing—notably after a slightly soft housing starts report this past week. Existing home sales will hit the wires and hard weather may play a role in the December data. FHFA house prices have been on an uptrend—providing some lift to consumer confidence about recovery in household wealth. The FHFA report this week may play a notable role in traders’ views on confidence in the consumer sector.

U.S. Holiday: Martin Luther King, Jr. Day. All Markets Closed

Initial jobless claims were little changed, down 2,000 in the January 11 week to 326,000. This was the first report in two months that was not heavily skewed by special factors or shortened holiday weeks, and the results point to steady conditions in the labor market. The 4-week average was at 335,000, which was nearly 10,000 below the month-ago trend and which points to moderate improvement from December. Continuing claims showed a spike but, reported with a one week lag, were clouded by the New Year's holiday. Continuing claims for the January 4 week jumped 174,000 to 3.030 million which was the first 3 million reading since July.

Jobless Claims Consensus Forecast for 1/18/14: 330,000

Range: 303,000 to 355,000

The Markit PMI manufacturing index (final) picked up slightly in the latter half of December which came in at 55.0 for final December, the best reading since January and up from 54.4 at mid-month and compared to 54.7 in final November. New orders at 56.1—up from 54.5 in November—also were solid and sustainable. New export orders were soft but positive, steady at 51.4, while total backlog orders were climbing, at 52.8 which was solid for this reading.

Markit PMI manufacturing flash index Consensus Forecast for January 14: 55.0

Range: 54.0 to 56.0

Existing home sales were definitely down in November as sales fell a sharp 4.3 percent to a 4.900 million annual rate for a 4th straight month of disappointment. And for the first time in nearly 2-1/2 years, the year-on-year rate was in contraction at minus 1.2 percent. And for a second month in a row, all regions showed monthly declines led once again by the West where November sales fell 8.5 percent. Lack of homes for sale, especially in the West, was a major reason for the weak sales. Supply on the market fell to 2.090 million in the month from 2.110 million. Because of the weakness in sales, monthly supply on a sales basis did improve but not by much, to 5.1 months from 4.9 months.

Existing home sales Consensus Forecast for December 13: 4.900 million-unit rate

Range: 4.800 to 5.200 million-unit rate

The FHFA purchase only house price index gained 0.5 percent in October on a seasonally adjusted basis, following a 0.2 percent rise the prior month. The October HPI was the 21st consecutive monthly price increase in the purchase-only, seasonally adjusted index. Seven of nine Census regions showed gains in the latest month while one declined and one was unchanged. The year-on-year rate for October came in at 8.2 percent, following 8.4 percent in September.

FHFA purchase only house price index Consensus Forecast for November 13: +0.4 percent

Range: +0.2 to +0.5 percent

The Conference Board's index of leading indicators surged 0.8 percent in November, following a rise of 0.1 percent in October and a spike of 1.0 percent in September. The November gain was backed by strength in manufacturing orders and convincing strength in both credit conditions and the stock market. But there was less convincing strength coming from unemployment claims which came down from quirky levels in October that were tied to the government shutdown and counting problems in California. And the report's yield spread was once again the leading contributor even as long rates go up, a rise that will limit economic strength. Another reading included a solid 0.4 percent gain in the coincident index which points to ongoing strength in the economy.

Leading indicators Consensus Forecast for December 13: +0.1 percent

Range: +0.1 to +0.3 percent

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books.

He can also be found on a weekly broadcast talking about the U.S. economy, the easiest way to find him is by going to iTunes and searching for "Simply Economics."

Econoday Senior Writer Mark Pender contributed to this article.

|