|

Payroll gains for March were higher than February but fell short of expectations. The Fed will continue to point to a sluggish labor market and low inflation to keep policy loose.

Despite a notably negative end to the week, most major indexes ended the week up and closed the quarter on a strong positive note. The first two days of trading during the week were notably positive. With little economic news, stocks were spurred up sharply on week’s open on remarks by Fed Chair Janet Yellen that the Fed will support the economy "for some time to come." The S&P 500 closed at an all-time high Tuesday. Yellen’s Monday comments continued to provide lift, motor vehicle sales topped expectations, and ISM manufacturing remained positive and came in close to forecasts. Despite a notably negative end to the week, most major indexes ended the week up and closed the quarter on a strong positive note. The first two days of trading during the week were notably positive. With little economic news, stocks were spurred up sharply on week’s open on remarks by Fed Chair Janet Yellen that the Fed will support the economy "for some time to come." The S&P 500 closed at an all-time high Tuesday. Yellen’s Monday comments continued to provide lift, motor vehicle sales topped expectations, and ISM manufacturing remained positive and came in close to forecasts.

At mid-week, the S&P 500 again closed at a record high. ADP private employment essentially matched expectations (showing improvement) and setting a positive tone ahead of the Friday BLS jobs report. Also, Atlanta Fed’s Dennis Lockhart said central bank policy should remain accommodative “for quite some time.”

Stocks declined the last two days of trading. Equities were led down by a sharp drop in biotech and momentum stocks, including Facebook, Tesla and Netflix. Also, initial jobless claims rose more than expected. On Friday, stocks were led down by techs as the Nasdaq fell the biggest daily drop in almost two years. Biotechnology also declined sharply. Friday’s payroll gain for March was an improvement but fell short of expectations.

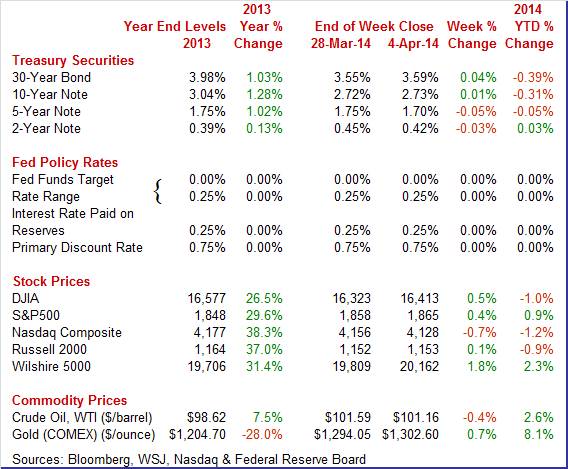

Equities were mostly up this past week. The Dow was up 0.5 percent; the S&P 500, up 0.4 percent; the Russell 2000, up 0.1 percent; and the Wilshire 5000, up 1.8 percent. The Nasdaq was down 0.7 percent. Equities were mostly up this past week. The Dow was up 0.5 percent; the S&P 500, up 0.4 percent; the Russell 2000, up 0.1 percent; and the Wilshire 5000, up 1.8 percent. The Nasdaq was down 0.7 percent.

Equities were mixed for the month of March. The Dow was up 0.8 percent; the S&P 500, up 0.7 percent; the Nasdaq, down 2.5 percent; the Russell 2000, down 0.8 percent; and the Wilshire 5000, up 0.2 percent.

Equities were mostly up for the first quarter. The Dow was down 0.7 percent; the S&P 500, up 1.3 percent; the Nasdaq, up 0.5 percent; the Russell 2000, up 0.8 percent; and the Wilshire 5000, up 1.5 percent. Equities were mostly up for the first quarter. The Dow was down 0.7 percent; the S&P 500, up 1.3 percent; the Nasdaq, up 0.5 percent; the Russell 2000, up 0.8 percent; and the Wilshire 5000, up 1.5 percent.

For the year-to-date, major indexes are mixed as follows: the Dow, down 1.0 percent; the S&P 500, up 0.9 percent; the Nasdaq, down 1.2 percent; the Russell 2000, down 0.9 percent; and the Wilshire 5000, up 2.3 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields changed very moderately this past week. Short rates eased somewhat while a couple of long rates firmed. After a quiet Monday, rates rose modestly Tuesday—mainly in the longer maturities—as economic data, ISM manufacturing in particular, were seen validating improvement in economic growth and providing ammunition for the Fed to maintain its taper schedule. Treasury yields changed very moderately this past week. Short rates eased somewhat while a couple of long rates firmed. After a quiet Monday, rates rose modestly Tuesday—mainly in the longer maturities—as economic data, ISM manufacturing in particular, were seen validating improvement in economic growth and providing ammunition for the Fed to maintain its taper schedule.

Rates firmed further on Wednesday on news of a healthy ADP private employment report. After little change Thursday, rates fell Friday despite an improved payroll gain in BLS payroll numbers. Rates dipped because the payroll jobs increase was below expectations.

For this past week Treasury rates were mixed as follows: 3-month T-bill, unchanged; the 2-year note, down 3 basis points; the 5-year note, down 5 basis points; the 7-year note, down 2 basis points; the 10-year note, up 1 basis point; and the 30-year bond, up 4 basis points.

The biggest daily swings were on Tuesday, Thursday, and Friday. Other days were little changed. On Tuesday, WTI declined just over $2 per barrel on belief that U.S. inventories gained for the latest week. Also, the ISM manufacturing index posted lower than expected and a separate report showed Chinese manufacturing softened. The biggest daily swings were on Tuesday, Thursday, and Friday. Other days were little changed. On Tuesday, WTI declined just over $2 per barrel on belief that U.S. inventories gained for the latest week. Also, the ISM manufacturing index posted lower than expected and a separate report showed Chinese manufacturing softened.

On Thursday, spot WTI rose despite an increase in initial jobless claims. Spot WTI gained about a dollar a barrel on reports that discussions between the between the Libyan government and rebels will not result in the restoration of oil exports. Crude rose somewhat under a buck a barrel on Friday. Oil traders saw the rise in payroll jobs as a positive for economic growth.

Net for the week, the spot price for West Texas Intermediate nudged down 43 cents per barrel to settle at $101.16.

The recovery continues to improve but very slowly. Manufacturing is showing signs of coming out of winter doldrums.

Job growth is improving but not quite as much as forecast. Total nonfarm payroll jobs rose 192,000 in March after a 197,000 boost in February and a 144,000 increase in January. The net revision for the prior two months was up 37,000. Expectations for March were for 206,000. Private payrolls gained 192,000, following an increase of 197,000 in February. Analysts projected 215,000 for March. Private payroll jobs finally topped the latest pre-recession peak. Losses in government jobs are still keeping back full recovery in total payroll jobs—private plus government. Job growth is improving but not quite as much as forecast. Total nonfarm payroll jobs rose 192,000 in March after a 197,000 boost in February and a 144,000 increase in January. The net revision for the prior two months was up 37,000. Expectations for March were for 206,000. Private payrolls gained 192,000, following an increase of 197,000 in February. Analysts projected 215,000 for March. Private payroll jobs finally topped the latest pre-recession peak. Losses in government jobs are still keeping back full recovery in total payroll jobs—private plus government.

The unemployment rate held steady at 6.7 percent. The consensus projected 6.6 percent.

The “U-6” underemployment rate edged up to 12.7 percent from 12.6 percent in February. Fed Chair Janet Yellen has indicated that “U-6” is a key labor market indicator that she watches. It includes the unemployed, those working part time for economic reasons, and those marginally attached to the labor force (discouraged and not looking for a job but would work if offered a job).

Turning back to the payroll portion of the report, goods-producing jobs rose 25,000 in March after a gain of 40,000 in February. Construction advanced 19,000, following a 18,000 increase the month before. Manufacturing jobs slipped 1,000 after rising 19,000 in February. Turning back to the payroll portion of the report, goods-producing jobs rose 25,000 in March after a gain of 40,000 in February. Construction advanced 19,000, following a 18,000 increase the month before. Manufacturing jobs slipped 1,000 after rising 19,000 in February.

Private service-providing jobs increased 167,000, following an 148,000 rise in February. Professional and business services added 57,000 jobs in March. Health care added 19,000 jobs. Retail trade gained 21,000.

Government jobs were flat after rising 9,000 in February.

Average weekly hours improved to 34.5 from 34.3 in February. Average hourly earnings came off as unchanged in March after a spike of 0.4 percent in February.

Looking ahead to the personal income report, from the payroll survey, private aggregate weekly earnings rose 0.7 percent in March, pointing to a sizeable rise in private wages & salaries. Production worker hours in manufacturing jumped 1.3 percent for the month, suggesting a strong manufacturing component for March industrial production.

Overall, the labor market is improving but very gradually. The doves at the Fed—including Chair Yellen—almost certainly will see this report as still too soft.

Held down by heavy weather in January and February, unit vehicle sales surged 6.9 percent in March to a 16.4 million annual rate. Sales of domestic-made vehicles were especially strong, rising 7.0 percent to a 13.0 million rate. Sales of imported vehicles rose 6.4 percent to 3.4 million. The latest sales results are very positive, offering the first hint that the post-weather rebound for the economy may be stronger than expected. Auto sales are likely to add lift to retail sales for March. Held down by heavy weather in January and February, unit vehicle sales surged 6.9 percent in March to a 16.4 million annual rate. Sales of domestic-made vehicles were especially strong, rising 7.0 percent to a 13.0 million rate. Sales of imported vehicles rose 6.4 percent to 3.4 million. The latest sales results are very positive, offering the first hint that the post-weather rebound for the economy may be stronger than expected. Auto sales are likely to add lift to retail sales for March.

Markit's manufacturing PMI for final March is 55.5, unchanged from mid-month and a bit slower than February's 57.1. Despite the slowing, growth in March is still very solid led by new orders at 58.1. Growth in output is also very solid, at 57.5. The build in backlog orders slowed but the number is respectable at 54.5. Employment growth is steady and moderate at 53.9. These numbers are very solid and if matched, evenly closely matched, in the ISM report later this morning would give a lift to the manufacturing outlook.

Turning to the ISM report, manufacturing snapped back from a very soft February but not quite as much as expected, at least based on the ISM index which rose only 5 tenths to 53.7. Growth in new orders was respectable at 55.1 for a 6 tenths gain but this rate is well below the plus 60 levels through the second half of last year. A positive was new export orders, at 55.5 which was very solid for this reading. And backlog orders were especially solid in the latest report, at 57.5 for a 5.5 point gain.

Production, which in February was held down by the month's heavy weather, made a big comeback in ISM's sample, at 55.9 for a 7.7 point gain. Supplier delivery times, which were slowed significantly by February's weather, improved noticeably while inventories of raw materials held steady. In contrast, inventories of finished goods fell substantially which, in a positive, points to the need to restock those inventories and to increased production ahead. Price pressures for raw materials are steady and moderate.

A negative was employment which fell 1.2 points to 51.1 to indicate only the slightest level of growth. There are pluses and minuses in this report which, however, on net is positive, pointing to a respectable snap back as spring unfolds.

Manufacturing has been soft in some regions of the U.S., but not in Texas. Texas factory activity increased for the eleventh month in a row in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 10.8 to 17.1, indicating output grew at a stronger pace than in February. Manufacturing has been soft in some regions of the U.S., but not in Texas. Texas factory activity increased for the eleventh month in a row in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 10.8 to 17.1, indicating output grew at a stronger pace than in February.

Other measures of current manufacturing activity also reflected more robust growth. The new orders index rose to a nine-month high of 14.7, with nearly a third of manufacturers noting an increase in demand and less than a fifth noting a decrease. The shipments index rose from 13.3 to 19.5, posting its strongest reading in nearly four years. The capacity utilization index rose as well, climbing four points to 13.1.

Perceptions of broader business conditions were more optimistic in March. The general business activity index moved up to a six-month high of 4.9 after slipping to zero last month. The company outlook index also rebounded, rising six points to 9.1 after falling sharply in February.

Labor market indicators reflected stronger employment growth and longer workweeks. The March employment index rose markedly to a 21-month high of 15.

Expectations regarding future business conditions remained optimistic in March. The index of future general business activity edged up to 17.6, and the index of future company outlook rose 7 points to 27.4. Indexes for future manufacturing activity showed mixed movements but remained in solidly positive territory.

The Dallas Fed survey offers some optimism for the manufacturing sector. But Texas manufacturing is heavily influenced by the energy sector and this may make Texas momentum an exception.

The trade deficit widened to $42.3 billion in February from $39.3 billion in January. Market expectations were for a $38.8 billion deficit. Curiously, the winter Olympics play a notable role. Exports declined 1.1 percent in February, following a gain of 0.6 percent the month before. Imports rose 0.4 percent after gaining 0.5 percent. The trade deficit widened to $42.3 billion in February from $39.3 billion in January. Market expectations were for a $38.8 billion deficit. Curiously, the winter Olympics play a notable role. Exports declined 1.1 percent in February, following a gain of 0.6 percent the month before. Imports rose 0.4 percent after gaining 0.5 percent.

The expansion of the trade gap was led by a slowing in the services balance to plus $19.4 billion from plus $20.2 billion in January. Exports of services were virtually unchanged from January to February. Imports of services increased $0.8 billion from January to February. The increase was mainly accounted for by an increase in royalties and license fees ($0.8 billion), which included payments for the rights to broadcast the 2014 Winter Olympic Games. The petroleum deficit expanded to $19.9 billion in February from $19.3 billion the month before. The goods excluding petroleum gap grew to $40.0 billion from $39.2 billion. The expansion of the trade gap was led by a slowing in the services balance to plus $19.4 billion from plus $20.2 billion in January. Exports of services were virtually unchanged from January to February. Imports of services increased $0.8 billion from January to February. The increase was mainly accounted for by an increase in royalties and license fees ($0.8 billion), which included payments for the rights to broadcast the 2014 Winter Olympic Games. The petroleum deficit expanded to $19.9 billion in February from $19.3 billion the month before. The goods excluding petroleum gap grew to $40.0 billion from $39.2 billion.

Overall, the February trade gap was larger than expected and likely will result in many economists shaving their first quarter GDP forecast.

February construction outlays edged up 0.1 percent in February, following a decline of 0.2 percent the month before. Strength was in private nonresidential outlays which rebounded 1.2 percent after a 1.0 decrease in January. Private residential outlays decreased 0.8 percent in February, following a 1.3 percent boost in January. Public outlays nudged up 0.1 percent, following a drop of 1.3 percent in January. February construction outlays edged up 0.1 percent in February, following a decline of 0.2 percent the month before. Strength was in private nonresidential outlays which rebounded 1.2 percent after a 1.0 decrease in January. Private residential outlays decreased 0.8 percent in February, following a 1.3 percent boost in January. Public outlays nudged up 0.1 percent, following a drop of 1.3 percent in January.

On a year-ago basis, total outlays were up 8.7 percent after a 9.4 percent boost the prior month.

Adverse weather continues to raise question marks about economic data-including construction spending. March numbers likely will give a clearer picture.

The heavy weather of February made for an easy comparison in March for the ISM's non-manufacturing index which is up a sizable 1.5 points to 53.1. The report's employment index, which posted a near record plunge in February, jumped back 6.1 points to 53.6. New orders are also a key positive, rising 2.1 points to a 53.4 level that however is still on the moderate side. Inventories show a draw which is probably a plus, pointing to restocking ahead. Today's report isn't gang-busters but is respectable, perhaps pointing to a little acceleration for the economy heading into the spring. The Dow is moving slightly higher. The heavy weather of February made for an easy comparison in March for the ISM's non-manufacturing index which is up a sizable 1.5 points to 53.1. The report's employment index, which posted a near record plunge in February, jumped back 6.1 points to 53.6. New orders are also a key positive, rising 2.1 points to a 53.4 level that however is still on the moderate side. Inventories show a draw which is probably a plus, pointing to restocking ahead. Today's report isn't gang-busters but is respectable, perhaps pointing to a little acceleration for the economy heading into the spring. The Dow is moving slightly higher.

The services PMI got a weather-related lift in March, rising 2.0 points to 53.5 and little changed from March's flash reading of 55.5. But details show less strength with outstanding business, at 48.3, down 1.6 points from February and showing outright contraction for March. New business did growth, at 53.0, but at a slower pace than February's 56.0. Employment growth remains very slow for this sample, little changed and only slightly above 50 at 51.8. Price readings remain moderate. One positive is a 3.0 point rise in business expectations, to a very optimistic 76.4.

The recovery appears to be coming out of the adverse effects of severe winter weather—especially for manufacturing and the consumer sector. The spring thaw appears to be on.

This week is relatively light. But there are a number of consumer sector reports to digest. Consumer credit outstanding has been boosted by government purchases of student loans held by private lenders. The question is whether revolving credit will rise to reflect advancing consumer demand. Jobless claims rose in the latest week after a large drop the week before. Consumer sentiment has been stagnant but will getting past winter doldrums boost the consumer mood'

Consumer credit outstanding in January gained $13.7 billion but the rise masked yet another decline for revolving credit. Revolving credit posted a gain in December but reverted back to the negative column in January, at minus $0.2 billion. And December's gain, originally at $5.0 billion, is now revised down to $3.1 billion. The slope for revolving credit has barely been on the rise this recovery, a factor that has held back consumer spending and the recovery along with it. Once again the non-revolving component shows outsized strength, up $13.9 billion in January and once again skewed higher by government purchases of student loans.

Consumer credit Consensus Forecast for February 14: +$14.0 billion

Range: +$10.6 billion to +$16.3 billion

The NFIB Small Business Optimism Index fell sharply in February, down 2.7 points to 91.4. A weakening in sales expectations pulled the index down the most followed by economic expectations and hiring plans. Respondents continue to reduce inventories and are reporting no more than limited pricing power.

NFIB Small Business Optimism Index Consensus Forecast for March 14: 92.4

Range: 90.5 to 93.2

The Labor Department’s Job Openings and Labor Turnover Survey showed 4.0 million job openings on the last business day of January, little changed from December. The hires rate (3.3 percent) and separations rate (3.2 percent) were little changed in January.

There were 4.0 million job openings in January, little changed from December. The number of openings also was little changed in total private and government. The number of job openings decreased in retail trade; the number increased in health care and social assistance and in arts, entertainment, and recreation. The West region experienced a rise in job openings in January.

JOLTS job openings Consensus Forecast for February 14: 4.000 million

Range: 3.974 million to 4.030 million

Wholesale inventories rose 0.6 percent in January against a 1.9 percent plunge in sales, a heavy mismatch that drives the sector's stock-to-sales ratio up 2 notches to 1.20 which is one of the heaviest readings of the recovery. Details show large builds in autos, metals, and machinery, three groups where January sales were weak. Nondurable goods show especially large builds against especially soft sales including paper, drugs and petroleum.

Wholesale inventories Consensus Forecast for February 14: +0.6 percent

Range: +0.3 to +0.7 percent

The Minutes of the March 18-19, 2014 FOMC meeting are scheduled for release at 2:00 p.m. ET. The latest FOMC policy statement moved from a specific 6.5 percent unemployment rate as a trigger for policy discussions to remove easy monetary policy. The minutes may show more light on this decision. Also, the statement indicated that policy rates will remain exceptionally low for some time after the end of taper when long-term bond purchases end. During the Fed chair’s press conference, a 6 month waiting period was inferred as possible. The minutes may clarify how long policy rates are to remain exceptionally low.

Initial jobless claims rose 16,000 in the March 29 week to 326,000, which is 6,000 over the Econoday consensus. But the 4-week average is stable, little changed at 319,500 which is nearly 20,000 below the month-ago comparison and which points to strength for March employment. Continuing claims, which are reported with a one-week lag, also rose, up 22,000 in the March 22 week to 2.836 million. But here too, the 4-week average is favorable, down 14,000 to 2.842 million which is roughly 80,000 below the month-ago comparison.

Jobless Claims Consensus Forecast for 4/5/14: 318,000

Range: 310,000 to 326,000

Import prices jumped 0.9 percent in February but reflected a 4.4 percent weather-related surge in oil prices and a 22.4 percent weather-related spike in natural gas. Excluding fuel, import prices actually fell, down 0.2 percent for the second negative reading in the last three months. Export prices also jumped in February, up 0.6 percent but again reflect fuel costs and also a one-month jump in agricultural costs. Export prices excluding food and fuels show a second 0.2 percent gain that follows two 0.1 percent declines.

Import prices Consensus Forecast for March 14: +0.2 percent

Range: -0.2 to +0.9 percent

Export prices Consensus Forecast for March 14: +0.3 percent

Range: -0.3 to +0.6 percent

The U.S. Treasury monthly budget report showed in February came in at a lower-than-expected $193.5 billion deficit. The year-to-date deficit, five months into the government's fiscal year, is $377.4 billion for a 24 percent improvement. When adjusting for calendar timing of government payments, the year-to-date deficit falls to $334.0 billion for a 32 percent improvement. Year-to-date receipts, boosted by higher corporate income taxes and social insurance receipts, are up 9.3 percent. Year-to-date outlays are down 1.5 percent led by declines in defense spending and net interest payments. Looking ahead, the month of March typically shows a deficit for the month. Over the past 10 years, the average deficit for the month of March has been $112.4 billion and $150.0 billion over the past 5 years. The March 2013 deficit came in at $106.5 billion.

Treasury Statement Consensus Forecast for March 14: -$132.8 billion

Range: -$193.5 billion to -$72.0 billion.

The producer price index for final demand dipped 0.1 percent in February after rising 0.2 percent in January. Market expectations were for 0.2 percent. Total final demand excluding food & energy declined 0.2 percent after increasing 0.2 percent the month before. Total final demand excluding food, energy, and trade services edged up 0.1 percent in February, matching the pace in January. In February, the 0.1-percent decrease in final demand prices can be traced to the index for final demand services, which fell 0.3 percent. Most of the February drop can be traced to margins for final demand trade services, which fell 1.0 percent. In contrast, prices for final demand goods advanced 0.4 percent.

PPI-FD Consensus Forecast for March 14: +0.1 percent

Range: -0.1 to +0.3 percent

PPI-FD ex Food & Energy Consensus Forecast for March 14: +0.2 percent

Range: -0.2 to +0.3 percent

PPI-FD ex Food & Energy & Trade Services Consensus Forecast for March 14: +0.1 percent

Range: +0.1 to +0.1 percent

The Reuters/University of Michigan's consumer sentiment index held steady the last two weeks of March at a moderate level, at 80.0 versus a mid-month reading of 79.9 and versus a final February reading of 81.6. Details in the month-to-month comparison with February are mixed, showing no significant change for current conditions, at 95.7 versus 95.4, but a little weakness for expectations, at 70.0 vs 72.7. The decline in expectations may reflect disappointment over the jobs outlook. Inflation expectations, despite the rise underway in gasoline prices, are unchanged, at 3.2 percent for the 1-year outlook and at 2.9 percent for the 5-year outlook.

Consumer sentiment index Consensus Forecast for preliminary April 14: 81.0

Range: 79.5 to 82.5

R. Mark Rogers is the author of The Complete Idiot’s Guide to Economic Indicators, Penguin Books.

He can also be found on a weekly broadcast talking about the U.S. economy, the easiest way to find him is by going to iTunes and searching for "Simply Economics."

Econoday Senior Writer Mark Pender contributed to this article.

|