|

There are further signs that the economy is regaining strength in the second quarter. Meanwhile, the Fed is engaging in medium-term planning on its exit strategy for the Fed's balance sheet.

Equities gained notably for the week with the S&P 500 closing the week at a record high. Equities gained notably for the week with the S&P 500 closing the week at a record high.

Equities were up Monday, lifted by gains in Internet and biotech stocks. Pandora Media Inc., TripAdvisor Inc. and Netflix led Internet stocks while Pfizer led biotech.

On Tuesday, stocks ended lower thanks to disappointing earnings from the retail sector, including Staples and Urban Outfitters. Selling intensified in the afternoon after Philadelphia Fed president Charles Plosser said that the Fed may need to act sooner rather than later should the economy accelerate.

The rest of the week was positive with Wednesday's advances largely reflecting favorable reaction to the Fed's FOMC minutes which continued to indicate loose monetary policy for some time. Thursday saw further gains on mixed but mostly favorable economic news. While initial jobless claims rose after falling to a seven year low the week before, existing home sales, Markit flash PMI for manufacturing, and leading indicators were healthy. The rest of the week was positive with Wednesday's advances largely reflecting favorable reaction to the Fed's FOMC minutes which continued to indicate loose monetary policy for some time. Thursday saw further gains on mixed but mostly favorable economic news. While initial jobless claims rose after falling to a seven year low the week before, existing home sales, Markit flash PMI for manufacturing, and leading indicators were healthy.

On Friday, the S&P 500 closed at 1,900.53—a record high. Equities were boosted by better-than-expected sales of new homes.

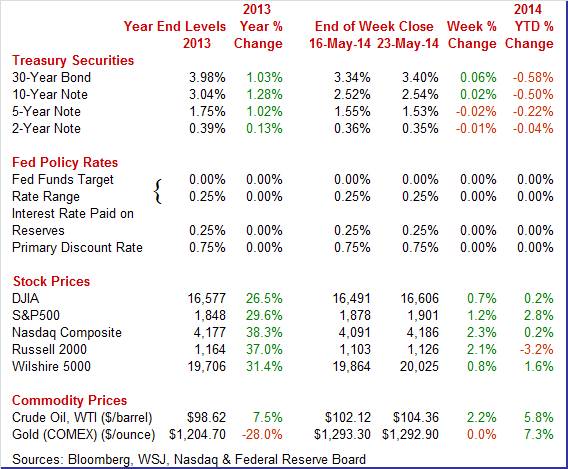

Equities were up this past week. The Dow was up 0.7 percent; the S&P 500, up 1.2 percent; the Nasdaq, up 2.3 percent; the Russell 2000, up 2.1 percent; and the Wilshire 5000, up 0.8 percent.

For the year-to-date, major indexes are mostly up as follows: the Dow, up 0.2 percent; the S&P 500, up 2.8 percent; the Nasdaq, up 0.2 percent; and the Wilshire 5000, up 1.6 percent. The Russell 2000 is down 3.2 percent

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields this past week were mixed and little changed except for the long bond yield which rose moderately. Bets ahead of Wednesday's Fed FOMC minutes swung Monday and Tuesday with long rates up somewhat Monday and then yields easing marginally Tuesday. The easing was in part due to comments by Fed Bank of New York President William Dudley that the pace of eventual policy rate increases from virtually zero "will probably be relatively slow." Treasury yields this past week were mixed and little changed except for the long bond yield which rose moderately. Bets ahead of Wednesday's Fed FOMC minutes swung Monday and Tuesday with long rates up somewhat Monday and then yields easing marginally Tuesday. The easing was in part due to comments by Fed Bank of New York President William Dudley that the pace of eventual policy rate increases from virtually zero "will probably be relatively slow."

Reaction to the Wednesday release of Fed FOMC minutes was muted but slightly on the upside for rates as Treasuries gave back earlier price gains. Rates nudged up Thursday on worries that inflation may be headed up—albeit slowly. At week's close, yields eased slightly as many traders wanted to be on the sidelines ahead of the presidential election in Ukraine during the weekend.

For this past week Treasury rates were mixed as follows: 3-month T-bill, up 2 basis points; the 2-year note, down 1 basis point; the 5-year note, down 2 basis points; the 7-year note, down 1 basis point; the 10-year note, up 2 basis points; and the 30-year bond, up 6 basis points.

The spot price of West Texas Intermediate posted a moderate gain this past week. The only notable daily swing was at mid-week with an increase of almost $1-1/2 per barrel on news that U.S. oil imports fell to a 17-year low, cutting into supplies. WTI rose a little over half a dollar on Friday on favorable home sales and on a drop in Gulf Coast supplies. The week ended on a six-week high. The spot price of West Texas Intermediate posted a moderate gain this past week. The only notable daily swing was at mid-week with an increase of almost $1-1/2 per barrel on news that U.S. oil imports fell to a 17-year low, cutting into supplies. WTI rose a little over half a dollar on Friday on favorable home sales and on a drop in Gulf Coast supplies. The week ended on a six-week high.

Net for the week, the spot price for West Texas Intermediate gained $2.24 per barrel to settle at $104.36.

Housing is making a modest comeback while manufacturing is showing improvement in May.

Sales of existing homes are finally showing some life, up 1.3 percent in April to a 4.65 million annual rate for only the second gain in the last nine months. And the key single-family component is also showing life, up 0.5 percent for the first gain of the year. Sales of condos, which have been much stronger than sales of single-family homes, jumped 7.3 percent in April. Sales of existing homes are finally showing some life, up 1.3 percent in April to a 4.65 million annual rate for only the second gain in the last nine months. And the key single-family component is also showing life, up 0.5 percent for the first gain of the year. Sales of condos, which have been much stronger than sales of single-family homes, jumped 7.3 percent in April.

In a positive for the outlook, supply is now rushing into the market, to 2.29 million units for a 16.8 percent increase from March. Supply at the monthly sales rate is sharply higher, to 5.9 months from March's 5.1 months. However, the year-on-year sales rate was down 6.8 percent in a comparison that points to moderation for home prices ahead.

Housing is headed back in the right direction but is still well below the recovery peak level of activity.

New home sales also made a comeback in April but homebuilders are still cautious about new construction in the single-family sector.

April did provide a spring lift to the housing sector at least compared to March, evident in the latest report on existing home sales and especially evident in April's 6.4 percent jump in new home sales to a higher-than-expected 433,000 annual rate. Also positive was an upward net revision of 11,000 to the two prior months. April did provide a spring lift to the housing sector at least compared to March, evident in the latest report on existing home sales and especially evident in April's 6.4 percent jump in new home sales to a higher-than-expected 433,000 annual rate. Also positive was an upward net revision of 11,000 to the two prior months.

But, unlike the existing home sales report that showed a sudden swelling in supply, supply on the new home side remains scarce and will remain a negative for sales. Supply was hardly changed on the month, at 192,000 units for sale, while supply at the current sales rate fell to 5.3 months from March's 5.6 months.

The new home market got an April bounce but against a very weak March. In context, April's 433,000 is the second weakest rate of the last seven months. Still, the gain is welcome and should give a slight boost to the housing outlook.

Manufacturing appears to be gaining momentum in May. Regional surveys are positive, and at the national level, Markit's PMI is pointing to improvement. Markit's flash reading on manufacturing for May was up noticeably, to 56.2 versus 55.4 in both the mid-month and final readings for April. Strong and sustaining growth in orders was a major highlight of the report, at 58.2 for new orders and at 55.9 for backlog orders. A negative, however, was lagging strength for the export orders which show only modest monthly growth at 51.5.

Output for Markit's U.S. sample remained very strong, at 59.6 versus 58.2 in final April. The April reading is noteworthy given the surprise and heavy decline in the manufacturing component of the April industrial production report.

This was a very positive report and confirms strength seen in earlier regional manufacturing reports from New York and Philadelphia. This past week's Kansas City Fed report for May gets added to this list.

Regional manufacturing activity continues to look positive in May. Regional manufacturing activity continues to look positive in May.

Kansas City Fed District manufacturing activity expanded solidly in May, and producers' expectations for future factory activity remained at healthy levels. Most price indexes increased somewhat, particularly current selling prices.

The month-over-month composite index was 10 in May, up from 7 in April and equal to 10 in March. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing activity improved slightly at most durable goods-producing plants, particularly for machinery and construction materials, but remained mostly flat for non-durable products. Other month-over-month indexes were mixed. The production index inched higher from 12 to 14, and the new orders and employment indexes also rose. In contrast, the shipments index fell from 14 to 5, and the order backlog and new orders for exports indexes also decreased. The raw materials inventory index increased from -1 to 11, and the finished goods inventory index also edged up.

Overall, it appears that momentum in the manufacturing sector is picking up in May.

With three consecutive healthy gains in the index of leading indicators, economic growth is likely to be stronger in the second quarter and later. With three consecutive healthy gains in the index of leading indicators, economic growth is likely to be stronger in the second quarter and later.

Growth in the index of leading economic indicators slowed in April to a still strong 0.4 percent from an upwardly revised and outsized gain of 1.0 percent in March. The Fed's near-zero rate policy, reflected in the yield-spread component, is once again the biggest positive followed this time, however, by very welcome strength out of the housing sector with a big surge in building permits.

The other eight components, however, were narrowly mixed with credit showing some strength and the factory workweek showing weakness.

Other readings include a slowing in the coincident index to plus 0.1 percent from plus 0.3 percent and a slowing in the lagging index to plus 0.2 percent from a very strong 0.7 percent in March.

The Fed's April 29-30 policy meeting had no surprises. The minutes released this past week focused on the path for normalizing monetary policy. This was seen as prudent planning. Participants spent a good deal of time debating its forward guidance as the Bank plans an exit from its easy monetary policy. According to the minutes, "a number" of officials wanted to give more information about how long the Fed will wait before it starts to reduce the size of its balance sheet.

The Fed is beginning to deal with how they will curtail their balance sheet. The minutes follow New York Fed president William Dudley's comments this past Tuesday for a change in exit strategy. Dudley said the Fed should keep its balance sheet steady until after it has first raised interest rates, a move currently expected in mid-2015. As head of the New York Fed, he carries significant influence on balance sheet issues—he oversees the New York Fed trading desk.

The meeting also gave more attention to how guidance should be used. Early communication was seen as providing clarity to markets and giving the Fed more credibility. Some participants want to give more information on how long the Fed should continue reinvestment of pay down on Fed assets.

Regarding the economy, the Fed expects a pickup in growth. First quarter softness was attributed as weather related.

The Fed sees inflation as remaining below goal (2 percent PCE inflation) for the next few years and slack in labor markets is expected to continue, indicating likely low policy rates. Risks to the forecast for real GDP growth were viewed as tilted a little to the downside, especially because the economy was not well positioned to withstand adverse shocks while the target for the federal funds rate was at its effective lower bound.

Overall, the minutes indicate that taper is still on but the level of the balance sheet will likely come down slowly. Also, policy rates are likely to rise slowly and it will take a few years for monetary policy to return to normal.

There are increased signs that the spring thaw continues and that economic growth will be stronger the rest of the year. Manufacturing may be retaking the lead for the recovery while housing—although at subdued levels—has turned modestly positive.

This week's highlight is Friday's personal income report. With consumer confidence oscillating and recent swings in income and spending due to adverse winter weather and subsequent catch up, the April report may be the first under normal conditions in several months. Manufacturing surveys have been positive recently and the durables report will get trader attention for this sector. Home sales rebounded somewhat in the latest releases and both Case-Shiller and FHFA home price reports will show if stronger sales are translating into higher prices and improvement in home equity.

U.S. Holiday: Memorial Day. Bond, Equity Markets Closed

Durable goods orders jumped 2.5 percent in March after a 2.6 percent boost the month before. Excluding transportation, March was still robust with a 2.1 percent advance, following a rise of 0.8 percent in February. The transportation component increased a monthly 3.4 percent after jumping 6.9 percent the month before. Within transportation, the gain was led by a sharp gain in nondefense aircraft orders with motor vehicle orders also positive. Defense aircraft orders fell after a large jump in February. Outside of transportation, orders were up on a widespread basis. All major components were positive. Numbers reflect revisions from the more recent total factory orders report.

New orders for durable goods Consensus Forecast for April 14: -0.8 percent

Range: -3.0 percent to +0.5 percent

New orders for durable goods, ex-trans., Consensus Forecast for April 14: -0.1 percent

Range: -0.6 percent to +1.0 percent

The FHFA purchase only house price index increased 0.6 percent in February on a seasonally adjusted basis, following a 0.3 percent gain the month before. Six of nine Census regions showed gains in the latest month while two declined and one was unchanged. The largest regional increase was in the South Atlantic Census Division with a 1.7 percent boost. The New England region decreased 2.5 percent. Atypically adverse weather may have been a factor in demand in this region. The year-on-year rate came in at 6.9 percent, following 7.2 percent in January.

FHFA purchase only house price index Consensus Forecast for March 14: +0.5 percent

Range: +0.2 to +0.7 percent

The S&P/Case-Shiller 20-city home price index (SA) in February gained 0.8 percent versus increases of 0.8 percent and 0.7 percent in January and December. The unadjusted rate came in unchanged as expected in February which is a seasonally slow month for home sales. However, year-on-year rates are coming down though slowly. Both the adjusted and unadjusted year-on-year rates were identical over the last four months: plus 12.9 percent in February versus 13.2 percent, 13.4 percent, and 13.7 percent in the three prior months (note that seasonal differences are muted in year-on-year comparisons in contrast to month-to-month comparisons where seasonal differences are heightened). Slowing price appreciation may be helping to boost sales.

The S&P/Case-Shiller 20-city HPI (SA, m/m) Consensus Forecast for March 14: +0.7 percent

Range: +0.2 to +1.1 percent

The S&P/Case-Shiller 20-city HPI (NSA, m/m) Consensus Forecast for March 14: +0.2 percent

Range: +0.1 to +0.2 percent

The S&P/Case-Shiller 20-city HPI (NSA, y/y) Consensus Forecast for March 14: +11.9 percent

Range: +11.6 to +12.9 percent

The Markit PMI services index ended April at 55.0, up from 54.2 in the mid-month flash reading and versus 55.3 in the final March reading. New business came in at 55.1, up 2.1 points from March. Business expectations are very strong and steady in Markit's sample, at 76.4. Despite the strength in both new business and the outlook for business, employment growth is not strong, at least yet. The employment index was not much over breakeven 50, at 51.2 and down from March's already soft 51.8.

Markit PMI services index (flash) Consensus Forecast for May 14: 55.4

Range: 54.0 to 56.2

The Conference Board's consumer confidence index eased in April but still remained over the key 80 level, at 82.3 in April versus March's upwardly revised 83.9. These readings are the highest of the recovery and follow five straight prior readings under 80. However, the present situation component fell under 80, to 78.3 and sizably below March's 82.5. The expectations component was steady and solid at 84.9 vs 84.8 in March. Those seeing more jobs opening up in the months ahead were up, to 15.0 percent vs March's 14.1 percent, as were those seeing their income going up, to 17.1 percent from 15.3 percent. Nevertheless, those seeing their own income falling rose to 12.9 percent from 11.5 percent.

Consumer confidence Consensus Forecast for May 14: 83.0

Range: 71.5 to 85.6

The Richmond Fed manufacturing index moved back into positive ground in April, at plus 7 versus minus 7 and minus 6 in the prior two months. New orders led the details, at plus 10 vs minus 9 in both March and February. Employment was also up, at plus 4 versus zero readings in the prior two months.

Richmond Fed manufacturing index Consensus Forecast for May 14: 9

Range: 4 to 10

The Dallas Fed general business activity index in its Texas manufacturing survey for April rose for a second consecutive month, increasing from 4.9 to 11.7. The company outlook index jumped nearly 15 points to a four-year high of 23.4, reflecting a sharp rise in optimism among manufacturers. The production index, a key measure of state manufacturing conditions, rose from 17.1 to 24.7, reaching its highest level in four years and indicating stronger output growth. The new orders index posted a four-year high, rising to 21.3.

Dallas Fed general business activity index Consensus Forecast for May 14: 9.6

Range: 9.0 to 16.0

GDP growth came to a standstill in the first quarter, largely due to adverse weather slowing production. First quarter GDP rose a meager 0.1 percent annualized after a 2.6 percent gain in the fourth quarter. Final sales of domestic demand gained 0.7 percent after a 2.7 percent boost in the fourth quarter. Final sales to domestic purchasers eased to 1.5 percent in the first quarter after a 1.6 percent increase the prior quarter. The overall price index posted at 1.3 percent annualized, following 1.6 percent in the fourth quarter. Core chain prices softened to a 1.3 percent rate from 1.9 percent in the prior quarter.

Real GDP Consensus Forecast for second estimate Q1 14: -0.5 percent annual rate

Range: -0.8 to +0.2 percent annual rate

GDP price index Consensus Forecast for second estimate Q1 14: +1.3 percent annual rate

Range: +1.3 to +1.4 percent annual rate

Initial jobless claims rose a sharp 28,000 in the May 17 week to a 326,000 level. The May 17 week is the sample week for the monthly employment report and a comparison with the sample week for the April employment report is not favorable. The weekly level of 326,000 is 21,000 higher from the April 12 week with the 4-week average more than 10,000 higher, at 322,500 vs 312,000.

Jobless Claims Consensus Forecast for 5/23/14: 317,000

Range: 315,000 to 325,000

The pending home sales index ended nine straight months of declines with a 3.4 percent surge in March. In another positive, February was revised upward by 3 tenths to minus 0.5 percent. March's gain was led by the West, at plus 5.7 percent, and by the largest region for existing home sales, the South, at plus 5.6 percent. The Northeast showed a small gain and the Midwest a small decline.

Pending home sales Consensus Forecast for April 14: +1.0 percent

Range: -0.5 to +4.2 percent

Personal income rose a healthy 0.5 percent in March after a 0.4 percent gain the month before. The consumer sector is improving with wages & salaries up a strong 0.6 percent after a rise of 0.3 percent in February. Spending was quite robust. PCEs gained 0.9 percent in March after a 0.5 percent boost the prior month. Spending is making a comeback after adverse weather in January and February. Inflation firmed a bit. PCE inflation rose 0.2 percent, following a 0.1 percent rise in February. Core inflation followed the same pattern with an increase of 0.2 percent, following a boost of 0.1 percent in February.

Personal income Consensus Forecast for April 14: +0.4 percent

Range: +0.2 to +0.6 percent

Personal consumption expenditures Consensus Forecast for April 14: +0.2 percent

Range: 0.0 to +0.5 percent

PCE price index Consensus Forecast for April 14: +0.2 percent

Range: +0.2 to +0.3 percent

Core PCE price index Consensus Forecast for April 14: +0.2 percent

Range: +0.2 to +0.2 percent

The Chicago PMI for April jumped to 63.0 from 55.9 in March to signal major acceleration in monthly growth for the Chicago economy. The report noted strong gains for new orders and backlog orders and a plus-70 reading for production. The report also notes solid expansion in employment. The report cites improved weather and improved consumer demand for the outsized gains, ones that point to strength for April's run of economic data.

Chicago PMI Consensus Forecast for May 14: 61.0

Range: 59.9 to 64.5

The Reuter's/University of Michigan's consumer sentiment index softened noticeably in mid-May, to 81.8 versus 84.1 in final April and 82.6 versus mid-month April. Weakness was split evenly between the composite's two components with expectations down 1.5 points from final April to 73.2 and with current conditions down to 95.1 which is 3.6 points below final April and which signals specific monthly weakness for the run of consumer data for May.

Consumer sentiment Consensus Forecast for final May 14: 82.5

Range: 81.0 to 84.0

R. Mark Rogers is the author of The Complete Idiot's Guide to Economic Indicators, Penguin Books.

He can also be found on a weekly broadcast talking about the U.S. economy, the easiest way to find him is by going to iTunes and searching for "Simply Economics."

Econoday Senior Writer Mark Pender contributed to this article.

|