|

We are finally getting past data impacted by adverse winter weather and the following rebound. And the latest numbers are showing improvement—providing lift to equities. But the latest employment data show that improved growth is still moderate.

At the start of the week, equities were mixed with the S&P and Dow Jones industrials closing at record levels. The ISM manufacturing report provided unexpected volatility to markets. After hours of confusion, the Institute for Supply Management officially corrected its initial report to show that the pace of growth in the US manufacturing sector accelerated in May instead slowing in the initial release. Stocks had moved lower after the ISM reported what turned out to be erroneous data. However, they rebounded in the afternoon once the corrected data on manufacturing showed the sector expanding at a faster pace in May than forecast. At the start of the week, equities were mixed with the S&P and Dow Jones industrials closing at record levels. The ISM manufacturing report provided unexpected volatility to markets. After hours of confusion, the Institute for Supply Management officially corrected its initial report to show that the pace of growth in the US manufacturing sector accelerated in May instead slowing in the initial release. Stocks had moved lower after the ISM reported what turned out to be erroneous data. However, they rebounded in the afternoon once the corrected data on manufacturing showed the sector expanding at a faster pace in May than forecast.

Equities were marginally down Tuesday as traders and investors were cautious after Monday's record highs for the Dow and S&P 500 and on waiting for Thursday's ECB policy announcement and Friday's employment report. At mid-week, stocks rose despite a somewhat disappointing ADP employment report. The ISM non-manufacturing index topped expectations while a widening international trade deficit for the U.S. suggested possible improvement in domestic demand. Equities were marginally down Tuesday as traders and investors were cautious after Monday's record highs for the Dow and S&P 500 and on waiting for Thursday's ECB policy announcement and Friday's employment report. At mid-week, stocks rose despite a somewhat disappointing ADP employment report. The ISM non-manufacturing index topped expectations while a widening international trade deficit for the U.S. suggested possible improvement in domestic demand.

Stocks advanced Thursday with the S&P hitting a record for the seventh time in eight sessions after the European Central Bank cut rates to record lows and pledged to do more if needed to fight off the risk of deflation. The ECB cut the deposit rate to minus 0.1 percent from zero, making the ECB the world's first major central bank to use a negative rate. The benchmark rate was lowered to 0.15 percent from 0.25 percent.

Although the Friday U.S. payroll gain was somewhat below expectations, traders were in a positive mood, lifting equities, as May's payroll total topped the pre-recession peak for the first time.

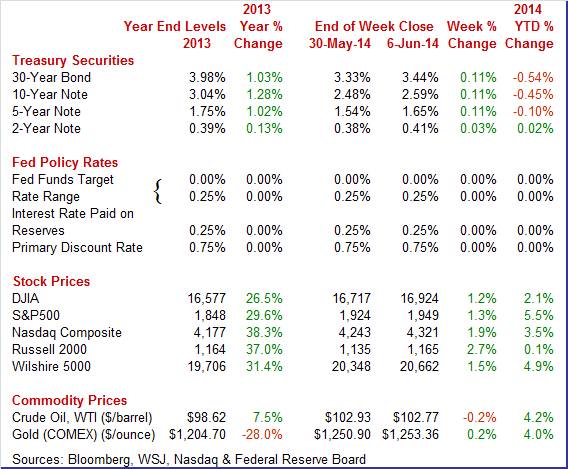

Equities were up this past week. The Dow was up 1.2 percent; the S&P 500, up 1.3 percent; the Nasdaq, up 1.9 percent; the Russell 2000, up 2.7 percent; and the Wilshire 5000, up 1.5 percent.

For the year-to-date, major indexes are up as follows: the Dow, up 2.1 percent; the S&P 500, up 5.5 percent; the Nasdaq, up 3.5 percent; the Russell 2000, up 0.1 percent; and the Wilshire 5000, up 4.9 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields rose notably this past week. The biggest moves were Monday and Tuesday. At the week's start, yields rose moderately on news of a measure of Chinese manufacturing hitting a five-month high and on a corrected ISM report showed manufacturing in May at its strongest growth this year. Treasury yields rose notably this past week. The biggest moves were Monday and Tuesday. At the week's start, yields rose moderately on news of a measure of Chinese manufacturing hitting a five-month high and on a corrected ISM report showed manufacturing in May at its strongest growth this year.

After no change Wednesday (no reaction to the Beige Book), rates nudged down after the ECB announced unprecedented policy measures to loosen monetary policy. Yields rose slightly Friday after the May jobs report which showed a moderate rise in payrolls and an unchanged unemployment rate at 6.3 percent.

For this past week Treasury rates were up as follows: the 2-year note, up 3 basis points; the 5-year note, up 11 basis points; the 7-year note, up 13 basis points; the 10-year note, up 11 basis points; and the 30-year bond, up 11 basis points. The 3-month T-bill was unchanged.

The spot price of West Texas Intermediate was virtually unchanged for the week. Daily changes were exceptionally small with no notable factors coming into play. But prices are still elevated due to relatively low inventories and a rise in refinery operating rates. The spot price of West Texas Intermediate was virtually unchanged for the week. Daily changes were exceptionally small with no notable factors coming into play. But prices are still elevated due to relatively low inventories and a rise in refinery operating rates.

Net for the week, the spot price for West Texas Intermediate edged down 16 cents per barrel to settle at $102.77.

This past week saw key updates for the consumer, manufacturing, and construction sectors. Data were mostly favorable.

Job growth moderated a bit in May, largely as expected. Total nonfarm payroll jobs advanced 217,000 in May after a 282,000 boost in April and a 203,000 increase in March. The net revision for the prior two months was down 6,000. Private jobs gained 216,000 after a 270,000 increase the prior month. Expectations were for 215,000. Job growth moderated a bit in May, largely as expected. Total nonfarm payroll jobs advanced 217,000 in May after a 282,000 boost in April and a 203,000 increase in March. The net revision for the prior two months was down 6,000. Private jobs gained 216,000 after a 270,000 increase the prior month. Expectations were for 215,000.

The unemployment rate held steady from 6.3 percent in April. Analysts expected 6.4 percent. The labor market in the establishment data rebounded 192,000, following a huge 806,000 drop in April. Civilian employment gained 145,000 in May after a 73,000 dip the month before. The labor force participation rate remains low, posting at an unchanged 62.8 percent, The under-employed rate, (so-called "U-6" by BLS) edged down to 12.2 percent in May from 12.3 percent the month before. This rates remains significantly elevated from the pre-recession low of 7.9 percent for December 2006.

Turning back to the payroll portion of the report, goods-producing jobs rose 18,000 in May after a jump of 46,000 in April. Construction increased 6,000 in May after a 34,000 surge the month before. Manufacturing rose 10,000 in May, following an increase of 4,000 in April.

Private service-providing jobs provided the bulk of May's job gains, increasing 198,000, following a 224,000 gain in April. Leading this component was professional & business services which rose 55,000 after a 71,000 jump in April. But it was not in temp help which slipped to a 14,000 rise after a 16,000 increase in April. In May, health care and social assistance added 55,000 jobs. Moderate strength was seen in trade & transportation and also in leisure & hospitality. Private service-providing jobs provided the bulk of May's job gains, increasing 198,000, following a 224,000 gain in April. Leading this component was professional & business services which rose 55,000 after a 71,000 jump in April. But it was not in temp help which slipped to a 14,000 rise after a 16,000 increase in April. In May, health care and social assistance added 55,000 jobs. Moderate strength was seen in trade & transportation and also in leisure & hospitality.

Government jobs edged up 1,000 after a boost of 12,000 in April.

Average weekly hours were unchanged at 34.5 hours. Average hourly earnings improved to a rise of 0.2 percent from flat in April.

Looking ahead to the personal income report from the payroll survey, private aggregate weekly earnings rose 0.4 percent in May pointing to a moderate rise in private wages & salaries. Production worker hours in manufacturing were up a sharp 0.8 percent for the month, suggesting a sizeable gain in the manufacturing component for May industrial production.

Overall, the job market can be called moderate at best and possibly still sluggish. Despite the 6.3 percent unemployment rate, the latest report likely will not inspire the Fed to accelerate taper or its schedule for policy rates.

The first hard indication on consumer strength in May is very good as unit vehicle sales rose 4.6 percent to a 16.8 million annual rate that was well beyond the high-end of the Econoday consensus for 16.3 million. May's rate was the highest of the recovery, since July 2006. Sales of domestic-made vehicles rose 3.9 percent to a 13.3 million rate which was the highest since January 2006. Foreign-made sales rose 6.3 percent to a 3.4 million rate that was last matched in March. The data point to solid strength for the motor vehicle component of the government's retail sales report for May. This is favorable for second quarter GDP. The first hard indication on consumer strength in May is very good as unit vehicle sales rose 4.6 percent to a 16.8 million annual rate that was well beyond the high-end of the Econoday consensus for 16.3 million. May's rate was the highest of the recovery, since July 2006. Sales of domestic-made vehicles rose 3.9 percent to a 13.3 million rate which was the highest since January 2006. Foreign-made sales rose 6.3 percent to a 3.4 million rate that was last matched in March. The data point to solid strength for the motor vehicle component of the government's retail sales report for May. This is favorable for second quarter GDP.

The manufacturing sector appears to be regaining more momentum. Production worker hours are up in May and the latest national surveys on manufacturing indicate improvement in growth.

Markit's final manufacturing reading for May, at 56.4, was 2 tenths higher than the mid-month reading. The final reading for April was 55.4.

Order readings were very strong, led by 58.8 for new orders and including 56.0 for backlog orders. Growth in new export orders was lagging but improved, at a plus 50 reading of 52.2 for a 5 tenths gain from April. This export orders number likely reflects a still sluggish economy in Europe. Output showed the greatest monthly growth of any reading, at 59.6 for a sizable 1.4 point gain. This was a very positive report, one pointing to extending strength for the manufacturing economy through the summer. Order readings were very strong, led by 58.8 for new orders and including 56.0 for backlog orders. Growth in new export orders was lagging but improved, at a plus 50 reading of 52.2 for a 5 tenths gain from April. This export orders number likely reflects a still sluggish economy in Europe. Output showed the greatest monthly growth of any reading, at 59.6 for a sizable 1.4 point gain. This was a very positive report, one pointing to extending strength for the manufacturing economy through the summer.

Turning the ISM report, traders were left scratching their heads over initially released numbers and later corrected data. Initially, the composite was reported as down but later in the morning revised to up. The ISM corrected its PMI to 55.4 in May from an originally reported 53.2. April posted at 54.9. The correction, which was tied to seasonal adjustment calculations, turned the original report upside down, from sizable deceleration in monthly growth to slight acceleration in monthly growth.

Those components that are seasonally adjusted -- new orders, production, employment, supplier deliveries -- eventually showed greater rates of monthly growth than the original report.

New orders are at a very solid 56.9, well up from 55.1 in April which points to acceleration ahead for composite activity this summer. Production, up 5.3 points from April, is now especially strong at 61.0 for the best reading of the year, while employment, at 52.8, is still on the soft side but less so than the original report. Supplier deliveries show less improvement than the initial report which again is a sign of greater strength in activity than originally reported.

Both Markit and ISM survey indicate that the manufacturing sector is improving.

The trade deficit in April widened much worse than expected, partly due to annual revisions. The trade gap grew to $47.2 billion from $44.2 billion in March. Exports slipped 0.2 percent in April after a 2.0 percent jump the month before. Imports expanded 1.2 percent, following a 3.1 percent surge the month before. The trade deficit in April widened much worse than expected, partly due to annual revisions. The trade gap grew to $47.2 billion from $44.2 billion in March. Exports slipped 0.2 percent in April after a 2.0 percent jump the month before. Imports expanded 1.2 percent, following a 3.1 percent surge the month before.

The widening of the trade deficit was led by goods excluding petroleum which had a gap that posted at $46.8 billion in April versus $42.2 billion the prior month. The petroleum shortfall actually shrank somewhat-to $18.0 billion from $19.0 billion. The service surplus grew to $18.6 billion from $18.3 billion.

Trade by country now is seasonally adjusted: China posted minus $28 billion after minus $26.3 billion in March. Japan came in at minus $5.3 billion after minus $5.7 billion, and OPEC minus $5.5 billion after minus $5.9 billion. The April trade with the European Union hit a new low of minus $13.1 billion, following minus $11.2 billion, largely reflecting imports from Germany. Trade by country now is seasonally adjusted: China posted minus $28 billion after minus $26.3 billion in March. Japan came in at minus $5.3 billion after minus $5.7 billion, and OPEC minus $5.5 billion after minus $5.9 billion. The April trade with the European Union hit a new low of minus $13.1 billion, following minus $11.2 billion, largely reflecting imports from Germany.

The report likely bumped down estimates for second quarter GDP and probably put the first quarter further into negative territory. However, stronger imports suggest that demand in the U.S. may be picking up.

Growth in the nation's service sector accelerated strongly in May based on Markit's business activity index which finished the month far over 50 at 58.1 versus 58.4 at mid-month and versus 55.0 in final the reading for April. This was the highest reading since March of last year. New business showed strong acceleration, at 58.7 in May versus April's 55.1, while outstanding business moved out of contraction to 52.4 versus 47.4 in April. Business expectations were especially bright, at 79.3 for a 2.9 point gain. Less bright, unfortunately, was employment which is not much over 50 at 52.8. Still, employment in May shows better growth than April's 51.2.

Turning to the ISM non-manufacturing report, growth in the bulk of the nation's economy is very strong but the strength is not leading to new hiring—similar to Markit's report. The ISM composite index rose to 56.3 versus April's 55.2. Business activity was exceptionally strong in the ISM report, at 62.1 for a 1.3 point gain as were new orders at 60.5 for a 2.3 point gain. Backlog orders were also strong, moving out of contraction with a 5.0 point gain to 54.0 versus April's 49.0. Growth in employment, however, lagged behind, at 52.4 though up from April's 51.3. Turning to the ISM non-manufacturing report, growth in the bulk of the nation's economy is very strong but the strength is not leading to new hiring—similar to Markit's report. The ISM composite index rose to 56.3 versus April's 55.2. Business activity was exceptionally strong in the ISM report, at 62.1 for a 1.3 point gain as were new orders at 60.5 for a 2.3 point gain. Backlog orders were also strong, moving out of contraction with a 5.0 point gain to 54.0 versus April's 49.0. Growth in employment, however, lagged behind, at 52.4 though up from April's 51.3.

Overall, the manufacturing sector is gaining strength—at a moderate pace—and should support improvement in second quarter GDP.

Construction outlays advanced in April but fell short of expectations. Outlays gained 0.2 percent after a 0.6 percent boost in March. Analysts expected a 0.7 percent increase for April. Construction outlays advanced in April but fell short of expectations. Outlays gained 0.2 percent after a 0.6 percent boost in March. Analysts expected a 0.7 percent increase for April.

The latest gain was led by a 0.8 percent rise in public outlays, following a 0.3 percent increase the month before. Private residential spending edged up 0.1 percent after a 1.5 percent spike in March. Strength was in both new one-family outlays and especially multifamily outlays. Weakness was in the excluding new homes category which fell after a healthy March.

On a year-ago basis, total outlays were up 8.6 percent after a 9.5 percent increase the prior month.

Despite the shortfall of expectations, construction is still on an upward trend, although a modest one. The latest data still point to an improvement in second quarter GDP growth.

According to the latest Beige Book, the Fed found that the economy continued to expand along with an ongoing improvement in the labor market. The Fed reported that consumer spending and manufacturing expanded throughout the 12 Federal Reserve Districts. The Federal Reserve Bank of New York prepared the report. It reported that there was a generalized increase in bank lending, coupled with an increase in loan demand in two thirds of the districts.

The pace of growth was characterized as "moderate" in seven districts including Boston, New York, Richmond, Chicago, Minneapolis, Dallas, and San Francisco and "modest" growth in the remaining five.

According to the Beige Book, "consumer spending expanded across almost all Districts, to varying degrees. Non-auto retail sales grew at a moderate pace across most of the country: Although improved weather generally gave a boost to business, lingering wintry weather in the Northeast continued to weigh on sales in parts of the Boston and New York Districts. Increasingly strong new vehicle sales were reported by more than half the Districts, with most other regions seeing steady sales."

Transportation activity strengthened in most Districts reporting on that sector, with Richmond and Atlanta observing brisk growth in port activity. Cleveland noted a rebound from weather-related weakness earlier. "Manufacturing activity expanded throughout the nation, and at an increasingly strong pace in a number of Districts -- notably along the East Coast, as well as in the St. Louis and Kansas City Districts."

Regarding housing, the Beige Book reported that residential real estate activity was mixed with some reports of low inventories constraining sales especially in the Boston, New York and Kansas City Districts. "Still, home prices continued to increase across most of the country, while the markets for both condos and apartment rentals were mostly robust. Residential construction activity was mixed, with half the Districts reporting increases but a few indicating some weakening in activity; multi-family construction remained particularly robust. Both non-residential construction activity and commercial real estate markets were generally steady to stronger since the last report."

According to Beige Book contacts, labor market conditions generally strengthened in the latest reporting period, with hiring activity steady to stronger across most of the country and with several Districts reporting shortages of skilled workers. In most Districts, wage increases have remained generally subdued.

The Beige Book essentially shows that the economy is close to the Fed's expectations. This report likely leaves plans for taper and later rate increases on track as currently expected.

The spring thaw is largely over and the news is generally favorable. The consumer, manufacturing, and construction sectors are on uptrends, albeit moderate.

The focus this week is on the consumer. Last week showed moderation in employment gains and the question is whether the consumer will continue the spring thaw in spending. Motor vehicle sales are up strongly for May but will other components in retail sales follow' Consumer confidence has been stalling and we get an early reading for consumer sentiment for June this week.

The NFIB Small Business Optimism Index for April rose a sizable 1.8 points to 95.2 for the best level of the recovery, since 2007. Gains were broad with 7 components up, 1 unchanged, and 2 down. Hiring was up for a 7th month in a row for the longest winning streak since 2006. Unfilled jobs were also up as are sales which are at their best level since 2012.

NFIB Small Business Optimism Index Consensus Forecast for May 14: 95.5

Range: 95.0 to 96.5

The Labor Department's Job Openings and Labor Turnover Survey reported that there were 4.014 million job openings on the last business day of March, down from February at 4.125 million. The hires rate (3.4 percent) and separations rate (3.2 percent) were unchanged in March. There were 4.625 million hires in March, compared to 4.699 million in February. There were 4.431 million total separations in March, little changed from February at 4.459 million.

JOLTS job openings Consensus Forecast for April 14: 4.025 million

Range: 4.020 million to 4.100 million

The U.S. Treasury monthly budget report posted a large $106.9 billion surplus in the month of April, pulling down the year-to-date deficit, 8 months into the fiscal year, to $305.8 billion for a dramatic 37 percent improvement from this time last year. Corporate tax receipts were up 15.0 percent year-to-date with individual tax receipts, a much larger component, up 3.6 percent year-to-date. Spending was down 2.4 percent year-to-date led by declines in defense spending and net interest payments. Looking ahead, the month of May typically shows a deficit for the month. Over the past 10 years, the average deficit for the month of May has been $102.2 billion and $129.3 billion over the past 5 years. The May 2013 deficit came in at $138.7 billion.

Treasury Statement Consensus Forecast for May 14: -$139.0 billion

Range: -$155.0 billion to -$131.0 billion.

Initial jobless claims edged higher in the May 31 week, up 8,000 to 312,000, but the trend still points to improvement. The 4-week average was down 2,250 to a new recovery low of 310,250 which was down about 10,000 from the month-ago trend. Continuing claims, in lagging data for the May 24 week, continued to move lower, down 20,000 to 2.603 million and a new recovery low. The 4-week average, also at a recovery low, was down 18,000 to 2.635 million.

Jobless Claims Consensus Forecast for 6/7/14: 309,000

Range: 300,000 to 340,000

Retail sales were soft in April and below expectations. But April followed two strong months—including an upwardly revised March. Retail sales edged up 0.1 percent, following a 1.5 percent jump in March (previously 1.2 percent including annual revisions) and a 0.9 percent increase in February. The revised March gain was the biggest since March 2010. Excluding motor vehicles, sales were flat after a 1.0 percent boost in March. Gasoline sales were up notably in April. Excluding autos and gasoline, retail sales slipped 0.1 percent after spiking 1.4 percent in March. Forecasts were for 0.5 percent.

Within the core, there were some bright spots. Department store sales jumped 1.8 percent with strength also seen in clothing & accessories, and health & personal care. A moderate rise in building materials & garden equipment is encouraging for housing after a large boost in March. Weakness was led by declines in electronics & appliance stores and miscellaneous store retailers.

More recently, motor vehicle sales jumped 4.6 percent in May, suggesting a strong headline number for retail sales.

Retail sales Consensus Forecast for May 14: +0.6 percent

Range: +0.2 to +0.9 percent

Retail sales excluding motor vehicles Consensus Forecast for May 14: +0.4 percent

Range: -0.4 to +0.6 percent

Less motor vehicles & gasoline Consensus Forecast for May 14: +0.5 percent

Range: +0.3 to +0.6 percent

Import prices eased back in April after having shown some rare strength in March. Import prices fell 0.4 percent to reverse the prior month's revised gain of 0.4 percent. Export prices fell 1.0 percent to reverse March's revised jump of 1.0 percent. On the import side, petroleum products and petroleum-based products swept lower with petroleum down 0.7 percent and industrial supplies down 1.0 percent. Industrial supplies also pulled back prices on the export side, down 3.4 percent and offsetting a strong gain of 1.4 percent for agricultural products. Year-on-year rates in total are in the deflationary column for imported prices, at minus 0.3 percent, with exports nearly flat at plus 0.1 percent. These rates, however, have been trending higher in recent months but not by much.

Import prices Consensus Forecast for May 14: +0.2 percent

Range: -0.1 to +0.4 percent

Export prices Consensus Forecast for May 14: +0.2 percent

Range: -0.1 to +0.4 percent

Business inventories rose 0.4 in March versus a strong 1.0 percent rise in sales, a very favorable combination that kept the inventory-to-sales ratio unchanged at 1.30. Details among the components were very positive with wholesalers a special highlight, showing a dip in their inventory-to-sales ratio despite an enormous 1.1 percent jump in inventories which was offset by an even larger 1.4 percent rise in sales. Destocking during March among retailers, whose inventory-to-sales ratio dipped, was another big positive given the disappointing retail sales report for April.

Business inventories Consensus Forecast for April 14: +0.4 percent

Range: +0.3 to +0.7 percent

The producer price index for final demand jumped 0.6 percent in April, following a 0.5 percent boost the month before. The April increase was the largest gain since September 2012. Total final demand excluding food & energy gained 0.5 percent, following an increase of 0.6 percent in March. Total final demand excluding food, energy, and trade services increased 0.3 percent, matching the pace in March. A big part of the jump in overall final demand was the food component which spiked a monthly 2.7 percent, following a rise of 1.1 percent in March. Energy was subdued with a 0.1 percent rise in April, following a 1.2 percent drop the month before. Also, light motor trucks rebounded 1.4 percent, following a 0.4 percent dip the month before.

PPI-FD Consensus Forecast for May 14: +0.1 percent

Range: -0.1 to +0.2 percent

PPI-FD ex Food & Energy Consensus Forecast for May 14: +0.1 percent

Range: -0.2 to +0.2 percent

The Reuter's/University of Michigan's consumer sentiment index took a pause in May, at 81.9 versus a mid-month reading of 81.8 and down from April's very solid 84.1. Weakness in the latest month was centered in current conditions, down 4.2 points to 94.5 which is not a good omen for the run of May's consumer data. But expectations, which pivot on the jobs and income outlook, were more resilient, down only 1.0 point to 73.7. Inflation expectations, which often rise in the summer as gasoline prices go up, are up 1 tenth from April for both the one-year outlook, at 3.3 percent, and the five-year outlook at 2.8 percent.

Consumer sentiment Consensus Forecast for preliminary June 14: 83.0

Range: 80.0 to 85.0

R. Mark Rogers is the author of The Complete Idiot's Guide to Economic Indicators, Penguin Books.

He can also be found on a weekly broadcast talking about the U.S. economy, the easiest way to find him is by going to iTunes and searching for "Simply Economics."

Econoday Senior Writer Mark Pender contributed to this article.

|