|

This week showed mixed numbers—especially for housing. Sales were up but prices were soft. And the first quarter GDP growth rate was revised down sharply—but it was written off by traders as old news and just weather related. The big question is where the recovery is headed. Manufacturing and the consumer sectors have decent momentum. The latest housing data leave more questions than answers.

Stocks were mixed with Blue Chips down, techs and small caps up. Stocks were mixed with Blue Chips down, techs and small caps up.

At the start of the week, stocks were little changed after a healthy Markit PMI for manufacturing report and a surprisingly strong surge in existing home sales. Offsetting were trader worries about equities being at all-time highs for some indexes and also geopolitical concerns—Ukraine, Iraq, and Syria. On Tuesday, stocks retreated after early gains based on a combination of reports showing stronger new home sales and a rebound in consumer confidence. However, news reports of an escalation in hostilities in Iraq triggered a late afternoon selloff.

At mid-week, investors ignored the surprisingly steep downward revision to first quarter growth as just a weather issue. Headline durables orders disappointed but traders focused on positive detail for capital spending—indicating that businesses are somewhat upbeat. The Fed came into play Thursday with comments by St. Louis Fed president James dumping on equities. He stated that higher interest rates may happen sooner than thought. Trading was thin as many watched the U.S. versus Germany soccer (football if you are anywhere but the U.S.) match. At mid-week, investors ignored the surprisingly steep downward revision to first quarter growth as just a weather issue. Headline durables orders disappointed but traders focused on positive detail for capital spending—indicating that businesses are somewhat upbeat. The Fed came into play Thursday with comments by St. Louis Fed president James dumping on equities. He stated that higher interest rates may happen sooner than thought. Trading was thin as many watched the U.S. versus Germany soccer (football if you are anywhere but the U.S.) match.

Equities mostly headed up Friday as consumer sentiment was healthier than expected.

The Russell index included an annual rebalancing this past Friday.

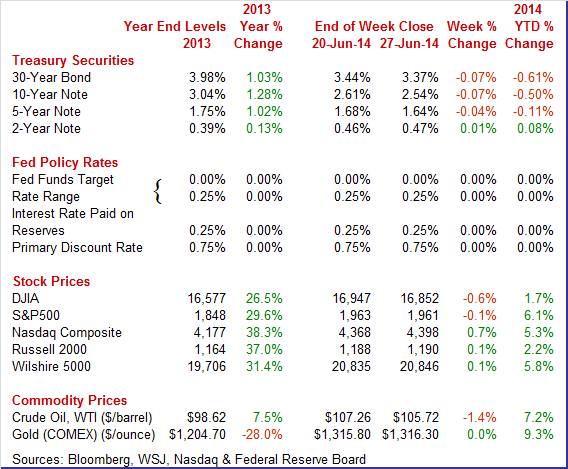

Equities were mixed this past week. The Dow was down 0.6 percent; the S&P 500, down 0.1 percent; the Nasdaq, up 0.7 percent; the Russell 2000, up 0.1 percent; and the Wilshire 5000, up 0.1 percent.

For the year-to-date, major indexes are up as follows: the Dow, up 1.7 percent; the S&P 500, up 6.1 percent; the Nasdaq, up 5.3 percent; the Russell 2000, up 2.2 percent; and the Wilshire 5000, up 5.8 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury rates mostly eased this past week—though moderately. The notably daily swings were Tuesday and Thursday. Treasury rates mostly eased this past week—though moderately. The notably daily swings were Tuesday and Thursday.

Yields dipped Tuesday on flight to safety. Traders were concerned that turmoil in the Middle East is growing. Geopolitical issues are at the forefront rather than Fed policy. Rates fell despite hawkish comments from Philly Fed president Charles Plosser. Yes, bond traders think differently than equities traders.

Thursday, Treasury rates dipped as weak PCE spending more than offset favorable jobless claims.

For this past week Treasury rates were mostly down as follows: the 5-year note, down 4 basis points; the 7-year note, down 6 basis points; the 10-year note, down 7 basis points; and the 30-year bond, down 7 basis points. The 3-month T-bill and the 2-year note nudged up 1 basis point.

The spot price of West Texas Intermediate showed little daily change except for Monday. Crude fell a little more than $1-1/2 Monday as traders viewed Islamist militant gains in Iraq as threatening global economic growth—reduced oil supplies cutting into growth. This was especially a concern for Europe where growth is questionable. The spot price of West Texas Intermediate showed little daily change except for Monday. Crude fell a little more than $1-1/2 Monday as traders viewed Islamist militant gains in Iraq as threatening global economic growth—reduced oil supplies cutting into growth. This was especially a concern for Europe where growth is questionable.

Net for the week, the spot price for West Texas Intermediate declined $1.54 per barrel to settle at $105.72.

The first quarter was harder hit by adverse weather than earlier believed but more recent data show moderately healthy growth.

Real GDP really surprised on the downside for the third estimate for Q1. Adverse winter weather had a huge impact as the first quarter fell a revised 2.9 percent after rising an annualized 2.6 percent in the fourth quarter. The latest number was significantly below market expectations for a 1.8 percent decline. The second estimate was a "mere" minus 1.0 percent annualized.

The first quarter number was the weakest since minus 5.4 percent for the first quarter of 2009.

A huge hit came in the consumer sector as PCEs growth was revised down to 1.0 percent from the second estimate of 3.1 percent. Consumers were hindered from shopping due to severe winter weather. Net exports were lowered sharply to minus $441.1 billion versus the prior estimate of minus $418.9 billion.

The good news is that weakness was largely in inventory investment as change in inventories posted at $45.9 billion, compared to $111.7 billion in the fourth quarter.

Final sales of domestic product declined an annualized 1.3 percent after growing 2.7 percent in the prior quarter. Final sales to domestic purchasers edged up 0.3 percent in the first quarter, compared to 1.6 percent in the fourth quarter.

On the price front, the chain-weighted price index posted at 1.3 percent annualized, down from 1.6 percent in the fourth quarter. The latest number matched expectations. The core chain index eased to 1.2 percent in the first quarter from the reading of 1.9 percent in the fourth quarter.

Overall, most economists and Fed officials are writing off the first quarter as an aberration. The second quarter monthly data are looking moderately positive for the consumer and manufacturing. And housing is posting mixed data as opposed to earlier flat data.

Personal income for May came in moderately healthy but spending was sluggish. Inflation remained below Fed goal but moved closer. Personal income for May came in moderately healthy but spending was sluggish. Inflation remained below Fed goal but moved closer.

Personal income rose 0.4 percent in May, following a 0.3 percent advance the month before. Expectations were for a 0.4 percent boost. The important wages & salaries component increased 0.4 percent after a 0.3 percent gain in April.

Personal consumption posted a sluggish 0.2 percent rise in May versus no change the month before. For May, sluggishness was in services which edged up only 0.1 percent after a 0.1 percent rise in April. Durables-reflecting auto sales-rebounded 0.7 percent, following a 0.9 percent drop in April. Nondurables rose a soft 0.2 percent after a 0.4 percent boost in April.

PCE inflation came in at a monthly 0.2 percent for both May and April and coming in a little below expectations of 0.3 percent. Core PCE inflation monthly numbers were the same as headline for May and April.

On a year ago basis, headline inflation was 1.8 percent in May versus 1.6 percent the month before. Core inflation on a year-ago basis firmed to 1.5 percent from 1.4 percent in April.

The latest report was mixed. Income looked good while spending was sluggish. Economists likely will be shaving their forecast for second quarter GDP. Also, inflation is moving closer to the Fed's goal of 2 percent year-on-year. Hawks likely will start talking about moving up when the first fed funds rate hike should be. But Fed doves will point to soft spending. Taper scheduling likely will be unchanged to keep markets settled. But the timing of the next fed funds rate change is becoming more of a question mark.

While the recovery remains soft, consumers apparently see forward momentum—and that is positive in their view. Also, the labor market is somewhat improved—also adding to consumer confidence. While the recovery remains soft, consumers apparently see forward momentum—and that is positive in their view. Also, the labor market is somewhat improved—also adding to consumer confidence.

Consumer confidence is moving steadily to new recovery highs, to 85.2 in June vs a revised 82.2 in May. This is the fourth straight month that the index is over the 80 barrier, above which indicates that optimists are out ahead of pessimists.

June's gain was centered in the present situation component which is at a recovery best of 85.1 for a 4.8 point gain from May. This June-to-May comparison points to strength for the run of June's consumer-sector data.

Turning to the Reuters/University of Michigan index, consumer sentiment edged higher the last two weeks in June, coming in at a final 82.5 for June versus a mid-month reading of 81.2 and versus a final May reading of 81.9. The current conditions component rose to 96.6 compare to a final May reading of 94.5 for a 2.1 point gain that points to monthly strength for the consumer sector during June. The expectations component held little changed, at 73.5.

Housing "may" be on a comeback based on May data—excuse the pun. Housing "may" be on a comeback based on May data—excuse the pun.

Existing home sales jumped 4.9 percent in May on top of April's 1.5 percent gain. This was the first back-to-back gain for this series going all the back to April and May of last year. May's annual rate of 4.89 million was plus 5.1 percent on a year-ago basis versus a minus 5.0 percent rate for April.

In a special plus, sales strength was centered completely in the key single-family component which had been lagging in prior months. Single-family sales rose 5.7 percent to a 4.30 million annual rate. The condo component, which has shown respectable life in prior months, showed no change in May at a 0.59 million rate.

Tight supply and rising prices did not hold back sales in May. Supply at the current sales rate fell to 5.6 months from 5.7 months.

By region, the South over the past year has been the leading sales region, down only 0.5 percent. The weakest has been the West, down a year-on-year 11.4 percent. But for May, all regions show monthly gains led by the Midwest at 8.7 percent and followed by the South at 5.7 percent.

New home sales in May surged a monthly 18.6 percent to a 504,000 annual rate that was far beyond expectations. The gain is led by the two biggest regions for new home sales, the South, up 14.2 percent in the month, and the West, up a very sizable 34.0 percent. New home sales in May surged a monthly 18.6 percent to a 504,000 annual rate that was far beyond expectations. The gain is led by the two biggest regions for new home sales, the South, up 14.2 percent in the month, and the West, up a very sizable 34.0 percent.

New homes on the market were unchanged in May at 189,000 but the surge in sales lowered supply relative to sales, to 4.5 months vs 5.3 months back in April.

The housing sector appears to have jumped back to life coming out of the cold winter.

Home price gains appear to have lost steam in April. According to the FHFA, home prices were unchanged in April, following a gain of 0.7 percent the prior month. Expectations were for 0.5 percent. Home price gains appear to have lost steam in April. According to the FHFA, home prices were unchanged in April, following a gain of 0.7 percent the prior month. Expectations were for 0.5 percent.

By Census region, prices were divided in the latest month with five of nine Census regions showing price increases in April and four declining. Advances were led by the East South Central region, up 0.6 percent. The largest decline was 0.8 percent for the West South Central.

The year-on-year rate for April came in at 5.9 percent, following 6.4 percent in March.

Turning to the latest Case-Shiller report, home-price growth slowed very sharply in April, to only plus 0.2 percent seasonally adjusted from plus 1.2 percent in March. A change of this degree is unusual for Case Shiller's data which are smoothed by a three-month moving average. The average aside, April's monthly change was no doubt deeply in the negative column as the average would not have been pulled down so much unless the April actual was so weak—perhaps even negative. Turning to the latest Case-Shiller report, home-price growth slowed very sharply in April, to only plus 0.2 percent seasonally adjusted from plus 1.2 percent in March. A change of this degree is unusual for Case Shiller's data which are smoothed by a three-month moving average. The average aside, April's monthly change was no doubt deeply in the negative column as the average would not have been pulled down so much unless the April actual was so weak—perhaps even negative.

The adjusted year-on-year rate slowed to 10.8 percent, down from 12.3 percent in March and slightly higher readings in the preceding months.

The FHFA home price report also confirmed that home-price growth hit a soft spot in April, which is the beginning of the home-buying season. Home prices have been strong especially relative to sales, but recent reports do mark a shift downward from trend.

For manufacturing, what data do you believe' Durables orders are volatile. That likely is the biggest, latest story. Averages can be a good idea. For manufacturing, what data do you believe' Durables orders are volatile. That likely is the biggest, latest story. Averages can be a good idea.

Durables orders were much weaker than expected for May. Durables orders fell 1.0 percent in May after rising 0.8 percent in April. Excluding transportation, orders slipped 0.1 percent, following a 0.4 percent gain in April.

Transportation fell 3.0 percent after a 1.7 percent rise in April. The latest dip was from weakness in nondefense aircraft. Motor vehicles and defense aircraft orders rose.

Outside of transportation, gains were seen in primary metals, fabricated metals, and "other." Declines were posted for machinery, computers & electronics, and electrical equipment.

On a positive note, there was improvement in equipment investment. Nondefense capital goods orders excluding aircraft rebounded 0.7 percent in May after decreasing 1.1 percent the month before. Shipments of this series rebounded 0.4 percent after a 0.4 percent dip in April. Shipments numbers (on average) suggest a strong equipment component for second quarter GDP.

The latest durables report is in contrast to recently positive regional manufacturing surveys and also the sharp jump in manufacturing production worker hours of 0.8 percent for May. But durables data are very volatile and we likely need a couple of more months of data before taking a negative tone on this sector.

Indeed, the latest national data on manufacturing show improvement for June.

Factories are heating up as are perhaps costs for raw materials, with the latest evidence coming from Markit's flash PMI which was at 57.5 for June versus 56.4 in final May and 56.2 for the May flash.

June's flash report was led by new orders, at a very strong 61.7 for a 2.9 point acceleration from final May. Backlog orders are up 9 tenths to 56.9 which is particularly strong for this reading. These order readings point in the months ahead to a rising rate of output which is already very strong at 61.0 for a 1.4 point rise.

Inflationary pressures have been popping up in some economic data. Input prices in this report were up 6 tenths to 57.0, still only a moderate rate of monthly gain for this reading. There was only very slight pressure on output prices, up 1.6 points to 52.0.

Activity may be slowing in June in the Richmond Fed's manufacturing district but not new orders. The headline index slowed 4 points to a reading of 3 with shipments and employment both slowing significantly. But the pace of new orders actually improved slightly, up 1 point to 4. The Richmond Fed has been showing less of a post-winter bounce than other regional reports, especially Empire State and Philly Fed. Activity may be slowing in June in the Richmond Fed's manufacturing district but not new orders. The headline index slowed 4 points to a reading of 3 with shipments and employment both slowing significantly. But the pace of new orders actually improved slightly, up 1 point to 4. The Richmond Fed has been showing less of a post-winter bounce than other regional reports, especially Empire State and Philly Fed.

In the Kansas City Fed District, manufacturing activity slowed somewhat in June, while producers' expectations for future factory activity showed little change and remained at solid levels. Firms noted some difficulty finding skilled workers, especially for welders, engineers, and machinists. Most price indexes decreased moderately after several months. In the Kansas City Fed District, manufacturing activity slowed somewhat in June, while producers' expectations for future factory activity showed little change and remained at solid levels. Firms noted some difficulty finding skilled workers, especially for welders, engineers, and machinists. Most price indexes decreased moderately after several months.

The month-over-month composite index was 6 in June, down from 10 in May and 7 in April. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Most other month-over-month indexes were mixed. The production index dropped from 14 to 2, and the new orders, employment, and new orders for exports indexes also declined.

The post-winter bounce is giving a major lift to Markit's service-sector sample where readings are at or near their best levels in the 5-year history of the report. The headline business activity index, at 61.2, is up 2.8 points from May's flash reading and is up 3.1 points from final May. The plus-60 reading indicates very sharp monthly growth. The index has risen 7.9 points from its winter low in February. New business, perhaps the most important reading of all in the report, is up 2.9 points from final May to 61.6 which points to general strength ahead. Employment is also on the rise, up 2.6 points to a respectable 55.4.

Manufacturing seems to be gaining and the consumer appears to not be looking at the rear view mirror at the recent recession any more. Housing is a big question mark. Why are sales up but not prices' Guestimation points to a fear factor of potentially rising mortgage rates and homebuyers trying to beat rate increases. While the job market is slowly improving, it does not yet provide the fundamentals for sustained growth in housing. Essentially, the recent improvement in housing sales could prove to be temporary. For now, count on manufacturing and a slowly improving consumer sector. Wait for more data on housing.

This week's holiday abbreviated schedule's highlight is Thursday's (yes, Thursday's) employment report. Some at the Fed are arguing that the labor market is getting closer to goal and that policy rates may rise earlier than predicted. It will be a data battle—unemployment rate versus participation rate versus payroll job growth. Manufacturing has shown improvement overall and this week's numbers include Markit PMI and ISM manufacturing index. Finally, consumer mood readings have improved. Will that show up in June motor vehicle sales'

The Chicago PMI for May posted very strong with the composite index far over breakeven 50 at 65.5 versus 63.0 in April. Details are not provided to the public, but the report did note that order data were strong though employment growth slowed.

Chicago PMI Consensus Forecast for June 14: 64.0

Range: 61.0 to 66.5

The pending home sales index rose 0.4 percent in April, building slightly on top of March's 3.4 percent surge and offering a positive indication for final sales of existing homes. April's gain was narrow however, centered almost entirely in the Midwest where contract signings rose 5.0 percent. Both the South and West, two very closely followed regions, fell slightly in the month.

Pending home sales Consensus Forecast for May 14: +1.0 percent

Range: -0.5 to +2.3 percent

The Dallas Fed general business activity index in its Texas manufacturing survey remained elevated but moved down from 11.7 in April to 8.0 in May. The company outlook index plummeted to 4.1 after rising sharply in April. Although both these indexes fell from last month, both were up strongly from their negative readings a year ago. The production index, a key measure of state manufacturing conditions, fell from 24.7 to 11.0, indicating output grew but not strongly as in April. Other measures of current manufacturing activity also reflected slower growth. The new orders index fell sharply to 3.8, hitting its lowest level this year but still remaining in positive growth territory.

No consensus numbers are available for this month's report

Sales of total light motor vehicles in May were very good as unit vehicle sales rose 4.6 percent to a 16.8 million annual rate that was well beyond the high-end of the Econoday consensus for 16.3 million. May's rate was the highest of the recovery, since July 2006. Sales of domestic-made vehicles rose 3.9 percent to a 13.3 million rate which was the highest since January 2006. Foreign-made sales rose 6.3 percent to a 3.4 million rate that was last matched in March.

Motor vehicle domestic sales Consensus Forecast for June 14: 13.0 million-unit rate

Range: 12.8 to 13.3 million-unit rate

Motor vehicle total sales Consensus Forecast for June 14: 16.4 million-unit rate

Range: 15.8 to 17.0 million-unit rate

The Markit PMI manufacturing flash index for June came in at 57.5 versus 56.4 in final May and 56.2 for the May flash. June's flash report was led by new orders, at a very strong 61.7 for a 2.9 point acceleration from final May. Backlog orders were up 9 tenths to 56.9 which was particularly strong for this reading. These order readings point in the months ahead to a rising rate of output which is already very strong at 61.0 for a 1.4 point rise.

Markit PMI manufacturing index (final) Consensus Forecast for June 14: 57.0

Range: 56.8 to 57.7

The composite index from the ISM manufacturing survey for May was messy due to data corrections during the reporting day. Traders were left scratching their heads over initially released numbers and later corrected data. Initially, the composite was reported as down but later in the morning revised to up. The ISM corrected its PMI to 55.4 in May from an originally reported 53.2. April posted at 54.9. The correction, which was tied to seasonal adjustment calculations, turned the original report upside down, from sizable deceleration in monthly growth to slight acceleration in monthly growth. Those components that are seasonally adjusted -- new orders, production, employment, supplier deliveries -- eventually showed greater rates of monthly growth than the original report. New orders are at a very solid 56.9, well up from 55.1 in April which points to acceleration ahead for composite activity this summer.

ISM manufacturing composite index Consensus Forecast for June 14: 55.6

Range: 54.8 to 57.0

Construction spending in April gained 0.2 percent after a 0.6 percent boost in March. The latest gain was led by a 0.8 percent rise in public outlays, following a 0.3 percent increase the month before. Private residential spending edged up 0.1 percent after a 1.5 percent spike in March. Strength was in both new one-family outlays and especially multifamily outlays. Weakness was in the excluding new homes category which fell after a healthy March.

Construction spending Consensus Forecast for May 14: +0.5 percent

Range: +0.1 to +1.3 percent

ADP private payroll employment growth for May posted at 179,000. The BLS comparable measure for May came in at 216,000.

ADP private payrolls Consensus Forecast for June 14: 213,000

Range: 190,000 to 240,000

Factory orders rose a higher-than-expected 0.7 percent in April in the latest sign of strength in the manufacturing sector. The gain was well balanced between durable goods, up 0.6 percent (revised from the initial reading of plus 0.8 percent), and nondurable goods, up 0.7 percent on strength in petroleum and coal products. Another positive was a solid upward revision to March, now at plus 1.5.

Factory orders Consensus Forecast for May 14: -0.3 percent

Range: -0.5 to +1.0 percent

Nonfarm payroll employment moderated a bit in May. Total nonfarm payroll jobs advanced 217,000 in May after a 282,000 boost in April and a 203,000 increase in March. The net revision for the prior two months was down 6,000. Private jobs gained 216,000 after a 270,000 increase the prior month. The unemployment rate held steady from 6.3 percent in April. Turning back to the payroll portion of the report, private jobs increased 216,000 after a 270,000 gain in April. Government jobs edged up 1,000 after a boost of 12,000 in April. Average weekly hours were unchanged at 34.5 hours. Average hourly earnings improved to a rise of 0.2 percent from flat in April.

Nonfarm payrolls Consensus Forecast for June 14: 211,000

Range: 199,000 to 290,000

Private payrolls Consensus Forecast for June 14: 210,000

Range: 195,000 to 285,000

Unemployment rate Consensus Forecast for June 14: 6.3 percent

Range: 6.2 to 6.3 percent

Average workweek Consensus Forecast for June 14: 34.5 hours

Range: 34.5 to 34.6 hours

Average hourly earnings Consensus Forecast for June 14: +0.2 percent

Range: +0.2 to +0.3 percent

The U.S. international trade gap in April widened much worse than expected, partly due to annual revisions. The trade gap grew to $47.2 billion from $44.2 billion in March. Exports slipped 0.2 percent in April after a 2.0 percent jump the month before. Imports expanded 1.2 percent, following a 3.1 percent surge the month before. The widening of the trade deficit was led by goods excluding petroleum which had a gap that posted at $46.8 billion in April versus $42.2 billion the prior month. The petroleum shortfall actually shrank somewhat-to $18.0 billion from $19.0 billion. The service surplus grew to $18.6 billion from $18.3 billion.

International trade balance Consensus Forecast for May 13: -$45.1 billion

Range: -$46.5 billion to -$42.1 billion

Initial jobless claims fell 2,000 in the June 21 week to 312,000. The 4-week average, at 314,250, has been very steady the past month, holding in a tight range roughly between 310,000 and 315,000. Continuing claims, reported with a 1-week lag, have also been trending lower. Though up 12,000 in the June 14 week to 2.571 million, the 4-week average was down 13,000 at 2.587 million. This was the 18th straight decline for the 4-week average. The unemployment rate for insured workers is at 2.0 percent, up 1 tenth from the prior week's recovery low of 1.9 percent (revised).

Jobless Claims Consensus Forecast for 6/28/14: 314,000

Range: 307,000 to 325,000

The Markit PMI services flash index for June saw a post-winter bounce, giving a major lift to Markit's service-sector sample where readings were at or near their best levels in the 5-year history of the report. The headline business activity index, at 61.2, was up 2.8 points from May's flash reading and was up 3.1 points from final May. The plus-60 reading indicates very sharp monthly growth. The index has risen 7.9 points from its winter low in February.

No consensus numbers are available for this month's report

The composite index from the ISM non-manufacturing survey in May rose to 56.3 versus April's 55.2. Business activity was exceptionally strong in the ISM report, at 62.1 for a 1.3 point gain as were new orders at 60.5 for a 2.3 point gain. Backlog orders were also strong, moving out of contraction with a 5.0 point gain to 54.0 versus April's 49.0. Growth in employment, however, lagged behind, at 52.4 though up from April's 51.3.

ISM non-manufacturing composite index Consensus Forecast for June 14: 56.2

Range: 55.5 to 58.5

NYSE Early Close, 1:00 p.m. ET

U.S. Holiday: Independence Day. All Markets Closed.

R. Mark Rogers is the author of The Complete Idiot's Guide to Economic Indicators, Penguin Books.

He can also be found on a weekly broadcast talking about the U.S. economy, the easiest way to find him is by going to iTunes and searching for "Simply Economics."

Econoday Senior Writer Mark Pender contributed to this article.

|