|

The economy may be stronger than earlier believed as the November employment situation report topped expectations in several facets. But it is only one month of data.

A somewhat volatile week largely ended on the plus side. However, the week got off to a negative start Monday amid news reports that "Black Friday" sales disappointed. Also, equities were weighed down by manufacturing data for the Eurozone showing a slower than expected pace of expansion in November with similar softness from China. A somewhat volatile week largely ended on the plus side. However, the week got off to a negative start Monday amid news reports that "Black Friday" sales disappointed. Also, equities were weighed down by manufacturing data for the Eurozone showing a slower than expected pace of expansion in November with similar softness from China.

Tuesday was positive with better-than-expected construction data and comments by Fed officials that the drop in oil prices is bolstering the consumer sector. On Wednesday, the Dow Jones industrials and S&P once again set records thanks to robust gains for energy, materials and industrial shares following a rebound in oil and gold prices. Also, survey data pointed to improving conditions in the service sector which makes up a majority of the economy.

Stocks eased Thursday despite a drop in initial jobless claims. The European Central Bank was the main focus for the day. Stocks declined in early trading after ECB President Mario Draghi said the bank would table its decisions on any more economic stimulus until early next year. Equities gained Friday after the employment situation report for November showed a much larger increase than expected—prompting worries that the Fed might start rate increases sooner than earlier believed. Stocks eased Thursday despite a drop in initial jobless claims. The European Central Bank was the main focus for the day. Stocks declined in early trading after ECB President Mario Draghi said the bank would table its decisions on any more economic stimulus until early next year. Equities gained Friday after the employment situation report for November showed a much larger increase than expected—prompting worries that the Fed might start rate increases sooner than earlier believed.

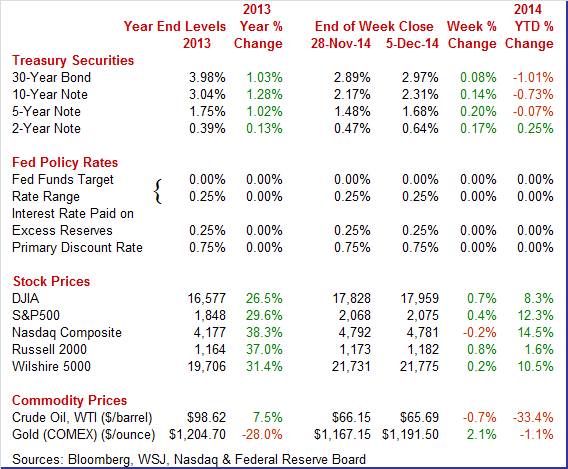

Equities were mostly up this past week. The Dow was up 0.7 percent; the S&P 500, up 0.4 percent; the Russell 2000, up 0.8 percent; and the Wilshire 5000, up 0.2 percent. The Nasdaq slipped 0.2 percent after a strong prior week.

For the year-to-date, major indexes are up as follows: the Dow, up 8.3 percent; the S&P 500, up 12.3 percent; the Nasdaq, up 14.5 percent; the Russell 2000, up 1.6 percent; and the Wilshire 5000, up 10.5 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury yields posted moderately strong gains this past week on better-than-expected economic news and FedSpeak. Rates firmed Monday after ISM manufacturing remained healthy and above expectations. Also, Fed Vice Chairman Stanley Fischer and New York Fed President William C. Dudley both said the sharp decline in oil prices will boost consumer spending. Rates rose further Tuesday as large amounts of corporate bond sales cut into demand for Treasuries somewhat. Treasury yields posted moderately strong gains this past week on better-than-expected economic news and FedSpeak. Rates firmed Monday after ISM manufacturing remained healthy and above expectations. Also, Fed Vice Chairman Stanley Fischer and New York Fed President William C. Dudley both said the sharp decline in oil prices will boost consumer spending. Rates rose further Tuesday as large amounts of corporate bond sales cut into demand for Treasuries somewhat.

After little change Wednesday and Thursday, yields rose notably on Friday after payroll job growth for November sharply exceeded expectations.

Recently healthy economic indicators have pushed forward expectations for when the Fed will start increasing policy rates. The next round of Fed forecasts on the economy and rates will be released with the December 17 FOMC statement.

For this past week Treasury rates were up as follows: 3-month T-bill, up 1 basis point; the 2-year note, up 17 basis points; the 5-year note, up 20 basis points; the 7-year note, up 17 basis points; the 10-year note, up 14 basis points; and the 30-year bond, up 8 basis points.

The spot price of West Texas Intermediate slipped further this past week. The biggest daily move was Monday with a $3 per barrel boost after the market paused from a selloff from OPEC not cutting production. But crude declined $2 per barrel Tuesday after the Iraqi government and Kurdish authorities reached an agreement that likely leads to increased oil exports. The spot price of West Texas Intermediate slipped further this past week. The biggest daily move was Monday with a $3 per barrel boost after the market paused from a selloff from OPEC not cutting production. But crude declined $2 per barrel Tuesday after the Iraqi government and Kurdish authorities reached an agreement that likely leads to increased oil exports.

Oil prices also were weighed down by Saudi officials stating that lower oil prices likely will do little to slow U.S. oil shale production.

Net for the week, the spot price for West Texas Intermediate eased 46 cents per barrel to settle at $65.69. This is the lowest price since mid-2009.

The economy showed better-than-expected strength across a variety of sectors—including consumer and construction sectors. Manufacturing was mixed but mostly positive.

The Fed may need to re-evaluate when to start raising policy rates if payroll gains continue at November's relatively strong pace.

The November employment situation was significantly stronger than expected. Payroll jobs jumped 321,000 after gaining 243,000 in October. Analysts expected a 230,000 rise and the November boost topped the Econoday high forecast for 275,000. The November boost was the largest since January 2012. September and October gains were revised up notably by a net 44,000. The November employment situation was significantly stronger than expected. Payroll jobs jumped 321,000 after gaining 243,000 in October. Analysts expected a 230,000 rise and the November boost topped the Econoday high forecast for 275,000. The November boost was the largest since January 2012. September and October gains were revised up notably by a net 44,000.

The unemployment rate held steady at 5.8 percent. The U-6 underemployment rate nudged down to 11.4 percent from 11.5 percent in September. The participation rate held roughly steady at 62.8 percent.

Going back to the payroll report, private payrolls advanced 314,000 after increasing 236,000 in October. Analysts projected 225,000. Going back to the payroll report, private payrolls advanced 314,000 after increasing 236,000 in October. Analysts projected 225,000.

Goods-producing jobs gained 48,000 in November after a 28,000 advance the month before. Manufacturing employment increased 28,000 in November, following a boost of 20,000 in October. Motor vehicles and parts rose 11,000, after increasing 5,000 the month before. Construction jumped 20,000 after a gain of 7,000 in October. Mining slipped 1,000 in November, following no change the prior month. Goods-producing jobs gained 48,000 in November after a 28,000 advance the month before. Manufacturing employment increased 28,000 in November, following a boost of 20,000 in October. Motor vehicles and parts rose 11,000, after increasing 5,000 the month before. Construction jumped 20,000 after a gain of 7,000 in October. Mining slipped 1,000 in November, following no change the prior month.

Private service-providing jobs jumped 266,000 after a 208,000 increase in October. Strength again was in professional & business services and retail trade.

Wages rose sharply in the latest month. Average hourly earnings jumped 0.4 percent in November after edging up 0.1 percent the month before. Expectations were for a 0.2 percent rise. On a year-ago basis, wage growth held steady at a still soft 2.2 percent.

Average weekly hours edged up to 34.6 hours from 34.5 hours in October. Analysts expected 34.6 hours.

Looking ahead to the personal income report from the payroll survey, private aggregate weekly earnings jumped 0.9 percent in November, pointing to a sizeable rise in private wages & salaries. Production worker hours in manufacturing were up 0.5 percent for the month, suggesting a significant increase in the manufacturing component for November industrial production.

The November employment report clearly shows an improving labor sector and economy. This suggests improving profits but also likely will raise chatter of the Fed moving forward the first increase in policy rates. However, most analysts still expect any Fed rate increases to be gradual.

The consumer is back in auto show rooms and is making deals.

Vehicle sales rose a strong 4.5 percent in November to a 17.2 million unit annual rate which was above the top end of the Econoday consensus for 17.0 million. Sales of North American-made vehicles proved especially strong, at a 14.0 million rate which is also outside the top-end forecast. Vehicle sales rose a strong 4.5 percent in November to a 17.2 million unit annual rate which was above the top end of the Econoday consensus for 17.0 million. Sales of North American-made vehicles proved especially strong, at a 14.0 million rate which is also outside the top-end forecast.

Sales of foreign-made vehicles rose to a 3.3 million rate from 3.2 million. The latest data point to a second straight gain, and an especially strong gain, for the motor vehicle component of the November retail sales report which rose a solid 0.5 percent in October. The latest report also points to a strong consumer spending component in fourth quarter GDP.

The latest national surveys on manufacturing are mixed in strength. The latest national surveys on manufacturing are mixed in strength.

Rates of monthly growth in ISM's manufacturing sample remain extremely strong. ISM's composite index held very strong near recovery highs, at 58.7 in November vs 59.0 in October. New orders came in at a blistering 66.0 versus October's 65.8 with backlog orders up 2.0 points to 55.0 which is very strong for this reading. Employment growth remained solid, at 54.9 vs 55.5, while production growth remained very strong at 64.4 vs 64.8. Delivery times slowed in a further indication of strength while inventories held steady. A notable reading in the report was contraction in input prices, at 44.5 vs October's 53.5. This is the first price contraction since July last year and reflects falling oil prices.

Turning to the Markit Economics survey, Markit's U.S. manufacturing sample slowed in November, to a 10-month low of 54.8 from 55.9 in October. The mid-month flash for November was 54.7. Looking at details, output slowed for a 3rd straight month and was also at a 10-month low for this sample. New orders also slowed and were also at a 10-month low with export orders in contraction. A plus in the report was a strong gain for employment, yet whether Markit's sample will continue to hire is uncertain given the slowing in new orders.

Overall, the ISM report is more consistent with the latest manufacturing numbers in the November employment report.

The international sector showed a marginally improved trade deficit but one that sharply disappointed. Improvement was largely due to lower oil prices. The international sector showed a marginally improved trade deficit but one that sharply disappointed. Improvement was largely due to lower oil prices.

In October, the U.S. trade gap narrowed to a disappointing $43.4 billion from a revised $43.6 billion in September. Analysts expected the deficit to narrow to $41 billion. Exports were up 1.2 percent after sliding 1.8 percent the month before while imports added 0.9 percent after recording no change. The October petroleum goods trade gap was $15.2 billion, up from $14.0 billion in September. Petroleum imports were down 0.6 percent while exports sank 11.1 percent. The changes in petroleum no doubt reflect the drop in crude oil prices.

The October decline in the goods and services deficit reflected a decrease in the goods deficit of less than $0.1 billion to $62.7 billion and an increase in the services surplus of $0.1 billion to $19.2 billion. Year-to-date, the goods and services deficit increased 5.1 percent from the same period in 2013. Exports increased 3.1 percent. Imports increased 3.4 percent. The October decline in the goods and services deficit reflected a decrease in the goods deficit of less than $0.1 billion to $62.7 billion and an increase in the services surplus of $0.1 billion to $19.2 billion. Year-to-date, the goods and services deficit increased 5.1 percent from the same period in 2013. Exports increased 3.1 percent. Imports increased 3.4 percent.

On the month, exports of capital goods increased $1.7 billion. Civilian aircraft increased $1 billion while generators, transformers & accessories edged up $0.3 billion. Exports of services increased $0.3 billion to $59.5 billion in October. The increase reflected increases in financial services, in maintenance & repair services and in charges for the use of intellectual property.

Imports of goods increased $2.0 billion to $200.7 billion in October. Automotive vehicles, parts and engines increased $1.3 billion while capital goods increased $1.1 billion.

The economy is getting surprise lift from construction—at least for one month. The trend is still soft. The economy is getting surprise lift from construction—at least for one month. The trend is still soft.

Construction outlays rebounded significantly on public outlays and the private residential component. Construction spending jumped 1.1 percent in October after a 0.1 percent dip in September.

October's increase was led by public outlays which rebounded 2.3 percent after a 1.6 percent fall in September. Private residential spending gained 1.3 percent, following an increase of 0.8 percent the month before.

Private nonresidential construction spending slipped 0.1 percent, following a rise of 0.2 percent in September.

On a year-ago basis, total outlays were up 3.3 percent in October compared to 3.9 percent in September.

October construction outlays probably will nudge up estimates for fourth quarter GDP.

The Beige Book indicated a moderately positive outlook for the economy. Information was collected on or before November 24. Sources of strength were autos and aerospace. Construction and real estate were mixed. Inventories were seen in line with sales. Some improvement is expected in business investment. Also, job gains were widespread.

Consumer spending continued to expand in most Districts. Lower gasoline prices were seen as boosting other spending and cold weather lifted apparel sales. Many Districts were optimistic about holiday sales. Auto sales were strong in many Districts. Hiring plans increased in a number of Districts.

Manufacturers in several Districts were expanding capital budgets both to replace existing equipment and to expand capacity.

Residential construction increased on balance across the Districts and multifamily construction remained stronger than single-family construction in a number of Districts.

Overall price and wage inflation remained subdued in October and November.

The latest Beige Book is moderately positive. There are arguments for both hawks and doves within the Fed. The economy is improving-including the labor market-but inflation still appears to be below target.

This past week's economic news generally was more favorable than expected and across a variety of sectors. The news more than offset worries about the Fed speeding up rate increases (which are still expected to be very slow). Equities gained on positive economic prospects.

The consumer sector has provided the bulk of growth in recent months and we'll see if that trend continues with November retail sales. The general view is that Black Friday sales disappointed but online sales and auto sales may offset. November jobs growth was much stronger than expected, indicating a better-than-believed labor market. The initial jobless claims report may indicate if this trend continues.

The Labor Department's Job Openings and Labor Turnover Survey for September was mixed but net moderately positive. Job openings were positive, hires rose, while the quits rate rose. A rising quits rate may reflect a stronger jobs market. There were 4.735 million job openings on the last business day of September, compared to 4.853 million in August.

The hires level increased to 5.026 million in September, up from 4.742 million in August. This was the highest level of hires since December 2007. There were 4.788 million total separations in September, up from 4.531 million in August. The number of quits increased from 2.510 million in August to 2.753 million in September. This was the highest level of quits since April 2008 which may indicate increased job mobility. In September, there were 388,000 other separations for total nonfarm, little changed from August.

JOLTS job openings Consensus Forecast for October 14: 4.790 million

Range: 4.750 million to 4.800 million

Wholesale inventories were up 0.3 percent in September and held steady relative to sales which rose only 0.2 percent in the month, keeping the stock-to-sales ratio in the sector unchanged at 1.19. Still, the ratio is at the high end of recent trend.

Wholesale inventories Consensus Forecast for October 14: +0.2 percent

Range: -0.6 to +0.5 percent

The NFIB Small Business Optimism Index rose 8 tenths in October to 96.1 led by gains in capital spending plans and sales expectations. Current job openings are also on the rise. Lack of credit is not constraining NFIB's sample with those reporting problems with access to loans at a record low and an unusually high number saying they have no interest in borrowing.

NFIB Small Business Optimism Index Consensus Forecast for November 14: 96.1

Range: 96.0 to 97.5

The U.S. Treasury monthly budget report showed the start of the fiscal year 2015 with a bit deeper deficit: $121.7 billion for October versus $90.6 billion in October last year. But this was due to a calendar issue excluding which the deficit would have been smaller than last October, at about $84 billion. Because November 1 fell on a weekend this year, benefit payments for the military, veterans, social security and Medicare were made in October, not November. This effect should reverse with November's statement. The receipt side of October's ledger was very solid with a 6.9 percent gain from October last year on higher tax receipts.

Looking ahead, the month of November typically shows a deficit for the month. Over the past 10 years, the average deficit for the month of November has been $115.2 billion and $143.1 billion over the past 5 years. The November 2013 deficit came in at $135.2 billion.

Treasury Statement Consensus Forecast for November 14: -$63.0 billion

Range: -$79.5 billion to -$59.0 billion

Initial jobless claims fell 17,000 in the November 29 week to a roughly as expected 297,000. But the prior week's spike was still elevating the 4-week average which rose 4,750 to a 299,000 level that is trending a very large 20,000 above the month ago trend. The November 22 week also was a tough week for continuing claims which are reported with a 1-week lag. Continuing claims in the week rose 39,000 to 2.362 million with the 4-week average up 1,000 to 2.355 million. But here the 4-week average was down 20,000 from the month-ago trend.

Jobless Claims Consensus Forecast for 12/6/14: 295,000

Range: 280,000 to 315,000

Retail sales in October were up despite downward headwinds from lower gasoline prices. Retail sales in October rebounded 0.3 percent after declining 0.3 percent in September. Auto sales made a partial rebound of 0.5 percent after a 1.2 percent drop in September and jump of 1.8 percent in August, largely reflecting unit new motor vehicle sales. Auto sales have fluctuated due to on and off sales incentives. Excluding autos, sales gained 0.3 percent after no change in September. Due to declines in gasoline prices, gasoline station sales fell 1.5 percent in October after decreasing 0.8 percent the prior month. Excluding both autos and gasoline, sales jumped 0.6 percent in October after a 0.1 percent rise the month before.

Retail sales Consensus Forecast for November 14: +0.4 percent

Range: +0.1 to +0.7 percent

Retail sales excluding motor vehicles Consensus Forecast for November 14: +0.1 percent

Range: -0.1 to +0.4 percent

Less motor vehicles & gasoline Consensus Forecast for November 14: +0.5 percent

Range: +0.3 to +0.8 percent

Import prices in October declined a very steep 1.3 percent monthly. This was the fourth straight monthly decrease for import prices and the steepest in nearly 2-1/2 years. Oil was the central factor with petroleum import prices down 6.9 percent in the month. But even when excluding petroleum, import prices were down with October, September and August all at minus 0.1 percent. Year-on-year, total import prices were down a very sizable 1.8 percent though, in a rare plus reading in the latest report, were up a year-on-year 0.5 percent when excluding petroleum.

The export side was very similar with prices down 1.0 percent in October for a third straight decline. Agricultural prices were the main factor on the export side with related exports down 2.1 percent for a fifth straight decline, all of them steep. Year-on-year, export prices were down 0.8 percent with agricultural prices down 4.6 percent.

Import prices Consensus Forecast for November 14: -1.7 percent

Range: -2.1 to -0.5 percent

Export prices Consensus Forecast for November 14: -0.2 percent

Range: -1.4 to 0.0 percent

Business inventories were up 0.3 percent in September, and rose a bit relative to sales, which were unchanged, but not enough to shake up the inventory-to-sales ratio which held steady at 1.30. Retail inventories did pile up slightly, to an inventory-to-sales ratio of 1.42 vs 1.41 in August. But the solid retail sales report for October points to easing for this ratio in the November report. Ratios in the report's other two components were unchanged, at 1.30 for manufacturers and 1.19 for wholesalers.

Business inventories Consensus Forecast for October 14: +0.3 percent

Range: -0.1 to +0.5 percent

The producer price index for final demand was stronger than expected in October but on average remains sluggish. Headline inflation posted at a monthly 0.2 percent versus expectations of a 0.1 percent dip and a 0.1 percent decrease in September. Excluding food & energy, producer price inflation jumped 0.4 percent compared to no change in September. The index for final demand services moved up 0.5 percent in October, the largest increase since a 0.5-percent rise in July 2013. The October advance can be traced to a 1.5-percent increase in margins for final demand trade services. The index for final demand goods moved down 0.4 percent in October, the fourth consecutive decrease. The October decline was led by prices for final demand energy, which fell 3.0 percent. The index for final demand goods less foods and energy edged down 0.1 percent. Conversely, prices for final demand foods moved up 1.0 percent.

PPI-FD Consensus Forecast for November 14: -0.1 percent

Range: -0.4 to +0.1 percent

PPI-FD ex Food & Energy Consensus Forecast for November 14: +0.1 percent

Range: 0.0 to +0.2 percent

The Reuters/University of Michigan's consumer sentiment index slowed in the last half of the month but not by much, coming in at 88.8 versus 89.4 at mid-month and up from October's final reading of 86.9. The current conditions component finished November at 102.7, well up from October's 98.3 in a reading that, in contrast to many other indicators including the consumer confidence report, points to month-to-month strength for November. The expectations component finished November at 79.9, not much changed from October's 79.6. Inflation expectations were down, the result of lower gasoline prices with 1-year expectations at 2.8 percent, down 1 tenth from October, and 5-year expectations at 2.6 percent, down 2 tenths.

Consumer sentiment index Consensus Forecast for preliminary December 14: 89.5

Range: 88.5 to 91.0

R. Mark Rogers is the author of The Complete Idiot's Guide to Economic Indicators, Penguin Books.

He can also be found on a weekly broadcast talking about the U.S. economy, the easiest way to find him is by going to iTunes and searching for "Simply Economics."

Econoday Senior Writer Mark Pender contributed to this article.

|