|

The economy appears to be gaining some momentum as jobs continue to post moderately healthy gains. The labor market got a notable upgrade with revisions to earlier payroll data.

Equities were up sizably this past week. Monday saw stocks lifted largely by the energy sector as oil prices rose. Prices rose again Tuesday on increases in oil prices and merger news between Staples and Office Depot. Equities were up sizably this past week. Monday saw stocks lifted largely by the energy sector as oil prices rose. Prices rose again Tuesday on increases in oil prices and merger news between Staples and Office Depot.

Equities were little changed Wednesday. Stocks were initially up notably but slipped after the European Central Bank increased pressure on the new Greek government to come to terms with its creditors.

Upward momentum continued Thursday with better-than-expected jobless claims and higher oil prices. Equities slipped marginally Friday despite a favorable jobs report. Traders worried about Greece. The concerns were sparked midday Friday after Standard & Poor's downgraded the country's long-term sovereign-debt rating to B-minus from B. Also, a euro zone official said Greece has a February 16 deadline to apply for an extension of its bailout program. Upward momentum continued Thursday with better-than-expected jobless claims and higher oil prices. Equities slipped marginally Friday despite a favorable jobs report. Traders worried about Greece. The concerns were sparked midday Friday after Standard & Poor's downgraded the country's long-term sovereign-debt rating to B-minus from B. Also, a euro zone official said Greece has a February 16 deadline to apply for an extension of its bailout program.

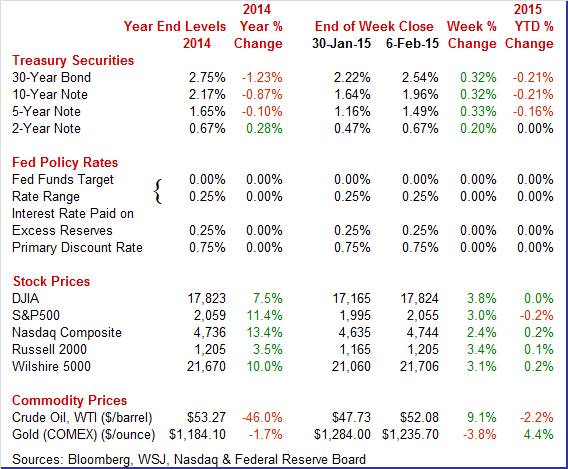

Equities were up this past week. The Dow was up 3.8 percent; the S&P 500, up 3.0 percent; the Nasdaq, up 2.4 percent; the Russell 2000, up 3.4 percent; and the Wilshire 5000, up 3.1 percent.

For the year-to-date, major indexes are mixed as follows: the Dow, unchanged; the S&P 500, down 0.2 percent; the Nasdaq, up 0.2 percent; the Russell 2000, up 0.1 percent; and the Wilshire 5000, up 0.1 percent.

Weekly percent change column reflects percent changes for all components except interest rates. Interest rate changes are reflected in simple differences.

Treasury rates were up sharply this past week. After little change Monday, yields increased Tuesday as traders believed that a resolution would occur for the debt standoff between Greece's new government and its Eurozone partners. Surging oil prices, after setting six-year lows, also put upward pressure on yields. Treasury rates were up sharply this past week. After little change Monday, yields increased Tuesday as traders believed that a resolution would occur for the debt standoff between Greece's new government and its Eurozone partners. Surging oil prices, after setting six-year lows, also put upward pressure on yields.

Yields were little changed Wednesday. Rates firmed moderately Thursday on better-than-expected jobless claims and on expectations of improved payrolls gains to be announced Friday. Indeed, payrolls rose more than expected for January, boosting rates on Friday. Additionally adding lift were sizeable upward revisions to November and December payrolls.

The bottom line is that a somewhat improved labor market has led to higher Treasury rates.

For this past week Treasury rates were up as follows: the 2-year note, up 19 basis points; the 5-year note, up 33 basis points; the 7-year note, up 33 basis points; the 10-year note, up 32 basis points; and the 30-year bond, up 12 basis points. The 3-month T-bill was unchanged.

The spot price of West Texas Intermediate rebounded this past week but remains notably low compared to just a few months ago. The spot price of West Texas Intermediate rebounded this past week but remains notably low compared to just a few months ago.

Technical factors affected crude this past week—along with fundamentals. Monday, WTI rose just over $2 a barrel on news of a strike by refinery workers in the U.S. But gains were weighed down by expectations of inventory build. Prices surged again over $2 per barrel Tuesday on the U.S. refinery strike.

Crude, however, fell $3 per barrel on Wednesday as inventories hit an almost 80 year high. Oil prices have plunged about 50 percent since June 2014. WTI jumped almost $11 per barrel Thursday as traders began—for now—to anticipate a reduction in oil production due to lower prices. Yes, traders occasionally think in terms of supply and demand. Friday, WTI slipped a buck and a half on mere market views of supply and demand. Oil prices posted their biggest one-week gain since 2011. Still, prices are relatively low and are boosting consumer confidence.

Net for the week, the spot price for West Texas Intermediate jumped $10.38 per barrel to settle at $58.11.

Currently, the U.S. economy is leading the global economy and the consumer sector is carrying the load. Inflation is low—including for wages. The Fed still has the option of keeping policy loose. However, the latest employment report will likely raise debate within the Fed on how soon to start slowly raising rates.

The latest employment situation report was heavily positive even though the unemployment rate edged up. Payroll jobs gained 257,000 in January after strong increases of 329,000 in December and 423,000 in November. December and November were revised up a net 86,000. With the revision, November is the strongest month since May 2010. The latest employment situation report was heavily positive even though the unemployment rate edged up. Payroll jobs gained 257,000 in January after strong increases of 329,000 in December and 423,000 in November. December and November were revised up a net 86,000. With the revision, November is the strongest month since May 2010.

This report may tip the balance for the Fed to think about a first increase in policy rates this year rather than next—although still at a slow pace.

The unemployment rate nudged up to 5.7 percent from 5.6 percent in December. The rise was due to a sharp rebound in the labor force. The labor force participation rate rose to 62.9 percent from 62.7 percent in December. It appears that some discouraged workers are returning to the labor force---a positive sign for how workers view the economy. The unemployment rate nudged up to 5.7 percent from 5.6 percent in December. The rise was due to a sharp rebound in the labor force. The labor force participation rate rose to 62.9 percent from 62.7 percent in December. It appears that some discouraged workers are returning to the labor force---a positive sign for how workers view the economy.

Looking at the broader underemployment measure from the household survey, the U-6 measure edged up to 11.3 percent from 11.2 percent in December.

Turning back to the establishment survey, private payrolls increased 267,000 in January after a 329,000 boost the month before.

Goods-producing jobs increased 58,000 after a 73,000 boost in December. Manufacturing increased 22,000 after rising 26,000 in December. Construction jumped 39,000 in January after gaining 44,000 the month before. Mining slipped 4,000 after rising 3,000 in December. These numbers offer hope that the manufacturing and construction sectors are improving. In recent months, they have been sluggish. Goods-producing jobs increased 58,000 after a 73,000 boost in December. Manufacturing increased 22,000 after rising 26,000 in December. Construction jumped 39,000 in January after gaining 44,000 the month before. Mining slipped 4,000 after rising 3,000 in December. These numbers offer hope that the manufacturing and construction sectors are improving. In recent months, they have been sluggish.

Private service-providing industries posted a 209,000 increase after a gain of 247,000 in December. Government jobs declined by 10,000 in January after a rise of 9,000 the month before.

The labor force may be tightening a bit as average hourly earnings rebounded 0.5 percent, following a 0.2 percent dip in December. January's increase was the largest in about six years. However, part of the boost in wages was due to increases in some states' minimum wage. The average workweek held steady at 34.6 hours.

Looking ahead to the personal income report based on the payroll survey, private aggregate weekly earnings rose 0.7 percent in January, suggesting a healthy gain in private wages & salaries. Production worker hours in manufacturing were up 0.2 percent for the month, suggesting a modest rise in the manufacturing component of the January industrial production report.

Overall, the latest employment situation indicates that the consumer sector is still the current backbone of the recovery. Also, the labor market has been given an upgrade with upward revisions to November and December. A caveat for the latest report is that seasonal factors for cold weather months can be volatile.

The next big labor market news will be Monday's untimed release (although generally about 10:00 ET or a little later) of the Fed's labor market conditions index.

The consumer sector has been volatile on a monthly basis for spending while income growth has been steadier. Meanwhile, inflation has been weak. Personal income grew 0.3 percent in December after advancing 0.3 percent in November. Market expectations were for a 0.3 percent rise. December matched expectations. The wages & salaries component increased a modest 0.1 percent, but followed a jump of 0.6 percent the prior month. On average, wages & salaries are moderately healthy at the aggregate level. But based on average hourly earnings, there is still softness at the individual level. The consumer sector has been volatile on a monthly basis for spending while income growth has been steadier. Meanwhile, inflation has been weak. Personal income grew 0.3 percent in December after advancing 0.3 percent in November. Market expectations were for a 0.3 percent rise. December matched expectations. The wages & salaries component increased a modest 0.1 percent, but followed a jump of 0.6 percent the prior month. On average, wages & salaries are moderately healthy at the aggregate level. But based on average hourly earnings, there is still softness at the individual level.

Personal spending decreased 0.3 percent, following a boost of 0.5 percent in November. Analysts projected a dip of 0.2 percent for December.

Durables fell 1.2 percent on a swing in auto sales, following a rise of 1.8 percent in November. Nondurables, tugged down by gasoline prices, decreased 1.3 percent after decreasing 0.3 percent the prior month. Services edged up 0.1 percent, following a 0.5 percent spike in November.

PCE inflation remained weak-largely due to lower energy costs. Headline inflation decreased 0.2 percent on a monthly basis, following a drop of 0.2 percent in November. Forecasts were for a 0.3 percent drop. Core PCE inflation was flat in both December and November. December matched expectations. PCE inflation remained weak-largely due to lower energy costs. Headline inflation decreased 0.2 percent on a monthly basis, following a drop of 0.2 percent in November. Forecasts were for a 0.3 percent drop. Core PCE inflation was flat in both December and November. December matched expectations.

On a year-ago basis, headline PCE inflation decelerated to 0.7 percent in December from 1.2 percent the prior month. Year-ago core inflation posted at 1.3 percent in December compared to 1.4 percent in November. Both series remain below the Fed goal of 2 percent year-ago inflation.

The first definitive indication on January's economy is soft as sales of cars and light trucks fell 1.2 percent in the month to a 16.7 million annual rate versus 16.9 million in December. Weakness is centered in foreign-made vehicles where sales fell 8.8 percent to a 3.1 million rate. Sales of North American-made vehicles fell 0.7 percent to a 13.5 million rate. The data point to a second month of weakness for the motor vehicles component of the government's monthly retail sales report which fell 0.7 percent in December. The first definitive indication on January's economy is soft as sales of cars and light trucks fell 1.2 percent in the month to a 16.7 million annual rate versus 16.9 million in December. Weakness is centered in foreign-made vehicles where sales fell 8.8 percent to a 3.1 million rate. Sales of North American-made vehicles fell 0.7 percent to a 13.5 million rate. The data point to a second month of weakness for the motor vehicles component of the government's monthly retail sales report which fell 0.7 percent in December.

ISM growth had been running hot compared to other manufacturing reports but has slowed down noticeably the last two readings. January's composite score of 53.5 compares with a revised 55.1 in December and 57.6 in November. October was the fourth quarter's peak at 57.9. ISM growth had been running hot compared to other manufacturing reports but has slowed down noticeably the last two readings. January's composite score of 53.5 compares with a revised 55.1 in December and 57.6 in November. October was the fourth quarter's peak at 57.9.

New orders slowed substantially in January, to 52.9 from 57.8. In contrast, order growth during November and October was in the low 60s. Weakness in foreign demand is a key factor here as new export orders fell 2.5 points to a sub-50 reading of 49.5. This is the lowest for export orders since November 2012. Total backlog orders also moved into contraction, to 46.0 for a 6.5 point loss.

Production remained strong in part because of the working down of backlogs. A big headline is prices paid which fell 3.5 points to 35.0 which is very low, the lowest reading since April 2009.

This report is a concern, reflecting weak foreign markets and also troubles in the oil patch. The ISM wasn't the first to signal slowing for the manufacturing sector but it now heavily underscores prior indications.

Turning to the latest Markit report on manufacturing, steady and sustainable growth continues to be the indication from Markit's U.S. manufacturing sample where the composite index finished January at 53.9 versus 53.7 at mid-month. December's readings were the same: 53.9 for final December and 53.7 at mid-month.

On the strong side were output volumes and employment, the latter is a special plus, while on the soft side was new business growth which is being held down by weakness in export orders. Here, the strong dollar and slowing foreign markets are a concern.

Weakness in the price-depressed oil & gas sector is also a factor holding down new business. Price pressures, because of oil, are very soft.

Growth in ISM's non-manufacturing sample held steady and solid, at 56.7 in January versus a revised 56.5 in December. This index peaked in August last year at 59.6 and has averaged 57.2 over the past 4 months. Growth in ISM's non-manufacturing sample held steady and solid, at 56.7 in January versus a revised 56.5 in December. This index peaked in August last year at 59.6 and has averaged 57.2 over the past 4 months.

New orders, at 59.5, are very solid and point to sustainable and strong rates of overall growth in the months ahead. Employment, however, is a weak point in the January report, down a sharp 4.1 points to 51.6 which is the lowest rate of monthly growth since April last year. Input prices, at 45.5, are on the negative side of breakeven 50 for the second straight month and are at their sharpest rate of contraction since July 2009.

A sign of weakness in the report is lack of breadth across industries, with 8 reporting expansion in the month and 8 reporting contraction. The contraction side includes mining and also construction but the expansion is led by accommodation & food services where gains point to discretionary spending.

Though there are negatives including the slowing in employment, this report on balance is solid.

According to Markit's survey, service sector growth is picking back up but only slightly, to 54.2 for the final January reading from 54.0 at mid-month and compared against December's 10-month low of 53.3. Though this index has been slowing from 60-plus peaks mid-year last year, the current rate of growth is respectable and sustainable.

A negative is sharp slowing in incoming new work to the slowest rate in the 5-year history of the report. On the plus side is solid growth in employment which underscores upbeat expectations for business growth over the year ahead. On prices, cost pressures are at their lowest since November 2010, the result of low fuel prices, while prices charged are showing only marginal traction.

Construction outlays rebounded 0.4 percent in December after dipping 0.2 percent the month before. December was below market expectations which were for a 0.6 percent gain. Construction outlays rebounded 0.4 percent in December after dipping 0.2 percent the month before. December was below market expectations which were for a 0.6 percent gain.

December's increase was led by public outlays which rebounded 1.1 percent after dropping 1.8 percent in November. Private residential spending rose 0.3 percent after edging up 0.1 percent in November. Private nonresidential construction spending eased 0.2 percent in December after a 0.8 percent rise the month before.

On a year-ago basis, total outlays were up 2.2 percent in December compared to 2.7 percent in November.

The latest employment report was clearly positive. Payrolls continued to rise and even the unemployment rate edged up for a positive reason. The Fed likely will increase debate on when to start raising policy rates, albeit likely slowly, but for the good reason that the recovery is gaining traction. The consumer sector currently is leading the way and other sectors likely will be following. While not in the news this week, inflation remains low and still gives the Fed latitude for keeping rates below "normal."

This coming week is light on the indicator front but notable consumer sector numbers are posted. After Friday's better-than-expected employment report, traders will be looking to see if the consumer sector gains in other aspects. The JOLTS report is posted Tuesday and the key question is whether increases in job openings continue. Retail sales declined in December on lower gasoline prices and volatile auto sales. We may see more of the same for January on both factors but with the underlying trend still healthy. Readings on the consumer mood have been relatively strong and on Friday we get an update for early February from the University of Michigan.

The NFIB Small Business Optimism Index was at its highest point of the recovery, since October 2006, up 2.3 points in December to 100.4. December's gain was broad based with 8 of 10 components advancing led by expectations for higher sales. Sentiment on expansion, capital outlays, and employment also posted solid gains. Inflation pressures remained muted though a sizable 22 percent of the sample do plan to raise prices in the months ahead which the report noted could be a source of future inflationary pressures.

NFIB Small Business Optimism Index Consensus Forecast for January 14: 101.0

Range: 100.0 to 105.0

The Labor Department's Job Openings and Labor Turnover Survey showed 4.972 million job openings on the last business day of November, little changed from 4.830 million in October. Hires (4.990 million) were little changed and separations (4.623 million) declined in November. Within separations, the quits rate (1.9 percent) was unchanged and the layoffs and discharges rate (1.2 percent) was little changed. The job openings rate was 3.4 percent. The number of job openings was little changed for total private and increased for government in November.

JOLTS job openings Consensus Forecast for December 14: 4.975 million

Range: 4.900 million to 5.000 million

Wholesale inventories looked a bit heavy in the wholesale sector, up 0.8 percent in November versus a 0.3 percent decline in sales that lifted the stock-to-sales ratio to 1.21 from October's 1.20 and compared to 1.19 in September. Weak sales made for unwanted inventory builds in metals, chemicals, lumber, machinery and farm products.

Wholesale inventories Consensus Forecast for December 14: +0.1 percent

Range: 0.0 to +0.7 percent

The U.S. Treasury monthly budget report for December showed a 2.4 percent widening above the same period a year ago. Medicare outlays, driven by Obamacare, were up 9.8 percent year to date with net interest up 6.1 percent and social security, which is the largest outlay component, up 4.3 percent. The second largest outlay component, defense, remained lower than a year ago but just barely at minus 0.2 percent. The increases in outlays offset a very healthy receipt side of the ledger which, driven by gains in taxes that reflect the strength of the economy, was up 11.0 percent year to date. Looking ahead, the month of January typically shows a deficit for the month. Over the past 10 years, the average deficit for the month of January has been $10.6 billion and $25.5 billion over the past 5 years. The January 2014 deficit came in at $10.5 billion.

Treasury Statement Consensus Forecast for January 15: -$18.5 billion

Range: -$35.0 billion to -$3.5 billion

Initial jobless claims were up 11,000 to a much lower-than-expected 278,000 in the January 31 week, keeping the bulk of the improvement from the prior week's revised 42,000 fall. The 4-week average, down a sizable 6,500 in the week to 292,750, has been trending right at the month-ago level. Continuing claims, reported with a 1-week lag, were also at healthy levels though the month-ago comparison was less favorable. Continuing claims in the January 24 week rose 6,000 to 2.400 million while the 4-week average, though down 22,000, was at a 2.421 million level that is slightly above the month-ago trend.

Jobless Claims Consensus Forecast for 2/7/14: 288,000

Range: 275,000 to 300,000

Retail sales in December fell 0.9 percent after posting a 0.4 percent gain in November and a 0.3 percent rise in October. The December decrease was the largest negative since January 2014. Excluding autos, sales decreased 1.0 percent after rising 0.1 percent in November. Excluding both autos and gasoline sales declined 0.3 percent after advancing 0.6 percent in November. Within the core, weakness was broad based, led by miscellaneous store retailers (down 1.9 percent), building materials & garden supplies (down 1.9 percent), electronics & appliance (down 1.6), and general merchandise (down 0.9 percent). Notable gains were seen in furniture & home furnishings (up 0.8 percent) and food services & drinking places (up 0.8 percent).

Retail sales Consensus Forecast for January 15: -0.5 percent

Range: -1.0 to +0.4 percent

Retail sales excluding motor vehicles Consensus Forecast for January 15: -0.5 percent

Range: -1.2 to +0.3 percent

Less motor vehicles & gasoline Consensus Forecast for January 15: +0.4 percent

Range: +0.2 to +0.7 percent

Business inventories growth was modest in November, up 0.2 percent for a second straight month, and was steady relative to sales which fell 0.2 percent following a 0.3 percent decline in October. The stock-to-sales ratio was a moderate 1.31 in both months. A look at components shows a 0.3 percent inventory decline at retailers, a draw that may not be repeated in December given that month's weakness in retail sales, weakness that points to a build for retail inventories. Inventories at factories were little changed in November, up 0.1 percent, while inventories at wholesalers rose a sharp 0.8 percent in what appears to have been an unwanted build given a 0.3 percent decline in wholesale sales.

Business inventories Consensus Forecast for December 14: +0.2 percent

Range: -0.2 to +0.4 percent

Import prices fell a very steep 2.5 percent in December following a downwardly revised contraction of 1.8 percent in November and declines of 1.4 percent and 0.8 percent in the prior 2 months. Year-on-year, import prices are down 5.5 percent. The contraction in oil prices is of course the central factor behind the deflation with petroleum prices down 16.6 percent in December alone for a year-on-year decline of 30.1 percent. But excluding petroleum, import prices were no better than flat, up 0.1 percent in December and unchanged year-on-year. Export prices, where petroleum is less of a factor, were also down. Export prices fell 1.2 percent in the month for a year-on-year decline of 3.2 percent. Agricultural prices are key on the export side and were down 0.7 percent on the month and down 4.9 percent on the year.

Import prices Consensus Forecast for January 15: -3.0 percent

Range: -4.5 to -1.6 percent

Export prices Consensus Forecast for January 15: -0.8 percent

Range: -1.5 to 0.0 percent

The University of Michigan's consumer sentiment index held on to its very strong surge at the beginning of the month, ending January at 98.1 versus the mid-month reading of 98.2 and compared against 93.6 in December. The current conditions component extended its first half gain to 109.3 versus 108.3 at mid-month and against 104.8 in December. The comparison with December points to strength for January consumer activity. The expectations component ended January at 91.0 versus 91.6 at mid-month and 86.4 in December.

Consumer sentiment Consensus Forecast for preliminary February 15: 98,5

Range: 96.5 to 100.2

R. Mark Rogers is the author of The Complete Idiot's Guide to Economic Indicators, Penguin Books.

He can also be found on a weekly broadcast talking about the U.S. economy, the easiest way to find him is by going to iTunes and searching for "Simply Economics."

Econoday Senior Writer Mark Pender contributed to this article.

|