|

An important step has been taken along the path to the Federal Reserve's first rate hike of the recovery. And it's what is not included in April's FOMC statement. The statement in March offered assurance that the coming hike would not be immediate and would not be on the table for the April meeting: "... the Committee judges that an increase in the target rate for the federal funds rate remains unlikely at the April FOMC meeting." The removal of this assurance in the April statement follows the prior removal in the March statement of "patient," the word the Fed had been using to describe its own outlook for the rate hike. The Yellen Fed has been very transparent, easing step by step to that delicate moment when they either signal that a hike is imminent or they go ahead and pull the trigger without any more fuss. The bulls are now looking down the barrel of a rate hike, and no one can complain they haven't been warned.

The possibility of a hike at any time gives new urgency to economic indicators. An outsized gain in the April employment report could, for example, result in an outsized reaction in the financial markets. A second outsized gain in the subsequent May report could very likely seal expectations for a rate hike at the June FOMC meeting.

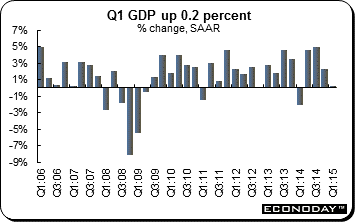

Gains for employment wouldn't surprise the Fed which, in last week's statement, cited "transitory" factors for what was a very slow first quarter when GDP barely grew at all, up only 0.2 percent. They didn't spell out what these transitory factors exactly were but we can guess that heavy weather is the biggest one followed perhaps by the now resolved port dispute on the West Coast. Other factors could be the initial effects of the drop in oil prices, which has stunted investment in the oil & gas sector, and perhaps the first-quarter surge in the value of the dollar which has stunted the nation's exports. These latter factors could prove to have long-term effects on the economy or, if oil goes up and the dollar goes down, their effects could reverse. What had been a headwind could become a tailwind. Gains for employment wouldn't surprise the Fed which, in last week's statement, cited "transitory" factors for what was a very slow first quarter when GDP barely grew at all, up only 0.2 percent. They didn't spell out what these transitory factors exactly were but we can guess that heavy weather is the biggest one followed perhaps by the now resolved port dispute on the West Coast. Other factors could be the initial effects of the drop in oil prices, which has stunted investment in the oil & gas sector, and perhaps the first-quarter surge in the value of the dollar which has stunted the nation's exports. These latter factors could prove to have long-term effects on the economy or, if oil goes up and the dollar goes down, their effects could reverse. What had been a headwind could become a tailwind.

Much more certain is the weather which is guaranteed to warm up and give a boost to second-quarter consumer and business spending. The effects of the port strike, though still a lingering factor delaying shipments, is also certain to unwind through the quarter. How big will these effects be' Turning back to last year offers a reasonable clue at least regarding the weather. First-quarter GDP in 2014 was severely hurt by what was then the Polar Vortex which helped pull GDP down by minus 2.1 percent. This set up a rebound in the second-quarter for plus 4.6 percent. Such a swing for this second quarter would unquestionably put the hawks in the driver seat at the Fed.

For those of us who follow economic indicators, this is all very exciting news! Second-quarter GDP won't be released, of course, until the end of July, but we'll know plenty about where it's heading well in advance beginning in fact with April's data. Here, however, there is surprisingly little indication of springtime acceleration, at least not yet.

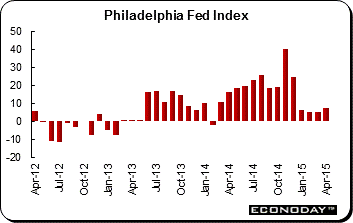

Manufacturing surveys, which offer some of the earliest clues on each month's activity, have been surprisingly soft. Most, like the Philadelphia Fed survey, which is one of the most closely watched of all, show virtually no uplift yet from the first quarter. This index came in at a paltry 7.5 in April, in the plus column, yes, but not by much. This index averaged only 5.5 during the first quarter, far lower than the 28.7 average during the fourth quarter before all the transitory factors hit. And what is even worse news in this report is the new order index which slowed to 0.7, barely above zero and down from its already very weak first-quarter average of 5.9. The Philadelphia report is no outlier with similar results reported by the New York Fed, the Richmond Fed, and the Kansas City Fed. Manufacturing surveys, which offer some of the earliest clues on each month's activity, have been surprisingly soft. Most, like the Philadelphia Fed survey, which is one of the most closely watched of all, show virtually no uplift yet from the first quarter. This index came in at a paltry 7.5 in April, in the plus column, yes, but not by much. This index averaged only 5.5 during the first quarter, far lower than the 28.7 average during the fourth quarter before all the transitory factors hit. And what is even worse news in this report is the new order index which slowed to 0.7, barely above zero and down from its already very weak first-quarter average of 5.9. The Philadelphia report is no outlier with similar results reported by the New York Fed, the Richmond Fed, and the Kansas City Fed.

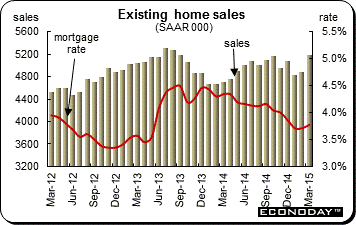

Housing, unlike manufacturing, has been showing some life, at least life for used homes. The earliest indications on housing come from weekly mortgage applications for home purchases which have been on a convincing climb, up in four of the last five reporting weeks going out to the third week of April. The pending home sales report has also been on the climb, up for three straight months. This report tracks contract signings for existing home sales and hints at a springtime lift.

In the latest data for final sales of existing homes, which was for March, sales rose sharply, up 6.1 percent for the best gain since way back in September 2013. Home prices for existing homes have also been rising, up 5.1 percent in the March report to a median $212,100. And prices have also been moving higher in more detailed data posted by S&P Case-Shiller. But what life there is in used homes isn't spilling over yet into the new home market where sales are down sharply. Starts & permits are also down sharply as is residential construction spending. The much greater price for a new home, at a median $277,400, may explain the stubborn weakness in the new home market. Perhaps, however, the early uptick on the used home side may hint at an approaching uptick for new homes. In the latest data for final sales of existing homes, which was for March, sales rose sharply, up 6.1 percent for the best gain since way back in September 2013. Home prices for existing homes have also been rising, up 5.1 percent in the March report to a median $212,100. And prices have also been moving higher in more detailed data posted by S&P Case-Shiller. But what life there is in used homes isn't spilling over yet into the new home market where sales are down sharply. Starts & permits are also down sharply as is residential construction spending. The much greater price for a new home, at a median $277,400, may explain the stubborn weakness in the new home market. Perhaps, however, the early uptick on the used home side may hint at an approaching uptick for new homes.

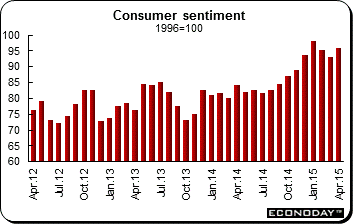

Early signs of strength, and with them a rising risk of a rate hike, may be coming from consumer measures. The FOMC went out of its way in the April statement to describe consumer confidence as "remaining high." The signal they may want to be sending here is their own expectations for a pickup in consumer spending which, though up a solid 0.4 percent for personal consumption outlays in March, has been decidedly soft. Outside of spending on services, spending mostly contracted through the first quarter. Early signs of strength, and with them a rising risk of a rate hike, may be coming from consumer measures. The FOMC went out of its way in the April statement to describe consumer confidence as "remaining high." The signal they may want to be sending here is their own expectations for a pickup in consumer spending which, though up a solid 0.4 percent for personal consumption outlays in March, has been decidedly soft. Outside of spending on services, spending mostly contracted through the first quarter.

Consumers may not be spending but they are responding favorably in questionnaires. The consumer sentiment report has held steadily at recovery highs from the winter months and into April as well. The same is true for the consumer confidence report which actually peaked during the heaviest weather in January. Once the consumer gets out of the house, we can expect to see an uptick for consumer spending, at least that's what the Fed appears to think.

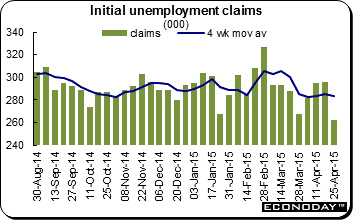

Savings from gas prices are a plus for the consumer as is the rise underway in the savings rate which climbed well into the 5 percent range during the first quarter. But whether the consumer begins to spend, and whether the Fed begins to raise rates, depends ultimately on the labor market. And the latest jobless claims report is definitely pointing to strength. Initial claims fell to a 15-year low of 262,000 in the April 25 week. A comparison of the 4-week averages during the April and March sampling periods of the monthly employment report shows a significant drop of 20,000. Data on continuing claims are telling the same story and are also at 15-year lows. Savings from gas prices are a plus for the consumer as is the rise underway in the savings rate which climbed well into the 5 percent range during the first quarter. But whether the consumer begins to spend, and whether the Fed begins to raise rates, depends ultimately on the labor market. And the latest jobless claims report is definitely pointing to strength. Initial claims fell to a 15-year low of 262,000 in the April 25 week. A comparison of the 4-week averages during the April and March sampling periods of the monthly employment report shows a significant drop of 20,000. Data on continuing claims are telling the same story and are also at 15-year lows.

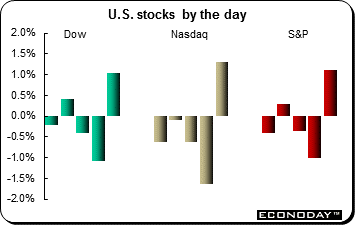

Turning to the market, it was a flat week for stocks which showed surprisingly little reaction, not even the customary volatility, to Wednesday's FOMC statement. But volatility did appear late in the week with sizable declines on Thursday turning into sizable gains on Friday. Economic news, on net, was also flat and was not a major factor for the market. Turning to the market, it was a flat week for stocks which showed surprisingly little reaction, not even the customary volatility, to Wednesday's FOMC statement. But volatility did appear late in the week with sizable declines on Thursday turning into sizable gains on Friday. Economic news, on net, was also flat and was not a major factor for the market.

Early in the week stocks were hit by company news out of the healthcare sector including bad news for Amgen, whose skin cancer drug met with criticism from the Food and Drug Administration, and bad news from Celladon whose gene therapy for heart failure failed a key test. Twitter caused a fuss at midweek after its earnings, which were lower than expected, were released early. Apple also made news, issuing a conservative outlook amid reports that early interest in the Apple Watch isn't that hot.

Indexes for the week mostly edged lower including the Dow industrials which fell 0.3 percent but is still up 1.1 percent year-to-date. The S&P 500 slipped 0.4 percent in the week while the Nasdaq, pressured in part by Apple, fell 1.7 percent.

Changes in the April FOMC statement shouldn't be downplayed. They take data dependency to a more immediate level and they raise the chance of accelerated reaction to economic events. And this urgency could be felt as soon as Friday should the employment report surprise to the upside.

This is a busy week for economic news ending with employment on Friday, a report that could affect rate-hike expectations and where the consensus is very wide. Building up to the report will be updates on manufacturing with factory orders on Monday and updates on services with two related reports on Tuesday. The ADP employment report on Wednesday and jobless claims on Thursday will keep talk alive going into Friday.

Factory orders have been one of the most disappointing indicators on the calendar, falling in 6 out of the last 7 reports. But a 2.1 percent gain is expected for the March report based on the previously released 4.0 percent jump in the durable goods component that got a boost from not only aircraft but also motor vehicles. Still, a gain for March won't raise too much enthusiasm given the broad weakness seen in April's manufacturing surveys.

Factory Orders - Consensus Forecast for March: +2.1%

Range: +1.4% to +3.6%

The international trade deficit is expected to widen out sharply in March, to $42.0 billion from $35.4 billion in February when imports fell sharply, a drop tied to soft import prices and the West Coast port strike. Imports are expected to bounce back up in the March report. Also keep an eye out on exports which will offer the latest clues on the negative effects of the strong dollar.

International Trade - Consensus Forecast for March: -$42.0 billion

Range: -$45.0 billion to -$37.8 billion

The PMI services index has been strong, underscoring the strength of the domestic economy. The mid-month flash for this report came in at 57.8 with expectations for the final reading at 57.7. The long-term average for this index is 55.9. Recent strength has been centered in new orders and also employment where gains have been robust.

PMI Services Index - Consensus Forecast for April: 57.7

Range: 57.5 to 59.1

The ISM non-manufacturing index is expected to hold steady, at a very solid 56.5 and in line with the indication from the flash PMI services index. New orders have been consistently solid in the ISM report with backlog orders also on the rise.

ISM Non-Manufacturing Index - Consensus Forecast for April: 56.5

Range: 54.0 to 57.5

The ADP employment report doesn't always offer the right signals for the government's data but it did in March, foretelling what was that's month very disappointing employment report. ADP's count for government payroll growth is expected to bounce back in April, to 205,000 vs 189,000 in March, but the consensus range is very wide at 170,000 to 295,000 which points to uncertainty.

ADP Employment Report - Consensus Forecast for April: 205,000

Range: 170,000 to 295,000

Weakness in first-quarter GDP, up only 0.2 percent, points to a decline in productivity and a rise for unit labor costs. Productivity is expected to fall 1.9 percent in the quarter which would be a second straight decline. And costs are expected to post their second straight jump, up 4.6 percent in a gain that would be in line with pressure in last week's employment cost index.

Nonfarm Productivity - Consensus Forecast for first quarter: -1.9%

Range: -2.5% to -1.2%

Unit Labor Costs - Consensus Forecast for first quarter: +4.6%

Range: +3.8% to +5.6%

Initial jobless claims have been a highlight of the calendar, moving to 15-year lows and pointing to improvement underway in the labor market. Initial claims are expected to give back some of their improvement from the 262,000 level of the prior week, but not much with the Econoday consensus at 280,000. Continuing claims have also been moving lower to 15-year lows.

Jobless Claims - Consensus Forecast for May 2 week: 280,000

Range: 275,000 to 285,000

Consumer credit is expected to once again show a strong increase with the Econoday consensus at $15.9 billion for March. But the gains have repeatedly been confined to the non-revolving component which is being inflated by the government's acquisition of student loans from private lenders. The revolving component, where credit cards are tracked, has been dead flat.

Consumer Credit - Consensus Forecast for March: +$15.9 billion

Range: +$14.0 billion to +$20.0 billion

Nonfarm payroll employment is expected to rebound sharply in April, to 220,000 from an unusually weak 126,000 in March, a month that should prove to be an outlier. Still, a 220,000 gain would still be tepid. The consensus range for April is very wide, from only 180,000 on the low side to a very robust 335,000 on the high side. The unemployment rate is seen moving down 1 tenth to 5.4 percent. Hourly earnings are expected to show less pressure, at plus 0.2 percent for April vs plus 0.3 percent in March. Another month of weakness in this report could end talk once and for all of a rate hike at the June FOMC meeting, though an outsized gain could revive that talk.

Nonfarm Payrolls - Consensus Forecast for April: 220,000

Range: 180,000 to 335,000

Private Payrolls - Consensus Forecast for April: 223,000

Range: 170,000 to 330,000

Unemployment Rate - Consensus Forecast for April: 5.4 percent

Range: 5.3 to 5.5 percent

Average Hourly Earnings - Consensus Forecast for April: +0.2 percent

Range: +0.1 to +0.3 percent

Average Workweek - Consensus Forecast for April: 34.5 hours

Range: 34.5 to 34.6 hours

Labor Force Participation Rate - Consensus Forecast for April: 62.7 percent

Range: 62.7 percent to 62.7 percent

Wholesale inventories have been rising at the same time that wholesale sales have been falling. The inventory-to-sales ratio for the sector, at 1.29, is the highest since the recession period of 2009. High inventories may prove a headwind for the second quarter, holding down production and also employment.

Wholesale Inventories - Consensus Forecast for March: +0.3%

Range: +0.3% to +0.5%

|