|

Inflation is beginning to move incrementally higher but, what is not expected by Federal Reserve policy makers, is a sudden slowing in consumer spending. Other indications in the week are mixed with factory activity still being held down by the strong dollar but with little holding back the housing sector where second half momentum is building.

Janet Yellen, in her testimony to Congress during the week, emphasized the Fed's view that rates of inflation are likely to tick higher as the effects of gasoline prices ease. This diminishing effect  will be most apparent in month-to-month comparisons, not year-on-year comparisons which will still reflect the enormous decrease in gasoline prices from this time last year. Shifting our focus to monthly rates confirms the Fed's view, at least for the last several months, as both consumer prices and producer prices are beginning to show monthly increases as seen on the right side of the accompanying graph. The CPI, having previously plunged on falling gasoline prices, has now posted five straight monthly gains including an outsized 0.4 percent jump in May followed by a 0.3 percent rise in June. The PPI is showing similar gains, up 0.4 percent in June on top of a 0.5 percent rise in May. Core rates, where energy prices are excluded, are showing less monthly increases but are also trending higher. The core CPI rose 0.2 percent in June following May's 0.1 percent rise. The producer price side shows similar results for the core, up 0.3 percent in June vs a 0.1 percent gain in May. And there was one especially interesting inflationary signal out of the CPI and that was a 0.4 percent rise for owners' equivalent rent which is very high for this reading, in fact the highest since October 2006. This reflects rising rent costs and is a factor, as we'll discuss later, behind the surge underway in apartment construction. will be most apparent in month-to-month comparisons, not year-on-year comparisons which will still reflect the enormous decrease in gasoline prices from this time last year. Shifting our focus to monthly rates confirms the Fed's view, at least for the last several months, as both consumer prices and producer prices are beginning to show monthly increases as seen on the right side of the accompanying graph. The CPI, having previously plunged on falling gasoline prices, has now posted five straight monthly gains including an outsized 0.4 percent jump in May followed by a 0.3 percent rise in June. The PPI is showing similar gains, up 0.4 percent in June on top of a 0.5 percent rise in May. Core rates, where energy prices are excluded, are showing less monthly increases but are also trending higher. The core CPI rose 0.2 percent in June following May's 0.1 percent rise. The producer price side shows similar results for the core, up 0.3 percent in June vs a 0.1 percent gain in May. And there was one especially interesting inflationary signal out of the CPI and that was a 0.4 percent rise for owners' equivalent rent which is very high for this reading, in fact the highest since October 2006. This reflects rising rent costs and is a factor, as we'll discuss later, behind the surge underway in apartment construction.

Year-on-year rates, however, are definitely less hot, at a sliver of plus 0.1 percent for the total CPI and at minus 0.7 percent for the PPI. But again this is a bit misleading given the comparison against much higher energy costs at this time last year. The feeling of inflation is actually incremental by nature, week to week, month to month. Prices this time last year are not vivid memories to most of us. Still, though, year-on-year is the benchmark measure for inflation with the Fed's general target at 2.0 percent. And core rates, which again are not directly affected by this year's much lower cost for energy, are moving higher, up 1 tenth for the CPI to 1.8 percent and zeroing in on the Fed's target. The PPI core, at plus 0.8 percent year-on-year, still has a long way to go but did rise by a 2 tenth chunk in June.

One upward factor, that Yellen also pointed to during the week, is the diminishing effect of the dollar's prior appreciation, which of course slammed the nation's exporters but has also been contributing to lower inflation rates as consumers substitute imports, where prices are falling due to the dollar's strength, for what have comparatively become higher priced domestic goods. The accompanying graph compares year-on-year import prices against consumer prices. When the dollar was comparatively weaker back in 2011, import prices were high and, as seen on the  graph, were pulling up consumer prices. Then mid-year last year, the dollar started to rise and import prices started to fall, this time pulling down consumer prices which, year-on-year, have been holding at or near the zero line. How, in fact, the dollar will move for the balance of the year is of course unknown though the Fed, in its statements and projections, sees the dollar stable to soft. Perhaps so, but the European crisis over Greece may not be over yet and new trouble could feed new gains for the dollar. Also, the successful inclusion of Greece in Europe may not prove to be a complete positive for the euro given Greece's very weak economy which will tend to pull down the value of the euro. And on that score, growth in the U.S. may not be that hot but is likely to prove greater compared to other economies, which is an important point that hints at renewed appreciation for the dollar. graph, were pulling up consumer prices. Then mid-year last year, the dollar started to rise and import prices started to fall, this time pulling down consumer prices which, year-on-year, have been holding at or near the zero line. How, in fact, the dollar will move for the balance of the year is of course unknown though the Fed, in its statements and projections, sees the dollar stable to soft. Perhaps so, but the European crisis over Greece may not be over yet and new trouble could feed new gains for the dollar. Also, the successful inclusion of Greece in Europe may not prove to be a complete positive for the euro given Greece's very weak economy which will tend to pull down the value of the euro. And on that score, growth in the U.S. may not be that hot but is likely to prove greater compared to other economies, which is an important point that hints at renewed appreciation for the dollar.

The Fed has been describing consumer spending as soft but, pointing to strength for consumer confidence, the Fed has been projecting building strength ahead. But strength in  confidence has not really translated, outside of May's gain, to strength for spending. Retail sales for June came in way below expectations, at minus 0.3 percent. Motor vehicles were part of the reason, excluding which sales came in at a less weak minus 0.1 percent. But excluding both autos and gasoline, core sales fell 0.2 percent which is clearly disappointing. A look at year-on-year sales rates, seen in the graph, underscores the complete lack of consumer punch, at only plus 1.4 percent for total retail sales and trending completely in the wrong direction. Moving back to monthly rates, auto sales fell 1.1 percent in June, furniture sales fell 1.6 percent, apparel slid 1.5 percent, building materials dipped 1.3 percent, and restaurants fell 0.2 percent. confidence has not really translated, outside of May's gain, to strength for spending. Retail sales for June came in way below expectations, at minus 0.3 percent. Motor vehicles were part of the reason, excluding which sales came in at a less weak minus 0.1 percent. But excluding both autos and gasoline, core sales fell 0.2 percent which is clearly disappointing. A look at year-on-year sales rates, seen in the graph, underscores the complete lack of consumer punch, at only plus 1.4 percent for total retail sales and trending completely in the wrong direction. Moving back to monthly rates, auto sales fell 1.1 percent in June, furniture sales fell 1.6 percent, apparel slid 1.5 percent, building materials dipped 1.3 percent, and restaurants fell 0.2 percent.

And the fall in restaurant sales doesn't speak to strong levels of consumer confidence that everyone's been talking about. Consumer sentiment is actually softening this month, to 93.3 in the mid-month July reading which is sizably below Econoday's low estimate for 94.5. The current  conditions component is down nearly 3 points to 106.0 in an early reading for July that points to another month of weakness for consumer activity. The graph compares the index with actual retail spending and nothing is hinting at acceleration. U.S. consumers are typically immune to global developments and are focused most on the outlook for their own jobs. But Greece and volatility in the global markets, especially China of course, may be affecting our confidence over here. Consumer sentiment has been running very strong most of this year but the flash report for July points to flattening and suggests that the best for confidence may already have passed. conditions component is down nearly 3 points to 106.0 in an early reading for July that points to another month of weakness for consumer activity. The graph compares the index with actual retail spending and nothing is hinting at acceleration. U.S. consumers are typically immune to global developments and are focused most on the outlook for their own jobs. But Greece and volatility in the global markets, especially China of course, may be affecting our confidence over here. Consumer sentiment has been running very strong most of this year but the flash report for July points to flattening and suggests that the best for confidence may already have passed.

The strong dollar's most dramatic effect on the economy has been to depress exports. Research published during the week from the New York Federal Reserve concludes that a 10 percent appreciation in the dollar will cut GDP by a very sizable half percentage point. By the New York Fed's measure, the dollar is up 12 percent from this time last year. This isn't news to the nation's manufacturers which are reporting the weakest trends of the recovery. One of the week's biggest disappointments came from the manufacturing component of the industrial production report which was no better than unchanged for a second straight month. Year-on-year, the component is tracking at a very soft plus 1.8 percent. Capacity utilization in the manufacturing sector slipped 1 tenth to 77.2 percent, noticeably below the 78.4 percent rate when including utilities and mining. Motor vehicle production was very weak, down 3.7 percent in the June report. Retail sales of vehicles, remember, turned lower in June which doesn't point to much of a rebound for vehicle production later this summer. The week's other reports on manufacturing were likewise in the dumps, with both the Empire State and Philly Fed reports both pointing to extending weakness.

But optimists did get some good news this week and, once again, it was out of the housing sector, specifically the apartment sector. Strong demand for apartment units drove housing starts  and permits data far beyond expectations, overshadowing less strength for the key single-family home category. Starts jumped 9.8 percent in June to a 1.174 million annual rate, reflecting a 29.4 percent surge in the multi-family component. The unusual rise for multi-family units reflects high levels of rent, evident in the June CPI report. The single-family component actually fell 0.9 percent. The permit side shows a similar pattern, up 7.4 percent overall to a much higher-than-expected 1.343 million rate but here too multi-family units rose 15.3 percent with single-family up far less but at a still very strong 0.9 percent. and permits data far beyond expectations, overshadowing less strength for the key single-family home category. Starts jumped 9.8 percent in June to a 1.174 million annual rate, reflecting a 29.4 percent surge in the multi-family component. The unusual rise for multi-family units reflects high levels of rent, evident in the June CPI report. The single-family component actually fell 0.9 percent. The permit side shows a similar pattern, up 7.4 percent overall to a much higher-than-expected 1.343 million rate but here too multi-family units rose 15.3 percent with single-family up far less but at a still very strong 0.9 percent.

Regional data, where the separation between single-family homes and multi-family units is not broken out, show special strength for the South which is by far the largest region for housing. Starts in the South rose 13.5 percent in June with permits up 10.4 percent, gains that underscore separate data from the New York Fed that expectations for home price appreciation are the highest in the South.

Though the single-family component is lagging, the 0.9 percent rise in June permits does point to strong second-half activity for the new home sector. But as far as GDP goes, gains in multi-family units, which are smaller and less costly to construct, don't have nearly the punch that gains in single-family homes have.

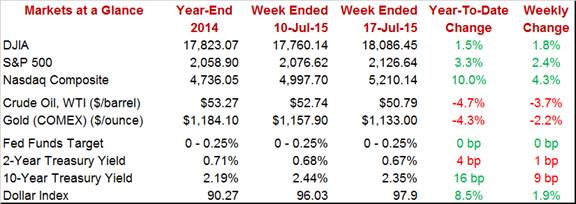

The off again and on again, the no-to-Europe and yes-to-Europe struggle over Greece seems, at least for now, to have been settled with Greece, austerity or not, to stay. Demand for stock-market risk picked up strongly in the week with the Dow up 1.8 percent bringing its year-to-date total back in the plus column at 1.5 percent. The Nasdaq was a special favorite for risk takers, up 4.3 percent in the week bringing its year-to-date gain to 10 percent. Risk or not, there was less interest in oil, down 3.7 percent in the week and back near $50 at $50.79, and there was less interest in gold which appears to be breaking down, 2.2 percent lower to end the week at $1,133. The dollar, not to the delight of exporters, rose 1.9 percent for a year-to-date gain of 8.5 percent on the dollar index. The off again and on again, the no-to-Europe and yes-to-Europe struggle over Greece seems, at least for now, to have been settled with Greece, austerity or not, to stay. Demand for stock-market risk picked up strongly in the week with the Dow up 1.8 percent bringing its year-to-date total back in the plus column at 1.5 percent. The Nasdaq was a special favorite for risk takers, up 4.3 percent in the week bringing its year-to-date gain to 10 percent. Risk or not, there was less interest in oil, down 3.7 percent in the week and back near $50 at $50.79, and there was less interest in gold which appears to be breaking down, 2.2 percent lower to end the week at $1,133. The dollar, not to the delight of exporters, rose 1.9 percent for a year-to-date gain of 8.5 percent on the dollar index.

The week's economic signals point to increasing pressure for inflation, which is a plus for the Fed, but less strength for the consumer, which is definitely not a plus for the Fed. But housing is a positive as perhaps is the economy's general inertia which appears to be tracking at a moderate 2.5 percent rate of growth, more or less consistent with the Fed's rate liftoff plans sometime later this year. Inflation data make a September rate hike a reasonable possibility, though another month or two of consumer weakness could make November or December a more reasonable possibility.

The week starts off slowly but will pick up steam on Wednesday with the FHFA house price index and existing home sales report. Housing is, in fact, the week's theme with new home sales to be posted Friday. Gains are expected for all these reports. Other data include initial jobless claims which, in an important point for expectations, will cover the sample week of the monthly employment report.

The FHFA house price index is expected to rise a respectable 0.4 percent in lagging data for May, 1 notch higher than April's more moderate 0.3 percent rise. Both this report and the Case-Shiller report pointed to price softness earlier in the year but with the spring acceleration in the housing sector, both reports should begin to pick up some steam.

FHFA House Price Index - Consensus Forecast for May: +0.4%

Range: +0.2% to +0.7%

Existing Home Sales are expected to rise a solid 0.9 percent in June to a 5.40 million rate vs May's 5.35 million rate which was up very strongly from April as springtime housing acceleration took hold. Supply has been tight, at 5.1 months in the May report, which is likely to bring homes into the market. The mix between single-family homes and the less expensive condo category will be of special interest given signs in starts & permit data of a surge underway in condos.

Existing Home Sales - Consensus Forecast for June: 5.40 million rate

Range: 5.30 to 5.46 million rate

Summer auto retooling always makes jobless claims hard to read during July as temporary layoffs in the sector are unpredictable and difficult to adjust. Forecasters see little change in the July 18 week, at 279,000 for initial claims vs 281,000 in the prior week. Note that the latest report will be especially important as it covers the sample week of the monthly employment report.

Jobless Claims - Consensus Forecast for July 18 week: 279,000

Range: 275,000 to 300,000

June was a soft month for the economy as the employment and retail sales reports both proved weak. But forecasters see only limited weakness for the national activity index where the consensus is calling for a marginally negative reading of only 0.05.

National Activity Index - Consensus Forecast for June: -0.05

Range: -0.11 to +0.05

The index of leading economic indicators is expected to post a slight gain of 0.2 percent in June though forecasts vary widely with the high end at plus 0.7 percent. And 0.7 percent was the outsized gain for May which benefited from housing permits where their surge extended to June.

Leading Economic Indicators - Consensus Forecast for June: +0.2%

Range: +0.1% to +0.7%

The PMI manufacturing index is expected to hold steady in the flash report for July, at a consensus 53.7 vs 53.6 in June. Export orders have been especially weak in this report but not hiring which, for this sample at least, has been strong.

PMI Manufacturing Index, Flash - Consensus Forecast for July: 53.7

Range: 53.3 to 54.0

New home sales have been posting strong gains with forecasters seeing another sharp rise for June, at a consensus 0.9 percent to a 0.550 million rate vs May's 0.546 rate. Builders are confident and are making for big gains in permits. But lead times in construction are long and lack of supply on the market is likely to constrain sales gains and lift prices.

New Home Sales - Consensus Forecast for June: 0.550 million

Range: 0.535 to 0.570 million

|