|

The epic buildup to the September FOMC meeting took a dramatic turn against the hawks on Friday as cracks widened in consumer sentiment. Yet sentiment aside, much of the week's other economic data, including updates on the labor market and producer prices, are in the hawk's favor.

An initial rumble came early in the week and from JOLTS of all reports. This report rarely moves the markets and, by the way, stands for Job Openings and Labor Turnover Survey. Job openings, the columns in the accompanying graph, surged more than 8 percent in July to a record high 5.75 million. This at the same time that the report's hires rate fell, not rose, nearly 4 percent to 4.98 million. The black line in the graph has been barely trending higher the last several years and may now be headed in the wrong direction. This is strong evidence that employers are having a hard time finding people to fill jobs, a precursor perhaps to wage inflation. The report's quits rate, steady at 1.9 percent, remains low but could definitely move higher should wages pick up and attract workers to new jobs. In a special detail, the report shows strong demand for professional & business services which is considered a leading indicator for total employment. An initial rumble came early in the week and from JOLTS of all reports. This report rarely moves the markets and, by the way, stands for Job Openings and Labor Turnover Survey. Job openings, the columns in the accompanying graph, surged more than 8 percent in July to a record high 5.75 million. This at the same time that the report's hires rate fell, not rose, nearly 4 percent to 4.98 million. The black line in the graph has been barely trending higher the last several years and may now be headed in the wrong direction. This is strong evidence that employers are having a hard time finding people to fill jobs, a precursor perhaps to wage inflation. The report's quits rate, steady at 1.9 percent, remains low but could definitely move higher should wages pick up and attract workers to new jobs. In a special detail, the report shows strong demand for professional & business services which is considered a leading indicator for total employment.

The strength of the JOLTS report is raising talk that demand for labor may not only be growing but may suddenly be growing very strongly. Another positive indication in the week came from the Federal Reserve's very own labor market conditions index where improvement, boosted by the decline in available labor, is tangible but less dramatic. Labor market conditions, a broad composite of 19 employment indicators, rose 3 tenths to 2.1 in August. This is a soft level compared to the mid-single digit trend of 2013 and 2014 but is still the highest reading of the year. And the latest gain, as seen in the graph, is the fourth in a row. The strength of the JOLTS report is raising talk that demand for labor may not only be growing but may suddenly be growing very strongly. Another positive indication in the week came from the Federal Reserve's very own labor market conditions index where improvement, boosted by the decline in available labor, is tangible but less dramatic. Labor market conditions, a broad composite of 19 employment indicators, rose 3 tenths to 2.1 in August. This is a soft level compared to the mid-single digit trend of 2013 and 2014 but is still the highest reading of the year. And the latest gain, as seen in the graph, is the fourth in a row.

And there was more evidence that labor is scarce, from initial claims which moved back lower in the September 5 week, down 6,000 to 275,000. As the graph shows, claims have held steady near or below 280,000 for the past six months. This is, even without adjusting for population growth, the lowest run in 40 years! Continuing claims, where data goes back only 15 years, are telling the same story, steady at a near record low of 2.260 million. Still, a close look at the graph shows that initial claims aren't quite as low as they were a month or so ago, which doesn't point to greater strength for the September employment report. And there was more evidence that labor is scarce, from initial claims which moved back lower in the September 5 week, down 6,000 to 275,000. As the graph shows, claims have held steady near or below 280,000 for the past six months. This is, even without adjusting for population growth, the lowest run in 40 years! Continuing claims, where data goes back only 15 years, are telling the same story, steady at a near record low of 2.260 million. Still, a close look at the graph shows that initial claims aren't quite as low as they were a month or so ago, which doesn't point to greater strength for the September employment report.

The hawks also got a lift of sorts from the producer price report where service prices are on the rise. The graph compares final demand service prices, the dark columns and the red columns at the very right, with final demand goods prices, the light columns that have been stuck in the negative zone for the bulk of the last year including the last two months. This reflects weakness in commodity prices where global factors have a large influence. In contrast, service prices are insulated from global demand and reflect the fundamental strength of the nation's domestic service-based economy. Whether this pressure will begin showing up in consumer prices, however, is uncertain, as is how compelling the service argument will be for the hawks. The hawks also got a lift of sorts from the producer price report where service prices are on the rise. The graph compares final demand service prices, the dark columns and the red columns at the very right, with final demand goods prices, the light columns that have been stuck in the negative zone for the bulk of the last year including the last two months. This reflects weakness in commodity prices where global factors have a large influence. In contrast, service prices are insulated from global demand and reflect the fundamental strength of the nation's domestic service-based economy. Whether this pressure will begin showing up in consumer prices, however, is uncertain, as is how compelling the service argument will be for the hawks.

Now the balance of the week's data begins to turn in favor of the doves. Unlike the producer price report, there is no service component in import & export prices where significant declines continue to sweep nearly all categories — and are pointing squarely at a deepening of cross-border deflationary pressures. The graph compares the index levels for import & export prices, both now as low as they've been since 2010. The August drops for both are the steepest since the oil-price rout of January. Petroleum pulled down the import side but even when excluding petroleum, prices were down sharply on the month. Exports have been getting hit by lower prices for industrial supplies, foods-feeds-beverages, and also agricultural products. This report highlights the risk that inflation, though it may be getting a little lift from service gains, may not be moving to the Fed's 2 percent target any time soon. Now the balance of the week's data begins to turn in favor of the doves. Unlike the producer price report, there is no service component in import & export prices where significant declines continue to sweep nearly all categories — and are pointing squarely at a deepening of cross-border deflationary pressures. The graph compares the index levels for import & export prices, both now as low as they've been since 2010. The August drops for both are the steepest since the oil-price rout of January. Petroleum pulled down the import side but even when excluding petroleum, prices were down sharply on the month. Exports have been getting hit by lower prices for industrial supplies, foods-feeds-beverages, and also agricultural products. This report highlights the risk that inflation, though it may be getting a little lift from service gains, may not be moving to the Fed's 2 percent target any time soon.

News early in the week pointed to a little strength for the consumer, specifically a sharp and extending rise in revolving credit outstanding. This points to increasing use of credit cards which would hint, you would think, at consumer confidence. But the credit report was for July, not August and certainly not September when the market meltdown has now become part of everyday life. There have been only a few readings so far on the meltdown's impact on the consumer, most of them confined to August when it first started. Now with data early in September, the negative effect appears to be growing, at least based on the consumer sentiment index which fell more than 6 points to 85.7 to erase a year of gains. Recent FOMC statements have directly cited the importance of consumer confidence readings and New York Fed President William Dudley said he is specifically focused on the sentiment report as an early indication of how U.S. consumers are responding to Chinese-based turbulence. It's this report, heightened and underscored by the Fed itself, which offers the doves their rallying cry. News early in the week pointed to a little strength for the consumer, specifically a sharp and extending rise in revolving credit outstanding. This points to increasing use of credit cards which would hint, you would think, at consumer confidence. But the credit report was for July, not August and certainly not September when the market meltdown has now become part of everyday life. There have been only a few readings so far on the meltdown's impact on the consumer, most of them confined to August when it first started. Now with data early in September, the negative effect appears to be growing, at least based on the consumer sentiment index which fell more than 6 points to 85.7 to erase a year of gains. Recent FOMC statements have directly cited the importance of consumer confidence readings and New York Fed President William Dudley said he is specifically focused on the sentiment report as an early indication of how U.S. consumers are responding to Chinese-based turbulence. It's this report, heightened and underscored by the Fed itself, which offers the doves their rallying cry.

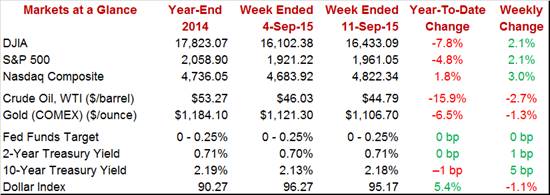

So let's start imagining the scenarios. If the Fed doesn't tighten, will the markets immediately sell-off and price in a tightening for the December meeting? Or if the Fed goes ahead and tightens, will the markets believe the worst is over and begin to rally? The possibilities go back and forth, all a reminder that a pivot point in policy is a pivot point for the markets. The markets had a constructive week, less related to the Fed and more to an easing in Chinese volatility. The Dow, at 16,433, posted a 2.1 percent gain on the week as did the Nasdaq while the S&P 500 added 3.0 percent. Demand for Treasuries eased slightly but not much, and demand for the week's 10- and 30-year auctions was unusually strong, both getting a big boost from buy-and-hold investors who, understandably, may be looking for a little shelter right now. So let's start imagining the scenarios. If the Fed doesn't tighten, will the markets immediately sell-off and price in a tightening for the December meeting? Or if the Fed goes ahead and tightens, will the markets believe the worst is over and begin to rally? The possibilities go back and forth, all a reminder that a pivot point in policy is a pivot point for the markets. The markets had a constructive week, less related to the Fed and more to an easing in Chinese volatility. The Dow, at 16,433, posted a 2.1 percent gain on the week as did the Nasdaq while the S&P 500 added 3.0 percent. Demand for Treasuries eased slightly but not much, and demand for the week's 10- and 30-year auctions was unusually strong, both getting a big boost from buy-and-hold investors who, understandably, may be looking for a little shelter right now.

Lack of slack in the labor market may warrant a rate hike but not the inflation picture. And if volatility in the markets continues, as it certainly did through this last week, then consumer sentiment may only get worse, not to mention the health of foreign economies. The minutes of the July FOMC, remember, said "almost all" of the voters saw no need for immediate liftoff. It should be no great shock if September's meeting produces a similar result.

The big week is here but doesn't get underway until Tuesday with the retail sales report. Unusual strength in the report could alter the outlook for Thursday's FOMC announcement, as could surprise strength in Tuesday's industrial production report which, however, is expected to show weakness. Wednesday's CPI is the last chance for data to upend FOMC expectations. A 0.2 percent gain for the core CPI is expected but wouldn't be enough to lift rate-hike odds. Thursday's announcement will transfix the markets and will also include FOMC forecasts and the Chair's press conference. Other data Thursday will include housing starts & permits, the former seen down but the latter up, as well as weekly jobless claims where the sample week is the same as the sample week of the monthly employment report.

Retail sales are expected to rise 0.3 percent in August, a moderate gain that would not change the fate of the week's FOMC meeting. But the range of forecasts is wide and a print near the top forecast of 1.0 percent could very well lift the chances of a rate hike. And strength in the month is seen in core sales reflected in the ex-auto ex-gas reading which is expected to rise a solid 0.4 percent. Gasoline stations are expected to post sharply lower sales in line with the month's fall in gasoline prices.

Retail Sales, M/M Chg - Consensus Forecast for August: +0.3%

Range: 0% to +1.0%

Retail Sales Ex-Autos, M/M Chg - Consensus Forecast for August: +0.2%

Range: -0.2% to +0.6%

Retail Sales Ex-Autos, Ex-Gas, M/M Chg - Consensus Forecast for August: +0.4%

Range: +0.2% to +0.5%

The Empire State manufacturing index is expected to bounce back in September, to a consensus minus 0.50 which would indicate only slight month-to-month contraction vs August's extremely deep contraction of minus 14.92. Focus will be on new orders which, at minus 15.70 in August, posted its weakest reading in 5 years.

Empire State Manufacturing Index - Consensus Forecast for September: -0.50

Range: -6.00 to 5.00

There isn't any need for a rate hike based on expectations for industrial production which is expected to decline 0.2 percent in August, driven lower by an expected 0.3 percent drop in the manufacturing component. Expectations for the manufacturing component are tied to weak hour data in the monthly employment report. In July, the manufacturing component jumped sharply on strength in vehicle production.

Industrial Production, M/M Chg - Consensus Forecast for August: -0.2%

Range: -0.7% to +0.5%

Capacity Utilization Rate - Consensus Forecast for August: 77.8%

Range: 77.5% to 78.5%

Manufacturing Production, M/M Chg - Consensus Forecast for August: -0.3%

Range: -0.5% to +0.3%

Inventory overhang, which is moderate, is expected to ease with business inventories forecast to rise only 0.1 percent in July. Prior data for the factory and wholesale sectors showed stable conditions in July.

Business Inventories, M/M Chg - Consensus Forecast for July: +0.1%

Range: 0% to +0.5%

Lower gasoline prices are expected to hold the consumer price index to no change in August, but when excluding food and energy, prices are expected to rise 0.2 percent. Still, a 0.2 percent gain for the core would not scramble the outlook of the week's FOMC meeting. One component to watch is owners equivalent rent which posted sizable gains of 0.3 and 0.4 percent in July and June, reflecting tight supply in the housing sector.

Consumer Price Index, M/M Chg - Consensus Forecast for August: 0%

Range: -0.2% to +0.1%

CPI Excluding Food & Energy, M/M Chg - Consensus Forecast for August: +0.2%

Range: +0.1% to +0.2%

The housing market index, a measure of home builder sentiment, has been very strong this year, reflecting low supply in the new housing market. Forecasters see the index holding at 61 in September. Expectations of future sales have been the leading component in this report.

Housing Market Index - Consensus Forecast for September: 61

Range: 59 to 63

Housing starts are expected to dip 3.2 percent in August to a 1.168 million annual rate, reflecting a prior dip for permits. But housing permits are expected to rise 3.7 percent to a 1.160 million rate, reversing a plunge in July that was skewed by a change in New York City real estate law. A drop in starts and a rise in permits could lower expectations for third quarter housing while raising expectations for the fourth quarter.

Housing Starts, Annualized Rate - Consensus Forecast for August: 1.168 million

Range: 1.100 to 1.230 million

Housing Permits, Annualized Rate - Consensus Forecast for August: 1.160 million

Range: 1.100 to 1.235 million

Initial jobless claims are expected to hold steady at 275,000 in the September 12th week which is also the sample week for the September employment report. Initial claims have been holding at 40-year lows.

Initial Jobless Claims - Consensus Forecast for September 12 Week: 275,000

Range: 270,000 to 280,000

The current account deficit is expected to hold little changed at $113.5 billion in the second quarter vs $113.3 billion in the first quarter. A strengthening in the nation's surplus on service exports helped hold down the first-quarter deficit. The gap relative to GDP in the first quarter was a manageable 2.6 percent.

Current Account Deficit - Consensus Forecast for Second Quarter: -$113.5 billion

Range: -$119.0 to -$109.3 billion

The Philly Fed index is expected to slip 2.0 points in September to a still respectable 6.3. New orders were only 5.8 in August and a rise in September would boost expectations for October strength.

Philadelphia Fed Index - Consensus Forecast for September: 6.3

Range: 2.5 to 10.5

The index of leading economic indicators is expected to rise 0.2 percent in August after dipping 0.2 percent in July. Unusual swings in housing permits have been distorting recent LEI readings which otherwise have been pointing to strong rates of growth ahead for the economy.

Leading Indicators, M/M Chg - Consensus Forecast for August: +0.2%

Range: -0.3% to +0.4%

|