|

The September employment report has made the chances of a month-end FOMC rate hike seem as distant as foreign shores. But it's the weakness of foreign demand, which the FOMC warned us about at their last meeting, that appears to be tipping the economy to the soft side. This week was packed with data, some of it not so good like employment and factory orders, and some of it, closer to home, actually very good.

The September employment report came in weaker than expected on all scores with nonfarm payroll at 142,000, well under low-end expectations which were at 180,000. Gains in government once again supported the headline, up 24,000 in September and averaging 29,000 the last four months. But how long can government payrolls stay this strong? Government payrolls have averaged a monthly gain of only 7,000 over the last 2 years and have averaged a decline of 6,000 over the last 3 years. Pulling down on payrolls, and offering negative signals on global effects, was the factory sector which lost jobs. Factory payrolls fell 9,000 after falling 18,000 in August. These are losses that can be blamed on weak foreign markets together with the negative effect of the strong dollar. Mining has also been hurting, the result here of low commodity prices. Payrolls in this industry fell 13,000 on top of August's 22,000 decline. Rounding out the weakness are average hourly earnings which also came in below the low-end estimate, showing no change month-on-month and a year-on-year rate of 2.2 percent that was unchanged from August. The September employment report came in weaker than expected on all scores with nonfarm payroll at 142,000, well under low-end expectations which were at 180,000. Gains in government once again supported the headline, up 24,000 in September and averaging 29,000 the last four months. But how long can government payrolls stay this strong? Government payrolls have averaged a monthly gain of only 7,000 over the last 2 years and have averaged a decline of 6,000 over the last 3 years. Pulling down on payrolls, and offering negative signals on global effects, was the factory sector which lost jobs. Factory payrolls fell 9,000 after falling 18,000 in August. These are losses that can be blamed on weak foreign markets together with the negative effect of the strong dollar. Mining has also been hurting, the result here of low commodity prices. Payrolls in this industry fell 13,000 on top of August's 22,000 decline. Rounding out the weakness are average hourly earnings which also came in below the low-end estimate, showing no change month-on-month and a year-on-year rate of 2.2 percent that was unchanged from August.

One of the most unpleasant surprises in the September employment report was a sharp 2 tenths dip in the labor participation rate to 64.4 percent for a nearly 40-year low. At the same time unemployment remains very low at 5.1 percent and job openings, as tracked in the recent JOLTS report, are unusually high. Why is there an ever greater share of people out of the workforce? An aging population is one answer as well perhaps as the rise in incentives, such as disability insurance, to stay out of the workforce. Another possible factor is pay, that wages are not high enough to attract workers back into the workforce. One of the most unpleasant surprises in the September employment report was a sharp 2 tenths dip in the labor participation rate to 64.4 percent for a nearly 40-year low. At the same time unemployment remains very low at 5.1 percent and job openings, as tracked in the recent JOLTS report, are unusually high. Why is there an ever greater share of people out of the workforce? An aging population is one answer as well perhaps as the rise in incentives, such as disability insurance, to stay out of the workforce. Another possible factor is pay, that wages are not high enough to attract workers back into the workforce.

Rounding out the bad news was a steep 0.6 percent decline in manufacturing hours that points to contraction for industrial production. And in one last twist, there was supposed to be an outsized risk that nonfarm payrolls in August, a month when the timing of the school year makes adjustments difficult, would be revised higher, but instead it was revised lower as was July for a total subtraction of 59,000. The graph tracks the dark line of the unemployment rate with the shaded area of the available labor supply which continues to sink, down a sizable 91,000 in the month and below 14 million for a second month, at 13.9 million. Rounding out the bad news was a steep 0.6 percent decline in manufacturing hours that points to contraction for industrial production. And in one last twist, there was supposed to be an outsized risk that nonfarm payrolls in August, a month when the timing of the school year makes adjustments difficult, would be revised higher, but instead it was revised lower as was July for a total subtraction of 59,000. The graph tracks the dark line of the unemployment rate with the shaded area of the available labor supply which continues to sink, down a sizable 91,000 in the month and below 14 million for a second month, at 13.9 million.

Global weakening, as underscored by the FOMC, is a wildcard for the economy, and it is the nation's factories, as evidenced by factory payrolls, that are at the front line. Orders for the export-hit sector fell a steeper-than-expected 1.7 percent in August. Orders for energy products fell on price weakness while orders and shipments for core capital goods (nondefense ex-aircraft) also fell. Total shipments of factory goods fell a steep 0.7 percent in the month with unfilled orders in slight contraction. Meanwhile, inventories relative to shipments are on the rise and point to the risk of inventory overhang that could further limit production and employment. But there are pluses in the report including a continuing bounce back for energy equipment and another strong gain for furniture. Global weakening, as underscored by the FOMC, is a wildcard for the economy, and it is the nation's factories, as evidenced by factory payrolls, that are at the front line. Orders for the export-hit sector fell a steeper-than-expected 1.7 percent in August. Orders for energy products fell on price weakness while orders and shipments for core capital goods (nondefense ex-aircraft) also fell. Total shipments of factory goods fell a steep 0.7 percent in the month with unfilled orders in slight contraction. Meanwhile, inventories relative to shipments are on the rise and point to the risk of inventory overhang that could further limit production and employment. But there are pluses in the report including a continuing bounce back for energy equipment and another strong gain for furniture.

The factory orders report doesn't breakdown exports which turns our attention to the week's advance report on the international trade of goods where, as shown in the light line of the graph, exports fell to $123.1 billion in August for a 3.2 percent monthly decline that reflected a drop in exports of industrial supplies and consumer goods. And not pointing to much relief for September is the ISM new export index, which at 46.5 as seen in the dark line, is in its fourth month of contraction. This index has only posted one plus 50 score this year. The factory orders report doesn't breakdown exports which turns our attention to the week's advance report on the international trade of goods where, as shown in the light line of the graph, exports fell to $123.1 billion in August for a 3.2 percent monthly decline that reflected a drop in exports of industrial supplies and consumer goods. And not pointing to much relief for September is the ISM new export index, which at 46.5 as seen in the dark line, is in its fourth month of contraction. This index has only posted one plus 50 score this year.

Vehicle production has been helping to limit the trouble in the factory sector while vehicle sales have definitely been adding to momentum in the retail sector. In by far the best news of the week and a reminder of the resilience of the domestic economy, vehicle sales surged 2.3 percent in September to an 18.2 million rate for the strongest result since way back in July 2005. The gain is centered in North American-made vehicles where sales jumped 4.3 percent to a 14.7 million rate which is also a 10-year high. Sales of foreign-made vehicles, pulled down in part by a 17 percent month-to-month plunge for Volkswagen, fell 5.4 percent to an annual rate of 3.5 million. The net gain, as seen in the dark line of the graph, points to strength for the motor vehicle component of the monthly retail sales report and underscores the theme of the two-way economy: domestic-based which is rising and foreign-exposed which is declining. Vehicle production has been helping to limit the trouble in the factory sector while vehicle sales have definitely been adding to momentum in the retail sector. In by far the best news of the week and a reminder of the resilience of the domestic economy, vehicle sales surged 2.3 percent in September to an 18.2 million rate for the strongest result since way back in July 2005. The gain is centered in North American-made vehicles where sales jumped 4.3 percent to a 14.7 million rate which is also a 10-year high. Sales of foreign-made vehicles, pulled down in part by a 17 percent month-to-month plunge for Volkswagen, fell 5.4 percent to an annual rate of 3.5 million. The net gain, as seen in the dark line of the graph, points to strength for the motor vehicle component of the monthly retail sales report and underscores the theme of the two-way economy: domestic-based which is rising and foreign-exposed which is declining.

Vehicle sales were the best news of the week while the most surprising news came from consumer confidence which, instead of retreating after an outsized gain in August, rose again to 103.0 in September to exceed the high-end estimate by 3 full points. The rise was subsequently confirmed by solid strength in a separate report, the consumer comfort index which jumped for a second straight week. Volatility in the stock market and uncertainty over the global economy, not even to mention soft payroll growth, are apparently not holding down the U.S. consumer — which for retailers is pleasant to hear heading into the holidays. Another good holiday indication for retailers, as tracked in the dark line of the graph, is accelerating growth in revolving credit which, in an indication of increased credit card use and a likely manifestation of increasing confidence, rose $4.3 billion in the latest report for a fifth straight gain and the best run of the recovery. Vehicle sales were the best news of the week while the most surprising news came from consumer confidence which, instead of retreating after an outsized gain in August, rose again to 103.0 in September to exceed the high-end estimate by 3 full points. The rise was subsequently confirmed by solid strength in a separate report, the consumer comfort index which jumped for a second straight week. Volatility in the stock market and uncertainty over the global economy, not even to mention soft payroll growth, are apparently not holding down the U.S. consumer — which for retailers is pleasant to hear heading into the holidays. Another good holiday indication for retailers, as tracked in the dark line of the graph, is accelerating growth in revolving credit which, in an indication of increased credit card use and a likely manifestation of increasing confidence, rose $4.3 billion in the latest report for a fifth straight gain and the best run of the recovery.

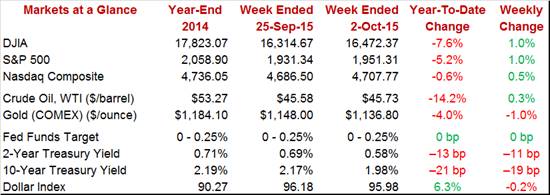

We'll all know for sure when and if expectations turn completely away from a near-term rate hike. That will be when bad news is not treated as good news as it was in Friday's stock market. The Dow, because of the weak employment report and the complete scratching of an October liftoff, jumped 1.2 percent to end the week just under 16,500 at 16,472. But if global weakness fully plays out and begins to hold down U.S. growth, that is if it begins to creep in and slow domestic demand, the prospect of a rate hike will become more distant. This is when, however, the stock market will begin to treat bad news as simply bad news. And that's what the Treasury market is already doing! Money simply flooded (and that's no exaggeration) into the Treasury market in the week in what seems to defy any possibility of a rate hike anytime soon. The 2-year yield plunged an amazing 11 basis points in the week to 0.58 percent. The 10-year was down 19 basis points and is under 2 percent at 1.98 percent. We'll all know for sure when and if expectations turn completely away from a near-term rate hike. That will be when bad news is not treated as good news as it was in Friday's stock market. The Dow, because of the weak employment report and the complete scratching of an October liftoff, jumped 1.2 percent to end the week just under 16,500 at 16,472. But if global weakness fully plays out and begins to hold down U.S. growth, that is if it begins to creep in and slow domestic demand, the prospect of a rate hike will become more distant. This is when, however, the stock market will begin to treat bad news as simply bad news. And that's what the Treasury market is already doing! Money simply flooded (and that's no exaggeration) into the Treasury market in the week in what seems to defy any possibility of a rate hike anytime soon. The 2-year yield plunged an amazing 11 basis points in the week to 0.58 percent. The 10-year was down 19 basis points and is under 2 percent at 1.98 percent.

There's still two employment reports to go before the December FOMC but they will have to be very much stronger than what we got in September, otherwise scratch liftoff from what remains of your 2015 calendar. Some of the FOMC hawks were vocal in their dissent against the September decision to push back the liftoff, saying core inflation is bound to rise and it's the Fed's business to look tough and act tough. It will be interesting to see how vocal the hawks will be now and how, or if, they may change their tune.

Strength in the service sector is central right now for the economy given export weakness in the factory sector. Both the services PMI and the ISM non-manufacturing reports will offer updates on Monday while the labor market conditions index could refocus attention on the prior week's employment report. Weakness in exports, based on advance data, is certain for Tuesday's trade report where imports, in contrast, will show a sharp rise that points to the strength of domestic demand. And recent gains for the revolving credit component of the consumer credit report, to be released Wednesday, have been offering new evidence of domestic demand. Another jobless claims report, where readings have been very low, will be posted on Thursday while import & export prices, which have been in long contraction, will be posted Friday.

The services PMI has been running in the mid-50s to indicate very solid growth in composite activity and the Econoday consensus is calling for a September reading of 55.8. But new orders have been slowing and service providers have been working down backlogs to keep busy. It hasn't stopped the sample from hiring, however, which the report has been describing all year as "robust". Price readings have been in contraction.

Services PMI - Consensus Forecast for September, Final: 55.8

Range: 54.8 to 58.0

Growth in the ISM non-manufacturing sample is expected to edge back 1 point to a composite 58.0, which nevertheless would be a very strong rate of growth. And in sharp contrast to the services PMI report, new orders have been rising sharply and backlog orders have been growing not contracting. Note that the ISM report includes the construction and mining sectors as well as the services sector.

ISM Non-Manufacturing Index - Consensus Forecast for September: 58.0

Range: 57.0 to 58.8

The labor market conditions index is expected to hold steady at 2.0, in what would extend growth to five straight months. Still, growth has been a bit slower than the mid-single digit trend over 2013 and 2014.

Labor Market Conditions Index - Consensus Forecast for September: 2.0

Range: 0.0 to 3.0

The international trade gap is expected to widen substantially based on the prior week's advance data in the international trade in goods report where, due to a decline in exports and a rise in imports, the gap rose sharply. Weakness in exports has been a negative theme all year for the economy but the rise in imports, though counted as a subtraction in the national accounts, does underscore the strength of domestic demand. The consensus sees a gap at a very steep $48.6 billion for August.

International Trade, M/M Chg - Consensus Forecast for August: -$48.6 billion

Range: -$50.2 to -$41.0 billion

Consumer credit is expected to rise $20.5 billion in August but the key will be the revolving credit component which has posted a rare run of five straight gains to indicate rising use of credit card debt, which in turn signals greater confidence among consumers.

Consumer Credit, M/M Chg - Consensus Forecast for August: +$20.5 billion

Range: +$18.0 to +$23.0 billion

Jobless claims are expected to fall back slightly to 271,000 in the October 3 week. For the past six months, claims have been signaling tight conditions in the labor market and have been offering the hawks their strongest arguments at the FOMC.

Initial Jobless Claims - Consensus Forecast for October 3 Week: 271,000

Range: 260,000 to 275,000

Import & export prices have been signaling deepening rates of cross-border price contraction. The declines have swept nearly all readings in this report through much of the year. Easing declines, but declines nevertheless, are forecast for September.

Import Prices, M/M Chg - Consensus Forecast for September: -0.4%

Range: -0.9% to +0.4%

Export Prices, M/M Chg - Consensus Forecast for September: -0.2%

Range: -0.5% to 0.0%

Wholesale inventories are expected to rise 0.1 percent in August, a build that would not be of concern as long as wholesale sales post a gain. Slow economic growth is making the nation's inventories look heavy.

Wholesale Inventories, M/M Chg - Consensus Forecast for August: +0.1%

Range: -0.2% to +0.2%

|