|

Barring an exogenous shock — such as an asteroid or a sudden collapse in the financial markets — a rate hike at the December 15 and 16 FOMC is guaranteed following the solid strength of November's employment report. Despite weakness in global demand, the nation's economy is generating enough jobs to sop up whatever remaining slack there is in the labor market. There may be no definitive signs yet of inflation but at least the Fed isn't behind the curve, that is chasing inflation and trying to bring it down. The first rate hike in nearly a decade awaits us. Will you be long or short when history is made?

Janet Yellen, as it turned out, prepared us nicely for the Friday employment report. On Thursday she told a joint congressional committee that monthly payrolls only need to increase by 100,000 at the most to absorb new entrants into the labor force. She further noted that this is "quite a bit less" than 200,000, a level widely seen as consistent with strength. And that's just what we got and a little bit more wiith November nonfarm payrolls, as seen in the graph, up 211,000. As you can see, this is right about at the median which is actually 225,000 over the last two years. The average over this span is 234,000 with the recent 3-month average a little lower but not by much, at 218,000. And year-to-date, November is right at the average which is 210,000 and, looking at the expansion as a whole going back to 2009, the average is 155,000 which makes November look very respectable. The month's gain was underpinned by a giant 46,000 surge in construction that followed strong gains of 34,000 and 19,000 in the two prior months. And gains here are consistent with gains in construction spending. With the weather the way it is, the construction sector is enjoying a springtime of an autumn. Janet Yellen, as it turned out, prepared us nicely for the Friday employment report. On Thursday she told a joint congressional committee that monthly payrolls only need to increase by 100,000 at the most to absorb new entrants into the labor force. She further noted that this is "quite a bit less" than 200,000, a level widely seen as consistent with strength. And that's just what we got and a little bit more wiith November nonfarm payrolls, as seen in the graph, up 211,000. As you can see, this is right about at the median which is actually 225,000 over the last two years. The average over this span is 234,000 with the recent 3-month average a little lower but not by much, at 218,000. And year-to-date, November is right at the average which is 210,000 and, looking at the expansion as a whole going back to 2009, the average is 155,000 which makes November look very respectable. The month's gain was underpinned by a giant 46,000 surge in construction that followed strong gains of 34,000 and 19,000 in the two prior months. And gains here are consistent with gains in construction spending. With the weather the way it is, the construction sector is enjoying a springtime of an autumn.

The November employment report, however, did not show much pressure in wages, up only 0.2 percent and making October's 0.4 percent gain look like what it is, a not-so-frequent outlier. Year-on-year, as seen in the dark line of the graph, average hourly earnings dipped 2 tenths to 2.3 percent. Still, though, the line definitely does show lift starting in May this year. Not showing any lift, however, is the Fed's central inflation gauge and that's core PCE prices where the year-on-year rate, at only 1.3 percent and the light line in the graph, has been trending lower for the past year. When energy and food are included, the PCE drops to a year-on-year rate of only plus 0.2 percent. The November employment report, however, did not show much pressure in wages, up only 0.2 percent and making October's 0.4 percent gain look like what it is, a not-so-frequent outlier. Year-on-year, as seen in the dark line of the graph, average hourly earnings dipped 2 tenths to 2.3 percent. Still, though, the line definitely does show lift starting in May this year. Not showing any lift, however, is the Fed's central inflation gauge and that's core PCE prices where the year-on-year rate, at only 1.3 percent and the light line in the graph, has been trending lower for the past year. When energy and food are included, the PCE drops to a year-on-year rate of only plus 0.2 percent.

But there was a wage scare of sorts in the week and that was the compensation component of the productivity & costs report which, in the second estimate for the third quarter, came in at an annualized 3.0 percent. This isn't exactly on fire but it is the best result of the year and does back up concern that labor market tightness is bound to lift wages (note that volatility on the left side of the graph reflects the effects of 2013 tax hikes). The uplift in the third quarter also corresponds with an uptick in the employment cost index which, after dipping in the second quarter, returned to its prior pace. And again, this uptick is also consistent with low levels of unemployment that may be forcing employers, in order to attract new employees and keep their existing ones, to raise wages and benefits. For businesses, labor costs are the biggest factor in production. If commodity prices and import prices do no more than hold steady in the coming year, the effect of labor costs could definitely become more pronounced. But there was a wage scare of sorts in the week and that was the compensation component of the productivity & costs report which, in the second estimate for the third quarter, came in at an annualized 3.0 percent. This isn't exactly on fire but it is the best result of the year and does back up concern that labor market tightness is bound to lift wages (note that volatility on the left side of the graph reflects the effects of 2013 tax hikes). The uplift in the third quarter also corresponds with an uptick in the employment cost index which, after dipping in the second quarter, returned to its prior pace. And again, this uptick is also consistent with low levels of unemployment that may be forcing employers, in order to attract new employees and keep their existing ones, to raise wages and benefits. For businesses, labor costs are the biggest factor in production. If commodity prices and import prices do no more than hold steady in the coming year, the effect of labor costs could definitely become more pronounced.

Low prices for gasoline right now, which keep sinking, are making for very strong demand for cars and especially light trucks. For the last three months, as seen in the line of the graph, consumers have bought vehicles at an annualized rate of 18.2 million which is a 12-year high. That's right, for three months in a row. Low gas prices are keeping more money in consumer pockets, reflected not only in a rising savings rate (last at a 3-year high of 5.6 percent) but also in exceptionally strong vehicle sales. Nevertheless, November's unit sales, however strong, do not point to monthly acceleration for the motor vehicle component of the November retail sales report though the shaded area of the graph does seem to be lagging the recent surge in unit sales. This could hint, despite the flat month-to-month result for unit sales, at a pop higher for the motor vehicle component (including revisions). Low prices for gasoline right now, which keep sinking, are making for very strong demand for cars and especially light trucks. For the last three months, as seen in the line of the graph, consumers have bought vehicles at an annualized rate of 18.2 million which is a 12-year high. That's right, for three months in a row. Low gas prices are keeping more money in consumer pockets, reflected not only in a rising savings rate (last at a 3-year high of 5.6 percent) but also in exceptionally strong vehicle sales. Nevertheless, November's unit sales, however strong, do not point to monthly acceleration for the motor vehicle component of the November retail sales report though the shaded area of the graph does seem to be lagging the recent surge in unit sales. This could hint, despite the flat month-to-month result for unit sales, at a pop higher for the motor vehicle component (including revisions).

Not hinting at a pop higher at all, however, for vehicle sales is the consumer sentiment index. Tracked in the line on the graph, it has been sagging all year, showing special weakness in the financial flip-flop of August and September and also over the last couple of weeks when the November reading late in the month may have moved down to the high 80s in weakness offset by strength early in the month. This would correspond with the Paris attacks and are an unfortunate reminder that monetary policy, including the pending liftoff, are subject to outside risks. Other confidence readings have also been coming down including the monthly report from the Conference Board and Bloomberg's consumer comfort index which has fallen in five of the last six weeks. Not hinting at a pop higher at all, however, for vehicle sales is the consumer sentiment index. Tracked in the line on the graph, it has been sagging all year, showing special weakness in the financial flip-flop of August and September and also over the last couple of weeks when the November reading late in the month may have moved down to the high 80s in weakness offset by strength early in the month. This would correspond with the Paris attacks and are an unfortunate reminder that monetary policy, including the pending liftoff, are subject to outside risks. Other confidence readings have also been coming down including the monthly report from the Conference Board and Bloomberg's consumer comfort index which has fallen in five of the last six weeks.

The ISM manufacturing report shook up the factory outlook early in the week, with the composite down 1.5 points and breaking below 50 to 48.6 for the lowest reading since June 2009. And the new orders index, tracked in the line of the graph, fell 4.0 points to 48.9 for its lowest reading since August 2012. Backlog orders extended their contraction streak to six months while new export orders at 47.5, also show contraction for six straight months. Though the ISM report is only now signaling contraction, factory orders as tracked by the government have been sinking all year. Still, the downward shift for the ISM is a bit ominous and is definitely not raising the odds for a factory snapback. The ISM manufacturing report shook up the factory outlook early in the week, with the composite down 1.5 points and breaking below 50 to 48.6 for the lowest reading since June 2009. And the new orders index, tracked in the line of the graph, fell 4.0 points to 48.9 for its lowest reading since August 2012. Backlog orders extended their contraction streak to six months while new export orders at 47.5, also show contraction for six straight months. Though the ISM report is only now signaling contraction, factory orders as tracked by the government have been sinking all year. Still, the downward shift for the ISM is a bit ominous and is definitely not raising the odds for a factory snapback.

Export data rounded out the week showing, however, not strength but of course weakness tied to low global demand made lower by high prices for U.S. goods. Exports in October fell 1.4 percent for the fourth decrease in the last six months. The graph tracks the shaded and sinking area of exports against the sharp climb of the trade-weighted dollar. And further gains for the dollar are a real possibility given the prospect of diverging interest rates between the U.S. (rates going up) and Europe (rates going down)., This is the result of diverging monetary policy with the U.S. withdrawing stimulus and Europe adding more. Export data rounded out the week showing, however, not strength but of course weakness tied to low global demand made lower by high prices for U.S. goods. Exports in October fell 1.4 percent for the fourth decrease in the last six months. The graph tracks the shaded and sinking area of exports against the sharp climb of the trade-weighted dollar. And further gains for the dollar are a real possibility given the prospect of diverging interest rates between the U.S. (rates going up) and Europe (rates going down)., This is the result of diverging monetary policy with the U.S. withdrawing stimulus and Europe adding more.

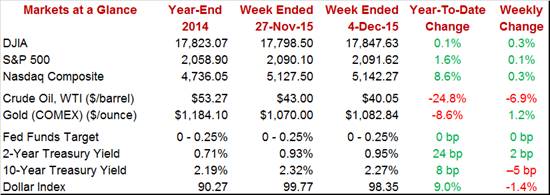

The Fed's long and painstaking communication effort this year, together with its promise that the upward path in rates will be shallow and gradual, point, at least in theory, to limited reaction to a rate hike in the financial markets. But the markets do their own thing and could nevertheless prove touchy counting down to December 16. Risk could be sold for safety. And there was a big reaction to the European Central Bank's announcement on Thursday when new stimulus wasn't seen as quite enough, making for heavy selling in the bond market and heavy buying of euros. Yet the outlook for long rates is contained though increases here will be closely watched for their effect, not only on the financial markets, but on the housing outlook as well. Markets in the week moved violently on Thursday and Friday to end the week with mild looking results. Not mild, however, is the drop for oil, down $3 in the week and testing $40 again in weakness that will limit any coming gains for inflation. The Fed's long and painstaking communication effort this year, together with its promise that the upward path in rates will be shallow and gradual, point, at least in theory, to limited reaction to a rate hike in the financial markets. But the markets do their own thing and could nevertheless prove touchy counting down to December 16. Risk could be sold for safety. And there was a big reaction to the European Central Bank's announcement on Thursday when new stimulus wasn't seen as quite enough, making for heavy selling in the bond market and heavy buying of euros. Yet the outlook for long rates is contained though increases here will be closely watched for their effect, not only on the financial markets, but on the housing outlook as well. Markets in the week moved violently on Thursday and Friday to end the week with mild looking results. Not mild, however, is the drop for oil, down $3 in the week and testing $40 again in weakness that will limit any coming gains for inflation.

Possible volatility in the financial markets, as well as weakness in exports and emerging weakness in consumer confidence, are risks right now to the outlook, at least limited risks. With liftoff all but assured (not even a shock plunge in the coming retail sales report would turn the tide), attention turns to the path of future hikes. Will the January FOMC be a live meeting for instance? Expectations wouldn't say so with the Fed expected to make three or maybe four hikes spread evenly out through 2016. Job growth isn't exactly astronomical right now and neither is the outlook for the global economy, both pointing to a cautious post-liftoff path for monetary policy.

Following last week's heavy run of news culminating in Friday's solid employment report, the pace of this week's calendar slows. Market-moving data don't appear until Thursday with jobless claims which, fortunately, have been very low. Also on Thursday will be export & import prices which, unfortunately in this case, have also been very low. Producer prices, where service prices have been surprisingly weak, will be posted on Friday, a day when the headline report, however, will be retail sales. Perhaps held down by softening consumer sentiment, retail sales have not been building much momentum and November's data will offer the first indications on the holiday mood. Moderate gains are expected. The early December reading on consumer sentiment, which came down markedly in late November, will also be posted on Friday.

The labor market conditions index is expected to rise slightly to 1.7 in November from 1.6 in October, not showing much lift from last week's mostly solid employment report. Despite low levels of unemployment, this index, comprising 19 separate components, has been very soft this cycle.

Labor Market Conditions Index - Consensus Forecast for November: +1.7

Range: +1.5 to +2.0

Consumer credit is expected to rise $20.0 billion in October following September's record $28.9 billion gain. The revolving credit component of this report, which had been dormant this cycle, has finally been showing steam and suggests that consumers are growing less reluctant to run up their credit cards. Nonrevolving credit has been strong the whole cycle, reflecting vehicle demand and also demand for student loans which are tracked in this report.

Consumer Credit - Consensus for October: +$20.0 billion

Range: +$12.7 to +$25.6 billion

The small business optimism index has been showing steady, moderate strength especially employment where hiring plans have been at their best levels of the year. And in a hint of wage pressures to come, small businesses have been reporting the most difficulty of the recovery in finding qualified employees. Capital outlays in this report have also been positive and point to building business optimism. The Econoday consensus is calling for a ready reading, with the November index consensus at 96.0 vs October's 96.1.

Small Business Optimism Index - Consensus Forecast for November: 96.0

Range: 95.6 to 96.6

Wholesale inventories have been heavy with the stock-to-sales ratio for the sector generally on the rise. But businesses, including wholesalers, have been working hard to keep their inventories in check as sales have mostly been soft. The Econoday consensus for October wholesale inventories is calling for a 0.2 percent increase.

Wholesale Inventories, M/M Chg. - Consensus Forecast for October: +0.2%

Range: 0.0% to +0.4%

Initial jobless claims have been trending at 42-year lows and, as a share of the whole labor market, are likely at record lows. For the December 5 week, Econoday forecasters see initial claims holding steady, up 1,000 to a still very low 270,000. Continuing claims have also been at record lows.

Initial Jobless Claims - Consensus Forecast for December 5 week: 270,000

Range: 260,000 to 300,000

Import & export prices have been in deep contraction and further contraction is expected. The Econoday consensus is calling for a steep 0.8 percent decrease for import prices as well as a sizable 0.3 percent decrease for export prices. Weakness in this report has not been confined to oil as non-petroleum import prices have also been in clear contraction. Year-on-year rates in this report have been deeply negative, just over double digits for import prices and in the high single digits for export prices. Contraction in import prices reflects the strength of the dollar which has been giving U.S. buyers more for their dollars, while contraction in export prices reflects deflationary trends in global prices.

Import Prices, M/M Chg - Consensus Forecast for November: -0.8%

Range: -1.2% to 0.0%

Export Prices, M/M Chg - Consensus Forecast for November: -0.3%

Range: -0.4% to 0.0%

Service prices proved an unlikely source of deflationary pressure in the producer price report for October, falling for a second month in a row. Both energy prices and food prices fell with both finished goods and export prices also down. For November, forecasters are calling for no change in the producer prices - final demand headline and a 0.1 percent gain for the core rate. Year-on-year rates have been falling deeper into negative territory, to minus 1.6 percent for the headline reading in October.

PPI-FD - Consensus for November: 0.0%

Range: -0.2% to +0.1%

PPI-FD Less Food & Energy - Consensus for November: +0.1%

Range: -0.1% to +0.2%

Consumer spending has been lukewarm going into year-end but in part reflects low sales at gasoline stations which are getting hurt, and continue to get hurt, by low prices. But vehicle sales have been strong though unit sales in November, holding for a third month at a 12-year high, aren't pointing to a monthly gain for the motor vehicle component. Ex-auto ex-gas core sales have been showing some life with October coming in at plus 0.3 percent. For November, forecasters see core sales rising another 0.3 percent despite unseasonably warm weather that likely held down sales of winter goods. Total retail sales are also expected to rise 0.3 percent as are ex-auto sales.

Retail Sales - Consensus for November: +0.3%

Range: -0.2% to +0.5%

Retail Sales Ex-Autos - Consensus for November: +0.3%

Range: -0.1% to +0.6%

Retail Sales Ex-Autos Ex-Gas - Consensus for November: +0.3%

Range: +0.3% to +0.8%

Business inventories are widely considered to be too heavy relative to sales, posing risks to future production and also to future hiring. Inventories rose 0.3 percent in the September report, against no change for sales in a mismatch that drove the inventory-to-sales ratio up one notch to 1.38, well up from 1.31 in September last year. Forecasters see inventories rising 0.1 percent in October.

Business Inventories - Consensus for October: +0.1%

Range: 0.0% to +0.3%

Consumer sentiment fell back sharply in the last half of November to a final reading of 91.3 vs a mid-month flash of 93.1 but is expected to improve slightly to 92.0 in the flash reading for December. Weakness in this report, and in other confidence reports as well, has been centered in expectations and not current conditions which is a plus for holiday sales. Nevertheless, lowered expectations, presumably the effects of global issues, could begin to hold down expectations for growth in 2016. And note the low forecast in the Econoday consensus, at 86.5 in a reading that could scramble the outlook for holiday spending.

Consumer Sentiment, Preliminary - Consensus for December: 92.0

Range: 86.5 to 94.0

|