|

The Fed appears ready to carry out its first rate hike in nine years, sharpening the axe and preparing things. But the big move won't be coming against a run of enormously strong economic data. The November employment report was definitely solid but still the non-farm payroll gain, driven in large part by weather-related strength for construction, was less than spectacular at an intrend 211,000. The latest week of data tells the same story with retail sales showing some areas of strength but overall coming out no better than moderate. But there may be early signs of pressure appearing, of all places, on the inflation front. The FOMC is about to make history so let's brush up on the numbers.

Like the 0.1 percent headline gain for October, the 0.2 percent gain for November understates underlying strength in the retail sales report. The ex-auto ex-gas core reading came in very solid at plus 0.5 percent reflecting another big gain for restaurants, a discretionary category that points to the underlying confidence of the consumer. But one area of strength now is no longer an area of strength as auto sales fell for a second straight month. The shaded area of the graph is the monthly sales level in dollars for the motor vehicle component of the retail sales report, and you can see that it has edged off after peaking in September. In contrast, sales in units as reported by manufacturers, which is the dark line in the graph, accelerated strongly going into September where they have held at an 18.2 million annualized rate (rounding to one place) which is a 12-year high. But this unit strength, however, has not translated to retail strength. This anomaly is likely tied to an increased share of auto sales to businesses, not consumers, over the past several months. This commercial-vs-retail distinction is not separated out in unit sales data, making it buyer beware when looking for indications on the retail sector. Like the 0.1 percent headline gain for October, the 0.2 percent gain for November understates underlying strength in the retail sales report. The ex-auto ex-gas core reading came in very solid at plus 0.5 percent reflecting another big gain for restaurants, a discretionary category that points to the underlying confidence of the consumer. But one area of strength now is no longer an area of strength as auto sales fell for a second straight month. The shaded area of the graph is the monthly sales level in dollars for the motor vehicle component of the retail sales report, and you can see that it has edged off after peaking in September. In contrast, sales in units as reported by manufacturers, which is the dark line in the graph, accelerated strongly going into September where they have held at an 18.2 million annualized rate (rounding to one place) which is a 12-year high. But this unit strength, however, has not translated to retail strength. This anomaly is likely tied to an increased share of auto sales to businesses, not consumers, over the past several months. This commercial-vs-retail distinction is not separated out in unit sales data, making it buyer beware when looking for indications on the retail sector.

What does the decline for vehicle sales mean? It might suggest that, after heavy gains all year, buyers are now less abundant then they were. Low gas prices have been driving up sales of light trucks. But has this effect, despite still falling gas prices, already dissipated? Anyway, lower vehicle sales certainly can't be good news as this component makes up 20 percent of total retail sales. Looking at the graph, auto sales have been very strong. The slope of the dark line, which is motor vehicle sales, turned up steeply beginning early last year. In contrast, the light line, which is retail sales excluding motor vehicles, is much flatter — and may become flatter still if vehicle sales don't pick back up. Year-on-year rates tell the same story with vehicle sales, despite two months of disappointment, still up 4.0 percent against only a 0.7 percent rise for retail sales excluding vehicles. What does the decline for vehicle sales mean? It might suggest that, after heavy gains all year, buyers are now less abundant then they were. Low gas prices have been driving up sales of light trucks. But has this effect, despite still falling gas prices, already dissipated? Anyway, lower vehicle sales certainly can't be good news as this component makes up 20 percent of total retail sales. Looking at the graph, auto sales have been very strong. The slope of the dark line, which is motor vehicle sales, turned up steeply beginning early last year. In contrast, the light line, which is retail sales excluding motor vehicles, is much flatter — and may become flatter still if vehicle sales don't pick back up. Year-on-year rates tell the same story with vehicle sales, despite two months of disappointment, still up 4.0 percent against only a 0.7 percent rise for retail sales excluding vehicles.

Vehicles and restaurants are the two prominent discretionary components of the retail sales report where a year of gains has helped lead the nation's economic growth. But, as seen in the graph, sales rates for these components are edging lower. The 4.0 percent November rate for vehicles is the last data point for the shaded line which is half the strength it was back in September and a third of what is was at the beginning of the year. Less dramatic has been the slowing for restaurants, to a year-on-year and very strong plus 6.5 percent in November but down, nevertheless, from the 10 percent line in January. Easing contributions from these two components could be hinting at spending exhaustion among consumers. Restaurants, categorized as food services & drinking places in the government data, make up nearly 12 percent of total retail sales. Vehicles and restaurants are the two prominent discretionary components of the retail sales report where a year of gains has helped lead the nation's economic growth. But, as seen in the graph, sales rates for these components are edging lower. The 4.0 percent November rate for vehicles is the last data point for the shaded line which is half the strength it was back in September and a third of what is was at the beginning of the year. Less dramatic has been the slowing for restaurants, to a year-on-year and very strong plus 6.5 percent in November but down, nevertheless, from the 10 percent line in January. Easing contributions from these two components could be hinting at spending exhaustion among consumers. Restaurants, categorized as food services & drinking places in the government data, make up nearly 12 percent of total retail sales.

Finding signs of inflation has nearly been as difficult as finding signs of Big Foot. But something did appear in the November producer price report that needs to be discussed. Service prices, which had been mysteriously underwater for two months, suddenly resurfaced, standing tall at a monthly gain of 0.5 percent as seen in the last dark column of the graph. With import prices in contraction and oil prices still going lower, domestic service inflation — reflecting rising demand in the nation's service sector — is essential for the Fed to deliver on its 2 percent inflation goal. Service prices did in fact offset weakness in goods prices which are the light column in the graph, making for a respectable 0.3 percent gain for total wholesale prices. But even goods prices, down five months in a row, are showing improvement with only a small decline in November. Finding signs of inflation has nearly been as difficult as finding signs of Big Foot. But something did appear in the November producer price report that needs to be discussed. Service prices, which had been mysteriously underwater for two months, suddenly resurfaced, standing tall at a monthly gain of 0.5 percent as seen in the last dark column of the graph. With import prices in contraction and oil prices still going lower, domestic service inflation — reflecting rising demand in the nation's service sector — is essential for the Fed to deliver on its 2 percent inflation goal. Service prices did in fact offset weakness in goods prices which are the light column in the graph, making for a respectable 0.3 percent gain for total wholesale prices. But even goods prices, down five months in a row, are showing improvement with only a small decline in November.

But not showing much of any improvement have been import prices. The graph tracks year-on-year change in prices of imported finished goods and all three components have been decisively in the contraction zone all year. The strength of the dollar is at play here as U.S. consumers are getting more for their money when buying foreign goods. Domestic service prices may be back on the rise but look to be offset, at least in part, by imported deflation. And with commodity and oil prices extending even lower, the inflation section of the coming FOMC statement, which will almost certainly repeat confidence in the 2 percent outlook, is certain to make interesting reading. But not showing much of any improvement have been import prices. The graph tracks year-on-year change in prices of imported finished goods and all three components have been decisively in the contraction zone all year. The strength of the dollar is at play here as U.S. consumers are getting more for their money when buying foreign goods. Domestic service prices may be back on the rise but look to be offset, at least in part, by imported deflation. And with commodity and oil prices extending even lower, the inflation section of the coming FOMC statement, which will almost certainly repeat confidence in the 2 percent outlook, is certain to make interesting reading.

What ultimately justifies the pending liftoff isn't the outlook for inflation but simply the current strength of the labor market. Payroll growth has been solid and the available labor supply may be all but exhausted. Yet, the week's data offered a chilly threesome of odd disappointment. The Fed's labor market conditions index did hold above zero but only at a lower-than-expected 0.5, this despite November's respectable jobs report. Growth in this index, a composite of 19 separate indicators, has been slow all year and well below last year which hints at an aging business cycle. The JOLTS report then followed showing a surprising decline in job openings to 5.383 million in October, down 2.7 percent from September and down 5.0 percent from July's recovery peak at 5.668 million. But the decline is just as well given the still conservative pace of hiring, unchanged at 3.6 percent of total employment. And in another less-than-strong reading, the quits rate held unchanged at 1.9 percent suggesting that those who have jobs aren't confident enough to shop themselves around, at least yet. What ultimately justifies the pending liftoff isn't the outlook for inflation but simply the current strength of the labor market. Payroll growth has been solid and the available labor supply may be all but exhausted. Yet, the week's data offered a chilly threesome of odd disappointment. The Fed's labor market conditions index did hold above zero but only at a lower-than-expected 0.5, this despite November's respectable jobs report. Growth in this index, a composite of 19 separate indicators, has been slow all year and well below last year which hints at an aging business cycle. The JOLTS report then followed showing a surprising decline in job openings to 5.383 million in October, down 2.7 percent from September and down 5.0 percent from July's recovery peak at 5.668 million. But the decline is just as well given the still conservative pace of hiring, unchanged at 3.6 percent of total employment. And in another less-than-strong reading, the quits rate held unchanged at 1.9 percent suggesting that those who have jobs aren't confident enough to shop themselves around, at least yet.

And there was the real shocker of the week, an odd jump higher for jobless claims. The last column in the graph is the higher-than-expected 282,000 reading for initial claims. This is the highest reading since all the way back in July. Continuing claims, curiously, also showed pressure, up a very steep 82,000 to 2.243 million which is the highest since September. Claims at this time of year, when weeks are short, are often hard to adjust which leads to weekly volatility. Still, the gains raise the question whether the labor market may be coming down a notch. And there was the real shocker of the week, an odd jump higher for jobless claims. The last column in the graph is the higher-than-expected 282,000 reading for initial claims. This is the highest reading since all the way back in July. Continuing claims, curiously, also showed pressure, up a very steep 82,000 to 2.243 million which is the highest since September. Claims at this time of year, when weeks are short, are often hard to adjust which leads to weekly volatility. Still, the gains raise the question whether the labor market may be coming down a notch.

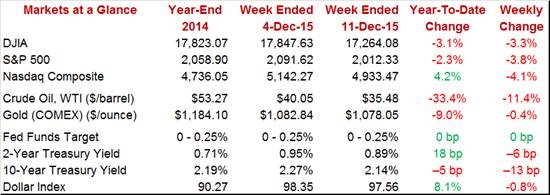

What a week of bone jarring volatility for the financial markets, not anything that a central banker would condone. In theory, the Fed's devotion to transparency and communication should make it no surprise that a 1/4 point rate hike in the fed funds policy rate is nearly certain at Wednesday's announcement. Still, there is the odd risk (and I'm not trying to make waves) that markets could react in unpredictable ways (which is what they do anyway). But if this happens, we shouldn't blame our FOMC policy makers. Because if we do, they could turn around and say nasty things about us. Take for example the European Central Bank where their recent stimulus decision was considered stingy by the markets, launching the euro on a nearly once-in-a-lifetime instant blast of 3 percent. We don't need to ask ECB governing council member Ewald Nowotny what he thinks, calling market expectations (at a public press conference of all things) "absurd" and blaming market analysts for "a massive error". So why didn't he say something before? Because, that's simply not his job: "It is not the task of a central bank to correct the erroneous opinions of individuals." So much for ECB communication efforts. For the Fed? Hopefully things will go as planned on December 16 and markets will behave. Not behaving at all, however, has been the price of oil which, on the prospect of ever rising output, fell more 11 percent in the week. For the Fed, this pushes out what is supposed to be a diminishing drag, not an increasing drag, from oil prices. The topic of oil prices is guaranteed to make for delicate composition and delicate reading in the announcement. What a week of bone jarring volatility for the financial markets, not anything that a central banker would condone. In theory, the Fed's devotion to transparency and communication should make it no surprise that a 1/4 point rate hike in the fed funds policy rate is nearly certain at Wednesday's announcement. Still, there is the odd risk (and I'm not trying to make waves) that markets could react in unpredictable ways (which is what they do anyway). But if this happens, we shouldn't blame our FOMC policy makers. Because if we do, they could turn around and say nasty things about us. Take for example the European Central Bank where their recent stimulus decision was considered stingy by the markets, launching the euro on a nearly once-in-a-lifetime instant blast of 3 percent. We don't need to ask ECB governing council member Ewald Nowotny what he thinks, calling market expectations (at a public press conference of all things) "absurd" and blaming market analysts for "a massive error". So why didn't he say something before? Because, that's simply not his job: "It is not the task of a central bank to correct the erroneous opinions of individuals." So much for ECB communication efforts. For the Fed? Hopefully things will go as planned on December 16 and markets will behave. Not behaving at all, however, has been the price of oil which, on the prospect of ever rising output, fell more 11 percent in the week. For the Fed, this pushes out what is supposed to be a diminishing drag, not an increasing drag, from oil prices. The topic of oil prices is guaranteed to make for delicate composition and delicate reading in the announcement.

It is nearly a foregone conclusion that the Fed will meet its own expectations and, confirming what it sees as its tradition of prudent leadership, will raise its policy rate on Wednesday the 16th. But data dependency, given the recent run of weakness, doesn't point to any further rate-hike expectations for the January FOMC which is not likely to be classified "a live" meeting. But it's the December FOMC and the decisions and explanations and, yes, the reactions in the markets that are certain to be the stuff of immortality, at least for now.

What is likely to be a history making week kicks off Tuesday with consumer prices where the core rate, just over 2 percent, has been showing the most pressure of any inflation reading. Housing starts and permits, which have been up and down, will share Wednesday morning with industrial production where a decline in utility output could mask a slight gain for manufacturing. Wednesday afternoon will be devoted to the FOMC where the first rate hike of the cycle is expected. FOMC forecasts will be updated and Janet Yellen's press conference will follow. Jobless claims, where the sample week matches that of the monthly employment report, will highlight Thursday's calendar as will the Philly Fed which will offer the latest December update on manufacturing.

FOMC meeting begins

Consumer prices have been showing some lift with October's year-on-year rate for the core at plus 1.9 percent and the year-to-date rate at 2.1 percent. Service prices, led by medical care, showed special pressure in October. But pressures in this report have been limited and Econoday forecasters are calling for no change at the headline level though they are calling for an intrend 0.2 percent rise for the core.

Consumer Price Index, M/M Chg - Consensus Forecast for November: 0.0%

Range: -0.1% to +0.2%

CPI Less Food & Energy, M/M Chg - Consensus Forecast for November: +0.2%

Range: +0.1% to +0.2%

The Empire State report has been offering decisive signals of weakness in the factory sector with the headline index in significant contraction since August. Order data have all been deeply negative as has the workweek. Employment is in its weakest streak since late 2009. Prices have also been in contraction with final-goods prices down for three straight months. The Econoday consensus is calling for a headline of minus 7.00 vs November's minus 10.74.

Empire State Index - Consensus Forecast for December: -7.00

Range: -10.00 to +2.00

The housing market index has been very solid though the November report did come in well under expectations, at 62 for a 3 point loss. Both future and present sales slowed in November but not traffic which, though still lagging this cycle, has been showing new life thanks to greater interest from first-time buyers. The Econoday consensus is calling for a 1 point rebound in December to 63.

Housing Market Index - Consensus Forecast for December: 63

Range: 61 to 68

Housing starts are expected to rebound 7.6 percent in November to a 1.141 million annualized rate while housing permits are expected fall 0.3 percent to a 1.146 million rate. Housing starts were a big disappointment in October, falling 11 percent though permits, which are a leading indication for starts, rebounded more than 4 percent. New homes have been leading the housing sector though strength has sometimes been inconsistent.

Housing Starts - Consensus Forecast for November: 1.141 million

Range: 1.100 to 1.200 million

Housing Permits - Consensus Forecast for November: 1.146 million

Range: 1.125 to 1.200 million

Down 0.2 percent, industrial production was weak in October but not the manufacturing component where production, boosted by strong demand for construction supplies, rose a solid 0.4 percent to end two prior months of decline and offering rare good news for a sector that has been hurt by weak exports. The warm weather here in the U.S. is behind the strength in construction supplies and also behind a big dip in utility output which is what pulled down the October headline. And more of the same is expected for November with the Econoday consensus at minus 0.2 percent for the headline but up 0.1 percent for manufacturing.

Industrial Production, M/M Chg - Consensus Forecast for November: -0.2%

Range: -0.6% to +0.3%

Manufacturing Production, M/M Chg - Consensus Forecast for November: +0.1%

Range: -0.3% to +0.3%

Capacity Utilization Rate - Consensus Forecast for November: 77.4%

Range: 77.0% to 77.6%

The manufacturing PMI, which had been posting much stronger levels of activity than other manufacturing reports, slowed sharply in November with new orders showing their slowest pace in more than two years. Export orders have been in outright contraction, once again the result of weak foreign demand made weaker for U.S. goods by the strength of the dollar. Forecasters see the December flash holding steady at November's 52.8 level.

Manufacturing PMI, Flash - Consensus Forecast for December: 52.8

Range: 52.3 to 53.3

The first rate hike of the recovery is expected for the FOMC meeting announcement at 2:00 p.m. ET, lifting the fed funds rate to 0.375 percent from a range of zero to 0.25 percent. The assessments of the labor market and of inflation will be closely watched, with the former having improved but the latter remaining soft. FOMC forecasts will also be posted along with the announcement, shortly followed by the Fed Chair press conference.

FOMC Consensus Forecast for Dec. 15 Policy Vote on Fed Funds Target: to 0.375 percent from a range of zero to 0.25 percent

Initial jobless claims moved higher in the December 5 week, to 282,000 for the highest reading since July. Continuing claims also rose, to their highest level since September. Still, levels in this report remain near historic lows. The December 12 week carries special importance as it is also the sample week for the monthly employment report. Econoday forecasters see initial claims falling back, down 12,000 to 270,000 in a result that would point to continued improvement for the labor market.

Initial Jobless Claims - Consensus Forecast for December 12 week: 270,000

Range: 260,000 to 278,000

The Philadelphia Fed manufacturing index has definitely been soft, ending two months of prior contraction in November but only barely, at a thin looking 1.9. New orders, however, remained in the negative column as did backlog orders and, understandably, employment as well. Results in this report are closely watched as a leading indicator for the nation's manufacturing sector as a whole and Econoday forecasters see no better than flat results for December, at a consensus of plus 1.2.

Philadelphia Fed Manufacturing Index - Consensus Forecast for December: 1.2

Range: -5.0 to +8.0

Pulled down by weak exports, the current account deficit is expected to widen to $119.0 billion in the third quarter from $109.7 billion in the second quarter. The gap relative to GDP in the second quarter was a manageable 2.6 percent though this reading is expected to move higher.

Current Account Deficit - Consensus Forecast for Second Quarter: -$119.0 billion

Range: -$126.0 to -$110.3 billion

Leading indicators had been dead flat since July until jumping 0.5 percent in October, in a gain helped by the month's rebound in the stock market and gains for housing permits. But October's jump aside, this index has been pointing to no more than sluggish growth for the economy. And the Econoday consensus isn't calling for much strength in November, at a 0.2 percent gain.

Index of Leading Economic Indicators - Consensus Forecast for November: +0.2%

Range: 0.0% to +0.5%

The services PMI has been one of the strongest indicators on the calendar and more of the same is expected for the flash December reading, at a consensus 56.1 which would match November's final reading. The report described new orders in November as "robust" and "accelerating" with hiring described as "sustained". The service sector, where exposure to global weakness is limited, is the bread and butter of the U.S. economy.

Services PMI - Consensus Forecast for December, Flash: 56.1

Range: 55.8 to 56.4

|