|

The consumer got out fast in the second quarter but mid-quarter was less fast and the end of the quarter, at least based on early indications for June, may have been downright slow. This and other indications (not even mentioning Brexit volatility) do not point to much acceleration going into the third quarter.

The week's most substantial news is from the personal income & spending report for May. But it really isn't the news on May that is most telling but the old news on April where the revision confirms a one-month surge — 1.1 percent for the best monthly gain of the cycle, since August 2009. But May's gain of 0.4 percent is very good on its own, the second best in fact since November last year. April and May together track at 4 percent annualized growth which has lifted outside expectations for a 3 handle in second-quarter GDP. This would be well above the low 2 percent long-term trend and no-less-than torrid compared to the first quarter's paltry 1.1 percent result. The week's most substantial news is from the personal income & spending report for May. But it really isn't the news on May that is most telling but the old news on April where the revision confirms a one-month surge — 1.1 percent for the best monthly gain of the cycle, since August 2009. But May's gain of 0.4 percent is very good on its own, the second best in fact since November last year. April and May together track at 4 percent annualized growth which has lifted outside expectations for a 3 handle in second-quarter GDP. This would be well above the low 2 percent long-term trend and no-less-than torrid compared to the first quarter's paltry 1.1 percent result.

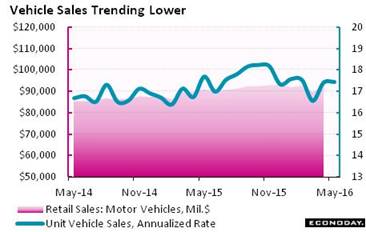

Consumer spending makes up 70 percent of total GDP of which a healthy 3.5 percent share is for motor vehicles & parts. Which brings us to other important news in the week, unit vehicle sales and the first hard consumer data on June. Unfortunately, manufacturers reported weak sales in the month, at an annualized 16.7 million units for a 4.6 percent plunge from May. This puts the motor vehicle component of the retail sales report, one which contributed strongly to retail gains during May and April, in serious jeopardy. It also raises the serious question whether the consumer had the stamina to extend the strength of April and May into June. Weak vehicle sales will not boost confidence in the auto sector which, for all you history buffs, was one of the major highlights of the 2015 economic year. Consumer spending makes up 70 percent of total GDP of which a healthy 3.5 percent share is for motor vehicles & parts. Which brings us to other important news in the week, unit vehicle sales and the first hard consumer data on June. Unfortunately, manufacturers reported weak sales in the month, at an annualized 16.7 million units for a 4.6 percent plunge from May. This puts the motor vehicle component of the retail sales report, one which contributed strongly to retail gains during May and April, in serious jeopardy. It also raises the serious question whether the consumer had the stamina to extend the strength of April and May into June. Weak vehicle sales will not boost confidence in the auto sector which, for all you history buffs, was one of the major highlights of the 2015 economic year.

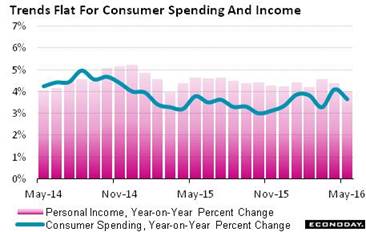

Now turning back to the personal income & spending report, trends really aren't that strong even though recent monthly readings have been. Year-on-year spending growth slowed 4 tenths in May to a not-so-great 3.7 percent which is up a bit over the last year but not by much. Spending growth this cycle peaked in mid-2014 at 5 percent then began to slow in lockstep with most other readings on the economy — and June's vehicle sales won't raise much hope for improvement. Income, despite low wage growth, is doing slightly better than spending, at 4.1 percent in the May report but a rate that has hardly changed over the past 2 years. Now turning back to the personal income & spending report, trends really aren't that strong even though recent monthly readings have been. Year-on-year spending growth slowed 4 tenths in May to a not-so-great 3.7 percent which is up a bit over the last year but not by much. Spending growth this cycle peaked in mid-2014 at 5 percent then began to slow in lockstep with most other readings on the economy — and June's vehicle sales won't raise much hope for improvement. Income, despite low wage growth, is doing slightly better than spending, at 4.1 percent in the May report but a rate that has hardly changed over the past 2 years.

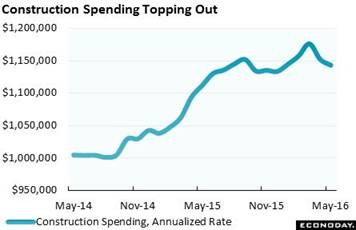

Construction spending proved surprisingly weak in May, down 0.8 percent on the month and not able to benefit from a weak comparison with a 2.0 percent fall in April. Spending on single-family homes, despite steady rates of housing starts, fell 1.3 percent in May for a third straight decline with the year-on-year gain moving slightly lower to a 6.3 percent rate that is still, how do you say, constructive. Multi-family homes have been much stronger, up 1.8 percent in the month for a 23.9 percent year-on-year gain. Looking at non-housing, construction spending has been very soft with May down 0.7 percent for a second straight decline. Year-on-year, private nonresidential spending is up but only 3.9 percent, led by the office category but pulled down by manufacturing. Public spending on buildings and highways has been flat to slightly negative. Weakness in construction, together with weakness in business investment, will be offsets to consumer spending gains for second-quarter GDP. Construction spending proved surprisingly weak in May, down 0.8 percent on the month and not able to benefit from a weak comparison with a 2.0 percent fall in April. Spending on single-family homes, despite steady rates of housing starts, fell 1.3 percent in May for a third straight decline with the year-on-year gain moving slightly lower to a 6.3 percent rate that is still, how do you say, constructive. Multi-family homes have been much stronger, up 1.8 percent in the month for a 23.9 percent year-on-year gain. Looking at non-housing, construction spending has been very soft with May down 0.7 percent for a second straight decline. Year-on-year, private nonresidential spending is up but only 3.9 percent, led by the office category but pulled down by manufacturing. Public spending on buildings and highways has been flat to slightly negative. Weakness in construction, together with weakness in business investment, will be offsets to consumer spending gains for second-quarter GDP.

A highlight of the week came on Friday with the ISM manufacturing report for June where the headline index easily beat expectations at 53.2 for the best reading since February last year. The report's new orders index is especially strong, up 1.3 points in June to 57.0 with export orders now keeping up, gaining 1.0 point to 53.5 for the 4th straight plus-50 showing. New orders are closely watched in this report and the results will lift expectations for strength in subsequent government data. The risk, however, that Brexit could begin pulling back U.S. exports, specifically worldwide investment in new equipment, definitively does cloud the significance of all of June's advance reports. Taking a look at them anyway shows Empire State, Philly Fed, and Kansas City on the plus side in June with Dallas and Richmond on the negative side. The national PMI from Markit Economics was nearly flat. Mixed results, ISM aside, probably point to mixed results for the government's data. A highlight of the week came on Friday with the ISM manufacturing report for June where the headline index easily beat expectations at 53.2 for the best reading since February last year. The report's new orders index is especially strong, up 1.3 points in June to 57.0 with export orders now keeping up, gaining 1.0 point to 53.5 for the 4th straight plus-50 showing. New orders are closely watched in this report and the results will lift expectations for strength in subsequent government data. The risk, however, that Brexit could begin pulling back U.S. exports, specifically worldwide investment in new equipment, definitively does cloud the significance of all of June's advance reports. Taking a look at them anyway shows Empire State, Philly Fed, and Kansas City on the plus side in June with Dallas and Richmond on the negative side. The national PMI from Markit Economics was nearly flat. Mixed results, ISM aside, probably point to mixed results for the government's data.

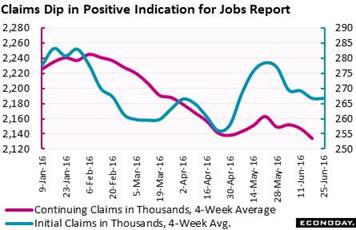

Brexit may have scrambled the outlook but its approach during June probably had no significant economic effect here in the United States. We're going to get the most important piece of June's data with the coming employment report on Friday, July 8. The easy comparisons with May and April, which were very weak months for the labor market, have raised expectations for a big bounce in June, with the Econoday consensus at 180,000. But a welcome decline in jobless claims offers more than just a favorable comparison and more than just hope that the June employment report will indeed prove solid. Initial claims in the June 25 week did move in the wrong direction, up slightly to 268,000, but follow a giant decline in the prior week which was also the sample week for the monthly employment report. Continuing claims are also trending lower with the unemployment rate for insured workers at a record low of only 1.5 percent. Brexit may have scrambled the outlook but its approach during June probably had no significant economic effect here in the United States. We're going to get the most important piece of June's data with the coming employment report on Friday, July 8. The easy comparisons with May and April, which were very weak months for the labor market, have raised expectations for a big bounce in June, with the Econoday consensus at 180,000. But a welcome decline in jobless claims offers more than just a favorable comparison and more than just hope that the June employment report will indeed prove solid. Initial claims in the June 25 week did move in the wrong direction, up slightly to 268,000, but follow a giant decline in the prior week which was also the sample week for the monthly employment report. Continuing claims are also trending lower with the unemployment rate for insured workers at a record low of only 1.5 percent.

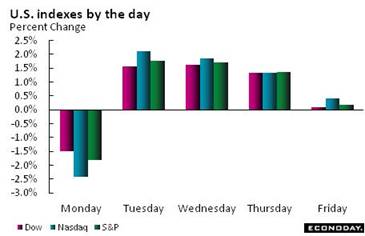

"The Two Headed Brex" is not only a B-movie I've been working on but is also a description of the week's markets. Bargain hunting dominated the stock market but accounts weren't moving out of the safety of Treasuries, demand for which is holding very strong to say the least. The 2-year Treasury yield fell 5 basis points in the week but it was the long end that led the way with the 10-year yield down 13 basis points to 1.44 percent. Two factors in the favor of Treasuries are low rates on foreign bonds and confidence in the dollar. And the dollar index held onto last week's 1.5 percent surge with a 0.1 percent gain. The Dow, after day-to-day swings, rose 3.2 percent on the week to 17,949, very near the 18,000 level where it was just before Brexit hit and suggesting that the economic risk of a Brexit shock may only be a mirage. But if the stock market's initial reaction was off base, what are chances that the second look is any better? "The Two Headed Brex" is not only a B-movie I've been working on but is also a description of the week's markets. Bargain hunting dominated the stock market but accounts weren't moving out of the safety of Treasuries, demand for which is holding very strong to say the least. The 2-year Treasury yield fell 5 basis points in the week but it was the long end that led the way with the 10-year yield down 13 basis points to 1.44 percent. Two factors in the favor of Treasuries are low rates on foreign bonds and confidence in the dollar. And the dollar index held onto last week's 1.5 percent surge with a 0.1 percent gain. The Dow, after day-to-day swings, rose 3.2 percent on the week to 17,949, very near the 18,000 level where it was just before Brexit hit and suggesting that the economic risk of a Brexit shock may only be a mirage. But if the stock market's initial reaction was off base, what are chances that the second look is any better?

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2015 |

24-Jun-16 |

1-Jul-16 |

Change |

Change |

| DJIA |

17,425.03 |

17,399.86 |

17,949.37 |

3.0% |

3.2% |

| S&P 500 |

2,043.94 |

2,037.30 |

2,102.95 |

2.9% |

3.2% |

| Nasdaq Composite |

5,007.41 |

4,707.98 |

4,862.57 |

-2.9% |

3.3% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$37.40 |

$47.62 |

$49.19 |

31.5% |

3.3% |

| Gold (COMEX) ($/ounce) |

$1,060.00 |

$1,321.60 |

$1,343.30 |

26.7% |

1.6% |

|

|

|

|

|

|

| Fed Funds Target |

0.25 to 0.50% |

0.25 to 0.50% |

0.25 to 0.50% |

0 bp |

0 bp |

| 2-Year Treasury Yield |

1.05% |

0.65% |

0.60% |

–45 bp |

–5 bp |

| 10-Year Treasury Yield |

2.27% |

1.57% |

1.44% |

–83 bp |

–13 bp |

| Dollar Index |

98.84 |

95.58 |

95.65 |

-3.2% |

0.1% |

The economic data are getting a lift right now from the unusual consumer strength of April, strength however that is not likely to be matched any time soon. Strength in consumer spending is tied inseparably to strength in the labor market and the 180,000 payroll gain expected for June would be an improvement. But the expected gain would still be well under the 225,000 trend of the last two years, a factor apart from Brexit that points to as much chance for a rate hike as for a rate cut. And as far as Brexit goes, there's no cutting to the chase in this one. Rising drama and continuing confusion is the outlook ahead of the UK's ultimate (or is it?) invocation of Article 50.

Friday's employment report, where bounce back strength is expected, will dominate an otherwise light week for the calendar. Factory orders on Tuesday and international trade on Wednesday are both expected to show weakness, the former tied to continued declines in business investment and the latter to continued declines for exports. Domestic demand has been the economy's strength and the ISM non-manufacturing report on Wednesday is expected to show acceleration in June though against an easy comparison with a weak May. The Econoday consensus for Friday's employment report is a return to comparatively healthy nonfarm payroll growth, at 180,000. But even a stronger gain, and even including upward revisions to the dismal totals for May and April, would offer only little help for rate-hike expectations, not with Brexit.

Factory Orders for May

Consensus Forecast, Month-to-Month Change: -1.0%

Consensus Range: -1.4% to -0.3%

Factory orders are expected to fall 1.0 percent in May as the advance release of the 2.2 percent decline in the durables component is expected to be offset by an oil-related price gain for nondurables. Capital goods have been very weak and were weak once again in the May durables report, underscoring retrenchment in business expectations and further trouble for the nation's productivity. The factory sector has been held back for nearly 2 years by weakness in capital goods, including mining & oil field equipment, and also by general weakness in exports -- and this was all before Brexit.

International Trade Balance for May

Consensus Forecast: -$40.0 billion

Consensus Range: -$40.5 to -$38.4 billion

The nation's trade deficit is expected to widen in May, to a consensus $40.0 billion vs April's $37.4 billion. Advanced data on goods showed a gain for imports at the same time that exports fell. Still, the decline in exports was limited while the gain in imports, though a subtraction in the national accounts, points to solid foreign demand for most goods with the unfortunate and very important exception of capital goods.

ISM Non-Manufacturing Index for June

Consensus Forecast: 53.3

Consensus Range: 52.0 to 54.1

The ISM non-manufacturing index for June is expected to recover only some of its decline during May when the index fell unexpectedly to 52.9 or roughly 2 points below trend. The employment index, falling more than 3 points to 49.7 in May, was in line with what proved to be a very weak employment report from the government in May. New orders in May did slow by nearly 6 points but at 54.2 were still respectable which is a positive for the June report. The Econoday forecast for June is 53.3.

ADP, Private Payrolls for June

Consensus Forecast: 150,000

Consensus Range: 100,000 to 209,000

The ADP employment report, which had been a very good indicator for this year's employment reports, reverted back to false signals in May, estimating a 173,000 gain for private payrolls that turned out to be a dismal 38,000 and a game changer for FOMC policy makers who have since taken a near-term rate hike off the table. ADP's estimate for June is expected to come in at 150,000, significantly below expectations for underlying private payroll growth of 170,000.

Initial Jobless Claims for July 2 week

Consensus Forecast: 269,000

Consensus Range: 255,000 to 271,000

Initial jobless claims did rise 10,000 in the June 25 week to 268,000 but the gain followed a 19,000 decline in the prior week to 258,000. Forecasters see claims holding near the higher level, at a consensus 269,000 for the July 2 week. Levels of initial claims as well as continuing claims are at or near historic lows in a strong indication of health for the labor market.

Nonfarm Payrolls for June

Consensus Forecast: 180,000

Consensus Range: 130,000 to 235,000

Private Payrolls

Consensus Forecast: 170,000

Consensus Range: 135,000 to 233,000

Unemployment Rate

Consensus Forecast: 4.8%

Consensus Range: 4.7% to 4.8%

Average Hourly Earnings

Consensus Forecast: +0.2%

Consensus Range: +0.2% to +0.3%

Average Workweek

Consensus Forecast: 34.4 hours

Consensus Range: 34.4 to 34.5 hours

After May's dismal 38,000 gain, nonfarm payrolls are expected to get back on track with a 180,000 gain for June. A revision to May, along perhaps with an upward revision to April's disappointing 123,000 gain, could be major factors in the latest report. A positive factor for June is the return of 35,100 Verizon strikers. The unemployment rate is expected to rise 1 tenth to 4.8 percent following May's 3 tenths plunge to 4.7 percent, a plunge not tied to rising demand for labor but to discouraged workers who left the labor force. Average hourly earnings were flat in May and another flat month is expected for June with the consensus calling for another 0.2 percent tick higher. Even if this report were to beat expectations, the impact on policy expectations would likely be minimal given ongoing concern over Brexit.

Consumer Credit for May

Consensus Forecast: +$16.0 billion

Consensus Range: +$15.0 to +$18.5 billion

Consumer credit is expected to rise $16.0 billion in May following April's moderate $13.4 billion gain. Revolving credit has been showing intermittent lift but only real strength in this component would point to less reluctance among consumers to run up their credit cards. Non-revolving credit has been the strength of this report, in part reflecting easing loan terms for vehicle sales.

|