|

The employment report for September is respectable if not outright solid, but one thing it definitely is not is robust. The report cuts off the flame from under Federal Reserve policy makers who won't have to raise rates at the November 2nd FOMC and crowd out headlines from the November 8th election. The week's news also includes hints of hope for what is still a very less-than-robust factory sector. The economy is improving but is far from overheating.

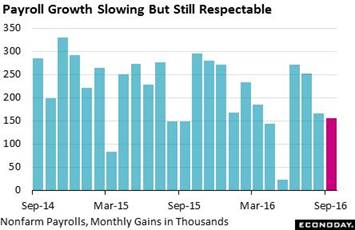

Non-farm payrolls rose 156,000 in September, down slightly from August's 167,000 and well down from gains of 252,000 and 271,000 in June and July. It would have taken growth at June's and July's rates to put in play at least the possibility of a November hike. Yet there are definitely strong positives in the report, especially a rise in the labor participation rate, up 1 tenth to 62.9 percent. This gives a deceptive lift to the unemployment rate that is 1 tenth higher at 5.0 percent. The increasing inclusion of discouraged workers is one of Janet Yellen's policy objectives and the participation rate points to improvement. Another positive is a rise in the workweek, up to 34.4 hours from 34.3 hours with the manufacturing week also slightly higher in what is a positive indication for September industrial production. Non-farm payrolls rose 156,000 in September, down slightly from August's 167,000 and well down from gains of 252,000 and 271,000 in June and July. It would have taken growth at June's and July's rates to put in play at least the possibility of a November hike. Yet there are definitely strong positives in the report, especially a rise in the labor participation rate, up 1 tenth to 62.9 percent. This gives a deceptive lift to the unemployment rate that is 1 tenth higher at 5.0 percent. The increasing inclusion of discouraged workers is one of Janet Yellen's policy objectives and the participation rate points to improvement. Another positive is a rise in the workweek, up to 34.4 hours from 34.3 hours with the manufacturing week also slightly higher in what is a positive indication for September industrial production.

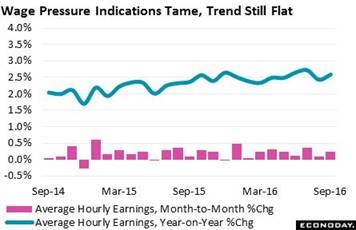

The question of raising rates, which now falls to the December FOMC, is tied to what the Fed sees as the risk of wage inflation. Here the results are a bit mixed. On a monthly basis, average hourly earnings came in 0.2 percent higher (to $25.79 per hour for the curious among you). This is only a moderate gain at the low end of expectations. Yet the year-on-year rate is showing some pressure, up 2 tenths to 2.6 percent which is still, however, 1 tenth under where it was in July. A look at the accompanying graph shows the moderate sequence of recent monthly gains (red columns) and the not-so-accelerating trend for the year-on-year rate (blue line). The hawks, and their commitment to fight inflation, really won't have everyone's permission to complain very loudly until this line begins pointing more convincingly to the 3 percent line. Really, let's not futz. With the election around the corner, 2.6 percent is tame enough. The question of raising rates, which now falls to the December FOMC, is tied to what the Fed sees as the risk of wage inflation. Here the results are a bit mixed. On a monthly basis, average hourly earnings came in 0.2 percent higher (to $25.79 per hour for the curious among you). This is only a moderate gain at the low end of expectations. Yet the year-on-year rate is showing some pressure, up 2 tenths to 2.6 percent which is still, however, 1 tenth under where it was in July. A look at the accompanying graph shows the moderate sequence of recent monthly gains (red columns) and the not-so-accelerating trend for the year-on-year rate (blue line). The hawks, and their commitment to fight inflation, really won't have everyone's permission to complain very loudly until this line begins pointing more convincingly to the 3 percent line. Really, let's not futz. With the election around the corner, 2.6 percent is tame enough.

And there are definite weak spots in the report including manufacturing employment which is down 13,000 following August's 16,000 decline. Manufacturing payrolls are down 47,000 from this time last year, a sad contrast with the 2.5 million gain in total payrolls. A positive in the report, however, is a 23,000 rise in construction payrolls which are up a solid 218,000 from September last year. And one of the biggest positives is a sharp 67,000 monthly rise in professional & business services for a year-on-year gain of 582,000. The latest month for this reading includes an outsized 23,000 gain for the temporary help component. A reasonable guess is that many of these temporary jobs will turn into permanent jobs. Reliance on temporary help also confirms other evidence that open positions are hard to fill right now, that supply of labor relative to demand is low. This is what, especially for the hawks, is evidence of full employment and the risk that employers will begin bidding up wages to attract the right candidates. The accompanying graph shows job openings vs hiring as tracked in the government's JOLTS report. Openings have been on the rise, at nearly 5.9 million in the latest available data which are for July, well over hires that are slumped around 5.2 million. JOLTS data for August will be posted on Wednesday, October 12. And there are definite weak spots in the report including manufacturing employment which is down 13,000 following August's 16,000 decline. Manufacturing payrolls are down 47,000 from this time last year, a sad contrast with the 2.5 million gain in total payrolls. A positive in the report, however, is a 23,000 rise in construction payrolls which are up a solid 218,000 from September last year. And one of the biggest positives is a sharp 67,000 monthly rise in professional & business services for a year-on-year gain of 582,000. The latest month for this reading includes an outsized 23,000 gain for the temporary help component. A reasonable guess is that many of these temporary jobs will turn into permanent jobs. Reliance on temporary help also confirms other evidence that open positions are hard to fill right now, that supply of labor relative to demand is low. This is what, especially for the hawks, is evidence of full employment and the risk that employers will begin bidding up wages to attract the right candidates. The accompanying graph shows job openings vs hiring as tracked in the government's JOLTS report. Openings have been on the rise, at nearly 5.9 million in the latest available data which are for July, well over hires that are slumped around 5.2 million. JOLTS data for August will be posted on Wednesday, October 12.

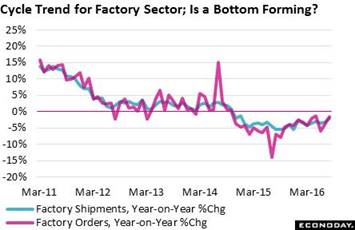

The week's other headlines come out of the factory sector including mostly good news out of Europe where strong gains for industrial production were posted by Germany, up 2.5 percent month-on-month, France up 2.1 percent, and also Spain up 1.4 percent. Is the tide finally lifting for the global factory sector? There are also strong indications from the ISM manufacturing report where new orders jumped 6.0 points in the September report and are once again well above the breakeven 50 level at 55.1. This hints at improvement for manufacturing payrolls in the October employment report. Export orders are less striking in the ISM report but still respectable at 52.0, especially given the recent strength of the dollar which makes our exports more expensive for foreign buyers. Still, as seen on the graph which tracks five years of factory orders and shipments, the slope for the factory sector isn't that great at all with year-on-year rates improving perhaps but still in the negative single digits. The week's other headlines come out of the factory sector including mostly good news out of Europe where strong gains for industrial production were posted by Germany, up 2.5 percent month-on-month, France up 2.1 percent, and also Spain up 1.4 percent. Is the tide finally lifting for the global factory sector? There are also strong indications from the ISM manufacturing report where new orders jumped 6.0 points in the September report and are once again well above the breakeven 50 level at 55.1. This hints at improvement for manufacturing payrolls in the October employment report. Export orders are less striking in the ISM report but still respectable at 52.0, especially given the recent strength of the dollar which makes our exports more expensive for foreign buyers. Still, as seen on the graph which tracks five years of factory orders and shipments, the slope for the factory sector isn't that great at all with year-on-year rates improving perhaps but still in the negative single digits.

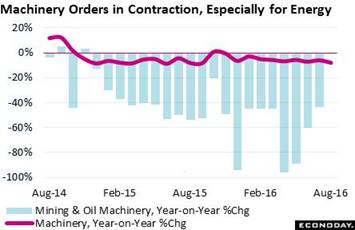

The latest data on factory orders were posted on Wednesday and show a very moderate 0.2 percent monthly rise in August that masks, however, accelerating strength in core capital goods (nondefense ex-aircraft). Here, orders jumped 0.9 percent following impressive gains of 0.8 percent and 0.5 percent in the prior two months. These results point to a rebound for business investment which otherwise has been depressed this year. Machinery, that is equipment which produces goods, is at the heart of the capital-goods sector and there really isn't any acceleration to report as of yet, as seen on the graph. Year-on-year orders remain below the zero line, pulled down in part by the deep ongoing contraction in energy equipment (blue columns which the government updates with a month's delay). Recent gains for the price of oil, which moved back over $50 in the week for the first time since June, may point to new demand for energy equipment but we shouldn't expect a big rush anytime soon. Turning to shipments of capital goods, the recent trend has not been strong which is a negative for third-quarter GDP, specifically nonresidential fixed investment. Yet there is some good news to report in cross-border trade as imports of capital goods in the August international trade report rose a sharp $1.2 billion to $50.2 billion for best showing since August last year. And there are also hints of foreign demand as exports of capital goods, when excluding aircraft, rose a bit to $37.6 billion in the month. Exports of capital goods have been on a long deep slide, especially for the past two years. The latest data on factory orders were posted on Wednesday and show a very moderate 0.2 percent monthly rise in August that masks, however, accelerating strength in core capital goods (nondefense ex-aircraft). Here, orders jumped 0.9 percent following impressive gains of 0.8 percent and 0.5 percent in the prior two months. These results point to a rebound for business investment which otherwise has been depressed this year. Machinery, that is equipment which produces goods, is at the heart of the capital-goods sector and there really isn't any acceleration to report as of yet, as seen on the graph. Year-on-year orders remain below the zero line, pulled down in part by the deep ongoing contraction in energy equipment (blue columns which the government updates with a month's delay). Recent gains for the price of oil, which moved back over $50 in the week for the first time since June, may point to new demand for energy equipment but we shouldn't expect a big rush anytime soon. Turning to shipments of capital goods, the recent trend has not been strong which is a negative for third-quarter GDP, specifically nonresidential fixed investment. Yet there is some good news to report in cross-border trade as imports of capital goods in the August international trade report rose a sharp $1.2 billion to $50.2 billion for best showing since August last year. And there are also hints of foreign demand as exports of capital goods, when excluding aircraft, rose a bit to $37.6 billion in the month. Exports of capital goods have been on a long deep slide, especially for the past two years.

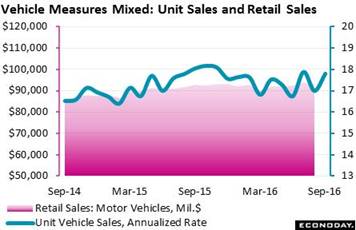

The last major news of the week is also positive but, again, just a little equivocal. Vehicle sales in September were very strong, surging 4.7 percent to a 17.8 million annualized rate. As seen in the blue line of the graph, this is where vehicle sales were trending for much of last year. Though the result hints at a needed rebound for total retail sales, there's no promises. Unit vehicle sales are reported by manufacturers who make no distinction between consumer purchases and business purchases. This discrepancy was especially strong last year as the bulging 18 million trend for unit sales failed to mean much for the vehicle component of the monthly retail sales report which held roughly steady at little more than $90 billion per month. This discrepancy, which by the way has been cited by Janet Yellen herself, obscures our indication for September, at least it does a bit. Still, the gain in unit sales, especially the size of the gain, is a favorable indication for the next retail sales report which will be the week's big highlight on Friday, October 14. By the way, the Econoday consensus is calling for a 0.6 percent overall increase for the September report and a 0.5 percent increase when excluding autos. The last major news of the week is also positive but, again, just a little equivocal. Vehicle sales in September were very strong, surging 4.7 percent to a 17.8 million annualized rate. As seen in the blue line of the graph, this is where vehicle sales were trending for much of last year. Though the result hints at a needed rebound for total retail sales, there's no promises. Unit vehicle sales are reported by manufacturers who make no distinction between consumer purchases and business purchases. This discrepancy was especially strong last year as the bulging 18 million trend for unit sales failed to mean much for the vehicle component of the monthly retail sales report which held roughly steady at little more than $90 billion per month. This discrepancy, which by the way has been cited by Janet Yellen herself, obscures our indication for September, at least it does a bit. Still, the gain in unit sales, especially the size of the gain, is a favorable indication for the next retail sales report which will be the week's big highlight on Friday, October 14. By the way, the Econoday consensus is calling for a 0.6 percent overall increase for the September report and a 0.5 percent increase when excluding autos.

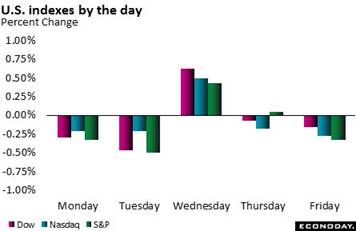

Markets really didn't respond much to the week's economic news but they did to talk that the European Central Bank, despite low growth in the Eurozone, may begin to cut back on its €80 billion per month in bond buying. The ECB has formally denied the talk but that didn't keep global bonds, and stocks with them, from sinking on the week. Pulling back on accommodation, that is normalizing policy in central bank parlance, may also be a risk for the U.S. markets should talk build for a December FOMC hike. U.S. Treasury yields moved higher in the week, again not on strong U.S. economic data but on talk of ECB normalization. The 2-year yield rose 6 basis points on the week to 0.83 percent with the 10-year up 12 basis points to 1.72 percent. The dollar moved higher with yields, up 1.0 percent on the dollar index to 96.49 and cutting year-to-date depreciation to only 2.4 percent. Markets really didn't respond much to the week's economic news but they did to talk that the European Central Bank, despite low growth in the Eurozone, may begin to cut back on its €80 billion per month in bond buying. The ECB has formally denied the talk but that didn't keep global bonds, and stocks with them, from sinking on the week. Pulling back on accommodation, that is normalizing policy in central bank parlance, may also be a risk for the U.S. markets should talk build for a December FOMC hike. U.S. Treasury yields moved higher in the week, again not on strong U.S. economic data but on talk of ECB normalization. The 2-year yield rose 6 basis points on the week to 0.83 percent with the 10-year up 12 basis points to 1.72 percent. The dollar moved higher with yields, up 1.0 percent on the dollar index to 96.49 and cutting year-to-date depreciation to only 2.4 percent.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2015 |

30-Sep-16 |

7-Oct-16 |

Change |

Change |

| DJIA |

17,425.03 |

18,308.15 |

18,240.49 |

4.7% |

-0.4% |

| S&P 500 |

2,043.94 |

2,168.27 |

2,153.74 |

5.4% |

-0.7% |

| Nasdaq Composite |

5,007.41 |

5,312.00 |

5,292.40 |

5.7% |

-0.4% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$37.40 |

$47.96 |

$49.63 |

32.7% |

3.5% |

| Gold (COMEX) ($/ounce) |

$1,060.00 |

$1,320.60 |

$1,257.10 |

18.6% |

-4.8% |

|

|

|

|

|

|

| Fed Funds Target |

0.25 to 0.50% |

0.25 to 0.50% |

0.25 to 0.50% |

0 bp |

0 bp |

| 2-Year Treasury Yield |

1.05% |

0.77% |

0.83% |

–22 bp |

6 bp |

| 10-Year Treasury Yield |

2.27% |

1.60% |

1.72% |

–55 bp |

12 bp |

| Dollar Index |

98.84 |

95.5 |

96.49 |

-2.4% |

1.0% |

Indications on third-quarter GDP, due in part to softness in consumer spending and also capital-goods shipments, have been coming down, moving from the 3 percent range to the low 2 percent area. This is a secondary factor that also points to no chance for a rate hike at the November meeting, no matter how "live" policy makers insist it will be. The meeting following November will be in mid-December, giving all of us two more employment reports to ponder — not to mention of course the outcome of the 2016 presidential election.

Retail sales will be the week's key highlight on Friday where strength would improve the third-quarter outlook and chances for a Federal Reserve rate hike at the December FOMC. JOLTS employment data, in which job openings have been showing deep strength, will be Wednesday's initial focus followed by minutes from the FOMC's contentious September policy meeting that saw a split 7 to 3 vote and the hawks calling for an immediate rate hike. Jobless claims data, which have been very low, will follow on Thursday together with import & export prices which have been very soft, as have producer prices which will be posted on Friday morning. Friday's retail sales are expected to show a solid 0.6 percent headline gain with only slightly less strength excluding autos, at a consensus plus 0.5 percent.

Small Business Optimism Index for September

Consensus Forecast: 95.0

Consensus Range: 94.4 to 95.6

The small business optimism index is expected to rise to 95.0 in September vs 94.4 in August. Job openings have been very strong in this report but small businesses are having a hard time filling them. Capital expansion plans have been another positive. Earnings growth has been on the weak side amid depressed expectations.

Initial Jobless Claims for October 8 week

Consensus Forecast: 254,000

Consensus Range: 245,000 to 255,000

Initial jobless claims have been tracking at historic lows and pointing to healthy conditions in the labor market. Continuing claims have likewise been very low. Forecasters see initial claims rising but only slightly in the October 8 week, up 5,000 to a consensus 254,000 from the prior week's 249,000. A special factor will be Hurricane Matthew which struck the lower East Coast during the reporting week.

Import Prices for September

Consensus Forecast, Month-to-Month Change: +0.1%

Consensus Range: -0.3% to +0.4%

Export Prices

Consensus Forecast, Month-to-Month Change: +0.1%

Consensus Range: -0.1% to +0.4%

Cross-border price pressures did show life in the second quarter but have been falling back since, coming in at minus 0.2 percent for imports in August and minus 0.8 percent for exports. Low petroleum prices have been a factor on the import side and low agricultural prices a factor on the export prices, but price weakness on both sides is very broad. Finished prices for all goods have been inching into outright contraction. Forecasters see only incremental improvement in September, plus 0.1 percent for import prices and also plus 0.1 percent for export prices.

PPI-FD for September

Consensus Forecast, Month-to-Month Change: +0.2%

Consensus Range: +0.1% to +0.3%

PPI-FD Less Food & Energy: +0.1%

Consensus Forecast, Month-to-Month Change: +0.1%

Consensus Range: +0.1% to +0.3%

Producer prices did show pressure in May and June but then fell sharply in July and came in flat in August, the latter at no change for the headline and up only 0.1 percent less food & energy. Goods prices have been in outright contraction and offset only in part by marginal pressure for service prices. Forecasters see September's headline coming in at plus 0.2 percent with the core at only plus 0.1 percent.

Retail Sales for September

Consensus Forecast: +0.6%

Consensus Range: +0.4% to +0.9%

Retail Sales Ex-Autos

Consensus Forecast: +0.5%

Consensus Range: +0.1% to +0.7%

Retail Sales Ex-Autos Ex-Gas

Consensus Forecast: +0.3%

Consensus Range: +0.1% to +0.4%

After a strong second quarter, retail sales slowed sharply in July and August. But, boosted by a surge in unit auto sales, forecasters see a bounce for September, up what would be a very solid 0.6 percent for the total headline. Excluding autos forecasters see only slightly less strength, at a consensus plus 0.5 percent. But when excluding autos and gasoline, forecasters are calling for a more moderate but still constructive 0.3 percent increase.

Business Inventories for August

Consensus Forecast, Month-to-Month Change: +0.1%

Consensus Range: -0.1% to +0.2%

Business inventories have been holding steady at lean levels. Advance data on retail inventories did rise a sharp 0.5 percent in data for August but wholesale inventories fell 0.2 percent with factory inventories up only 0.1 percent. Forecasters see total August inventories coming in at plus 0.1 percent.

Consumer Sentiment Index, Final September

Consensus Forecast: 92.0

Consensus Range: 91.5 to 94.5

Consumer sentiment trended solidly higher to a roughly 92 to 93 pace the last two weeks of September, led by income expectations among higher income households. Forecasters see the preliminary reading for October coming in at a consensus 92.0.

|