|

Simply Economics will be taking the Thanksgiving week off

and will return on Friday, December 2

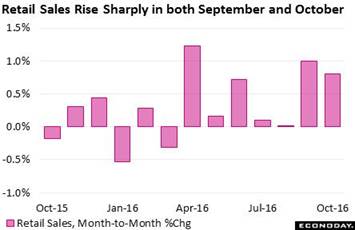

Donald Trump's victory and expectations of strong fiscal stimulus are pushing the stock market up but are pulling the bond market down. What is not down at all is consumer spending, at least it wasn't going into the November 8 result. Retail sales in September and October simply surged with strength concentrated where it is most convincing — in autos.

Retail sales jumped 0.8 percent in October with September's gain revised 4 tenths higher to 1.0 percent. These are the strongest back-to-back gains since the spring of 2014 and point to an upward revision to third-quarter GDP and a strong start for fourth-quarter GDP. Both months show wide gains led by the most important component of all, autos which rose 1.1 percent in October on top of September's 1.9 percent surge. And excluding autos, given the breadth across components, doesn't make any difference at all in the monthly gain, also at plus 0.8 percent for ex-autos, and excluding autos only shaves 3 tenths from September where the ex-auto reading is a very strong 0.7 percent. Building materials & garden equipment have been very strong, up 1.1 percent in October following September's 1.8 percent gain and pointing to renewed strength in residential investment. Non-store retailers, boosted by e-commerce, are also a standout, up 1.5 percent and 0.9 percent in the two months. Retail sales jumped 0.8 percent in October with September's gain revised 4 tenths higher to 1.0 percent. These are the strongest back-to-back gains since the spring of 2014 and point to an upward revision to third-quarter GDP and a strong start for fourth-quarter GDP. Both months show wide gains led by the most important component of all, autos which rose 1.1 percent in October on top of September's 1.9 percent surge. And excluding autos, given the breadth across components, doesn't make any difference at all in the monthly gain, also at plus 0.8 percent for ex-autos, and excluding autos only shaves 3 tenths from September where the ex-auto reading is a very strong 0.7 percent. Building materials & garden equipment have been very strong, up 1.1 percent in October following September's 1.8 percent gain and pointing to renewed strength in residential investment. Non-store retailers, boosted by e-commerce, are also a standout, up 1.5 percent and 0.9 percent in the two months.

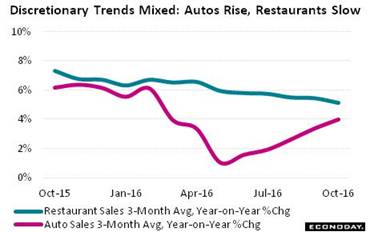

Turning back to autos, sales have been steadily improving for the past half year as seen on the accompanying graph which tracks the 3-month average of the year-on-year rate, at plus 4 percent in the latest report. There is, however, one discretionary component that has not been accelerating and that's restaurants. Sales here fell 0.7 percent in the monthly data for October with year-on-year growth still ahead of autos but going in the wrong direction, slowing 3 tenths for the three-month average to 5.2 percent. Restaurant sales of course may be suffering at the expense of autos, or could the slowdown reflect a new commitment to finally lose some weight? Turning back to autos, sales have been steadily improving for the past half year as seen on the accompanying graph which tracks the 3-month average of the year-on-year rate, at plus 4 percent in the latest report. There is, however, one discretionary component that has not been accelerating and that's restaurants. Sales here fell 0.7 percent in the monthly data for October with year-on-year growth still ahead of autos but going in the wrong direction, slowing 3 tenths for the three-month average to 5.2 percent. Restaurant sales of course may be suffering at the expense of autos, or could the slowdown reflect a new commitment to finally lose some weight?

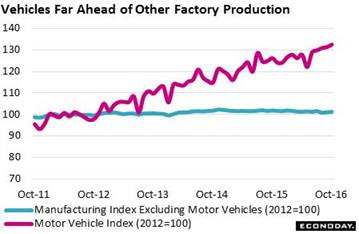

The factory sector has had a hard time showing much life this year but there are positive indications emerging as we move to year end. The manufacturing component of the industrial production report managed a second straight 0.2 percent gain in October, which doesn't sound like much but is only the second back-to-back gain in the last year-and-a-half. Autos, thanks of course to the strength in retail sales, have been a central strength of the factory sector this whole cycle. The trend for total manufacturing production (measured in the industrial production report by volume) has been edging higher but, as seen in the graph, is actually dead flat when autos are excluded. The factory sector has had a hard time showing much life this year but there are positive indications emerging as we move to year end. The manufacturing component of the industrial production report managed a second straight 0.2 percent gain in October, which doesn't sound like much but is only the second back-to-back gain in the last year-and-a-half. Autos, thanks of course to the strength in retail sales, have been a central strength of the factory sector this whole cycle. The trend for total manufacturing production (measured in the industrial production report by volume) has been edging higher but, as seen in the graph, is actually dead flat when autos are excluded.

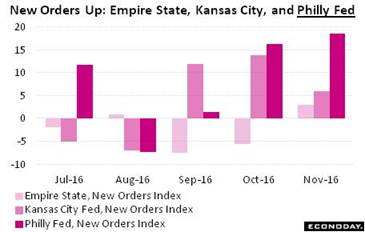

The Philly Fed's Mid-Atlantic report is the most closely watched of all advance indications for the factory sector, and the latest news couldn't be much better. New orders are up for three months in a row and the last two readings, at 18.6 for November and 16.3 in October, are the best showings over the last two years. And unfilled orders, which are negative nearly every month, are back in the plus column at 4.1 for their best showing since February last year. Two other regional reports are also showing life for new orders, both Empire State and Kansas City. The Philly Fed's Mid-Atlantic report is the most closely watched of all advance indications for the factory sector, and the latest news couldn't be much better. New orders are up for three months in a row and the last two readings, at 18.6 for November and 16.3 in October, are the best showings over the last two years. And unfilled orders, which are negative nearly every month, are back in the plus column at 4.1 for their best showing since February last year. Two other regional reports are also showing life for new orders, both Empire State and Kansas City.

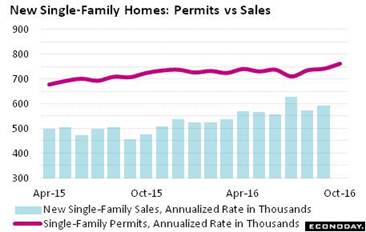

The week also offers good news from the housing sector where the new home market continues to trend higher. Permits to build single-family homes rose 2.7 percent in October to an annualized rate of 762,000 units. And new supply needs to come on the market quickly and is, with starts soaring 10.7 percent in the month and completions up 3.9 percent. Actual sales of new homes have been trending higher all year and would be higher still if not for the lack of supply. A sudden negative to watch, however, is the surge underway in Treasury yields and specifically mortgage rates which, according to the Mortgage Bankers Association, jumped 18 basis points in the November 11 week to 3.95 percent (for conforming loans $417,500 or less). New home sales for October, which will not have been affected by November's jump in mortgage rates, will be one of the coming week's highlights (released Wednesday, November 23). The week also offers good news from the housing sector where the new home market continues to trend higher. Permits to build single-family homes rose 2.7 percent in October to an annualized rate of 762,000 units. And new supply needs to come on the market quickly and is, with starts soaring 10.7 percent in the month and completions up 3.9 percent. Actual sales of new homes have been trending higher all year and would be higher still if not for the lack of supply. A sudden negative to watch, however, is the surge underway in Treasury yields and specifically mortgage rates which, according to the Mortgage Bankers Association, jumped 18 basis points in the November 11 week to 3.95 percent (for conforming loans $417,500 or less). New home sales for October, which will not have been affected by November's jump in mortgage rates, will be one of the coming week's highlights (released Wednesday, November 23).

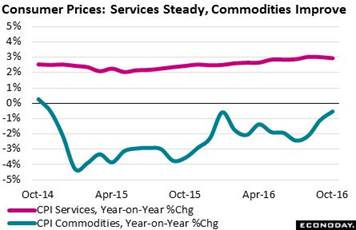

Crowded among all the news in the week is the consumer price report where pressure, outside a monthly jump in energy costs, is hard to find. Commodity costs jumped 0.6 percent in the month largely due to a 7.0 percent surge for gasoline. Service costs, however, didn't show much life at all, up only 0.2 percent with costs for medical care now moderating. The graph tracks year-on-year rates with services slowing 1 tenth to 2.9 percent and commodities improving 6 tenths to minus 0.5 percent. Something to note is that gasoline prices so far this month are down from last month, which doesn't point to much strength for commodity prices in the November report. Crowded among all the news in the week is the consumer price report where pressure, outside a monthly jump in energy costs, is hard to find. Commodity costs jumped 0.6 percent in the month largely due to a 7.0 percent surge for gasoline. Service costs, however, didn't show much life at all, up only 0.2 percent with costs for medical care now moderating. The graph tracks year-on-year rates with services slowing 1 tenth to 2.9 percent and commodities improving 6 tenths to minus 0.5 percent. Something to note is that gasoline prices so far this month are down from last month, which doesn't point to much strength for commodity prices in the November report.

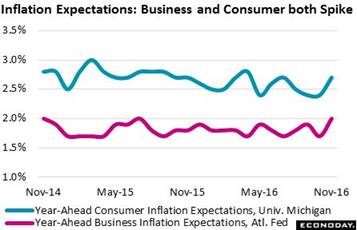

And there's more inflation news, specifically on the mysterious category of inflation expectations. In the prior week, inflation expectations in the consumer sentiment report surged, yes mysteriously, up 3 tenths for both the 1- and 5-year outlooks to 2.7 percent. I say mysteriously because the sampling was done before the November 8 election so the results (probably) did not include expectations for the effects of significant fiscal stimulus under a Trump administration. Less mysterious (perhaps) is a 3 tenths rise in the Atlanta Fed's 1-year business outlook for inflation expectations which does include November 8. This is the largest monthly jump in 4 years and the highest rate since July last year! I'm quietly looking for answers on my Ouija Board (Classic Edition) ... And there's more inflation news, specifically on the mysterious category of inflation expectations. In the prior week, inflation expectations in the consumer sentiment report surged, yes mysteriously, up 3 tenths for both the 1- and 5-year outlooks to 2.7 percent. I say mysteriously because the sampling was done before the November 8 election so the results (probably) did not include expectations for the effects of significant fiscal stimulus under a Trump administration. Less mysterious (perhaps) is a 3 tenths rise in the Atlanta Fed's 1-year business outlook for inflation expectations which does include November 8. This is the largest monthly jump in 4 years and the highest rate since July last year! I'm quietly looking for answers on my Ouija Board (Classic Edition) ...

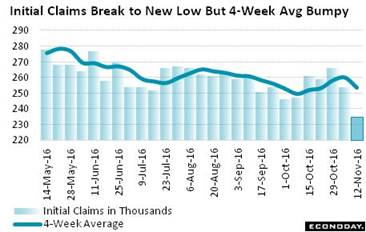

Also crowded into the week's news is a very good showing for initial jobless claims, down 19,000 in the November 12 week to a far lower-than-expected 235,000 and a new 43-year low. The November 12 week was also the sample week for the monthly employment and a comparison with the October sample week shows a substantial 26,000 decrease in the headline level. This is a very positive indication for the November employment report but is offset by lack of improvement in the 4-week average, at 253,500 for the latest reading vs 252,000 in the October week. What is certain, however, is that labor is in strong demand and employers are keeping their people in place. Also crowded into the week's news is a very good showing for initial jobless claims, down 19,000 in the November 12 week to a far lower-than-expected 235,000 and a new 43-year low. The November 12 week was also the sample week for the monthly employment and a comparison with the October sample week shows a substantial 26,000 decrease in the headline level. This is a very positive indication for the November employment report but is offset by lack of improvement in the 4-week average, at 253,500 for the latest reading vs 252,000 in the October week. What is certain, however, is that labor is in strong demand and employers are keeping their people in place.

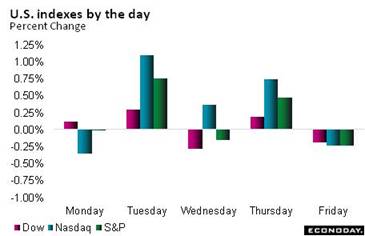

The giant sell-off in the Treasury market extended to a second week as the 2-year yield, ending Friday at 1.07 percent, rose another 15 basis points in the week following its 13 basis point spike in the immediate wake of Donald Trump's victory. The 10-year yield spiked 38 basis points that week and, ending Friday at 2.34 percent, added another 19 basis points in the latest week. Who wants to book losses? Bond traders no more than anyone else I guess. And the more losses they book as the year-end approaches, the lower the bond market will go and the less rich their poor 2016 bonuses will be. Both the 2- and 10-year rates are at their highest levels of the year as is the dollar index, over 100 at 101.34 in what can't be very good news at all for exports and the factory sector. Expectations, of course, of significant fiscal stimulus under the Trump administration are behind the volatility, swings that also include gains for the stock market. The Nasdaq added another 1.6 percent to its prior week surge of 3.8 percent though the momentum for the Dow, which initially surged 5.4 percent, slowed as the average managed only a 0.1 percent gain in the week. The giant sell-off in the Treasury market extended to a second week as the 2-year yield, ending Friday at 1.07 percent, rose another 15 basis points in the week following its 13 basis point spike in the immediate wake of Donald Trump's victory. The 10-year yield spiked 38 basis points that week and, ending Friday at 2.34 percent, added another 19 basis points in the latest week. Who wants to book losses? Bond traders no more than anyone else I guess. And the more losses they book as the year-end approaches, the lower the bond market will go and the less rich their poor 2016 bonuses will be. Both the 2- and 10-year rates are at their highest levels of the year as is the dollar index, over 100 at 101.34 in what can't be very good news at all for exports and the factory sector. Expectations, of course, of significant fiscal stimulus under the Trump administration are behind the volatility, swings that also include gains for the stock market. The Nasdaq added another 1.6 percent to its prior week surge of 3.8 percent though the momentum for the Dow, which initially surged 5.4 percent, slowed as the average managed only a 0.1 percent gain in the week.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2015 |

11-Nov-16 |

18-Nov-16 |

Change |

Change |

| DJIA |

17,425.03 |

18,847.66 |

18,867.93 |

8.3% |

0.1% |

| S&P 500 |

2,043.94 |

2,164.45 |

2,181.90 |

6.7% |

0.8% |

| Nasdaq Composite |

5,007.41 |

5,237.11 |

5,321.51 |

6.3% |

1.6% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$37.40 |

$43.22 |

$45.61 |

22.0% |

5.5% |

| Gold (COMEX) ($/ounce) |

$1,060.00 |

$1,225.00 |

$1,207.70 |

13.9% |

-1.4% |

|

|

|

|

|

|

| Fed Funds Target |

0.25 to 0.50% |

0.25 to 0.50% |

0.25 to 0.50% |

0 bp |

0 bp |

| 2-Year Treasury Yield |

1.05% |

0.92% |

1.07% |

2 bp |

15 bp |

| 10-Year Treasury Yield |

2.27% |

2.15% |

2.34% |

7 bp |

19 bp |

| Dollar Index |

98.84 |

99.05 |

101.34 |

2.5% |

2.3% |

Strong demand for labor is having its positive effects on consumers who are showing their strength and their confidence by buying autos. The economy is accelerating into year-end which, questions of fiscal stimulus aside, make a rate hike at the December 13 and 14 FOMC look like a forgone conclusion.

It will be a very busy holiday week for the economic calendar, mostly packed into Wednesday ahead of Thanksgiving on Thursday. Existing home sales, which have been mostly soft this year, will be Tuesday's highlight and a second month of improvement is not expected. New home sales have been much stronger than resales but the Econoday consensus is calling for slightly monthly weakness in Wednesday's mid-morning report. Wednesday will open with weekly jobless claims which have been signaling very favorable conditions in the labor market as well as durable goods orders for October and the PMI manufacturing flash for November. Wednesday's consumer sentiment report will be closely watched for early indications on the effects of the November 8 election. FOMC minutes from the November 1 and 2 meeting will close out Wednesday's pre-holiday session. Friday resumes with advance data on the trade deficit and also a flash reading on November's service sector.

Existing Home Sales for October

Consensus Forecast, Annualized Rate: 5.420 million

Consensus Range: 5.350 to 5.515 million

Existing home sales showed life in September and less is expected for October. Forecasters see the annualized sales rate dipping 0.9 percent to 5.420 million despite a 1.5 percent September jump in pending sales (contract signings). Soft prices have been limiting the number of homes coming into the market which has held down sales.\

Durable Goods Orders for October

Consensus Forecast, Month-to-Month Change: +1.5%

Consensus Range: -0.5% to +4.5%

Durable Goods Orders, Ex-Transportation

Consensus Forecast: +0.2%

Consensus Range: 0.0% to +0.8%

Advance factory surveys were mixed in October but did include solid strength for the most closely watched report, the Philly Fed where new orders surged to a 2-year high. And forecasters do see strength for October durable goods orders with the consensus gain at 1.5 percent. Ex-transportation orders, which strip out monthly swings in aircraft orders and also vehicle orders which have been strong, are expected to rise 0.2 percent. Orders for capital goods, which had shown life during the summer, fell sharply in the September report. The core reading for October capital goods will set up expectations for fourth-quarter business investment.

Initial Jobless Claims for November 19 week

Consensus Forecast: 250,000

Consensus Range: 245,000 to 255,000

Initial jobless claims are expected to come in at 250,000 in the November 19 week following their surprise 19,000 drop to 235,000 in the prior week and a new 43-year low. Both initial claims and continuing claims have been tracking at historic lows all year and pointing to healthy conditions in the labor market.

FHFA House Price Index for September

Consensus Forecast: +0.7%

Consensus Range: +0.4% to +0.9%

Home-price appreciation has been moderate this year, trending in the 5 percent range for most readings. The FHFA house price index, however, rose a very sharp 0.7 percent in August to a year-on-year 6.4 percent for a 2-1/2 year high. And forecasters don't see the monthly rate for September moderating at all, with the consensus at August's plus 0.7 percent gain.

Manufacturing PMI, November Flash

Consensus Forecast: 53.5

Consensus Range: 53.4 to 54.0

The PMI for Markit Economics' manufacturing sample picked up strength in October, rising 1.9 points to 53.4 and including strength in domestic new orders. October aside, however, this report has generally tracked in line with ISM's manufacturing sample, both pointing to no more than modestly positive conditions for a sector that has been held down by weak global demand and weak business demand for new equipment. The Econoday consensus for the manufacturing PMI November flash is for a steady reading at 53.5.

New Home Sales for October

Consensus Forecast, Annualized Rate: 590,000

Consensus Range: 580,000 to 620,000

New home sales rose 3.1 percent in September but prior months were revised sharply lower. Yet the trend remains solidly positive making the new home sales market a top performer of the 2016 economy. Though permits, starts, and completions are up, supply of new single-family homes remains limited and will continue to hold down sales gains. Forecasters see new home sales slipping a monthly 0.5 percent to a 593,000 annualized rate for October, a month that preceded this month's surge in mortgage rates.

Consumer Sentiment Index, Final November

Consensus Forecast: 91.6

Consensus Range: 89.5 to 92.5

The consumer sentiment final for November will offer early and closely watched indications on the effects of the November 8 election. The flash for the month rose very sharply, up nearly 4 points to 91.6 for a sampling period, however, that ended before the election. The flash also included a sharp rise in inflation expectations that foreshadowed a similar spike in the Atlanta Fed's business inflation expectations index that did cover the November 8 period. Forecasters see no change for the consumer sentiment final reading with the consensus at 91.6.

FOMC Minutes

Covering the November 1 & 2 Meeting

Status quo was the result of the FOMC meeting in early November which preceded the November 8 election and where the federal funds target remained unchanged, between 0.25 and 0.50 percent. Changes in language were few and did not include any specific hints for a rate hike at the next FOMC meeting in December. Policy makers continued to describe job gains as solid but did see a little greater inflationary pressures then before. Boston's Rosengren moved his vote to the majority with the tally at 8 to 2 vs September's vote of 7 to 3.

International Trade In Goods for October

Consensus Forecast, Month-to-Month Change: -$59.7 billion

Consensus Range: -$61.4 to -$56.9 billion

The nation's trade deficit in goods came in at a revised $57.5 billion in September vs an initial $56.1 billion. Capital goods exports rose sharply in September as did exports of civilian aircraft. Imports slowed in the month including declines for capital goods and consumer goods. Oil imports were marginally lower. The Econoday consensus for October's trade deficit in goods is for a reversal of these factors and sharp widening to $59.7 billion.

|