|

Economic policy is at a cross roads, that is the Fed is ready to tap the brakes while the new administration is promising to step hard on the accelerator. These cross currents are certain to make for a one-of-a-kind FOMC meeting that will feature Janet Yellen's quarterly press conference and include the FOMC's updated forecasts. There will be no lack of things to talk about.

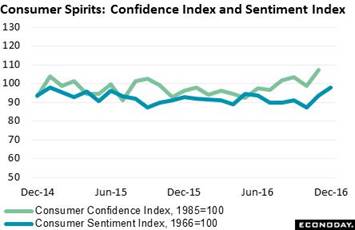

How much the FOMC addresses the new era at the coming meeting still has to play out, but the new era is definitely what the consumer is talking about. The University of Michigan reported during the week that consumers are spontaneously citing the expected positive impact of new economic policy like never before, well at least in the 64-year history of the consumer sentiment report. The early reading on December is up more than 4 points from November to a 98.0 level that is just 1 tenth away from the cycle peak hit in January last year. A sharp rise in the current conditions component, up 4.5 percent from November to 112.1, offers an early indication of strength for December's holiday spending while a gain for expectations, up 4.3 percent to 88.9, points to optimism in the jobs outlook. The Conference Board's consumer confidence report, posted in the prior week, easily hit its cycle high, at 107.1. How much the FOMC addresses the new era at the coming meeting still has to play out, but the new era is definitely what the consumer is talking about. The University of Michigan reported during the week that consumers are spontaneously citing the expected positive impact of new economic policy like never before, well at least in the 64-year history of the consumer sentiment report. The early reading on December is up more than 4 points from November to a 98.0 level that is just 1 tenth away from the cycle peak hit in January last year. A sharp rise in the current conditions component, up 4.5 percent from November to 112.1, offers an early indication of strength for December's holiday spending while a gain for expectations, up 4.3 percent to 88.9, points to optimism in the jobs outlook. The Conference Board's consumer confidence report, posted in the prior week, easily hit its cycle high, at 107.1.

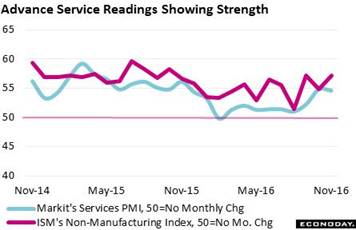

Consumer confidence is not the only thing pointing to fourth-quarter strength. The nation's service sector got an upgrade in the week from the ISM non-manufacturing index which rose 2.4 points in November to 57.2 for the best reading since October last year. New orders are also very strong, at 57.0, with business activity even stronger at 61.7 and pointing to greater demand for labor where the related index is already at 58.2. Markit Economics' service-sector index confirms the strength, at 54.6 for November and just off October's 2016 high at 54.8. New orders in this report are also a highlight which Markit attributes to the end of the election cycle and to an improved economic outlook. Consumer confidence is not the only thing pointing to fourth-quarter strength. The nation's service sector got an upgrade in the week from the ISM non-manufacturing index which rose 2.4 points in November to 57.2 for the best reading since October last year. New orders are also very strong, at 57.0, with business activity even stronger at 61.7 and pointing to greater demand for labor where the related index is already at 58.2. Markit Economics' service-sector index confirms the strength, at 54.6 for November and just off October's 2016 high at 54.8. New orders in this report are also a highlight which Markit attributes to the end of the election cycle and to an improved economic outlook.

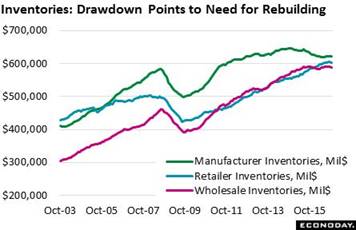

Yet strength in the service sector is really no surprise, unlike the year-end strength that is emerging from the long dormant factory sector. Led by a big rush in new orders from the Philly Fed report, advance indications on November have mostly been positive. And October proved a very good month for the sector with factory orders surging 2.7 percent. Though aircraft, both commercial and defense, were major positives, the strength was well distributed with the monthly gain excluding all aircraft at a very strong 0.7 percent. After two years in contraction, year-on-year rates are again positive for both orders, at 1.3 percent, and shipments, at 0.4 percent. Turning back to monthly rates, October details included a useful 0.4 percent rise in shipments and a 0.7 percent jump in unfilled orders that ended a long run of contraction for this reading. And the strength in monthly shipments made for another positive, keeping down inventories which had looked on the heavy side going into the quarter. Yet strength in the service sector is really no surprise, unlike the year-end strength that is emerging from the long dormant factory sector. Led by a big rush in new orders from the Philly Fed report, advance indications on November have mostly been positive. And October proved a very good month for the sector with factory orders surging 2.7 percent. Though aircraft, both commercial and defense, were major positives, the strength was well distributed with the monthly gain excluding all aircraft at a very strong 0.7 percent. After two years in contraction, year-on-year rates are again positive for both orders, at 1.3 percent, and shipments, at 0.4 percent. Turning back to monthly rates, October details included a useful 0.4 percent rise in shipments and a 0.7 percent jump in unfilled orders that ended a long run of contraction for this reading. And the strength in monthly shipments made for another positive, keeping down inventories which had looked on the heavy side going into the quarter.

But inventories aren't looking heavy any more. Data on the wholesale sector showed a 0.4 percent inventory decline in October, a draw reflecting a 1.4 percent surge in wholesale sales. The mismatch dropped the stock-to-sales ratio from 1.32 to 1.30 for the lowest reading in nearly two years. Advance October data for the retail sector point to a similar decline for retail inventories which aren't looking heavy at all given the enormous strength of retail sales during September and October. The need to restock inventories could prove a big plus for production and employment going into year end, not to mention 2017. But inventories aren't looking heavy any more. Data on the wholesale sector showed a 0.4 percent inventory decline in October, a draw reflecting a 1.4 percent surge in wholesale sales. The mismatch dropped the stock-to-sales ratio from 1.32 to 1.30 for the lowest reading in nearly two years. Advance October data for the retail sector point to a similar decline for retail inventories which aren't looking heavy at all given the enormous strength of retail sales during September and October. The need to restock inventories could prove a big plus for production and employment going into year end, not to mention 2017.

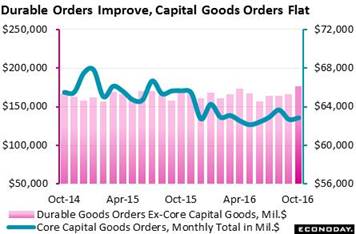

But not all the data during the week were good. Capital goods in the factory orders report proved flat as core orders (nondefense excluding aircraft) rose only 0.2 percent in October, far from offsetting September's 1.5 percent decline. And shipments for this reading got fourth-quarter business investment off to a slow start, down 0.1 percent in October and pointing to early trouble for the business investment component of the GDP report. The graph tracks core capital goods orders (blue line) against durable orders excluding core capital goods (red columns). The latter had been flat but is now edging higher while the former has been struggling to form a bottom. But not all the data during the week were good. Capital goods in the factory orders report proved flat as core orders (nondefense excluding aircraft) rose only 0.2 percent in October, far from offsetting September's 1.5 percent decline. And shipments for this reading got fourth-quarter business investment off to a slow start, down 0.1 percent in October and pointing to early trouble for the business investment component of the GDP report. The graph tracks core capital goods orders (blue line) against durable orders excluding core capital goods (red columns). The latter had been flat but is now edging higher while the former has been struggling to form a bottom.

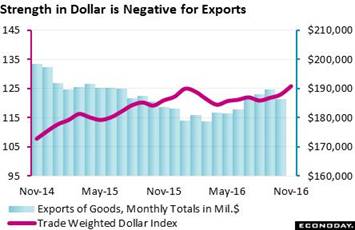

Bad news also came from the international trade report where the nation's deficit widened substantially in October, to a deeper-than-expected $42.6 billion vs September's $36.2 billion and reflecting the combination of a 1.8 percent decline in exports together with a 1.3 percent rise in imports. Exports were soft across the board including for agricultural products, industrial supplies and also the key category of capital goods where weak exports point to a lack of global investment. One outcome from the post-election surge in the markets is the dollar's nearly 5 percent gain (4.7 percent on the dollar index since November 8). The stronger dollar may make U.S. investments more attractive but as far as exports go, it raises the cost and lowers demand. Bad news also came from the international trade report where the nation's deficit widened substantially in October, to a deeper-than-expected $42.6 billion vs September's $36.2 billion and reflecting the combination of a 1.8 percent decline in exports together with a 1.3 percent rise in imports. Exports were soft across the board including for agricultural products, industrial supplies and also the key category of capital goods where weak exports point to a lack of global investment. One outcome from the post-election surge in the markets is the dollar's nearly 5 percent gain (4.7 percent on the dollar index since November 8). The stronger dollar may make U.S. investments more attractive but as far as exports go, it raises the cost and lowers demand.

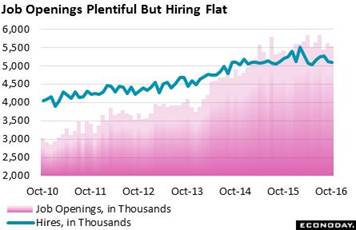

But strength not weakness is the story that the economic data are telling. And strength, and a great of deal of it, is unquestionably appearing in the labor market. JOLTS data (Job Openings and Labor Turnover Survey) are pointing increasingly to lack of supply in the labor market, specifically to a scarcity of skilled labor. Job openings have been trending near 5.5 million for the past year while hiring has been struggling to hold at the 5 million line, at 5.1 million in the latest data for October. Year-on-year, openings are up 2.1 percent in contrast to hiring which is down 2.2 percent. Simply put, there's plenty of jobs available but employers are having a hard time finding the right people. But strength not weakness is the story that the economic data are telling. And strength, and a great of deal of it, is unquestionably appearing in the labor market. JOLTS data (Job Openings and Labor Turnover Survey) are pointing increasingly to lack of supply in the labor market, specifically to a scarcity of skilled labor. Job openings have been trending near 5.5 million for the past year while hiring has been struggling to hold at the 5 million line, at 5.1 million in the latest data for October. Year-on-year, openings are up 2.1 percent in contrast to hiring which is down 2.2 percent. Simply put, there's plenty of jobs available but employers are having a hard time finding the right people.

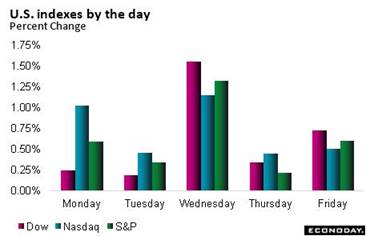

Demand continues to build in the stock market where the Dow posted a weekly gain of 3.1 percent to close Friday at a new record high of 19,756. The accompanying graph speaks for itself, showing no daily negatives for any of the three main indexes. But unlike stocks, the bond market has been weakened by the Trump victory. The 10-year rate has moved 70 basis points higher since the election to the 2.50 percent area and demand for the maturity will be given an important test during the coming week with a $20 billion auction. Treasury demand from China, which had been edging lower going into the election, is the hot button issue for bonds right now. Except for stocks, other markets showed little movement in the week. Demand continues to build in the stock market where the Dow posted a weekly gain of 3.1 percent to close Friday at a new record high of 19,756. The accompanying graph speaks for itself, showing no daily negatives for any of the three main indexes. But unlike stocks, the bond market has been weakened by the Trump victory. The 10-year rate has moved 70 basis points higher since the election to the 2.50 percent area and demand for the maturity will be given an important test during the coming week with a $20 billion auction. Treasury demand from China, which had been edging lower going into the election, is the hot button issue for bonds right now. Except for stocks, other markets showed little movement in the week.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2015 |

2-Dec-16 |

9-Dec-16 |

Change |

Change |

| DJIA |

17,425.03 |

19,170.63 |

19,756.85 |

13.4% |

3.1% |

| S&P 500 |

2,043.94 |

2,191.97 |

2,259.53 |

10.5% |

3.1% |

| Nasdaq Composite |

5,007.41 |

5,255.65 |

5,444.50 |

8.7% |

3.6% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$37.40 |

$51.59 |

$51.49 |

37.7% |

-0.2% |

| Gold (COMEX) ($/ounce) |

$1,060.00 |

$1,177.20 |

$1,160.40 |

9.5% |

-1.4% |

|

|

|

|

|

|

| Fed Funds Target |

0.25 to 0.50% |

0.25 to 0.50% |

0.25 to 0.50% |

0 bp |

0 bp |

| 2-Year Treasury Yield |

1.05% |

1.12% |

1.13% |

8 bp |

1 bp |

| 10-Year Treasury Yield |

2.27% |

2.40% |

2.46% |

19 bp |

6 bp |

| Dollar Index |

98.84 |

100.7 |

101.6 |

2.8% |

0.9% |

Inflation may still be soft, which will be a discussion point at the FOMC meeting, but the service and factory sectors, not to mention the consumer, may be picking up steam at the same time that the labor market is already at full employment. And the Fed, if nothing else, is data dependent, right? The unemployment rate, down 3 tenths remember to 4.6 percent in the prior week's November employment report, has been inside the Fed's longer-run range of 4.5 to 5.0 percent since all the way back in October last year. Putting the Trump outlook aside, the Fed will likely act within its own parameters and raise rates in what, in appearance at least, would work against the approaching aim of fiscal policy. How and whether the FOMC and Yellen reconcile this disconnect could make for an unusually interesting meeting.

Wednesday is the highlight of the week, opening with retail sales which are expected to show good gains in the first definitive look at holiday spending. Industrial production will be posted later Wednesday morning but here weakness is expected including an end to a two-month run of gains for manufacturing. At mid-afternoon, the FOMC will issue both its policy statement and quarterly forecasts and Janet Yellen will take questions at what looks to be an interesting meeting that will bridge present policy with pending stimulus under the Trump administration. A 25 basis point rate hike, only the second hike of the cycle, is widely expected. Consumer prices will lead Thursday's data though no acceleration is expected. Also on Thursday, the Philly Fed and Empire State reports will offer early looks at December's factory activity while housing starts and permits, which have been volatile but still solid, will end the week on Friday.

Small Business Optimism Index for November

Consensus Forecast: 96.5

Consensus Range: 94.9 to 97.0

The small business optimism index is expected to rise sharply to 96.5 in November vs 94.9 in October. Current job openings and plans to increase employment have been two leading strengths of this report, offset by a weak economic outlook and severe weakness in earnings trends in readings that may improve following the November 8 election.

Import Prices for November

Consensus Forecast, Month-to-Month Change: -0.4%

Consensus Range: -0.7% to +0.3%

Export Prices

Consensus Forecast, Month-to-Month Change: 0.0%

Consensus Range: -0.2% to +0.3%

Forecasters see a reversal for import prices in November, at a consensus decline of 0.4 percent to nearly offset a 0.5 percent jump in October. Export prices are called unchanged for November. The import price jump in October was tied entirely to a monthly swing higher in energy prices. Export prices, which rose 0.2 percent in October, reflected a narrow gain for agricultural products.

PPI-FD for November

Consensus Forecast, Month-to-Month Change: +0.2%

Consensus Range: +0.1% to +0.3%

PPI-FD Less Food & Energy

Consensus Forecast, Month-to-Month Change: +0.2%

Consensus Range: +0.1% to +0.3%

At no change for the headline and a core decrease of 0.2 percent, producer prices in October were pulled down by weakness service prices that included declines for legal work, physician services, and also declines at securities brokerages. Energy prices were up in the October report but are not expected to be a major factor in November. Forecasters see headline producer prices rising 0.2 percent in November with the less food & energy rate also up 0.2 percent.

Retail Sales for November

Consensus Forecast: +0.4%

Consensus Range: +0.1% to +0.6%

Retail Sales Ex-Autos

Consensus Forecast: +0.4%

Consensus Range: +0.2% to +0.5%

Retail Sales Ex-Autos Ex-Gas

Consensus Forecast: +0.3%

Consensus Range: +0.1% to +0.5%

Retail sales posted outsized gains of 0.8 percent and 1.0 percent in October and September and some give back is expected. Still, forecasters are calling for a respectable 0.4 percent gain for retail sales in November. Auto sales have been exceptionally strong but are not expected to be a factor in November with the excluding autos reading also expected to rise 0.4 percent. Ex-autos ex-gas are seen at plus 0.3 percent in what would represent a moderate opening for the holiday spending season.

Industrial Production for November

Consensus Forecast, Month-to-Month Change: -0.2%

Consensus Range: -0.8% to +0.3%

Manufacturing Production

Consensus Forecast, Month-to-Month Change: -0.1%

Consensus Range: -0.8% to +0.3%

Capacity Utilization Rate

Consensus Forecast: 75.0%

Consensus Range: 74.3% to 75.4%

The manufacturing component of the industrial production report posted back-to-back 0.2 percent gains in October and September, modest but still one of the best performances over the past two years. But forecasters don't see the strength extending into November with manufacturing production seen down 0.1 percent. Total industrial production is expected to fall 0.2 percent. The capacity utilization rate is expected to fall back 3 tenths to 75.0 percent.

Business Inventories for October

Consensus Forecast, Month-to-Month Change: 0.0%

Consensus Range: -0.2% to +0.3%

Business inventories appeared heavy going into the fourth quarter but now appear to be light given strength in demand. Forecasters see no change for business inventories in October.

Federal Funds Rate Target for December 13 & 14 Meeting:

Consensus Forecast, Midpoint: 0.625%

Consensus Range: 0.50% to 0.75%

Forecasters see the FOMC raising the Federal funds rate target range by a 1/4 point to a midpoint of 0.625 percent in what would be only second hike of the cycle. The unemployment rate at 4.6 percent is well within the Fed's long-term range though inflation remains under target, though even here PCE price readings have been edging higher. The Beige Book didn't signal any signs of rising demand though recent economic data, including a post-election surge in consumer confidence, have been showing improvement. The meeting will also include Janet Yellen's quarterly press conference and updates for FOMC forecasts. It is uncertain how much consideration will be given to the outlook for increased fiscal stimulus under the Trump administration.

Consumer Price Index for November

Consensus Forecast, Month-to-Month Change: +0.2%

Consensus Range: +0.1% to +0.3%

CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: +0.2%

Consensus Range: +0.2% to +0.3%

Energy prices skewed the October consumer price index 0.4 percent higher with the less food & energy rate up only 0.1 percent. Outside of energy, there was little pressure to be found in the October report though housing costs did show limited strength. Forecasters see the consumer price index for November rising only 0.2 percent with the less food & energy rate also up 0.2 percent.

Initial Jobless Claims for December 10 week

Consensus Forecast: 255,000

Consensus Range: 250,000 to 260,000

Initial claims have been volatile in recent weeks but not the 4-week average which has been steady and low and signaling strong demand for labor. Forecasters see initial jobless claims falling slightly in the December 10 week, down 3,000 to 255,000.

Philadelphia Fed Manufacturing Index for December

Consensus Forecast: 10.0

Consensus Range: 6.0 to 12.5

The Philadelphia Fed index is on a 4-month winning streak with the new orders index on a 3-month streak that included outstanding strength in both October and November. Forecasters see the general business conditions index adding 2.4 points in December to a very respectable 10.0.

Empire State Index for December

Consensus Forecast: 3.0

Consensus Range: 2.0 to 5.0

The Empire State report has been signaling only limited strength for the manufacturing sector, unlike the Philadelphia Fed index where recent readings have shown sizable improvement. The Econoday consensus for December's Empire State is plus 3.0 which would mark the first back-to-back gain for this index since June and July.

Housing Market Index for December

Consensus Forecast: 63

Consensus Range: 61 to 64

The housing market index has been steady and strong since September and forecasters see the strength extending to December where the consensus is calling for a steady reading at 63. Current sales and future sales have been the leading components, offsetting weakness in traffic which has been held down all cycle by lack of first-time buyers.

Housing Starts for November

Consensus Forecast, Adjusted Annualized Rate: 1.230 million

Consensus Range: 1.125 to 1.290 million

Housing Permits

Consensus Forecast: 1.240 million

Consensus Range: 1.130 to 1.260 million

Housing starts have been swinging very sharply but the overall trend, including for both single-family and multi-family units, has been very positive. Housing permits, however, have been showing less strength which in turn points to less strength ahead for starts. Housing starts, which spiked in October, are expected to fall 7.0 percent to a 1.230 million annualized rate for November with housing permits seen rising 0.8 percent to a 1.240 million rate.

|