|

Simply Economics will be taking the holidays off

and will return on Friday, December 30

There were surprises in the week but few of them came from the Fed. With the labor market at full employment, the Fed stuck to its guns and raised its target rate one quarter-point notch in only its second rate hike this cycle. Economic news in the week points to an extension of steady growth, though a couple of signals are unusually strong.

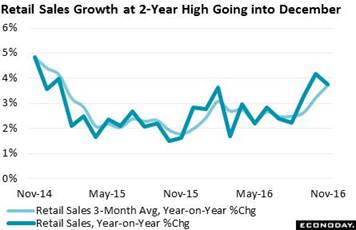

The headline for November retail sales, at only plus 0.1 percent, masks what has been a rising tide for consumer spending. The graph compares year-on-year growth for retail sales (dark line) with the 3-month moving average (light line). Both are near 4 percent and are at their best levels in two years. For retailers, this points to underlying momentum going into the December holiday finale. Discretionary categories have been showing life including restaurants where sales shot 0.8 percent higher in November for the strongest monthly gain since February. There are also signs of strength tied to housing as both furniture and building materials posted constructive increases. November's weakness is centered in auto sales, which fell 0.5 percent in a decline however that follows gains of 0.5 percent and 1.9 percent in the prior two months. Weakness in November sales, based on unit sales, was in light trucks which, however, have been trending much better than car sales the last couple of years. Excluding autos, retail sales were higher but not by much, at only plus 0.2 percent. Nonstore retailers, which is where ecommerce is tracked, is another disappointment, up only 0.1 percent in the month despite a year-on-year rate that's running in the double-digits. The spike underway in consumer confidence didn't translate to great gains for November retail sales but certainly may in December, at least that's what retailers are hoping. The headline for November retail sales, at only plus 0.1 percent, masks what has been a rising tide for consumer spending. The graph compares year-on-year growth for retail sales (dark line) with the 3-month moving average (light line). Both are near 4 percent and are at their best levels in two years. For retailers, this points to underlying momentum going into the December holiday finale. Discretionary categories have been showing life including restaurants where sales shot 0.8 percent higher in November for the strongest monthly gain since February. There are also signs of strength tied to housing as both furniture and building materials posted constructive increases. November's weakness is centered in auto sales, which fell 0.5 percent in a decline however that follows gains of 0.5 percent and 1.9 percent in the prior two months. Weakness in November sales, based on unit sales, was in light trucks which, however, have been trending much better than car sales the last couple of years. Excluding autos, retail sales were higher but not by much, at only plus 0.2 percent. Nonstore retailers, which is where ecommerce is tracked, is another disappointment, up only 0.1 percent in the month despite a year-on-year rate that's running in the double-digits. The spike underway in consumer confidence didn't translate to great gains for November retail sales but certainly may in December, at least that's what retailers are hoping.

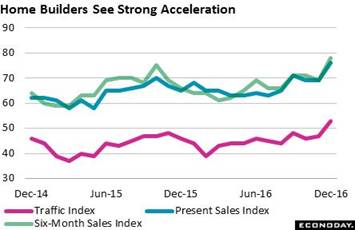

Confidence is not isolated to consumers and is really alive among the nation's home builders. The housing market index is up a very sharp 7 points this month to 70 and a new cycle high. Future sales are December's strongest component, up 9 points to 78 with current sales only slightly behind, up 7 points to 76. These are big surprises and a reminder that actual new home sales as tracked by the government have been growing at a 20 percent clip this year. Traffic is even in the plus column in the home builder report, up 6 points to 53 for the first score over breakeven 50 in 11 years! The gain in traffic points to the effect of high rents which may finally be pushing more first-time buyers into the market. The hottest region is the West, which is a key market for home builders. The South, which is the largest housing region, is also very strong. The sharp rise in mortgage rates since the November election (up about 50 basis points for 30-year mortgages to 4.25 percent) hasn't hurt housing confidence or sales indications, at least yet. And the spike perhaps may even be encouraging fence sitters to enter the market before rates possible move higher. Confidence is not isolated to consumers and is really alive among the nation's home builders. The housing market index is up a very sharp 7 points this month to 70 and a new cycle high. Future sales are December's strongest component, up 9 points to 78 with current sales only slightly behind, up 7 points to 76. These are big surprises and a reminder that actual new home sales as tracked by the government have been growing at a 20 percent clip this year. Traffic is even in the plus column in the home builder report, up 6 points to 53 for the first score over breakeven 50 in 11 years! The gain in traffic points to the effect of high rents which may finally be pushing more first-time buyers into the market. The hottest region is the West, which is a key market for home builders. The South, which is the largest housing region, is also very strong. The sharp rise in mortgage rates since the November election (up about 50 basis points for 30-year mortgages to 4.25 percent) hasn't hurt housing confidence or sales indications, at least yet. And the spike perhaps may even be encouraging fence sitters to enter the market before rates possible move higher.

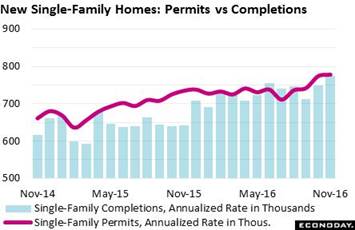

Lack of new homes on the market has been a long and unwanted theme in the housing sector, reflecting lack of available lots and also supply constraints in the construction industry and labor market. Permits for single-family homes rose a useful 0.5 percent in November to a 778,000 annualized rate for a year-on-year increase of just below 6 percent. Housing completions, as seen on the graph, have been holding in line with permits for the last year. It takes about three months for a completed home to be sold, down from about four months at mid-year and another positive indication of strength. Lack of new homes on the market has been a long and unwanted theme in the housing sector, reflecting lack of available lots and also supply constraints in the construction industry and labor market. Permits for single-family homes rose a useful 0.5 percent in November to a 778,000 annualized rate for a year-on-year increase of just below 6 percent. Housing completions, as seen on the graph, have been holding in line with permits for the last year. It takes about three months for a completed home to be sold, down from about four months at mid-year and another positive indication of strength.

Perhaps the best surprise in the week comes out of the factory sector where the Philly Fed's general business conditions index came in at a very strong 21.5 in December and a fifth consecutive showing in the plus column. New orders in this report have been a standout among all factory data, at 13.9 for a third-straight double-digit showing. And the 6-month outlook for new orders, which itself is a measure of confidence, surged nearly 22 points to 51.9 for one of the very best readings of the cycle. The Empire State index, which is compiled by the New York Fed, is also signaling strength. At 9.0 in December, the index made it in the plus column for a second month in a row and one of the best results of the last two years. Perhaps the best surprise in the week comes out of the factory sector where the Philly Fed's general business conditions index came in at a very strong 21.5 in December and a fifth consecutive showing in the plus column. New orders in this report have been a standout among all factory data, at 13.9 for a third-straight double-digit showing. And the 6-month outlook for new orders, which itself is a measure of confidence, surged nearly 22 points to 51.9 for one of the very best readings of the cycle. The Empire State index, which is compiled by the New York Fed, is also signaling strength. At 9.0 in December, the index made it in the plus column for a second month in a row and one of the best results of the last two years.

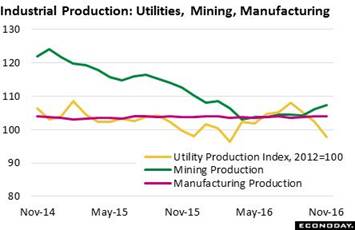

But these are factory signals for December. Actual hard data from November are less favorable. The manufacturing component of the industrial production report proved soft, down 0.1 percent following a 0.3 percent rise in October. Motor vehicle production, which had been a leading strength for manufacturing with five straight gains, fell a steep 2.3 percent in the month with assemblies of light trucks, which had been solid, going into reverse, much as they did on the sales side during November. Hi-tech goods, also a leading strength, could only manage a 0.1 percent gain. Market groups show a 0.5 percent decline for consumer goods and, importantly, a 0.3 percent dip for business equipment which is one more disappointment for business investment and the outlook for productivity. Manufacturing, which has been very flat in recent years, represents about 80 percent of industrial production with utilities and mining making up 10 percent each. But these are factory signals for December. Actual hard data from November are less favorable. The manufacturing component of the industrial production report proved soft, down 0.1 percent following a 0.3 percent rise in October. Motor vehicle production, which had been a leading strength for manufacturing with five straight gains, fell a steep 2.3 percent in the month with assemblies of light trucks, which had been solid, going into reverse, much as they did on the sales side during November. Hi-tech goods, also a leading strength, could only manage a 0.1 percent gain. Market groups show a 0.5 percent decline for consumer goods and, importantly, a 0.3 percent dip for business equipment which is one more disappointment for business investment and the outlook for productivity. Manufacturing, which has been very flat in recent years, represents about 80 percent of industrial production with utilities and mining making up 10 percent each.

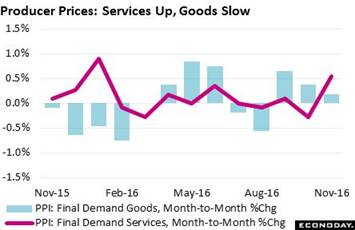

There were also a number of readings on inflation during the week, most of them subdued. Not producer prices, however, which rose a solid 0.4 percent in November despite a downtick in energy costs. An important plus in the report is strength in service prices which rose 0.5 percent and were boosted by trade services at plus 1.3 percent, far offsetting the prior month's 0.3 percent declines in both readings. Goods prices showed far less strength in the month, up only 0.2 percent and held down not only by energy prices but also by prices for finished goods which were unchanged in the month. There were also a number of readings on inflation during the week, most of them subdued. Not producer prices, however, which rose a solid 0.4 percent in November despite a downtick in energy costs. An important plus in the report is strength in service prices which rose 0.5 percent and were boosted by trade services at plus 1.3 percent, far offsetting the prior month's 0.3 percent declines in both readings. Goods prices showed far less strength in the month, up only 0.2 percent and held down not only by energy prices but also by prices for finished goods which were unchanged in the month.

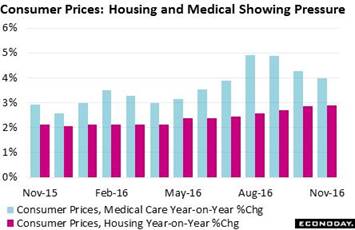

Service prices are also the strength (what strength there is, that is) at the consumer level. The CPI rose only 0.2 percent in November with the year-on-year rate up 1 tenth to plus 1.7 percent and still short of the magic 2 percent line. Two areas covered in service prices are housing and medical, the former cited by the Labor Department as a central area of consistent price improvement. The housing component, where the year-on-year rate has been moving toward 3 percent, could manage only a 0.2 percent monthly gain in November but this follows two prior 0.4 percent gains. Owners' equivalent rent, a closely watched measure of mortgage costs, rose 0.3 percent for a second straight month while rent of primary residence posted a second straight 0.4 percent gain. Rent has been a leading source of pressure in the housing component, running at nearly a 4 percent annual pace. Medical prices have also been a source of pressure but were unchanged in November for a second month in a row with this year-on-year rate slowing down toward 4 percent. Service prices are also the strength (what strength there is, that is) at the consumer level. The CPI rose only 0.2 percent in November with the year-on-year rate up 1 tenth to plus 1.7 percent and still short of the magic 2 percent line. Two areas covered in service prices are housing and medical, the former cited by the Labor Department as a central area of consistent price improvement. The housing component, where the year-on-year rate has been moving toward 3 percent, could manage only a 0.2 percent monthly gain in November but this follows two prior 0.4 percent gains. Owners' equivalent rent, a closely watched measure of mortgage costs, rose 0.3 percent for a second straight month while rent of primary residence posted a second straight 0.4 percent gain. Rent has been a leading source of pressure in the housing component, running at nearly a 4 percent annual pace. Medical prices have also been a source of pressure but were unchanged in November for a second month in a row with this year-on-year rate slowing down toward 4 percent.

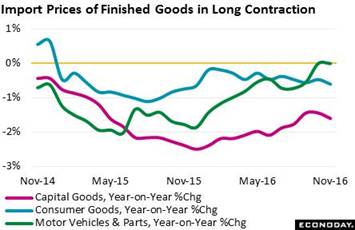

There won't be much inflation coming from abroad, given the ongoing strength of the dollar which is certain to hold down import prices in the months ahead. And import prices in November were already weak, down 0.3 percent for the second decline in four months. Goods prices at the consumer level, which had improving at mid-year, may now be fading. The graph tracks year-on-year rates for finished goods (capital goods, consumer goods, vehicles) and all are in the minus column, especially capital goods which is another signal of softness in business investment. By country, China is the greatest deflationary force for total import prices, down 1.5 percent year-on-year with the EU right behind at minus 0.8 percent. There won't be much inflation coming from abroad, given the ongoing strength of the dollar which is certain to hold down import prices in the months ahead. And import prices in November were already weak, down 0.3 percent for the second decline in four months. Goods prices at the consumer level, which had improving at mid-year, may now be fading. The graph tracks year-on-year rates for finished goods (capital goods, consumer goods, vehicles) and all are in the minus column, especially capital goods which is another signal of softness in business investment. By country, China is the greatest deflationary force for total import prices, down 1.5 percent year-on-year with the EU right behind at minus 0.8 percent.

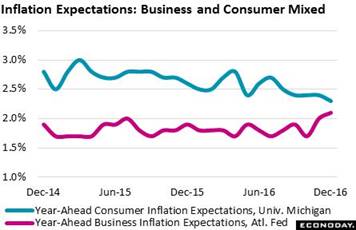

Consumer expectations for inflation are very low and, unlike consumer confidence, have not been showing any recent surge. But here there is a disconnect as business expectations for inflation, as measured by the Atlanta Fed, are moving convincingly higher. The graph tracks year-ahead inflation expectations in the consumer sentiment report, which have been slowing steadily to 2.3 percent in the December reading, against year-ahead expectations in the Atlanta Fed report which have jumped 4 tenths in the last two months, to 2.1 percent on the graph. The rise on the business side doesn't yet reflect costs, which are stable and low, but does hint at how confident businesses are in the outlook. It will be interesting to watch if the consumer side begins to follow the business side when it comes to inflation expectations. Consumer expectations for inflation are very low and, unlike consumer confidence, have not been showing any recent surge. But here there is a disconnect as business expectations for inflation, as measured by the Atlanta Fed, are moving convincingly higher. The graph tracks year-ahead inflation expectations in the consumer sentiment report, which have been slowing steadily to 2.3 percent in the December reading, against year-ahead expectations in the Atlanta Fed report which have jumped 4 tenths in the last two months, to 2.1 percent on the graph. The rise on the business side doesn't yet reflect costs, which are stable and low, but does hint at how confident businesses are in the outlook. It will be interesting to watch if the consumer side begins to follow the business side when it comes to inflation expectations.

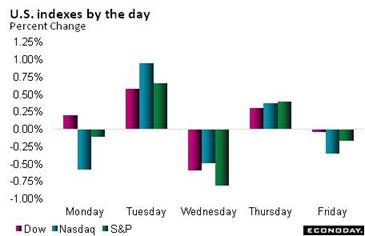

Strength in the dollar has been a salient feature of the post-election markets, one that supports confidence in U.S. assets but one that won't be good for the nation's exports. The dollar index, which is normally very stable, has shot 6 percent higher since the election and, near 103, is up more than 4 percent year-on-year. The upward move in rates, reflecting expectations of significant stimulus under the Trump administration, resumed during the week following the Fed's 1/4 point rate hike and indication for continuing rate hikes through next year. The 2-year yield rose 14 basis points in the week to a cycle high at 2.59 percent with the 10-year yield up 13 basis points to 1.26 percent and a 2-year high. Higher rates attract buy-and-hold investors who, in good news for the Treasury, were out in force at the week's 10-year and 30-year auctions. Stocks were narrowly mixed in the week with the Dow ending 0.4 percent higher but just a little short of 20,000 at 19,842. Strength in the dollar has been a salient feature of the post-election markets, one that supports confidence in U.S. assets but one that won't be good for the nation's exports. The dollar index, which is normally very stable, has shot 6 percent higher since the election and, near 103, is up more than 4 percent year-on-year. The upward move in rates, reflecting expectations of significant stimulus under the Trump administration, resumed during the week following the Fed's 1/4 point rate hike and indication for continuing rate hikes through next year. The 2-year yield rose 14 basis points in the week to a cycle high at 2.59 percent with the 10-year yield up 13 basis points to 1.26 percent and a 2-year high. Higher rates attract buy-and-hold investors who, in good news for the Treasury, were out in force at the week's 10-year and 30-year auctions. Stocks were narrowly mixed in the week with the Dow ending 0.4 percent higher but just a little short of 20,000 at 19,842.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2015 |

9-Dec-16 |

16-Dec-16 |

Change |

Change |

| DJIA |

17,425.03 |

19,756.85 |

19,842.55 |

13.9% |

0.4% |

| S&P 500 |

2,043.94 |

2,259.53 |

2,258.05 |

10.5% |

-0.1% |

| Nasdaq Composite |

5,007.41 |

5,444.50 |

5,437.16 |

8.6% |

-0.1% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$37.40 |

$51.49 |

$52.00 |

39.0% |

1.0% |

| Gold (COMEX) ($/ounce) |

$1,060.00 |

$1,160.40 |

$1,135.60 |

7.1% |

-2.1% |

|

|

|

|

|

|

| Fed Funds Target |

0.25 to 0.50% |

0.25 to 0.50% |

0.50 to 0.75% |

25 bp |

25 bp |

| 2-Year Treasury Yield |

1.05% |

1.13% |

1.27% |

22 bp |

14 bp |

| 10-Year Treasury Yield |

2.27% |

2.46% |

2.59% |

32 bp |

13 bp |

| Dollar Index |

98.84 |

101.6 |

102.9 |

4.1% |

1.3% |

Prospects of significant federal stimulus under the Trump administration did not factor much in the final decision from the Fed which, as conceded by Janet Yellen during her quarterly press conference, is playing a waiting game to see how events unfold. Most economic indications are favorable and some of them are increasingly favorable. But inflation remains low and, as Yellen herself says, will give the Fed space to maneuver in a landscape where monetary stimulus is decreasing at the same time that fiscal stimulus looks to increase, and perhaps increase in a big way.

It will be a light week for key indicators starting Wednesday with existing home sales which have been struggling to build steady momentum. Personal income and spending data on Thursday are expected to show moderate gains on both scores though price readings are expected to prove flat. Durable goods orders, also on Thursday, are expected to fall sharply at the headline level but, when excluding aircraft orders, are expected to hold steady. Thursday's jobless claims report will, for initial claims, cover the sample week of the December employment report, a factor that will heighten attention to what are expected to be favorable results. New home sales, which have been uneven but strong on net, and consumer sentiment, which has been exceptionally strong, will round out the week on Friday.

Existing Home Sales for November

Consensus Forecast, Annualized Rate: 5.535 million

Consensus Range: 5.400 to 5.650 million

Existing home sales are expected to slip 1.2 percent in November to a 5.535 million annualized rate, reversing much of October's 2.0 percent jump. Existing home sales have been flat the past year, held down in part by lack of homes on the market and lack of interest among first-time buyers and renters. Pending sales of existing homes, advance data that track contract signings, inched only 0.1 percent higher in the last reading.

Durable Goods Orders for November

Consensus Forecast, Month-to-Month Change: -4.0%

Consensus Range: -6.3% to -2.4%

Durable Goods Orders, Ex-Transportation

Consensus Forecast: 0.2%

Consensus Range: -0.1% to 0.7%

Durable goods orders rose a very sharp 4.8 percent in October but, in a give back, are expected to decline 4.0 percent in November. Ex-transportation orders, which strip out monthly swings in aircraft orders, are expected to inch 0.2 percent higher. The factory sector has been showing momentum going into year-end though capital goods have remained soft, pointing to limited business investment and a limited contribution from the nonresidential investment component of the fourth-quarter GDP report.

Real GDP, 3rd Quarter, 3rd Estimate, Annualized Rate

Consensus Forecast: 3.3%

Consensus Range: 3.2% to 3.4%

GDP Price Index

Consensus Forecast: 1.4%

Consensus Range: 1.4% to 1.4%

The third estimate of third-quarter GDP is expected to come in little changed, at plus 3.3 percent vs 3.2 percent for the second estimate. Consumer spending was an important contributor to the third quarter, rising at a 2.8 percent annualized rate (based on the second estimate) and providing momentum for the early part of the fourth quarter. Improvement in the trade gap was another positive for the quarter. The GDP price index is expected to come in unchanged at a modest 1.4 percent.

Initial Jobless Claims for December 17 week

Consensus Forecast: 256,000

Consensus Range: 250,000 to 260,000

Initial claims have been volatile in recent weeks but not the 4-week average which has been steady and low and signaling strong demand for labor. Forecasters see initial jobless claims edging slightly higher in the December 17 week, up 2,000 to 256,000. Note that the December 17 week is also the sample week for the December employment report which will heighten interest in the results.

FHFA House Price Index for October

Consensus Forecast: 0.5%

Consensus Range: 0.5% to 0.6%

Home-price appreciation has been moderate this year, trending in the 5 percent range for most readings. The FHFA house price index, however, has been running slightly stronger, in the 6 percent range and near a 2-1/2 year high. Some moderation is expected for October with forecasters calling for a 0.5 percent monthly increase.

Personal Income for November

Consensus Forecast, Month-to-Month Change: 0.3%

Consensus Range: 0.1% to 0.4%

Consumer Spending

Consensus Forecast: 0.3%

Consensus Range: 0.1% to 0.5%

PCE Price Index

Consensus Forecast: 0.2%

Consensus Range: 0.1% to 0.3%

Core PCE Price Index

Consensus Forecast: 0.1%

Consensus Range: 0.1% to 0.3%

Weakness in November retail sales is not discouraging forecasters who see November consumer spending getting a boost from a bounce back in service spending and rising a respectable 0.3 percent. Personal income has been showing life in recent reports, rising a sharp 0.6 percent in October with forecasters calling for slowing to a 0.3 percent increase in November. PCE price indexes have been flat to marginally higher but year-on-year rates, benefiting from easing comparisons, have been moving toward the Fed's 2 percent target. On a monthly basis, the PCE price index is seen rising a modest 0.2 percent in November with the PCE core index seen up 0.1 percent.

Index of Leading Economic Indicators for November

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.0% to 0.4%

November was a very strong month for consumer confidence and the stock market which will be two pluses for the index of leading indicators which is expected to post a modest gain of 0.2 percent. Another positive will be the spike in long-term interest rates which will widen November's yield spread component. Offsets will be a dip in building permits and a decline in the factory workweek.

New Home Sales for November

Consensus Forecast, Annualized Rate: 580,000

Consensus Range: 570,000 to 600,000

New home sales have been strong this year but have been uneven in recent months due in part to lack of supply on the market. Forecasters see November sales rising 3.0 percent to a 580,000 annualized rate. Note that month-to-month results for this report, where sample sizes are small, are often volatile and subject to sharp revisions.

Consumer Sentiment Index, Final December

Consensus Forecast: 98.0

Consensus Range: 94.1 to 99.0

Consumer sentiment has been surging since the beginning of November, up more than 10 points to 98.0 for the December preliminary reading where the final monthly reading is expected to hold. Both the expectations and current conditions component have been rising sharply but it will be the latter that will offer the more tangible indication on the outlook for the holiday shopping season.

Three indicators running soft compared to other housing data will be a focus of the holiday shortened week. Home-price appreciation in Case-Shiller data, which opens the week on Tuesday, has been running at about 5 percent, below other measures including FHFA which has been at about 6 percent. Purchase and refinancing applications, which are out Wednesday with Mortgage Bankers data, have been moving into reverse after November's spike in mortgage rates while pending home sales, also out Wednesday, have been barely showing any strength at all. Outside of housing, one report showing weakness has been international trade in goods on Thursday where a drop in exports during October made for a weak opening to fourth-quarter GDP. Two reports showing enormous strength will also be released, consumer confidence on Tuesday and the Chicago PMI on Friday.

|