|

With rare enthusiasm is how the American consumer has greeted the results of the presidential election and its promises of fiscal stimulus, tax cuts, and deregulation. But the good feelings have yet to translate into strength for ongoing economic data where year-end weakness appears to be the theme.

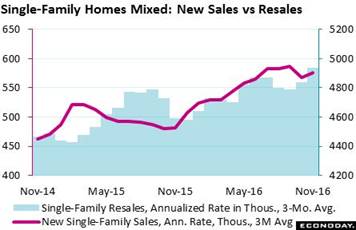

A striking headline of the last couple of weeks comes from new single-family home sales which jumped more than 5 percent in November to a 592,000 annualized rate. For a single month, this is the second strongest result of the entire economic cycle. But this report, because of low sample sizes, is very volatile month-to-month and is best analyzed with a 3-month moving average (red line in graph). And the average tells a slightly different story — that is a 575,000 rate which is still favorable but a bit lower than the third-quarter trend. In contrast, the moving average for single-family resales (blue columns in graph) has been on the climb, up nearly 2 percent in November to a 4.933 million annualized rate and a new cycle high. Together, trends for single-family sales appear to be pointing to moderate strength going into 2017. A striking headline of the last couple of weeks comes from new single-family home sales which jumped more than 5 percent in November to a 592,000 annualized rate. For a single month, this is the second strongest result of the entire economic cycle. But this report, because of low sample sizes, is very volatile month-to-month and is best analyzed with a 3-month moving average (red line in graph). And the average tells a slightly different story — that is a 575,000 rate which is still favorable but a bit lower than the third-quarter trend. In contrast, the moving average for single-family resales (blue columns in graph) has been on the climb, up nearly 2 percent in November to a 4.933 million annualized rate and a new cycle high. Together, trends for single-family sales appear to be pointing to moderate strength going into 2017.

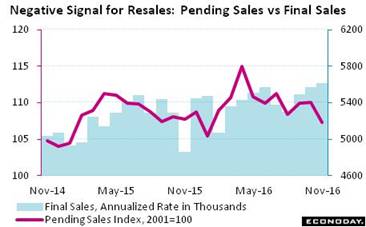

But not so fast! Pending sales of existing homes (which include condos) are down very sharply, 2.5 percent lower in weakness the National Association of Realtors blames on the year-end spike in mortgage rates. The graph tracks the red line of pending sales against the blue columns of final sales of existing homes which, in distinction to the prior graph, also include condos. Contracts usually take one or two months to close and the pending results point squarely at weakness for final resales in early 2017. Rates for 30-year mortgages, now at about 4.50 percent, rose roughly 50 basis points in November and rose another 25 basis during December. But not so fast! Pending sales of existing homes (which include condos) are down very sharply, 2.5 percent lower in weakness the National Association of Realtors blames on the year-end spike in mortgage rates. The graph tracks the red line of pending sales against the blue columns of final sales of existing homes which, in distinction to the prior graph, also include condos. Contracts usually take one or two months to close and the pending results point squarely at weakness for final resales in early 2017. Rates for 30-year mortgages, now at about 4.50 percent, rose roughly 50 basis points in November and rose another 25 basis during December.

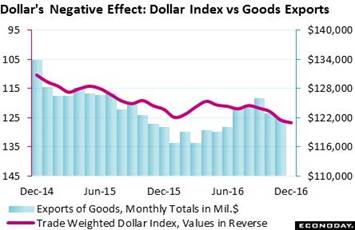

The rise in interest rates is only one of the post-election trends. The rise in the dollar is another. The worst economic news of late comes from the international trade in goods report where the deficit widened sharply in November to $65.3 billion from October's $61.9 billion. Goods exports fell 1.0 percent in the month to $121.7 billion as tracked in the blue columns of the graph. Food exports have been especially soft as have vehicle exports, and capital goods exports fell very sharply in a reminder that the lack of business investment is a global issue. The effect of the dollar's sudden appreciation during November, up 2.4 percent on the dollar index in the month, is only a marginal factor for November's drop in exports. Yet this is a negative factor that will likely build in the months ahead as foreign buyers shift to lower priced exports from other countries. Note that the red line tracking the dollar index is in reverse order, thereby lining up cause and effect. The rise in interest rates is only one of the post-election trends. The rise in the dollar is another. The worst economic news of late comes from the international trade in goods report where the deficit widened sharply in November to $65.3 billion from October's $61.9 billion. Goods exports fell 1.0 percent in the month to $121.7 billion as tracked in the blue columns of the graph. Food exports have been especially soft as have vehicle exports, and capital goods exports fell very sharply in a reminder that the lack of business investment is a global issue. The effect of the dollar's sudden appreciation during November, up 2.4 percent on the dollar index in the month, is only a marginal factor for November's drop in exports. Yet this is a negative factor that will likely build in the months ahead as foreign buyers shift to lower priced exports from other countries. Note that the red line tracking the dollar index is in reverse order, thereby lining up cause and effect.

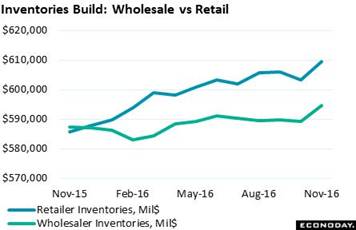

The widening in the goods deficit looks to be a major negative that will hold down fourth-quarter GDP. An offset, however, comes not from good news but from what is likely bad news. Wholesale and retail inventories spiked higher in November, up 0.9 percent to a total $595 billion for wholesalers and up 1.0 percent to $610 billion for retailers. These are very sharp jumps that may prove hard to work off, especially if consumer spending in December (data yet to be released) proves as soft as it was in November. Rising inventories are a positive in the GDP calculation but are serious negatives for future production and employment. The widening in the goods deficit looks to be a major negative that will hold down fourth-quarter GDP. An offset, however, comes not from good news but from what is likely bad news. Wholesale and retail inventories spiked higher in November, up 0.9 percent to a total $595 billion for wholesalers and up 1.0 percent to $610 billion for retailers. These are very sharp jumps that may prove hard to work off, especially if consumer spending in December (data yet to be released) proves as soft as it was in November. Rising inventories are a positive in the GDP calculation but are serious negatives for future production and employment.

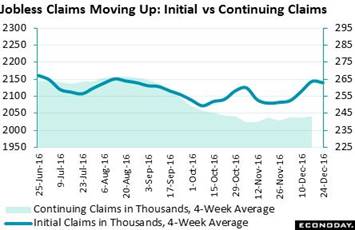

Not-so-great news also comes from jobless claims which have been on the rise going into year end. Initial claims have been trending 10,000 higher compared to November while continuing claims are about 20,000 higher. Claims data are still near historic lows and are pointing to very strong demand for labor, but the month-to-month comparisons are not favorable indications for the December employment report. Yet claims data at year-end, due to shortened weeks, are often subject to volatility, and Econoday forecasters are not calling for weakness in December nonfarm payrolls with the consensus at 175,000 vs November's 178,000. Not-so-great news also comes from jobless claims which have been on the rise going into year end. Initial claims have been trending 10,000 higher compared to November while continuing claims are about 20,000 higher. Claims data are still near historic lows and are pointing to very strong demand for labor, but the month-to-month comparisons are not favorable indications for the December employment report. Yet claims data at year-end, due to shortened weeks, are often subject to volatility, and Econoday forecasters are not calling for weakness in December nonfarm payrolls with the consensus at 175,000 vs November's 178,000.

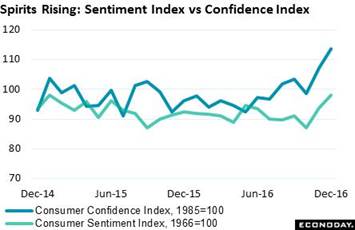

The best of all the data, certainly the most spectacular, are giant gains underway in consumer confidence, all coming after the November 8 election. The consumer sentiment index ended December at 98.2 and a new cycle high. A record percentage of respondents, at 18 percent, spontaneously mentioned the expected favorable impact of new economic policies under the Trump administration. The prior record for this measure was 9 percent back in 1981 following Reagan's victory. Also at a cycle high is the consumer confidence index, at 113.7 and up 12.9 points since Trump's victory and reflecting special enthusiasm among older consumers. But there is one caveat in these reports: the gains have been clearly centered not in the current conditions components but in expectations which are getting their boost from the job and income outlooks. How much of a lift did higher expectations actually give holiday sales? We'll know with the December retail sales report on Friday, January 13. The best of all the data, certainly the most spectacular, are giant gains underway in consumer confidence, all coming after the November 8 election. The consumer sentiment index ended December at 98.2 and a new cycle high. A record percentage of respondents, at 18 percent, spontaneously mentioned the expected favorable impact of new economic policies under the Trump administration. The prior record for this measure was 9 percent back in 1981 following Reagan's victory. Also at a cycle high is the consumer confidence index, at 113.7 and up 12.9 points since Trump's victory and reflecting special enthusiasm among older consumers. But there is one caveat in these reports: the gains have been clearly centered not in the current conditions components but in expectations which are getting their boost from the job and income outlooks. How much of a lift did higher expectations actually give holiday sales? We'll know with the December retail sales report on Friday, January 13.

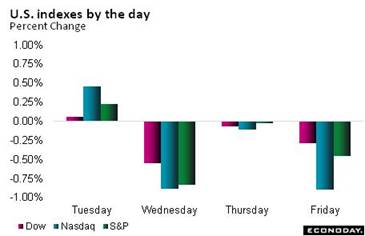

The Dow ended the year unable to mount a sustained assault on 20,000 but still up 13.4 percent on the year to 19,762. Oil had the best year, up 44 percent for West Texas Intermediate to a nearly $54 level that apparently looks secure given OPEC's recent agreement to cut production. And gold had a solid year, up 8.7 percent to $1,152.50. A less striking gain but one perhaps most important for the U.S. economy is a 3.5 percent increase for the dollar index, an index that had been in negative ground for most of the year. Further strength in the dollar could spell continued trouble for the nation's factory sector. Interest rates were volatile during 2016, hitting lows at mid-year before spiking after the election. With the dust clear, Treasury yields ended only moderately higher as the 2-year gained 16 basis points to 1.21 percent and the 10-year up 18 basis points to 2.45 percent. The Dow ended the year unable to mount a sustained assault on 20,000 but still up 13.4 percent on the year to 19,762. Oil had the best year, up 44 percent for West Texas Intermediate to a nearly $54 level that apparently looks secure given OPEC's recent agreement to cut production. And gold had a solid year, up 8.7 percent to $1,152.50. A less striking gain but one perhaps most important for the U.S. economy is a 3.5 percent increase for the dollar index, an index that had been in negative ground for most of the year. Further strength in the dollar could spell continued trouble for the nation's factory sector. Interest rates were volatile during 2016, hitting lows at mid-year before spiking after the election. With the dust clear, Treasury yields ended only moderately higher as the 2-year gained 16 basis points to 1.21 percent and the 10-year up 18 basis points to 2.45 percent.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2015 |

23-Dec-16 |

30-Dec-16 |

Change |

Change |

| DJIA |

17,425.03 |

19,933.81 |

19,762.60 |

13.4% |

-0.9% |

| S&P 500 |

2,043.94 |

2,263.79 |

2,238.83 |

9.5% |

-1.1% |

| Nasdaq Composite |

5,007.41 |

5,462.69 |

5,383.12 |

7.5% |

-1.5% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$37.40 |

$53.09 |

$53.71 |

43.6% |

1.2% |

| Gold (COMEX) ($/ounce) |

$1,060.00 |

$1,133.10 |

$1,152.50 |

8.7% |

1.7% |

|

|

|

|

|

|

| Fed Funds Target |

0.25 to 0.50% |

0.50 to 0.75% |

0.50 to 0.75% |

25 bp |

25 bp |

| 2-Year Treasury Yield |

1.05% |

1.20% |

1.21% |

16 bp |

1 bp |

| 10-Year Treasury Yield |

2.27% |

2.54% |

2.45% |

18 bp |

–9 bp |

| Dollar Index |

98.84 |

103.01 |

102.26 |

3.5% |

-0.7% |

For GDP, the drop in November's goods exports will be offset by the rise in November's inventories, putting the GDP calculation roughly in the 2 percent range in the quarter. This would be a respectable result but down from the consumer-driven 3.5 percent rate of the third quarter. The consumer has been talking the talk, but talk is cheap. How strong spending proved to be in December is an open question, one that still has to be settled before the fourth quarter can be put in the books. A bigger question, of course, is how 2017 will play out and whether and when new policies will begin to show traction.

What is expected to prove a solid employment report on Friday will cap off a week of key readings on December's strength. The ISM manufacturing index opens the New Year on Tuesday and is expected to move to a 1-year high at 53.8. Vehicle sales follow on Wednesday but here monthly weakness is expected, but not so with Thursday's ISM non-manufacturing where solid strength at 56.8 is the call. Friday caps the week with trade data, where a sharp widening is expected, and December employment where continuing and impressive strength is the consensus, at 175,000 for nonfarm payrolls and a 4.7 percent unemployment rate.

ISM Manufacturing Index for December

Consensus Forecast: 53.8

Consensus Range: 53.0 to 54.7

The ISM manufacturing index has been moving to 1-year highs, to 53.2 November with forecasters seeing December coming in at 53.8. New orders, at 53.0 in November, have been running in line with the composite index and pointing to factory strength ahead for the first quarter. Production has also been positive as has employment which had lagged noticeably through most of the year.

Construction Spending for November

Consensus Forecast, Month-to-Month Change: +0.6%

Consensus Range: +0.1% to +0.8%

What had looked to be a flat year for construction spending turned higher in October with a 0.5 percent gain and a year-on-year rate of plus 3.4 percent. October's results included sharp upward revisions for the prior two months in this often very volatile report. Residential spending showed October strength for both single-family and multi-family homes with nonresidential spending mostly slowing. Forecasters see November's headline coming in with a second straight strong gain, at 0.6 percent.

Total Vehicle Sales for December

Consensus Forecast, Annualized Rate: 17.7 million

Consensus Range: 17.5 to 18.0 million

North American-made Vehicle Sales

Consensus Forecast, Annualized Rate: 13.8 million

Consensus Range: 13.6 to 14.0 million

Unit vehicle sales correctly foreshadowed what was a swing downward for the motor vehicle component of the November retail sales report. November unit sales fell 2.9 percent to a 17.9 million annualized rate with forecasters not seeing any snapback for December, instead a 1.1 percent decline to a 17.7 million rate. Vehicle sales, reflecting strength in the labor market, were solid throughout 2016 but still down from 2015's exceptionally strong rates.

ADP, Private Payrolls for December

Consensus Forecast: 172,000

Consensus Range: 160,000 to 185,000

ADP's employment estimate had a good year, accurately forecasting directional shifts in private payrolls more times than not. But ADP called for unusual strength in November which, at 156,000 in the government's data, proved solid but not spectacular. Forecasters see ADP's call for December coming in at 172,000 in a result that would provide a solid base for the government's report.

FOMC Minutes

Covering the December 13 & 14 Meeting

The December FOMC was the first meeting after the November presidential election and the second this cycle to produce a rate hike, a 25 basis point increase for the federal funds target to a range of 0.50 to 0.75 percent. The FOMC took a wait-and-see approach to new policies under the Trump administration and, given full employment and improvement in inflation trends, was planning for three further 25 point hikes in 2017. Discussion in the minutes of possible changes in fiscal policy will be of special interest.

Initial Jobless Claims for December 31 week

Consensus Forecast: 260,000

Consensus Range: 255,000 to 262,000

Though still near record lows, initial claims trended higher in December as did continuing claims. Recent readings, consistent with holiday periods, have been volatile though forecasters see only modest change for initial claims in the December 31 week, down 5,000 to 260,000. Volatility aside, claims data remain at or near historic lows and consistent with a strong labor market.

ISM Non-Manufacturing Index for December

Consensus Forecast: 56.8

Consensus Range: 56.0 to 57.6

The ISM non-manufacturing index, at 57.2 in November, has been pointing to steady and strong conditions for the bulk of the U.S. economy. New orders in November came in at 57.0 with employment showing unusual strength at 58.2. The Econoday consensus for the November composite is 56.8.

Nonfarm Payrolls for December

Consensus Forecast: 175,000

Consensus Range: 151,000 to 210,000

Private Payrolls

Consensus Forecast: 165,000

Consensus Range: 136,000 to 200,000

Unemployment Rate

Consensus Forecast: 4.7%

Consensus Range: 4.6% to 4.8%

Average Hourly Earnings

Consensus Forecast: +0.3%

Consensus Range: +0.2% to +0.4%

Average Workweek

Consensus Forecast: 34.4 hours

Consensus Range: 34.4 to 34.5 hours

A very sharp 3 tenths decline in the unemployment rate to 4.6 percent highlighted a November employment report that proved very solid. Forecasters see December's unemployment rate giving back some of the improvement with the consensus at 4.7 percent. Nonfarm payrolls, at a consensus 175,000, are expected to come in roughly at November's 178,000 headline. Unusual strength in average hourly earnings was the highlight of the October employment report but they posted a small decline in November. Forecasters see earnings back in the plus column in December at a strong 0.3 percent gain.

International Trade Balance for November

Consensus Forecast: -$44.5 billion

Consensus Range: -$46.0 to -$42.0 billion

November's international trade report looks to be unusually negative given the sharp $3.4 billion rise in the goods deficit to an advance reading of $65.3 billion. When adding what is expected to be another steady surplus for cross-border service trade, forecasters see November's deficit coming in at $44.5 billion vs October's deficit of $42.6 billion. Fourth-quarter GDP estimates could turn on the results of this report.

Factory Orders for November

Consensus Forecast, Month-to-Month Change: -2.5%

Consensus Range: -3.6% to -1.9%

Factory orders for October are expected to fall 2.5 percent in line with a sharp decline in the month's advance durable goods orders that is expected to be offset by nondurable goods. Much of the weakness in the durables report was tied to monthly swings for commercial aircraft orders which masked strength in defense aircraft and more importantly for core capital goods orders (nondefense ex-aircraft).

|