|

Higher federal spending, lower taxes, and deregulation are the promises of the incoming administration which, through this major program of stimulus, hopes to add 25 million jobs over the next four years. But the plan will be hitting a labor market that, by the definition of the Federal Reserve at least, is already at full employment. And when rising demand for labor meets a limited supply of labor, one possible outcome is wage inflation.

Everyone wants higher wages, right? Everyone that is except inflation hawks who, though they probably wouldn't give back a raise if they got one themselves, aren't so happy if everyone is getting one. The worry, of course, is that higher wages could give an outsized lift to overall inflation which in turn could trigger an aggressive policy response, that is outsized hikes in official interest rates. Average hourly earnings in the December employment report rose 0.4 percent for the second significant monthly gain of the last three months (blue columns of graph). The year-on-year rate, now at a cycle high of 2.9 percent (red line), is fast approaching 3 percent, the threshold above which many believe earnings growth would begin to increase price pressures across the economy. Everyone wants higher wages, right? Everyone that is except inflation hawks who, though they probably wouldn't give back a raise if they got one themselves, aren't so happy if everyone is getting one. The worry, of course, is that higher wages could give an outsized lift to overall inflation which in turn could trigger an aggressive policy response, that is outsized hikes in official interest rates. Average hourly earnings in the December employment report rose 0.4 percent for the second significant monthly gain of the last three months (blue columns of graph). The year-on-year rate, now at a cycle high of 2.9 percent (red line), is fast approaching 3 percent, the threshold above which many believe earnings growth would begin to increase price pressures across the economy.

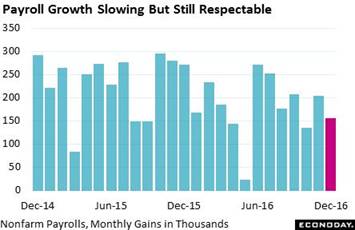

But one factor that would limit future wage growth is slowing in overall employment growth. Nonfarm payrolls rose a lower-than-expected 156,000 in December, growth that is the second slowest of the last seven months. And payroll growth through the second half of the year did in fact slow, to a fourth-quarter average of 165,000 per month vs the third-quarter average of 212,000. Details of the December report show a sizable 16,000 decline in temporary help services, a category that the Labor Department highlights as a leading indicator of future payroll growth. But one factor that would limit future wage growth is slowing in overall employment growth. Nonfarm payrolls rose a lower-than-expected 156,000 in December, growth that is the second slowest of the last seven months. And payroll growth through the second half of the year did in fact slow, to a fourth-quarter average of 165,000 per month vs the third-quarter average of 212,000. Details of the December report show a sizable 16,000 decline in temporary help services, a category that the Labor Department highlights as a leading indicator of future payroll growth.

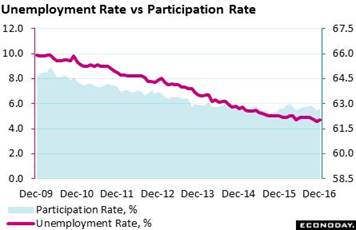

Another factor that could limit wage inflation is the return of the still substantial body of discouraged workers out there who are no longer pounding the pavement. The labor participation rate, currently at 62.7 percent, has been sinking most of this cycle though, as seen in the blue area of the graph, has been leveling the last year. Part of the reason that the unemployment rate is as low as it is, at 4.7 percent in the latest data, is because there are fewer in the workforce (which is defined as both those employed and those actively looking for employment). Draw back in those who have dropped out and the unemployment rate would rise, which in turn would ease the jitters of the inflation hawks. And for those keeping score, actual employment (those currently on payrolls or are actively self-employed) now stands at 152.1 million, up 14.1 million from the cycle low in December 2009. Another factor that could limit wage inflation is the return of the still substantial body of discouraged workers out there who are no longer pounding the pavement. The labor participation rate, currently at 62.7 percent, has been sinking most of this cycle though, as seen in the blue area of the graph, has been leveling the last year. Part of the reason that the unemployment rate is as low as it is, at 4.7 percent in the latest data, is because there are fewer in the workforce (which is defined as both those employed and those actively looking for employment). Draw back in those who have dropped out and the unemployment rate would rise, which in turn would ease the jitters of the inflation hawks. And for those keeping score, actual employment (those currently on payrolls or are actively self-employed) now stands at 152.1 million, up 14.1 million from the cycle low in December 2009.

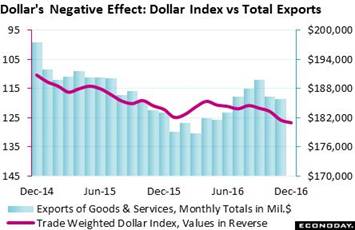

Though confidence is way up and the stock market and the dollar have been rallying sharply since the election, actual economic data, like that of the employment report, haven't been nearly as strong. Hard data on the factory sector have been no better than mixed while trade data have been negative. The rise in the dollar, up 4 percent on the dollar index since the election, is a significant negative for the nation's exports. Exports of goods and services fell 0.2 percent in November to a monthly $185.8 billion for the lowest level in five months. If the dollar keeps rising, foreign buyers will increasingly find lower cost substitutes among our competitors. Though confidence is way up and the stock market and the dollar have been rallying sharply since the election, actual economic data, like that of the employment report, haven't been nearly as strong. Hard data on the factory sector have been no better than mixed while trade data have been negative. The rise in the dollar, up 4 percent on the dollar index since the election, is a significant negative for the nation's exports. Exports of goods and services fell 0.2 percent in November to a monthly $185.8 billion for the lowest level in five months. If the dollar keeps rising, foreign buyers will increasingly find lower cost substitutes among our competitors.

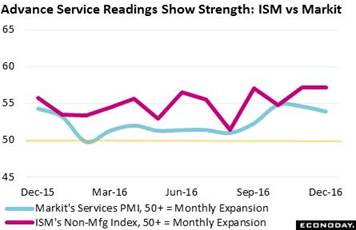

One area of the economy where strength in the dollar will have a lesser effect is the nation's service economy. The ISM non-manufacturing index, which tracks this sector along with construction and mining, has held at 57.2 the last two months for the best readings of the year. New orders, at 61.6, are at a 16-month high and are pointing squarely at rising activity going into the first quarter. The PMI services index has also been solid but showing less strength, at 53.9 in December though new orders are also a highlight, running at nearly a 12-month peak. One area of the economy where strength in the dollar will have a lesser effect is the nation's service economy. The ISM non-manufacturing index, which tracks this sector along with construction and mining, has held at 57.2 the last two months for the best readings of the year. New orders, at 61.6, are at a 16-month high and are pointing squarely at rising activity going into the first quarter. The PMI services index has also been solid but showing less strength, at 53.9 in December though new orders are also a highlight, running at nearly a 12-month peak.

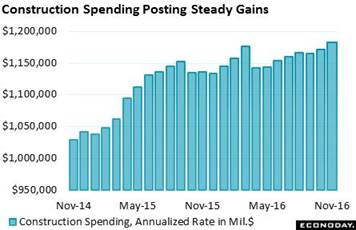

The construction sector is not part of the service economy but has also been showing strength, at least some. Spending inched higher through most of last year with the latest available data, for the month of November, posting a very solid 0.9 percent increase. Residential spending is the leading indicator of the report and it has been on the climb, boosted by gains in multi-family units and more recently by acceleration in the key single-family category. But non-residential spending has also been contributing to the strength, especially Federal construction spending with a 3.1 percent November gain. This is a category to keep our eye on as new stimulus is put in place. The construction sector is not part of the service economy but has also been showing strength, at least some. Spending inched higher through most of last year with the latest available data, for the month of November, posting a very solid 0.9 percent increase. Residential spending is the leading indicator of the report and it has been on the climb, boosted by gains in multi-family units and more recently by acceleration in the key single-family category. But non-residential spending has also been contributing to the strength, especially Federal construction spending with a 3.1 percent November gain. This is a category to keep our eye on as new stimulus is put in place.

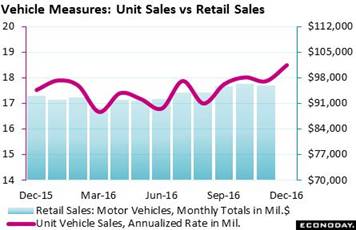

What could be considered nearly sensational news in the week came from unit vehicle sales which rose very impressively in December, up a monthly 3.4 percent to an annualized rate of 18.5 million for a new cycle high. December's gain is centered in light trucks which typically cost more than cars. This is a positive indication for the coming retail sales report where spending in dollars, not the change in units, is what counts. Aside from dollar change, another factor clouding indications from unit sales is the fact that unit sales include sales to businesses, data that are not included in retail sales. What could be considered nearly sensational news in the week came from unit vehicle sales which rose very impressively in December, up a monthly 3.4 percent to an annualized rate of 18.5 million for a new cycle high. December's gain is centered in light trucks which typically cost more than cars. This is a positive indication for the coming retail sales report where spending in dollars, not the change in units, is what counts. Aside from dollar change, another factor clouding indications from unit sales is the fact that unit sales include sales to businesses, data that are not included in retail sales.

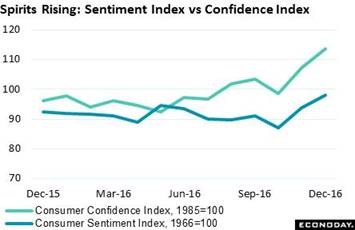

Even greater than the post-election rise in the stock market and the dollar has been the giant spike in consumer confidence. But greater confidence hasn't meant much yet for actual consumer spending which inched up an exhausted 0.2 percent in November. And November's retail sales component (which is roughly 1/3 of consumer spending) could manage only a 0.1 percent gain. But December's gain in unit vehicle sales does look to be a sizable plus for the coming retail sales report though the outlook for ex-auto ex-gas, the reading that will offer a focused indication on the strength of holiday sales, is probably as economist say "less sanguine". Econoday forecasters are calling for overall December retail sales to rise 0.7 percent with ex-auto ex-gas up a less remarkable 0.3 percent. Even greater than the post-election rise in the stock market and the dollar has been the giant spike in consumer confidence. But greater confidence hasn't meant much yet for actual consumer spending which inched up an exhausted 0.2 percent in November. And November's retail sales component (which is roughly 1/3 of consumer spending) could manage only a 0.1 percent gain. But December's gain in unit vehicle sales does look to be a sizable plus for the coming retail sales report though the outlook for ex-auto ex-gas, the reading that will offer a focused indication on the strength of holiday sales, is probably as economist say "less sanguine". Econoday forecasters are calling for overall December retail sales to rise 0.7 percent with ex-auto ex-gas up a less remarkable 0.3 percent.

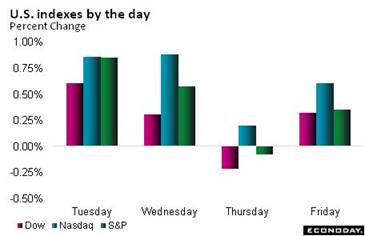

It wasn't until Friday that the Dow made its immediate approach to 20,000, reaching an intra-day high of 19,999.63 but ending at 19,963.80 for a 0.3 percent gain on the day and a very solid 1.0 percent gain on the week. Turning back to last year, much of the post-election rise in stocks, totaling 7.8 percent for the Dow, was perhaps tied to expectations for a 2017 cut in capital gains taxes, a possibility that may have discouraged profit taking in 2016. With this possibility no longer a factor, the latest week's gain is that more impressive and does speak to the effects of rising confidence. Gold also had a good week, up 1.7 percent to $1,172 in a gain perhaps consistent with expectations for rising inflation. Oil and interest rates held steady. It wasn't until Friday that the Dow made its immediate approach to 20,000, reaching an intra-day high of 19,999.63 but ending at 19,963.80 for a 0.3 percent gain on the day and a very solid 1.0 percent gain on the week. Turning back to last year, much of the post-election rise in stocks, totaling 7.8 percent for the Dow, was perhaps tied to expectations for a 2017 cut in capital gains taxes, a possibility that may have discouraged profit taking in 2016. With this possibility no longer a factor, the latest week's gain is that more impressive and does speak to the effects of rising confidence. Gold also had a good week, up 1.7 percent to $1,172 in a gain perhaps consistent with expectations for rising inflation. Oil and interest rates held steady.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2016 |

30-Dec-16 |

6-Jan-17 |

Change |

Change |

| DJIA |

19,762.60 |

19,762.60 |

19,963.80 |

1.0% |

1.0% |

| S&P 500 |

2,238.83 |

2,238.83 |

2,276.98 |

1.7% |

1.7% |

| Nasdaq Composite |

5,383.12 |

5,383.12 |

5,521.06 |

2.6% |

2.6% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$53.71 |

$53.71 |

$53.69 |

0.0% |

0.0% |

| Gold (COMEX) ($/ounce) |

$1,152.50 |

$1,152.50 |

$1,172.50 |

1.7% |

1.7% |

|

|

|

|

|

|

| Fed Funds Target |

0.50 to 0.75% |

0.50 to 0.75% |

0.50 to 0.75% |

0 bp |

25 bp |

| 2-Year Treasury Yield |

1.21% |

1.21% |

1.21% |

0 bp |

0 bp |

| 10-Year Treasury Yield |

2.45% |

2.45% |

2.42% |

–3 bp |

–3 bp |

| Dollar Index |

102.26 |

102.26 |

102.19 |

-0.1% |

-0.1% |

Fourth-quarter GDP estimates are running at roughly 2 percent which would be a sizable downgrade from the third-quarter's 3.5 percent rate. Net exports do not look like they will be favorable in the quarter which puts the burden once again on the consumer, and however upbeat the consumer is, it's spending that counts. Did some of the latest wage gains make their way into retail stores during the holidays? We'll find out on Friday.

Retail sales are the focus in a week, however, that begins slowly. Tuesday's small business optimism report and JOLTS report will offer new details on the condition of the labor market while inflation expectations among businesses will get an update by the Atlanta Fed on Wednesday. Data on actual inflation will be posted on Thursday with import & export prices and on Friday with producer prices, with much of this data likely to show oil-related pressure following OPEC's agreement to cut output. Friday's retail sales report is expected to get a significant lift from auto sales though the core reading on holiday shopping is expected to show only a moderate gain. Consumer sentiment will follow later Friday morning as will business inventories where a sizable and perhaps unwanted build is expected.

Consumer Credit for November

Consensus Forecast: +$18.5 billion

Consensus Range: +$12.0 to +$20.0 billion

Consumer credit is expected to rise $18.5 billion in November vs October's increase of $16.0 billion. Revolving credit, which is where credit-card debt is tracked, has been on the climb and is at a cycle high, at 6 percent annualized growth. Non-revolving credit remains the report's main source of growth, underpinned by student loans and also reflecting solid demand for vehicle financing.

Small Business Optimism Index for December

Consensus Forecast: 99.6

Consensus Range: 98.9 to 100.0

The small business optimism index jumped sharply in December, boosted by rising expectations for economic growth and higher sales to go with it. Job openings are very strong in this report as are plans to increase employment. And in one of the few indications of strength for future business investment, plans to increase capital outlays have been holding at high levels. At a consensus 99.6 for December, forecasters see the index adding to November's 1.9 point post-election surge to 98.4.

Wholesale Inventories for November

Consensus Forecast, Month-to-Month Change: +0.9%

Consensus Range: +0.3% to +0.9%

Wholesale inventories are to rise a very sharp 0.9 percent in November, in line with the 0.9 percent gain posted in the advance report. The advance indication for retail inventories also rose sharply and together with wholesale inventories are hinting at an unwanted fourth-quarter build, one that would give a boost to GDP but would pose risks for future production and employment.

Initial Jobless Claims for January 7 week

Consensus Forecast: 255,000

Consensus Range: 245,000 to 256,000

Initial claims had been trending higher in December before an outsized 28,000 decline in the December 31 week to 235,000. Forecasters see claims giving back most of the improvement with the consensus at 255,000 in what would be a 20,000 increase. Holiday volatility aside, claims data remain at or near historic lows and consistent with a strong labor market.

Import Prices for December

Consensus Forecast, Month-to-Month Change: +0.7%

Consensus Range: -0.1% to +1.4%

Export Prices

Consensus Forecast, Month-to-Month Change: +0.2%

Consensus Range: -0.2% to +1.9%

Following OPEC's agreement to cut output, petroleum prices rose in December and are expected to lift import prices which forecasters see rising a sharp 0.7 percent. But strength in the dollar, which makes foreign products cheaper, will work as an offset to oil. Forecasters see a 0.2 percent gain for export prices. Year-on-year trends for both import and export prices have been moving toward zero, ending two years of sharp contraction that was initially triggered by the 2014 collapse in oil prices.

PPI-FD for December

Consensus Forecast, Month-to-Month Change: +0.3%

Consensus Range: +0.2% to +0.5%

PPI-FD Less Food & Energy

Consensus Forecast, Month-to-Month Change: +0.1%

Consensus Range: +0.1% to +0.3%

PPI-FD Less Food, Energy, & Trade Services

Consensus Forecast, Month-to-Month Change: +0.2%

Consensus Range: +0.1% to +0.3%

Oil prices rose in December following OPEC's agreement to cut output and are expected to be reflected in a gain for producer prices. Forecasters are calling for a 0.3 percent rise for the overall headline but see less pressure when excluding food and energy, at a consensus gain of only 0.1 percent. But a bit better strength is expected in the less food, energy & trade services reading where plus 0.2 percent is the call.

Retail Sales for December

Consensus Forecast: +0.7%

Consensus Range: +0.4% to +0.9%

Retail Sales Ex-Autos

Consensus Forecast: +0.5%

Consensus Range: +0.4% to +0.8%

Retail Sales Ex-Autos Ex-Gas

Consensus Forecast: +0.3%

Consensus Range: +0.3% to +0.4%

Retail Sales Ex-Autos Ex-Gas Ex-Building Materials

Consensus Forecast: +0.5%

Consensus Range: +0.2% to +0.6%

Autos are not usually the focus of the December retail sales report where instead holiday spending is the key. But unit auto sales, as reported by manufacturers, were unusually strong in the month and are expected to give a significant lift to the motor vehicle component of December's retail sales report. Forecasters see retail sales rising 0.7 percent in the month. Sales at gasoline stations, which are not of course central to holiday demand, are likely to get a lift from December's rise in gasoline prices and underpin the ex-auto reading where a sizable 0.5 percent gain is the consensus. When excluding both autos and gasoline, which is the reading that is at the heart of holiday sales, forecasters see only a 0.3 percent rise in what would point to mild disappointment for the nation's merchants.

Business Inventories for November

Consensus Forecast, Month-to-Month Change: +0.6%

Consensus Range: +0.1% to +0.7%

Demand may be on the rise but inventories, based on advance data, appear to have risen sharply in November, raising the risk of an excessive build. Forecasters see business inventories rising 0.6 percent following October's 0.2 percent draw. High inventories are a plus for the GDP calculation but pose a risk to future production and employment.

Consumer Sentiment Index, Preliminary January

Consensus Forecast: 98.6

Consensus Range: 95.5 to 100.0

Consumer sentiment has been surging since the November election, up more than 10 points to 98.2 in December for a new cycle high. The expectations component has been showing the greatest strength but current conditions have also been very strong and offering a positive indication for consumer spending. A negative, however, has been a sharp and puzzling downturn underway in inflation expectations. Forecasters see a further rise for the preliminary January reading, up 4 tenths to 98.6.

|