|

Changes in consumer and business confidence don't always result in similar changes for consumer spending or business investment. The post-election surge in confidence has yet to spark, despite its enormity, much traction for actual economic data, at least for now. Yet, as we shall see, there is one very definitive indicator that is showing very significant traction and that may end up forcing the Fed's hand.

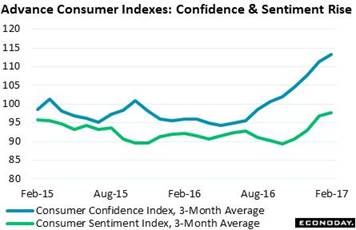

A highlight of the week is the extending strength of the consumer confidence index (blue line), underpinned by strong assessments of the jobs market and jumping again in the February report to 114.8 for the best reading of the economic cycle. The consumer sentiment index (green line) is on a less spectacular path but is also at cycle highs. This burst in confidence, last appearing in such force during the Reagan years, reflects expectations for robust stimulus ahead — specifically lower tax rates, deep deregulation and a burst of short-term government spending. The graph uses 3-month averages to smooth out monthly bumps which helps highlight the acceleration that began last year and is extending very strongly into this year. A highlight of the week is the extending strength of the consumer confidence index (blue line), underpinned by strong assessments of the jobs market and jumping again in the February report to 114.8 for the best reading of the economic cycle. The consumer sentiment index (green line) is on a less spectacular path but is also at cycle highs. This burst in confidence, last appearing in such force during the Reagan years, reflects expectations for robust stimulus ahead — specifically lower tax rates, deep deregulation and a burst of short-term government spending. The graph uses 3-month averages to smooth out monthly bumps which helps highlight the acceleration that began last year and is extending very strongly into this year.

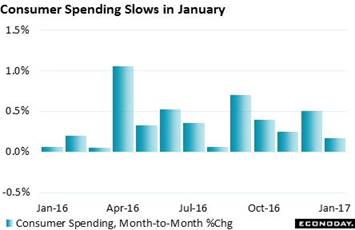

Yet the graphs for actual consumer spending are not going straight up at all. Consumer spending could muster only a 0.2 percent gain in January for the weakest result in 5 months. And when adjusted for inflation (which is on the rise as we'll see later), consumer spending fell 0.3 percent for the largest drop since September 2009. What nominal strength there was in January was helped by gasoline prices. However, they have since been edging lower and won't be helping February's sales punch any. What really held down January was unusual weakness in service spending (where's all the confidence?) together with a reversal for car and light truck sales. Yet the graphs for actual consumer spending are not going straight up at all. Consumer spending could muster only a 0.2 percent gain in January for the weakest result in 5 months. And when adjusted for inflation (which is on the rise as we'll see later), consumer spending fell 0.3 percent for the largest drop since September 2009. What nominal strength there was in January was helped by gasoline prices. However, they have since been edging lower and won't be helping February's sales punch any. What really held down January was unusual weakness in service spending (where's all the confidence?) together with a reversal for car and light truck sales.

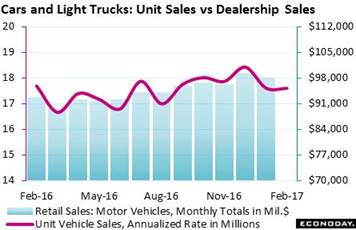

And gasoline won't be the only thing not helping consumer data in February. Unit vehicle sales were unchanged during the month at a 17.6 million annualized rate and they point to little change for dollar totals at dealerships. Putting gas and autos aside, let's look at core sales in the month. Several retailers are warning that a slow tax refund season, which is about 10 percent behind this time last year, hurt their February sales. Something else to note is that a difficult comparison is in the cards as core ex-gas ex-auto sales jolted higher in January which, by itself alone, makes the February retail sales report an uphill climb. And gasoline won't be the only thing not helping consumer data in February. Unit vehicle sales were unchanged during the month at a 17.6 million annualized rate and they point to little change for dollar totals at dealerships. Putting gas and autos aside, let's look at core sales in the month. Several retailers are warning that a slow tax refund season, which is about 10 percent behind this time last year, hurt their February sales. Something else to note is that a difficult comparison is in the cards as core ex-gas ex-auto sales jolted higher in January which, by itself alone, makes the February retail sales report an uphill climb.

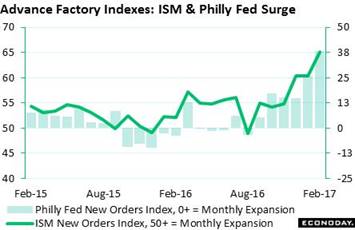

Turning to the factory sector, a disconnect is also appearing between advance reports which are on fire and actual data that can't quite get going. The ISM, which tracks anecdotal assessments from a national sample of purchasers, made big headlines in the week with a 4.7 point jump in its new orders index to 65.1. This level of order growth was last exceeded in August 2009 and follows two prior 60 readings as tracked by the green line of the graph. This is rare strength. Among regional reports, the most closely watched one, the Philly Fed, has been making similar headlines with its new orders index surging 12 points to a 38 level that was last witnessed way back in 1987. Turning to the factory sector, a disconnect is also appearing between advance reports which are on fire and actual data that can't quite get going. The ISM, which tracks anecdotal assessments from a national sample of purchasers, made big headlines in the week with a 4.7 point jump in its new orders index to 65.1. This level of order growth was last exceeded in August 2009 and follows two prior 60 readings as tracked by the green line of the graph. This is rare strength. Among regional reports, the most closely watched one, the Philly Fed, has been making similar headlines with its new orders index surging 12 points to a 38 level that was last witnessed way back in 1987.

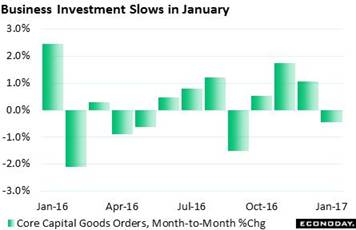

But here, unlike the consumer confidence question, there is at least some traction in the government data. Most measures of factory orders have been moving higher the last few months — but they are definitely not setting any records. Strength is uneven in the accompanying graph which tracks core business investment (nondefense capital goods ex-aircraft). Why hasn't the enormous strength in anecdotal orders yet to translate to anything close to similar gains for actual orders? Different methodologies are at play but let's put that aside and consider whether sentiment may be leaking in. Respondents in advance reports don't march in tight formation, their input is voluntary and their monthly participation is sometimes hit and miss. Participation in any one month may amount to no more than two-thirds of the panel, totals that can come out to only a couple of hundred responses. And there's no guarantee that the respondents who do fill out the forms are checking their assessments against the company's actual order books or, instead, are just giving their own gut score of month-to-month change. But here, unlike the consumer confidence question, there is at least some traction in the government data. Most measures of factory orders have been moving higher the last few months — but they are definitely not setting any records. Strength is uneven in the accompanying graph which tracks core business investment (nondefense capital goods ex-aircraft). Why hasn't the enormous strength in anecdotal orders yet to translate to anything close to similar gains for actual orders? Different methodologies are at play but let's put that aside and consider whether sentiment may be leaking in. Respondents in advance reports don't march in tight formation, their input is voluntary and their monthly participation is sometimes hit and miss. Participation in any one month may amount to no more than two-thirds of the panel, totals that can come out to only a couple of hundred responses. And there's no guarantee that the respondents who do fill out the forms are checking their assessments against the company's actual order books or, instead, are just giving their own gut score of month-to-month change.

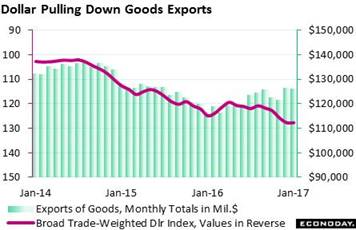

The decline for January capital goods orders makes for a disappointing start to first-quarter GDP as does another indicator during the week. Data on goods trade show a major widening in the deficit, to $69.2 billion during January. Foreign buyers showed little interest in U.S. goods in the month as exports of capital goods fell sharply and pulled total exports down 0.3 percent to $126 billion as tracked on the graph. Imported goods, in contrast, jumped 2.3 percent to $195 billion and once again were fed by America's appetite for foreign consumer goods and foreign vehicles. Ongoing strength in the dollar, as tracked in reverse by the red line, will hold back exports by making U.S. products more expensive to foreign buyers and it will lift imports by making foreign products less expensive to U.S. buyers. The decline for January capital goods orders makes for a disappointing start to first-quarter GDP as does another indicator during the week. Data on goods trade show a major widening in the deficit, to $69.2 billion during January. Foreign buyers showed little interest in U.S. goods in the month as exports of capital goods fell sharply and pulled total exports down 0.3 percent to $126 billion as tracked on the graph. Imported goods, in contrast, jumped 2.3 percent to $195 billion and once again were fed by America's appetite for foreign consumer goods and foreign vehicles. Ongoing strength in the dollar, as tracked in reverse by the red line, will hold back exports by making U.S. products more expensive to foreign buyers and it will lift imports by making foreign products less expensive to U.S. buyers.

Exports are just one concern for the factory sector right now. A key hole is backlog which is contracting, down a monthly 0.4 percent for unfilled orders in the January durable goods report. This is the 7th decline of the last 8 months in what is the weakest run since the recession. Backlogs are a key factor in the employment equation and low ones are no reason to bring new people in. The accompanying graph tracks year-on-year change in unfilled orders against the flat line of year-on-year change for factory payrolls. Exports are just one concern for the factory sector right now. A key hole is backlog which is contracting, down a monthly 0.4 percent for unfilled orders in the January durable goods report. This is the 7th decline of the last 8 months in what is the weakest run since the recession. Backlogs are a key factor in the employment equation and low ones are no reason to bring new people in. The accompanying graph tracks year-on-year change in unfilled orders against the flat line of year-on-year change for factory payrolls.

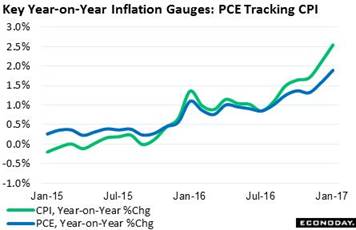

But the biggest news of the week comes from the Fed's own personal inflation gauge, the PCE price index which is suddenly very near their 2.0 percent target, jumping a sharp 3 tenths in January to 1.9 percent. The gain is tracked in the blue line of the graph whose acceleration was signaled nicely in advance by another important inflation gauge, the consumer price index. Though the PCE is not quite at target, its clear upward trajectory should make a pending breach of 2 percent no big surprise. This together with full employment (which Janet Yellen herself agrees is here) means that the Fed can say, with pride of accomplishment, that it has successfully met its policy goals. But the biggest news of the week comes from the Fed's own personal inflation gauge, the PCE price index which is suddenly very near their 2.0 percent target, jumping a sharp 3 tenths in January to 1.9 percent. The gain is tracked in the blue line of the graph whose acceleration was signaled nicely in advance by another important inflation gauge, the consumer price index. Though the PCE is not quite at target, its clear upward trajectory should make a pending breach of 2 percent no big surprise. This together with full employment (which Janet Yellen herself agrees is here) means that the Fed can say, with pride of accomplishment, that it has successfully met its policy goals.

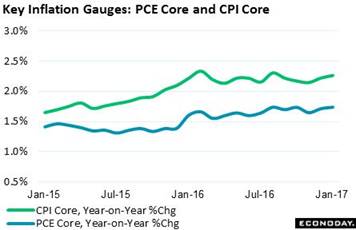

But with a new administration assembling a program of massive stimulus, do higher rates really fit in? Higher rates could further slow our slow-growth economy and specifically put upward pressure on the dollar and, with that, downward pressure on exports. And, yes, exports are front and center in the nation's economic debate. For FOMC members who may understandably want to punt, the PCE core is the indicator made to order. Excluding food, the core also excludes energy which is the source of the current lift. But there may be a little fudging when it comes to citing the core since, unlike the PCE price index, the FOMC doesn't post long-run forecasts for this measure though the 2 percent line, like that for overall prices, is the tacit target. But the doves may not even be able to use the core for cover if, in data that will precede the mid-month FOMC, average hourly earnings resume their march higher. But with a new administration assembling a program of massive stimulus, do higher rates really fit in? Higher rates could further slow our slow-growth economy and specifically put upward pressure on the dollar and, with that, downward pressure on exports. And, yes, exports are front and center in the nation's economic debate. For FOMC members who may understandably want to punt, the PCE core is the indicator made to order. Excluding food, the core also excludes energy which is the source of the current lift. But there may be a little fudging when it comes to citing the core since, unlike the PCE price index, the FOMC doesn't post long-run forecasts for this measure though the 2 percent line, like that for overall prices, is the tacit target. But the doves may not even be able to use the core for cover if, in data that will precede the mid-month FOMC, average hourly earnings resume their march higher.

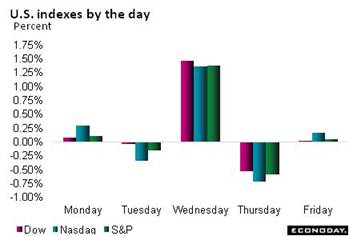

Short rates spiked this week as Fed officials talked up a rate hike for the March FOMC, talk capped off on Friday by Janet Yellen herself who acknowledged that full employment is "essentially here" and said the pace of tightening will be picking up. The 2-year yield jumped 18 basis points in the week to 1.31 percent for what is suddenly and easily a cycle high. There was less selling in longer maturities though the 10-year yield did rise 16 basis points to 2.48 percent. The dollar edged higher in the week which cut into the year-to-date dip for the dollar index. If rates continue to move higher and if the dollar joins along, currency jawboning from the administration which wants a lower dollar wouldn't be a surprise. Though hard economic data aren't offering any fireworks yet, stock markets are looking like the consumer confidence index in explosive strength. The Dow extended its record run in the week, ending at 21,005 for a 0.9 percent weekly gain and a 6.3 percent gain so far this year. Short rates spiked this week as Fed officials talked up a rate hike for the March FOMC, talk capped off on Friday by Janet Yellen herself who acknowledged that full employment is "essentially here" and said the pace of tightening will be picking up. The 2-year yield jumped 18 basis points in the week to 1.31 percent for what is suddenly and easily a cycle high. There was less selling in longer maturities though the 10-year yield did rise 16 basis points to 2.48 percent. The dollar edged higher in the week which cut into the year-to-date dip for the dollar index. If rates continue to move higher and if the dollar joins along, currency jawboning from the administration which wants a lower dollar wouldn't be a surprise. Though hard economic data aren't offering any fireworks yet, stock markets are looking like the consumer confidence index in explosive strength. The Dow extended its record run in the week, ending at 21,005 for a 0.9 percent weekly gain and a 6.3 percent gain so far this year.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2016 |

24-Feb-17 |

3-Mar-17 |

Change |

Change |

| DJIA |

19,762.60 |

20,821.76 |

21,005.71 |

6.3% |

0.9% |

| S&P 500 |

2,238.83 |

2,367.34 |

2,383.12 |

6.4% |

0.7% |

| Nasdaq Composite |

5,383.12 |

5,845.31 |

5,870.75 |

9.1% |

0.4% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$53.71 |

$54.04 |

$53.18 |

-1.0% |

-1.6% |

| Gold (COMEX) ($/ounce) |

$1,152.50 |

$1,258.30 |

$1,234.30 |

7.1% |

-1.9% |

|

|

|

|

|

|

| Fed Funds Target |

0.50 to 0.75% |

0.50 to 0.75% |

0.50 to 0.75% |

0 bp |

0 bp |

| 2-Year Treasury Yield |

1.21% |

1.13% |

1.31% |

10 bp |

18 bp |

| 10-Year Treasury Yield |

2.45% |

2.32% |

2.48% |

3 bp |

16 bp |

| Dollar Index |

102.26 |

101.13 |

101.38 |

-0.9% |

0.2% |

In their long history that parallels the history of government data, anecdotal reports are delivering an unforgettable show of sudden strength. Though the magnitude of the signal may be exaggerated, its direction is unmistakable. But there are never any guarantees and if the economy just lays flat, anecdotal reports will have proven themselves, in the end, no more useful than election polls.

A week ending with the February employment report starts Monday with factory orders and, based on advance durables data, weakness outside of aircraft may be the theme. Weakness also looks to be the theme for Tuesday's trade report where advance data showed goods exports on the decline and goods imports on the rise. ADP, coming off its big success in predicting outsized strength in the January employment report, will get special attention on Wednesday, likely overshadowing the second revision to productivity which is expected to once again show weakness. Import & export prices on Thursday will start off the run of February inflation reports that will extend into the following week and Friday will see the employment report with the Econoday consensus, at 195,000 for nonfarm payrolls, calling for solid strength.

Factory Orders for January

Consensus Forecast, Month-to-Month Change: 1.1%

Consensus Range: 0.9% to 3.9%

Factory orders are expected to rise 1.1 percent at the headline level but will be getting an outsized lift from aircraft which posted monthly upswings in the advance durables report. Weakness in core capital goods orders was a major disappointment of the durables report.

International Trade Balance for January

Consensus Forecast: -$48.5 billion

Consensus Range: -$49.4 to -$45.0 billion

At a deficit of $69.2 billion, January was a very weak month for advance goods data. Exports were pulled down by an unpromising drop in capital goods while a surge in imports was once again led by consumer goods and vehicles. Forecasters see the international trade balance for February, which includes service exports, coming in at minus $48.5 billion in what would be one of the widest deficits in 5 years and an opening round negative for first-quarter GDP.

Consumer Credit for January

Consensus Forecast: $18.3 billion

Consensus Range: -$15.0 to $20.5 billion

Consumer credit is expected to rise $18.3 billion in January following December's moderate $14.5 billion gain. Growth in consumer credit has been running in the mid-to-high single digits the last 5 years led by strong demand for nonrevolving credit. But in a special sign of consumer activity, revolving credit has been showing sporadic strength in recent months.

ADP, Private Payrolls for February

Consensus Forecast: 183,000

Consensus Range: 152,000 to 215,000

ADP's employment estimate very accurately predicted January's strength, and it was outlier strength, for private payrolls which rose 237,000. At a consensus 183,000, forecasters see significant give back for February's payrolls in what however would still be sizable growth.

Nonfarm Productivity, 2nd Estimate, Fourth Quarter

Consensus Forecast, Annualized Rate: 1.4%

Consensus Range: 0.8% to 1.7%

Unit Labor Costs

Consensus Forecast, Annualized Rate: 1.6%

Consensus Range: 1.4% to 1.9%

It took more hours to produce goods and services at a slower rate during the fourth quarter, based on the first estimate for nonfarm productivity and costs and there is little change expected for the second estimate. And weak productivity, where the consensus for the second estimate is an annualized rate of only 1.4 percent, points to pressure for unit labor costs which are expected to come in at a 1.6 percent rate.

Initial Jobless Claims for March 4 week

Consensus Forecast: 238,000

Consensus Range: 234,000 to 240,000

Initial jobless claims have remained very favorable, at new 40-year lows and running more than 5,000 below January's levels which points to strength for the February employment report. Continuing claims have also been coming down, running about 20,000 below a month ago. Forecasters are calling for an increase from the prior week's cycle low of 223,000 in initial claims, at a consensus 238,000 for the March 4 week.

Import Prices for February

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.0% to 0.3%

Export Prices

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.0% to 0.3%

Import prices have been on the rise as energy prices continue to recovery. Outside of petroleum, however, there has been little pressure. Export prices, getting no lift from agricultural prices, have also been flat. The Econoday consensus calls for a modest 0.2 percent increase for both import and export prices in February.

Nonfarm Payrolls for February

Consensus Forecast: 195,000

Consensus Range: 162,000 to 220,000

Private Payrolls

Consensus Forecast: 190,000

Consensus Range: 168,000 to 215,000

Unemployment Rate

Consensus Forecast: 4.7%

Consensus Range: 4.6% to 4.8%

Average Hourly Earnings

Consensus Forecast, Month-to-Month Change: 0.3%

Consensus Range: 0.1% to 0.4%

Average Workweek

Consensus Forecast: 34.4 hours

Consensus Range: 34.4 to 34.5 hours

The Econoday consensus for February nonfarm payrolls is a solid 195,000 in what would mark only limited give back from January's surprisingly strong 227,000 gain. In further strength, forecasters see a 1 tenth dip in February's unemployment rate to 4.7 percent and a sizable 0.3 percent increase in average hourly earnings that could raise talk of wage inflation. The average workweek is expected to hold steady at 34.4 hours. If the report meets consensus, chances for a rate hike at the mid-month FOMC would increase further.

Treasury Budget for February

Consensus Forecast: -$181.5 billion

Consensus Range: -$200.0 to -$151.0 billion

Three months into the fiscal year, the government's deficit in January was tracking 3.3 percent higher than the prior year. Though a $181.5 billion deficit is forecast for February, it would still be more than $11 billion lower than last February's deficit and would mark an improvement. Receipts have been the weak link so far in fiscal 2017, held down by a decline in corporate tax receipts.

|