|

The economy is creating a substantial number of jobs and inflation is on the rise, setting up what appears certain to be a rate hike at this week's FOMC. But a risk to the outlook is foreign demand for our goods and services which may be showing some new cracks even as talk of trade re-negotiations build under the new administration.

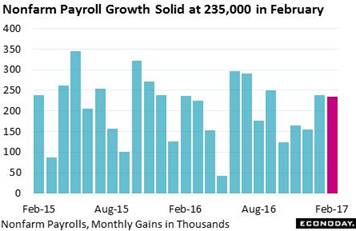

February employment came in at the very outside of expectations, rising 235,000 for nonfarm payrolls vs Econoday expectations for 200,000 which, after Wednesday's ADP report, were rising going into the results. There was also an 11,000 upward revision to January which now stands at 238,000. Sectors showing special strength include construction where payrolls, reflecting rising traction in home building and also office and commercial building, jumped 0.8 percent for one of the very best showings of the economic cycle. Manufacturing was also a standout, rising 0.2 percent which doesn't sound like much but it is for this sector and was last matched in February last year. February employment came in at the very outside of expectations, rising 235,000 for nonfarm payrolls vs Econoday expectations for 200,000 which, after Wednesday's ADP report, were rising going into the results. There was also an 11,000 upward revision to January which now stands at 238,000. Sectors showing special strength include construction where payrolls, reflecting rising traction in home building and also office and commercial building, jumped 0.8 percent for one of the very best showings of the economic cycle. Manufacturing was also a standout, rising 0.2 percent which doesn't sound like much but it is for this sector and was last matched in February last year.

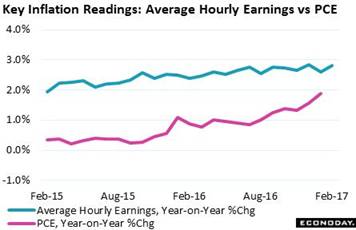

High levels of employment point to the risk that employers will have to bid up wage offers to increase their payrolls. Wages haven't caught fire yet but they are inching higher, increasing a sizable 0.3 percent in the month of February which lifts the year-on-year rate to 2.8 percent. The Federal Reserve's specific inflation target is the PCE price index which, at 1.9 percent, is knocking at the 2-percent door, the level the Fed has been working to achieve all cycle long. And the Fed's other goal, full employment, was arguably met all the way back in May last year when the unemployment rate first moved below 5 percent. February's unemployment rate came in at 4.7 percent. High levels of employment point to the risk that employers will have to bid up wage offers to increase their payrolls. Wages haven't caught fire yet but they are inching higher, increasing a sizable 0.3 percent in the month of February which lifts the year-on-year rate to 2.8 percent. The Federal Reserve's specific inflation target is the PCE price index which, at 1.9 percent, is knocking at the 2-percent door, the level the Fed has been working to achieve all cycle long. And the Fed's other goal, full employment, was arguably met all the way back in May last year when the unemployment rate first moved below 5 percent. February's unemployment rate came in at 4.7 percent.

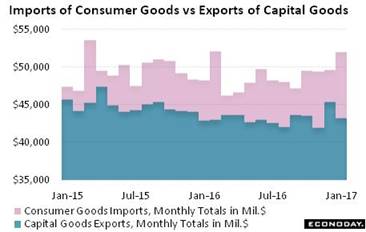

Despite the strength in employment, first-quarter GDP is getting off to a bad start. The nation's trade gap widened sharply in January reflecting weakening in the nation's greatest strength, which is exports of capital goods, and strengthening in our greatest vice, foreign consumer goods. Capital goods exports, which include machinery, electronics, fabrications, and aircraft and which help foreign economies improve their output, have been edging lower, moving to $43 billion per month from $45 billion over the past two years. In contrast consumer imports, which are goods that do not help to improve output, have kept up pace, at $52 billion in January vs a 2-year average of $51 billion. The difference between these two categories comes out to $5 billion in cross-border outflow per month. Adding in all the categories, including imported oil and the nation's demand for foreign vehicles, January's trade gap came in at $48.5 billion, the deepest monthly red ink in nearly 5 years. Despite the strength in employment, first-quarter GDP is getting off to a bad start. The nation's trade gap widened sharply in January reflecting weakening in the nation's greatest strength, which is exports of capital goods, and strengthening in our greatest vice, foreign consumer goods. Capital goods exports, which include machinery, electronics, fabrications, and aircraft and which help foreign economies improve their output, have been edging lower, moving to $43 billion per month from $45 billion over the past two years. In contrast consumer imports, which are goods that do not help to improve output, have kept up pace, at $52 billion in January vs a 2-year average of $51 billion. The difference between these two categories comes out to $5 billion in cross-border outflow per month. Adding in all the categories, including imported oil and the nation's demand for foreign vehicles, January's trade gap came in at $48.5 billion, the deepest monthly red ink in nearly 5 years.

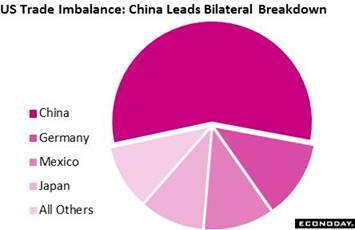

And much of these consumer goods to say the least come from China where the net trade imbalance, for both goods and services, has been running at more than $25 billion per month, coming in at $310 billion last year. This dwarfs other single countries like Germany and Mexico where net monthly imbalances have held in the $5 billion range, coming in at $68 billion for Germany for all of 2016 and at $61 billion for Mexico. The deficit with Japan is next deepest at $56 billion, which by the way is the exact total for all other countries combined. But no one has been forcing U.S. consumers to spend, spend, spend, buying Chinese goods that apparently attract American buyers with their price, and German goods where quality and also allure are at play. And much of these consumer goods to say the least come from China where the net trade imbalance, for both goods and services, has been running at more than $25 billion per month, coming in at $310 billion last year. This dwarfs other single countries like Germany and Mexico where net monthly imbalances have held in the $5 billion range, coming in at $68 billion for Germany for all of 2016 and at $61 billion for Mexico. The deficit with Japan is next deepest at $56 billion, which by the way is the exact total for all other countries combined. But no one has been forcing U.S. consumers to spend, spend, spend, buying Chinese goods that apparently attract American buyers with their price, and German goods where quality and also allure are at play.

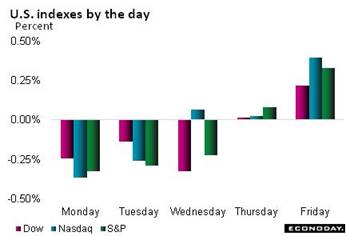

The week's feature is the same as the prior week, that is sharp selling in short-term Treasuries as expectations center on a 25 basis point rate hike at the coming FOMC. The 2-year Treasury yield jumped 5 points in the latest week following the 18 point surge of the prior week with the level now at 1.36 percent, the highest by far of the cycle and last matched in October 2008. It was hawkish Fedspeak that drove the rate higher in the prior week followed in the latest week by ADP's stellar call on Wednesday for what correctly proved to be a very strong employment report on Friday. Higher rates haven't yet tripped big gains for the dollar though this risk is worth watching. The dollar index edged only slightly higher in the week and, at 101.21, is still down 1.0 percent on the year. Higher rates often lower demand for gold which, of course, doesn't pay a yield. Gold fell 2.5 percent in the week and is testing support at $1,200 while oil, where bloated inventories are the focus, tumbled nearly 9 percent and back under $50 at $48.50. The rampage rally in stocks has been easing with the Dow edging back 0.5 percent to 20,902. The week's feature is the same as the prior week, that is sharp selling in short-term Treasuries as expectations center on a 25 basis point rate hike at the coming FOMC. The 2-year Treasury yield jumped 5 points in the latest week following the 18 point surge of the prior week with the level now at 1.36 percent, the highest by far of the cycle and last matched in October 2008. It was hawkish Fedspeak that drove the rate higher in the prior week followed in the latest week by ADP's stellar call on Wednesday for what correctly proved to be a very strong employment report on Friday. Higher rates haven't yet tripped big gains for the dollar though this risk is worth watching. The dollar index edged only slightly higher in the week and, at 101.21, is still down 1.0 percent on the year. Higher rates often lower demand for gold which, of course, doesn't pay a yield. Gold fell 2.5 percent in the week and is testing support at $1,200 while oil, where bloated inventories are the focus, tumbled nearly 9 percent and back under $50 at $48.50. The rampage rally in stocks has been easing with the Dow edging back 0.5 percent to 20,902.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2016 |

3-Mar-17 |

10-Mar-17 |

Change |

Change |

| DJIA |

19,762.60 |

21,005.71 |

20,902.98 |

5.8% |

-0.5% |

| S&P 500 |

2,238.83 |

2,383.12 |

2,372.60 |

6.0% |

-0.4% |

| Nasdaq Composite |

5,383.12 |

5,870.75 |

5,861.73 |

8.9% |

-0.2% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$53.71 |

$53.18 |

$48.50 |

-9.7% |

-8.8% |

| Gold (COMEX) ($/ounce) |

$1,152.50 |

$1,234.30 |

$1,202.70 |

4.4% |

-2.6% |

|

|

|

|

|

|

| Fed Funds Target |

0.50 to 0.75% |

0.50 to 0.75% |

0.50 to 0.75% |

0 bp |

0 bp |

| 2-Year Treasury Yield |

1.21% |

1.31% |

1.36% |

15 bp |

5 bp |

| 10-Year Treasury Yield |

2.45% |

2.48% |

2.58% |

13 bp |

10 bp |

| Dollar Index |

102.26 |

101.13 |

101.21 |

-1.0% |

0.1% |

If the Fed goes ahead, as it very likely will, and raises rates at this month's meeting, one unsurprising effect would be strengthening in the dollar and the increased risk of further of widening in the nation's trade gap as our goods and services become more expensive and foreign products even less expensive. The Trump administration has yet to articulate its position on the dollar which, during the campaign at least, the president said was too high and was making our products less competitive. A rate hike at the March 14 and 15 FOMC could spark special focus on the dollar and offer the administration, in their reaction, a chance to spell out its currency position in greater detail.

The consumer, the factory sector, and inflation get key updates but they all look to get upstaged by the March FOMC. Retail sales, unlike consumer confidence, have been uneven and forecasters don't see much improvement for February's report on Wednesday. Consumer prices, which jumped in the prior report, will also be reported Wednesday and much less pressure is expected. Factory data will get advance readings from Empire State and Philly Fed, which have been exceptionally strong, followed on Friday by the industrial production report where strength in contrast has been limited. Wednesday's FOMC is expected to produce a rate hike, one ultimately aimed at slowing inflation in a full employment economy.

Small Business Optimism Index for February

Consensus Forecast: 105.0

Consensus Range: 102.5 to 106.8

The small business optimism index has moved to cycle highs following the November election driven by economic optimism and strong employment readings. The Econoday consensus for February is 105.0, only modestly lower than January's 105.9.

PPI-FD for February

Consensus Forecast, Month-to-Month Change: 0.1%

Consensus Range: -0.1% to 0.3%

PPI-FD Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.0% to 0.3%

PPI-FD Less Food, Energy, & Trade Services

Consensus Forecast, Month-to-Month Change: 0.3%

Consensus Range: 0.2% to 0.3%

Producer prices in January correctly signaled what proved to be outsized gains for consumer prices during the month. Forecaster see the PPI-FD headline for February rising but only a slight 0.1 percent, down from January's 0.6 percent jump and reflecting the month's decline in energy costs. When excluding energy as well as food, prices are expected to rise 0.2 percent from 0.4 percent. Moderation is also expected for trade services which also jumped in January with the February consensus excluding food, energy & trade services seen rising 0.3 percent from 0.2 percent.

Consumer Price Index for January

Consensus Forecast, Month-to-Month Change: 0.1%

Consensus Range: 0.0% to 0.2%

Consumer Price Index for January

Consensus Forecast, Year-on-Year Change: 2.7%

Consensus Range: 2.6% to 2.8%

CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.0% to 0.3%

CPI Core, Less Food & Energy

Consensus Forecast, Year-on-Year Change: 2.2%

Consensus Range: 2.2% to 2.3%

Significant pressure in January consumer prices foretold significant pressure in the Federal Reserve's PCE price target. But moderation, tied in part to lower gasoline prices, is the call for the February consumer price index which is expected to slow from January's 0.6 percent to 0.1 percent in February. When excluding food & energy, only a 0.2 percent gain is expected, down from 0.3 percent in January. Year-on-year rates are mixed with the total CPI seen rising 2 tenths to 2.7 percent but the core down 1 tenth to 2.2 percent. Lower readings in this report would help ease concern that inflation pressures are suddenly building and may overshoot the Federal Reserve's plans.

Retail Sales for February

Consensus Forecast: 0.2%

Consensus Range: 0.0% to 0.9%

Retail Sales Ex-Autos

Consensus Forecast: 0.2%

Consensus Range: 0.0% to 0.6%

Retail Sales Ex-Autos Ex-Gas

Consensus Forecast: 0.3%

Consensus Range: 0.2% to 0.5%

Retail Sales Control Group (Ex-Food Services, Ex-Autos, Ex-Gas, Ex-Building Materials)

Consensus Forecast: 0.3%

Consensus Range: 0.2% to 0.5%

Retail sales are expected to move slightly lower than January's moderate 0.4 percent gain with the Econoday consensus calling for only a 0.2 percent February increase. Vehicle sales are not expected to benefit February as the ex-auto consensus increase is the same, at 0.2 percent vs January's outsized 0.8 percent performance. Ex-auto ex-gas sales, in a snap back from a very disappointing December, were the strength of the January report, jumping 0.7 percent with February however seen rising only 0.3 percent. Control group sales are expected to underscore a moderate showing, also at a consensus gain of 0.3 percent and down from January's 0.4 percent rise.

Empire State Index for March

Consensus Forecast: 15.7

Consensus Range: 14.0 to 18.5

Empire State has been signaling increasing acceleration in the manufacturing sector. Key readings are at 2-1/2 year highs including the headline index, at 18.7 in February with forecasters however expecting slowing in March to what would still be a very solid 15.7. This report will offer the first advance look at this month's factory conditions.

Business Inventories for January

Consensus Forecast, Month-to-Month Change: 0.3%

Consensus Range: 0.1% to 0.3%

Inventories have been on the rise and raising the risk of unwanted overhang. Business inventories are expected to build 0.3 percent in January vs December's 0.4 percent increase. Rising inventories in a slow growth economy pose risks to future production and future employment though they are an immediate plus in the GDP calculation.

Housing Market Index for March

Consensus Forecast: 66

Consensus Range: 65 to 66

The housing sector strengthened at year end but has been uneven so far this year. The housing market index slowed 2 points in January and another 2 points in February to 65 though forecasters see the index gaining back 1 point to 66 in March. The traffic component has been the wildcard, surging to cycle-high strength following the November election but falling back into sub-50 contraction during February.

Federal Funds Rate Target for March 14 & 15 Meeting:

Consensus Forecast, Midpoint: 0.875%

Consensus Range: 0.75% to 1.00%

Having met their employment goals and with inflation nearly at target, the FOMC is expected to raise rates at their March meeting by 25 basis points to a range of 0.75 to 1.00 percent. This would be the 3rd rate hike this cycle. The Beige Book, which was compiled for this meeting, continued to describe economic activity as no better than modest to moderate though strong post-election confidence was noted and, importantly, that available labor is growing scarcer. Prospects of rising government stimulus have yet to affect policy as FOMC members wait for related efforts to take form in Washington. This meeting will include updated quarterly forecasts and a Janet Yellen press conference.

Housing Starts for February

Consensus Forecast, Adjusted Annualized Rate: 1.266 million

Consensus Range: 1.251 to 1.310 million

Building Permits

Consensus Forecast: 1.267 million

Consensus Range: 1.235 to 1.290 million

Permits for single-family housing have been climbing at a double-digit pace and may now be overtaking multi-family units as the strongest forward indicator for a new home market where lack of supply has been holding down sales. For starts, the roles reverse with multi units leading single units. Forecasters see housing starts coming in at a 1.266 million annualized pace in February in what would be a 1.6 percent gain from January's 1.246 million rate. For building permits, the consensus is 1.267 million for what would be a 2.0 percent decline from January's revised 1.293 million.

Initial Jobless Claims for March 11 week

Consensus Forecast: 242,000

Consensus Range: 240,000 to 250,000

Both initial and continuing claims have been remarkably very low and favorable with the consensus for initial claims in the March 11 week at 242,000 vs 243,000 in the prior week.

Philadelphia Fed Manufacturing Index for March

Consensus Forecast: 32.5

Consensus Range: 26.5 to 41.2

The Philadelphia Fed report has been running at the highest levels since the 1980s with exceptional acceleration for new orders the most important plus. Yet all this strength, first signaled by this report late last year then followed by the host of other regional reports, has yet to appear in data out of Washington which have remained mostly flat. Forecasters see the general business conditions index in March easing but only slightly, to 32.5 from February's extraordinary reading of 43.3.

Industrial Production for February

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: -0.1% to 0.4%

Manufacturing Production

Consensus Forecast, Month-to-Month Change: 0.4%

Consensus Range: 0.2% to 0.5%

Capacity Utilization Rate

Consensus Forecast: 75.4%

Consensus Range: 75.1% to 75.6%

Swings in utility output often skew the monthly readings for industrial production but the vast core of the report, manufacturing production, has been stubbornly flat. One pivot factor for manufacturing is vehicle production which fell sharply in January and which opens the way for a February bounce back. Forecasters see manufacturing production rising a solid 0.4 percent in February, up from the prior month's 0.2 percent gain, with overall industrial production rising 0.2 percent vs minus 0.3 percent in January. Mining is the report's third component and has been showing sporadic life. February's overall capacity utilization rate is expected to rise to 75.4 percent vs January's 75.3 percent.

Consumer Sentiment Index, Preliminary March

Consensus Forecast: 97.0

Consensus Range: 95.0 to 98.9

Unlike other confidence measures, the consumer sentiment index has edged off its post-election peak, to 95.7 in preliminary February and 96.3 in final February and compared against 98.5 in January. But forecasters, at a consensus 97.0 for preliminary March, see the index showing renewed strength. This report has been noting extreme polarization in its sample, between Democrats whose index is near record lows and Republicans whose index is near record highs. The swing factor has been independents who are closer to Republicans in their optimism.

Index of Leading Economic Indicators for February

Consensus Forecast, Month-to-Month Change: 0.4%

Consensus Range: 0.2% to 0.6%

The index of leading economic indicators has been sending solid signals of strength for future economic growth, rising 0.6 percent and 0.5 percent in the prior two reports. The gains have reflected special strength for consumer expectations, building permits, and for advance signals on factory orders. Forecasters see February's gain for the LEI easing but only slightly, to 0.4 percent in March.

|