|

Never during the 8-year expansion has consumer spending been so weak, setting up the necessity for a major reversal if hopes for a strong economic year are going to be met. And reasons for optimism aren't farfetched. The drop in vehicle sales isn't likely to be repeated and business investment is suddenly springing to life. For economic news, it was a week of contrasts and contradictions.

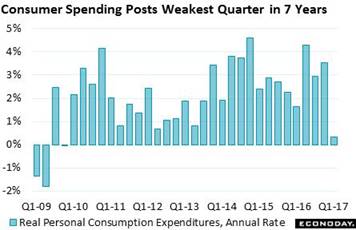

First-quarter GDP was paltry enough at 0.7 percent but consumer spending was even more paltry, at only 0.3 percent for the most embarrassing annualized pace since 2009. Unemployment is unusually low and consumer confidence unusually high making the results difficult to explain. The effect of seasonal adjustments are exaggerated during the winter and may very well be holding back the results. Yet even for a first quarter, this one was slow. First-quarter GDP was paltry enough at 0.7 percent but consumer spending was even more paltry, at only 0.3 percent for the most embarrassing annualized pace since 2009. Unemployment is unusually low and consumer confidence unusually high making the results difficult to explain. The effect of seasonal adjustments are exaggerated during the winter and may very well be holding back the results. Yet even for a first quarter, this one was slow.

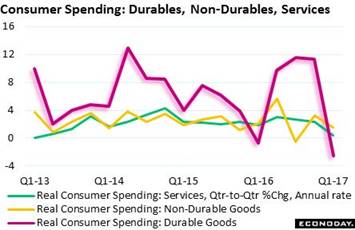

Consumer spending makes up 69 percent of GDP and making up the bulk of consumer spending is spending on services such as housing and healthcare. Non-durables, such as food and gas, is next largest followed by the most closely watched component, durables where shifts offer clues on discretionary demand. First-quarter vehicle sales were oddly weak and took durable spending down with it, falling from double digits to 2.5 percent contraction. Consumer spending makes up 69 percent of GDP and making up the bulk of consumer spending is spending on services such as housing and healthcare. Non-durables, such as food and gas, is next largest followed by the most closely watched component, durables where shifts offer clues on discretionary demand. First-quarter vehicle sales were oddly weak and took durable spending down with it, falling from double digits to 2.5 percent contraction.

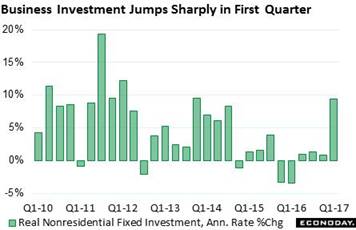

Confidence readings may be lousy indicators for consumer spending but regional factory reports may be proving to be good ones. Enormous strength in the ISM and Philly Fed haven't yet translated to similar strength for factory orders or production but they do coincide with a sudden leap in business investment, jumping to a 9.4 percent pace. Both structures and equipment showed strength with mining the standout industry. Confidence readings may be lousy indicators for consumer spending but regional factory reports may be proving to be good ones. Enormous strength in the ISM and Philly Fed haven't yet translated to similar strength for factory orders or production but they do coincide with a sudden leap in business investment, jumping to a 9.4 percent pace. Both structures and equipment showed strength with mining the standout industry.

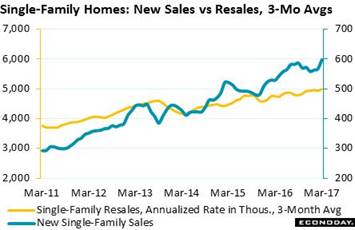

Residential investment was another strength in GDP and reflected a strong quarter for new home sales which, after stalling through much of last year, have burst to expansion highs. March sales rose 6 percent to lift the 3-month average to a recovery high of 598,000. Resales, in contrast, are rising at a shallower rate though nearing the 5 million mark and also at expansion highs. Note that home sales are volatile and make moving averages a necessity. Residential investment was another strength in GDP and reflected a strong quarter for new home sales which, after stalling through much of last year, have burst to expansion highs. March sales rose 6 percent to lift the 3-month average to a recovery high of 598,000. Resales, in contrast, are rising at a shallower rate though nearing the 5 million mark and also at expansion highs. Note that home sales are volatile and make moving averages a necessity.

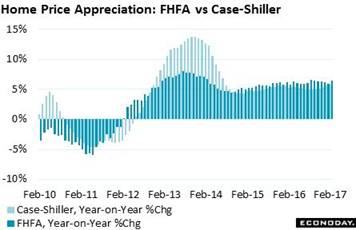

Some parts of housing are doing better than others as some parts of the economy are doing better than others. But two reports on home prices are moving together, both pointing to 6 percent appreciation. The FHFA index, which tracks Fannie Mae and Freddie Mac data, is at 6.4 percent with Case-Shiller, which tracks resales in 20 cities, at 5.9 percent. Home prices are steady and solid and based on these readings, a bubble isn't in play. Some parts of housing are doing better than others as some parts of the economy are doing better than others. But two reports on home prices are moving together, both pointing to 6 percent appreciation. The FHFA index, which tracks Fannie Mae and Freddie Mac data, is at 6.4 percent with Case-Shiller, which tracks resales in 20 cities, at 5.9 percent. Home prices are steady and solid and based on these readings, a bubble isn't in play.

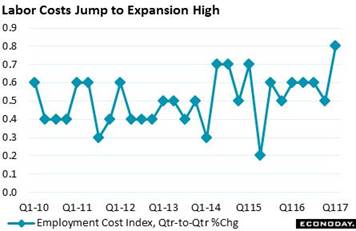

But there are price readings that are showing unusual pressure. Input costs in the regional factory reports are way up as is the employment cost index which, in another of the week's oddities, jumped 0.8 percent in the first quarter. This is the sharpest quarterly jump since the height of the prior expansion in 2007. Hourly earnings and core consumer prices have been stable, but the ECI suggests that pressure may be approaching. But there are price readings that are showing unusual pressure. Input costs in the regional factory reports are way up as is the employment cost index which, in another of the week's oddities, jumped 0.8 percent in the first quarter. This is the sharpest quarterly jump since the height of the prior expansion in 2007. Hourly earnings and core consumer prices have been stable, but the ECI suggests that pressure may be approaching.

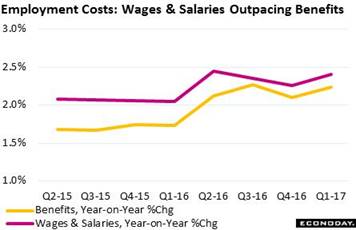

The ECI is broken into wages & salaries and benefits. And despite rising health care, increases in benefit costs for employers have been lagging wage & salary costs. Looking at annual growth, both of these costs are still under 2.5 percent which compares with a 3.5 percent peak for wages & salaries in the prior expansion and a 7 percent peak for benefits. The ECI may be running hot for this cycle, but not historically. The ECI is broken into wages & salaries and benefits. And despite rising health care, increases in benefit costs for employers have been lagging wage & salary costs. Looking at annual growth, both of these costs are still under 2.5 percent which compares with a 3.5 percent peak for wages & salaries in the prior expansion and a 7 percent peak for benefits. The ECI may be running hot for this cycle, but not historically.

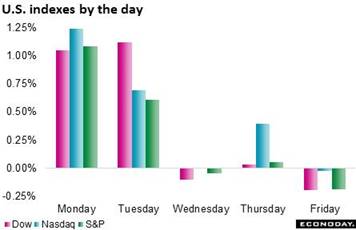

Stocks had a good week, rising early as the Trump administration unveiled its tax reform plans. Lower corporate taxes can't be bad for stocks but getting a tax package through Congress doesn't look easy. The pace of putting in place the new economy appears to be much slower than many bulls had probably expected back in November. The Dow rose 1.9 percent in the week to bring its year-to-date gain to a very bullish 6.0 percent. Stocks had a good week, rising early as the Trump administration unveiled its tax reform plans. Lower corporate taxes can't be bad for stocks but getting a tax package through Congress doesn't look easy. The pace of putting in place the new economy appears to be much slower than many bulls had probably expected back in November. The Dow rose 1.9 percent in the week to bring its year-to-date gain to a very bullish 6.0 percent.

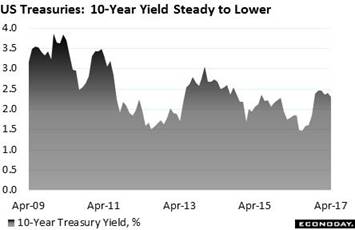

Bonds are telling a different story. The 10-year yield, which based on the stock market should probably be going higher, has been coming down. The yield did back up 9 basis points in the week to 2.29 percent but this is after two weeks of strong demand. Two or three more increases in the federal funds target are expected this year with tapering also a possibility, but the view from the bond market isn't pointing to any rate-hike urgency. Bonds are telling a different story. The 10-year yield, which based on the stock market should probably be going higher, has been coming down. The yield did back up 9 basis points in the week to 2.29 percent but this is after two weeks of strong demand. Two or three more increases in the federal funds target are expected this year with tapering also a possibility, but the view from the bond market isn't pointing to any rate-hike urgency.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2016 |

21-Apr-17 |

28-Apr-17 |

Change |

Change |

| DJIA |

19,762.60 |

20,547.76 |

20,940.51 |

6.0% |

1.9% |

| S&P 500 |

2,238.83 |

2,348.69 |

2,384.20 |

6.5% |

1.5% |

| Nasdaq Composite |

5,383.12 |

5,910.52 |

6,047.61 |

12.3% |

2.3% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$53.71 |

$50.26 |

$49.15 |

-8.5% |

-2.2% |

| Gold (COMEX) ($/ounce) |

$1,152.50 |

$1,286.50 |

$1,269.20 |

10.1% |

-1.3% |

|

|

|

|

|

|

| Fed Funds Target |

0.50 to 0.75% |

0.75 to 1.00% |

0.75 to 1.00% |

25 bp |

0 bp |

| 2-Year Treasury Yield |

1.21% |

1.18% |

1.27% |

6 bp |

9 bp |

| 10-Year Treasury Yield |

2.45% |

2.22% |

2.29% |

–16 bp |

7 bp |

| Dollar Index |

102.26 |

99.96 |

99.96 |

-2.2% |

0.0% |

The inflation flash from the ECI will make FOMC members a little less comfortable pushing back a rate hike at the coming week's meeting, but the weakness in consumer demand gives them strong cover. Of the last 10 recessions, consumer spending has been in contraction in 9 of them. The 0.3 percent showing in the first quarter will hopefully be revised to something more respectable and in any case will be quickly forgotten once the consumer comes back to life. And if housing and the factory sectors are any indications, the second quarter does look like pay back time.

There will be plenty of suspense in the week but it won't be centered on Wednesday's FOMC statement where no change, given the softness of economic growth, is the universal expectation. Instead it will be Friday's employment report that will be the week's focus with the Econoday consensus calling for significant improvement, at 185,000 for April's nonfarm payrolls vs March's disappointing 98,000. Even outside of these two events, the week is very heavy starting Monday with personal income and spending that will offer a March breakdown of the first-quarter's disappointing GDP data. ISM manufacturing, which has been sky high, could move Monday's markets though construction spending, where housing data components have been solid, may deserve the greater attention. Tuesday's vehicle sales will not only offer definitive indications on the economic strength of April but also offer the first clues on second-quarter GDP. Thursday's ISM non-manufacturing report, specifically the employment component, could affect expectations for the April employment on Friday unlike Wednesday's report from ADP whose call for March was way off the mark.

Personal Income for March

Consensus Forecast, Month-to-Month Change: 0.3%

Consensus Range: 0.2% to 0.5%

Consumer Spending

Consensus Forecast, Month-to-Month Change: 0.1%

Consensus Range: -0.2% to 0.3%

PCE Price Index

Consensus Forecast, Month-to-Month Change: -0.1%

Consensus Range: -0.3% to 0.2%

PCE Price Index

Consensus Forecast, Year-on-Year Change: 1.8%

Consensus Range: 1.8% to 2.2%

Core PCE Price Index

Consensus Forecast, Month-to-Month Change: 0.0%

Consensus Range: -0.2% to 0.3%

Core PCE Price Index

Consensus Forecast, Year-on-Year Change: 1.7%

Consensus Range: 1.6% to 2.0%

Personal income has been rising at a moderate to solid rate though consumer spending has been very weak. Forecasters see income rising 0.3 percent in March following February's 0.4 percent gain with spending at only plus 0.1 percent. Consumer prices were soft in March and the consensus for the PCE price index is at minus 0.1 percent for a yearly plus 1.8 percent. Core PCE (less food & energy) is seen unchanged with this yearly rate steady at 1.7 percent. Note that the report will offer a March breakdown of consumer data already bundled in the first-quarter GDP report.

PMI Manufacturing for April, Final

Consensus Forecast: 52.8

Consensus Range: 52.0 to 52.8

Unlike the rival ISM, Markit Economics' PMI has not been pointing to outstanding acceleration for the manufacturing sector. To the contrary, loss of momentum was the signal from the April flash which fell 6 tenths and included slowing for new orders. Forecasters see the final reading unchanged from mid-month at a consensus 52.8.

ISM Manufacturing Index for April

Consensus Forecast: 56.5

Consensus Range: 55.5 to 57.2

The ISM manufacturing index has been signaling unusually strong conditions and has beaten the Econoday consensus for the last 7 reports in a row. New orders, in the mid-60s, are at 3-year highs with export orders at a 4-year high. Backlog orders are piling up to a 6-year high with employment also at a 6-year high. Delivery times have been slowing in further confirmation of general strength. And some of this strength, as well as similar strength in other advance reports, may now be appearing in government data out of Washington including first-quarter business investment which jumped sharply. Forecasters are calling for only slight slowing in the April ISM to an otherwise strong 56.5 vs March's 57.2.

Construction Spending for March

Consensus Forecast, Month-to-Month Change: 0.5%

Consensus Range: 0.3% to 1.0%

Construction spending has been flat and held back by public building where government spending has been in nearly double-digit contraction. In contrast, residential spending has been solid and led by double-digit gains for multi-family units where accelerating construction reflects the high cost of homes and resulting demand for rentals. A negative for March construction spending, however, was the month's weather-related decline for both single-family and multi-family starts. Still, Econoday's April consensus is calling for a solid 0.5 percent gain.

Total Vehicle Sales for April

Consensus Forecast, Annualized Rate: 17.2 million

Consensus Range: 17.1 to 17.4 million

North American-made Vehicle Sales

Consensus Forecast, Annualized Rate: 13.5 million

Consensus Range: 13.5 to 13.8 million

Vehicle sales have been offering reliable indications for changes in the motor vehicle component of the monthly retail sales report. After spiking late last year, vehicles sales have been moving sharply lower and pulling down consumer spending. Total unit vehicle sales proved very weak in March, hitting a 2-year low at a 16.6 million annualized rate. This makes for an easy comparison and forecasters see sales rising to a 17.2 million rate in April with North American-made models at 13.5 million vs March's 13.3 million. Note that April's result will offer the first hard indication on the second-quarter economy.

ADP, Private Payrolls for March

Consensus Forecast: 170,000

Consensus Range: 125,000 to 230,000

ADP's spectacularly accurate calls for standout strength in January and February payrolls was followed by a spectacularly inaccurate call for March. ADP's estimate for March private payrolls, at 263,000, was nearly three times over actual growth of 98,000. This report is back in the dog house and is unlikely to have much affect on expectations for the April employment report.

PMI Services for April, Final

Consensus Forecast: 52.3

Consensus Range: 52.0 to 52.5

PMI services have been one of the very few advance reports signaling, not great strength, but slowing. March indications fell sharply while the April flash fell 4 tenths to a 52.5 level that is only moderately above breakeven 50. In a negative signal for the April employment report, hiring in the sample slowed to a nearly 7-year low at mid-month. If the economy continues to slow, this report should be remembered for the accuracy of its advanced signal. The Econoday consensus for the April final is 52.3.

ISM Non-Manufacturing Index for April

Consensus Forecast: 55.8

Consensus Range: 54.1 to 56.6

ISM non-manufacturing slowed noticeably in March and offered an accurate advance indication for what turned out to be a generally weak month for the economy. And the report accurately forecast March's abrupt slowing in payroll growth as well with the report's employment index down sharply to 51.6, a level only modestly above breakeven 50 and the lowest in 7 months. But most readings in the report remained very strong in March including new orders at 58.9 and export orders at a 10-year high of 62.5. The Econoday consensus for April points to strength, at 55.8 vs March's 55.2.

Federal Funds Target for May 2 & 3 Meeting:

Consensus Forecast, Midpoint: 0.875%

Consensus Range: 0.75% to 1.00%

In their last meeting in March, the Federal Open Market Committee raised the federal funds rate by 25 basis points to a range of 0.75 to 1.00 percent with a 0.875 percent midpoint. A further two or three such rate hikes are expected for the remainder of the year but no action is the unanimous call for May's meeting. The Fed describes the economic pace as modest to moderate despite low unemployment and early signs of labor scarcity. They consider inflation, running at a steady 1.75 percent for the core, to still be below target. Prospects of rising government stimulus have yet to affect policy as FOMC members wait for developments to take shape in Washington.

International Trade Balance for March

Consensus Forecast: -$44.5 billion

Consensus Range: -$47.8 to -$41.4 billion

Forecasters see the international trade gap for goods and services widening to a consensus $44.5 billion in March from February's $43.6 billion. This would be in line with advance data on the goods deficit which rose $0.9 billion in March to $64.8 billion. Any surprises in the report could affect revision expectations for first-quarter GDP.

Initial Jobless Claims for April 29 week

Consensus Forecast: 246,000

Consensus Range: 245,000 to 250,000

Jobless claims have been very low and pointing to unusually strong demand for labor. Forecasters sees initial claims coming in at 246,000 in the April 29 week and reversing the prior week's 14,000 rise to 257,000.

Nonfarm Productivity, 1st Estimate, 1st Quarter

Consensus Forecast, Annualized Rate: 0.0%

Consensus Range: -0.4% to 0.5%

Unit Labor Costs

Consensus Forecast, Annualized Rate: 2.7%

Consensus Range: 2.5% to 3.6%

Weak first-quarter GDP points to weak productivity, at a consensus no change and a resulting increase for unit labor costs where the consensus is 2.7 percent. Weak productivity, reflecting lack of investment in new equipment but also lack of skill in the labor force, has been the Achilles heel of the expansion.

Factory Orders for March

Consensus Forecast, Month-to-Month Change: 0.4%

Consensus Range: -0.3% to 0.4%

Factory orders are on the rise and are expected to gain 0.4 percent at the headline level in February. Orders for civilian aircraft, as indicated in the advance durable goods report, have been improving and are expected to boost March's totals as they did in both February and January. But capital goods orders in this report have been weak.

Nonfarm Payrolls for April

Consensus Forecast: 185,000

Consensus Range: 150,000 to 225,000

Private Payrolls

Consensus Forecast: 180,000

Consensus Range: 158,000 to 210,000

Unemployment Rate

Consensus Forecast: 4.6%

Consensus Range: 4.5% to 4.6%

Average Hourly Earnings

Consensus Forecast, Month-to-Month Change: 0.3%

Consensus Range: 0.2% to 0.4%

Average Hourly Earnings

Consensus Forecast, Year-on-Year Change: 2.7%

Consensus Range: 2.7% to 2.9%

Average Workweek

Consensus Forecast: 34.4 hours

Consensus Range: 34.3 to 34.4 hours

Nonfarm payroll growth, at a consensus 185,000 in April, is expected to improve from March's disappointing gain of 98,000. But the unemployment rate, which in March came in at an expansion low of 4.5 percent, is expected to retrace 1 tenth of the improvement to a consensus 4.6 percent. The workweek in March, held down by the heavy weather of the mid-month sample week, was noticeably soft and is expected to rise to 34.4 from 34.3 hours. Average hourly earnings were also soft but aren't expected to improve, at a monthly consensus gain of 0.3 percent for a year-on-year rate of 2.7 percent. Consensus results would point to a good start for a second quarter that needs to make up lost ground as the first quarter proved weak for the economy.

Consumer Credit for March

Consensus Forecast: $15.6 billion

Consensus Range: $10.0 to $20.8 billion

Credit growth has been moderate and constructive with consumer credit posting steady monthly gains averaging in the $15 to $20 billion range. Revolving credit has been uneven though growth in nonrevolving credit, reflecting vehicle financing and also student loans, has been steady and sizable. A $15.6 billion increase is expected for consumer credit in March.

|