|

Contrasts and conflicting signals are the features right now of U.S. economic data, patterns pointing perhaps to a change underway in momentum. The abundance of jobs is the economy's key strength though weakness in wages is its key weakness. Inflation, or the lack of it, is suddenly a central topic as is the lack of consumer spending. Still, in a week filled with numbers, the balance points to strength.

The consumer may be slowing but the jobs market is not. April's nonfarm payroll gain of 211,000 is the third 200,000 plus result of the last four months. This is roughly double the pace needed to absorb new entrants into the labor force. Looking at industries, job growth in business services has been especially solid as more and more companies, having difficulty finding new staff of their own, farm out work to outside contractors. Mining jobs are rising at their best pace since 2011 with food manufacturing also strong. The consumer may be slowing but the jobs market is not. April's nonfarm payroll gain of 211,000 is the third 200,000 plus result of the last four months. This is roughly double the pace needed to absorb new entrants into the labor force. Looking at industries, job growth in business services has been especially solid as more and more companies, having difficulty finding new staff of their own, farm out work to outside contractors. Mining jobs are rising at their best pace since 2011 with food manufacturing also strong.

The total number of employed Americans, and this includes both the self-employed and those on payrolls, is 153.2 million and a new record. This total has been rising steadily since falling to a cycle low in December 2009 of 138.0 million. Doing the math here means that 15.2 million jobs have been added during this expansion. The upward slope has been steady and is showing no sign of letting up. The peak in the prior cycle was 146.7 million, hit in November 2007. The total number of employed Americans, and this includes both the self-employed and those on payrolls, is 153.2 million and a new record. This total has been rising steadily since falling to a cycle low in December 2009 of 138.0 million. Doing the math here means that 15.2 million jobs have been added during this expansion. The upward slope has been steady and is showing no sign of letting up. The peak in the prior cycle was 146.7 million, hit in November 2007.

As employment rises the other side of the labor market, that is the unemployed, shrinks — and it's shrinking fast! Those actively looking for work fell to 7.1 million while those not actively looking but wanting a job fell to 5.7 million. Together they make up the pool of available labor which is drying up, at 12.8 million and a 9-year low. These numbers make for unemployment rates of 4.4 percent for those looking (which is a 16-year low) and 8.6 percent for everyone together (a 10-year low). As employment rises the other side of the labor market, that is the unemployed, shrinks — and it's shrinking fast! Those actively looking for work fell to 7.1 million while those not actively looking but wanting a job fell to 5.7 million. Together they make up the pool of available labor which is drying up, at 12.8 million and a 9-year low. These numbers make for unemployment rates of 4.4 percent for those looking (which is a 16-year low) and 8.6 percent for everyone together (a 10-year low).

The theory at play is that strong hiring in a shrinking labor pool is bound to trigger wage inflation, that employers will have to bid up wages in order to hire the last available workers. But this theory isn't showing any traction, at least yet. Average hourly earnings did rise 0.27 percent in April but the monthly trend over the last year is still closer to 0.20 percent. And without wage heat, total inflation is sagging as headlined in the week by core PCE prices which, at minus 0.14 percent, posted the lowest monthly result in 16 years. The theory at play is that strong hiring in a shrinking labor pool is bound to trigger wage inflation, that employers will have to bid up wages in order to hire the last available workers. But this theory isn't showing any traction, at least yet. Average hourly earnings did rise 0.27 percent in April but the monthly trend over the last year is still closer to 0.20 percent. And without wage heat, total inflation is sagging as headlined in the week by core PCE prices which, at minus 0.14 percent, posted the lowest monthly result in 16 years.

PCE prices are part of personal income & spending, a report that opened the week on a decidedly defensive note. Personal income, holding at year-on-year growth of 4.5 percent, had been climbing from 2015 lows but the ongoing lack of wage punch isn't helping. Spending will move in line with income and the lack of strength for the latter doesn't really support expectations for a big consumer spending spree in the second quarter, especially those counting on a rebound in discretionary spending and auto demand. PCE prices are part of personal income & spending, a report that opened the week on a decidedly defensive note. Personal income, holding at year-on-year growth of 4.5 percent, had been climbing from 2015 lows but the ongoing lack of wage punch isn't helping. Spending will move in line with income and the lack of strength for the latter doesn't really support expectations for a big consumer spending spree in the second quarter, especially those counting on a rebound in discretionary spending and auto demand.

April employment offers the first major look at what to expect for the second quarter but another early look isn't pointing to much strength. Unit vehicle sales did recover in April but not by much, to a 16.9 million annualized rate that missed expectations for a definitive rebound. Vehicle sales in the retail sales report, measured in dollars, fell each month of the first quarter in what proved a decisive negative for GDP. But unit sales were up and are a plus for the coming week's highlight: retail sales for April. April employment offers the first major look at what to expect for the second quarter but another early look isn't pointing to much strength. Unit vehicle sales did recover in April but not by much, to a 16.9 million annualized rate that missed expectations for a definitive rebound. Vehicle sales in the retail sales report, measured in dollars, fell each month of the first quarter in what proved a decisive negative for GDP. But unit sales were up and are a plus for the coming week's highlight: retail sales for April.

Let's move from consumer spending and turn back to details of the employment report. As already noted, mining payrolls have been coming alive perhaps in reaction to expectations for deregulation. In the same vein, factory payrolls have been on the rise perhaps in response to the President's urging to keep jobs at home. But factory employment will have to resist the downward pull from weakness in unfilled orders. Until orders pile up, manufacturers won't need new blood to keep shipments going. Let's move from consumer spending and turn back to details of the employment report. As already noted, mining payrolls have been coming alive perhaps in reaction to expectations for deregulation. In the same vein, factory payrolls have been on the rise perhaps in response to the President's urging to keep jobs at home. But factory employment will have to resist the downward pull from weakness in unfilled orders. Until orders pile up, manufacturers won't need new blood to keep shipments going.

Construction jobs have not been showing the same kind of life as mining or manufacturing jobs. Spending on construction has been slowing which in turn has pulled down related employment. Public spending is the weak link with educational structures and highways & streets in outright contraction. But the residential side is not in contraction and is supported by both new building and home improvements. And strong growth for housing permits looks to offer future support for construction labor as well. Construction jobs have not been showing the same kind of life as mining or manufacturing jobs. Spending on construction has been slowing which in turn has pulled down related employment. Public spending is the weak link with educational structures and highways & streets in outright contraction. But the residential side is not in contraction and is supported by both new building and home improvements. And strong growth for housing permits looks to offer future support for construction labor as well.

Now let's shift from payrolls and look at the economy as a whole, or at least the service sector. ISM non-manufacturing tracks not only services but construction and mining as well and its results have been unmistakable: broad and strong growth. In contrast PMI services, a rival report that tracks only services, has been one of the few advance reports to get it right, that is slow growth for the bulk of the economy. In either case, it really doesn't pay to rely too much on anecdotal reports for your view of the economy. Now let's shift from payrolls and look at the economy as a whole, or at least the service sector. ISM non-manufacturing tracks not only services but construction and mining as well and its results have been unmistakable: broad and strong growth. In contrast PMI services, a rival report that tracks only services, has been one of the few advance reports to get it right, that is slow growth for the bulk of the economy. In either case, it really doesn't pay to rely too much on anecdotal reports for your view of the economy.

However much the economy may or may not be chugging along, this has been a low productivity expansion. And what exactly are the reasons for low productivity? One is lack of investment in new equipment and also, as some may argue, a general lack of brilliant ideas nowadays. But another may be low wages. Let's face it. Low wages don't get the adrenilin going for a hard day's work. Productivity declined again in the first quarter which drives the cost of labor — in distinction to wages — sharply higher. However much the economy may or may not be chugging along, this has been a low productivity expansion. And what exactly are the reasons for low productivity? One is lack of investment in new equipment and also, as some may argue, a general lack of brilliant ideas nowadays. But another may be low wages. Let's face it. Low wages don't get the adrenilin going for a hard day's work. Productivity declined again in the first quarter which drives the cost of labor — in distinction to wages — sharply higher.

And the economy hits the wall, if you will, when it comes to the trade deficit. March imports of $235 billion once again dwarfed exports at $191 million. This monthly gap has trended steadily in the low $40 billion range for the last couple of years with both imports and exports, in a general sign of global weakness, edging lower together. The big negatives on the import side are consumer goods and vehicles while the big positive for exports is services, specifically foreign demand for U.S. technical know-how. And the economy hits the wall, if you will, when it comes to the trade deficit. March imports of $235 billion once again dwarfed exports at $191 million. This monthly gap has trended steadily in the low $40 billion range for the last couple of years with both imports and exports, in a general sign of global weakness, edging lower together. The big negatives on the import side are consumer goods and vehicles while the big positive for exports is services, specifically foreign demand for U.S. technical know-how.

High inventories should make for low prices, not steady prices. Right? But that's the impression oil's been giving, at least until the latest week when WTI did fall and sizably, down $2.85 to $46.30. U.S. inventories are very heavy, at 527.8 million barrels in the latest weekly data which comes out to a 60 percent build over the last three years. And, yes, WTI is down about 50 percent over the same three years — but it's the lack of price movement over the past year that may be hinting at a new tipping point. High inventories should make for low prices, not steady prices. Right? But that's the impression oil's been giving, at least until the latest week when WTI did fall and sizably, down $2.85 to $46.30. U.S. inventories are very heavy, at 527.8 million barrels in the latest weekly data which comes out to a 60 percent build over the last three years. And, yes, WTI is down about 50 percent over the same three years — but it's the lack of price movement over the past year that may be hinting at a new tipping point.

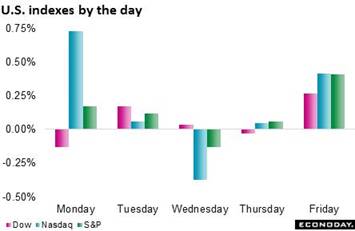

The Dow held steady in narrow trading, ending at 21,006 for a weekly increase of 0.3 percent that lifts the year-to-date gain to 6.3 percent. The dollar was soft, down 1.4 percent on the dollar index to 98.56 and reflecting the mixed tone of U.S. economic data but also strength in the euro as the outlook dims for Le Pen's National Front Party. Less risk for Europe means less safe-haven demand for Treasuries where yields climbed, up 6 basis points for the 10-year to 2.35 percent. The Dow held steady in narrow trading, ending at 21,006 for a weekly increase of 0.3 percent that lifts the year-to-date gain to 6.3 percent. The dollar was soft, down 1.4 percent on the dollar index to 98.56 and reflecting the mixed tone of U.S. economic data but also strength in the euro as the outlook dims for Le Pen's National Front Party. Less risk for Europe means less safe-haven demand for Treasuries where yields climbed, up 6 basis points for the 10-year to 2.35 percent.

| Markets at a Glance |

Year-End |

Week Ended |

Week Ended |

Year-To-Date |

Weekly |

|

2016 |

28-Apr-17 |

5-May-17 |

Change |

Change |

| DJIA |

19,762.60 |

20,940.51 |

21,006.94 |

6.3% |

0.3% |

| S&P 500 |

2,238.83 |

2,384.20 |

2,399.29 |

7.2% |

0.6% |

| Nasdaq Composite |

5,383.12 |

6,047.61 |

6,100.76 |

13.3% |

0.9% |

|

|

|

|

|

|

| Crude Oil, WTI ($/barrel) |

$53.71 |

$49.15 |

$46.30 |

-13.8% |

-5.8% |

| Gold (COMEX) ($/ounce) |

$1,152.50 |

$1,269.20 |

$1,228.20 |

6.6% |

-3.2% |

|

|

|

|

|

|

| Fed Funds Target |

0.50 to 0.75% |

0.75 to 1.00% |

0.75 to 1.00% |

25 bp |

0 bp |

| 2-Year Treasury Yield |

1.21% |

1.27% |

1.31% |

10 bp |

4 bp |

| 10-Year Treasury Yield |

2.45% |

2.29% |

2.35% |

–10 bp |

6 bp |

| Dollar Index |

102.26 |

99.96 |

98.56 |

-3.6% |

-1.4% |

The price decline in oil, if it is the beginning of a trend, would pull down the economic outlook, at least for the energy sector which is just now emerging from a 2-1/2 year price slump. It would also be a negative for inflation which, judging from wages and the core PCE, doesn't need any downward pull. The consumer has jobs but not a lot of income strength and though slack in the labor market is evaporating, the lack of consumer punch doesn't make a rate hike at the June FOMC a foregone conclusion.

March was the month for unexpectedly low inflation readings and the second week of May looks to be when April's price data, boosted by both food and gas, see a rebound. Import & export prices were the first to show negatives for March with April's edition to be posted Wednesday. Producer prices follow on Thursday with consumer prices, where both the headline and core declined in March, out on Friday. The highlight of the week will also be Friday with retail sales. Lack of consumer spending was the story of the first quarter but perhaps not for the second as April retail sales are expected to open the quarter with a solid bounce.

Small Business Optimism Index for April

Consensus Forecast: 103.8

Consensus Range: 102.0 to 104.0

The small business optimism index has been holding near expansion highs on strong job readings and a positive outlook. Sales expectations and capital improvement plans have also been positives. The Econoday consensus for April is for slight retracement, to 103.8 vs March's 104.7.

Wholesale Inventories for March

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: -0.1% to 0.3%

Wholesale trade inventories are expected to rise 0.2 percent in March despite a 0.1 percent decline in advance data. Inventories, in a positive for future production and employment, held steady through the first quarter including at the wholesale level.

Import Prices for April

Consensus Forecast, Month-to-Month Change: 0.1%

Consensus Range: -0.3% to 0.4%

Export Prices

Consensus Forecast, Month-to-Month Change: 0.1%

Consensus Range: 0.0% to 0.2%

March proved to be unusually weak month for inflation readings and the weakness was first signaled by import prices which fell 0.2 percent on a decline in oil prices but also a general decline in prices of imported consumer goods. Export prices showed slight strength in March and benefited from higher agricultural prices which also should help April. Forecasters see import prices, getting a boost this time from oil, back in the plus column at 0.1 percent in April and see export prices also up 0.1 percent.

Initial Jobless Claims for May 6 week

Consensus Forecast: 244,000

Consensus Range: 241,000 to 245,000

Jobless claims have been very low and pointing to unusually strong demand for labor. Forecasters sees initial claims coming in at 244,000 in the May 6 week vs 238,000 in the prior week.

PPI-FD for April

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: -0.2% to 0.3%

PPI-FD Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.2% to 0.2%

PPI-FD Less Food, Energy, & Trade Services

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.2% to 0.3%

The producer price report in March, like import & export prices before it and consumer and PCE prices after, was unexpectedly weak, the result at least in part of the month's decline in oil prices. But service prices at the producer level were also weak as they also proved to be at the consumer level. Lack of price pressure does point to lack of demand though April's better showing for oil is pointing to a rebound for the PPI-FD headline, at a consensus gain of 0.2 percent vs March's 0.1 percent decline. Less food & energy is also expected to rise 0.2 percent with the less food, energy & trade reading also at a 0.2 percent consensus.

Consumer Price Index for April

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: -0.1% to 0.3%

Consumer Price Index

Consensus Forecast, Year-on-Year Change: 2.3%

Consensus Range: 2.2% to 2.5%

CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.1% to 0.3%

CPI Core, Less Food & Energy

Consensus Forecast, Year-on-Year Change: 2.0%

Consensus Range: 2.0% to 2.2%

Consumer prices fell unexpectedly in March both at the headline and core levels as gasoline prices came down as did cellphone plans amid a provider price war. Forecasters are calling for an April rebound with the headline consensus at a 0.2 percent gain on the month for, however, a 2.3 percent year-on-year rate that would be down slightly from March. Less food & energy, the index is seen rising 0.2 percent with this yearly rate unchanged at 2.0 percent. A rebound in this report would help boost confidence that inflation, despite lack of wage traction, is still stable and near the Federal Reserve's 2 percent target zone.

Retail Sales for April

Consensus Forecast: 0.6%

Consensus Range: 0.4% to 1.0%

Retail Sales Ex-Autos

Consensus Forecast: 0.5%

Consensus Range: 0.3% to 0.6%

Retail Sales Ex-Autos Ex-Gas

Consensus Forecast: 0.4%

Consensus Range: 0.2% to 0.6%

Retail Sales Control Group (Ex-Food Services, Ex-Autos, Ex-Gas, Ex-Building Materials)

Consensus Forecast: 0.4%

Consensus Range: 0.3% to 0.5%

Consumer spending has emerged as a major concern for the 2017 economy, having slowed abruptly during the first quarter. But adjustment issues with the data may be at play given the winter's uneven weather and also the Easter shift into April, two factors that may have specifically held down March's totals. The Econoday consensus is calling for a significant rebound in April retail sales, at a 0.6 percent gain with the ex-auto reading very positive at 0.5 percent. Core readings are also expected to show solid gains with ex-auto ex-gas up 0.4 percent and the control group up 0.4 percent.

Business Inventories for March

Consensus Forecast, Month-to-Month Change: 0.1%

Consensus Range: 0.1% to 0.2%

Inventories were well behaved in the first quarter, rising only modestly after building sharply in the fourth quarter. Business inventories are expected to inch 0.1 percent higher in March, roughly in line with sales which are also likely to prove modest in the month. Steady inventory management helps limit the risk of unwanted overhang.

Consumer Sentiment Index, Preliminary May

Consensus Forecast: 97.3

Consensus Range: 96.5 to 98.0

The consumer sentiment index has been showing less strength than other confidence measures yet is still near its expansion highs. This report has been noting strong polarization in its sample, between Democrats whose outlook is negative and Republicans and Independents who are optimistic. Econoday's consensus for preliminary May is 97.3 vs April's 97.0.

|