|

The health of global manufacturing is of increasing concern as reports out of the sector indicate an ongoing pivot from marginal growth to perhaps the beginning of contraction, mirroring similar movement in cross-border trade data. The US Federal Reserve isn't the first central bank this year to step into the rate-cut path, but following the leads of the Bank of India and the Bank of Australia it is the biggest. The Fed has started cautiously with an incremental 1/4 point cut yet the question is how far along the rate-cut path will it go? Well, maybe a bit further if economic data, specifically manufacturing data, don't begin to improve.

Modestly billed by Jerome Powell as a "mid-cycle policy adjustment" in distinction to a long-term pivot toward more and more stimulus, the Fed cut rates for the first time in a decade citing the risk of weak global trade and its ongoing and unfolding effects on the US economy. But as far as the assessment of the US economy goes, the latest policy statement was much like the last one. The statement back in June described the jobs market as strong as did July's and economic growth once again as moderate. "Picking up" was repeated exactly when describing household spending in contrast to business spending which was once again said to be soft. What is different is a direct reference in the policy statement itself to "global developments for the economic outlook". This addition should be no surprise as back in June rising tensions and tariffs and their effects on manufacturing were the concerns that led the FOMC, as described at the time by Jerome Powell, to tilt policy bias from neutral to accommodative. And accommodative for July also included an immediate end to quantitative tightening, cutting the program two months short. The Fed will now be fully reinvesting maturing Treasuries and mortgage-backed securities on its balance sheet, not lowering reinvestment which is a plus for the bond market. Accelerating the return of core inflation (currently running at 1.6 percent) to the Fed's 2 percent target was another justification for July's hike. Powell cited persistent disinflation in the global economy and soft inflation at home as negatives. Modestly billed by Jerome Powell as a "mid-cycle policy adjustment" in distinction to a long-term pivot toward more and more stimulus, the Fed cut rates for the first time in a decade citing the risk of weak global trade and its ongoing and unfolding effects on the US economy. But as far as the assessment of the US economy goes, the latest policy statement was much like the last one. The statement back in June described the jobs market as strong as did July's and economic growth once again as moderate. "Picking up" was repeated exactly when describing household spending in contrast to business spending which was once again said to be soft. What is different is a direct reference in the policy statement itself to "global developments for the economic outlook". This addition should be no surprise as back in June rising tensions and tariffs and their effects on manufacturing were the concerns that led the FOMC, as described at the time by Jerome Powell, to tilt policy bias from neutral to accommodative. And accommodative for July also included an immediate end to quantitative tightening, cutting the program two months short. The Fed will now be fully reinvesting maturing Treasuries and mortgage-backed securities on its balance sheet, not lowering reinvestment which is a plus for the bond market. Accelerating the return of core inflation (currently running at 1.6 percent) to the Fed's 2 percent target was another justification for July's hike. Powell cited persistent disinflation in the global economy and soft inflation at home as negatives.

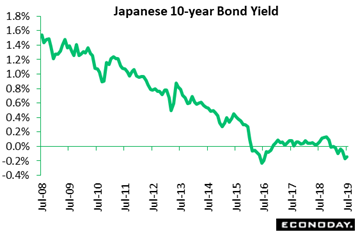

The Bank of Japan's Monetary Policy Board left policy settings unchanged at its July meeting, in line with expectations. As it has been since early 2016, the BoJ's short-term policy rate for excess reserves remains at minus 0.1 percent while the target level for the long-term 10-year yield remains at around zero percent. Officials continue to judge that the economy is "expanding moderately" and they expect this to continue. They also retained their view that inflation is likely to increase "gradually" toward their target level of 2.0 percent. Officials also reaffirmed their commitment to keeping policy accommodative until inflation is above target and stays there "in a stable manner". In line with previous comments, they consider that policy rates will need to remain at "extremely low" levels at least until early 2020. In his post-meeting press conference, Governor Haruhiko Kuroda argued that there has not been a loss of momentum toward meeting the inflation target but acknowledged that external developments represent a potential risk to this momentum. Kuroda promised that officials would ease policy "without hesitation" if inflation were to sputter once again. He also noted, as he did last month, that officials have a range of policy options available to them, including lowering short-term rates, lowering long-term rates, and expanding asset purchases. The Bank of Japan's Monetary Policy Board left policy settings unchanged at its July meeting, in line with expectations. As it has been since early 2016, the BoJ's short-term policy rate for excess reserves remains at minus 0.1 percent while the target level for the long-term 10-year yield remains at around zero percent. Officials continue to judge that the economy is "expanding moderately" and they expect this to continue. They also retained their view that inflation is likely to increase "gradually" toward their target level of 2.0 percent. Officials also reaffirmed their commitment to keeping policy accommodative until inflation is above target and stays there "in a stable manner". In line with previous comments, they consider that policy rates will need to remain at "extremely low" levels at least until early 2020. In his post-meeting press conference, Governor Haruhiko Kuroda argued that there has not been a loss of momentum toward meeting the inflation target but acknowledged that external developments represent a potential risk to this momentum. Kuroda promised that officials would ease policy "without hesitation" if inflation were to sputter once again. He also noted, as he did last month, that officials have a range of policy options available to them, including lowering short-term rates, lowering long-term rates, and expanding asset purchases.

Headlining the week's economic data were a series of advance indications on July conditions in global manufacturing. We'll start off where the news continues to be the very worst, Germany. The manufacturing PMI for the country ended July deeply under breakeven 50, at 43.2 and a 7-year low. Compared to June, the index fell an uncomfortable 1.8 points to not only suggest that the sector is mired in recession but that things may be getting worse. New orders in July contracted at the fastest pace since April (with autos experiencing a particularly pronounced slide) while exports saw their steepest drop in more than a decade. Backlogs fell more sharply than in any month since June 2009 and a reduction in headcount was the most severe in seven years. Not surprisingly at all, business optimism is sinking and is also at a 7-year low. Weakness in industrial prices is an unwanted but developing theme in the global data seen here in a steep and accelerated decline for input costs and the first outright fall in factory gate prices in almost three years. Headlining the week's economic data were a series of advance indications on July conditions in global manufacturing. We'll start off where the news continues to be the very worst, Germany. The manufacturing PMI for the country ended July deeply under breakeven 50, at 43.2 and a 7-year low. Compared to June, the index fell an uncomfortable 1.8 points to not only suggest that the sector is mired in recession but that things may be getting worse. New orders in July contracted at the fastest pace since April (with autos experiencing a particularly pronounced slide) while exports saw their steepest drop in more than a decade. Backlogs fell more sharply than in any month since June 2009 and a reduction in headcount was the most severe in seven years. Not surprisingly at all, business optimism is sinking and is also at a 7-year low. Weakness in industrial prices is an unwanted but developing theme in the global data seen here in a steep and accelerated decline for input costs and the first outright fall in factory gate prices in almost three years.

Less alarming has been Japan's PMI which at least is still near the breakeven 50 line. July's headline came in little changed at 49.4 in July to nevertheless indicate contraction in the sector for the fifth time in the last six months. Survey respondents again cited US-China trade tensions as a major factor weighing on activity and sentiment but also noted the impact of trade tensions between Japan and South Korea. The Japanese government earlier this month announced restrictions on the export to South Korea of raw materials used for technology products, citing concerns about the potential for the materials to be re-exported to other countries and used for military purposes. Additional restrictions are also being considered by the Japanese government. But there was good news in the report as respondents reported an increase in payrolls, though output fell for the seventh month in a row while new orders and new export orders declined further. Confidence in the 12-month outlook remained subdued. Input costs were reported to have risen at the slowest pace since December 2016, while respondents lowered their selling prices at the sharpest pace in nearly three years. Less alarming has been Japan's PMI which at least is still near the breakeven 50 line. July's headline came in little changed at 49.4 in July to nevertheless indicate contraction in the sector for the fifth time in the last six months. Survey respondents again cited US-China trade tensions as a major factor weighing on activity and sentiment but also noted the impact of trade tensions between Japan and South Korea. The Japanese government earlier this month announced restrictions on the export to South Korea of raw materials used for technology products, citing concerns about the potential for the materials to be re-exported to other countries and used for military purposes. Additional restrictions are also being considered by the Japanese government. But there was good news in the report as respondents reported an increase in payrolls, though output fell for the seventh month in a row while new orders and new export orders declined further. Confidence in the 12-month outlook remained subdued. Input costs were reported to have risen at the slowest pace since December 2016, while respondents lowered their selling prices at the sharpest pace in nearly three years.

Like Japan, the manufacturing PMI for China has been skirting the 50 line and in July edged 5 tenths higher to 49.9, suggesting the month's conditions in the sector were virtually stagnant, broadly in line with the trend seen over the last 12 months. Respondents continued to cite weaker external demand and ongoing US-China trade tensions as major negatives. Output and new orders improved modestly in July with the survey's measure of business confidence also picking up but from June's record low. New export orders were little changed from weak levels seen previously, while payrolls were cut at the fastest pace since February. Input costs rose at a slower pace than in June while companies in the sample, trying to boost sales, cut their selling prices for the first time since January. Like Japan, the manufacturing PMI for China has been skirting the 50 line and in July edged 5 tenths higher to 49.9, suggesting the month's conditions in the sector were virtually stagnant, broadly in line with the trend seen over the last 12 months. Respondents continued to cite weaker external demand and ongoing US-China trade tensions as major negatives. Output and new orders improved modestly in July with the survey's measure of business confidence also picking up but from June's record low. New export orders were little changed from weak levels seen previously, while payrolls were cut at the fastest pace since February. Input costs rose at a slower pace than in June while companies in the sample, trying to boost sales, cut their selling prices for the first time since January.

Showing a greater effect than China is ISM manufacturing for the US. Though at 51.2 and still over 50 to indicate growth, the ISM index has dropped nearly 10 points over the last year. The strongest positive in July was in fact marginal at the very most as new orders rose 8 tenths to a still very soft 50.8. The run of negatives included an abrupt 3.3 point slowing in production growth to 50.8 and a 2.8 point slowing in employment now at 51.7. The report's prices paid index has been a prominent negative, also down 2.8 points to a sub-50 level of 45.1 to indicate monthly contraction in raw material prices and the steepest contraction in 3-1/2 years. This report does support the Fed's concerns over manufacturing and specifically confirms Jerome Powell's remarks at Wednesday's press conference that manufacturing contacts are reporting increasing trouble citing tariff effects and global slowing specifically in Europe and China. Showing a greater effect than China is ISM manufacturing for the US. Though at 51.2 and still over 50 to indicate growth, the ISM index has dropped nearly 10 points over the last year. The strongest positive in July was in fact marginal at the very most as new orders rose 8 tenths to a still very soft 50.8. The run of negatives included an abrupt 3.3 point slowing in production growth to 50.8 and a 2.8 point slowing in employment now at 51.7. The report's prices paid index has been a prominent negative, also down 2.8 points to a sub-50 level of 45.1 to indicate monthly contraction in raw material prices and the steepest contraction in 3-1/2 years. This report does support the Fed's concerns over manufacturing and specifically confirms Jerome Powell's remarks at Wednesday's press conference that manufacturing contacts are reporting increasing trouble citing tariff effects and global slowing specifically in Europe and China.

Trouble in manufacturing was actually masked by the solid headline in one of the week's highlights, a mostly favorable US employment report for July. At 164,000, headline payroll growth beat expectations and benefited from an unexpectedly large boost in government payrolls, a rise consistent with rising government spending. And manufacturing payrolls, as tracked in the accompanying graph, did increase a better-than-expected 16,000. Yet further growth for manufacturing isn't indicated by a key detail in the report: manufacturing hours which, at 40.4 hours in the week, were down from 40.7 hours in June with manufacturing overtime also down, at 3.2 hours from 3.4 hours. These will be inputs into the manufacturing section of the next industrial production report and point to trouble for this component, one that would no doubt focus new attention on the weakness of the sector and the effects of slowing global trade. July industrial production report for the US which will be posted Thursday, August 15. Trouble in manufacturing was actually masked by the solid headline in one of the week's highlights, a mostly favorable US employment report for July. At 164,000, headline payroll growth beat expectations and benefited from an unexpectedly large boost in government payrolls, a rise consistent with rising government spending. And manufacturing payrolls, as tracked in the accompanying graph, did increase a better-than-expected 16,000. Yet further growth for manufacturing isn't indicated by a key detail in the report: manufacturing hours which, at 40.4 hours in the week, were down from 40.7 hours in June with manufacturing overtime also down, at 3.2 hours from 3.4 hours. These will be inputs into the manufacturing section of the next industrial production report and point to trouble for this component, one that would no doubt focus new attention on the weakness of the sector and the effects of slowing global trade. July industrial production report for the US which will be posted Thursday, August 15.

The root of manufacturing trouble appears to be straightforward, that is a decline in total global trade meaning, services aside, a decline in the volume of goods being purchased and sold. Less goods being swapped means less goods that need to be produced. Another major report came out of the US on Friday and that was a very soft international trade report. The headline for June showed little change, at an adjusted deficit of $55.2 billion versus $55.3 billion in May yet both imports and exports contracted, down a monthly 1.7 percent and 2.1 percent respectively. Year-on-year, as tracked in the graph, exports are down 2.2 percent with imports up but only marginally at 1.2 percent. These rates are at or near 3-year lows. June's US goods deficit with China was $30.0 billion versus May's $30.2 billion and though country comparisons, unlike the report's other data, are not adjusted for seasonal and calendar factors, the message is still clear — that the US has a deep and persistent bilateral deficit with China. The deficit with Mexico also remains very deep, at $9.9 billion from May's $9.6 billion. But there were isolated pluses in the report including a respectable rise in civilian aircraft exports, which are in focus on Boeing 737 concerns, and slight improvement for exports of agricultural products which have been lagging other exports. The root of manufacturing trouble appears to be straightforward, that is a decline in total global trade meaning, services aside, a decline in the volume of goods being purchased and sold. Less goods being swapped means less goods that need to be produced. Another major report came out of the US on Friday and that was a very soft international trade report. The headline for June showed little change, at an adjusted deficit of $55.2 billion versus $55.3 billion in May yet both imports and exports contracted, down a monthly 1.7 percent and 2.1 percent respectively. Year-on-year, as tracked in the graph, exports are down 2.2 percent with imports up but only marginally at 1.2 percent. These rates are at or near 3-year lows. June's US goods deficit with China was $30.0 billion versus May's $30.2 billion and though country comparisons, unlike the report's other data, are not adjusted for seasonal and calendar factors, the message is still clear — that the US has a deep and persistent bilateral deficit with China. The deficit with Mexico also remains very deep, at $9.9 billion from May's $9.6 billion. But there were isolated pluses in the report including a respectable rise in civilian aircraft exports, which are in focus on Boeing 737 concerns, and slight improvement for exports of agricultural products which have been lagging other exports.

We'll end the week's data review with a look at producer prices which, reflecting manufacturing troubles, are beginning to look as weak as the various PMIs. Showing wide softness, prices of industrial products in Canada fell a sharper-than-expected 1.4 percent in June. Year-on-year as tracked in the graph, industrial prices fell 1.7 percent for the first negative reading in nearly three years. Prices for raw materials purchased by manufacturers also decreased more than expected, falling 5.9 percent on the month and 9.2 percent on the year. Lower prices for energy and petroleum products were the main negatives in the month but even when excluding these, industrial product prices fell a monthly 0.5 percent. Also contributing to the monthly decline were primary non-ferrous metals, which fell 1.2 percent in June in a broad-based downward movement affecting 23 of the 27 sub-classes including for copper, zinc and aluminum. Lower prices for animals and animal products (minus 1.8 percent) also contributed to the decline for raw materials, led by hogs (minus 5.6 percent) as prices reverse a 52.9 percent increase from February to May due to a decrease in global supply caused by African swine fever in China. We'll end the week's data review with a look at producer prices which, reflecting manufacturing troubles, are beginning to look as weak as the various PMIs. Showing wide softness, prices of industrial products in Canada fell a sharper-than-expected 1.4 percent in June. Year-on-year as tracked in the graph, industrial prices fell 1.7 percent for the first negative reading in nearly three years. Prices for raw materials purchased by manufacturers also decreased more than expected, falling 5.9 percent on the month and 9.2 percent on the year. Lower prices for energy and petroleum products were the main negatives in the month but even when excluding these, industrial product prices fell a monthly 0.5 percent. Also contributing to the monthly decline were primary non-ferrous metals, which fell 1.2 percent in June in a broad-based downward movement affecting 23 of the 27 sub-classes including for copper, zinc and aluminum. Lower prices for animals and animal products (minus 1.8 percent) also contributed to the decline for raw materials, led by hogs (minus 5.6 percent) as prices reverse a 52.9 percent increase from February to May due to a decrease in global supply caused by African swine fever in China.

Producer prices (ex-construction) in the Eurozone fell for a fourth consecutive month in June. A 0.6 percent decline was the steepest so far this year and sharper than expectations. Year-on-year, the PPI dropped from 1.6 percent to just 0.7 percent, its lowest mark since November 2016. Weakness was centered in energy where prices slumped a monthly 2.2 percent. Excluding this, the PPI would still have been no better than flat on the month and only 0.8 percent higher on the year, down from May's 1.0 percent rate. Intermediates lost ground at minus 0.3 percent on the month while capital goods and consumer durables were flat. Regionally, most member states recorded monthly falls including Germany, France, and Italy. The latest data leave intact a very subdued trend in underlying price pressures. Indeed, the core PPI has not seen a monthly rise of more than 0.1 percent in a year. Producer prices (ex-construction) in the Eurozone fell for a fourth consecutive month in June. A 0.6 percent decline was the steepest so far this year and sharper than expectations. Year-on-year, the PPI dropped from 1.6 percent to just 0.7 percent, its lowest mark since November 2016. Weakness was centered in energy where prices slumped a monthly 2.2 percent. Excluding this, the PPI would still have been no better than flat on the month and only 0.8 percent higher on the year, down from May's 1.0 percent rate. Intermediates lost ground at minus 0.3 percent on the month while capital goods and consumer durables were flat. Regionally, most member states recorded monthly falls including Germany, France, and Italy. The latest data leave intact a very subdued trend in underlying price pressures. Indeed, the core PPI has not seen a monthly rise of more than 0.1 percent in a year.

Demand for Treasuries isn't being held back by ever declining yields, on the contrary. President Trump's move on Thursday to raise tariffs on $300 billion of Chinese goods including consumer imports triggered a very sizable rush to the safety of US Treasuries. The 2-year yield fell 16 basis points on Thursday and Friday to 1.71 percent while the 10-year fell 21 points to end the week at 1.85 percent. These are jolting moves that put the 2-year yield at a 2-year low and the 10-year at a 3-year low. Yet the 14 basis-point spread between the notes has been steady and is actually no thinner than at the beginning of the year. Inversion among T-bills and in the middle of the curve has been in place all year as it is now with the 3- and 5-year both at 1.68 percent and 4 basis points below the 2-year. But until the 10-year moves below the 2-year (the two representing polar and especially liquid points on the coupon curve) full inversion and with it the calamitous certainty of recession can't be said to have been reliably signaled. The US dollar rose sharply in initial reaction to the Fed's limited rate cut before moving lower and ending the week little changed on the dollar index near 98 even. Global stocks were several percentage points lower in the week including 2.6 percent declines for both Japan's Nikkei and China's Shanghai. Losses for Germany's Dax and France's Cac were both steep, at 4.5 and 4.4 percent, while in the US the Dow lost 2.6 percent and the Nasdaq 3.9 percent. Demand for Treasuries isn't being held back by ever declining yields, on the contrary. President Trump's move on Thursday to raise tariffs on $300 billion of Chinese goods including consumer imports triggered a very sizable rush to the safety of US Treasuries. The 2-year yield fell 16 basis points on Thursday and Friday to 1.71 percent while the 10-year fell 21 points to end the week at 1.85 percent. These are jolting moves that put the 2-year yield at a 2-year low and the 10-year at a 3-year low. Yet the 14 basis-point spread between the notes has been steady and is actually no thinner than at the beginning of the year. Inversion among T-bills and in the middle of the curve has been in place all year as it is now with the 3- and 5-year both at 1.68 percent and 4 basis points below the 2-year. But until the 10-year moves below the 2-year (the two representing polar and especially liquid points on the coupon curve) full inversion and with it the calamitous certainty of recession can't be said to have been reliably signaled. The US dollar rose sharply in initial reaction to the Fed's limited rate cut before moving lower and ending the week little changed on the dollar index near 98 even. Global stocks were several percentage points lower in the week including 2.6 percent declines for both Japan's Nikkei and China's Shanghai. Losses for Germany's Dax and France's Cac were both steep, at 4.5 and 4.4 percent, while in the US the Dow lost 2.6 percent and the Nasdaq 3.9 percent.

Perspective matters when assessing the economy. Right now the focus is on manufacturing which, by traditional default, is considered a bellwether for the economy at large. But the economy at large is very large, the other 90 percent of total activity where growth rates are mixed with slowing in Asia and especially Europe but growth holding very positive in the US especially for consumer spending. If policy makers get this right and more monetary accommodation offsets constriction underway in trade, manufacturing will begin to improve without the non-manufacturing balance of the economy barely even noticing. But perfection, on the other hand, is often difficult to achieve.

**Jeremy Hawkins and Brian Jackson contributed to this article

Announcements out of Australia and New Zealand, two central banks with distinct accommodative tilts, will offer updates on global monetary policy early in the week. Consumer data out of Switzerland on confidence and retail sales, both of which have been soft, start the week on Monday. After last week's rush on the manufacturing side, service PMIs get rolling early in the week with the UK's CIPS expected to prove flat and the US's ISM solidly higher. A bounce back is the call for one of the week's highlights and that's German manufacturing orders on Tuesday where improvement could help ease concerns over global slowing. German industrial production follows on Wednesday with Chinese trade data, and an update on the Chinese front of the US-China trade war, due on Thursday. Consumer and producer data out of China will also be posted on Thursday as will second-quarter GDP for Japan. Housing starts and the labour force survey from Canada will be posted on Friday amid mixed expectations as will US producer prices where another subdued set of results are the call.

Switzerland: SECO Consumer Climate for August (Mon 01:45 EDT; Mon 05:45 GMT; Mon 07:45 CEST)

Consensus Forecast, Change: -8

After a lower-than-expected minus 6 in July that reflected weakness for household financial positions and also for savings, forecasters see the consumer climate index coming in at minus 8 for the August report.

Swiss Adjusted Real Retail Sales for June (Mon 02:30 EDT; Mon 06:30 GMT; Mon 08:30 CEST)

Consensus Forecast: -0.6%

Retail sales came in much weaker than expected in May, down a year-on-year 1.7 percent for the poorest showing since September last year. Forecasters see no reversal for June at a consensus dip of 0.6 percent.

UK CIPS/PMI Services Index for July (Mon 04:30 EDT; Mon 08:30 EDT; Mon 09:30 BST)

Consensus Forecast: 50.2

The CIPS/PMI services is expected to hold nearly dead flat and unchanged at 50.2 in July after a June report that showed extended declines for both new orders and backlog orders.

US ISM Non-Manufacturing Index for July (Mon 10:00 EDT; Mon 14:00 GMT)

Consensus Forecast: 55.5

Consensus Range: 54.5 to 56.0

Forecasters see steady strength in July at a consensus 55.5 versus June's very favorable 55.1 for ISM's non-manufacturing survey. Most growth rates, including for new orders, slowed in June but still remained very solid.

Reserve Bank of Australia Announcement for August (Tue 00:30 EDT; Tue 04:30 GMT; Tue 14:30 AET)

Consensus Forecast: No consensus

There is no consensus for the Reserve Bank of Australia's announcement. The last meeting in July produced an as-expected second straight 25-basis-point cut to 1.00 percent. The July statement again cited household consumption as the main domestic uncertainty.

German Manufacturers' Orders for May (Tue 02:00 EDT; Tue 06:00 GMT; Tue 08:00 CEST)

Consensus Forecast, Month-to-Month: 0.6%

Steep declines were the unwelcome result of May manufacturers' orders, down 2.2 percent month-to-month and down 8.7 percent year-on-year, the latter the worst showing of the expansion. May's weakness was centered in exports, far offsetting a rise in domestic orders. For June, forecasters are looking for a monthly 0.6 percent increase.

Reserve Bank of New Zealand Announcement (Tue 20:00 EDT; Wed 02:00 GMT: Wed 14:00 NZT)

Consensus Forecast: No consensus

The Reserve Bank of New Zealand left rates unchanged at their last meeting in June after cutting the overnight cash rate in May by 25 basis points to 1.50 percent. The June statement said that global economic growth had weakened and that downside risks related to global trade had intensified. There is no forecast consensus for this meeting.

German Industrial Production for June (Wed 02:00 EDT; Wed 06:00 GMT; Wed 08:00 CEST)

Consensus Forecast, Month-to-Month: -0.8%

In May, production posted a modest 0.3 percent monthly increase though year-on-year contraction, at minus 3.7 percent, continued to deepen. Forecasters are looking for a monthly 0.8 percent decrease in June.

Chinese Merchandise Trade Balance for June (Thursday: Release Time Not Set)

Consensus Forecast: No consensus

China's merchandise trade balance in June was a higher-than-expected surplus of US$50.98 billion. Yet exports were down 1.3 percent while imports fell a very sharp 7.3 percent. Exports to the European Union and especially to the US have been showing pronounced weakness.

Japanese GDP Preliminary Second Quarter (Thu 19:50 EDT; Thu 23:50 GMT; Thu 08:50 JST)

Consensus Forecast, Quarter-over-Quarter: 0.2%

Preliminary GDP in the second quarter is expected to rise a quarterly 0.2 percent versus 0.6 percent growth in the first quarter. Annualized, GDP in the first quarter rose 2.2 percent.

Chinese CPI for July (Thu 21:30 EDT; Fri 01:30 GMT; Fri 09:30 CEST)

Consensus Forecast, Year-over-Year: 2.7%

The CPI in June matched May's 15-month high at 2.7 percent, supported by increases in fruit and pork prices. For July, 2.7 percent is the consensus forecast.

Chinese PPI for July (Thu 21:30 EDT; Fri 01:30 GMT; Fri 09:30 CEST)

Consensus Forecast, Year-over-Year: -0.6%

Producer prices in June, which were unchanged on the year, were held down by weakness in oil prices. For July, forecasters see deterioration at a consensus decline of 0.6 percent.

UK Second-Quarter GDP Preliminary (Fri 04:30 EDT; Fri 08:30 GMT; Fri 09:30 BST)

Consensus Forecast: No consensus

First-quarter GDP expanded at a 0.5 percent quarterly basis and a 1.8 percent yearly basis with household spending and business spending as well as inventory building all contributing to growth.

Canadian Housing Starts for July (Fri 08:15 EDT; Fri 12:15 GMT)

Consensus Forecast: 208,000

Starts jumped very sharply in June as the housing sector continued to rebound from bad weather early in the year. Starts in July are expected to come in at a 208,000 annual rate versus June's 245,657.

US PPI-FD for July

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.1% to 0.4%

PPI-FD

Consensus Forecast, Year-over-Year Change: 1.7%

Consensus Range: 1.6% to 1.9%

PPI-FD Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.1% to 0.2%

PPI-FD Less Food & Energy

Consensus Forecast, Year-over-Year Change: 2.4%

Consensus Range: 2.2% to 2.4%

PPI-FD Less Food, Energy, & Trade Services

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.1% to 0.2%

Producer prices were mixed in June, showing only a 0.1 percent rise for the headline but a more solid 0.3 percent gain for the less food & energy core and also a lift for trade services. For July the headline consensus is a 0.2 percent increase with the core also seen at 0.2 percent and 0.2 percent for ex-food ex-energy ex-trade services as well.

Canadian Labour Force Survey for July (Fri 08:30 EDT; Fri 12:30 GMT)

Consensus Forecast: 6,000

A 2,200 fall in June employment was unexpected and down from a 27,700 rise in May. Forecasters are looking for a 6,000 increase in July with the unemployment rate seen up 1 tenth to 5.6 percent.

|