|

Global slowing tied to trade tensions is the official reason for central bank caution and the global move, made expedient by subdued inflation pressures, toward lower interest rates by reserve bank to reserve bank, by nation to nation. Currency devaulation, however, is the elephant in the room. China's transparent move to lower the value of its currency not only marks a definitive escalation in the trade war but also lifts the veil on the most concrete issue buried under monetary policy statements. For the markets and for central banks it was a busy week as it was for economic news, much of it weak but some of the leading indicators strong. And should growth improve and the global slowdown prove brief, ostensible reasons to further cut rates may lose their force, forcing perhaps central bankers to more directly cite the role of currency valuation and the need to protect exporters in their decisions. We start the week's rundown with three monetary policy decisions where you will see for yourself that foreign exchange is not a big topic.

The Reserve Bank of New Zealand cut its policy rate, the overnight cash rate (OCR), by 50 basis points to a new record low of 1.00 percent. This was more aggressive than the consensus forecast for a cut of 25 basis points. This rate was also cut by 25 basis points at the RBNZ's meeting in May. Although recent data have shown strong labour market conditions and an increase in headline inflation to 1.7 percent, well within the RBNZ's target range of 1.0 to 3.0 percent, officials noted that inflation remains below the mid-point of that range and that the outlook for both employment and inflation is now "softer" than before. They also argued that the balance of risks to meeting inflation and employment objectives is "tilted to the downside" with weakness in the global economy cited as of particular concern. Based on these factors, officials agreed that policy rates should be lowered and, although there was some consideration given to lowering rates by just 25 basis points, they concluded that a bigger move "would best ensure" their objectives are met. The Reserve Bank of New Zealand cut its policy rate, the overnight cash rate (OCR), by 50 basis points to a new record low of 1.00 percent. This was more aggressive than the consensus forecast for a cut of 25 basis points. This rate was also cut by 25 basis points at the RBNZ's meeting in May. Although recent data have shown strong labour market conditions and an increase in headline inflation to 1.7 percent, well within the RBNZ's target range of 1.0 to 3.0 percent, officials noted that inflation remains below the mid-point of that range and that the outlook for both employment and inflation is now "softer" than before. They also argued that the balance of risks to meeting inflation and employment objectives is "tilted to the downside" with weakness in the global economy cited as of particular concern. Based on these factors, officials agreed that policy rates should be lowered and, although there was some consideration given to lowering rates by just 25 basis points, they concluded that a bigger move "would best ensure" their objectives are met.

The Reserve Bank of India cut its benchmark repurchase rate by 35 basis points to 5.40 percent in a move, like New Zealand's, that was bigger than the consensus forecast for a 25-basis-point cut. The upsized move follows cuts of 25 basis points at the RBI's three most recent meetings and takes the rate to its lowest level since mid-2010. Though incoming data have shown somewhat stronger growth in industrial production, the bank lowered its near-term growth forecasts, with GDP now expected to grow by 6.9 percent in the 2019-20 fiscal year compared with a prior forecast of 7.0 percent. Headline inflation has picked up gradually from 2.99 percent in April to 3.05 percent in May and 3.18 percent in June but has remained well below the mid-point of the bank's target range of 2.0 to 6.0 percent. Given the current level of inflation and the lowered growth outlook, policy makers concluded that another rate cut was appropriate. The decision also suggests that officials remain open to lowering rates again in upcoming meetings if inflation remains below the mid-point of the target range. The Reserve Bank of India cut its benchmark repurchase rate by 35 basis points to 5.40 percent in a move, like New Zealand's, that was bigger than the consensus forecast for a 25-basis-point cut. The upsized move follows cuts of 25 basis points at the RBI's three most recent meetings and takes the rate to its lowest level since mid-2010. Though incoming data have shown somewhat stronger growth in industrial production, the bank lowered its near-term growth forecasts, with GDP now expected to grow by 6.9 percent in the 2019-20 fiscal year compared with a prior forecast of 7.0 percent. Headline inflation has picked up gradually from 2.99 percent in April to 3.05 percent in May and 3.18 percent in June but has remained well below the mid-point of the bank's target range of 2.0 to 6.0 percent. Given the current level of inflation and the lowered growth outlook, policy makers concluded that another rate cut was appropriate. The decision also suggests that officials remain open to lowering rates again in upcoming meetings if inflation remains below the mid-point of the target range.

Unlike the RBNZ and the RBI, the Reserve Bank of Australia left its main policy rate unchanged at a record low of 1.00 percent. This follows cuts, however, of 25 basis point rates at the RBA's prior two meetings. The latest statement said the outlook for the global economy remains "reasonable" but again cautioned that risks are tilted to the downside, citing uncertainty caused by global trade and technology disputes. Officials noted that domestic growth in the first half of this year was lower than expected but they continue to expect activity to strengthen "gradually", forecasting GDP to grow by 2.5 percent over 2019 and 2.75 percent over 2020. Prospects for household consumption, however, were once again cited as the main domestic uncertainty. A moderate assessment of the labour market has played a major role in the bank's decision to cut rates in recent months and the statement notes that the unemployment rate has moved higher, up slightly to 5.2 percent. Importantly, officials retained their assessment that this level of spare capacity in the labour market indicates that the economy can sustain lower rates of unemployment without triggering excessive inflation risks. In a quarterly statement released later in the week, the bank said "there appears to be more spare capacity remaining in the labour market than had been thought." Unlike the RBNZ and the RBI, the Reserve Bank of Australia left its main policy rate unchanged at a record low of 1.00 percent. This follows cuts, however, of 25 basis point rates at the RBA's prior two meetings. The latest statement said the outlook for the global economy remains "reasonable" but again cautioned that risks are tilted to the downside, citing uncertainty caused by global trade and technology disputes. Officials noted that domestic growth in the first half of this year was lower than expected but they continue to expect activity to strengthen "gradually", forecasting GDP to grow by 2.5 percent over 2019 and 2.75 percent over 2020. Prospects for household consumption, however, were once again cited as the main domestic uncertainty. A moderate assessment of the labour market has played a major role in the bank's decision to cut rates in recent months and the statement notes that the unemployment rate has moved higher, up slightly to 5.2 percent. Importantly, officials retained their assessment that this level of spare capacity in the labour market indicates that the economy can sustain lower rates of unemployment without triggering excessive inflation risks. In a quarterly statement released later in the week, the bank said "there appears to be more spare capacity remaining in the labour market than had been thought."

The week's economic run begins with a July update from the front. Data from both China and the US have been showing significant contraction underway in bilateral trade, as the latest merchandise trade report from China confirms. Exports to the US fell 6.5 percent compared to last July for the fourth year-on-year decrease in a row as tracked in the blue columns of the accompanying graph. This is also the seventh contraction in eight months. Yet showing a much steeper decline are Chinese imports of US goods, down 19.1 percent as tracked in the red line for the eleventh monthly contraction in a row. And escalating tensions, not to mention China's decision to boycott US food products, are not pointing to much chance of improvement ahead. For China's overall trade balance, the decline in imports from the US, along with strong exports to both the European Union and Southeast Asia, made for a larger-than-expected surplus of $41.9 billion in the month. Overall exports were up a solid 3.3 percent year-on-year in contrast to imports which were down 5.6 percent. The week's economic run begins with a July update from the front. Data from both China and the US have been showing significant contraction underway in bilateral trade, as the latest merchandise trade report from China confirms. Exports to the US fell 6.5 percent compared to last July for the fourth year-on-year decrease in a row as tracked in the blue columns of the accompanying graph. This is also the seventh contraction in eight months. Yet showing a much steeper decline are Chinese imports of US goods, down 19.1 percent as tracked in the red line for the eleventh monthly contraction in a row. And escalating tensions, not to mention China's decision to boycott US food products, are not pointing to much chance of improvement ahead. For China's overall trade balance, the decline in imports from the US, along with strong exports to both the European Union and Southeast Asia, made for a larger-than-expected surplus of $41.9 billion in the month. Overall exports were up a solid 3.3 percent year-on-year in contrast to imports which were down 5.6 percent.

The dive underway in Chinese imports isn't good news for the world's manufacturing sector including or especially in Germany where the PMI sample has been drowning at the 45 line. Industrial production data have been confirming the trouble, with goods production declining sharply and much more steeply than expected in June. Following a 0.1 percent monthly rise in May, German output shrank a full 1.5 percent, its second fall of more than 1 percent in the last three months. Annual contraction, as tracked in the graph, fell 6 tenths to minus 5.1 percent. The last time there was a run this deep and this long was 10 years ago during the recession when contraction hit 20 percent. The latest setback is broad-based: intermediates decreased 2.0 percent, capital goods 1.8 percent and consumer goods 1.4 percent. With energy also down 1.6 percent, construction was the only subsector to record a rise and only 0.3 percent at that. For overall manufacturing, output declined 1.8 percent. The June report leaves industrial production at its weakest level since December 2016 and puts second quarter output a sizeable 1.9 percent below its first quarter mark. Having already contracted a revised 0.3 percent during the first three months of the year, this means that goods producing industries are in technical recession and will have had a sizeable hit on second-quarter GDP. The dive underway in Chinese imports isn't good news for the world's manufacturing sector including or especially in Germany where the PMI sample has been drowning at the 45 line. Industrial production data have been confirming the trouble, with goods production declining sharply and much more steeply than expected in June. Following a 0.1 percent monthly rise in May, German output shrank a full 1.5 percent, its second fall of more than 1 percent in the last three months. Annual contraction, as tracked in the graph, fell 6 tenths to minus 5.1 percent. The last time there was a run this deep and this long was 10 years ago during the recession when contraction hit 20 percent. The latest setback is broad-based: intermediates decreased 2.0 percent, capital goods 1.8 percent and consumer goods 1.4 percent. With energy also down 1.6 percent, construction was the only subsector to record a rise and only 0.3 percent at that. For overall manufacturing, output declined 1.8 percent. The June report leaves industrial production at its weakest level since December 2016 and puts second quarter output a sizeable 1.9 percent below its first quarter mark. Having already contracted a revised 0.3 percent during the first three months of the year, this means that goods producing industries are in technical recession and will have had a sizeable hit on second-quarter GDP.

But production is only a coincident indicator and for the optimists the second quarter is already old news anyway. Manufacturing orders, a leading indicator, posted a surprisingly strong rebound in June. Following a 2.0 percent monthly fall in May, new business was up 2.5 percent for the strongest performance since August 2017. Annual growth improved sharply from minus 8.5 percent to, however, a still negative 3.7 percent and the 11th month of contraction in a row. Overseas demand, in a break from the long run of bad trade news, was behind June's improvement, up 5.0 percent on the month. By contrast, the domestic market contracted 1.0 percent, more than offsetting May's 0.9 percent bounce and its fifth fall in six months. Capital goods led the way with a 3.7 percent gain ahead of intermediates, up 1.3 percent. Overall orders are now at their highest level since the start of the year and three increases in the last four months could mean that manufacturing's longstanding downward trend is finally starting to flatten out. Even so, the data are volatile and the second quarter was still 1.0 percent below the first quarter. Crucially too, domestic demand clearly remains weak so new trouble in exports could be doubly damaging. And with business surveys like the PMI notably negative about developments in July, it would seem too early to call the turn just yet. But production is only a coincident indicator and for the optimists the second quarter is already old news anyway. Manufacturing orders, a leading indicator, posted a surprisingly strong rebound in June. Following a 2.0 percent monthly fall in May, new business was up 2.5 percent for the strongest performance since August 2017. Annual growth improved sharply from minus 8.5 percent to, however, a still negative 3.7 percent and the 11th month of contraction in a row. Overseas demand, in a break from the long run of bad trade news, was behind June's improvement, up 5.0 percent on the month. By contrast, the domestic market contracted 1.0 percent, more than offsetting May's 0.9 percent bounce and its fifth fall in six months. Capital goods led the way with a 3.7 percent gain ahead of intermediates, up 1.3 percent. Overall orders are now at their highest level since the start of the year and three increases in the last four months could mean that manufacturing's longstanding downward trend is finally starting to flatten out. Even so, the data are volatile and the second quarter was still 1.0 percent below the first quarter. Crucially too, domestic demand clearly remains weak so new trouble in exports could be doubly damaging. And with business surveys like the PMI notably negative about developments in July, it would seem too early to call the turn just yet.

One of the great puzzles of the expansion (now perhaps forgotten but not understood) is the lack of wage pressures in the global economy — inflation that has yet to appear despite very low if not historically low rates of unemployment across the major economies. Wages in the US have been improving and edging to expansion highs but pressure is still no more than moderate. And moderate at best may be the future path for wages based on the latest JOLTS report. Job openings in the report, at 7.348 million in June, have been steadily moving lower from January's peak at 7.625 million and, in year-on-year terms, dipped into contraction in the latest data, to minus 0.6 percent. This is the first negative showing for this reading in more than two years. Monthly quits in this report, which are closely tracked by Federal Reserve officials for indications of worker mobility and related wage pressure, remained flat at 3.433 million with the quits rate unchanged at 2.3 percent. One of the great puzzles of the expansion (now perhaps forgotten but not understood) is the lack of wage pressures in the global economy — inflation that has yet to appear despite very low if not historically low rates of unemployment across the major economies. Wages in the US have been improving and edging to expansion highs but pressure is still no more than moderate. And moderate at best may be the future path for wages based on the latest JOLTS report. Job openings in the report, at 7.348 million in June, have been steadily moving lower from January's peak at 7.625 million and, in year-on-year terms, dipped into contraction in the latest data, to minus 0.6 percent. This is the first negative showing for this reading in more than two years. Monthly quits in this report, which are closely tracked by Federal Reserve officials for indications of worker mobility and related wage pressure, remained flat at 3.433 million with the quits rate unchanged at 2.3 percent.

But, in an echo of the play between German production and orders, openings and quits may all be academic as the most timely indications suggest that momentum in the US labor market may actually be building. Favorable declines to even more favorable levels are the latest results from jobless claims, down a better-than-expected 8,000 for new claims to a lower-than-expected 209,000 in the August 3 week. The 4-week average of 212,250 is roughly 5,000 lower than early July which hints at strong demand for labor. Continuing claims fell 15,000 to 1.684 million in lagging data for the July 27 week with this 4-week average down 11,000 to 1.687 million and also trending lower. The unemployment rate for insured workers is unchanged at 1.2 percent. The momentum going into the monthly August employment report (which by the way is being sampled in the August 12 to 16 week) points to steady and strong if not increasingly strong demand for labor, results that would point to the resilient strength of the US domestic economy and that could cool expectations for extending Fed rate cuts. But, in an echo of the play between German production and orders, openings and quits may all be academic as the most timely indications suggest that momentum in the US labor market may actually be building. Favorable declines to even more favorable levels are the latest results from jobless claims, down a better-than-expected 8,000 for new claims to a lower-than-expected 209,000 in the August 3 week. The 4-week average of 212,250 is roughly 5,000 lower than early July which hints at strong demand for labor. Continuing claims fell 15,000 to 1.684 million in lagging data for the July 27 week with this 4-week average down 11,000 to 1.687 million and also trending lower. The unemployment rate for insured workers is unchanged at 1.2 percent. The momentum going into the monthly August employment report (which by the way is being sampled in the August 12 to 16 week) points to steady and strong if not increasingly strong demand for labor, results that would point to the resilient strength of the US domestic economy and that could cool expectations for extending Fed rate cuts.

We end the economics run with a reminder of a still developing and possibly serious risk to the outlook: Crisis in Hong Kong. The Hong Kong purchasing managers' index fell sharply from 47.9 in June to 43.8 in July, its lowest level since March 2009 and indicating that activity in Hong Kong has contracted for sixteen consecutive months. In addition to the impact of ongoing US-China trade tensions, the survey indicates that the escalation of recent weeks has also contributed significantly to this deterioration in business conditions. Output and new orders were again reported to have fallen in July, with orders from mainland China falling at the deepest pace in nearly four years. Confidence about the twelve-month outlook also fell to its lowest level in nearly four years, while both input costs and selling prices were reported to have fallen in July. We end the economics run with a reminder of a still developing and possibly serious risk to the outlook: Crisis in Hong Kong. The Hong Kong purchasing managers' index fell sharply from 47.9 in June to 43.8 in July, its lowest level since March 2009 and indicating that activity in Hong Kong has contracted for sixteen consecutive months. In addition to the impact of ongoing US-China trade tensions, the survey indicates that the escalation of recent weeks has also contributed significantly to this deterioration in business conditions. Output and new orders were again reported to have fallen in July, with orders from mainland China falling at the deepest pace in nearly four years. Confidence about the twelve-month outlook also fell to its lowest level in nearly four years, while both input costs and selling prices were reported to have fallen in July.

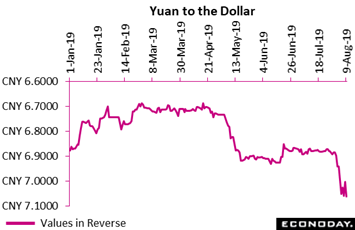

Under seven, over seven, not quite seven jolted markets up and down all week as small degrees of valuation made for large swings in expectations. The silent assumption for most of the last year, bursts of concern and relief aside, was that the US-China trade war would not be a war at all, but that an amicable agreement would be reached. Alarms, however, began sounding in May and June when the US, threatening new tariffs, started to push the pace of the talks. China's reaction crystallized in the latest week as it depreciated its currency in a warning shot — conveniently framed by the psychological breaking of a whole number — took the markets by surprise. Unlike other central banks, the People's Bank of China, in its statement, didn't mince words: "Under the influence of factors including unilateralism, protectionist trade measures, and expectations of tariffs against China, the yuan has depreciated against the dollar today, breaking through 7 yuan per dollar.” To better show what's up is up and down is down, the accompanying graph, like global trade itself, is upside down. Note the sharp volatility in recent sessions. Under seven, over seven, not quite seven jolted markets up and down all week as small degrees of valuation made for large swings in expectations. The silent assumption for most of the last year, bursts of concern and relief aside, was that the US-China trade war would not be a war at all, but that an amicable agreement would be reached. Alarms, however, began sounding in May and June when the US, threatening new tariffs, started to push the pace of the talks. China's reaction crystallized in the latest week as it depreciated its currency in a warning shot — conveniently framed by the psychological breaking of a whole number — took the markets by surprise. Unlike other central banks, the People's Bank of China, in its statement, didn't mince words: "Under the influence of factors including unilateralism, protectionist trade measures, and expectations of tariffs against China, the yuan has depreciated against the dollar today, breaking through 7 yuan per dollar.” To better show what's up is up and down is down, the accompanying graph, like global trade itself, is upside down. Note the sharp volatility in recent sessions.

Round numbers can have outsized effects on our minds especially for those in the markets. How fast and how much will central banks cut rates are only one set of questions, now eclipsed perhaps by the yuan and how fast and how much will China allow it to depreciate. Just a little bit? Or maybe quit a bit?

**Jeremy Hawkins and Brian Jackson contributed to this article

Monetary policy takes a break in the coming week which instead will be focused on a run of industrial production reports, from China and the Eurozone on Wednesday and the US on Thursday. Weakness in these reports would no doubt be attributed to declines underway in global trade and their effects on manufacturing. Labour market data from the UK will be posted on Tuesday as will Germany's ZEW confidence survey which has been very weak. Machine orders out of Japan will lead Wednesday's calendar along with Chinese data which, along with industrial production, will also include fixed asset investment and retail sales. Consensus for the week's Chinese data is steady to soft. Germany's GDP flash will also be posted Wednesday and strength here is not the consensus. The consumer will be the focus on Thursday with retail sales reports from both the UK and the US where strength in core readings for the latter is expected. The week winds up on Friday with merchandise trade out of the Eurozone and housing starts & permits out of the US.

Japanese Producer Price Index for July (Mon 19:50 EDT; Mon 23:50 GMT; Tue 08:50 JST)

Consensus Forecast, Month-to-Month: -0.5%

Consensus Forecast, Year-over-Year: 0.1%

Producer prices in Japan have been soft, contracting 0.5 percent in June and 0.1 percent May. Year-on-year, the PPI fell into contraction in June at minus 0.1 percent from plus 0.7 percent in May. For July, forecasters see minus 0.5 percent for the monthly rate and plus 0.1 percent for the yearly rate.

UK Labour Market Report for July (Tue 04:30 EDT; Tue 08:30 EDT; Tue 09:30 BST)

ILO Unemployment Rate, Consensus Forecast: 3.8%

Claimant Count, Consensus Forecast: 22,000

Average Weekly Earnings, Consensus Forecast: 3.7%

The ILO unemployment rate is expected to hold unchanged in July at 3.8 percent with claimant count joblessness seen rising 22,000 versus a 38,000 gain in June. The call for average hourly earnings including bonuses, which rose sharply and unexpectedly in June, is a further 3-tenth rise to 3.7 percent year-on-year.

Germany: ZEW Survey for August (Tue 05:00 EDT; Tue 09:00 GMT; Tue 11:00 CEST)

Consensus Forecast, Current Conditions: -6.4

Consensus Forecast, Business Expectations: -28.0

Business expectations grew more pessimistic in July at minus 24.5 with no bounce back expected in August, at a minus 28.0 consensus. Current conditions are expected to continue to contract, to minus 6.4 compared with July's minus 1.1.

US Consumer Price Index for July (Tue 08:30 EDT; Tue 12:30 GMT)

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.2% to 0.4%

Consumer Price Index

Consensus Forecast, Year-on-Year Change: 1.7%

Consensus Range: 1.6% to 1.8%

CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.2% to 0.2%

CPI Core, Less Food & Energy

Consensus Forecast, Year-on-Year Change: 2.1%

Consensus Range: 2.1% to 2.2%

US consumer prices were mixed in June, subdued at the headline level with a 0.1 percent gain but showing some pressure for the ex-food ex-energy core with a 0.3 percent gain. Forecasters see modest pressure in July at 0.2 percent increases for both total prices and the core. Year-on-year rates are expected to rise slightly for total prices, to 1.7 percent, and hold unchanged for the core at 2.1 percent.

Japanese Machine Orders for June (Tue 19:50 EDT; Tue 23:50 GMT; Wed 08:50 JST)

Consensus Forecast, Month-to-Month: -1.0%

At a month-to-month 1.0 percent decrease for June, forecasters see Japanese machine orders adding to May's unexpectedly steep 7.8 percent drop. Year-on-year orders in May were down 3.7 percent.

Chinese Fixed Asset Investment for July ( Tue 22:00 EDT; Wed 02:00 GMT; Wed 10:00 CST)

Consensus Forecast, Year-to-date: 5.7%

Consensus Range: 5.5% to 6.5%

Helped by investment in manufacturing, fixed asset investment rose 5.8 percent year-to-date in June to just beat expectations. Forecasters see July fixed asset investment rising a year-to-date 5.7 percent.

Chinese Industrial Production for July (Wednesday, No time given)

Consensus Forecast: 5.7%

Growth in steel and also mining helped boost industrial production to a higher-than-expected 6.3 percent yearly rate in June. July, however, is seen moderating to 5.7 percent.

Chinese Retail Sales for July (Wednesday, No time given)

Consensus Forecast, Year-over-Year: 8.5%

Broad-based strength including for autos drove a surprisingly strong showing for June retail sales at a year-on-year 9.8 percent. For July, the call is 8.5 percent.

German GDP First-Quarter Flash (Wed 02:00 EDT; Wed 06:00 GMT; Wed 08:00 CEST)

Consensus Forecast, Quarter-on-Quarter: -0.1%

Consensus Forecast, Year-over-Year: 0.1%

A 0.1 percent decline is expected for quarter-to-quarter change in the second-quarter GDP flash and only 0.1 percent growth year-on-year. This would mark definite slowing from quarterly growth of 0.4 percent in the first quarter and a yearly growth rate of 0.7 percent.

Eurozone Industrial Production for June (Wed 05:00 EDT; Wed 09:00 GMT; Wed 11:00 CEST)

Consensus Forecast, Month-to-Month: -1.4%

Consensus Forecast, Year-over-Year: -1.5%

Eurozone industrial production rebounded strongly with a 0.9 percent monthly gain in May though the year-on-year rate remained in contraction at minus 0.5 percent. Consumer goods were May's strength with France leading the country data. For June the monthly consensus is a 1.4 percent decrease with the yearly rate seen at minus 1.5 percent.

UK Retail Sales for July (Thu 04:30 EDT; Thu 08:30 GMT; Thu 09:30 BST)

Consensus Forecast, Month-to-Month: -0.2%

Retail sales rose a solid and better-than-expected 1.0 percent in June in a report that showed wide improvement following a 0.6 percent dip in May. For July, forecasters see give back from June's pace and a 0.2 percent monthly decline.

US Retail Sales for July, Month-to-Month (Thu 08:30 EDT; Thu 12:30 GMT)

Consensus Forecast: 0.3%

Consensus Range: -0.3% to 0.5%

Retail Sales Ex-Autos

Consensus Forecast: 0.4%

Consensus Range: -0.2% to 0.6%

Retail Sales Ex-Autos & Gas

Consensus Forecast: 0.5%

Consensus Range: 0.4% to 0.5%

Retail Sales Control Group (Ex-Food Services, Ex-Autos, Ex-Gas, Ex-Building Materials)

Consensus Forecast: 0.3%

Consensus Range: 0.3% to 0.3%

Following a surprisingly upbeat retail sales report in June, forecasters see steady growth for July, at a headline consensus increase of 0.3 percent versus 0.4 percent in June. Unit vehicle sales slowed in July which may give a relative boost to ex-auto sales which are expected to rise 0.4 percent. Ex-autos ex-gasoline sales are expected at a 0.5 percent increase with the control group at 0.3 percent.

US Industrial Production for July (Thu 09:15 EDT; Thu 13:15 GMT)

Consensus Forecast, Month-to-Month: 0.1%

Consensus Range: -0.4% to 0.4%

Manufacturing Production

Consensus Forecast, Month-to-Month: -0.1%

Consensus Range: -0.3% to 0.1%

Capacity Utilization Rate

Consensus Forecast: 77.8%

Consensus Range: 77.7% to 78.2%

Manufacturing production moved solidly higher in June boosted by wide strength including for hi-tech and business equipment. But reversal is the expectation for July where the consensus, after June's 0.4 percent gain, is calling for a 0.1 percent decline. Headline industrial production, which was unchanged in June on weakness at utilities, is expected to edge 0.1 percent higher. The capacity utilization rate is expected to dip to 77.8 percent versus June's 77.9 percent.

Eurozone Merchandise Trade Balance for June (Fri 05:00 EDT: Fri 09:00 GMT; Fri 11:00 CEST)

Consensus Forecast: €16.3 billion

After a healthy trade surplus of €29.2 billion in May, forecasters see Eurozone's black ink easing slightly to €16.3 billion. Unlike many other trade reports where there are declines on both sides of the ledger, both imports and exports are posting mid-single digit growth.

US Housing Starts for July (Fri 08:30 EDT; Fri 12:30 GMT)

Consensus Forecast, Annualized Rate: 1.260 million

Consensus Range: 1.210 to 1.280 million

Building Permits

Consensus Forecast: 1.270 million

Consensus Range: 1.220 to 1.290 million

After a disappointing June report that included a sharp decline for permits, the housing starts report for July is expected to be mixed. Starts are expected to come in at a 1.260 million annual pace and little changed from June's 1.253 million while the consensus for permits in July is calling for a correction higher, to 1.270 million vs 1.220 million in June.

|