|

The direction of global data is far from completely one sided but many of the reports, especially those tied to manufacturing and international trade, are posting some of the weakest numbers in years. Yet there are still plenty of strong points in the week's news, strength however that may be overlooked as central banks prepare themselves for what appears to be a simultaneous push for new stimulus.

After rebounding from stagnation at the start of the year, the German economy as expected slowed and fell into marginal contraction in the second quarter. A provisional 0.1 percent quarterly decline in total output followed a 0.4 percent quarterly increase previously. This pulled down the annual workday adjusted expansion rate, as tracked in the accompanying graph, by 0.3 percentage points to 0.4 percent. The only other information provided by the Federal Statistical Office indicates that shrinking foreign trade slowed economic growth during the quarter, with exports falling more than imports. Further contributing to the slowdown were declines in gross fixed capital formation and construction. In contrast, domestic demand made positive contributions during the quarter on rising household consumption expenditures, government expenditures, and investment. Full details of the GDP expenditure components will be released on August 27th. After rebounding from stagnation at the start of the year, the German economy as expected slowed and fell into marginal contraction in the second quarter. A provisional 0.1 percent quarterly decline in total output followed a 0.4 percent quarterly increase previously. This pulled down the annual workday adjusted expansion rate, as tracked in the accompanying graph, by 0.3 percentage points to 0.4 percent. The only other information provided by the Federal Statistical Office indicates that shrinking foreign trade slowed economic growth during the quarter, with exports falling more than imports. Further contributing to the slowdown were declines in gross fixed capital formation and construction. In contrast, domestic demand made positive contributions during the quarter on rising household consumption expenditures, government expenditures, and investment. Full details of the GDP expenditure components will be released on August 27th.

Slowing trade has also been affecting smaller economies. Revised data for the second quarter confirm that Hong Kong's economy contracted for the third time in the last five quarters with GDP down by 0.4 percent. Year-on-year growth, as tracked in the graph, was revised from the initial estimate of 0.6 percent to 0.5 percent, down from the first quarter's 0.6 percent and the weakest showing since all the way back in 2009. The weakness shown in the GDP data is broadly in line with monthly PMI survey data over this period, with US-China trade tensions and recent civil unrest in Hong Kong weighing on activity. Hong Kong's government announced an economic support package in the week aimed at providing a boost to low-income households, small businesses, and parts of the services sector. Slowing trade has also been affecting smaller economies. Revised data for the second quarter confirm that Hong Kong's economy contracted for the third time in the last five quarters with GDP down by 0.4 percent. Year-on-year growth, as tracked in the graph, was revised from the initial estimate of 0.6 percent to 0.5 percent, down from the first quarter's 0.6 percent and the weakest showing since all the way back in 2009. The weakness shown in the GDP data is broadly in line with monthly PMI survey data over this period, with US-China trade tensions and recent civil unrest in Hong Kong weighing on activity. Hong Kong's government announced an economic support package in the week aimed at providing a boost to low-income households, small businesses, and parts of the services sector.

Slowing in global trade spells general slowing in goods production at least until domestic production picks up to fill the gaps in imports. Industrial production data, like most GDP reports, have been slowing across the major regions with China's July edition extending a general year-long downtrend. Chinese industrial production did rise a year-on-year 4.8 percent in July, a very solid rate but nevertheless down sharply from 6.3 percent in June and well below expectations for 5.7 percent. This is the weakest growth since 2012. The decline was largely driven by a similar drop in year-on-year growth in manufacturing output from 6.2 percent to 4.5 percent, with weaker growth reported in the output of textiles, chemicals, general equipment, electric machinery, communication equipment and steel products, offset by a smaller drop in auto production. Mining output, after increasing 7.3 percent in June, was up 6.6 percent on the year while year-on-year growth in utilities output picked up from 6.6 percent to 6.9 percent. On the month, Chinese industrial production rose 0.19 percent in July after increasing 0.67 percent in June. Slowing in global trade spells general slowing in goods production at least until domestic production picks up to fill the gaps in imports. Industrial production data, like most GDP reports, have been slowing across the major regions with China's July edition extending a general year-long downtrend. Chinese industrial production did rise a year-on-year 4.8 percent in July, a very solid rate but nevertheless down sharply from 6.3 percent in June and well below expectations for 5.7 percent. This is the weakest growth since 2012. The decline was largely driven by a similar drop in year-on-year growth in manufacturing output from 6.2 percent to 4.5 percent, with weaker growth reported in the output of textiles, chemicals, general equipment, electric machinery, communication equipment and steel products, offset by a smaller drop in auto production. Mining output, after increasing 7.3 percent in June, was up 6.6 percent on the year while year-on-year growth in utilities output picked up from 6.6 percent to 6.9 percent. On the month, Chinese industrial production rose 0.19 percent in July after increasing 0.67 percent in June.

Industrial production is of special note for the US Federal Reserve which, directly citing concerns over the health of manufacturing, cut rates last month for the first time since the Great Recession. Pressured by contraction in both manufacturing and also mining, industrial production came in near the low end of Econoday's consensus range with a 0.2 percent decline in July. Utilities, where production is affected by the weather and where results are often volatile, jumped 3.1 percent in the month following a 3.3 percent June decline. Outside of this component, however, positives in the July report were scarce. Manufacturing production fell 0.4 percent in the month to miss the low end of the consensus range. The year-on-year rate, as tracked in the graph, was minus 0.5 percent and in contraction for the second time in four months. Construction supplies were down in July as were motor vehicles where production had been on the rise. Business equipment, an area of even more specific concern for the Fed, also fell. Mining, which along with manufacturing and utilities is the third major component in the report, has been contributing strongly to total growth for the past couple of years but not in July as output fell sharply on the month. Industrial production is of special note for the US Federal Reserve which, directly citing concerns over the health of manufacturing, cut rates last month for the first time since the Great Recession. Pressured by contraction in both manufacturing and also mining, industrial production came in near the low end of Econoday's consensus range with a 0.2 percent decline in July. Utilities, where production is affected by the weather and where results are often volatile, jumped 3.1 percent in the month following a 3.3 percent June decline. Outside of this component, however, positives in the July report were scarce. Manufacturing production fell 0.4 percent in the month to miss the low end of the consensus range. The year-on-year rate, as tracked in the graph, was minus 0.5 percent and in contraction for the second time in four months. Construction supplies were down in July as were motor vehicles where production had been on the rise. Business equipment, an area of even more specific concern for the Fed, also fell. Mining, which along with manufacturing and utilities is the third major component in the report, has been contributing strongly to total growth for the past couple of years but not in July as output fell sharply on the month.

Whether business or consumer, sentiment is a bit intangible yet is cited often as an important factor for monetary policy. And results in the latest week are not positive. Analysts became much more pessimistic about the state of the German economy in August and ZEW's survey results were considerably softer than market consensus. Business expectations plunged 19.6 points to minus 44.1, their third straight fall and their worst showing since 2011. Their long-run average is up at 21.6. The current conditions gauge dropped 12.4 points to minus 13.5, its tenth fall in the last eleven months and the lowest reading since 2010. ZEW said August's poor survey findings reflect a significant deterioration in the outlook for the German economy, as escalation of the US trade dispute with China, the risk of competitive devaluations and the increased likelihood of a no-deal Brexit put additional pressure on economic growth and further strain on the development of German exports and industrial production. Whether business or consumer, sentiment is a bit intangible yet is cited often as an important factor for monetary policy. And results in the latest week are not positive. Analysts became much more pessimistic about the state of the German economy in August and ZEW's survey results were considerably softer than market consensus. Business expectations plunged 19.6 points to minus 44.1, their third straight fall and their worst showing since 2011. Their long-run average is up at 21.6. The current conditions gauge dropped 12.4 points to minus 13.5, its tenth fall in the last eleven months and the lowest reading since 2010. ZEW said August's poor survey findings reflect a significant deterioration in the outlook for the German economy, as escalation of the US trade dispute with China, the risk of competitive devaluations and the increased likelihood of a no-deal Brexit put additional pressure on economic growth and further strain on the development of German exports and industrial production.

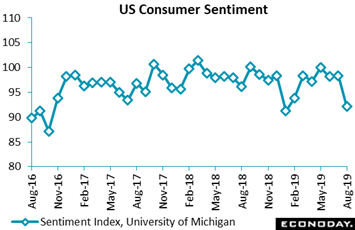

Fed chief Jerome Powell specifically cited falling confidence levels in June, when tariff tensions were escalating sharply, as another reason for the Fed's rate cut. Not since the US government was shut down early in the year has US consumer sentiment been this low, at 92.1 for preliminary August in what was a very unexpected and sharp decline from 98.4 in July. A key reason for the drop according to the report is the latest US tariff hike on China that is set to take effect at the beginning of next month (though some products will be exempt until Christmas). This action was spontaneously cited by 33 percent of the report's telephone sample and near a prior peak on tariff issues of 37 percent. Another reason for the drop is the Federal Reserve's rate cut last month, one that the report says is raising apprehensions about a possible recession. Weakness in August's data is centered in the expectations component, down more than 8 points to 82.3 and reflecting new concerns over income prospects. Fed chief Jerome Powell specifically cited falling confidence levels in June, when tariff tensions were escalating sharply, as another reason for the Fed's rate cut. Not since the US government was shut down early in the year has US consumer sentiment been this low, at 92.1 for preliminary August in what was a very unexpected and sharp decline from 98.4 in July. A key reason for the drop according to the report is the latest US tariff hike on China that is set to take effect at the beginning of next month (though some products will be exempt until Christmas). This action was spontaneously cited by 33 percent of the report's telephone sample and near a prior peak on tariff issues of 37 percent. Another reason for the drop is the Federal Reserve's rate cut last month, one that the report says is raising apprehensions about a possible recession. Weakness in August's data is centered in the expectations component, down more than 8 points to 82.3 and reflecting new concerns over income prospects.

However much sentiment readings may be helping to guide policy makers, changes in sentiment don't always tie in directly with actual changes in demand, at least not right away. Unexpected strength, in contrast to consumer sentiment, is a fair description of recent retail sales reports out of the US including July's where all major readings easily surpassed Econoday's consensus ranges. Total sales rose a monthly 0.7 percent for a year-on-year rate of 3.5 percent, the latter down from nearly 4 percent peaks in March and April but still one of the best showings since late last year. Out front as usual were non-stores where monthly sales jumped 2.8 percent following gains of 1.9 and 2.3 percent in June and May. This component is dominated by e-commerce which is making increasingly greater gains at the expense of brick-and-mortar stores. Department stores have been one of the victims but not in July as sales recovered sharply. Electronics & appliance stores also posted strong gains as did clothing stores and food & beverage stores. Gasoline stations, benefiting from higher prices, also had a heavy sales month. But punctuating the strength and speaking to the underlying discretionary power of the consumer was yet another very strong gain for restaurants, up 1.1 percent following four prior monthly gains of 0.7, 1.1, and 0.7 percent and right behind non-stores in the voting for the most valuable component. The consumer held up second-quarter US GDP posting robust and inflation-adjusted annual spending growth of 4.3 percent, a mark that would be difficult to match let alone exceed yet, despite all the doom and gloom, this is a possibility given the strong jump out of the gate for July retail sales. However much sentiment readings may be helping to guide policy makers, changes in sentiment don't always tie in directly with actual changes in demand, at least not right away. Unexpected strength, in contrast to consumer sentiment, is a fair description of recent retail sales reports out of the US including July's where all major readings easily surpassed Econoday's consensus ranges. Total sales rose a monthly 0.7 percent for a year-on-year rate of 3.5 percent, the latter down from nearly 4 percent peaks in March and April but still one of the best showings since late last year. Out front as usual were non-stores where monthly sales jumped 2.8 percent following gains of 1.9 and 2.3 percent in June and May. This component is dominated by e-commerce which is making increasingly greater gains at the expense of brick-and-mortar stores. Department stores have been one of the victims but not in July as sales recovered sharply. Electronics & appliance stores also posted strong gains as did clothing stores and food & beverage stores. Gasoline stations, benefiting from higher prices, also had a heavy sales month. But punctuating the strength and speaking to the underlying discretionary power of the consumer was yet another very strong gain for restaurants, up 1.1 percent following four prior monthly gains of 0.7, 1.1, and 0.7 percent and right behind non-stores in the voting for the most valuable component. The consumer held up second-quarter US GDP posting robust and inflation-adjusted annual spending growth of 4.3 percent, a mark that would be difficult to match let alone exceed yet, despite all the doom and gloom, this is a possibility given the strong jump out of the gate for July retail sales.

Retail sales out of China have also been holding their own though July was a step back. Chinese retail sales grew 7.6 percent on the year in the month, a very strong rate of growth but well down from 9.8 percent in June and below the consensus forecast for 8.5 percent. Auto sales slowed particularly sharply, down 2.6 percent on the year in July after advancing 17.2 percent in June in a surge that was prompted by the introduction of new emission standards. Sales of oil and oil products fell 1.1 percent on the year after increasing 3.5 percent previously, with sales of communications equipment, furniture, and home appliances also slowing. Year-on-year growth in rural retail sales moderated from 10.1 percent to 8.6 percent, while urban retail sales growth fell from 9.8 percent to 7.4 percent. On the month, total Chinese retail sales rose 0.22 percent in July after increasing 0.91 percent in June. Retail sales out of China have also been holding their own though July was a step back. Chinese retail sales grew 7.6 percent on the year in the month, a very strong rate of growth but well down from 9.8 percent in June and below the consensus forecast for 8.5 percent. Auto sales slowed particularly sharply, down 2.6 percent on the year in July after advancing 17.2 percent in June in a surge that was prompted by the introduction of new emission standards. Sales of oil and oil products fell 1.1 percent on the year after increasing 3.5 percent previously, with sales of communications equipment, furniture, and home appliances also slowing. Year-on-year growth in rural retail sales moderated from 10.1 percent to 8.6 percent, while urban retail sales growth fell from 9.8 percent to 7.4 percent. On the month, total Chinese retail sales rose 0.22 percent in July after increasing 0.91 percent in June.

Sentiment may be too iffy a factor to base near-term predictions on consumer spending. More reliable is employment which is the concrete foundation for the consumer's sense of well being and which is very strong through most of the major economies. Australia's labour market saw an increase of 41,100 in the number of employed in July, up sharply from a fall of 2,300 in June. The unemployment rate was unchanged at 5.2 percent in July, stronger than the consensus forecast of 5.3 percent, while the participation rate increased but only slightly from 66.0 percent to 66.1 percent. Over the last year, full-time employment in Australia has increased by 255,600 while part-time employment has increased by 77,000. Yet these gains aren't likely to upend plans at the Reserve Bank of Australia which is on a rate-cut course. Employment growth aside, general stability in the unemployment and participation rates may reinforce the view among policy makers that significant spare capacity remains in the labour market and that the Australian economy can sustain a lower rate of unemployment without causing a spike in inflation. This is how the assessment is expressed in Australia and July's jobs data aren't likely to upend the policy outlook. Sentiment may be too iffy a factor to base near-term predictions on consumer spending. More reliable is employment which is the concrete foundation for the consumer's sense of well being and which is very strong through most of the major economies. Australia's labour market saw an increase of 41,100 in the number of employed in July, up sharply from a fall of 2,300 in June. The unemployment rate was unchanged at 5.2 percent in July, stronger than the consensus forecast of 5.3 percent, while the participation rate increased but only slightly from 66.0 percent to 66.1 percent. Over the last year, full-time employment in Australia has increased by 255,600 while part-time employment has increased by 77,000. Yet these gains aren't likely to upend plans at the Reserve Bank of Australia which is on a rate-cut course. Employment growth aside, general stability in the unemployment and participation rates may reinforce the view among policy makers that significant spare capacity remains in the labour market and that the Australian economy can sustain a lower rate of unemployment without causing a spike in inflation. This is how the assessment is expressed in Australia and July's jobs data aren't likely to upend the policy outlook.

Wage-fed inflation also doesn't appear to be a risk yet for the Fed though there may be a scare forming in consumer prices. Emerging pressure in medical costs and steady pressure in housing lifted the US CPI in July by 0.3 percent for both the headline and the ex-food ex-energy core. Both of these results were 1 tenth above expectations as were the respective year-on-year rates, at 1.8 and 2.2 percent. The latter yearly rate is tracked in the blue line of the accompanying graph along with the green line of the Fed's central inflation gauge, the core PCE price index. Versus an already noticeable 0.4 percent monthly rise in June, medical care services in July rose 0.5 percent. Medical care was up 3.3 percent from July last year. Housing costs in July rose 0.3 percent for a second straight month with this rate up 3.0 percent on the year. These rates, which together make up about half of all consumer prices, are well above the Fed's general 2 percent target and are offsetting lower levels of pressure in other prices. Yet the loudest alarm in the report comes from the 0.3 percent monthly rise of the core. This is the second straight such gain to mark the greatest two months of pressure since 2005. Whether some of this emerging pressure is tied to higher tariffs is hard to pin down in the data but questions over this possibility are certain to be a hot topic among the few remaining policy hawks. Wage-fed inflation also doesn't appear to be a risk yet for the Fed though there may be a scare forming in consumer prices. Emerging pressure in medical costs and steady pressure in housing lifted the US CPI in July by 0.3 percent for both the headline and the ex-food ex-energy core. Both of these results were 1 tenth above expectations as were the respective year-on-year rates, at 1.8 and 2.2 percent. The latter yearly rate is tracked in the blue line of the accompanying graph along with the green line of the Fed's central inflation gauge, the core PCE price index. Versus an already noticeable 0.4 percent monthly rise in June, medical care services in July rose 0.5 percent. Medical care was up 3.3 percent from July last year. Housing costs in July rose 0.3 percent for a second straight month with this rate up 3.0 percent on the year. These rates, which together make up about half of all consumer prices, are well above the Fed's general 2 percent target and are offsetting lower levels of pressure in other prices. Yet the loudest alarm in the report comes from the 0.3 percent monthly rise of the core. This is the second straight such gain to mark the greatest two months of pressure since 2005. Whether some of this emerging pressure is tied to higher tariffs is hard to pin down in the data but questions over this possibility are certain to be a hot topic among the few remaining policy hawks.

Consumer inflation isn't being watched as the global economy's central risk. This is reserved for cross-border trade where we'll end the week's data run. Singapore trade data for July showed some improvement in exports, broadly in line with Chinese data published in the prior week showing a moderate rebound in external demand. Singapore's non-oil domestic exports fell 11.2 percent on the year in July which is steep but better than a 17.4 percent decline in June. The smaller fall in yearly non-oil export growth was broad-based across products in July. Electronics exports fell 24.2 percent on the year after contracting 31.9 percent in June while non-electronics exports declined 6.6 percent on the year after dropping 12.6 percent previously. Export growth improved for seven of Singapore's top ten trading partners in July. Exports to the US rose 12.3 percent on the year after advancing 1.5 percent previously, while exports to China and the European Union both fell to a lesser extent than they did in June. Exports to Japan, however, were weaker, down 44.2 percent on the year in July after falling 25.3 percent in June. Total imports fell 6.3 percent on the year after falling 5.1 percent previously. Consumer inflation isn't being watched as the global economy's central risk. This is reserved for cross-border trade where we'll end the week's data run. Singapore trade data for July showed some improvement in exports, broadly in line with Chinese data published in the prior week showing a moderate rebound in external demand. Singapore's non-oil domestic exports fell 11.2 percent on the year in July which is steep but better than a 17.4 percent decline in June. The smaller fall in yearly non-oil export growth was broad-based across products in July. Electronics exports fell 24.2 percent on the year after contracting 31.9 percent in June while non-electronics exports declined 6.6 percent on the year after dropping 12.6 percent previously. Export growth improved for seven of Singapore's top ten trading partners in July. Exports to the US rose 12.3 percent on the year after advancing 1.5 percent previously, while exports to China and the European Union both fell to a lesser extent than they did in June. Exports to Japan, however, were weaker, down 44.2 percent on the year in July after falling 25.3 percent in June. Total imports fell 6.3 percent on the year after falling 5.1 percent previously.

The doomsdayers are getting their wish, witnessing a brief inversion of the 2-year to 10-year US Treasury curve at mid-week which at week's end was just out of inversion, at 1.49 percent for the 2-year and 1.56 percent for the 10-year. The fall in US yields has been accelerating sharply with the 2-year down 100 basis points so far this year and with nearly half of this move following the Fed's rate cut on July 31. For the 10-year, the year-to-date decline is a little more than 100 points with half of this move also in the last couple of weeks. The Fed's rate cut along with US intentions to increase tariffs on China not only pulled down US consumer sentiment but, along with China's move to weaken the yuan, they appear to be leading investors to lock in whatever yield they can get in Treasuries. Losses in the global stock markets, despite a volatile week, were limited mostly to 1 to 2 percentage points though year-on-year gains remain robust, near double digits or just over for many of the leading indexes. Strong simultaneous gains are not the norm for stocks and bonds — investment classes that are assumed to be at opposite polls of the demand spectrum, one seeking risk the other safety. This is a year for new definitions. The doomsdayers are getting their wish, witnessing a brief inversion of the 2-year to 10-year US Treasury curve at mid-week which at week's end was just out of inversion, at 1.49 percent for the 2-year and 1.56 percent for the 10-year. The fall in US yields has been accelerating sharply with the 2-year down 100 basis points so far this year and with nearly half of this move following the Fed's rate cut on July 31. For the 10-year, the year-to-date decline is a little more than 100 points with half of this move also in the last couple of weeks. The Fed's rate cut along with US intentions to increase tariffs on China not only pulled down US consumer sentiment but, along with China's move to weaken the yuan, they appear to be leading investors to lock in whatever yield they can get in Treasuries. Losses in the global stock markets, despite a volatile week, were limited mostly to 1 to 2 percentage points though year-on-year gains remain robust, near double digits or just over for many of the leading indexes. Strong simultaneous gains are not the norm for stocks and bonds — investment classes that are assumed to be at opposite polls of the demand spectrum, one seeking risk the other safety. This is a year for new definitions.

The week's data run was filled with multi-year alarms, whether declines in German GDP or increases in US core consumer prices. But inflation isn't getting much notice right now as central banks, gearing up to fight an increasingly threatening front on trade, position themselves to add stimulus. Reports popped up in the week, from Germany to New Zealand, of central banks looking further into what was once unconventional monetary policy, whether deeper moves into negative policy rates or new rounds of asset purchases under quantitative easing. As long as relative faith in currency valuations remain intact, that is no major currency collapses in reaction to over-aggressive stimulus policy, the risk of increased instability in the financial markets may well be limited. Whether China's stated move in the prior week to weaken the yuan upsets or upends this balanced race is a major act that is just getting underway in the center ring.

**Jeremy Hawkins and Brian Jackson contributed to this article

The coming week may prove to be an important one but the economic calendar is light. Central bank policy will be the focus especially the Federal Reserve's Jackson Hole conference which begins Thursday and includes a speech by Jerome Powell on Friday. Minutes from the prior meeting in July, when the Fed cut rates for the first time this cycle, will be posted on Wednesday with minutes from the Reserve Bank of Australia, which started cutting rates early in the year, due out on Tuesday and minutes from the European Central Bank, which appears to be preparing to cut rates next month, out on Thursday. Economic data will include August PMI flashes across Europe, including for Germany manufacturing which has been especially depressed, and trade and consumer price data out of Japan. Manufacturing sales, a sensitive focus right now, will be posted in Canada early in the week with home sales, both existing and new, out of the US.

Japanese Merchandise Trade for July (Sun 19:50 EDT; Sun 23:50 GMT; Mon 08:50 JST)

Consensus Forecast: ¥220.0 billion deficit

A deficit of ¥220.0 billion is expected for the July merchandise trade report versus a higher-than-expected ¥589.5 billion surplus in June. Exports fell a sharp 6.7 percent year-on-year in June while imports were down 5.2 percent.

German PPI for July (Tue 02:00 EDT; Tue 6:00 EDT; Tue 08:00 CEST)

Consensus Forecast, Month-to-Month: 0.0%

Consensus Forecast, Year-over-Year: 1.0%

Producer prices in Germany have missed expectations the past two reports especially in June which saw a 0.4 percent headline decline and a 1.2 percent overall yearly rate. June's consensus is no change for the monthly rate and plus 1.0 percent for the yearly rate.

Canadian Manufacturing Sales for June (Tue 08:30 EDT; Tue 12:30 GMT)

Consensus Forecast, Month-to-Month: -1.9%

Canadian manufacturing sales rebounded with a sharp 1.6 percent rise in May that nevertheless came up short of expectations following a 0.4 decline in April. The consensus for June is a fall of 1.9 percent.

Canadian CPI for July (Wed 08:30 EDT; Wed 12:30 GMT)

Consensus Forecast, Month-to-Month: 0.2%

Consensus Forecast, Year-over-Year: 1.7%

Declines in gasoline prices pulled consumer prices down 0.2 percent on the month in June and down 4 percentage points on the year to 2.0 percent. For July forecasters see a monthly rise of 0.2 percent for a yearly 1.7 percent.

US Existing Home Sales for July (Wed 10:00 EDT; Wed 02:00 GMT)

Consensus Forecast, Annualized Rate: 5.385 million

Consensus Range: 5.250 to 5.500 million

Existing home sales firmed in the early Spring but then sputtered. Big improvement is the call for July, at a 5.385 million annual rate versus 5.270 million in June.

German PMI Flashes for August (Thu 03:30 EDT; Thu 07:30 GMT; Thu 09:30 CEST)

Manufacturing Consensus: 43.1

Services Consensus: 53.9

Weakness at far under 50, Germany's PMI manufacturing sample has been suffering this year and confirming the slowdown underway in global growth and global trade. The flash index for August manufacturing is expected to come in at 43.1 versus a July final of 43.2 and a July flash of 43.1. Services have so far been holding their own, though a 6 tenth dip to 53.9 is the August consensus.

Eurozone: EC Consumer Confidence Flash for August (Thu 10:00 EDT; Thu 14:00 GMT; Thu 16:00 CEST)

Consensus Forecast: -6.8%

Consumer confidence has been soft, at minus 6.6 in July with forecasters seeing the European Commission's flash coming in at minus 6.8 for August.

Japanese Consumer Price Index for July (Thu 19:30 EDT; Thu 23:30 GMT; Fri 08:30 JST)

Consensus Forecast Ex-Food, Year-on-Year: 0.6%

Steady is the consensus for ex-food consumer prices, at only a year-on-year 0.6 percent pace and once again well below the Bank of Japan's 2 percent target.

US New Home Sales for July (Fri 10:00 EDT; Fri 14:00 GMT)

Consensus Forecast, Annualized Rate: 645,000

Consensus Range: 630,000 to 675,000

After a bright start to the year, new home sales flattened out in May and June despite soft pricing and ample supply. Econoday's consensus for July's annual rate is 645,000 which would be nearly unchanged from 646,000 in June.

|