|

Declines in manufacturing and trade have yet to rattle sentiment, evident in the week's long run of confidence data that on net remain stable if not always favorable. The latest data on manufacturing and on trade are anything but favorable and though central bankers are focused specifically on these two sectors, consumers seem less concerned. First we'll look at the US where two rival indexes are now telling the same story, that spirits have been better but still aren't so bad.

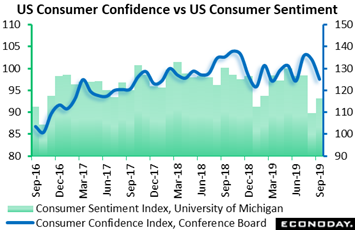

The consumer confidence index had been showing exceptional strength but fell back unexpectedly in September to 125.1 which is down sharply from 134.2 in August and 135.8 in July. Nevertheless, this index, which is produced by the Conference Board and tracked in the blue line of the accompanying graph, has been trying to move higher though the trend does look a bit tired right now. The difference between this index and the consumer sentiment index produced by the University of Michigan is the focus on the labor market which is central to the Conference Board's report and where September's results are mixed. Those saying jobs are currently hard-to-get did fall 4 tenths to 11.6 percent, which is a positive indication of increasing strength, but this is not confirmed by those who say jobs are currently plentiful which fell, not rose, 5.5 percentage points to 44.8 percent. The outlook for future employment strength is also negative with fewer saying there will be more jobs (17.5 vs August's 19.9 percent) and more saying there will be fewer jobs (15.7 vs 13.7 percent). A strong negative in September's report was a sharp decline in those who see their income improving in the months ahead, falling to 19.0 percent versus August's 24.7 percent, a downturn reflecting not only caution over the jobs outlook but also a tangible drop in stock market confidence where bears, at 35.3 percent, now outnumber bulls at 31.6 percent. This is the first time since January that bears are on top. Buying plans in the report were also noticeably lower including for autos and homes. The consumer confidence index had been showing exceptional strength but fell back unexpectedly in September to 125.1 which is down sharply from 134.2 in August and 135.8 in July. Nevertheless, this index, which is produced by the Conference Board and tracked in the blue line of the accompanying graph, has been trying to move higher though the trend does look a bit tired right now. The difference between this index and the consumer sentiment index produced by the University of Michigan is the focus on the labor market which is central to the Conference Board's report and where September's results are mixed. Those saying jobs are currently hard-to-get did fall 4 tenths to 11.6 percent, which is a positive indication of increasing strength, but this is not confirmed by those who say jobs are currently plentiful which fell, not rose, 5.5 percentage points to 44.8 percent. The outlook for future employment strength is also negative with fewer saying there will be more jobs (17.5 vs August's 19.9 percent) and more saying there will be fewer jobs (15.7 vs 13.7 percent). A strong negative in September's report was a sharp decline in those who see their income improving in the months ahead, falling to 19.0 percent versus August's 24.7 percent, a downturn reflecting not only caution over the jobs outlook but also a tangible drop in stock market confidence where bears, at 35.3 percent, now outnumber bulls at 31.6 percent. This is the first time since January that bears are on top. Buying plans in the report were also noticeably lower including for autos and homes.

The consumer sentiment report, one relying on detailed phone sampling, had like the confidence index been moving higher earlier in the year before, however, stumbling badly in August in what the report described as a major tariff effect. But tariff tensions between the US and China appear to be easing and with this the consumer sentiment showed some improvement in September, ending the month up a tangible 3.4 points with gains posted by both main components: current economic conditions as well as expectations. In a record for the report, nearly one-third of respondents negatively mentioned trade policies when assessing economic expectations. And though there was improvement in September, the sentiment index remains at one of its very lowest levels of the last three years. Yet consumer spending has remained strong, though it did slow in August and with September looking flat based on weekly Redbook data. Both the sentiment and the confidence reports offer a measure of caution and, if nothing else, suggest that further acceleration in consumer spending may be limited.

How much the Federal Reserve's decision to cut rates is helping US confidence isn't clear, though the European Central Bank's decision to ease policy earlier this month may have provided some support for Germany where confidence readings had been lagging much more than the US. While the new GfK survey confirmed a 9.7 reading on its climate indicator in September, unchanged from August, it also predicted a surprising 0.2 point gain to 9.9 in October. This would be the first increase since February and its highest level since June. For September, the outcome masked an improvement in both economic expectations and the propensity to buy. The former climbed 3 points to minus 9.0, although this was still a sizeable 33.6 points short of its mark a year ago. Buying intentions were up a larger 6.3 points to 55.1 and stand 3.5 points above their level in September 2018. Income expectations did ease but remain historically solid. Overall, the latest findings are surprisingly positive and suggest that households are well placed to provide at least some support to economic growth over the near-term. How much the Federal Reserve's decision to cut rates is helping US confidence isn't clear, though the European Central Bank's decision to ease policy earlier this month may have provided some support for Germany where confidence readings had been lagging much more than the US. While the new GfK survey confirmed a 9.7 reading on its climate indicator in September, unchanged from August, it also predicted a surprising 0.2 point gain to 9.9 in October. This would be the first increase since February and its highest level since June. For September, the outcome masked an improvement in both economic expectations and the propensity to buy. The former climbed 3 points to minus 9.0, although this was still a sizeable 33.6 points short of its mark a year ago. Buying intentions were up a larger 6.3 points to 55.1 and stand 3.5 points above their level in September 2018. Income expectations did ease but remain historically solid. Overall, the latest findings are surprisingly positive and suggest that households are well placed to provide at least some support to economic growth over the near-term.

The week was also loaded with surveys on business confidence and, for Germany, the results are similar though, perhaps, less promising. Ifo's latest survey found a marginal and much as expected improvement in business sentiment in September. At 94.6, the climate indicator was 0.3 points above August to unwind at least some of August's 1.3 point drop. September marked the first increase since May and only the second since September last year. The improvement was wholly attributable to current conditions which gained 1.1 points to 98.5. By contrast, expectations continued to decline. A 0.5 point slide to a lower than anticipated 90.8 was the fourth drop in a row and the worst showing since all the way back in June 2009. At a sector level, confidence improved in services and construction but fell to new multi-year lows in both manufacturing and trade. Despite the minor improvements, these results are once again disappointingly weak. Although, strictly speaking, not yet indicative of recession, the trend remains firmly in that direction. The week was also loaded with surveys on business confidence and, for Germany, the results are similar though, perhaps, less promising. Ifo's latest survey found a marginal and much as expected improvement in business sentiment in September. At 94.6, the climate indicator was 0.3 points above August to unwind at least some of August's 1.3 point drop. September marked the first increase since May and only the second since September last year. The improvement was wholly attributable to current conditions which gained 1.1 points to 98.5. By contrast, expectations continued to decline. A 0.5 point slide to a lower than anticipated 90.8 was the fourth drop in a row and the worst showing since all the way back in June 2009. At a sector level, confidence improved in services and construction but fell to new multi-year lows in both manufacturing and trade. Despite the minor improvements, these results are once again disappointingly weak. Although, strictly speaking, not yet indicative of recession, the trend remains firmly in that direction.

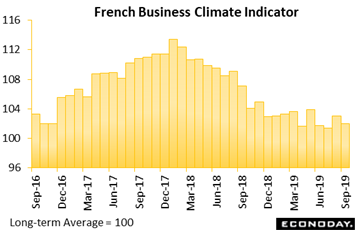

In France, business sentiment has been holding up much better than in Germany. September's 102 for the business climate index, published by the National Institute of Statistics and Economic Studies (INSEE), was down just 1 point versus August to extend a broadly stable trend seen so far in 2019. The dip in September masked a slight increase in order books which, however, are still well short of their levels last year. Past production was a little softer while expectations were mixed with the personal production outlook slipping in contrast to an improving prognosis for general industry. Economy-wide sentiment was up 1 point at 106, making for a third quarter average of also 106 that match's the second quarter average. Morale was a little more optimistic in construction and services and more notably so in retail trade. For all the major sectors, September's results show morale remaining above its long-run averages. This should be consistent with sustained economic growth for France this quarter which, while unlikely to be particularly robust, should still beat the Eurozone average. In France, business sentiment has been holding up much better than in Germany. September's 102 for the business climate index, published by the National Institute of Statistics and Economic Studies (INSEE), was down just 1 point versus August to extend a broadly stable trend seen so far in 2019. The dip in September masked a slight increase in order books which, however, are still well short of their levels last year. Past production was a little softer while expectations were mixed with the personal production outlook slipping in contrast to an improving prognosis for general industry. Economy-wide sentiment was up 1 point at 106, making for a third quarter average of also 106 that match's the second quarter average. Morale was a little more optimistic in construction and services and more notably so in retail trade. For all the major sectors, September's results show morale remaining above its long-run averages. This should be consistent with sustained economic growth for France this quarter which, while unlikely to be particularly robust, should still beat the Eurozone average.

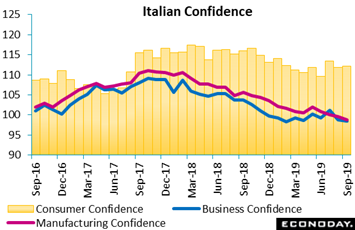

Confidence has also been holding up in Italy though deterioration here and there is evident. At 98.5 business confidence, published by the Italian statistic office (Istat), was 0.3 points short of August and at a 7-month low. The headline decline was mirrored in manufacturing where morale slipped a further 0.8 points to 98.8, its fourth decline in as many months and its worst outturn in nearly five years. Confidence was also down in retail trade but improved in both services and construction. Turning to consumers, they were a little more upbeat with the sentiment gauge here rising 0.3 points to 112.2. The consumer index has spent most of the year moving between 110 and 114 and September suggests a broadly flat underlying trend. Overall, September's results point to no near-term pick-up in business activity, a reminder that the coming week's PMI data for September are expected to track a zero pace for economic growth. Confidence has also been holding up in Italy though deterioration here and there is evident. At 98.5 business confidence, published by the Italian statistic office (Istat), was 0.3 points short of August and at a 7-month low. The headline decline was mirrored in manufacturing where morale slipped a further 0.8 points to 98.8, its fourth decline in as many months and its worst outturn in nearly five years. Confidence was also down in retail trade but improved in both services and construction. Turning to consumers, they were a little more upbeat with the sentiment gauge here rising 0.3 points to 112.2. The consumer index has spent most of the year moving between 110 and 114 and September suggests a broadly flat underlying trend. Overall, September's results point to no near-term pick-up in business activity, a reminder that the coming week's PMI data for September are expected to track a zero pace for economic growth.

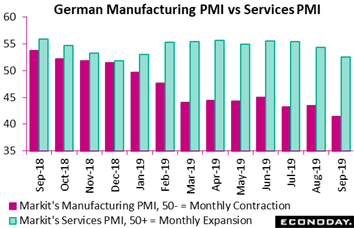

There's no louder alarm of trouble being sounded in any economic data than in Germany's manufacturing PMI. The flash for September fell to 41.4, a 10-year low for this sample and more than 2 points short of August's 43.5. Output at 42.7 collapsed in September, declining at its sharpest rate since July 2012. And ominously, new orders fell for a third straight month with sentiment in the sector holding close to record lows. Given the collapse in manufacturing, spillover concern is building for Germany's services sector which, at 52.5, at least held above 50 in September though well down from August's 54.8 and a 9-month trough. September's flash results point to a significant and surprisingly sharp deterioration in German business activity with combined manufacturing and services composite at a 7-year low. There's no louder alarm of trouble being sounded in any economic data than in Germany's manufacturing PMI. The flash for September fell to 41.4, a 10-year low for this sample and more than 2 points short of August's 43.5. Output at 42.7 collapsed in September, declining at its sharpest rate since July 2012. And ominously, new orders fell for a third straight month with sentiment in the sector holding close to record lows. Given the collapse in manufacturing, spillover concern is building for Germany's services sector which, at 52.5, at least held above 50 in September though well down from August's 54.8 and a 9-month trough. September's flash results point to a significant and surprisingly sharp deterioration in German business activity with combined manufacturing and services composite at a 7-year low.

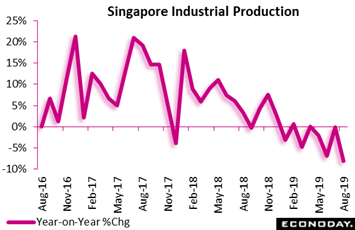

Once again the backdrop for Germany's trouble – slowing global growth – is the same for the US and China and can be especially evident in smaller economies. Manufacturing output in Singapore fell 8.0 percent on the year in August to deepen a long string of declines. Industrial production has now contracted for six consecutive months, broadly in line with similar weakness in Singapore's exports over this period. Weaker headline growth in August was largely driven by electronics output, which was down 24.4 percent on the year after no change previously. Precision engineering and general manufacturing industries also recorded weaker growth. This was partly offset by stronger growth in biomedical output which was up 10.6 percent on the year and with growth also stronger for the transport engineering and chemical industries. Excluding the volatile biomedical industry, manufacturing output fell 12.4 percent on the year in August after dropping 0.4 percent in July. Once again the backdrop for Germany's trouble – slowing global growth – is the same for the US and China and can be especially evident in smaller economies. Manufacturing output in Singapore fell 8.0 percent on the year in August to deepen a long string of declines. Industrial production has now contracted for six consecutive months, broadly in line with similar weakness in Singapore's exports over this period. Weaker headline growth in August was largely driven by electronics output, which was down 24.4 percent on the year after no change previously. Precision engineering and general manufacturing industries also recorded weaker growth. This was partly offset by stronger growth in biomedical output which was up 10.6 percent on the year and with growth also stronger for the transport engineering and chemical industries. Excluding the volatile biomedical industry, manufacturing output fell 12.4 percent on the year in August after dropping 0.4 percent in July.

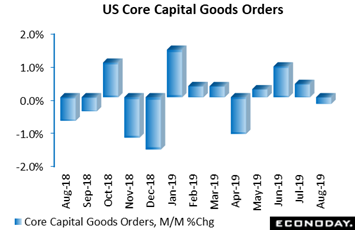

All this trouble in manufacturing, whether in small economies or large economies, is a major negative for the business investment outlook. And fizzling capital goods orders were the unwelcome headlines coming out of the US durable goods report. Core capital goods orders (nondefense ex-air) fell 0.2 percent on the month in August and included a major downward revision to July which had been at plus 0.4 percent but is now, like August, at no change. These two readings are not favorable indications for business investment trends, the lynchpin to Federal Reserve rate-cut policy and policy maker concerns that slowing global growth will eat into US manufacturing. Electrical equipment as well as communications equipment, which are both important pieces of the capital goods group, posted sharp monthly declines in August while computers & electronic products also posted a decline. These were more than enough to offset gains for primary metals, fabrications, and also machinery all of which also feed into the capital goods reading. For the calculation of GDP, orders don't count but shipments do and here the news wasn't much better as a 0.4 percent August rise was more than erased by a 0.6 percent July decline. Business investment has been a strong contributor to US GDP for the past couple of years but this trend appears to be, or already has come to an end. All this trouble in manufacturing, whether in small economies or large economies, is a major negative for the business investment outlook. And fizzling capital goods orders were the unwelcome headlines coming out of the US durable goods report. Core capital goods orders (nondefense ex-air) fell 0.2 percent on the month in August and included a major downward revision to July which had been at plus 0.4 percent but is now, like August, at no change. These two readings are not favorable indications for business investment trends, the lynchpin to Federal Reserve rate-cut policy and policy maker concerns that slowing global growth will eat into US manufacturing. Electrical equipment as well as communications equipment, which are both important pieces of the capital goods group, posted sharp monthly declines in August while computers & electronic products also posted a decline. These were more than enough to offset gains for primary metals, fabrications, and also machinery all of which also feed into the capital goods reading. For the calculation of GDP, orders don't count but shipments do and here the news wasn't much better as a 0.4 percent August rise was more than erased by a 0.6 percent July decline. Business investment has been a strong contributor to US GDP for the past couple of years but this trend appears to be, or already has come to an end.

We end the week's data run with trade data, one set out of a small economy and one out of a very large economy with both offering an explanation on why manufacturing sectors are on the slide. Hong Kong's merchandise trade deficit narrowed from HK$32.2 billion in July to HK$28.0 billion in August, the smallest deficit since January. But like other countries, the improved trade headline masks contraction on both sides of the ledger. Exports dropped 6.3 percent on the year in August after falling 5.7 percent in July, while imports declined 11.1 percent after falling 8.7 percent. External demand from major markets was again weak, with exports to mainland China, amid civil unrest, down 5.2 percent on the year and those to the US down 8.8 percent. Officials again cited weaker global growth and ongoing trade tensions between the US and China as factors weighing on exports and noted that these factors continue to represent downside risks to what they already expect will be weak performance in the near-term. We end the week's data run with trade data, one set out of a small economy and one out of a very large economy with both offering an explanation on why manufacturing sectors are on the slide. Hong Kong's merchandise trade deficit narrowed from HK$32.2 billion in July to HK$28.0 billion in August, the smallest deficit since January. But like other countries, the improved trade headline masks contraction on both sides of the ledger. Exports dropped 6.3 percent on the year in August after falling 5.7 percent in July, while imports declined 11.1 percent after falling 8.7 percent. External demand from major markets was again weak, with exports to mainland China, amid civil unrest, down 5.2 percent on the year and those to the US down 8.8 percent. Officials again cited weaker global growth and ongoing trade tensions between the US and China as factors weighing on exports and noted that these factors continue to represent downside risks to what they already expect will be weak performance in the near-term.

Sharp improvement in agricultural exports was an isolated highlight of an otherwise subdued August report on US goods trade that shows continued weakness overall for exports and limited results for imports. August's goods deficit totaled $72.8 billion which hints at possible improvement for third-quarter net exports. Yet exports overall managed only a 0.1 percent gain in the month with the year-on-year rate, as tracked in the red line of the graph, still in the negative column at minus 0.3 percent. Imports did rise 0.3 percent in the month to reverse the prior month's 0.3 percent decline but this yearly rate is also in the negative column at minus 1.3 percent. Exports of foods, feeds & beverages jumped 4.2 percent in the month to lift this yearly rate to plus 8.4 percent in results that will raise talk of Chinese buying. Note that country breakdowns for August won't be available until the coming week's international trade report that will also include data on cross-border services trade. Global trade has been slowing and may well be in contraction right now, a trend that offers arguments for the doves at the Fed to push for further rate cuts. Sharp improvement in agricultural exports was an isolated highlight of an otherwise subdued August report on US goods trade that shows continued weakness overall for exports and limited results for imports. August's goods deficit totaled $72.8 billion which hints at possible improvement for third-quarter net exports. Yet exports overall managed only a 0.1 percent gain in the month with the year-on-year rate, as tracked in the red line of the graph, still in the negative column at minus 0.3 percent. Imports did rise 0.3 percent in the month to reverse the prior month's 0.3 percent decline but this yearly rate is also in the negative column at minus 1.3 percent. Exports of foods, feeds & beverages jumped 4.2 percent in the month to lift this yearly rate to plus 8.4 percent in results that will raise talk of Chinese buying. Note that country breakdowns for August won't be available until the coming week's international trade report that will also include data on cross-border services trade. Global trade has been slowing and may well be in contraction right now, a trend that offers arguments for the doves at the Fed to push for further rate cuts.

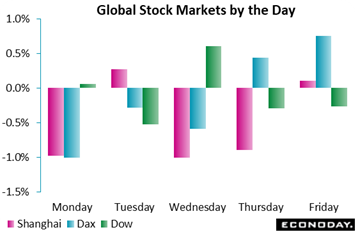

The preliminary move by Congress to impeach President Trump, and with it increased unpredictability for the political outlook and also the trade outlook, has so far had only a limited effect on global stock markets where major averages held up well in the week, with the Dow down only 0.4 percent and with Germany's Dax down 0.7 percent. Shanghai did fall 2.5 percent in the week but this is a pint-size move for this always volatile composite. And though there were moves into the bond market as the impeachment headlines unrolled at mid-week, there was very little movement into the safety of Treasuries by week's end as the 10-year yield edged only a few basis points lower to 1.68 percent. And the news certainly hasn't hurt the dollar which, on the dollar index, rose 0.8 percent on the week to 99.10. Whether the dollar would continue to climb if the impeachment builds steam is uncertain, as would the reaction if the impeachment loses steam. At least so far, Congress' investigation has not been a major market mover. The preliminary move by Congress to impeach President Trump, and with it increased unpredictability for the political outlook and also the trade outlook, has so far had only a limited effect on global stock markets where major averages held up well in the week, with the Dow down only 0.4 percent and with Germany's Dax down 0.7 percent. Shanghai did fall 2.5 percent in the week but this is a pint-size move for this always volatile composite. And though there were moves into the bond market as the impeachment headlines unrolled at mid-week, there was very little movement into the safety of Treasuries by week's end as the 10-year yield edged only a few basis points lower to 1.68 percent. And the news certainly hasn't hurt the dollar which, on the dollar index, rose 0.8 percent on the week to 99.10. Whether the dollar would continue to climb if the impeachment builds steam is uncertain, as would the reaction if the impeachment loses steam. At least so far, Congress' investigation has not been a major market mover.

Whether impeachment news is or isn't affecting confidence, whether for businesses or consumers or whether in the US or elsewhere, will be something to watch for in October's reports, global central bankers certainly will. Going into the new month, confidence readings on net were mostly soft but nevertheless roughly steady, resilience that reflects continued growth in service sectors and with that growth in global employment that continues to offset down moves in manufacturing and trade. Yet there may be a special warning in the week's data, and that's the decline in US capital goods orders, one that suggests businesses, instead of showing greater spirits, may be planning to take cover instead.

**Jeremy Hawkins and Brian Jackson contributed to this article

The week gets rolling early Monday morning out of Japan and China with industrial production and retail sales for the former and manufacturing PMIs for the latter, none of which are expected to show much acceleration. Switzerland will be in focus later Monday with leading indicators expected to be sluggish once again. Inflation data in the week will be highlighted by September's preliminary CPI out of Germany and once again increasing pressure is not the call. Tuesday opens with the quarterly Tankan survey followed by a rate decision by the rate-cutting Reserve Bank of Australia, though the call for the upcoming meeting is a toss up. ISM manufacturing data will be another Tuesday highlight with the rest of the week likely to be slow for market-moving numbers, that is until Friday and the US employment report where improved payroll growth combined with steady and visible wage pressure are the expectations, results that would not be raising many calls for further Federal Reserve rate cuts.

Japanese Industrial Production for August (Sun 19:50 EDT; Sun 23:50 GMT: Mon 08:50 JST)

Consensus Forecast: 0.3%

Industrial production has been up and down and was up 1.3 percent on the month in June. A limited 0.3 percent bounce higher is the expectation for August.

Japanese Retail Sales for August (Sun 19:50 EDT; Mon 23:50 GMT: Mon 08:50 JST)

Consensus Forecast, Year-over-Year: -0.4%

Retail sales are expected to contract 0.4 percent in August after missing expectations for a second month in a row in July, at 2.0 percent year-on-year contraction. Food and beverage sales were down in July though vehicle sales rebounded.

China: CFLP Manufacturing PMI for September (Sun 21:00 EDT; Mon 01:00 GMT; Mon 09:00 CST)

Consensus Forecast: 49.7

The CFLP manufacturing PMI in August, at 49.5, indicated contraction for the fourth straight month. For September, forecasters see a fifth straight month of contraction but only of very marginal contraction at a 49.7 consensus .

China: Caixin Manufacturing PMI for September (Sun 21:45 EDT; Mon 01:45 GMT; Mon 09:45 CST)

Consensus Forecast: 50.0

The Caixin PMI edged over the breakeven 50 line in August to 50.4 in a mostly favorable report that, however, included a sharp drop in export orders. The consensus for September's index is 50.0 even.

Switzerland: KOF Swiss Leading Indicator for September (Mon 03:00 EDT; Mon 07:00 GMT; Mon 09:00 CEST)

Consensus Forecast: 97.0%

The KOF Swiss leading indicator is expected to hold unchanged at 97.0 percent in September after showing little change in August which was the tenth straight sub-100 showing.

German Preliminary CPI for September (Mon 08:00 EDT; Mon 12:00 GMT; Mon 14:00 CEST)

Consensus Forecast, Month-to-Month: 0.1%

Consensus Forecast, Year-over-Year: 1.3%

Food and energy prices have been weak but so have overall goods prices. After a minus 0.2 percent monthly showing in August and a 1.4 percent year-on-year rate, forecasters see September coming in at plus 0.1 percent on the month and 1.3 percent on the year.

Japanese Tankan for the Third Quarter (Mon 19:50 EDT; Mon 23:50 GMT; Tue 08:50 JST)

Consensus Forecast, Large Manufacturers: 3

Consensus Forecast, Small Manufacturers: -3

Consensus Forecast, Capex Change: 7.9

For the third quarter Tankan survey, deterioration is the call with the consensus for large manufacturers at 3 versus 7 in the second quarter and minus 3 versus minus 1 for small manufacturing. The capex reading is expected to come in at 7.9 versus the second quarter's 7.4.

Reserve Bank of Australia Announcement for October (Tue 00:30 EDT; Tue 04:30 GMT; Tue 14:30 AET)

Consensus Forecast, Change: No consensus

Consensus Forecast, Level: No consensus

It's up in the air whether the Reserve Bank of Australia holds its policy rate at 1.00 percent or cuts it by 25 basis points to 0.75 percent. There is still slack in the labor market though the closer the policy rate gets to zero, the more limited the bank's policy flexibility would become.

US: ISM Manufacturing Index for September (Tue 10:00 EDT; Tue 14:00 GMT)

Consensus Forecast: 50.0

Consensus Range: 49.1 to 52.0

Stalling growth has been this year's consistent signal from the ISM manufacturing index which in August came in at 49.1 for a multi-year low and with sub-50 contraction in new orders, at 47.2, pointing to general trouble for the September report. For September, Econoday's consensus is 50.0 even that would indicate no change in monthly composite activity.

Australian Merchandise Trade for August (Wed 21:30 EDT; Thu 00:30 GMT; Thu 11:30 AET)

Consensus Forecast: A$7.5 billion

Imports rose sharply at the same time that export growth slowed making for a lower-than-expected A$7.268 billion surplus in July. For August, the consensus is a rise in the surplus to A$7.5 billion.

US Nonfarm Payrolls for September (Fri 08:30 EDT; Fri 12:30 GMT)

Consensus Forecast: 145,000

Consensus Range: 120,000 to 179,000

Unemployment Rate

Consensus Forecast: 3.7%

Consensus Range: 3.6% to 3.8%

Private Payrolls

Consensus Forecast: 135,000

Consensus Range: 105,000 to 166,000

Manufacturing Payrolls

Consensus Forecast: 3,000

Consensus Range: -12,000 to 6,000

Participation Rate

Consensus Forecast: 63.1%

Consensus Range: 63.0% to 63.2%

Average Hourly Earnings

Consensus Forecast, Month-to-Month Change: 0.3%

Consensus Range: 0.2% to 0.3%

Average Hourly Earnings

Consensus Forecast, Year-on-Year Change: 3.2%

Consensus Range: 3.1% to 3.4%

Average Workweek

Consensus Forecast: 34.4 hours

Consensus Range: 34.4 to 34.5 hours

Improved payroll growth is the expectation for September nonfarm payrolls, at a consensus 145,000 versus a much lower-than-expected 130,000 increase August. The unemployment rate is seen holding steady at 3.7 percent with average hourly earnings, which have been moving higher including a 0.4 percent jump in August, continuing to show heat with a monthly increase of 0.3 percent. The year-on-year rate for earnings is expected to hold steady in September at 3.2 percent. Private payrolls are seen rising 135,000 with manufacturing payrolls, which have been soft and were revised lower in the August report, expected to increase but only by 3,000. A rise in the participation rate to 63.2 percent, along with wages, was another signal of capacity constraint in the August report with this rate expected to ease to 63.1 percent. The workweek is seen steady at 34.4 hours.

|