|

The US jobs report of the latest week proved stronger than expected but, despite still heated wage growth, didn’t upset assumptions for a Federal Reserve rate cut, still off somewhere in the not-too-distant future. With the jobs report out of the way, the US consumer price report on Thursday of the coming week could prove to be the year’s first major economic event. In addition to the regular month-over-month and year-over-year data, December’s report will also include a reading on half-year change. If price pressures abated more rapidly in the second half of 2023 than in the first half, it could cement a pause at the month-end FOMC and help firm up everyone’s rate-cut forecasts. But the US is slow to report its inflation data, and flash reports from other economies could provide early clues on what to expect.

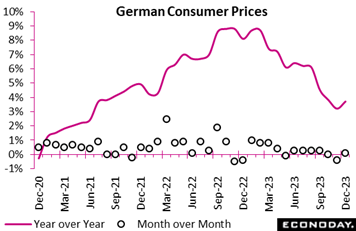

German inflation accelerated for the first time since last June. With prices having fallen a monthly 0.4 percent a year ago, a provisional 0.1 percent rise was enough to lift the annual inflation rate from November's 3.2 percent to 3.7 percent in December. That said, following November's sharp drop this was only a 2-month high and on the soft side of Econoday’s consensus. German inflation accelerated for the first time since last June. With prices having fallen a monthly 0.4 percent a year ago, a provisional 0.1 percent rise was enough to lift the annual inflation rate from November's 3.2 percent to 3.7 percent in December. That said, following November's sharp drop this was only a 2-month high and on the soft side of Econoday’s consensus.

Acceleration was fed by energy where inflation jumped from minus 4.5 percent to plus 4.1 percent. This lay behind the rate for overall goods jumping 1.1 percentage points to 4.1 percent. However, elsewhere, inflation in services eased from 3.4 percent to 3.2 percent while food dropped a full percentage point to 4.5 percent. As a result, the core rate, which is the focus for the European Central Bank, declined from 3.8 percent to 3.5 percent.

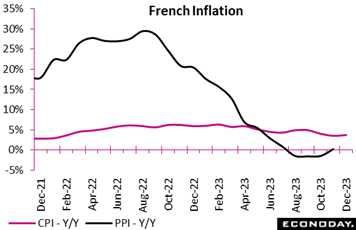

Inflation also moved higher in France, from 3.5 percent to an as-expected 3.7 percent in December. Like Germany, energy prices accounted for much of the increase, with this annual rate rising to 5.6 percent from 3.1 percent as base effects fell away. Food price inflation – while still elevated – declined to an annual rate of 7.1 percent from 7.7 percent. Sticky service inflation may raise some eyebrows among policy setters, rising to an annual 3.1 percent from 2.8 percent in November. Manufactured goods prices rose by 1.4 percent, down from 1.9 percent previously. Inflation also moved higher in France, from 3.5 percent to an as-expected 3.7 percent in December. Like Germany, energy prices accounted for much of the increase, with this annual rate rising to 5.6 percent from 3.1 percent as base effects fell away. Food price inflation – while still elevated – declined to an annual rate of 7.1 percent from 7.7 percent. Sticky service inflation may raise some eyebrows among policy setters, rising to an annual 3.1 percent from 2.8 percent in November. Manufactured goods prices rose by 1.4 percent, down from 1.9 percent previously.

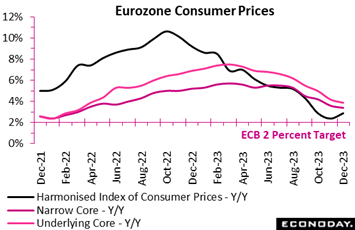

Turning from national data to harmonised data for the entire Eurozone, inflation accelerated at year-end for the first time since last October. However, at 2.9 percent, up from November's final 2.4 percent, the December print was less than the market consensus and essentially just attributable to the base effects caused by a 0.4 percent monthly fall in prices a year ago. Turning from national data to harmonised data for the entire Eurozone, inflation accelerated at year-end for the first time since last October. However, at 2.9 percent, up from November's final 2.4 percent, the December print was less than the market consensus and essentially just attributable to the base effects caused by a 0.4 percent monthly fall in prices a year ago.

More importantly, core inflation continued to fall. The narrowest measure was down a further 0.2 percentage points at 3.4 percent, matching Econoday’s consensus and its lowest post since March 2022. Excluding just energy and unprocessed food, the underlying rate declined an even sharper 0.3 percentage points to 3.9 percent. Among details, inflation in non-energy industrial goods decreased from 2.9 percent to 2.5 percent while services were flat at 4.0 percent. Consequently, with food, alcohol and tobacco (6.1 percent after 6.9 percent) also weaker, the headline boost came from a sharp jump in energy (minus 6.7 percent after minus 11.5 percent).

Regionally, inflation was up in most member states; headline rates in all countries are now back above zero. That said, several, including Italy (0.5 percent), remain below the 2 percent target.

Accordingly, despite the bounce in overall inflation, the December data should go down well at the ECB. Further progress on the core rates will be needed to facilitate a cut in key interest rates but December’s update, along with the November producer price report which we’ll turn to next, clearly keeps the door open to easing later in the year.

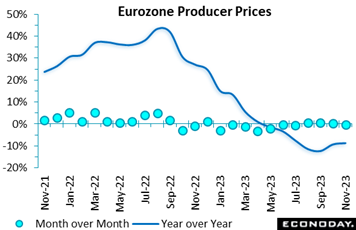

Producer prices in the Eurozone were surprisingly soft in November. A 0.3 percent monthly drop was 0.2 percentage points steeper than the market consensus and the first fall since July. The annual rate remained deeply negative at minus 8.8 percent. Producer prices in the Eurozone were surprisingly soft in November. A 0.3 percent monthly drop was 0.2 percentage points steeper than the market consensus and the first fall since July. The annual rate remained deeply negative at minus 8.8 percent.

On the month, there were broad-based declines among the main components with consumer non-durables (0.0 percent) the only exception. Energy was down 0.8 percent, intermediates 0.5 percent and both capital goods and consumer durables 0.1 percent. Excluding energy, prices fell 0.2 percent for a fourth straight month, reducing the annual core inflation rate from minus 0.2 percent to minus 0.5 percent.

Regionally, the national PPI fell on the month in Germany (0.5 percent), Italy (1.2 percent) and Spain (2.1 percent) but rose in France (2.4 percent).

The latest slide in core prices underscores a clear downward trend in underlying pipeline pressures in Eurozone manufacturing. The sector remains firmly on track to help the ECB meet its 2 percent HICP target sooner than expected just a few months ago.

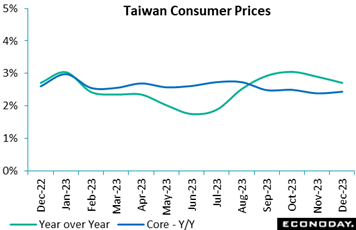

Taiwan's headline consumer price inflation moderated from 2.90 percent in November to a four-month low of 2.71 percent in December, with the index advancing 0.29 percent on the month after a previous decline of 0.07 percent. The moderation in headline inflation was largely driven by a decline in food prices as supply recovered from previous adverse weather conditions. Core inflation, which excludes fruits, vegetables, and energy prices, increased slightly from 2.38 percent to 2.43 percent. Taiwan's headline consumer price inflation moderated from 2.90 percent in November to a four-month low of 2.71 percent in December, with the index advancing 0.29 percent on the month after a previous decline of 0.07 percent. The moderation in headline inflation was largely driven by a decline in food prices as supply recovered from previous adverse weather conditions. Core inflation, which excludes fruits, vegetables, and energy prices, increased slightly from 2.38 percent to 2.43 percent.

Taiwan's central bank, the Central Bank of China, held its quarterly policy meeting in mid-December, with officials leaving the benchmark discount rate unchanged at 1.875 percent. Officials published revised inflation forecasts at that meeting, with headline inflation forecast to fall from 2.46 percent in 2023 to 1.89 percent in 2024 and core inflation forecast to fall from 2.61 percent to 1.83 percent.

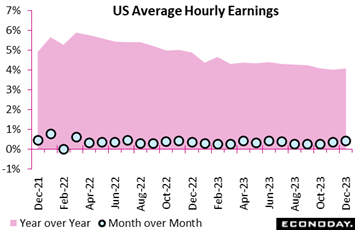

Consumer inflation in the US has cooled though the core rate, at 4.0 percent in November’s report, remained double what the Federal Reserve wants. December consumer prices, to be posted on Thursday of the coming week, are expected to show only limited improvement (see Looking Ahead for details). The CPI won’t be getting much relief from wages as average hourly earnings in December are likewise double what the Fed wants, up 0.4 percent on the month and 4.1 percent on the year, both higher than November and both just beyond Econoday’s consensus ranges. Nevertheless, stability as opposed to acceleration would be a fair assessment of the US wage picture. Consumer inflation in the US has cooled though the core rate, at 4.0 percent in November’s report, remained double what the Federal Reserve wants. December consumer prices, to be posted on Thursday of the coming week, are expected to show only limited improvement (see Looking Ahead for details). The CPI won’t be getting much relief from wages as average hourly earnings in December are likewise double what the Fed wants, up 0.4 percent on the month and 4.1 percent on the year, both higher than November and both just beyond Econoday’s consensus ranges. Nevertheless, stability as opposed to acceleration would be a fair assessment of the US wage picture.

December’s employment report as a whole was also stronger than expected; nonfarm payrolls rose 216,000, which was also above the Econoday’s consensus range, though in an offset the two prior month were revised downward by a net 71,000. The monthly average for the fourth quarter was 165,000 compared to 221,000 in the third quarter. This broadly slower trend in payroll growth is consistent with the FOMC's forecast for a loosening of conditions in the labor market in line with modest economic expansion.

Private payrolls rose 164,000 in December with goods-producers adding 22,000 jobs and service-providers gaining 142,000. Among goods-producers, construction rose 17,000 and reflecting homebuilding and home renovation given low inventories of existing homes on the market. Payroll increases among service-providers were broad-based. The most substantial gain was for education and health services at 74,000, or a little under half of the private service sector. Government payrolls rose 52,000 in December with substantial hiring at the local government level with 19,200 in education and 17,700 excluding education jobs.

The unemployment rate held steady at 3.7 percent while the U-6 unemployment rate – which includes those persons marginally attached to the labor force and those working part-time for economic reasons – edged up a tenth to 7.1 percent. There is a hint here that those who have more difficulty in finding a full-time job – for whatever reason – are not as able to participate as they might want.

The labor force participation rate fell 3 tenths to 62.5 percent in December, its lowest since 62.5 percent in February. The decline suggests that rebalancing of labor supply with labor demand suffered a setback in December. In separate data, layoff readings eased in December as did job openings, the latter falling 62,000 in data for November to 8.790 million. Though openings have fallen for four straight months, levels remain plentiful and above those of the pre-pandemic period.

Employment was virtually unchanged in December as the Canadian economy added only 100 jobs, far less than the 10,000 consensus expectation in Econoday’s survey. Full-time employment fell 23,500 in December while part-time increased 23,600. The unemployment rate held unchanged at 5.8 percent, below the 5.9 percent consensus, with the participation rate edging down to 65.4 percent from 65.6 percent the previous month, the lowest in a year. Employment was virtually unchanged in December as the Canadian economy added only 100 jobs, far less than the 10,000 consensus expectation in Econoday’s survey. Full-time employment fell 23,500 in December while part-time increased 23,600. The unemployment rate held unchanged at 5.8 percent, below the 5.9 percent consensus, with the participation rate edging down to 65.4 percent from 65.6 percent the previous month, the lowest in a year.

Yet, in a setback for the Bank of Canada, the jobs slowdown failed to translate into softer wage inflation. To the contrary, unadjusted average hourly wages rose 5.4 percent year-over-year compared with 4.8 percent in November.

Goods-producing industries shed 42,900 positions in December, with weakness across manufacturing, construction and agriculture, which together lost nearly 50,000 jobs. Employment rose slightly in natural resources and utilities.

By contrast, services added 43,100 jobs over the month, led by a 45,700 surge in professional, scientific and technical services, a 15,500 increase in health care and social assistance, and a 12,000 advance in other services excluding administration. Wholesale and retail trade employment fell 20,600 and business, building and other support services were down 13,600.

For 2023 as a whole, the Canadian economy added 430,300 jobs, up from 409,100 in 2022. However, the slowdown was noticeable in the second half of the year, with 139,800 jobs added, down from 290,500 in the first half of 2023.

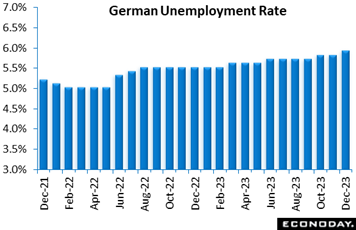

Germany’s labour market was broadly stable at year-end. A 5,000 monthly increase in joblessness was well down from November's 21,000 rise but still large enough to lift the unemployment rate a tenth to 5.9 percent. There was better news on vacancies which climbed 6,000, yet unemployment’s slow upward creep makes recession more likely when fourth-quarter GDP is posted at month end. Germany’s labour market was broadly stable at year-end. A 5,000 monthly increase in joblessness was well down from November's 21,000 rise but still large enough to lift the unemployment rate a tenth to 5.9 percent. There was better news on vacancies which climbed 6,000, yet unemployment’s slow upward creep makes recession more likely when fourth-quarter GDP is posted at month end.

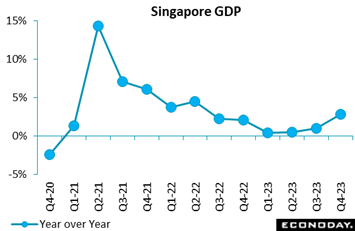

Singapore is always the first on Econoday’s calendar to post GDP first estimates and the results for the fourth quarter are favorable. GDP expanded by 1.7 percent on the quarter after advancing 1.3 percent in the third quarter. Annually, GDP rose 2.8 percent from the prior quarter’s increase of 1.0 percent. Growth was driven by the manufacturing sector which increased 9.0 percent on the quarter after a previous increase of just 0.3 percent. Service sector output weakened however, with output flat on the quarter after advancing 1.1 percent previously. Construction activity rose 4.3 percent after a previous increase of 0.8 percent. Singapore is always the first on Econoday’s calendar to post GDP first estimates and the results for the fourth quarter are favorable. GDP expanded by 1.7 percent on the quarter after advancing 1.3 percent in the third quarter. Annually, GDP rose 2.8 percent from the prior quarter’s increase of 1.0 percent. Growth was driven by the manufacturing sector which increased 9.0 percent on the quarter after a previous increase of just 0.3 percent. Service sector output weakened however, with output flat on the quarter after advancing 1.1 percent previously. Construction activity rose 4.3 percent after a previous increase of 0.8 percent.

Officials at the Monetary Authority of Singapore left policy settings on hold at their most recent semi-annual review in October. Officials judged then that the outlook for domestic growth remained "muted" in the near-term but should improve gradually over 2024.

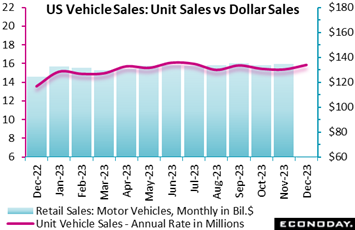

How fourth-quarter GDP plays out in the US may well depend on the outcome of the December retail sales report which will be posted on Wednesday, January 17. And early indications from the month’s unit vehicle sales will have forecasters lifting their estimates for this report. Sales climbed sharply to a 15.8 million annual rate from November’s 15.3 million which was far above 13.6 million in December 2022 and well above Econoday’s consensus for 15.4 million. Light trucks, which include minivans, SUVs, and crossovers, rose to a 12.8 million pace from 12.3 million and accounted for 81 percent of December’s sales. Dealers have responded to high financing costs with promotions and incentives. How fourth-quarter GDP plays out in the US may well depend on the outcome of the December retail sales report which will be posted on Wednesday, January 17. And early indications from the month’s unit vehicle sales will have forecasters lifting their estimates for this report. Sales climbed sharply to a 15.8 million annual rate from November’s 15.3 million which was far above 13.6 million in December 2022 and well above Econoday’s consensus for 15.4 million. Light trucks, which include minivans, SUVs, and crossovers, rose to a 12.8 million pace from 12.3 million and accounted for 81 percent of December’s sales. Dealers have responded to high financing costs with promotions and incentives.

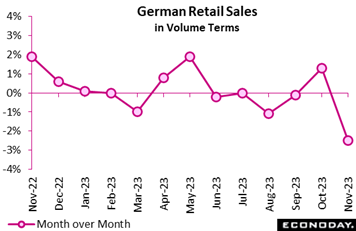

German retailers had a dismal November. Volumes slumped fully 2.5 percent on the month, falling well below the consensus and easily more than reversing October's upwardly revised 1.3 percent gain. The drop left sales at their lowest level since February 2021. It also reduced unadjusted annual growth from 0.2 percent to minus 2.0 percent. German retailers had a dismal November. Volumes slumped fully 2.5 percent on the month, falling well below the consensus and easily more than reversing October's upwardly revised 1.3 percent gain. The drop left sales at their lowest level since February 2021. It also reduced unadjusted annual growth from 0.2 percent to minus 2.0 percent.

Purchases of food were down 0.5 percent versus October but the real damage was done by the non-food sector where sales plummeted 3.6 percent with internet and mail order off 2.8 percent. However, there were some areas of strength with textiles and clothing up 2.0 percent.

November’s report makes for grim reading and leaves average overall volume sales in October/November 0.3 percent below their mean level in the third quarter. Absent any revisions, December will need a monthly jump of at least 2.3 percent just to keep the fourth quarter flat. As such, the sector looks very likely to have subtracted from quarterly GDP growth, boosting the likelihood of recession.

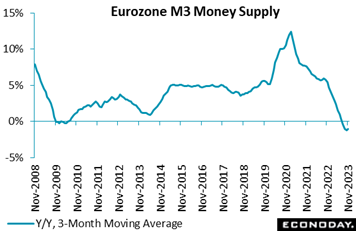

A weak performance for the Eurozone in the fourth quarter would be no surprise given declines underway in money supply. Annual broad money remained in contraction in November, at minus 0.9 percent following October's minus 1.0 percent and August's low of minus 1.3 percent. The headline 3-month moving average edged up from minus 1.2 percent to minus 1.0 percent, less weak than market expectations. A weak performance for the Eurozone in the fourth quarter would be no surprise given declines underway in money supply. Annual broad money remained in contraction in November, at minus 0.9 percent following October's minus 1.0 percent and August's low of minus 1.3 percent. The headline 3-month moving average edged up from minus 1.2 percent to minus 1.0 percent, less weak than market expectations.

The reduced pace of decline in the annual rate was largely attributable to narrow money M1 which saw a 9.5 percent drop following a 10.0 percent slide at the start of the quarter. Among the M3 counterparts, private sector loans rose 0.1 percent on the year, up from 0.0 percent. After adjustment for loan sales and securitisation as well for positions due to notable cash pooling services, the rate was unchanged at 0.4 percent. Within this, adjusted loans to households (0.5 percent after 0.6 percent) slowed further but to non-financial corporations (minus 0.4 percent after minus 0.9 percent) accelerated for the first time since October 2022.

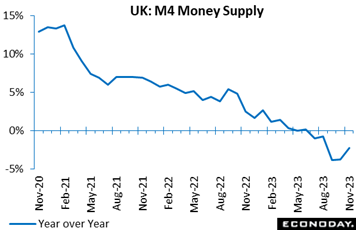

November’s money-supply data from the UK point to some stabilisation in overall economic activity and should bolster the case for Bank of England hawks arguing against any near-term rate cut. Broad M4 money did dip 0.1 percent on the month but with base effects positive, annual contraction eased from minus 3.8 percent to minus 2.3 percent. Even so, this was its fifth straight sub-zero print. However, lending expanded a monthly 0.5 percent, its steepest gain since September 2022 and large enough to boost yearly growth to minus 0.8 percent, a 9-month high. November’s money-supply data from the UK point to some stabilisation in overall economic activity and should bolster the case for Bank of England hawks arguing against any near-term rate cut. Broad M4 money did dip 0.1 percent on the month but with base effects positive, annual contraction eased from minus 3.8 percent to minus 2.3 percent. Even so, this was its fifth straight sub-zero print. However, lending expanded a monthly 0.5 percent, its steepest gain since September 2022 and large enough to boost yearly growth to minus 0.8 percent, a 9-month high.

Excluding intermediate other financial institutions, M4 also fell 0.1 percent versus October, its sixth drop since last April. By contrast, similarly adjusted lending was up a solid 0.6 percent and now stands only 0.2 percent lower on the year.

Elsewhere the financial data were mixed but modestly upbeat. In the housing market, November mortgage approvals climbed from 47,888 to 50,067, a 5-month high, although individuals made net loan repayments of £0.04 billion following a £0.1 billion repayment in October. At the same time, total consumer credit rose £2.005 billion, up from October's £1.411 billion gain and the steepest rise since March 2017.

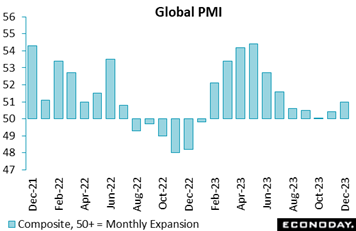

The week saw a heavy run of monthly purchasing managers data which on net were modestly positive. JP Morgan’s global composite managed a 6 tenths gain in December to 51.0 for the best level since July. China and India are among the leaders while Europe lags. The week saw a heavy run of monthly purchasing managers data which on net were modestly positive. JP Morgan’s global composite managed a 6 tenths gain in December to 51.0 for the best level since July. China and India are among the leaders while Europe lags.

The split between services and manufacturing widened slightly to the favor of the former where the global index rose a point to 51.6, also the best reading since July. Details here are led by a 1.2 point gain in new business to 51.7 which helped boost the index for future activity by 1.5 points to 63.2. Price readings show increasing pressure for costs, up 6 tenths to 57.6, and steady pressure for selling prices, down 2 tenths to 54.2.

Global manufacturing extended its long run of minimal contraction in December, at a PMI of 49.0 which is down 3 tenths from November. This index has held within a narrow range of 49.9 to 48.7 going back to September. Details include a 48.6 level for new orders which points to more of the same (modest sub-50 scores) for the headline index in the months ahead. Price readings here are better tamed than for the services sample, at 52.4 for costs and 51.5 for selling prices. Tame producer price inflation helps explain the sample's steady optimism, at 60.5 for future output.

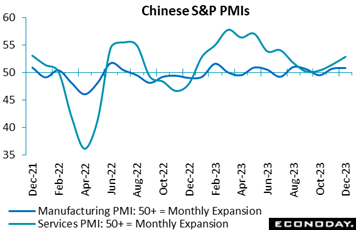

S&P’s PMI composite for China rose from 51.6 in November to 52.6 in December, indicating that the country's economy gained some momentum at the end of the year, largely driven by the services sector. The services headline rose from 51.5 to a five-month high of 52.9, while the manufacturing headline managed only a 1 tenth gain to 50.8, nevertheless a four-month high. S&P’s PMI composite for China rose from 51.6 in November to 52.6 in December, indicating that the country's economy gained some momentum at the end of the year, largely driven by the services sector. The services headline rose from 51.5 to a five-month high of 52.9, while the manufacturing headline managed only a 1 tenth gain to 50.8, nevertheless a four-month high.

Respondents to the services sample reported stronger increases in new orders and output as well as employment. The survey's measure of confidence increased to a three-month high. Respondents also reported stronger growth in input costs but a smaller increase in selling prices.

Manufacturing respondents reported slightly stronger output and new orders in December and a somewhat smaller decline in new export orders. Payrolls, however, were reported to have been cut for the fourth consecutive month and at a more pronounced rate, while the survey's measure of business confidence fell from its November level. Price pressures moderated in December.

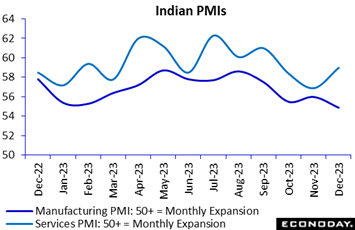

India's services PMI strengthened in December, increasing to 59.0 from 56.9 in November. The sample reported stronger growth in total new orders but weaker growth for export orders. Payrolls rose as did business confidence. Respondents reported a smaller increase in input costs but a bigger increase in selling prices. India's services PMI strengthened in December, increasing to 59.0 from 56.9 in November. The sample reported stronger growth in total new orders but weaker growth for export orders. Payrolls rose as did business confidence. Respondents reported a smaller increase in input costs but a bigger increase in selling prices.

The manufacturing PMI showed solid but slower growth, easing from 56.0 to 54.9. Respondents reported weaker growth for both new orders and new export orders though sales enquiries improved. Output slowed and payrolls increased modestly. Respondents reported steady increases in both input costs and selling prices in December.

Though manufacturing slowed, the rise in services lifted India’s composite PMI by more than a point to a very strong 58.5. Given the strength of the economy, the Reserve Bank of India's focus will likely remain on risks to the inflation outlook.

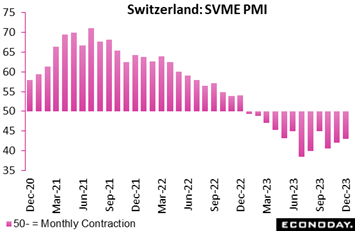

Swiss manufacturing activity contracted again at the end of 2023. At 43.0, the SVME PMI was up from November's lowly 42.1 but still well short of the 50-expansion threshold to complete an entire year of sub-50 readings. That said, the latest outturn was at least in line with the market consensus. Swiss manufacturing activity contracted again at the end of 2023. At 43.0, the SVME PMI was up from November's lowly 42.1 but still well short of the 50-expansion threshold to complete an entire year of sub-50 readings. That said, the latest outturn was at least in line with the market consensus.

All the components remained in negative growth territory although order books and purchasing volumes both recorded smaller falls than in mid-quarter. Production fell more sharply and purchase prices were sharply weaker.

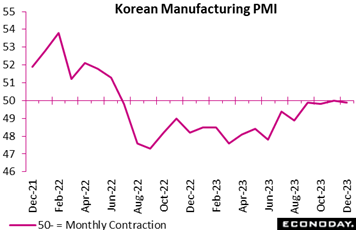

South Korea’s PMI showed conditions in the country’s manufacturing sector remained stagnant in December, with the survey's headline index at 49.9 from 50.0 in November. The sample reported steady but weak output, new orders, and new export orders in December but slightly stronger jobs growth. Business confidence fell back to its 2023 low. Respondents reported input costs rose at a slower but still significant pace while selling prices increased only marginally. South Korea’s PMI showed conditions in the country’s manufacturing sector remained stagnant in December, with the survey's headline index at 49.9 from 50.0 in November. The sample reported steady but weak output, new orders, and new export orders in December but slightly stronger jobs growth. Business confidence fell back to its 2023 low. Respondents reported input costs rose at a slower but still significant pace while selling prices increased only marginally.

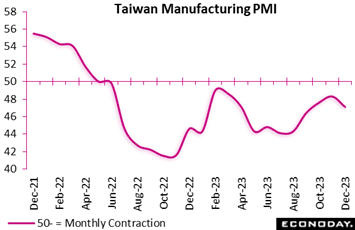

Taiwan’s manufacturing PMI contracted again in December and at a more pronounced pace, falling from 48.3 in November to 47.1. This survey has indicated contraction in the sector since the middle of 2022. Respondents, nevertheless, are modestly confident about the outlook. Survey respondents reported more pronounced declines in output, new orders, and new export orders in December but only a marginal decline in payrolls. Price pressures eased in December, with the survey showing a smaller increase in input costs and only a modest increase in selling prices. Taiwan’s manufacturing PMI contracted again in December and at a more pronounced pace, falling from 48.3 in November to 47.1. This survey has indicated contraction in the sector since the middle of 2022. Respondents, nevertheless, are modestly confident about the outlook. Survey respondents reported more pronounced declines in output, new orders, and new export orders in December but only a marginal decline in payrolls. Price pressures eased in December, with the survey showing a smaller increase in input costs and only a modest increase in selling prices.

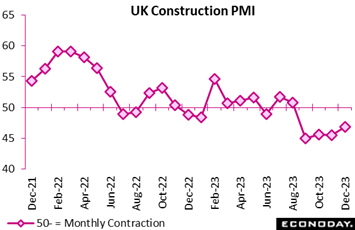

Construction activity in the UK fell again at year-end but by less than in November and also more slowly than expected. At 46.8, the sector PMI was 1.3 points firmer than in mid-quarter and while still well short of the 50-expansion threshold, some 0.8 points stronger than the market consensus. In fact, this was its highest reading in four months. Construction activity in the UK fell again at year-end but by less than in November and also more slowly than expected. At 46.8, the sector PMI was 1.3 points firmer than in mid-quarter and while still well short of the 50-expansion threshold, some 0.8 points stronger than the market consensus. In fact, this was its highest reading in four months.

In line with recent months, weakness was broad-based but dominated by the housing market where the subsector PMI (41.1) remained deep in recession territory. Elsewhere, commercial building (47.61) again held relatively firm while civil engineering (47.0) contracted at a notably less rapid pace than previously.

In a similar vein, aggregate new orders fell by less than in November and this prompted a return to positive growth for sector payrolls, albeit only marginal. Purchasing activity dropped by the least in four months and input costs decreased for a third straight month on the back of very competitive market conditions. Business confidence in the year ahead was modestly optimistic but contingent upon interest rates falling during the year.

Despite the surprisingly firm headline index, December's report still points to a poor fourth quarter for the construction industry which very probably subtracted from the period's GDP growth.

Global economic data are on an upswing reflected in the Relative Performance Index (RPI) which is at plus 15. Signs last week that the Eurozone economy might have been stronger than expected in December boosted the region’s RPI to 23 and the index less prices (RPI-P) to a solid 50. However, while such readings may help to reduce pressure for an early cut in key ECB interest rates, still declining core inflation ensures that the door to monetary easing later in the year remains open.

In line with the Eurozone, UK economic activity looks likely to have surprised on the upside at year-end. Fourth quarter GDP growth will still be weak but with both the RPI and RPI-P climbing to 19, the BoE finds itself with a little more time to contemplate the appropriate pace of any interest rate cuts. To this end, financial markets have tempered their previous aggressive easing expectations.

In Switzerland, the outperformance of the real economy that characterized the closing months of 2023 has carried over into the New Year. Even so, there remains a sizeable gap between the RPI-P (30) and the RPI (0) showing that recent inflation surprises are still on the downside. This suggests that while the next move in the SNB’s policy rate will almost certainly be down, it may not be until the second quarter.

In China, an unexpectedly marked pick-up in economic momentum last month was enough to boost the RPI and RPI-P to minus 7 and zero respectively. The broad picture still looks quite sluggish but following a string of disappointingly soft data, these latest readings will lift hopes that 2024 will deliver a much-improved performance.

A strong December employment report helped lift the US RPI to 30 both overall and less prices. Extended strength at this pace could forestall the Fed’s anticipated rate cut. Canada’s employment report was less favorable and left the RPI within the consensus range at minus 5, but when excluding what have been higher-than-expected inflation readings, the score drops to minus 23. Weak growth combined with high inflation would leave the Bank of Canada out on a limb.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Laurie Laird, Mace News, Max Sato, and Theresa Sheehan

Inflation is top of the week’s agenda led by US consumer prices on Thursday where less-than-auspicious results are expected: slight acceleration overall to 3.2 percent and only slight slowing for the ex-food ex-energy core to 3.8 percent. More material improvement is expected for Tokyo consumer prices on Tuesday but not so for consumer prices from India on Friday where an uptick is the call. Australia’s CPI will be posted on Wednesday and, at an expected 4.7 percent monthly rate, would remain unusually high. By contrast, China will post both consumer and producer prices on Friday and the expectation is continued contraction for both.

German manufacturers orders kick off the week on Monday with a rebound expected, in some contrast to German industrial production on Tuesday where the consensus is for no change. The Bank of Korea will meet on Thursday and is not expected to change rates. Friday’s highlight will be monthly GDP from the UK amid expectations for a small gain; the following Saturday is the estimated release time for Chinese merchandise trade data which are expected to benefit from a pickup in exports.

German Manufacturers Orders for November (Mon 0800 CET; Mon 0700 GMT; Mon 0200 EST)

Consensus Forecast, Month over Month: 1.3%

Manufacturers orders are expected to increase 1.3 percent on the month in November versus October’s unexpected 3.7 percent slump.

Eurozone: EC Economic Sentiment for December (Mon 1100 CET; Mon 1000 GMT; Mon 0500 EST)

Consensus Forecast: 94.1

Consensus Forecast, Industry Sentiment: -9.6

Economic sentiment in December is expected to rise to 94.1 from 93.8 in November which was up slightly from 93.5 in October to end six straight declines.

Eurozone Retail Sales for November (Mon 1100 CET; Mon 1000 GMT; Mon 0500 EST)

Consensus Forecast, Month over Month: 0.2%

Retail sales volumes in November are expected to rise 0.2 percent on the month following a marginal and lower-than-expected 0.1 percent increase in October that left volumes down 1.2 percent on the year.

Tokyo Consumer Price Index for December (Tue 0830 JST; Mon 2330 GMT; Mon 1830 EST)

Consensus Forecast, Year over Year: 2.4%

Ex-Fresh Food, Consensus Forecast: 2.1%

Ex-Fresh Food & Energy, Consensus Forecast: 3.5%

Consumer inflation in Tokyo is expected to slow to a year-over-year 2.4 percent in December versus 2.6 percent in November that was much lower than the 3.0 percent consensus. The ex-fresh food reading is seen at 2.1 percent versus 2.3 percent which was 1 tenth under the consensus as was ex-fresh food & energy at 3.6 percent. The latter is expected to slow a tenth to 3.5 percent.

Japanese Household Spending for November (Tue 0830 JST; Mon 2330 GMT; Mon 1830 EST)

Consensus Forecast , Month over Month: 0.3%

Consensus Forecast , Year over Year: -2.3%

Real household spending in November is expected to fall 2.3 percent on the year versus 2.5 percent contraction in October that reflected high prices and unseasonably warm weather.

Australian Retail Sales for November (Tue 1130 AEDT; Tue 0030 GMT; Mon 1930 EST)

Consensus Forecast, Month over Month: 1.2%

Retail sales in November are expected to rebound 1.2 percent on the month after October’s 0.2 percent unexpected dip.

German Industrial Production for November (Tue 0800 CET; Tue 0700 GMT; Tue 0200 EST)

Consensus Forecast, Month over Month: 0.0%

Industrial production in November is expected to come in unchanged after unexpectedly falling 0.4 percent in October, the fifth straight decline.

Eurozone Unemployment Rate for December (Tue 1100 CET; Tue 1000 GMT; Tue 0500 EST)

Consensus Forecast: 6.6%

Consensus for December's unemployment rate is a slight rise to 6.6 percent from November’s near record low of 6.5 percent.

Canada Merchandise Trade Balance for November (Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast: C$2.3 billion

November’s trade balance is seen in C$2.3 billion surplus versus October’s surplus of C$3.0 billion that compared with a C$1.1 billion surplus in September.

Australian November CPI (Wed 1130 AEDT; Wed 0030 GMT; Tue 1930 EST)

Consensus Forecast, Year over Year: 4.7%

Consumer prices in November are expected to ease but only slightly to a year-over-year 4.7 percent versus a lower-than-expected 4.9 percent in October and against 5.6 percent in September.

French Industrial Production for November (Wed 0845 CET; Wed 0745 GMT; Wed 0245 EST)

Consensus Forecast, Month over Month: 0.1%

November production is expected to rise 0.1 percent on the month after falling 0.3 and 0.6 percent in the prior two months.

Australian International Trade in Goods for November (Thu 1130 AEDT; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Balance: A$7.5 billion

Consensus for international trade in goods in November is a surplus of A$7.5 billion versus October’s surplus of A$7.1 billion that saw imports fall 1.9 percent on the month and exports rise 0.4 percent.

Bank of Korea Announcement (Thu 1000 KST; Thu 0100 GMT; Wed 2000 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 3.50%

The Bank of Korea has consistently kept policy unchanged, for its last seven meetings. For its January meeting, no change is once again the expectation. Consumer prices have been slowing and well behaved, at 3.2 percent overall and 2.8 percent for the core.

US CPI for December (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 3.2%

US CPI Core, Less Food & Energy

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 3.8%

Core prices in December are expected to rise a monthly 0.2 percent versus 0.3 percent in November. Overall prices are expected to also rise 0.2 percent after increasing 0.1 percent in November. Annual rates, at percent 3.1 percent overall and 4.0 percent for the core in November, are expected at 3.2 percent and 3.8 percent, respectively.

Chinese CPI for December (Fri 0130 GMT; Fri 0930 CST; Thu 2030 EST)

Consensus Forecast, Year over Year: -0.3%

After year-over-year contraction of 0.5 percent in November, December is expected to see consumer prices decrease 0.3 percent. China’s CPI last peaked in January at 2.1 percent.

Chinese PPI for December (Fri 0130 GMT; Fri 0930 CST; Thu 2030 EST)

Consensus Forecast, Year over Year: -2.6%

Producer prices have been in long annual contraction. December’s consensus is minus 2.6 percent on the year versus minus 3.0 percent in November.

UK GDP for November (Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, Month over Month: 0.1%

GDP in the month of November is expected to rise 0.1 percent versus steeper-than-expected contraction of 0.3 percent in October.

Indian CPI for December (Fri 1730 IST; Fri 1200 GMT; Fri 0700 EST)

Consensus Forecast, Year over Year: 5.7%

Consumer prices are expected to edge higher to 5.7 percent on the year in December versus November’s 5.55 percent and following October’s 4.87 percent.

Indian Industrial Production for November (Fri 1730 IST; Fri 1200 GMT; Fri 0700 EST)

Consensus Forecast, Year over Year: 3.7%

Year-over-year industrial production is expected to rise 3.7 percent in November which would be down sharply from 11.7 percent growth in October.

Chinese Merchandise Trade Balance for December (Estimated for Saturday, release time not set)

Consensus Forecast: US$76.0 billion

Consensus Forecast: Exports - Y/Y: 1.7%

China's trade surplus for December is expected to widen to US$76.0 billion versus November’s larger-than-expected US$68.39 billion surplus that saw exports rise 0.5 percent on the year. Exports in December are expected to rise 1.7 percent.

|