|

US consumer prices exceeded forecasts in December but the report did offer evidence that inflationary pressures are coming under control, that the “long and variable” lags in the transmission of monetary policy are becoming more visible. Despite the improvement, rates of inflation remain high in the US especially shelter costs, which together with a strong jobs market probably means the Federal Reserve won’t be in much of a hurry to begin cutting interest rates. And the same may be said for other central banks as indications of strength are beginning to appear including employment and consumer sentiment in Europe as well as GDP in the UK. But before running down the week’s updates, let’s first look at the Bank of Korea which, back in 2021, was the first this cycle to begin raising rates but has yet to be the first to cut rates.

The Bank of Korea left its main policy rate unchanged at 3.50 percent, in line with the consensus forecast. Officials have left this rate on hold since the start of 2023 after tightening policy aggressively over 2022 as part of efforts to return headline inflation to their target level of two percent. The Bank of Korea left its main policy rate unchanged at 3.50 percent, in line with the consensus forecast. Officials have left this rate on hold since the start of 2023 after tightening policy aggressively over 2022 as part of efforts to return headline inflation to their target level of two percent.

Since the previous BoK meeting in November, data have shown a decline in headline inflation as well as underlying inflation, the latter easing from 3.0 percent in November to 2.8 percent in December. In the bank’s latest statement, officials advised that "inflation is projected to maintain its slowing trend". They also expressed optimism about the growth outlook, while noting that "restrictive monetary policy stances", both at home and abroad, will exert some effect.

Reflecting their commitment to return inflation to the target level, officials concluded that it remains appropriate to leave policy rates on hold and that their policy stance should remain "restrictive" until they are satisfied that the target will be met. This suggests that officials see no case for tightening policy any further but also that they’re in no hurry to start unwinding the rate increases already delivered.

US consumer prices rose a monthly 0.3 percent in December, slightly above Econoday's consensus for 0.2 percent; the 12-month rate picked up to 3.4 percent from 3.1 percent, also above the consensus. Excluding food and energy, the CPI increased 0.3 percent on the month and 3.9 percent on the year, both of which were also slightly above forecasts. US consumer prices rose a monthly 0.3 percent in December, slightly above Econoday's consensus for 0.2 percent; the 12-month rate picked up to 3.4 percent from 3.1 percent, also above the consensus. Excluding food and energy, the CPI increased 0.3 percent on the month and 3.9 percent on the year, both of which were also slightly above forecasts.

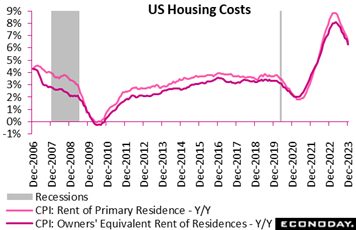

Shelter rose 0.5 percent on the month and contributed over half of the total increase (rents up 0.4 percent and the equivalent for homeowners up 0.5 percent). Pressure also came once again from both vehicle insurance, up 1.5 percent on the month, and medical care, up 0.7 percent. Gains in recreation, personal care and education further contributed to higher monthly prices as did energy which, moving out of monthly contraction, rose 0.4 percent. Food, where pressures have eased, rose 0.2 percent for a second straight month.

The report offers plenty for the Federal Reserve to consider at its month-end meeting, including half-year rates for 2023 which slowed to 1.5 percent overall in the second half of the year compared to 1.8 percent in the first half. In 2022, the half-year breakdown was 3.0 and 4.6 percent. The core also slowed and substantially, to 1.6 percent in the second half of last year from 2.5 percent in the first half and well below the near-term peak of 3.2 percent in the first half of 2022.

These trends are favorable though shelter costs do remain high, at 2.7 percent for the second half of 2023 which, nevertheless, is below 4.1 percent in the first half and 3.8 percent in the second half of 2022. Rents were up 6.5 percent on the year in December but continued to slow from a nearly 9 percent peak at the beginning of the 2023. The equivalent reading for homeowners was 6.3 percent in December, slowing from an 8 percent peak. Shelter costs in total, which also include lodging away from home, rose at a 6.2 percent pace in December – or more than three times the Fed’s general inflation target.

Why are shelter costs so high? One reason is supply, that homeowners are keeping their properties off the market; this is keeping resale prices up and pushing home buyers to new homes which are generally more expensive than resales. Demand is another reason, that better household incomes are widening access to the housing market and increasing competition for housing stock.

Were it not for shelter costs, the picture for consumer prices would be much more favorable. The CPI less shelter rose only 0.9 percent in the second half of 2023, although a bit faster than 0.7 percent in the first half but nonetheless down from the near-term peak of up 5.5 percent in the first half of 2022. The CPI less food, energy, and shelter rose 0.8 percent in the second half of 2023 compared to 1.4 percent in the first half of the year, 2.1 percent in the second half of 2022, and 3.6 percent in the in the first half of 2022.

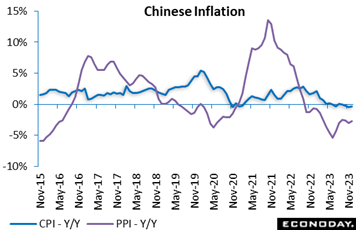

In contrast to the US and many other economies, inflation in China remains dormant. China's annual inflation rate is negative 0.3 percent, which is only marginally improved from November’s minus 0.5 percent. Consumer inflation has now been close to zero or in negative territory for nine consecutive months. The index advanced 0.1 percent on the month after dropping 0.5 percent previously. In contrast to the US and many other economies, inflation in China remains dormant. China's annual inflation rate is negative 0.3 percent, which is only marginally improved from November’s minus 0.5 percent. Consumer inflation has now been close to zero or in negative territory for nine consecutive months. The index advanced 0.1 percent on the month after dropping 0.5 percent previously.

Producer price inflation data published at the same time showed further weakness, falling an as-expected 2.7 percent on the year in December after a decline of 2.6 percent in November. Headline PPI inflation has now been in negative territory for more than a year. The index fell 0.3 percent on the month as it did in November.

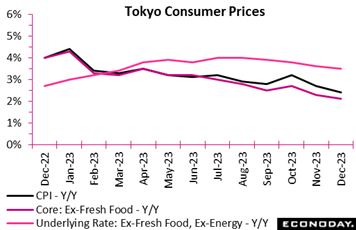

Consumer prices in Japan peaked in January last year at over 4 percent but have since eased. Reflecting downtrends in energy prices and hotel fees, Tokyo’s CPI, which precedes the national release, moderated further in December, to 2.4 percent from 2.7 percent in November and 3.2 percent in October. Consumer prices in Japan peaked in January last year at over 4 percent but have since eased. Reflecting downtrends in energy prices and hotel fees, Tokyo’s CPI, which precedes the national release, moderated further in December, to 2.4 percent from 2.7 percent in November and 3.2 percent in October.

The closely watched core CPI (excluding fresh food) slowed to 2.1 percent from November’s 2.3 percent and 2.7 percent in October. The core-core CPI (excluding fresh food and energy) slowed to 3.5 percent from 3.6 percent.

National CPI data for Japan will be posted on Friday of the coming week. Econoday’s consensus calls for general slowing in line with Tokyo’s December report including a 2-tenth headline decline to 2.6 percent.

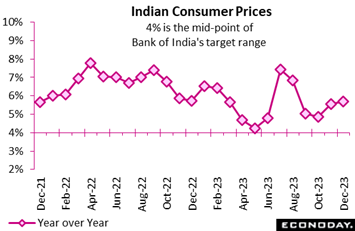

Inflation in India is not slowing, at 5.69 percent on the year in December versus 5.55 percent in November. This is the second consecutive increase for the CPI, taking it further away from the mid-point of the Reserve Bank of India's two to six percent target range. Inflation in India is not slowing, at 5.69 percent on the year in December versus 5.55 percent in November. This is the second consecutive increase for the CPI, taking it further away from the mid-point of the Reserve Bank of India's two to six percent target range.

At the RBI's December meeting, officials left policy rates on hold at 6.50 percent. They judged then that headline inflation could be volatile in the near-term, due to base effects and the impact of adverse weather conditions on food prices, but they expressed confidence that it would trend lower in coming quarters. They stressed that "monetary policy must continue to be actively disinflationary", suggesting that upside risks to the inflation outlook would likely remain their primary focus in upcoming meetings.

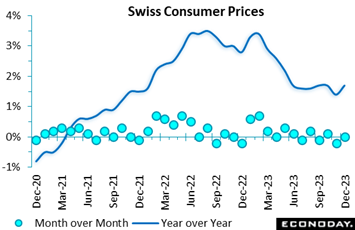

Consumer inflation in Switzerland is modest but was still slightly stronger than expected at year-end. A flat monthly performance was enough to lift December’s annual rate from 1.4 percent to 1.7 percent, fully reversing the 0.3 percentage point decline seen in November. Consumer inflation in Switzerland is modest but was still slightly stronger than expected at year-end. A flat monthly performance was enough to lift December’s annual rate from 1.4 percent to 1.7 percent, fully reversing the 0.3 percentage point decline seen in November.

Domestic prices rose 0.3 percent on the month to lift their yearly rate from 2.1 percent to 2.3 percent. The gain here was offset by a 0.7 percent decline in import prices although this too was enough to lift their 12-month rate from minus 0.6 percent to minus 0.2 percent.

Within the CPI basket, the largest increase was in restaurants and hotels where prices jumped 1.8 percent. Household goods and services were also up 0.9 percent. On the downside, the steepest decline was in petroleum products (3.9 percent) ahead of food and soft drinks (0.7 percent) and clothing and footwear (0.5 percent). As a result, core prices (ex-food and energy) rose 0.2 percent versus November, nudging the underlying inflation rate just a tick higher to 1.5 percent.

Inflation trends in Switzerland remain soft and at 1.5 percent the core rate should not be an issue for the Swiss National Bank. Even so, the acceleration in domestic prices helps to ensure that the SNB will be in no rush to cut its policy rate.

Headline inflation in Australia fell from 4.9 percent in October to 4.3 percent in November, a fall sharper than the consensus forecast for a decline to 4.7 percent. After rising in August and September, monthly headline inflation resumed the downward trend seen earlier in 2023, moving closer to the Reserve Bank of Australia's target range of two percent to three percent. Headline inflation in Australia fell from 4.9 percent in October to 4.3 percent in November, a fall sharper than the consensus forecast for a decline to 4.7 percent. After rising in August and September, monthly headline inflation resumed the downward trend seen earlier in 2023, moving closer to the Reserve Bank of Australia's target range of two percent to three percent.

November’s cooling was largely driven by a further deceleration in fuel prices. These rose 2.3 percent on the year in November after increasing 8.6 percent in October and 19.7 percent in September. Food price inflation also slowed from 5.3 percent to 4.6 percent, while prices of furnishings, household equipment and services fell 0.3 percent on the year after a previous increase of 0.4 percent. This was partly offset by an increase in housing inflation from 6.1 percent to 6.6 percent.

Underlying price pressures fell as well. The measure that excludes volatile items – including fuel and holiday travel – fell from 5.1 percent in October to 4.8 percent in November, while the monthly trimmed mean measure fell from 5.3 percent to 4.6 percent.

The RBA left policy rates on hold at their most recent meeting last month, noting then that "inflation is continuing to moderate". The latest data will likely reinforce their confidence that previous policy tightening is exerting downward pressure on inflation and strengthen the case for policy to remain on hold at their next meeting early next month.

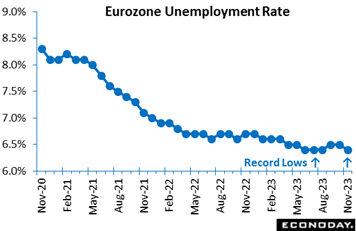

The Eurozone’s labour market proved surprisingly robust in November. Unemployment unexpectedly fell, dropping 99,000 on the month to 10.97 million and that following a much smaller revised 9,000 rise in October. The mid-quarter decline was steep enough to shave a tick off the jobless rate which, at 6.4 percent, was well below the consensus and matched its record low. The Eurozone’s labour market proved surprisingly robust in November. Unemployment unexpectedly fell, dropping 99,000 on the month to 10.97 million and that following a much smaller revised 9,000 rise in October. The mid-quarter decline was steep enough to shave a tick off the jobless rate which, at 6.4 percent, was well below the consensus and matched its record low.

The dip in the headline measure was largely attributable to Italy where unemployment dropped 66,000 to reduce the national rate by 0.2 percentage points to 7.5 percent. Elsewhere, Spain (11.9 percent after 12.0 percent) also registered a small decrease but there was no change in either France (7.3 percent) or Germany (3.1 percent).

The surprising strength of November's report will not be wasted on an ECB that, for its future policy decisions, has underlined the importance of wage negotiations currently taking place in may Eurozone countries. The worry will be that wage growth in such a tight market will remain too high for too long, making a near-term monetary easing all the less likely.

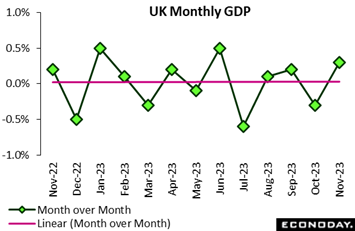

The UK economy was a good deal stronger than expected in November. A 0.3 percent monthly increase in GDP was 0.2 percentage points better than Econoday’s consensus and fully reversed October’s surprisingly sharp 0.3 percent contraction. This is the best performance since June. Annual growth climbed from minus 0.1 percent to plus 0.2 percent though the 3-monthly change was only flat at minus 0.2 percent. The UK economy was a good deal stronger than expected in November. A 0.3 percent monthly increase in GDP was 0.2 percentage points better than Econoday’s consensus and fully reversed October’s surprisingly sharp 0.3 percent contraction. This is the best performance since June. Annual growth climbed from minus 0.1 percent to plus 0.2 percent though the 3-monthly change was only flat at minus 0.2 percent.

November's rebound was driven by services where output was up 0.4 percent versus October. Within this there were solid gains in information and communication (1.5 percent), arts entertainment and recreation (1.4 percent) and other services (1.6 percent). Goods production increased 0.3 percent with manufacturing a tick firmer at 0.4 percent. By contrast, construction fell 0.2 percent, its fourth decline in the last five months.

November’s update reduces the chances of recession at year-end although it remains a possibility. Without any revisions, GDP will need to expand only 0.1 percent on the month in December to rule out a second successive quarterly contraction. As seen in the linear trendline of the accompanying graph, the UK economy appears to be flatlining.

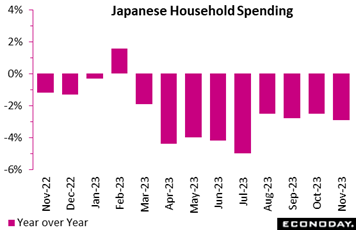

Real household spending in Japan posted a ninth straight annual drop in November, down a larger-than-expected 2.9 percent after a 2.5 percent dip in October. Econoday’s consensus called for a 2.3 percent November decline. High costs for food and daily necessities have been holding down demand including for home maintenance and vehicles. On the month, expenditures slumped 1.0 percent, much weaker than the expected 0.3 percent gain. Real household spending in Japan posted a ninth straight annual drop in November, down a larger-than-expected 2.9 percent after a 2.5 percent dip in October. Econoday’s consensus called for a 2.3 percent November decline. High costs for food and daily necessities have been holding down demand including for home maintenance and vehicles. On the month, expenditures slumped 1.0 percent, much weaker than the expected 0.3 percent gain.

The widespread move among consumers to switch to discount mobile phone plans remained in place while the pandemic-era necessity to simplify weddings and funerals continued to push down costs for ceremonies.

The core measure of real average household spending (excluding housing, motor vehicles and remittance), a key indicator used in GDP calculation, fell 0.9 percent on the year in November which was an improvement after falling 3.6 percent in October. The ministry's overall assessment on household spending is unchanged at flat.

The average real income of households with salaried workers posted a 14th straight year-over-year drop, down 4.7 percent in November (down 1.6 in nominal terms) after falling 5.2 percent October (down a nominal 1.5 percent).

Both the government and Bank of Japan have been providing stimulus to help the economy recover from the pandemic slump. Nominal wages are expected to grow at a fast pace in the current fiscal year amid labor shortages though real wages remain below year-earlier levels.

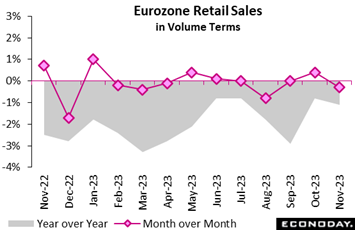

Retail sales in the Eurozone were much weaker than expected in November. A 0.3 percent monthly fall in volumes deepened annual contraction from minus 0.8 percent to minus 1.1 percent. This was the first monthly decline since August but leaves an essentially flat trend around levels last seen in early 2021. Retail sales in the Eurozone were much weaker than expected in November. A 0.3 percent monthly fall in volumes deepened annual contraction from minus 0.8 percent to minus 1.1 percent. This was the first monthly decline since August but leaves an essentially flat trend around levels last seen in early 2021.

The November decrease was broad-based with only auto fuel (1.4 percent) showing any strength. Food, drink and tobacco dipped 0.1 percent while non-food demand, excluding auto fuel, was off 0.4 percent, its third drop in the last four months. Within the latter, mail order and internet was down 1.2 percent.

Regionally, the headline fall was dominated by Germany where sales contracted fully 2.5 percent. By contrast, France (0.4 percent) and Spain (1.5 percent) both posted gains. Elsewhere, the picture was very mixed.

November’s update leaves average Eurozone volume sales in October/November unchanged from their mean level in the third quarter. Without any revisions, December will need at least a 0.3 percent monthly gain if the retail sector is not to be a drag on fourth-quarter GDP growth. Looking ahead, consumer confidence has improved in recent months though recovery for consumer spending is in question.

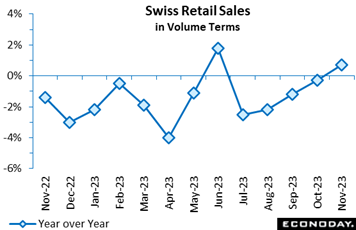

Swiss retail sales rose a solid 0.7 percent on the month in November following an upwardly revised 0.4 percent gain in October. The increase boosted annual growth from minus 0.3 percent to also 0.7 percent and lifted volumes to their highest level since last June. Swiss retail sales rose a solid 0.7 percent on the month in November following an upwardly revised 0.4 percent gain in October. The increase boosted annual growth from minus 0.3 percent to also 0.7 percent and lifted volumes to their highest level since last June.

The monthly headline advance was attributable to discretionary spending which rose fully 2.2 percent following a 0.4 percent gain at the start of the quarter. This was its third straight increase. By contrast, purchases of food, drink and tobacco were again weak, declining 0.2 percent after October's 0.6 percent drop.

Still, by and large, the Swiss consumer sector seems to be holding up relatively well. Average volume sales in October/November were up 1.1 percent versus their mean level in the third quarter and, absent any revisions, December would need at least a 3.3 percent monthly drop for the sector to subtract from fourth-quarter GDP growth. Combined with the stronger-than- expected December CPI report, the retail data will leave the SNB wary of delivering any early cut in interest rates.

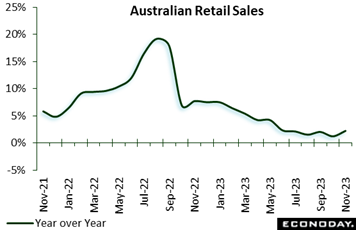

Retail sales in Australia rose 2.0 percent on the month in November after falling 0.2 percent in October, with year-over-year growth picking up from 1.2 percent to 2.2 percent. Officials noted that sales in November strengthened sharply after weak growth in October as consumers increasingly focus their holiday spending during Black Friday sales in late November. Officials also noted that these changes in consumer behaviour are impacting how they adjust sales data for seasonality. Retail sales in Australia rose 2.0 percent on the month in November after falling 0.2 percent in October, with year-over-year growth picking up from 1.2 percent to 2.2 percent. Officials noted that sales in November strengthened sharply after weak growth in October as consumers increasingly focus their holiday spending during Black Friday sales in late November. Officials also noted that these changes in consumer behaviour are impacting how they adjust sales data for seasonality.

Sales advanced at a pace relatively close to the national average in nearly all states and territories. Sales also recorded positive growth across all major categories, but the strongest increases were recorded by household goods retailing, clothing retailers, and department stores.

German manufacturing orders again disappointed in November. A 0.3 percent monthly rise was well short of Econoday’s consensus and followed a 3.8 percent slump in October. Base effects meant that annual growth jumped from minus 7.3 percent to minus 4.3 percent, but orders still matched their second-weakest level since June 2020. German manufacturing orders again disappointed in November. A 0.3 percent monthly rise was well short of Econoday’s consensus and followed a 3.8 percent slump in October. Base effects meant that annual growth jumped from minus 7.3 percent to minus 4.3 percent, but orders still matched their second-weakest level since June 2020.

More positively, the monthly headline advance was at least led by the domestic market which saw a 1.4 percent increase. By contrast, overseas demand fell 0.4 percent with new orders from the Eurozone down 1.9 percent and from the rest of the world 0.6 percent. At a sector level, capital goods recorded a 0.8 percent rise while consumer goods were up 1.1 percent. However, intermediates were off 0.4 percent.

November's meagre advance leaves average total orders in October/November still 2.6 percent below their third quarter average and so leaves intact a clear downtrend. Near-term prospects for industrial production remain poor.

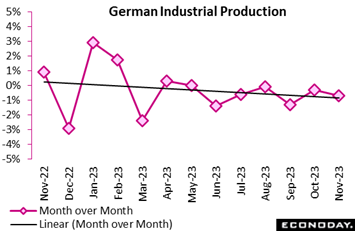

Production for the German industrial sector once again undershot expectations in November. A 0.7 percent monthly drop was well short of Econoday’s consensus and the sixth straight decline. The October fall was revised marginally shallower to 0.3 percent but annual contraction still deepened from minus 3.4 percent to minus 4.9 percent; output now stands at its lowest level since July 2020, in the midst of Covid. Production for the German industrial sector once again undershot expectations in November. A 0.7 percent monthly drop was well short of Econoday’s consensus and the sixth straight decline. The October fall was revised marginally shallower to 0.3 percent but annual contraction still deepened from minus 3.4 percent to minus 4.9 percent; output now stands at its lowest level since July 2020, in the midst of Covid.

Manufacturing fared almost as bad, posting a 0.5 percent monthly slide as capital goods fell 0.7 percent, intermediates 0.5 percent and consumer goods 0.1 percent. Elsewhere, energy jumped fully 3.1 percent but the ailing construction sector contracted a further 2.9 percent.

November's setback leaves average industrial production in the first two months of the quarter 1.6 percent below its mean level in the July-September period. As things currently stand, December needs a massive 5.1 percent monthly bounce just to keep the fourth quarter flat. Consequently, the sector almost certainly subtracted from GDP growth and probably triggered the arrival of recession in the German economy. And of course the new orders data make matters worse, pointing to extending trouble for the current quarter.

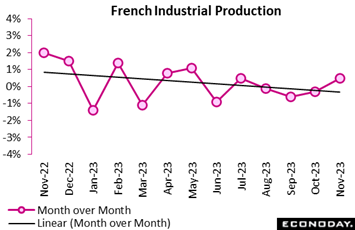

Industrial production in France had a strong November, rising 0.5 percent on the month to easily beat the consensus for a 0.1 percent gain. The advance, which was the first since July, more than reversed October's 0.3 percent decline though negative base effects saw annual expansion slide from 2.0 percent to just 0.6 percent. Indeed, production was still some 4.7 percent below its pre-pandemic level in February 2020. Industrial production in France had a strong November, rising 0.5 percent on the month to easily beat the consensus for a 0.1 percent gain. The advance, which was the first since July, more than reversed October's 0.3 percent decline though negative base effects saw annual expansion slide from 2.0 percent to just 0.6 percent. Indeed, production was still some 4.7 percent below its pre-pandemic level in February 2020.

Manufacturing output posted a smaller 0.3 percent monthly gain following a 0.2 percent increase previously. Within this, machinery and equipment (2.8 percent) was especially strong and well ahead of any other subsector while both transport equipment (minus 0.8 percent) and coke and refined petroleum products (minus 0.6 percent) recorded falls. Elsewhere, mining and quarrying, energy, water supply and waste management jumped 1.8 percent but construction was down 0.8 percent.

Despite November's rise, average overall industrial production in the first two months of the quarter was still 0.5 percent below its average level in the July-September period. Possible revisions aside, December will need at least a 1.3 percent monthly increase to secure a fourth quarter gain. Consequently, the sector looks likely to have subtracted from real GDP growth.

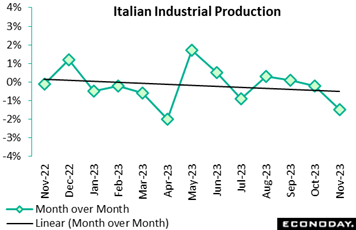

Industrial production fell again in Italy in November and much more sharply than expected. A 1.5 percent drop was the worst performance since last April and some 1.3 percentage points steeper than the market consensus. Following a 0.2 percent dip in October, the latest decrease reduced annual workday adjusted growth from minus 1.1 percent to minus 3.1 percent and means that output has still not expanded since August. Industrial production fell again in Italy in November and much more sharply than expected. A 1.5 percent drop was the worst performance since last April and some 1.3 percentage points steeper than the market consensus. Following a 0.2 percent dip in October, the latest decrease reduced annual workday adjusted growth from minus 1.1 percent to minus 3.1 percent and means that output has still not expanded since August.

To make matters worse, the monthly slide was broad-based. Energy (minus 4.0 percent) was particularly weak but there were hefty losses too in consumer goods and intermediates (both minus 1.8 percent). Capital goods were off 0.2 percent. Over the latest three months, total industrial production fell 0.8 percent.

Absent any revisions, the mid-quarter report leaves December needing an improbably large 3.4 percent monthly rise just to keep fourth quarter output flat. Accordingly, the sector almost certainly weighed on GDP growth, as it did in four of the last five quarters.

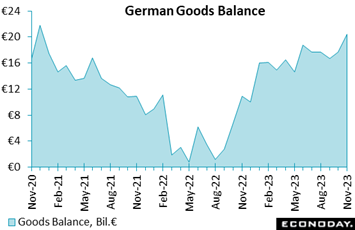

In contrast to Germany’s production downturn, the country’s seasonally adjusted merchandise trade balance saw a €20.4 billion surplus in November, up from October's €17.7 billion. This is the strongest performance in nearly two years. Unadjusted, the black ink stood at €22.0 billion, a marked improvement on the €13.0 billion a year ago. In contrast to Germany’s production downturn, the country’s seasonally adjusted merchandise trade balance saw a €20.4 billion surplus in November, up from October's €17.7 billion. This is the strongest performance in nearly two years. Unadjusted, the black ink stood at €22.0 billion, a marked improvement on the €13.0 billion a year ago.

The headline expansion reflected a 3.7 percent monthly jump in exports, their first rise since August and the steepest increase since February 2022. Extended gains for exports would be a new plus for the outlook. Imports, reflecting perhaps improved domestic demand, were up 1.9 percent following five successive declines. Unadjusted annual growth of the former now stands at minus 4.9 percent, unchanged from the October rate, and of the latter at minus 12.1 percent, up from minus 14.3 percent.

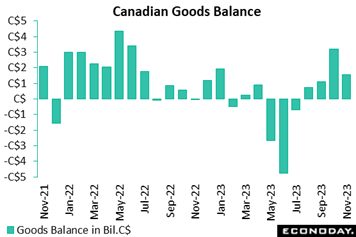

As imports rose while exports weakened, Canada's goods surplus narrowed more than expected in November, to C$1.6 billion and below Econoday's consensus forecast for C$2.3 billion. October's surplus was revised up to C$3.2 billion from C$3.0 billion. As imports rose while exports weakened, Canada's goods surplus narrowed more than expected in November, to C$1.6 billion and below Econoday's consensus forecast for C$2.3 billion. October's surplus was revised up to C$3.2 billion from C$3.0 billion.

Imports rebounded 1.9 percent after dropping 2.9 percent in October, with gains across 8 of 11 categories led by stronger activity as indicated by a 1.6 percent increase in volumes. An 11.6 percent gain in energy led the advance. Elsewhere, imports of electronic and electrical equipment and parts rose 4.7 percent and industrial machinery and equipment rose 4.9 percent. On the downside, consumer goods fell 2.2 percent, consistent with weakening in household spending.

Exports, by contrast, contracted 0.6 percent in November, the first decline since June 2023, following an upwardly revised 0.3 percent increase in October. Volumes edged down 0.1 percent. Declines were concentrated in four categories, led by a 6.5 percent decrease in metal and non-metallic mineral products, as well as a 16.8 percent drop in aircraft and other transportation equipment and parts. Excluding these two categories, exports were actually up 1.0 percent as seven categories posted gains on the month.

Regionally, trade activity with the US increased, with exports up 0.4 percent and imports up 1.7 percent. The import strength led to a smaller surplus of C$11.7 billion from C$12.1 billion. Exports to countries other than the US fell 4.2 percent and imports rose 2.3 percent, leading to a widening of the deficit to C$10.1 billion from C$9.0 billion.

In services, exports rose 1.0 percent and imports edged down 0.1 percent. The combined trade and services surplus narrowed to C$0.6 billion in November from C$2.0 billion in October.

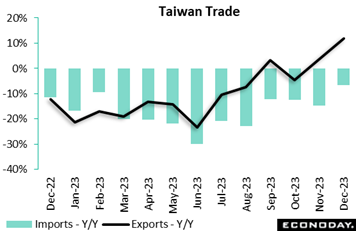

In early data for December, Taiwan's trade surplus rose to a record $11.10 billion from $9.80 billion in November. Exports strengthened with an increase of 11.8 percent on the year after advancing 3.8 percent previously, while imports fell at a less pronounced rate, down 6.5 percent after a previous decline of 14.8 percent. In early data for December, Taiwan's trade surplus rose to a record $11.10 billion from $9.80 billion in November. Exports strengthened with an increase of 11.8 percent on the year after advancing 3.8 percent previously, while imports fell at a less pronounced rate, down 6.5 percent after a previous decline of 14.8 percent.

Exports of information, communication and audio-video products recorded another month of very strong growth, up 94.7 percent on the year in December after previously increasing 74.0 percent. Exports of electronic components fell 1.2 percent on the year in December, an improvement from November's 3.6 percent decline.

Exports to mainland China and Hong Kong fell 6.4 percent on the year after a previous fall of 6.3 percent, while year-over-year growth in exports to the United States accelerated from 33.1 percent to 49.7 percent. Petroleum imports fell on the year for the second consecutive month while imports from mainland China and Hong Kong recorded modest growth.

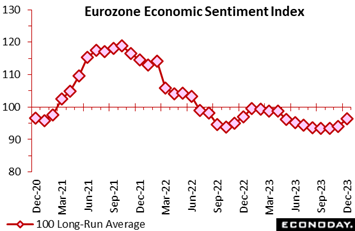

European economic sentiment recovered surprisingly strongly at the end of 2023. At 96.4, the EU Commission's gauge was up sharply from a slightly stronger revised 94.0 in November and 2.3 points above the consensus. This matched the highest reading since last April but still leaves the measure well short of its 100 long-run average. European economic sentiment recovered surprisingly strongly at the end of 2023. At 96.4, the EU Commission's gauge was up sharply from a slightly stronger revised 94.0 in November and 2.3 points above the consensus. This matched the highest reading since last April but still leaves the measure well short of its 100 long-run average.

The headline improvement reflects broad-based gains in confidence. There were rises in industry (minus 9.2 after minus 9.5), services (8.4 after 5.5), retail trade (minus 5.7 after minus 7.1), construction (minus 3.6 after minus 4.4) and in the consumer sector (minus 15.0 after minus 16.9).

Regionally, national sentiment indices rose in Germany (91.6 after 89.2), Italy (99.3 after 96.7) and Spain (101.4 after 99.0). Among the big four members, France (95.4 after 95.9) was the only country to post a decline. That said, just Spain was above the common 100 historic norm.

Inflation developments were on the firm side. Expected selling prices rose in manufacturing (3.2 after 2.4) and, for a third consecutive month, in services (18.1 after 17.7). In addition, inflation expectations were also up in the household sector (10.5 after 9.3).

The December data are likely to be met with a mixed response at the ECB. The improvement in overall sentiment will be welcome but, while still historically low, the deterioration in the inflation outlook found in all the three major sectors may ring some alarm bells. Certainly, December’s report will not pull forward the timing of the widely anticipated first cut in policy rates.

Global economic activity has been exceeding expectations for much of the past six weeks, though only modestly in the latest week at plus 6 on Econoday’s Relative Performance Index (RPI). Even so, extended outperformance would continue to prompt more cautious views for prospective rate cuts in 2024.

In the Eurozone, signs of an unexpectedly large improvement in economic sentiment combined with a surprisingly tight labour market to ensure that the RPI, at 14, and RPI less prices (RPI-P), at 28, remained above zero. Economic activity in general is still weak but, if sustained, positive readings here will give the European Central Bank more time to ponder when to cut key interest rates.

In the UK, a string of surprisingly upbeat data was enough to lift the RPI to 21 and the RPI to 16. Recession at the end of 2023 remains a possibility but is now less likely, a development that will bolster the likelihood of a steady Bank Rate at the Bank of England’s meeting next month.

In Switzerland, a mixed period for economic data left the RPI at minus 8 and the RPI-P at 6, indicating that activity is progressing broadly in line with forecasts.

In Japan, another surprisingly weak month for household spending helped to pull down the RPI to 18 and the RPI-R to 25 respectively. Still, both measures remain above zero which will underpin speculation that some form of monetary tightening is not too far away.

In China, further evidence of deflationary pressures saw the RPI slide to minus 14 and the RPI-P to minus 10. Despite the occasional blip into positive surprise territory, both measures have spent much of the last few months sub-zero, warning that the authorities may have more work to do to get underlying economic momentum building again.

In Canada, the RPI (minus 19) and RPI-P (minus 39) signaled increasing underperformance as both gauges dropped to their lowest level since mid-August. Current readings will fuel speculation that the slowdown in economic activity will be sharper than officially forecast leaving the Bank of Canada as a prime candidate to be among the first of the major central banks to cut interest rates in 2024.

But for the US, the Federal Reserve does not look to be among the first to cut rates. The country’s 19 overall score and 26 score when excluding prices make the start of 2024 look like much of 2023, tangible outperformance.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Forecasters see modest but still useful acceleration for Chinese GDP on Wednesday, from year-over-year growth of 4.9 percent in the third quarter to 5.2 percent in the fourth quarter. Similar results are expected for US retail sales also on Wednesday, where forecasters expect a moderate 0.4 percent month-over-month gain for December.

Mixed results are Econoday’s consensus for Canada’s CPI on Tuesday, at 3.4 percent for December which would be 3 tenths higher than November but at 3.3 percent for the core which would be 2 tenths lower. Only marginal cooling is expected for UK average earnings in Tuesday’s labour market report on Tuesday as well as UK consumer prices on Wednesday, the latter to 3.8 percent in December versus November’s 3.9 percent rate.

UK retail sales for December, in data to be released Friday, are not expected to match November’s surprising gains, nor is employment growth in Australia on Thursday.

Indian Wholesale Price Index for December (Mon 1200 IST; Mon 0630 GMT; Mon 0130 EST)

Consensus Forecast, Year over Year: 1.1%

Wholesale prices are expected to increase 1.1 percent on the month in December versus a 0.53 percent rise in November.

Eurozone Industrial Production for November (Mon 1100 CET; Mon 1000 GMT; Mon 0500 EST)

Consensus Forecast, Month over Month: -0.3%

Consensus Forecast, Year over Year: -5.9%

Production in November is expected to fall a further 0.3 percent after dropping an unexpectedly deep 0.7 percent in October. Consensus for November’s year-over-year rate is contraction of 5.3 percent versus October contraction of 6.6 percent.

Canadian Manufacturing Sales for November (Mon 08:30 EST; Mon 1330 GMT)

Consensus Forecast, Month over Month: 1.2%

After falling 2.8 percent in October, manufacturing sales in November are expected to rebound but only partially, up a consensus 1.2 percent.

Japanese Producer Price Index for December (Tue 0850 JST; Mon 2350 GMT; Mon 1850 EST)

Consensus Forecast, Month over Month: 0.0%

Consensus Forecast, Year over Year: -0.3%

Producer prices are expected to remain unchanged on the month in December for year-over-year contraction of 0.3 percent. These would compare with a 0.2 percent increase on the month in November and 0.3 percent increase on the year.

UK Labour Market Report (Tue 0700 GMT; Tue 0200 EST)

Consensus Forecast, ILO Unemployment Rate for three months to December: 4.3%

Consensus Forecast, Average Earnings for three months to December: 7.1%

The ILO unemployment rate for the three months to December is expected to rise to 4.3 percent versus 4.2 percent previously. Average earnings growth for the three months to December is seen easing only marginally to 7.1 percent from 7.2 percent.

Germany: ZEW Survey for January (Tue 1100 CET; Tue 1000 GMT; Tue 0500 EST)

Consensus Forecast, Current Conditions: -76.0

Consensus Forecast, Economic Sentiment: 12.7

Current conditions are expected to rise to minus 76.0 in January from December’s minus 77.1 which was lower than expected. Expectations (economic sentiment) are expected at 12.7 versus December’s 12.8 which, by contrast with current conditions, was higher than expected.

Canadian Housing Starts for December (Tue 0815 EST; Tue 1315 GMT)

Consensus Forecast, Annual Rate: 240,000

Housing starts are expected to accelerate to 240,000 in December versus November’s much lower-than-expected 212,624.

Canadian CPI for December (Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast, Month over Month: -0.3%

Consensus Forecast, Year over Year: 3.4%

Canadian CPI Core, Less Food & Energy

Consensus Forecast, Year over Year: 3.3%

After November’s annual rate of 3.1 percent, consumer prices in December are expected to rise to 3.4 percent. But the core rate, in contrast, is expected to slow to 3.3 percent from 3.5 percent.

Chinese Fixed Asset Investment for December (Wed 1000 CST; Wed 0300 GMT; Tue 2100 EST)

Consensus Forecast, Year-to-Date on Y/Y Basis: 2.9%

Fixed asset investment in December is expected to hold at 2.9 percent growth in both November and October.

Chinese Fourth-Quarter GDP (Wed 1000 CST; Wed 0200 GMT; Tue 2100 EST)

Consensus Forecast, Quarter over Quarter: 1.0%

Consensus Forecast, Year over Year: 5.2%

Fourth-quarter GDP is expected to rise 1.0 percent versus the third quarter which would compare with 1.3 percent sequential growth from the second quarter. But year-over-year expectations are for stronger growth, at 5.2 percent which would compare with 4.9 percent in the third quarter.

Chinese Industrial Production for December (Wed 1000 CST; Wed 0200 GMT; Tue 2100 EST)

Consensus Forecast, Year over Year: 6.6%

Year-over-year growth in industrial production is expected to hold steady in December at November’s 6.6 percent rate which was nearly a percentage point above the consensus.

Chinese Retail Sales for December (Wed 1000 CST; Wed 0200 GMT; Tue 2100 EST)

Consensus Forecast, Year over Year: 8.0%

After rising 10.1 percent in November versus expectations for 12.5 percent, year-over-year sales in December are expected to slow to 8.0 percent.

UK CPI for December (Wed 0700 GMT; Wed 0200 EST)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 3.8%

At 3.9 percent versus expectations for 4.4 percent, consumer prices fell sharply and, for a second month in a row in November, more than expected. December’s expectations are 3.8 percent. The monthly rate is seen rising 0.2 percent after falling 0.2 percent in November.

US Retail Sales for December (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Ex-Vehicles - M/M: 0.2%

Consensus Forecast, Ex-Vehicles, Ex-Gas - M/M: 0.3%

December sales are expected to rise a respectable 0.4 percent versus November’s surprising 0.3 percent gain which compared with expectations for a small decline. Ex-auto sales are expected to show a modest 0.2 percent rise with ex-auto ex-gas sales seen increasing 0.3 percent.

US Industrial Production for December (Wed 0915 EST; Wed 1415 GMT)

Consensus Forecast, Month over Month: -0.1%

Consensus Forecast, Manufacturing Output - M/M: 0.0%

Consensus Forecast, Capacity Utilization Rate: 78.7%

After a modest 0.2 percent rise in December, industrial production is expected to fall 0.1 percent in November. No change is expected for manufacturing output after rising 0.3 percent previously. Capacity utilization is expected to edge lower to 78.7 percent from 78.8 percent in November.

Japanese Machinery Orders for November (Thu 0850 JST; Wed 2350 GMT; Wed 1850 EST)

Consensus Forecast, Month over Month: -1.5%

Consensus Forecast, Year over Year: -0.6%

Machinery orders are expected to fall 1.5 percent in November for year-over-year contraction of 0.6 percent. Orders in October rose 0.7 percent on the month but were down 2.2 percent on the year. The government’s assessment in the October report repeated that machinery orders were “pausing”.

Australian Labour Force Survey for December (Thu 1130 AEDT; Thu 0030 GMT; Thu 1930 EST)

Consensus Forecast, Employment: 15,500

Consensus Forecast, Unemployment Rate: 3.9%

At a 15,500 consensus, employment growth in December is expected to slow sharply from November’s higher-than-expected 61,500 increase. Unemployment is expected to hold at 3.9 percent.

Japanese CPI for December (Fri 0830 JST; Thu 2330 GMT; Thu 1830 EST)

Consensus Forecast, Year over Year: 2.6%

Consensus Forecast, Ex-Fresh Food; Y/Y: 2.3%

Consensus Forecast, Ex-Fresh Food Ex-Energy; Y/Y: 3.7%

Consumer inflation in December is expected to ease to a year-over-year 2.6 percent versus an as-expected 2.8 percent in November which compared with 3.3 percent in October. Excluding fresh food, the rate is seen at 2.3 percent versus 2.5 and 2.9 percent in the two prior months. When also excluding energy the rate is seen at 3.7 percent versus November’s 3.8 and October’s 4.0 percent.

German PPI for December (Fri 0800 CET; Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, Month over Month: -0.4%

Consensus Forecast, Year over Year: -7.9%

After falling 0.5 percent on the month in November, December’s PPI is seen falling 0.4 percent. Year-over-year, the PPI is expected to fall 7.9 percent to match November’s contraction.

UK Retail Sales for December (Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, Month over Month: -0.1%

Consensus Forecast, Year over Year: 1.5%

Retail sales in December are expected to come in unchanged on the month after jumping a surprising 1.3 percent in November which more than doubled the consensus.

Canadian Retail Sales for November (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Month over Month: 0.0%

Retail sales in November are expected to come in unchanged following a 0.7 percent rise in October.

US Consumer Sentiment Index, Preliminary January (Fri 1500 GMT; Fri 1000 EST)

Consensus Forecast: 68.8

Year-Ahead Inflation Expectations

Consensus Forecast: 3.1

Consumer sentiment in the first indication for January, which in December jumped nearly 9 points to 69.7, is expected to slip back nearly a point to 68.8. Year-ahead inflation expectations are expected to hold at 3.1 percent.

|