|

The Reserve Bank of Australia expressed concerns at its February 6th meeting that inflation, though cooling, may not continue to cool as much as the bank would like. The RBA held rates steady but did not rule out the possibility for a return to rate hikes stressing the bank would do "what is necessary" to return inflation back to its target range.

Unlike RBA officials, those at the US Federal Reserve, according to the minutes of their January 30-31 meeting, weren’t rattling any sabers, instead agreeing that rates had "likely” peaked. Yet surprisingly strong employment and inflation data since the Fed’s meeting -- with many of the results doubling consensus estimates -- fairly raise the question whether the Fed’s careful and patient approach toward a rate cut may now increasingly become, especially if the US economy continues to outperform, a cautious if not hesitant approach.

Similarly for the European Central Bank, which published minutes for its January 25 meeting, the risk of cutting policy rates too early was still seen as outweighing that of cutting rates too late and having to reverse course at the possible cost to credibility. The point was also made that the risk of an inadvertent overtightening was mitigated by the fact that financial markets were already pricing in a number of rate cuts for this year, contributing to a loosening of both financial and financing conditions.

Policy is in a careful but stable balancing act right now with most central banks, facing no worse than flat economic activity, have time in their favor. Yet China, where a troubled property sector may not be improving, is a prominent exception.

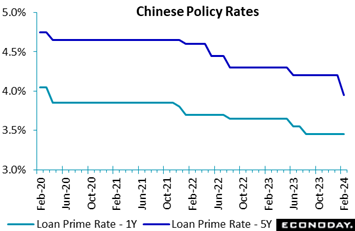

The People's Bank of China cut the five-year loan prime rate by 25 basis points from 4.20 percent to 3.95 percent, a reduction much greater than the consensus forecast for a cut of 5 basis points and the biggest since the rate was first introduced in 2019. This cut will lower mortgage rates for new borrowers though will have limited near-term impact on existing mortgage holders, as mortgage rates are generally reset on an annual basis. The PBoC left the one-year loan prime rate unchanged at 3.45 percent as expected. This rate has been left unchanged since August 2023. The People's Bank of China cut the five-year loan prime rate by 25 basis points from 4.20 percent to 3.95 percent, a reduction much greater than the consensus forecast for a cut of 5 basis points and the biggest since the rate was first introduced in 2019. This cut will lower mortgage rates for new borrowers though will have limited near-term impact on existing mortgage holders, as mortgage rates are generally reset on an annual basis. The PBoC left the one-year loan prime rate unchanged at 3.45 percent as expected. This rate has been left unchanged since August 2023.

The reduction in the 5-year rate follows recent moves to lower banks' reserve requirements and represents a further effort to support liquidity and boost lending in order to support economic recovery. Recent data have generally shown subdued activity and very weak price pressures in China's economy, in part reflecting the ongoing impact of the downturn in the property market. The cut may indicate that officials now consider more decisive policy support is required to restore confidence in the property market and the economic outlook and may be followed by further policy announcements at the annual meeting of the National People's Congress early next month. Housing data in the week underscored weakness as residential property prices fell 0.7 percent on the year in January after falling 0.4 percent in December.

The Bank of Korea, as it has since the start of 2023, left its main policy rate unchanged at 3.50 percent in line with the consensus forecast. Since the previous BoK meeting in early January, data have shown a decline in headline inflation from 3.2 percent in December to 2.8 percent in January, with core inflation moderating from 3.05 percent to 2.63 percent. In their statement, officials said they expect core inflation to be slightly lower this year than previously forecast, but they also noted that higher agricultural prices will likely push up headline inflation in the near-term and that "there are high uncertainties around the inflation outlook". The Bank of Korea, as it has since the start of 2023, left its main policy rate unchanged at 3.50 percent in line with the consensus forecast. Since the previous BoK meeting in early January, data have shown a decline in headline inflation from 3.2 percent in December to 2.8 percent in January, with core inflation moderating from 3.05 percent to 2.63 percent. In their statement, officials said they expect core inflation to be slightly lower this year than previously forecast, but they also noted that higher agricultural prices will likely push up headline inflation in the near-term and that "there are high uncertainties around the inflation outlook".

Officials also noted the growth outlook is highly uncertain, but their statement highlights that their priority is "to conduct monetary policy in order to stabilize consumer price inflation at the target level over the medium-term horizon". Reflecting this objective, officials concluded that monetary policy should remain "restrictive" until they are confident that inflation will converge on the target level. This suggests that policy rates will remain on hold until incoming inflation data provide enough evidence that the target is likely to be met.

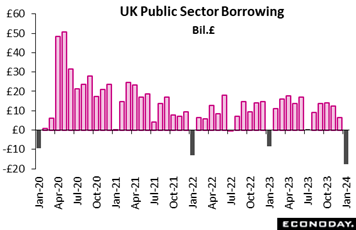

Public sector finances in the UK returned to the black in line with the usual seasonal pattern in January. At £17.62 billion, the surplus on overall public sector net borrowing (PSNB) was more than double that seen at the start of 2023 (£8.46 billion) and the largest on record, albeit still slightly short of the market consensus. The December deficit was also revised a little smaller to £6.45 billion. Excluding public sector banks (PSNB-X), the excess stood at £16.69 billion, up from £7.54 billion a year ago. Public sector finances in the UK returned to the black in line with the usual seasonal pattern in January. At £17.62 billion, the surplus on overall public sector net borrowing (PSNB) was more than double that seen at the start of 2023 (£8.46 billion) and the largest on record, albeit still slightly short of the market consensus. The December deficit was also revised a little smaller to £6.45 billion. Excluding public sector banks (PSNB-X), the excess stood at £16.69 billion, up from £7.54 billion a year ago.

Total receipts rose £4 billion on the year, largely because of gains in corporation tax and income tax inflows as well as an increase in national insurance contributions. At the same time, spending fell £5.2 billion, mainly a reflection of a significant fall in interest payments and the closure of energy support schemes. As a result, net debt was 96.5 percent of GDP, down from 98.2 percent in December but up from 94.7 percent in January 2023. However, it was 0.2 percentage points less than forecast by the Office for Budgetary Stability (OBR).

The January data put the cumulative PSNB-X so far in the current financial year at £96.6 billion. This was £9.2 billion less than expected by the OBR and leaves the government with some, but not much, room for some fiscal manoeuvre. To this end, January's update will be the last available before the budget when Chancellor Jeremy Hunt, on March 6th, will outline his spending and tax plans for what he will hope will be the current government's next parliamentary term.

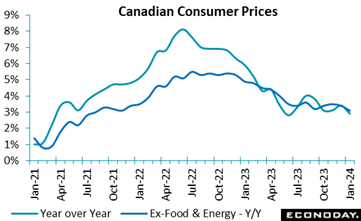

Consumer prices in Canada were flat in January and rose 2.9 percent year-over-year, below expectations of 0.4 percent and 3.2 percent in Econoday’s survey. Excluding food and energy, prices edged down 0.1 percent on the month and eased to 3.1 percent on the year, which like the headline, was down from 3.4 percent in December. Consumer prices in Canada were flat in January and rose 2.9 percent year-over-year, below expectations of 0.4 percent and 3.2 percent in Econoday’s survey. Excluding food and energy, prices edged down 0.1 percent on the month and eased to 3.1 percent on the year, which like the headline, was down from 3.4 percent in December.

Food prices were up 0.7 percent on the month and 3.9 percent year-over-year, while energy fell 1.1 percent and 2.7 percent, respectively, with gasoline down 0.9 percent and 4.0 percent.

Also reassuring, the Bank of Canada's own core measures of inflation averaged 3.4 percent year-over-year in January, down from 3.7 percent in December with all three measures slowing down. Note that the BoC warned in January that progress toward price stability had been "slow". January’s headline inflation rate of 2.9 percent puts the first-quarter average on a favorable path compared to the bank’s 3.2 percent quarterly projection.

But shelter costs continued to put upward pressure on prices, which should remain a concern for the BoC. It said in its January minutes that should the housing market rebound more than expected in the spring, "shelter inflation could keep CPI inflation materially above the target even while price pressures in other parts of the economy abated." In January, mortgage interest cost, up 1.6 percent, and rents, up 0.7 percent, were the first and third largest upward contributors to the monthly CPI. The two categories were up 27.4 percent and 7.9 percent year-over-year, respectively, making them the two largest upward contributors to the 12-month CPI advance. Overall, shelter prices increased 0.3 percent from December and 6.2 percent from a year earlier.

Air transportation, down 23.7 percent, was the largest downward contributor to the monthly CPI, while telephone services were the largest downward contributor to 12-month inflation.

Both services and goods prices were flat on the month, with 12-month gains of 4.2 percent and 1.3 percent, respectively.

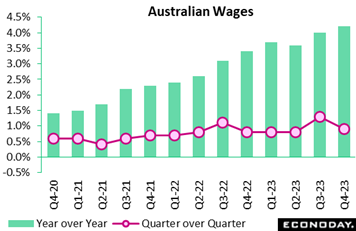

Australia's wage price index rose 0.9 percent on the quarter in the three months to December after advancing 1.3 percent in the three months to September, with year-over-year growth in the index picking up from 4.0 percent to 4.2 percent. Monthly labour market data over that period showed ongoing low unemployment rates and participation rates close to record highs. Australia's wage price index rose 0.9 percent on the quarter in the three months to December after advancing 1.3 percent in the three months to September, with year-over-year growth in the index picking up from 4.0 percent to 4.2 percent. Monthly labour market data over that period showed ongoing low unemployment rates and participation rates close to record highs.

The quarterly data are in line with the assessment made by officials at the Reserve Bank of Australia at their most recent policy meeting earlier in the month that conditions in the labour market remain tight. Officials noted then that wages growth has "remained robust" but judged that conditions in the labour market are likely to ease over 2024 and deliver growth in wages that are consistent with their inflation target. This forecast, however, is based on an assumption that productivity growth increases to around its long-run average, an assumption that officials acknowledged represents a "material risk".

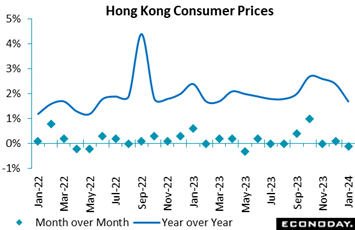

Hong Kong's headline consumer price index rose 1.7 percent on the year in January, slowing sharply from an increase of 2.4 percent in December. The index fell 0.1 percent on the month after advancing 0.1 percent previously. Excluding the impact of one-off government relief measures, Hong Kong's underlying inflation rate fell from 1.4 percent to 0.8 percent. Hong Kong's headline consumer price index rose 1.7 percent on the year in January, slowing sharply from an increase of 2.4 percent in December. The index fell 0.1 percent on the month after advancing 0.1 percent previously. Excluding the impact of one-off government relief measures, Hong Kong's underlying inflation rate fell from 1.4 percent to 0.8 percent.

This big decline in inflation largely reflects the timing of lunar new year holidays, which occurred in January last year but in February this year. This means that the price index was somewhat higher in January 2023 than it otherwise would have been and will likely be somewhat higher in February 2024. This, in turn, means that the year-over-year increase in the index is somewhat lower than it would otherwise be in January 2024 and will likely be somewhat higher in February 2024. Because of this factor, officials noted that it will be more meaningful to examine January and February data combined, when available, to assess the strength of price pressures at the start of the year.

Officials also again expressed confidence that domestic inflation will remain "moderate" in the near-term. They expect external price pressures to weaken further, offsetting a potential increase in domestic price pressures as economic conditions improve.

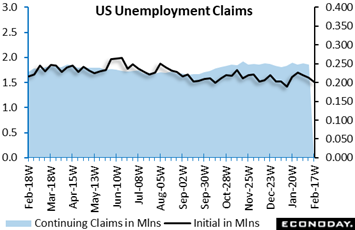

Initial jobless claims in the US fell 12,000 to 201,000 in the February 17 week, below the consensus of 216,000 in Econoday’s survey of forecasters. The greater-than-expected decline was mainly due to a larger decrease in unadjusted claims than accounted for in the seasonal adjustment factor. Unadjusted claims fell 26,053 to 197,932 in the February 17 week, down 11.6 percent where the seasonal factor was for a decrease of 6.0 percent. The four-week moving average fell 3,500 to 215,250 in the February 17 week. Overall, levels of applications for unemployment benefits are low and consistent with a tight labor market and moderate economic expansion. Initial jobless claims in the US fell 12,000 to 201,000 in the February 17 week, below the consensus of 216,000 in Econoday’s survey of forecasters. The greater-than-expected decline was mainly due to a larger decrease in unadjusted claims than accounted for in the seasonal adjustment factor. Unadjusted claims fell 26,053 to 197,932 in the February 17 week, down 11.6 percent where the seasonal factor was for a decrease of 6.0 percent. The four-week moving average fell 3,500 to 215,250 in the February 17 week. Overall, levels of applications for unemployment benefits are low and consistent with a tight labor market and moderate economic expansion.

Insured unemployment claims fell 27,000 to 1.862 million in the February 10 week after 1.889 million in the prior week. The four-week moving average was up 8,500 to 1.878 million in the February 10 week. The level of insured jobless claims (for those eligible for jobless benefits) are running somewhat above the year-ago week of 1.714 million. However, current levels reflect a healthy labor market able to absorb the unemployed, although not quite as quickly as the same time last year.

The insured rate of unemployment fell to 1.2 percent in the February 10 week after 1.3 percent in the prior week. For over a year, the insured rate of unemployment has hovered within a tenth of the 1.2 percent reading. Despite the potential for restrictive monetary policy to slow the US economy, indicators are not seeing much of an impact in the measures of unemployment.

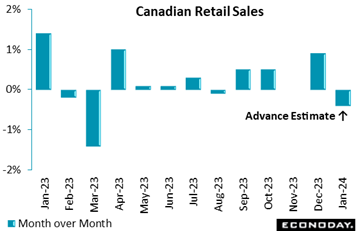

Owing to stronger activity, retail sales in Canada expanded more than expected in December, when they increased 0.9 percent on the month, the largest monthly gain since April 2023, above Econoday's consensus forecast of 0.8 percent. Volumes were up 0.8 percent. Owing to stronger activity, retail sales in Canada expanded more than expected in December, when they increased 0.9 percent on the month, the largest monthly gain since April 2023, above Econoday's consensus forecast of 0.8 percent. Volumes were up 0.8 percent.

Though December’s result provides an argument for the Bank of Canada to continue to wait before easing, the advance estimate for January, at a 0.4 percent decline, shows the momentum was short lived.

Retail sales expanded 1.0 percent in the fourth quarter, with volumes rising 1.3 percent. For 2023 as a whole, sales grew 2.2 percent as volumes were up 2.3 percent.

In December, sales were up in five of nine subsectors, led by a 1.9 percent gain in motor vehicles and parts. Excluding this category, the monthly advance was 0.6 percent. When also excluding a 0.9 percent increase in gasoline and fuel, core sales were up 0.5 percent.

Housing-related indicators were weak in December, with sales of furniture, home furnishings, electronics and appliances down 2.7 percent, and building material and garden equipment and supplies down 0.8 percent.

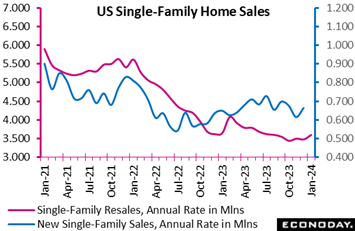

US existing home sales rose 3.1 percent to 4.00 million units at a seasonally adjusted annual rate, up from 3.88 million units in December. The level in January was slightly above the consensus of 3.98 million in Econoday’s survey of forecasters. US existing home sales rose 3.1 percent to 4.00 million units at a seasonally adjusted annual rate, up from 3.88 million units in December. The level in January was slightly above the consensus of 3.98 million in Econoday’s survey of forecasters.

Resales of single-family homes, as tracked in the red line of the accompanying graph, rose 3.4 percent in January to 3.60 million. Sales of new single-family homes, to be posted on Monday of the coming week, are expected to rise 3.2 percent to a 685,000 annual rate (see Looking Ahead for details). Note that January’s results will have benefited from December’s sharp decline in mortgage rates, a decline, however, that has reversed so far into 2024. Nevertheless, demand will continue to get a lift from ongoing scarcity of housing inventory and some momentum from homebuyers who locked in a lower rate in December and act to exercise it before the rate expires.

December’s supply of available resales was 3.0 months in January, little changed from 3.1 months in December and 2.9 in January 2023. However, the inventory of homes available for sale rose to 1.01 million units from 990,000 in December and was up from 980,000 in January 2023. The median price of an existing home fell 0.6 percent to $379,100 in January, but the highest for a January. The median price was up 5.1 percent compared to a year ago and firmer on a year-over-year basis for the past seven months.

Homes were on the market for an average of 36 days in January, up from 29 in December and 33 in January 2023. First time buyers accounted for 28 percent of home resales, little changed from 29 percent in December and 29 percent in January 2023.

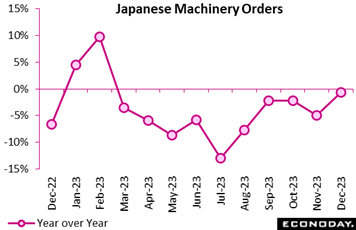

Machinery orders rebounded a nearly as expected 2.7 percent in December on higher demand from manufacturers, after falling a sharp 4.9 percent in November.. On the year, orders marked their 10th straight decline, falling 0.7 percent but up from a 5.0 percent slump in the prior month. Machinery orders rebounded a nearly as expected 2.7 percent in December on higher demand from manufacturers, after falling a sharp 4.9 percent in November.. On the year, orders marked their 10th straight decline, falling 0.7 percent but up from a 5.0 percent slump in the prior month.

On the quarter, orders dipped 1.0 percent after falling 1.8 percent in July-September. It was weaker than the official forecast of a 0.5 percent rise provided in November. The median forecast was a 0.8 percent drop.

The Cabinet Office is forecasting a 4.6 percent rise in the March quarter which would be the first increase in four quarters. The gain is expected to be led by the manufacturing sector to offset a slight drop from non-manufacturers.

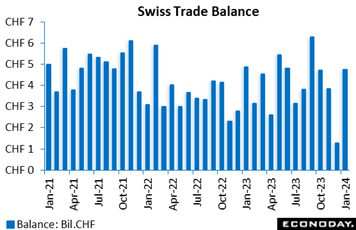

Switzerland’s merchandise trade surplus widened from December's CHF1.27 billion to CHF4.74 billion at the start of the year. This was almost double the CHF2.41 billion posted in January 2023 and a 3-month high. Yet the improvement reflected a 5.6 percent yearly fall in imports that more than offset a 5.3 percent slide in exports. Imports have been in contraction since last February. Switzerland’s merchandise trade surplus widened from December's CHF1.27 billion to CHF4.74 billion at the start of the year. This was almost double the CHF2.41 billion posted in January 2023 and a 3-month high. Yet the improvement reflected a 5.6 percent yearly fall in imports that more than offset a 5.3 percent slide in exports. Imports have been in contraction since last February.

Seasonally adjusted, the surplus stood at CHF2.84 billion, up from CHF1.30 billion and the best reading since October. Again the increase in the black ink masked fresh contractions in both sides of the balance sheet as exports dipped a monthly 0.4 percent while imports declined fully 9.3 percent. That said, the slide in the latter was only the second since the middle of 2023 and was driven by a hefty 19.6 percent slump in chemicals and pharmaceuticals.

Still, the real trade balance improved significantly as export volumes eased only 0.4 percent versus a 4.3 percent fall in their import counterpart. This boosts the chances of a positive contribution to real GDP growth this quarter following a small negative impact last quarter.

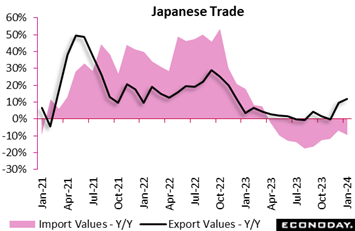

Japanese export values rose 11.9 percent on year in January, as largely expected (consensus was 11.5 percent), after rebounding 9.7 percent to a record high in December, led by shipments of automobiles, parts and chip-producing equipment. Japanese export values rose 11.9 percent on year in January, as largely expected (consensus was 11.5 percent), after rebounding 9.7 percent to a record high in December, led by shipments of automobiles, parts and chip-producing equipment.

Import values, by contrast, fell for the 10th straight month as energy prices remained below year-earlier levels and demand for foreign-made smartphones sagged due to high prices. The pace of decrease accelerated to 9.6 percent from 6.9 percent. The median forecast was a 7.5 percent drop.

The trade balance recorded a ¥1,758.3 billion deficit after chalking up a ¥68.89 billion surplus in December, which was the first positive figure in three months. The deficit was narrower than the median forecast of ¥1,923.4 billion and much smaller than a record shortfall of ¥3,506.43 billion hit in January 2023.

Shipments to China, one of the key export markets for Japanese goods, posted their second straight increase, surging 29.2 percent in January, after marking the first year-over-year rise in 13 months in December. The sharp gain in January was partly in reaction to a 17.1 percent slump in January 2023.

Japanese exports to the European Union also posted the second consecutive gain after showing their first year-over-year drop in 33 months in November while exports to the US remained robust, up for the 28th straight month, after rising to a record high in December.

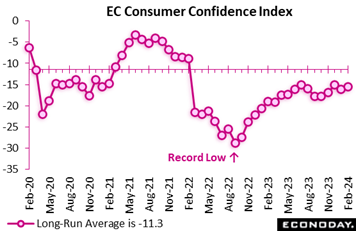

Consumer confidence in the euro area (those countries that have adopted the euro) improved only slightly but still by more than expected in February. The provisional EU Commission survey put the headline index at minus 15.5, up from minus 16.1 in January and 0.2 points above the market consensus. Even so, the mid-quarter increase failed to fully reverse January's 1 point drop and essentially leaves a flat trend in the measure since the middle of last year. The February reading remains well short of its long-run average and so remains in line with a subdued near-term outlook for consumer spending and a possible negative handle on first-quarter GDP. Consumer confidence in the euro area (those countries that have adopted the euro) improved only slightly but still by more than expected in February. The provisional EU Commission survey put the headline index at minus 15.5, up from minus 16.1 in January and 0.2 points above the market consensus. Even so, the mid-quarter increase failed to fully reverse January's 1 point drop and essentially leaves a flat trend in the measure since the middle of last year. The February reading remains well short of its long-run average and so remains in line with a subdued near-term outlook for consumer spending and a possible negative handle on first-quarter GDP.

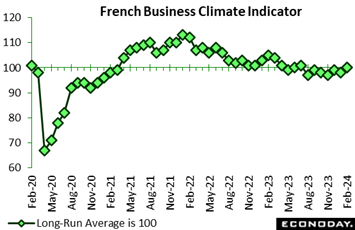

Sentiment in French manufacturing has improved this month. At 100, February’s headline index is up a couple of points versus January's downwardly revised mark and in line with the market consensus. This is its highest level since last July and also the first time since that month that the measure has at least matched its long-run average. Sentiment in French manufacturing has improved this month. At 100, February’s headline index is up a couple of points versus January's downwardly revised mark and in line with the market consensus. This is its highest level since last July and also the first time since that month that the measure has at least matched its long-run average.

Production (0 percent after minus 8 percent) stabilised having fallen in the previous three months and orders books (minus 17 percent after minus 19 percent) declined at a slightly slower rate. However, expected employment growth (3 percent after 6 percent) slowed and both personal production expectations (5 percent after 7 percent) and general production expectations (minus 8 percent after minus 7 percent) deteriorated. Expected selling prices (0 percent after 4 percent) were also softer.

Elsewhere, sentiment was stable in construction (103) but worsened in both services (99 after 101) and, more notably, retail trade (99 after 104). As a result, the economy-wide gauge dipped from 99 to 98.

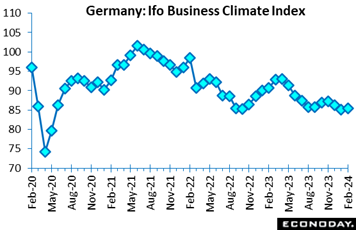

Ifo's February survey suggests just a marginal improvement in economic conditions. At 85.5 the overall climate indicator was up 0.3 points versus January, in line with the market consensus but reversing only a portion of the previous month's 1.1 point drop. As such, the latest reading was the second lowest since October 2022 and historically still very weak. Ifo's February survey suggests just a marginal improvement in economic conditions. At 85.5 the overall climate indicator was up 0.3 points versus January, in line with the market consensus but reversing only a portion of the previous month's 1.1 point drop. As such, the latest reading was the second lowest since October 2022 and historically still very weak.

Current conditions were unchanged at 86.9 and so remained at their lowest mark since July 2020. Expectations fared rather better, gaining 0.6 points to 84.1 although having fallen a cumulative 1.6 points in December and January, the rebound was only modest.

Among the main sectors, sentiment deteriorated in manufacturing (minus 17.4 after minus 15.8) and trade (minus 30.8 after minus 29.7) but improved in services (minus 4.1 after minus 4.8) and construction (minus 35.4 after minus 35.8).

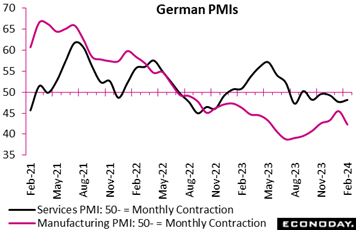

All in all, the February results increase the chances of the German economy sliding into recession this quarter. Manufacturing is clearly leading the way lower but services are also struggling to keep their head above water and construction has been in the doldrums for some time. The near-term outlook remains grim.

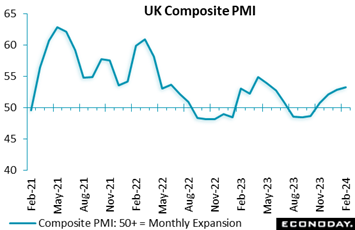

The UK economy continued to outperform expectations in mid-quarter. At 53.3, the flash composite output index was 0.6 points stronger than the market consensus and up from January's final 52.9. This is its highest reading in nine months. The UK economy continued to outperform expectations in mid-quarter. At 53.3, the flash composite output index was 0.6 points stronger than the market consensus and up from January's final 52.9. This is its highest reading in nine months.

However, headline growth remains restricted to services where the flash sector PMI weighed in at 54.3, unchanged from January's final mark. By contrast, in manufacturing, the PMI provisionally printed at 47.1, up 0.1 point from the start of the year but still well in contraction territory.

Aggregate new orders increased for a third straight month, mainly due to a solid advance in services. Backlogs extended their trend decline but employment rose again, albeit only marginally, and business expectations for the year ahead improved for a fourth time in as many months, hitting their best level since February 2022.

Meantime, input costs rose at the fastest rate in half a year on the back of higher wages in services. Manufacturers also pointed to more expensive freight charges linked to disruptions to traffic in the Red Sea. Consequently, output prices chalked up their sharpest increase since July 2023.

Taken at face value, February's update suggests only limited pressure on the BoE to cut interest rates any time soon. The apparent buoyancy of costs and prices in the service sector will not go unnoticed at the bank and should all but guarantee that the MPC will vote for no change in Bank Rate again next month.

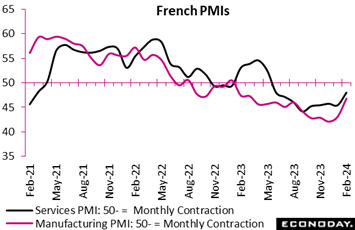

Private sector business activity in France continued to contract in February but at a much slower pace than at the start of the year. The flash composite output index improved to 47.7, up from January's 44.6 and a 9-month high. The latest print was also more than 2 points stronger than the market consensus but still short of the 50-expansion threshold. Private sector business activity in France continued to contract in February but at a much slower pace than at the start of the year. The flash composite output index improved to 47.7, up from January's 44.6 and a 9-month high. The latest print was also more than 2 points stronger than the market consensus but still short of the 50-expansion threshold.

The headline gain reflected less weak performances in both manufacturing and services. In the former, the flash sector PMI climbed from January's final 43.1 to 46.8, still well in contraction territory but its best outturn in 11 months. Its service sector counterpart clocked in at 48.0, up from 45.4 and an 8-month high.

Manufacturing output (46.3) hit its strongest mark in almost a year as new orders fell by the least since last May. Backlogs declined again but by less than in January and overall employment saw its first rise since October 2023 due to an increase in services. Against this backdrop, business expectations about the coming year improved to a 7-month peak.

Helping matters, inflationary pressures eased. Input costs rose at the slowest rate since March 2021 and paved the way for a marked fall in output price inflation which touched a 3-year low. Significantly, the re-routing of ships away from the Red Sea had only a limited effect. Delivery times lengthened but by less than in January and manufacturers' input costs fell further.

In sum, the February update paints a much less bleak picture of the French economy but does not remove the possibility of a contraction in first-quarter GDP.

The German economy disappointed in mid-quarter. At 46.1, February's flash composite output index was fully 1.5 points short of the market consensus and down from January's final 47.0. The latest reading was a 4-month low and extended the run of sub-50 prints that began in the middle of 2023. The German economy disappointed in mid-quarter. At 46.1, February's flash composite output index was fully 1.5 points short of the market consensus and down from January's final 47.0. The latest reading was a 4-month low and extended the run of sub-50 prints that began in the middle of 2023.

The headline fall was wholly attributable to manufacturing where the flash sector PMI dropped from a final 45.5 at the start of the year to just 42.3, a 4-month low. Manufacturing output (42.1) remained deep in contraction territory. By contrast, at 48.2, the flash services PMI rose versus January's final 47.7 but what was only a 2-month high still pointed to another month of declining business activity.

Ominously, aggregate new orders decreased by the most since last October on the back of falls in both sectors and weakness in domestic and overseas demand. Backlogs followed suit but employment was only fractionally lower, underlining the ongoing tightness of the labour market. Even so, business expectations about the coming year improved again to hit a 10-month peak due to increased optimism among service providers.

Meantime, higher wages in services lay behind overall input cost inflation rising to its highest level since last April and this masked another, albeit smaller, fall in manufacturers' costs. A similar picture was true of output prices where strength in services kept the inflation rate above its long-run trend.

In sum, the February data are again surprisingly soft and increase the likelihood of a negative handle on first-quarter GDP. Nonetheless, the ECB will take note of another pick-up in inflation pressures so, if anything, February's report probably further bolsters chances of no change in key interest rates next month.

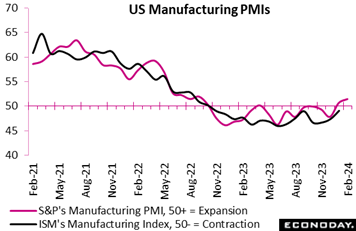

Tangible if only limited monthly expansion for manufacturers is the headline from February's PMI flashes for the US. The manufacturing PMI rose 1.2 points to 51.5, still near the breakeven 50 but nevertheless the best reading since September 2022. The result will help lift forecasts for the ISM manufacturing index which in January rose 1.7 points to 49.1 for its best reading since October 2022. Manufacturing details include a 21-month high in new orders, a 10-month high in output, and quicker delivery times. Tangible if only limited monthly expansion for manufacturers is the headline from February's PMI flashes for the US. The manufacturing PMI rose 1.2 points to 51.5, still near the breakeven 50 but nevertheless the best reading since September 2022. The result will help lift forecasts for the ISM manufacturing index which in January rose 1.7 points to 49.1 for its best reading since October 2022. Manufacturing details include a 21-month high in new orders, a 10-month high in output, and quicker delivery times.

February's services PMI, however, slowed by 1.2 points to 51.3 which will hold down forecasts for the ISM services index which rose 2.8 points in January to 53.4. Services details include slowing in new orders, contraction in backlogs, and slowing in employment growth. Aggregate details for both services and manufacturing include easing cost pressures yet an uptick in selling prices.

The global economy is performing much as expected. However, a Relative Performance Index of 1 masks a significant divergence between the major regions which, in the main, has left financial markets more cautious about the likely pace of central bank easing in 2024.

In the US, surprises in the economic data remained skewed to the upside leaving the RPI and RPI less prices (RPI-P) to close out the week at 22 and 16 respectively. Speculation about a rate cut from the Federal Reserve in March has now all but evaporated and investors have similarly ratcheted down further their expectations for a move in May.

The Eurozone economy remains very lethargic but no more so than forecast and at 15 and 31 respectively, the region’s RPI and RPI-P ended the week in positive surprise territory. Ahead of the ECB’s March 7th meeting, the latest readings will help to cement expectations for no move on key interest rates until later in the year.

In the UK, further signs that the current recession will be short-lived helped to lift both the RPI and RPI-P to 23. The surprising buoyancy of the economic reports so far this quarter makes a cut in Bank Rate next month all the more improbable.

In Japan, a slightly smaller than forecast January trade deficit did nothing to mask ongoing weakness in imports, itself due in part to inadequate domestic demand. In fact, with the RPI standing at minus 31 and the RPI-P at minus 39, the government felt obliged to revise down its own economic assessment for the first time in three months. Bank of Japan tightening in March remains unlikely.

There were no major data released out of China but a record cut in the central bank’s 5-year loan prime rate still reflected the unexpected weakness of local economic activity, as highlighted in an RPI of minus 21 and an RPI-P of minus 30.

In Canada, December strength in retail sales contrasted with a provisional January dip and especially with a much steeper-than-forecast drop in January inflation. The results left both the RPI (minus 19) and RPI-P (minus 6) below zero. Data surprises have been largely on the downside since mid-December and the Bank of Canada remains on course to be one of the first of the major central banks to cut in 2024, albeit probably not at their March 6th week.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

The Reserve Bank of New Zealand is expected to once again hold policy steady on Wednesday in what will be the week’s only policy announcement. But inflation news will be heavy including

Japan’s CPI on Tuesday which is expected to cool substantially in data for January and Australia’s CPI on Wednesday, also for January, which is expected to re-accelerate. An outsized monthly rise is expected for January’s US core PCE price index on Thursday.

Europe will post flash CPI’s for February beginning on Thursday with France and Germany followed on Friday with harmonised Eurozone data. Cooling is generally consensus with the latter expected to slow 3 tenths overall and also for the core, to 2.5 and 3.0 percent respectively.

India will post the first estimate of fourth-quarter GDP on Thursday with another roaring pace of 7.2 percent year-over-year growth expected. Canada’s first estimate for the fourth quarter, also on Thursday, is expected to be GDP growth of 1.0 percent on an annualized basis. China’s official CFLP PMIs on Friday are expected to show little change at flat levels, while Japanese industrial production on Thursday is expected to fall sharply reflecting suspended vehicle output tied to safety issues.

For the US, further improvement is expected for consumer confidence on Tuesday, with only marginal improvement expected for the ISM manufacturing index on Friday.

Japanese CPI for January (Tue 0830 JST; Mon 1830 EST; Mon 2330 GMT)

Consensus Forecast, Year over Year: 2.0%

Consensus Forecast, Ex-Fresh Food; Y/Y: 1.9%

Consensus Forecast, Ex-Fresh Food Ex-Energy; Y/Y: 3.3%

Consumer inflation in January is expected to further ease and sharply to a year-over-year 2.0 percent versus 2.6 percent in December which compared with 2.8 percent in November. Excluding fresh food, the rate is seen at 1.9 percent versus and 2.3 and 2.5 percent in the two prior months. When also excluding energy the rate is seen at 3.3 percent versus December’s 3.7 and November’s 3.8 percent.

Germany: GfK Consumer Climate for March (Tue 0800 CET; Tue 0700 GMT; Tue 0200 EST)

Consensus Forecast: -28.8

Consumer climate is expected to rise to minus 28.8 in March’s report after a nearly 5-point unexpected fall to minus 29.7 in February.

Eurozone M3 Money Supply for January (Tue 1000 CET; Tue 0900 GMT; Tue 0400 EST)

Consensus Forecast, Year-over-Year: 0.3%

Broad money growth (on a 3-month basis) is expected to rebound 0.3 percent in January versus 0.6 percent contraction in December.

US Durable Goods Orders for January (Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast: Month over Month: -4.5%

Consensus Forecast: Ex-Transportation - M/M: 0.2%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.1%

Forecasters see durable goods orders, reflecting an expected downturn for aircraft, falling 4.5 percent in January following no change in December. Ex-transportation orders, however, are seen rising a steady 0.2 percent in January with core capital goods orders expected to edge 0.1 percent higher.

US Consumer Confidence Index for February (Tue 1000 EST; Tue 1500 GMT)

Consensus Forecast: 115.0

The consumer confidence index is expected to rise a further though slight 2 tenths in February to 115.0. January’s 114.8 was ahead of expectations and nearly 7 points above December.

Australian January CPI (Wed 1130 AEDT; Wed 0030 GMT; Tue 1930 EST)

Consensus Forecast, Year over Year: 3.6%

Consumer prices in January are expected to rise to a year-over-year 3.6 percent versus a slightly lower-than-expected 3.4 percent in December and against 4.3 percent in November.

Reserve Bank of New Zealand Announcement (Wed 1400 NZDT; Wed 0000 GMT; Tue 2000 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 5.50%

Though inflation has remained stubbornly high, at 4.7 percent in the fourth quarter, the Reserve Bank of New Zealand has been keeping policy steady. And once again the consensus for February’s meeting is no change at 5.50 percent.

Eurozone: EC Economic Sentiment for February (Wed 1100 CET; Wed 1000 GMT; Wed 0500 EST)

Consensus Forecast: 96.7

Consensus Forecast, Industry Sentiment: -9.2

Consensus Forecast, Consumer Sentiment: -15.5

Economic sentiment in February is expected to rise to 96.7 from January’s 96.2 which remained well short of the 100 long-run average.

US International Trade in Goods (Advance) for January (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, Balance: -$88.1 billion

The US goods deficit (Census basis) is expected to deepen by $0.2 billion to $88.1 billion in January after deepening by $0.4 billion in December to $87.9 billion.

Japanese Industrial Production for January (Thu 0850 JST; Wed 2350 GMT; Wed 1850 EST)

Consensus Forecast, Month over Month: -7.2%

Consensus Forecast, Year over Year: -2.0%

Industrial production is expected to tumble 7.2 percent on the month in a collapse tied to suspended vehicle output over a safety test scandal.

Japanese Retail Sales for January (Thu 0850 JST; Wed 2350 GMT; Wed 1850 EST)

Consensus Forecast, Month over Month: 1.2%

Consensus Forecast, Year over Year: 2.0%

Retail sales are expected to rebound 2.0 percent on the year in January versus December’s deep 2.6 percent contraction. The government downgraded its assessment in the December report from retail sales being “on an uptrend” to “taking one step forward and one step back”.

Australian Fourth-Quarter Capital Expenditures (Thu 1130 AEDT; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Quarter over Quarter: 0.4%

Capital Expenditures for the fourth quarter are expected to rise 0.4 percent on the quarter versus 0.6 percent growth in the third quarter.

Australian Retail Sales for January (Thu 1130 AEDT; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Month over Month: 1.5%

Retail sales in January are expected to increase 1.5 percent on the month to partially reverse December’s sharper-than-expected 2.7 percent decline.

German Retail Sales for January (Thu 0800 CET; Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: -1.2%

Retail sales volumes are expected to rise 0.5 percent in January versus December’s steeper-than-expected 1.6 percent fall.

French CPI, Preliminary February (Thu 0845 CET; Thu 0745 GMT: Thu 0245 EST)

Consensus Forecast, Year over Year: 2.8%

Consumer inflation in February is expected to slow to 2.8 percent versus January’s 3.1 percent annual rate.

German Unemployment Rate for February (Tue 0955 CET; Tue 0855 GMT; Tue 0355 EST)

Consensus Forecast: 5.8%

February’s unemployment rate is expected to hold steady at January’s rate of 5.8 percent.

Indian Fourth-Quarter GDP (Thu 1730 IST; Thu 1200 GMT; Thu 0700 EST)

Consensus Forecast, Year over Year: 7.2%

Forecasters see GDP coming in at year-over-year growth of 7.2 percent in the December quarter versus stronger-than-expected growth of 7.6 percent in the September quarter.

German CPI, Preliminary February (Thu 1400 CET; Thu 1300 GMT; Thu 0800 EST)

Consensus Forecast, Month over Month: 0.7%

Consensus Forecast, Year over Year: 2.7%

February’s consensus is a year-over-year 2.7 percent in what would be further improvement from January’s much cooler-than-expected 2.9 percent rate that was down from 3.7 percent in December.

Canadian Monthly GDP for December (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Month over Month: 0.2%

Another 0.2 percent rise in December, which would match November’s gain, is the consensus.

Canadian Fourth-Quarter GDP (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Annualized: 1.0%

A 1.0 percent annualized growth rate is the consensus for Canadian fourth-quarter GDP versus 1.1 percent contraction in the third quarter.

US Personal Income for January (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Month over Month: 0.4%

US Consumption Expenditures

Consensus Forecast, Month over Month: 0.2%

US PCE Price Index

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 2.4%

US Core PCE Price Index

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 2.8%

Personal income is expected to rise 0.4 percent in January with consumption expenditures expected to increase 0.2 percent. These would compare with December’s respective increases of 0.3 and 0.7 percent. Inflation readings for January are expected at monthly increases of 0.3 percent overall and an overheated 0.4 percent for the core (versus 0.2 percent increases for both in December). Annual rates are expected at 2.4 percent overall and 2.8 percent for the core (versus December’s 2.6 and 2.9 percent).

Japanese Unemployment Rate for January (Fri 0830 JST; Thu 2330 GMT; Thu 1830 EST)

Consensus Forecast, Unemployment Rate: 2.4%

Japan's unemployment rate for January is expected to hold steady at 2.4 percent.

China: CFLP PMIs for February (Fri 0930 CST; Fri 0130 GMT; Thu 1930 EST)

Manufacturing PMI, Consensus Forecast: 49.3

Non-manufacturing PMI, Consensus Forecast: 50.8

The CFLP manufacturing PMI is expected to hold steady in February at 49.3 from January’s 49.2 which was slightly less weak than expected and up marginally from December’s 49.0. The non-manufacturing PMI, which in January was 50.7, is expected at 50.8.

China: S&P Manufacturing PMI for February (Fri 0945 CST; Fri 0145 GMT; Thu 2045 EST)

Consensus Forecast: 50.8

S&P's manufacturing PMI in February is expected to hold unchanged at January’s 50.8.

Eurozone HICP Flash for February (Fri 1100 CET; Fri 1000 GMT; Fri 0500 EST)

Consensus Forecast, Year over Year: 2.5%

Narrow Core

Consensus Forecast, Year over Year: 3.0%

Consensus for February’s HICP flash is 2.5 percent and 3.0 percent for the narrow core. These would compare respectively with January’s 2.8 and 3.3 percent, the former versus December’s 2.9 percent and the latter versus 3.4 percent.

Eurozone Unemployment Rate for January (Fri 1100 CET; Fri 1000 GMT; Fri 0500 EST)

Consensus Forecast: 6.4%

Consensus for January's unemployment rate is no change at 6.4 percent. Unemployment in the Eurozone has been running at record lows.

US: ISM Manufacturing Index for February (Fri 1000 EST; Fri 1500 GMT)

Consensus Forecast: 49.5

The ISM manufacturing index has been in contraction the last 15 months and isn’t expected to emerge in February, at a 49.5 consensus versus January’s 49.1.

|