|

A “soft” promise isn’t as good as a true promise but for a central bank it might as well be marriage. The European Central Bank has cemented to expectations for a rate cut in June in what is shaping up to be a delinking with the US where overheated shelter costs are keeping inflation up and the Federal Reserve on hold. For Europe its service costs that are keeping inflation up in what could, in fact, push back the ECB’s June party.

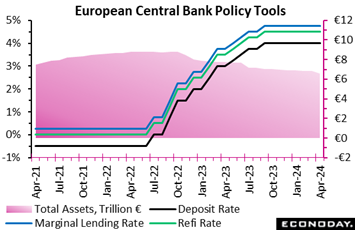

The European Central Bank as expected kept rates steady. The key deposit rate remains at its record high of 4.0 percent, the refi rate stays at 4.50 percent and the rate on the marginal lending facility at 4.75. percent. Predictably too, there were no adjustments made to the quantitative tightening programme, currently limited to the longstanding asset purchase programme (APP) but due to include the pandemic emergency purchase programme (PEPP) from July. The PEPP will have an average monthly reduction target of €7.5 billion through December when reinvestments will be discontinued. The European Central Bank as expected kept rates steady. The key deposit rate remains at its record high of 4.0 percent, the refi rate stays at 4.50 percent and the rate on the marginal lending facility at 4.75. percent. Predictably too, there were no adjustments made to the quantitative tightening programme, currently limited to the longstanding asset purchase programme (APP) but due to include the pandemic emergency purchase programme (PEPP) from July. The PEPP will have an average monthly reduction target of €7.5 billion through December when reinvestments will be discontinued.

The bank’s ‘soft' forward guidance was also unaltered, stating that the "Governing Council (GC) considers that the key ECB interest rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution" to meeting the inflation goal. Yet should the GC become more confident that inflation is converging towards target, it would be appropriate according to the statement to reduce rates. This re-affirms the importance of the bank's June economic forecasts.

In fact, the overall tone of the statement was mildly dovish, indicating that the latest data had been in line with the GC's previous assessment of the medium-term inflation outlook. Importantly, most measures of underlying inflation as well as wage growth were seen to be easing and firms were absorbing part of the rise in labour costs in their profits. That said, the bank still believes that domestic price pressures are strong, particularly in services.

In sum, the bank's statement and press confidence will not upset an increasingly strong market conviction that key rates will be lowered by 25 basis points at the next meeting in June. Indeed, already the focus is beginning to shift to whether or not an ease then might be followed by another as soon as July. With the Fed seemingly now on hold for longer than previously expected, the growing likelihood of widening interest rate differentials in favour of the dollar could become a problem for the euro and, potentially, a new hurdle in the path of meeting the ECB's inflation target.

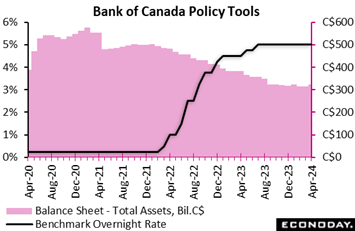

The Bank of Canada maintained its overnight policy rate at 5.0 percent for the sixth straight meeting, as officials need clearer evidence that inflation is on its way down to their two percent target amid elevated wage hikes. The bank said it is also continuing its policy of quantitative tightening to trim the bank's balance sheet to a normal level. "While inflation is still too high and risks remain, CPI and core inflation have eased further in recent months," the bank said. The Bank of Canada maintained its overnight policy rate at 5.0 percent for the sixth straight meeting, as officials need clearer evidence that inflation is on its way down to their two percent target amid elevated wage hikes. The bank said it is also continuing its policy of quantitative tightening to trim the bank's balance sheet to a normal level. "While inflation is still too high and risks remain, CPI and core inflation have eased further in recent months," the bank said.

Governor Tiff Macklem said at his news conference, "We don't want to leave monetary policy this restrictive longer than we need to. But if we lower our policy interest rate too early or cut too fast, we could jeopardize the progress we've made bringing inflation down."

The bank’s latest projections were mixed. It upped first-quarter GDP to 2.8 percent from 0.5 percent at its last forecast in January, and full year GDP was revised to 1.5 percent from 0.8 percent. Yet inflation forecasts, in contrast to growth, are lower to steady. It sees inflation at 2.6 percent this year, down from its previous projection of 2.8 percent. As for the CPI in 2025, the bank sees the rate remaining just above target at 2.2 percent, unchanged from January. The bank's CPI estimate for 2026 is 2.1 percent, roughly at target.

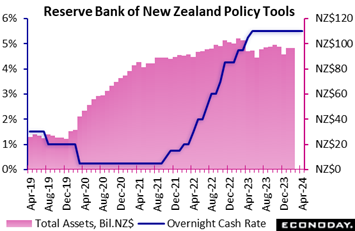

The Reserve Bank of New Zealand left its official cash rate unchanged at 5.50 percent for the sixth consecutive meeting, in line with the consensus forecast. Prior to this pause, officials had increased policy rates by a cumulative 525 basis points beginning in November 2021 as part of efforts to return inflation to their target range of one percent to three percent. The Reserve Bank of New Zealand left its official cash rate unchanged at 5.50 percent for the sixth consecutive meeting, in line with the consensus forecast. Prior to this pause, officials had increased policy rates by a cumulative 525 basis points beginning in November 2021 as part of efforts to return inflation to their target range of one percent to three percent.

Headline CPI inflation fell to 4.7 percent in the three months to December from 5.6 percent in the three months to September, with core inflation falling from 5.8 percent to 4.4 percent, its lowest level since mid-2021. Officials still expect inflation to trend lower toward their target range, noting that risks to this outlook are evenly balanced.

Reflecting this assessment, officials again concluded that "interest rates need to remain at a restrictive level for a sustained period of time". They also stressed that "there remains limited tolerance to increase the time to achieve the inflation target", suggesting they see little prospect of easing policy rates in upcoming meetings.

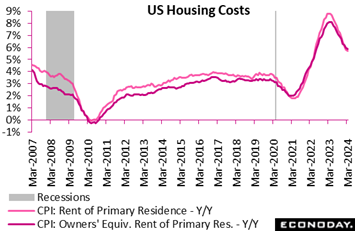

US consumer prices have come in on the high end of Econoday’s consensus ranges the past four reports. And March’s monthly increases of 0.4 percent both overall and for the ex-food ex-energy core won’t be pulling forward official rate cuts. Year-over-year rates are not cooling either, at 3.5 and 3.8 percent respectively, the latter of course nearly twice what the Federal Reserve wants to see. US consumer prices have come in on the high end of Econoday’s consensus ranges the past four reports. And March’s monthly increases of 0.4 percent both overall and for the ex-food ex-energy core won’t be pulling forward official rate cuts. Year-over-year rates are not cooling either, at 3.5 and 3.8 percent respectively, the latter of course nearly twice what the Federal Reserve wants to see.

Upward price pressures continue to be concentrated in the services sector where prices rose 0.5 percent on the month and 5.3 percent on the year, The commodities prices, in contrast, edged only 0.1 percent higher in March and only 0.6 percent on the year.

The index for shelter costs – about 1/3 of the CPI basket – rose 0.4 percent, the same increase as in February from January. On the year, shelter was unchanged at a substantial 5.7 percent. While increases have come down substantially from the increases seen in early 2023, a leveling off – if sustained – means that higher home prices and limited housing stock will keep this component from falling as much or as soon as hoped. Excluding shelter, the CPI rose 0.4 percent on the month and 2.3 percent year-over-year.

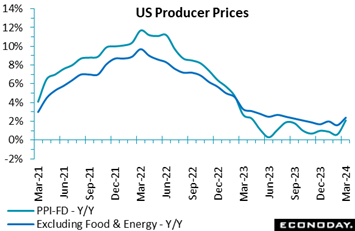

Helping to take the edge off consumer prices were lower-than-expected producer price data which nevertheless did show some pressure. Producer prices ended the first quarter on a softer note than expected, with the headline index up 0.2 percent on the month and 2.1 percent year-over-year, below Econoday's consensus forecasts of 0.3 percent and 2.3 percent. Yet the 12-month rate was still up from 1.6 percent in February, reaching its highest level since April 2023 and continuing its recent acceleration. Helping to take the edge off consumer prices were lower-than-expected producer price data which nevertheless did show some pressure. Producer prices ended the first quarter on a softer note than expected, with the headline index up 0.2 percent on the month and 2.1 percent year-over-year, below Econoday's consensus forecasts of 0.3 percent and 2.3 percent. Yet the 12-month rate was still up from 1.6 percent in February, reaching its highest level since April 2023 and continuing its recent acceleration.

When excluding food and energy, the PPI increase slowed to 0.2 percent from 0.3 percent, as expected. However, the 12-month rate came in at 2.4 percent, above the highest forecast of 2.3 percent. When also excluding trade services, producer prices rose 0.2 percent on the month after 0.3 percent in February. This 12-month rate, which the Bureau of Labor Statistics routinely highlights, increased to 2.8 percent from 2.7 percent.

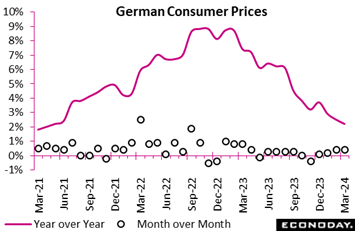

Germany inflation fell again in March. A final 0.4 percent monthly increase in consumer prices was small enough to trim the annual inflation rate from February's final 2.5 percent to 2.2 percent, matching its lowest level since April 2021. Germany inflation fell again in March. A final 0.4 percent monthly increase in consumer prices was small enough to trim the annual inflation rate from February's final 2.5 percent to 2.2 percent, matching its lowest level since April 2021.

However, the deceleration in the annual CPI rate was in large part due to food (minus 0.7 percent after 0.9 percent) and, to a lesser extent, energy (minus 2.7 percent after minus 2.4 percent). Falls here helped to slash inflation in overall goods from 1.8 percent to 1.0 percent but also served to mask a 0.3 percentage point increase in the rate in services to 3.7 percent. Consequently, the core rate edged just a tick lower to an unrevised 3.3 percent.

For the ECB the March inflation update remains something of a mixed bag. The central bank will be pleased with the drop in the headline and core rates but will be less than happy about the continued stickiness of prices in services. And it is this sector upon which it is placing increasing focus. Still, the data will not dent a solid market conviction that the ECB will be cutting interest rates in June. March's final CPI report puts the German RPI at minus 4 and the RPI-P at 10 (see Bottom Line for further RPI details). Economic activity in Germany is performing much as expected but prices continue to surprise on the downside.

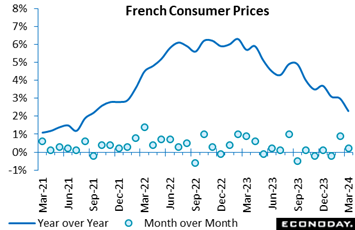

French consumer prices held at the flash estimate’s 0.2 percent increase on the month reducing the national annual rate from February's final 3.0 percent to 2.3 percent, its weakest mark since September 2021. French consumer prices held at the flash estimate’s 0.2 percent increase on the month reducing the national annual rate from February's final 3.0 percent to 2.3 percent, its weakest mark since September 2021.

The deceleration in the annual CPI rate was broad-based but helped by sharp declines in food (1.7 percent after 3.6 percent) and energy (3.4 percent after 4.3 percent). Inflation in overall manufactured goods dropped from 0.4 percent to a minimal 0.1 percent while its service sector counterpart eased from 3.2 percent to 3.0 percent. Consequently, the core rate fell from 2.6 percent to 2.2 percent, its weakest post since January 2022.

Confirmation of a sharp slowdown in French inflation last month will sit comfortably with the ECB though the bank will still take note of service sector prices. The update puts the French RPI at minus 7 and the RPI-P at 10 – limited underperformance by overall economic activity is wholly attributable to the unexpected weakness of prices.

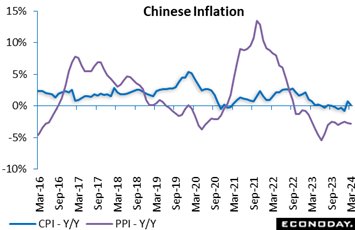

In contrast to others, China isn’t fighting inflation but outright deflation instead. China's headline consumer price index rose just 0.1 percent on the year in March, down from 0.7 percent on the year in February and against expectations for a 0.5 percent gain. Headline CPI inflation has now been close to zero or in negative territory for a full year. Producer prices were also weaker than expected, in 2.8 percent annual contraction in March after dropping 2.7 percent on the year in February. Headline PPI inflation has now been in negative territory for more than a year. In contrast to others, China isn’t fighting inflation but outright deflation instead. China's headline consumer price index rose just 0.1 percent on the year in March, down from 0.7 percent on the year in February and against expectations for a 0.5 percent gain. Headline CPI inflation has now been close to zero or in negative territory for a full year. Producer prices were also weaker than expected, in 2.8 percent annual contraction in March after dropping 2.7 percent on the year in February. Headline PPI inflation has now been in negative territory for more than a year.

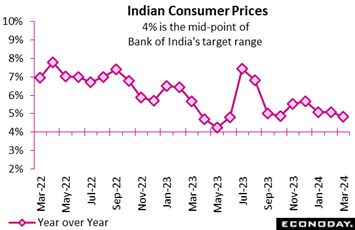

India's consumer price index rose 4.85 percent on the year in March, moderating from an increase of 5.09 percent in February. Inflation is now at a five-month low and closer to the mid-point of the Reserve Bank of India's target range of two percent to six percent. India's consumer price index rose 4.85 percent on the year in March, moderating from an increase of 5.09 percent in February. Inflation is now at a five-month low and closer to the mid-point of the Reserve Bank of India's target range of two percent to six percent.

Lower headline inflation largely reflected a bigger fall in fuel and light charges, which fell 3.24 percent on the year in March after falling 0.77 percent in February. Food and beverage prices rose 7.68 percent on the year, little changed from the previous increase of 7.66 percent. Inflation in urban areas fell from 4.78 percent in February to 4.14 percent in March, while inflation in rural areas increased from 5.34 percent to 5.45 percent.

At the RBI's most recent policy meeting, held in the prior week, officials left policy rates on hold at 6.50 percent. They advised then that they expect inflation to fall to around 4.5 percent in coming quarters, but stressed that "the path of disinflation needs to be sustained" until inflation falls to 4.0 percent.

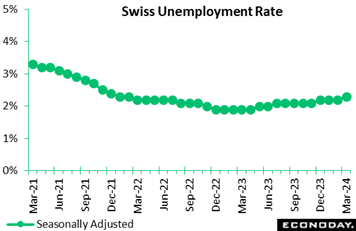

The Swiss labour market weakened further at quarter-end. Seasonally adjusted joblessness was up 3,079 or 3.0 percent on the month at 105,644. Moreover, the increase was steep enough to lift the unemployment rate by a tick to 2.3 percent, matching its highest reading since January 2022 and 0.1 percentage point above the market consensus. Unadjusted, the number of people out of work fell some 3,286 or 2.9 percent to 108,593, leaving the rate steady at 2.4 percent. However, this was 0.4 percentage points above its level a year ago, widening the gap by a tick versus that seen in both January and February. The Swiss labour market weakened further at quarter-end. Seasonally adjusted joblessness was up 3,079 or 3.0 percent on the month at 105,644. Moreover, the increase was steep enough to lift the unemployment rate by a tick to 2.3 percent, matching its highest reading since January 2022 and 0.1 percentage point above the market consensus. Unadjusted, the number of people out of work fell some 3,286 or 2.9 percent to 108,593, leaving the rate steady at 2.4 percent. However, this was 0.4 percentage points above its level a year ago, widening the gap by a tick versus that seen in both January and February.

Vacancies continued to decline with a 625 or 1.5 percent slide on the month to 40,747. This equated to an unadjusted yearly fall of 25.3 percent, up from January's 21.2 percent.

March's update is again consistent with a loosening trend in the Swiss labour market and will leave speculators contemplating another cut in the Swiss National Bank’s policy rate in June.

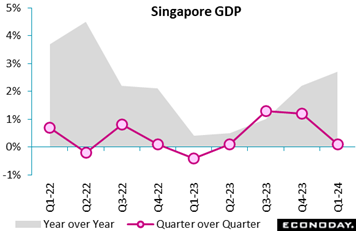

In a first look at the first quarter, Singapore's economy did expand but by just 0.1 percent on the quarter after advancing 1.2 percent in the fourth quarter. Yet on the year, GDP rose 2.7 percent which was up from the fourth quarter’s 2.2 percent increase. Monthly PMI survey data indicated solid growth in the Singapore economy over this period. In a first look at the first quarter, Singapore's economy did expand but by just 0.1 percent on the quarter after advancing 1.2 percent in the fourth quarter. Yet on the year, GDP rose 2.7 percent which was up from the fourth quarter’s 2.2 percent increase. Monthly PMI survey data indicated solid growth in the Singapore economy over this period.

Weaker headline quarter-over-quarter GDP growth was driven by the manufacturing sector, with output falling 2.9 percent on the quarter after a previous increase of 4.5 percent. Construction activity also weakened sharply, falling 1.7 percent on the quarter after a previous increase of 2.0 percent. Service sector output, in contrast, strengthened, with output up 1.2 percent on the quarter after advancing 0.3 percent previously.

In conjunction with the GDP announcement, the Monetary Authority of Singapore left policy settings on hold at their quarterly policy review. Officials judged that "prospects for the Singapore economy should improve over the course of 2024", forecasting GDP to grow between one percent and three percent this year. This reflects their assessment that an anticipated easing of global monetary policy will boost demand from major trading partners. They note, however, that core inflation has been slightly higher in the first two months of the year and that they expect it will remain "elevated" in coming months "before stepping down more discernibly" late in the year and early 2025.

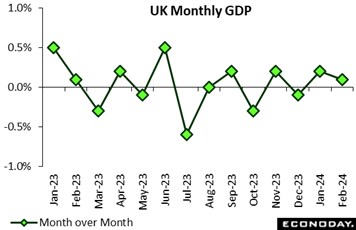

At mid-quarter, the UK performed in line with expectations. A 0.1 percent monthly rise in March GDP matched the market consensus and followed a slightly stronger revised 0.3 percent advance in January. This made for the first back-to-back increase since January/February 2023 and lifted the 3-monthly change by 0.2 percentage points to 0.2 percent. However, base effects saw annual growth dip from minus 0.1 percent to minus 0.2 percent. At mid-quarter, the UK performed in line with expectations. A 0.1 percent monthly rise in March GDP matched the market consensus and followed a slightly stronger revised 0.3 percent advance in January. This made for the first back-to-back increase since January/February 2023 and lifted the 3-monthly change by 0.2 percentage points to 0.2 percent. However, base effects saw annual growth dip from minus 0.1 percent to minus 0.2 percent.

The monthly headline advance in part reflected a 0.1 percent increase in services but it was the goods producing sector, where output expanded fully 1.1 percent, that did most of the work. Within this, manufacturing expanded 1.2 percent. However, elsewhere, construction fell 1.9 percent, more than reversing January's 1.1 percent gain and its fourth decline in the last five months.

Nonetheless, total output now stands at its highest mark since last June and average GDP in January/February 0.3 percent above its average level last quarter. Without any revisions, March will need at least a 1.1 percent monthly contraction to prevent positive first quarter growth. The Bank of England will be all the more wary about cutting interest rates too soon.

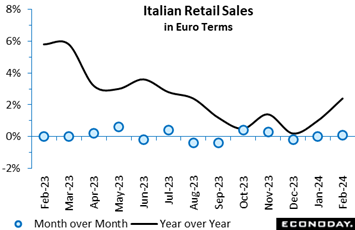

Retail sales in Italy rose 0.1 percent on the month in February following a flat performance in January. The increase was a little smaller than the market consensus but still large enough to put purchases at a 3-month peak. That said, the improving trend is shallow at best and positive base effects were largely responsible for lifting unadjusted annual growth from 1.0 percent to 2.4 percent, its highest level since last August. Retail sales in Italy rose 0.1 percent on the month in February following a flat performance in January. The increase was a little smaller than the market consensus but still large enough to put purchases at a 3-month peak. That said, the improving trend is shallow at best and positive base effects were largely responsible for lifting unadjusted annual growth from 1.0 percent to 2.4 percent, its highest level since last August.

Volumes were also up 0.1 percent versus January but this failed to offset that month's 0.2 percent drop and left a modestly declining trend. Both sales of food (0.1 percent) and non-food (0.2 percent) posted limited gains, the latter for the first time since last November.

February's update leaves average overall volume sales in January/February 0.4 percent below their mean level in the fourth quarter. Absent revisions, March will need at least a 1.3 percent monthly rise just to hold the quarter flat suggesting that the retail sector will provide a stinging seventh consecutive hit to real GDP growth this quarter.

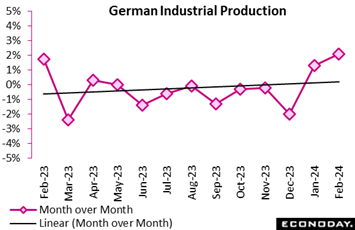

German industrial production was again stronger than expected in February. Following an upwardly revised 1.3 percent monthly increase in January, output increased a further 2.1 percent, easily beating Econoday’s consensus. Even so, while the advance boosted production to a 7-month high, it left yearly growth well below zero at minus 4.8 percent. German industrial production was again stronger than expected in February. Following an upwardly revised 1.3 percent monthly increase in January, output increased a further 2.1 percent, easily beating Econoday’s consensus. Even so, while the advance boosted production to a 7-month high, it left yearly growth well below zero at minus 4.8 percent.

Manufacturing output had a good month, expanding 1.9 percent versus January, mainly due to strength in autos (5.7 percent) and chemicals (4.6 percent). Intermediates were up 2.5 percent and capital goods 1.5 percent and consumer goods 1.9 percent. Elsewhere, energy dropped 6.5 percent but construction expanded fully 7.9 percent.

The February bounce puts average industrial production in the first two months of the quarter 1.0 percent above its fourth quarter mean. Absent any revisions, March would need a monthly fall of at least 4.1 percent to keep the sector from adding to quarterly GDP growth. Nonetheless, while last quarter is shaping up surprisingly well, the ongoing trend decline in orders still makes for a soft near-term outlook.

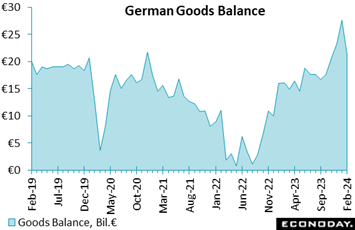

Germany’s merchandise trade surplus narrowed from €27.6 billion in January to a surprisingly small, but still sizeable, €21.4 billion in February. Unadjusted, the surplus stood at €24.7 billion, a marked increase on the €18.4 billion posted a year ago. Germany’s merchandise trade surplus narrowed from €27.6 billion in January to a surprisingly small, but still sizeable, €21.4 billion in February. Unadjusted, the surplus stood at €24.7 billion, a marked increase on the €18.4 billion posted a year ago.

The monthly headline deterioration reflected a combination of weaker exports and stronger imports. The former fell an adjusted 2.0 percent after a 6.3 percent jump at the start of the year while the latter climbed 3.2 percent following a 3.3 percent gain. The slide in exports trimmed unadjusted yearly growth from 1.6 percent to minus 1.2 percent but the increase in imports lifted their 12-month rate from minus 7.5 percent to minus 6.7 percent, an 11-month high.

Despite February's decline, the trade balance remains in a very healthy surplus and potentially on course to make a positive contribution to first quarter GDP growth.

China's trade surplus in US dollar terms narrowed to $58.55 billion in March from $125.16 billion in the combined months of January and February. Exports fell 7.5 percent on the year in March after increasing 7.1 percent in April, while imports fell 1.9 percent on the year after a previous increase of 3.5 percent. China's trade surplus in US dollar terms narrowed to $58.55 billion in March from $125.16 billion in the combined months of January and February. Exports fell 7.5 percent on the year in March after increasing 7.1 percent in April, while imports fell 1.9 percent on the year after a previous increase of 3.5 percent.

The trade surplus was well below the consensus forecast of US$71.1 billion, with both exports and imports weaker than expected. Nevertheless, China’s Relative Performance Indexes (see Bottom Line) continue to indicate that recent Chinese data in sum are coming in above consensus forecasts.

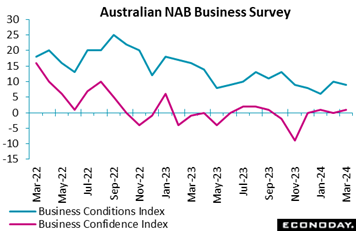

The National Australia Bank’s business survey showed slightly improved but still subdued business confidence in March and slightly weaker conditions. The survey's business conditions index fell from 10 in February to 9 in March, with respondents reporting steady trading conditions and employment but weaker profitability, and further weakness in forward orders. The survey showed more moderate increases in labour costs, purchase costs, and retail prices. The survey's business confidence index rose from zero in February to plus 1 in March. Sentiment remains weak across most sectors and most parts of the country, with the index still well below its long-run average. The National Australia Bank’s business survey showed slightly improved but still subdued business confidence in March and slightly weaker conditions. The survey's business conditions index fell from 10 in February to 9 in March, with respondents reporting steady trading conditions and employment but weaker profitability, and further weakness in forward orders. The survey showed more moderate increases in labour costs, purchase costs, and retail prices. The survey's business confidence index rose from zero in February to plus 1 in March. Sentiment remains weak across most sectors and most parts of the country, with the index still well below its long-run average.

Global data on net are coming in right at expectations, at plus 1 and very near the zero line on Econoday’s Relative Performance Index. When excluding inflation, however, the index less prices (RPI-P) rises to 13 to indicate that inflation, on a global scale, is running cooler than expected and that real activity is running warmer than expected. A welcome combination.

After dramatically underestimating US payrolls at the beginning of the month, forecasters have improved their aim with this country’s RPI at 3 and the RPI-P at minus 1. Yet an extension of as-expected results could, in an irony of sorts, keep the outlook for Federal Reserve policy in a holding pattern.

In Canada, the recent recovery in RPI-P (now 26) was reflected in the Bank of Canada’s decision to revise up its GDP growth forecast for 2024 and leave policy on hold. However, with the RPI (8) much closer to zero, the implication is that inflation is still undershooting forecasts leaving financial markets still focused on the June policy announcement as the most likely time for a near-term ease.

With an RPI of minus 8 and an RPI-P of 11 going into their meeting, the European Central Bank probably felt confident about its decision to leave policy on hold. Inflation is undershooting expectations but the real economy is outperforming, limiting pressure for a cut before an increasingly likely move in June.

In the UK, overall economic activity continues to perform much as expected, reflected in an RPI of 1. However, the RPI-P (10) also still shows some upside bias to real economy surprises. This will ensure that Tuesday’s labour market report is as important to policy as Wednesday’s inflation update.

In Switzerland, the week’s data again showed economic activity lagging behind forecasts, as it has for much of the year to date. Most of the downside surprises remain confined to the inflation data - the RPI stands at minus 23 while the RPI-P is a less weak minus 8 - but the real economy is also underperforming. Accordingly, speculation about another cut in the Swiss National Bank’s policy rate at the end of the quarter continues to build.

In Japan, both the RPI (minus 1) and RPI-P (minus 5) remain (just) in negative surprise territory, providing no support for the ailing yen. A generally surprisingly soft economy continues to restrict the Bank of Japan’s scope to raise key interest rates which, with Fed easing speculation being pushed further out, leaves the Japanese currency looking decidedly vulnerable.

By contrast, in China, both the RPI (36) and RPI-P (70) show recent economic activity easily beating expectations but note that the sizeable gap between the two measures means prices are still falling short. Deflationary worries may have eased but they have not gone away.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

No better-than-mixed results are expected for Tuesday’s sweep of Chinese data headlined by an expected 4.9 percent year-over-year rate for first-quarter GDP. This would mark slight slowing from 5.2 percent in the first quarter. Monthly data on both industrial production and retail sales are also expected to slow.

The week opens with a busy Monday that will include Japanese machinery orders and Eurozone industrial production and will be highlighted by US retail sales which are expected to once again be solid. UK consumer prices expected to continue to fall in data for Wednesday.

Japanese Machinery Orders for February (Sun 2350 GMT; Mon 0850 JST; Sun 1950 EDT)

Consensus Forecast, Month over Month: 0.7%

Consensus Forecast, Year over Year: -5.8%

Machinery orders are expected to rebound 0.7 percent on the month in February for year-over-year contraction of 5.8 percent. Orders in January, hit in part by suspended vehicle output tied to a safety scandal, fell 1.7 percent on the month and were down 10.9 percent on the year. The government downgraded its assessment in the January report, saying machinery orders “have weakened recently".

Indian Wholesale Price Index for March (Mon 0630 GMT; Mon 1200 IST; Mon 0230 EDT)

Consensus Forecast, Year over Year: 0.7%

Wholesale prices are expected to come in at a year-over-year 0.7 percent in March versus 0.2 percent in February which was the fourth straight result just above the zero line.

Eurozone Industrial Production for February (Mon 1100 CEST; Mon 0900 GMT; Mon 0500 EDT)

Consensus Forecast, Month over Month: 0.9%

Consensus Forecast, Year over Year: -5.7%

Production in February is expected to rise a monthly 0.9 percent after falling an unexpectedly steep 3.2 percent in January. Consensus for February’s year-over-year rate is 5.7 percent contraction versus January contraction of 6.7 percent which was the lowest level of production since September 2020.

US Retail Sales for March (Mon 0830 EDT; Mon 1230 GMT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Ex-Vehicles - M/M: 0.5%

Consensus Forecast, Ex-Vehicles, Ex-Gas - M/M: 0.3%

March sales are expected to rise 0.4 percent versus February’s nearly as-expected 0.6 percent gain. February’s ex-auto sales rose 0.3 percent with March expected at plus 0.5 percent; March ex-auto ex-gas are expected at an 0.3 percent gain.

Canadian Manufacturing Sales for February (Mon 08:30 EDT; Mon 1230 GMT)

Consensus Forecast, Month over Month: 0.7%

After increasing 0.2 percent in January that, however, followed a 1.1 percent decline in December, manufacturing sales in February are expected to rise 0.7 percent.

Chinese Fixed Asset Investment for March (Tue 1000 CST; Tue 0200 GMT; Mon 2200 EDT)

Consensus Forecast, Year-to-Date on Y/Y Basis: 4.0%

Fixed asset investment for year-to-date March is expected to rise 4.0 percent. This would compare with 4.2 percent growth in the last report which covered the combined months of January and February.

Chinese First-Quarter GDP (Tue 1000 CST; Tue 0200 GMT; Mon 2200 EDT)

Consensus Forecast, Quarter over Quarter: 1.5%

Consensus Forecast, Year over Year: 4.9%

Consensus Range, Year over Year: 4.7% to 5.0%

First-quarter GDP is expected to rise 1.5 percent versus the fourth quarter which would compare with as-expected 1.0 percent sequential growth from the third quarter. The year-over-year expectation in the fourth quarter is growth of 4.9 percent which would compare with 5.2 percent growth in the fourth quarter.

Chinese Industrial Production for March (Tue 1000 CST; Tue 0200 GMT; Mon 2200 EDT)

Consensus Forecast, Year over Year: 6.0%

Year-over-year growth in industrial production in the combined months of January and February rose 7.0 percent which was up from 6.8 percent in December and sharply higher than the 5.0 percent consensus. Expectations for March is 6.0 percent.

Chinese Retail Sales for March (Tue 1000 CST; Tue 0200 GMT; Mon 2200 EDT)

Consensus Forecast, Year over Year: 5.0%

After rising a year-over-year 5.5 percent in the combined months of January and February and rising 7.4 percent in December, sales in March are expected to rise 5.0 percent.

Germany: ZEW Survey for April (Tue 1100 CEST; Tue 0900 GMT; Tue 0500 EDT)

Consensus Forecast, Current Conditions: -79.0

Consensus Forecast, Economic Sentiment: 34.0

Current conditions are expected to firm to minus 79.0 versus March’s minus 80.5 which was up more than a point from February and on the strong side of forecasts. The report’s expectations component (economic sentiment) is seen at 34.0 versus March’s 31.7 which marked a nearly 12 point jump and the highest level since February 2022. The expectations component has exceeded expectations for eight months in a row.

Canadian Housing Starts for March (Tue 0815 EDT; Tue 1215 GMT)

Consensus Forecast, Annual Rate: 245,000

Housing starts are expected to slow to 245,000 in March versus February’s larger-than-expected 253,468 and January’s lower-than-expected 223,176.

Canadian CPI for March (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, Month over Month: 0.7%

Consensus Forecast, Year over Year: 3.0%

After February’s lower-than-expected to 2.8 percent, consumer prices in March are expected to increase to 3.0 percent.

US Industrial Production for March (Tue 1315 GMT; Fri 0915 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Manufacturing Output - M/M: 0.3%

Consensus Forecast, Capacity Utilization Rate: 78.5%

After edging 0.1 percent higher in February, industrial production is expected to rebound 0.4 percent in March. Manufacturing output is expected to rise an additional 0.3 percent after jumping 0.8 percent. Capacity utilization is expected to rise to 78.5 percent versus February’s 78.3 percent.

Japanese Merchandise Trade for March (Wed 0850 JST; Tue 2350 GMT; Tue 1950 EDT)

Consensus Forecast: ¥345.0 billion

Consensus Forecast, Imports Y/Y: -7.2%

Consensus Forecast, Exports Y/Y: 5.8%

A surplus of ¥345 billion is the consensus for March’s trade balance versus a deficit of ¥377.8 billion in February that was narrower than expected and reflected a solid gain for exports.

UK CPI for March (Wed 0700 BST; Wed 0600 GMT; Wed 0200 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 3.0%

At 3.4 percent in versus expectations for 3.6 percent and against 4.0 percent in January, consumer prices in February were on the weak side of expectations. March’s consensus is 3.0 percent.

Australian Labour Force Survey for March (Thu 1130 AEST; Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Employment: 5,000

Consensus Forecast, Unemployment Rate: 3.9%

Following February’s much greater-than-expected increase of 116,500 that reflected both underlying strength as well as a shift in seasonal patterns, employment in March is expected to rise a further but modest 5,000. Unemployment is expected to rise to 3.9 percent from 3.7 percent.

Japanese CPI for March (Fri 0830 JST; Thu 1930 EDT; Thu 2330 GMT)

Consensus Forecast, Year over Year: 2.9%

Consensus Forecast, Ex-Fresh Food; Y/Y: 2.6%

Consensus Forecast, Ex-Fresh Food Ex-Energy; Y/Y: 3.0%

Consumer inflation in March is expected to edge higher to 2.9 percent versus 2.8 percent in February which compared with 2.2 percent in January in a decline largely reflecting base effects for utility costs. Excluding fresh food, the rate is seen at 2.6 percent versus 2.8 and 2.0 percent in the two prior months. When also excluding energy the rate is seen at 3.0 percent versus February’s 3.2 percent and January’s 3.5 percent.

German PPI for March (Fri 0800 CEST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: -3.3%

After falling 0.4 percent on the month in February, March’s PPI is seen up a marginal 0.1 percent. Year-over-year, the PPI is expected to fall 3.3 percent versus 4.1 percent contraction in February.

|