|

US nonfarm payrolls may have come in below expectations but at 175,000 were historically very respectable nevertheless. More surprising were wage pressures which cooled noticeably yet still remain far above what the Federal Reserve wants to see. April’s results pulled down the Relative Performance Index (RPI) to minus 16 to indicate that US data are now coming in a bit below expectations which if extended could bring forward the long delayed rate cut. We’ll get to the RPI in the Bottom Line and to Friday’s employment report later in the article, first we’ll look at Wednesday’s FOMC update and the need for greater improvement on inflation.

The Fed as expected kept its policy target range at 5.25 to 5.50 percent for a 5.375 percent midpoint. Saying inflation is still too high and further progress not assured, Jerome Powell stressed that it "would not be appropriate" to cut rates until officials have greater confidence that inflation is moving sustainably to the Fed’s two percent goal. So far incoming data "haven't given us this greater confidence". The Fed as expected kept its policy target range at 5.25 to 5.50 percent for a 5.375 percent midpoint. Saying inflation is still too high and further progress not assured, Jerome Powell stressed that it "would not be appropriate" to cut rates until officials have greater confidence that inflation is moving sustainably to the Fed’s two percent goal. So far incoming data "haven't given us this greater confidence".

Importantly, the Fed Chair said reaching this level of confidence will take "longer than previously expected". Powell noted that PCE inflation, at 2.7 percent overall and 2.8 percent for the ex-food ex-energy core, is higher than expected and he further cited increases in short-term inflation expectations among consumer and business surveys. Powell said “we think rates are at their peak but can’t rule out a hike” though he stressed that a rate cut is “the most likely next step”.

Powell said the labor market remains "relatively tight" with demand for workers still exceeding the supply of workers. He did note that labor supply is improving helped by a continued "strong pace" of immigration.

On balance sheet unwinding, Powell said the Fed is slowing the pace of decline in its securities holdings (quantitative tightening) by roughly $40 billion per month and will focus its holdings on Treasuries. He said this will allow a gradual approach to an appropriate level of ample reserves. He was clear that the change should not be interpreted as a change in monetary policy. He said the move is not intended to provide accommodation or less restriction, just to avoid market turmoil.

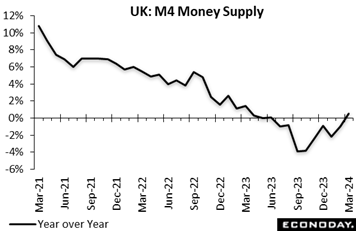

Broad UK money expanded a solid 0.7 percent on the month in March, its strongest performance since January 2023. Following an upwardly revised 0.6 percent gain in February, the latest increase lifted annual growth from minus 1.0 percent to 0.5 percent, its first positive print since last April. Annualised growth over the last three months now stands at 5.1 percent. There was also bullish news on M4 lending which fully unwound February's 0.9 percent decline. Broad UK money expanded a solid 0.7 percent on the month in March, its strongest performance since January 2023. Following an upwardly revised 0.6 percent gain in February, the latest increase lifted annual growth from minus 1.0 percent to 0.5 percent, its first positive print since last April. Annualised growth over the last three months now stands at 5.1 percent. There was also bullish news on M4 lending which fully unwound February's 0.9 percent decline.

Excluding intermediate other financial institutions, M4 rose 0.4 percent versus February and was up 0.3 percent on the year, a 9-month high. Similarly-adjusted lending increased a monthly 0.5 percent and was 0.9 percent firmer versus March 2023.

Elsewhere the financial data were more mixed. In the housing market, mortgage approvals climbed from an upwardly revised 60,497 to 61,325, their sixth straight gain and their highest level since September 2022. However, mortgage lending was only £0.26 billion, down from £1.65 billion, That said, overall consumer credit rose £1.577 billion, up from £1.429 billion.

In sum, Marchs data would appear consistent with a gradual recovery in economic activity. The housing market in particular looks to be enjoying quite solid growth although recent hikes in mortgage rates could be act as a brake over coming months.

Inflation in Europe provisionally held steady in April. A 0.6 percent monthly rise in the flash HICP left the annual rate at March's final 2.4 percent, in line with Econoday’s consensus. Accordingly, the headline rate remains just 0.4 percentage points above target. Inflation in Europe provisionally held steady in April. A 0.6 percent monthly rise in the flash HICP left the annual rate at March's final 2.4 percent, in line with Econoday’s consensus. Accordingly, the headline rate remains just 0.4 percentage points above target.

And there was more good news on the core. The narrowest measure dipped 0.2 percentage points to 2.7 percent, a tick below forecast. Moreover, excluding just energy and unprocessed food, the rate dropped fully 0.3 percentage points to 2.8 percent. Elsewhere the picture was also pleasantly reassuring. Inflation in non-energy industrial decreased again, from 1.1 percent to 0.9 percent but, more importantly, the rate in services finally moved off 4.0 percent, declining 0.3 percentage points to 3.7 percent. This was the latter's lowest reading since June 2022. Energy (minus 0.6 percent after minus 1.8 percent) provided another boost and food, alcohol and tobacco (2.8 percent after 2.6 percent) similarly offered a small lift.

Regionally, headline inflation was flat in France (2.4 percent) but rose in Germany (2.4 percent after 2.3 percent) and Spain (3.4 percent after 3.3 percent). Italy (1.0 percent after 1.2 percent) was the only member of the larger four economy group to record a fall and also the only one in that set below the 2 percent target.

The flash April data should go down very well at the European Central Bank. It will not be concerned that the headline rate held steady. Rather it will focus on the surprisingly sharp drop in the core rates and the marked, albeit overdue, deceleration in services. Underlying trends remain in the right direction and April's update should all but guarantee a 25 basis point cut in key interest rates in June.

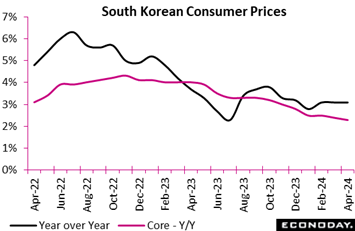

South Korea's headline consumer price index rose 2.9 percent on the year in April after an increase of 3.1 percent in March, moving closer to the Bank of Korea's 2.0 percent target. The index was unchanged on the month after advancing 0.1 percent previously. The fall in headline inflation was partly driven by food prices. These fell 1.2 percent on the month, with the year-over-year increase slowing from 6.7 percent to 5.9 percent. South Korea's headline consumer price index rose 2.9 percent on the year in April after an increase of 3.1 percent in March, moving closer to the Bank of Korea's 2.0 percent target. The index was unchanged on the month after advancing 0.1 percent previously. The fall in headline inflation was partly driven by food prices. These fell 1.2 percent on the month, with the year-over-year increase slowing from 6.7 percent to 5.9 percent.

Underlying price pressures also moderated slightly in April. Core CPI, excluding food and energy, rose 2.3 percent on the year, easing from an increase of 2.4 percent previously, and advanced 0.2 percent on the month after a previous increase of 0.1 percent. The year-over-year change in prices was relatively stable for most categories of spending.

At its most recent policy meeting held last month, the BoK left policy rates on hold. Officials advised then that they expect core inflation will "continue its slowing trend", forecasting a decline to around two percent at the end of the year. April's data showing headline inflation remains well above the target level and will likely reinforce officials' view that policy settings will need to remain restrictive in upcoming meetings.

Swiss consumer prices were a little firmer than expected at the start of the quarter. A 0.3 percent monthly increase was a tick above the market consensus and large enough to lift the annual inflation rate from 1.0 percent to 1.4 percent. This was the latter's first increase since last December and also a 4-month high. That said, the latest reading remains within the Swiss National Bank's definition of price stability. Swiss consumer prices were a little firmer than expected at the start of the quarter. A 0.3 percent monthly increase was a tick above the market consensus and large enough to lift the annual inflation rate from 1.0 percent to 1.4 percent. This was the latter's first increase since last December and also a 4-month high. That said, the latest reading remains within the Swiss National Bank's definition of price stability.

The headline acceleration reflected rises in both domestic and imported inflation. For the former, a 0.1 percent increase in prices raised the yearly rate from 1.8 percent to 2.0 percent while a sizeable 1.1 percent jump in import charges saw their rate climb from minus 1.3 percent to minus 0.4 percent.

Within the CPI basket a 2.4 percent monthly spurt in petroleum prices added nearly 0.1 percentage point to the overall change but there were strong gains too in household goods and services (2.2 percent) and recreation and culture (1.4 percent). The only falls were in restaurants and hotels (0.7 percent) and communication (0.1 percent). As a result, core prices (ex-food and energy) advanced 0.4 percent versus March, boosting the underlying yearly inflation rate from 1.0 percent to 1.4 percent, a 3-month peak.

The April data do not rule out another cut in the SNB policy rate in June but they will leave the ever-watchful central bank all the more cautious.

Average hourly earnings in the US rose 0.2 percent month-over-month, down from 0.3 percent in March. Earnings were up 3.9 percent year-over-year, down from 4.0 percent the previous month and below the 4.0 percent consensus. This is the lowest rate in nearly three years, since May 2021. Nevertheless, the rate is nearly double what the Fed wants. Average hourly earnings in the US rose 0.2 percent month-over-month, down from 0.3 percent in March. Earnings were up 3.9 percent year-over-year, down from 4.0 percent the previous month and below the 4.0 percent consensus. This is the lowest rate in nearly three years, since May 2021. Nevertheless, the rate is nearly double what the Fed wants.

Nonfarm payrolls increased 175,000 in April, less than even the lowest forecast of 190,000 in Econoday’s survey, following a 315,000 gain in March. Private payrolls rose 167,000 and government employment was little changed with an increase of 8,000. The unemployment rate inched up to 3.9 percent from 3.8 percent, coming in at the high end of expectations. The labor participation rate was unchanged at 62.7 percent, as expected.

The increase in private-sector employment was led by a 153,000 gain in services after 204,000 in March, including an 87,000 advance in health care and social assistance. Within goods-producing industries, construction added 9,000 jobs and manufacturing 8,000, concentrated in nondurable industries, more than offsetting a 3,000 decline in mining and logging.

While April's report brings evidence of a slowdown in hiring and the pace of earnings growth, the Fed will need assurance that the improvement is becoming a sustained trend.

Japanese payrolls posted a 20th straight rise on year in March amid labor shortages at hospitals, hotels, restaurants and telecommunications firms while the unemployment rate was unchanged after rising unexpectedly to a five-month high of 2.6 percent in February from a nearly four-year low of 2.4 percent in January. The seasonally adjusted jobless rate of 2.6 percent in March was slightly higher than the median forecast of 2.5 percent. The January rate was the lowest since 2.4 percent in February 2020.

Compared to the previous month, the number of people who lost their jobs or retired rose 4.5 percent in March, slowing from a 22.2 percent jump in February. The number of those who began looking for work and thus were counted as being unemployed was flat after rising in the previous two months. Those two factors were offset by a continued solid pace of increase in the number of those who quit to look for better positions, up 2.6 percent versus 2.7 percent in February, amid tight labor conditions and rising wages.

In its monthly economic report for March released last week, the government maintained its overall assessment, saying the economy is recovering moderately backed by a high pace of wage hikes amid widespread labor shortages. It also repeated that employment conditions are "showing signs of improvement."

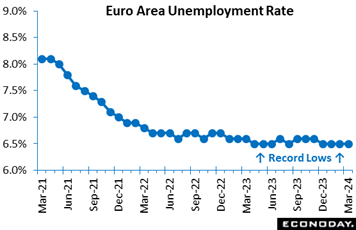

If Europe’s labour market is easing, it is doing so only very slowly. Joblessness fell some 94,000 in March, easily more than reversing February's revised 22,000 rise and leaving the unemployment rate steady at a record matching low of 6.5 percent. The rate was in line with expectations. If Europe’s labour market is easing, it is doing so only very slowly. Joblessness fell some 94,000 in March, easily more than reversing February's revised 22,000 rise and leaving the unemployment rate steady at a record matching low of 6.5 percent. The rate was in line with expectations.

As it is, while the steady regional rate reflected no change in Germany (3.2 percent), it masked falls in France (7.3 after 7.4 percent), Italy (7.2 after 7.4 percent) and Spain (11.7 after 11.8 percent).

March's update should not prevent the ECB lowering key interest rates in June but it will likely promote a more cautious view of how quickly borrowing costs should fall thereafter. The bottom line is that the labour market remains very tight and a clear potential threat to the two percent inflation target.

France’s economy was a little stronger than expected at the start of 2024. Following an unrevised 0.1 percent quarterly rise in the fourth quarter of 2023, GDP expanded 0.2 percent, a tick above the market consensus but still only in line with sluggish momentum. Annual workday growth was 1.1 percent, up from a marginally firmer revised 0.8 percent. France’s economy was a little stronger than expected at the start of 2024. Following an unrevised 0.1 percent quarterly rise in the fourth quarter of 2023, GDP expanded 0.2 percent, a tick above the market consensus but still only in line with sluggish momentum. Annual workday growth was 1.1 percent, up from a marginally firmer revised 0.8 percent.

In fact, final domestic demand was rather more upbeat, increasing at a 0.4 percent quarterly rate with household spending also up 0.4 percent and gross fixed capital formation 0.3 percent. Within the latter, business investment advanced 0.5 percent but residential investment fell again, this time by 1.5 percent. General government consumption gained 0.6 percent but inventories subtracted a further 0.2 percentage points having already made a 0.9 percentage point dent previously.

Net foreign trade had no net impact as a 0.5 percent rise in exports was offset by a 0.2 percent increase in imports. This followed a 1.0 percentage point boost in the fourth quarter.

In sum, the provisional first quarter data look a little better than expected. With all the main components of domestic demand gaining ground, should pave the way for a potentially respectable second quarter. That said, growth is still flat and lopsided, being largely dependent upon services.

Germany’s economy wasn’t as weak as expected at the start of the year but only after a sharper revised contraction at the end of 2023. GDP provisionally expanded at a 0.2 percent quarterly rate, a tick above the Econoday’s consensus but after the previous period's fall had been deepened from 0.3 percent to 0.5 percent. Annual workday adjusted contraction was minus 0.2 percent, matching the fourth-quarter print. Germany’s economy wasn’t as weak as expected at the start of the year but only after a sharper revised contraction at the end of 2023. GDP provisionally expanded at a 0.2 percent quarterly rate, a tick above the Econoday’s consensus but after the previous period's fall had been deepened from 0.3 percent to 0.5 percent. Annual workday adjusted contraction was minus 0.2 percent, matching the fourth-quarter print.

As usual, no GDP expenditure components were released in the first estimate but the Federal Statistical Office did indicate that the quarterly gain came courtesy of stronger construction and exports. Household spending declined.

While hardly robust, the first quarter data probably flatter to deceive since it looks as if final domestic demand was again weak. Business surveys have pointed to a better second quarter but with manufacturing still struggling and consumer sentiment depressed, growth is still unlikely to impress.

The Italian economy once again held up rather better than expected at the start of 2024. GDP provisionally expanded a quarterly 0.3 percent, well above the market consensus although following a smaller revised 0.1 percent increase in the previous period. However, negative base effect saw annual growth dip from a revised 0.7 percent to 0.6 percent. The Italian economy once again held up rather better than expected at the start of 2024. GDP provisionally expanded a quarterly 0.3 percent, well above the market consensus although following a smaller revised 0.1 percent increase in the previous period. However, negative base effect saw annual growth dip from a revised 0.7 percent to 0.6 percent.

In terms of output, the only other information provided by Istat indicated that quarterly growth was attributable to gains in goods production, services and agriculture, forestry and fishing. However, domestic demand subtracted leaving the expansion dependent upon a positive impact from net exports.

Preliminary flash data showed a return to positive growth at the start of the year. However, a slightly larger than expected 0.3 percent quarterly increase in GDP followed a downward revision to the fourth quarter which, at now minus 0.1 percent, means the Eurozone economy ended 2023 in mild recession. Annual growth last quarter was 0.4 percent, up from 0.1 percent previously. Preliminary flash data showed a return to positive growth at the start of the year. However, a slightly larger than expected 0.3 percent quarterly increase in GDP followed a downward revision to the fourth quarter which, at now minus 0.1 percent, means the Eurozone economy ended 2023 in mild recession. Annual growth last quarter was 0.4 percent, up from 0.1 percent previously.

Within the region's quarterly advance, France and Germany as we’ve seen expanded 0.2 percent and Italy 0.3 percent. Elsewhere, Spain rose 0.7 percent for a second straight quarter, Ireland grew 1.1 for the strongest gain and in so doing moved out of recession, and Latvia and Lithuania, both 0.8 percent, also had a good quarter and there were no outright contractions.

In sum, the first quarter report suggests that the Eurozone economy is starting to recover from the effects of earlier ECB tightening. This will not surprise the central bank but it will help to ensure that it keeps a very wary eye on a still very tight labour market and wages for fear that stronger growth might jeopardise the current disinflationary trend.

Advance estimates for Taiwan GDP show the economy grew 0.28 percent on the quarter in the three months to March after an increase of 2.34 percent in the three months to December. But growth picked up in year-over-year terms, increasing 6.51 percent on the year in the first quarter after growth of 4.93 percent in the fourth quarter. This increase in year-over-year growth was largely driven by stronger growth in exports, resulting in a bigger increase in the contribution of net exports to headline GDP growth. The contribution to growth from domestic demand also picked up, with growth in consumer spending rebounding from a previous decline and investment spending falling at a less pronounced rate. Advance estimates for Taiwan GDP show the economy grew 0.28 percent on the quarter in the three months to March after an increase of 2.34 percent in the three months to December. But growth picked up in year-over-year terms, increasing 6.51 percent on the year in the first quarter after growth of 4.93 percent in the fourth quarter. This increase in year-over-year growth was largely driven by stronger growth in exports, resulting in a bigger increase in the contribution of net exports to headline GDP growth. The contribution to growth from domestic demand also picked up, with growth in consumer spending rebounding from a previous decline and investment spending falling at a less pronounced rate.

The Canadian economy expanded by 0.2 percent in February, half the pace of the 0.4 percent expected in an Econoday survey. The reading was made even weaker by a downward revision to January's growth estimate now at 0.5 percent, down from 0.6 percent initially reported. And the advance estimate for March points to a flat reading which would put first quarter GDP growth at 0.6 percent. The Canadian economy expanded by 0.2 percent in February, half the pace of the 0.4 percent expected in an Econoday survey. The reading was made even weaker by a downward revision to January's growth estimate now at 0.5 percent, down from 0.6 percent initially reported. And the advance estimate for March points to a flat reading which would put first quarter GDP growth at 0.6 percent.

The update leaves interest rate cuts on the table. The Bank of Canada projects real GDP to grow at an annual pace of 2.8 percent in the first quarter and 1.5 percent in the second quarter.

In February, 12 of 20 sectors increased on the month. Services were up 0.2 percent while goods-producing industries were flat after contracting 0.1 percent in January. Utilities fell 2.6 percent while mining, quarrying and oil and gas extraction rose 2.5 percent. Manufacturing was down 0.4 percent, led by a 1.0 percent drop in nondurables.

The advance in services was led by a 1.4 percent gain in transportation and warehousing. The public sector rose 0.2 percent after 1.9 percent in January. Finance and insurance increased 0.3 percent, rising for a third consecutive month.

Japanese retail sales rose a disappointing 1.2 percent on year in March as solid department store sales and elevated food and beverage prices continued mitigating the impact of suspended vehicle output, but the pace of increase slowed from an upwardly revised 4.7 percent gain in February. Japanese retail sales rose a disappointing 1.2 percent on year in March as solid department store sales and elevated food and beverage prices continued mitigating the impact of suspended vehicle output, but the pace of increase slowed from an upwardly revised 4.7 percent gain in February.

Strong inbound spending and high demand for luxury brand goods continued to boost department store sales while lower temperatures in the first half of the month dampened spring clothing sales.

On the month, retail sales posted their first drop in three months, falling a seasonally adjusted 1.2 percent, also below the median forecast of a 0.6 percent increase, in payback for an upwardly revised 1.7 percent jump in February.

The METI maintained its assessment, saying retail sales are "taking one step forward and one step back." The three-month moving average in seasonally adjusted retail sales rose 0.2 percent on the month in March after rising at the same pace in February and falling in the previous three months.

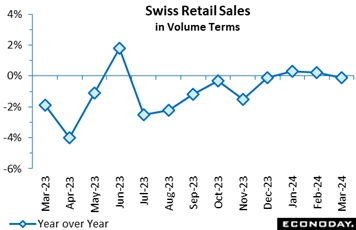

Retail sales in Switzerland were surprisingly soft again at quarter-end. Following an upwardly revised 0.1 percent gain in February, March's 0.4 percent monthly drop and was the first decline since last December and left volumes at their lowest level so far in 2024. Annual workday adjusted growth dipped from 0.2 percent to minus 0.1 percent. Retail sales in Switzerland were surprisingly soft again at quarter-end. Following an upwardly revised 0.1 percent gain in February, March's 0.4 percent monthly drop and was the first decline since last December and left volumes at their lowest level so far in 2024. Annual workday adjusted growth dipped from 0.2 percent to minus 0.1 percent.

In fact, the underlying picture was rather weaker as overall purchases were boosted by a 0.4 percent increase in food, drink and tobacco and a 0.8 percent bounce in auto fuel. Excluding auto fuel, non-food demand contracted a hefty 2.1 percent, its steepest decrease since April 2023 and leaving discretionary spending at its weakest mark since last October.

That said, despite March's setback, total volume sales last quarter were 0.8 percent higher than in the previous period so the retail sector provided another lift to GDP growth.

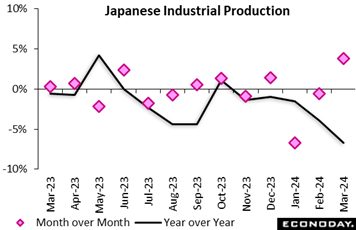

Japan's industrial production rose 3.8 percent on the month in March for the first rise in three months on resumed auto output, coming in just above the median forecast of a 3.5 percent gain and partially recovering from the effects of suspended vehicle output over a safety test scandal that had also hurt other sectors. It followed an unexpected decline of 0.6 percent in February and a 6.7 percent plunge in January. Japan's industrial production rose 3.8 percent on the month in March for the first rise in three months on resumed auto output, coming in just above the median forecast of a 3.5 percent gain and partially recovering from the effects of suspended vehicle output over a safety test scandal that had also hurt other sectors. It followed an unexpected decline of 0.6 percent in February and a 6.7 percent plunge in January.

Of the 15 industries, nine posted increases from the previous month and six marked decreases. The overall increase was led by the auto sector (passenger cars and trucks), production machinery for flat-panel displays and semiconductors as well as electronics parts and devices. Production was lower in the iron and steel and non-ferrous metals category and chemicals.

From a year earlier, factory output posted a fifth straight drop, down 6.7 percent, largely in line with a consensus call of a 6.6 percent decline, after a 3.9 percent fall in the prior month.

The METI's survey of producers indicated that output is expected to slip back 1.0 percent in April before a solid 4.4 percent rebound in May.

The auto output suspension took its toll on industrial production for the first quarter, which slumped 5.4 percent on quarter, and shipments of capital goods excluding transport equipment -- a key indicator of business investment in equipment in GDP data -- fell 2.1 percent in January-March. Preliminary first quarter GDP, due on May 16, is forecast by economists to post a slight contraction, hit by suspended vehicle production. Business investment is expected to slip after a strong rebound and private consumption remains sluggish amid elevated costs for daily necessities.

The ministry maintained its assessment after downgrading it for the first time in six months for the January data, saying industrial output "has weakened while taking one step forward and one step back." The METI repeated that it will keep a close watch on the effects of global economic growth and resumed automobile production.

Industrial production in France proved to be surprisingly weak in March. A 0.3 percent monthly fall more than unwound February's modest 0.2 percent rise and left output at its weakest level since April 2023. Annual growth still climbed from minus 0.6 percent to 0.7 percent courtesy of strongly positive base effects but production was 5.8 percent below its pre-Covid level in February 2020.

Manufacturing was weaker still, posting a 0.5 percent monthly decline. This only dented the previous period's 1.0 percent bounce but was the second drop in the last three months. Coke and refined petroleum products (minus 4.6 percent), machinery and equipment (minus 1.1 percent) and the other manufacturing category (minus 0.8 percent) all recorded losses. Transport equipment (2.3 percent) was the only area to record a gain. Elsewhere, food and drink (minus 0.4 percent) also contracted but there were advances in both mining and quarrying, energy, water supply and waste management (0.7 percent) and construction (1.1 percent).

March's setback leaves overall goods production last quarter 0.5 percent lower than in the previous quarter and so subtracting from GDP growth. Manufacturing output was down a marginally steeper 0.6 percent and with a sector PMI of just 45.3 in April, prospects for the current quarter do not look much better.

April’s CFLP manufacturing PMI did slow from 50.8 in March to 50.4 in April, but the result did come in just above the consensus forecast of 50.3. The CFLP non-manufacturing PMI fell from 53.0 to 51.2, below the consensus forecast of 52.2. The composite index covering the entire economy fell from 52.7 in March, its highest level since June 2023, to 51.7 in April. April’s CFLP manufacturing PMI did slow from 50.8 in March to 50.4 in April, but the result did come in just above the consensus forecast of 50.3. The CFLP non-manufacturing PMI fell from 53.0 to 51.2, below the consensus forecast of 52.2. The composite index covering the entire economy fell from 52.7 in March, its highest level since June 2023, to 51.7 in April.

The CFLP is China’s official PMI but the results closely track S&P’s data which for manufacturing came in at 51.4, up 3 tenths from March and 4 tenths over the consensus. S&P’s services and composite data for April will be posted in the coming week (see Looking Ahead for details).

Manufacturing activity in Switzerland contracted a good deal more sharply than expected in April. At just 41.4, the SVME PMI was more than 4 points short of the market consensus and well below its 45.2 March print. This was its weakest level since last October and indicative of a deep and ongoing recession in the sector. Last month's outturn duly extended the unbroken run of sub-50 readings that began back at the start of 2023. Production, orderbooks and purchasing activity all fell by more than in March but purchase prices essentially stabilised. Manufacturing activity in Switzerland contracted a good deal more sharply than expected in April. At just 41.4, the SVME PMI was more than 4 points short of the market consensus and well below its 45.2 March print. This was its weakest level since last October and indicative of a deep and ongoing recession in the sector. Last month's outturn duly extended the unbroken run of sub-50 readings that began back at the start of 2023. Production, orderbooks and purchasing activity all fell by more than in March but purchase prices essentially stabilised.

The ISM’s services index unexpectedly slipped back into contraction in April, ending 15 months of growth. ISM’s sample reported sluggish demand, cooling employment amid lingering concerns over inflation and geopolitical risks. April’s index slumped 2 full points to 49.4 for a third straight monthly drop and against expectations for 52.0. Output was especially weak as the business activity index fell 6.5 points to a nearly four-year low of 50.9. The ISM’s services index unexpectedly slipped back into contraction in April, ending 15 months of growth. ISM’s sample reported sluggish demand, cooling employment amid lingering concerns over inflation and geopolitical risks. April’s index slumped 2 full points to 49.4 for a third straight monthly drop and against expectations for 52.0. Output was especially weak as the business activity index fell 6.5 points to a nearly four-year low of 50.9.

S&P's services PMI posted an April score 51.3 to indicate slight monthly growth in composite activity and extending a 10-month run in a very tight range of 50 to 52 (ISM's index had been holding within a roughly similar range until April’s unexpected fall). The big negative for S&P’s sample was new orders which contracted for the first time since last October, a disappointment some respondents blamed on high interest rates. Employment was also down as were backlogs. Price pressures eased in the month, both input costs as well as selling prices.

At minus 7, the Relative Performance Index (RPI) extended an improving trend and is now signaling that global economic data on net are nearly meeting economic forecasts. At minus 2, the index less prices (RPI-P) is almost at breakeven zero.

In the UK, a mix of upside and downside surprises cancelled each other out to leave the RPI-P at exactly zero. At minus 7, the RPI shows overall economic activity falling slightly short of expectations but not to the extent that would prompt a majority of BoE MPC members to vote for a cut in Bank Rate on Thursday.

In the Eurozone, unexpectedly soft core inflation in April underpinned market expectations for an ECB interest rate cut in June despite a modest upside surprise on first-quarter GDP growth. At minus 3 and 8 respectively, both the RPI and RPI-P show recent data on balance coming in much as anticipated.

In Switzerland, economic activity looks to be moving ahead but at only a modest pace and rather more slowly than market forecasts. At minus 6 and minus 23 respectively, the RPI and RPI-P remain sub-zero. However, unexpectedly firm inflation last month has slightly dented speculation about another SNB rate cut later this quarter.

In Japan, economic news was typically on the soft side of market expectations, lowering the RPI to minus 14 and the RPI-P to 11. Neither reading offers any help to the beleaguered yen which against the dollar would probably have stabilized above 160 but for aggressive BoJ intervention.

In China, a stronger-than-expected manufacturing sector lifted both the RPI and RPI-P to 2, indicating that overall economic activity is now performing in line with forecasts. Having outperformed for most of March and early April, the latest readings should relieve some pressure on the authorities to ease policy further.

In Canada, the recent run of sub-zero RPI readings was borne out in disappointingly sluggish February GDP. At minus 52, the RPI is now at its lowest level since early 2022 while, at minus 53, the RPI-P is even weaker. High wage growth remains a risk but on current trends, a cut in Bank of Canada interest rates in June is very possible.

April’s lower-than-expected employment report left the US RPI at minus 16, both overall and when excluding inflation. Though these readings are among the lowest of the year, prior outperformance by the US economy and still high inflation are very likely to limit Federal Reserve rate-cut talk.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Both the Reserve Bank of Australia on Tuesday and the Bank of England on Thursday are expected to keep policy steady. Inflation in both countries remains above target with improvement slow especially in Australia.

China’s merchandise trade surplus on Thursday is expected to show a sharp jump on an April rebound in exports. Chinese CPI for April on Saturday is expected to remain near zero.

Underperformance is the call for German manufacturing orders on Tuesday and German industrial production on Wednesday.

The UK will post the first estimate for first-quarter GDP on Friday and modest growth is the consensus. Canada’s labour force survey on Friday is seen rebounding modestly in April following disappointment in March.

China: S&P PMI Composite for April (Mon 0945 CST; Mon 0145 GMT; Sun 2145 EDT)

Services Index, Consensus Forecast: 52.5

S&P's services PMI in April is expected to slow slightly to 52.5 from March’s 52.7.

Reserve Bank of Australia Announcement (Tue 1430 AEST; Tue 0430 GMT; Mon 0030 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 4.35%

Highlighting uncertainties surrounding the inflation outlook as well as tightness in the labour market, the Reserve Bank of Australia kept its policy rate steady at 4.35 percent at its March meeting. The RBA is expected to once again keep rates unchanged at its May meeting.

German Manufacturing Orders for March (Tue 0800 CEST; Tue 0600 GMT; Tue 0200 EDT)

Consensus Forecast, Month over Month: 0.2%

Manufacturing orders are expected to rise a monthly 0.2 percent in March to match February’s lower-than-expected pace.

Taiwan CPI for April (Tue 1600 CST; Tue 0800 GMT; Tue 0400 EDT)

Consensus, Year over Year: 2.10%

Consumer prices in April are expected to rise 2.10 percent versus a 2.14 percent year-over-year rate in March.

Eurozone Retail Sales for March (Tue 1100 CEST; Tue 0900 GMT; Tue 0500 EDT)

Consensus Forecast, Month over Month: 0.7%

Consensus Forecast, Year over Year: -0.3%

Retail sales volumes in March are expected to rise 0.7 percent on the month after February’s poor showing, declines of 0.5 percent on the month and 0.7 percent on the year.

German Industrial Production for March (Wed 0800 CEST; Wed 0600 GMT; Wed 0200 EDT)

Consensus Forecast, Month over Month: -1.0%

Consensus Forecast, Year over Year: -4.0%

Industrial production in March is expected to fall 1.0 percent on the month after rising a stronger-than-expected 2.1 percent in February that followed January’s upward revised 1.3 percent gain.

Chinese Merchandise Trade Balance for April (Estimated for Thursday, release time not set)

Consensus Forecast: US$81.3 billion

Consensus Forecast: Imports - Y/Y: 5.5%

Consensus Forecast: Exports - Y/Y: 2.0%

China's trade surplus for April is expected to jump to US$81.3 billion versus a lower-than-expected surplus of US$58.55 billion in March in a report that saw a steep 7.5 percent year-over-year decline in exports.

Bank of England Announcement (Thu 1200 BST; Thu 1100 GMT; Thu 0700 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 5.25%

With consumer inflation still above 3 percent and core inflation above 4 percent, Bank Rate is expected to be left at 5.25 percent.

Japanese Household Spending for March (Fri 0830 JST; Thu 2330 GMT; Thu 1930 EDT)

Consensus Forecast , Month over Month: 0.0%

Consensus Forecast , Year over Year: -2.3%

Real household spending in March is expected to fall 2.3 percent on the year versus shallower-than-expected contraction of 0.5 percent in February that benefited from mild weather and an extra day for leap year.

UK First-Quarter GDP, First Estimate (Fri 0700 GMT; Fri 0300 EDT)

Consensus Forecast, Quarter over Quarter: 0.4%

Consensus Forecast, Year over Year: 0.0%

Total quarter-over-quarter output is seen rising 0.4 percent in the first quarter versus 0.3 percent contraction in the fourth quarter. No change is expected for the annual reading versus fourth-quarter contraction of 0.2 percent

UK GDP for March (Fri 0700 BST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, Month over Month: 0.2%

GDP in the month of March is expected to rise 0.2 percent. Without any revisions, March would need to contract 1.1 percent to prevent positive first-quarter growth.

UK Merchandise Trade for March (Fri 0700 BST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, Balance: -£14.5

The merchandise trade deficit is seen deepening to £14.5 billion in March versus £14.21 billion in February.

Canadian Labour Force Survey for April (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast: Employment Change: 16,300

Consensus Forecast: Unemployment Rate: 6.2%

Employment in April is expected to rise 16,300 versus March’s unexpected 2,200 decline that, however, followed solid gains of 40,700 and 37.300 in the two prior months. April’s unemployment rate is expected to edge higher to 6.2 percent from March’s 6.1 percent which was 2 tenths higher than Econoday’s consensus.

US Consumer Sentiment Index, Preliminary May (Fri 1000 EDT; Fri 1400 GMT)

Consensus Forecast: 77.0

Year-Ahead Inflation Expectations

Consensus Forecast: 3.2

In the first indication for May, consumer sentiment is expected to hold steady at 77.0 from April’s lower-than-expected 77.2. Year-ahead inflation expectations are also expected to hold steady, at April’s 3.2 percent level which was higher-than-expected.

Chinese CPI for April (Sat 0930 CST; Sat 0130 GMT; Fri 2130 EDT)

Consensus Forecast, Year over Year: 0.2%

April’s year-over-year rate is expected to remain flat, at 0.2 percent versus March’s 0.1 percent rate. China’s CPI last peaked in January last year at 2.1 percent.

Chinese PPI for April (Sat 0930 CST; Sat 0130 GMT; Fri 2130 EDT)

Consensus Forecast, Year over Year: -2.4%

Producer prices have been in long annual contraction. April’s consensus is minus 2.4 percent on the year versus March’s as-expected contraction of 2.8 percent.

|