|

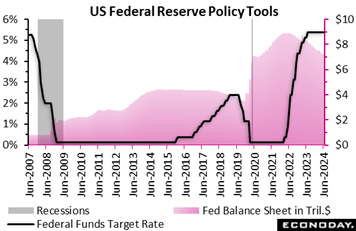

In contrast to the prior week’s cuts by the Bank of Canada and the European Central Bank, the US Federal Reserve is no hurry to add juice to the economy. The policy statement was virtually unchanged from the one published six weeks ago and, in a hawkish twist, the Fed moved its forecast for inflation a bit higher. The PCE deflator for 2024 was revised up 2 tenths to 2.6 percent with 2025 up a tenth to 2.3 percent; the ex-food ex-energy core showed a similar revision. The slightly more elevated inflation outlook is likely the main reason behind higher forecasts for the fed funds rate target. For 2024, the forecast is 5 tenths higher at 5.1 percent, and 2 tenths higher at 4.1 percent for 2025, but was unrevised at 3.1 percent in 2026. For 2024, the implied rate path is one rate cut of 25 basis points. For 2025 and 2026, the forecast implies four rate cuts of 25 basis points for each year.

Even at 2.7 percent on the PCE price index and at 2.8 percent for the ex-food ex-energy core, inflation remains "far too high", according to Jerome Powell in his opening remarks. Powell noted that May's consumer price data released the morning of the statement were also well above the Fed's inflation goal, at 3.3 percent overall and 3.4 percent for the core. Powell repeated that the Fed is "committed" to its two percent goal and that restoring price stability is "essential" for the achievement of maximum employment. Even at 2.7 percent on the PCE price index and at 2.8 percent for the ex-food ex-energy core, inflation remains "far too high", according to Jerome Powell in his opening remarks. Powell noted that May's consumer price data released the morning of the statement were also well above the Fed's inflation goal, at 3.3 percent overall and 3.4 percent for the core. Powell repeated that the Fed is "committed" to its two percent goal and that restoring price stability is "essential" for the achievement of maximum employment.

Powell was upbeat on the labor market, saying demand for labor and the availability of labor are coming into "better balance" as the supply of workers increase and the pace of immigration remains "strong". He said nominal wage growth has "eased" over the past year and noted that average payroll growth continues to exceed 200,000 per month and that the unemployment rate, though ticking slightly higher, remains "low" at 4.0 percent. "Relatively tight but not overheated" is how Powell described the labor market, saying it is now roughly in line with conditions prior to the pandemic.

On the economy in general, he said activity continues to expand at a "solid pace" and that consumer spending, though slowing from last year's robust pace, remains "solid". Powell further noted that business investment has improved.

Powell doesn't expect the Fed to cut rates until officials have "greater confidence" that inflation is moving sustainably toward their two percent goal. He said policy is well positioned to pursue both sides of its policy mandate (steady inflation and maximum employment) and that the FOMC will maintain the current level of rates "as long as appropriate".

In the Q&A, Powell emphasized that the policy outlook will be determined by the totality of the economic data, not any one indicator. He said there was nothing "mechanical" in how the FOMC would set rates at future meetings, adding that policymakers are not looking at one or two or even three months of data as a definitive period that would benchmark how the FOMC assesses the data. Powell reiterated that the FOMC will take a balanced approach and that decisions remain on a meeting-by-meeting basis.

Powell also noted that the FOMC is "well aware of the two-sided risks". He explained that "if we wait too long" it could come at the cost of growth, while "if we move too quickly it could undo the good that we've done" in making progress on inflation. At the moment solid economic growth and a healthy labor market give the FOMC "the ability now to approach this question carefully".

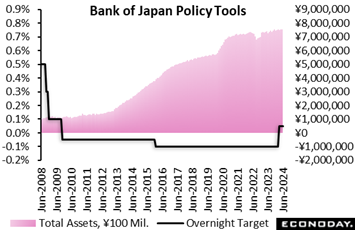

The Bank of Japan in a unanimous vote held its overnight interest rate target steady in a range of 0 percent to 0.1 percent, as widely expected. In an 8 to 1 vote, the BoJ set the stage for gradually reducing its large holdings of various financial assets over the next one to two years. The Bank of Japan in a unanimous vote held its overnight interest rate target steady in a range of 0 percent to 0.1 percent, as widely expected. In an 8 to 1 vote, the BoJ set the stage for gradually reducing its large holdings of various financial assets over the next one to two years.

The no vote came from the usual suspect, Toyoaki Nakamura, a former Hitachi executive. He supports the idea of lowering JGB buying but argues that such a decision should be made after assessing growth and inflation prospects in the bank's quarterly Outlook Report to be issued after the July 30-31 meeting. In March, Nakamura was one of two members who dissented in a vote to end the bank’s negative interest rate policy and set the overnight rate target above zero.

"Regarding the purchases of Japanese government bonds, CP (commercial paper) and corporate bonds, the bank will conduct purchases in accordance with the decisions made at the March 2024 MPM (monetary policy meeting)," the bank said, repeating its statement issued after its previous meeting in April.

The board also decided that "it would reduce its purchase amount JGBs thereafter to ensure long-term interest rates would be formed more freely in financial markets" as part of its move to gradually normalize its monetary policy after 11 years of large-scale easing. "It will collect views among market participants and at the next MPM, will decide on a detailed plan for the reduction of its purchase amount for the next one to two years or so."

Market participants expect the BoJ to raise the overnight rate again in July or September, and possibly one more time by year-end, barring any sharp downturn in economic growth.

Since the short-term rate is close to zero, bank officials have noted that monetary conditions will remain accommodative for now, but they have also acknowledged the negative impact of the weak yen on high import costs, which is partly due to the outlook that interest rates in Japan will stay well below those in the US, keeping the dollar's relative strength.

"Japan's economy is likely to keep growing at a pace above its potential growth rate (estimated by the bank to be zero to 0.5 percent), with overseas economies growing moderately and as a virtuous cycle from income to spending gradually intensifies against the background of factors such as accommodative financial conditions," the BOJ said, repeating its recent assessment.

Looking ahead, the bank also repeated its long-held assessment that "there are extremely high uncertainties" surrounding Japan's economy including developments in overseas economic activities and prices, commodity prices as well as domestic firms' wage- and price-setting behavior. "Under these circumstances, it is necessary to pay due attention to developments in financial and foreign exchange markets and their impact on Japan's economic activity and prices," the BOJ said, repeating its past statements.

In its Outlook Report issued in April, the BoJ largely maintained its latest inflation outlook that the year-on-year increase in the core CPI (excluding fresh food prices) is likely to be in the range of 2.5 percent to 3.0 percent for fiscal 2024 and then be at around 2 percent for fiscal 2025 and fiscal 2026.

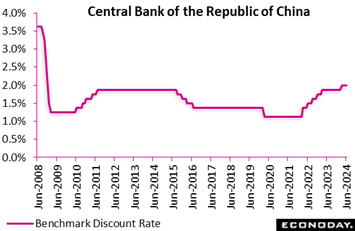

The Central Bank of the Republic of China, as expected, left its main policy rate unchanged at 2.00 percent. This follows an increase of 12.5 basis points at its previous meeting in March, which was the first increase in twelve months and took the rate to its highest level since 2008. The Central Bank of the Republic of China, as expected, left its main policy rate unchanged at 2.00 percent. This follows an increase of 12.5 basis points at its previous meeting in March, which was the first increase in twelve months and took the rate to its highest level since 2008.

Data released since the CBC's previous policy meeting in March have shown low and relatively steady headline inflation after some holiday-related volatility early in the year. PMI surveys have also shown modest expansion in the manufacturing sector in April and May after an extended period of contraction.

In their statement, Taiwan officials expressed confidence that external demand will continue to improve in the second half of the year, with domestic consumption and investment also expected to support stronger headline GDP growth. Officials revised up their annual GDP growth forecast for 2024 from 3.22 percent to 3.77 percent. Officials are also now more confident that price pressures will moderate in the near-term, revising down their forecast for annual headline inflation in 2024 from 2.49 percent to 2.12 percent and their forecast for annual core inflation from 2.58 percent to 2.00 percent.

Reflecting their updated forecasts for stronger growth and more moderate inflation, officials concluded that current policy settings remain appropriate. Nevertheless, they also noted risks to the outlook and stressed that they are ready to adjust policy "in a timely manner as warranted", but provided little guidance on whether they see a rate increase or rate cut as more likely.

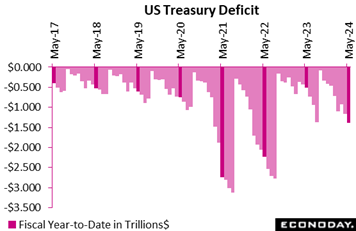

However much the Federal Reserve is reluctant to give any boost to the economy, US fiscal policy is becoming increasingly stimulative. The Treasury budget balance came in at a whopping deficit of $347.1 billion in May versus a deficit of $240.3 billion a year ago; expectations centered on $235 billion for the latest month with forecasts ranging from minus $348 billion to minus $203 billion. The latest monthly deficit reflected budget outlays of $670.8 billion compared with $547.8 billion in the year-ago month, while receipts were $323.6 billion compared with $307.5 billion last year. However much the Federal Reserve is reluctant to give any boost to the economy, US fiscal policy is becoming increasingly stimulative. The Treasury budget balance came in at a whopping deficit of $347.1 billion in May versus a deficit of $240.3 billion a year ago; expectations centered on $235 billion for the latest month with forecasts ranging from minus $348 billion to minus $203 billion. The latest monthly deficit reflected budget outlays of $670.8 billion compared with $547.8 billion in the year-ago month, while receipts were $323.6 billion compared with $307.5 billion last year.

Year-to-date for the fiscal period ending in September, the US deficit stood in May at $1.621 trillion which is far deeper than $1.165 trillion in May year (see dark red columns in accompanying graph).

The US CPI for May came in unchanged from April and was up 3.3 percent year-over-year. These were a tick below Econoday’s consensus of up 0.1 percent on the month and 3.4 percent on the year. May’s core CPI rose 0.2 percent from the prior month and was up 3.4 percent from a year ago. These increases were also just below the consensus estimates of 0.3 and 3.5 percent. The US CPI for May came in unchanged from April and was up 3.3 percent year-over-year. These were a tick below Econoday’s consensus of up 0.1 percent on the month and 3.4 percent on the year. May’s core CPI rose 0.2 percent from the prior month and was up 3.4 percent from a year ago. These increases were also just below the consensus estimates of 0.3 and 3.5 percent.

There is some indication that disinflation has been creeping back into consumer prices over April and May, but the improvement is incremental and could easily stall again. And as can seen in separately released data on inflation expectations for June, pressures may be resurfacing (see Sentiment section below). As stressed at the week’s FOMC meeting, policymakers will remain cautious regarding the inflation outlook until they have more data to confirm that prices are indeed trending lower. In any case, the annual pace of change remains above the Fed's two percent inflation objective.

Food and beverage prices edged up in May a scant 0.1 percent from April and were up 2.1 from May 2023. Energy prices fell 2.0 percent in May from April but were up 3.7 percent on the year. Within energy, gasoline prices fell 3.6 percent from the prior month were up 2.2 percent from May 2023.

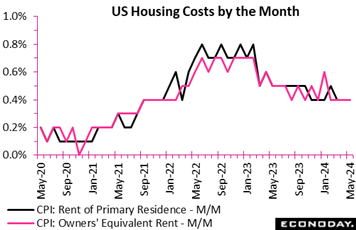

The index for shelter costs – about 1/3 of the CPI basket – rose 0.4 percent in May from April and were up 5.4 percent compared to the same month last year. Shelter costs have yet to moderate despite a soft housing market and deceleration in rent increases. Demand for housing continues to outstrip supply, especially for affordable units. The CPI excluding shelter only was down 0.2 percent in May from April and up 2.1 percent compared to May 2023. The CPI excluding food, energy and also shelter was flat in May from the prior month and up 1.9 percent from the same month last year.

Much of the disinflation trend is in commodities prices. The index for commodities fell 0.4 percent in May from April, and was up only 0.1 percent year-over-year. The index for services rose 0.2 percent in May from April and was up 5.2 percent from May 2023. The special aggregate of services less rent of shelter was flat in May from April and up 5.0 percent compared to the same month last year. Even though shelter costs remain a notable source of upward price pressure, non-housing services have likewise yet to show much moderation at an annual rate.

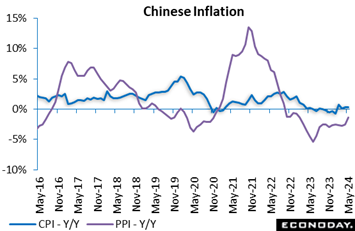

China's headline consumer price index rose 0.3 percent on the year in May, unchanged from the increase recorded in April. Excluding the impact of lunar new year holidays earlier in the year, headline inflation is now at its least weak level since April 2023. The index fell 0.1 percent on the month after increasing 0.1 percent previously. China's headline consumer price index rose 0.3 percent on the year in May, unchanged from the increase recorded in April. Excluding the impact of lunar new year holidays earlier in the year, headline inflation is now at its least weak level since April 2023. The index fell 0.1 percent on the month after increasing 0.1 percent previously.

China's headline producer price index fell 1.4 percent on the year in May after dropping 2.5 percent on the year in April. Headline PPI inflation has been in negative territory since late 2022 but this is the smallest year-over-year decline in the index since February 2023. The index rose 0.2 percent on the month after a previous decline of 0.2 percent.

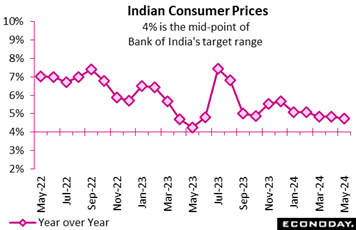

India's consumer price index rose 4.75 percent on the year in May, easing from an increase of 4.83 percent in April. Inflation is now at its lowest level in twelve months and closer to the mid-point of the Reserve Bank of India's target range of two percent to six percent. India's consumer price index rose 4.75 percent on the year in May, easing from an increase of 4.83 percent in April. Inflation is now at its lowest level in twelve months and closer to the mid-point of the Reserve Bank of India's target range of two percent to six percent.

Food and beverage prices rose 7.87 percent on the year, unchanged from the increase recorded previously, while fuel and light charges fell 3.83 percent on the year after a previous decline of 4.24 percent. Inflation in urban areas rose from 4.11 percent in April to 4.15 percent in May, while inflation in rural areas fell from 5.43 percent to 5.28 percent.

At the RBI's most recent policy meeting, held last month, officials left policy rates on hold at 6.50 percent. They advised then that they expect inflation to fall to around 4.5 percent in coming quarters but stressed that "the path of disinflation needs to be sustained" until inflation falls to 4.0 percent.

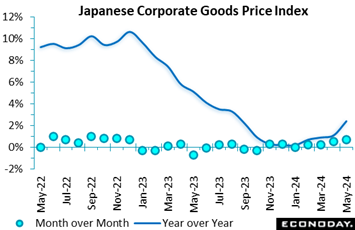

Producer inflation in Japan jumped to a higher-than-expected 2.4 percent on the year in May from 1.1 percent in April as the government raised the renewable energy charge that users pay for greener electricity and as global copper supply concerns boosted non-ferrous metals prices. May’s gain was the largest since a 3.4 percent increase in August 2023. On the month, prices rose 0.7 percent, also above the median forecast of a 0.5 percent rise and following a 0.5 percent rise in April. Producer inflation in Japan jumped to a higher-than-expected 2.4 percent on the year in May from 1.1 percent in April as the government raised the renewable energy charge that users pay for greener electricity and as global copper supply concerns boosted non-ferrous metals prices. May’s gain was the largest since a 3.4 percent increase in August 2023. On the month, prices rose 0.7 percent, also above the median forecast of a 0.5 percent rise and following a 0.5 percent rise in April.

In yen terms, the import price index rose 6.9 percent in May for the highest level since a 9.4 percent rise in March 2023 and followed a 6.6 percent rise in April.

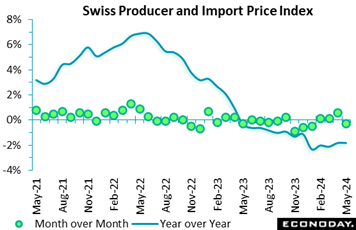

Switzerland’s combined producer and import price index surprisingly fell in May for the first time since January. A 0.3 percent monthly drop was well below the market consensus but only steep enough to leave the annual inflation rate unchanged at minus 1.8 percent, matching a 5-month high. Switzerland’s combined producer and import price index surprisingly fell in May for the first time since January. A 0.3 percent monthly drop was well below the market consensus but only steep enough to leave the annual inflation rate unchanged at minus 1.8 percent, matching a 5-month high.

Domestic prices decreased 0.5 percent versus April lowering their yearly rate from minus 0.4 percent to minus 1.3 percent. Import prices were flat, lifting their annual rate from minus 4.6 percent to minus 2.9 percent.

Within the PPI, petroleum products (minus 7.5 percent) saw the steepest monthly decline and subtracted almost 0.1 percentage point from the overall change. However, it was chemical and pharmaceutical products (minus 3.1 percent) that had the largest negative impact, subtracting fully 0.8 percentage points. On the upside, rubber and plastics (2.6 percent) and electricity and gas supply (6.0 percent) stood out. Consequently, overall core prices fell a sizeable 0.5 percent versus April, lowering the annual underlying rate from minus 1.7 percent to minus 2.2 percent.

Despite the May decline, May's update still suggests that the trend in pipeline price pressures may be turning higher.

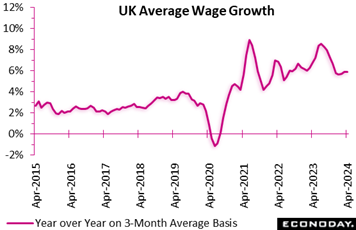

Wage developments in the UK were again surprisingly robust. At a 5.9 percent rate, average annual growth in the three months to April was unchanged from its upwardly revised rate in the first quarter and so matched a 5-month high. Regular pay proved just as sticky, holding stable at an even stronger 6.0 percent. Wage developments in the UK were again surprisingly robust. At a 5.9 percent rate, average annual growth in the three months to April was unchanged from its upwardly revised rate in the first quarter and so matched a 5-month high. Regular pay proved just as sticky, holding stable at an even stronger 6.0 percent.

Yet outside of wages, there were further signs of cooling. Claimant count unemployment rose a surprisingly steep 50,400 on the month in May following a marginally smaller revised 8,400 increase in April. This was its largest advance since the upswing began in September last year and sharp enough to boost the jobless rate from 4.1 percent to 4.3 percent, its highest reading since February 2022.

Meantime, ILO data for February-April showed the number of people out of work climbing a sizeable 138,000. This lifted this jobless rate to 4.4 percent, a tick above Econoday’s consensus and matching its highest outturn since the Covid-impacted third quarter of 2021. Employment was again weak, falling 139,000 over the same period to 32.967 million, its fourth consecutive decline and its lowest level since August-October 2022. As a result, the employment rate slipped from 74.5 percent to 74.3 percent to equal its weakest mark since the first quarter of 2021.

More up to date, payroll data also showed a 3,132 drop in May after a shallower revised 36,321 fall in April. This was its third decrease in the last four months, albeit the smallest of the sequence. In addition, looking forward, vacancies in the three months to May dropped 2,000 to 904,000, their lowest mark since the second quarter of 2021.

Though mixed in sum, the latest wage data further reduces the likelihood of a cut in Bank Rate at Thursday’s BoE MPC meeting. The labour market still looks to be easing but wage growth will probably need to slow a good deal more for most members to be convinced that the two percent inflation target can be met on a sustainable basis.

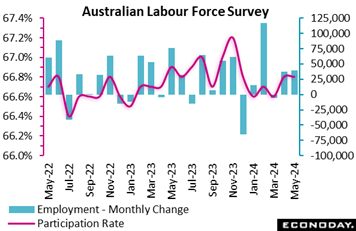

Labour market conditions in Australia remained tight in May, with unemployment falling and full-time employment rebounding from a previous decline. This strength will likely keep the focus of the Reserve Bank of Australia on risks to the inflation outlook, suggesting little prospect of a shift in officials' policy stance at their meeting scheduled for the coming week. Labour market conditions in Australia remained tight in May, with unemployment falling and full-time employment rebounding from a previous decline. This strength will likely keep the focus of the Reserve Bank of Australia on risks to the inflation outlook, suggesting little prospect of a shift in officials' policy stance at their meeting scheduled for the coming week.

The number of people employed in Australia rose by 39,700 n May, up from an increase of 37,400 in April. The consensus forecast was for an increase of 27,000. Full-time employment rose by 41,700 persons after a previous fall of 7,600, partially offset by a fall in part-time employment of 2,100 after a previous increase of 45,000.

May's data also showed the unemployment rate falling from 4.1 percent in April to 4.0 percent. The participation rate was unchanged at 66.8 percent, remaining historically high.

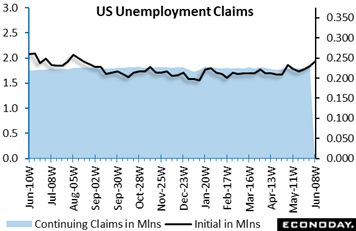

US initial jobless claims for the week ended June 8 jumped 13,000 to 242,000, which was far above Econoday’s consensus for 222,000. The increase may well have reflected an influx of claims from workers at school districts that was larger than anticipated by the seasonal adjustment factors. Unadjusted claims surged 38,530 in the week. A single sizeable increase is within the normal week-to-week behavior of the report and not immediately concerning unless followed by large gains in subsequent weeks. US initial jobless claims for the week ended June 8 jumped 13,000 to 242,000, which was far above Econoday’s consensus for 222,000. The increase may well have reflected an influx of claims from workers at school districts that was larger than anticipated by the seasonal adjustment factors. Unadjusted claims surged 38,530 in the week. A single sizeable increase is within the normal week-to-week behavior of the report and not immediately concerning unless followed by large gains in subsequent weeks.

The level of continuing claims rose 30,000 to 1.820 million in lagging data for the June 1 week. Again, a one week increase should not raise alarm about the health of the labor market and the June 1 reading remains well in line with levels seen over the past year. The insured rate of unemployment held at 1.2 percent where it has been since March 2023. At least among those eligible for unemployment benefits, unemployment remains low and time on the unemployment rolls is generally not outlasting available benefits.

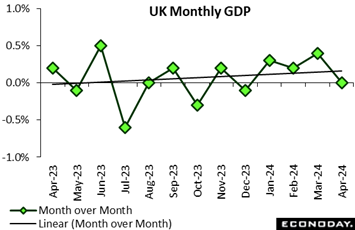

The UK economy unexpectedly stalled at the start of the second quarter. The flat quarterly rate followed an unrevised 0.4 percent bounce in March and was the weakest performance so far in 2024. However, 3-monthly growth still edged up a tick to 0.7 percent although the annual rate dipped by 0.1 percentage point to 0.6 percent. The UK economy unexpectedly stalled at the start of the second quarter. The flat quarterly rate followed an unrevised 0.4 percent bounce in March and was the weakest performance so far in 2024. However, 3-monthly growth still edged up a tick to 0.7 percent although the annual rate dipped by 0.1 percentage point to 0.6 percent.

The zero monthly change masked a 0.2 percent increase in services output that was essentially offset by a 0.9 percent fall in industrial production. Within the latter, manufacturing contracted fully 1.4 percent. Construction was also weak, declining 1.4 percent for its third straight drop, while agriculture, forestry and fishing was just 0.1 percent firmer.

The economy continues to recover from its mild recession at the end of 2023 but momentum is still quite soft and, despite the relative buoyancy of recent sector PMIs (May 51.2), manufacturing is not out of the woods yet.

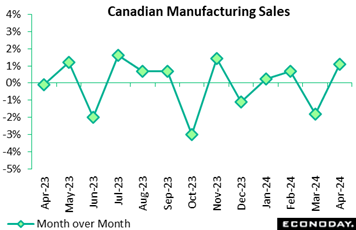

Canadian manufacturing sales rebounded by 1.1 percent in April after contracting 1.8 percent in March. The April bounce was close to the 1.2 percent rise expected. Real sales gained 0.4 percent, which means a higher volume of goods was sold. Nominal sales were down 1.0 percent year-over-year and declined 1.8 percent in real terms. Canadian manufacturing sales rebounded by 1.1 percent in April after contracting 1.8 percent in March. The April bounce was close to the 1.2 percent rise expected. Real sales gained 0.4 percent, which means a higher volume of goods was sold. Nominal sales were down 1.0 percent year-over-year and declined 1.8 percent in real terms.

Looking ahead, indicators generally suggest further recovery, as new orders were up 3.1 percent on the month though unfilled orders down 0.2 percent.

Inventories were down 0.2 percent, depressing the inventory-to-sales ratio to 1.71 in April from 1.73 a month earlier and 1.74 a year ago.

The unadjusted capacity utilization rate was flat at 78.1 in April from March and up from 77.6 percent a year ago.

In April, sales rose in 12 of 21 industries, led by transportation equipment, up 4.1 percent. The main driver there was sales of autos, where sales rose 5.6 percent in April after a 7.9 percent drop in March. Other big movers were primary metals, up 4.7 percent, and chemical products, up 4.0 percent. That was partly offset by a decline of 6.8 percent in aerospace.

Italy's merchandise trade balance posted a strong performance in April, recording a robust €4.81 billion surplus, a significant increase from March's €4.17 billion. This positive trend highlights the resilience and competitive strength of Italy’s economy in the global market. Italy's merchandise trade balance posted a strong performance in April, recording a robust €4.81 billion surplus, a significant increase from March's €4.17 billion. This positive trend highlights the resilience and competitive strength of Italy’s economy in the global market.

April saw a noteworthy 2.3 percent rise in exports compared to March 2024, showcasing the growing demand for domestically produced goods abroad. Conversely, imports decreased by 1.1 percent, indicating a shift in domestic consumption patterns and increased self-reliance. Excluding energy, the trade balance surplus was even more impressive, reaching €8.6 billion.

Despite the positive trade balance, import prices experienced a slight uptick, rising by 0.8 percent in April on a month-over-month basis. However, when viewed over the last three months compared to the previous quarter, import prices fell by 0.5 percent, suggesting some volatility but an overall downward trend. Year-over-year, import prices have decreased by 1.8 percent, reflecting improved import efficiency.

The April 2024 trade data paints a picture of a thriving economy with a healthy surplus and a favourable trade balance. The rise in exports and the substantial non-energy trade surplus underscore the country's economic resilience and ability to capitalise on global demand. This performance bodes well for the economic outlook in the coming months.

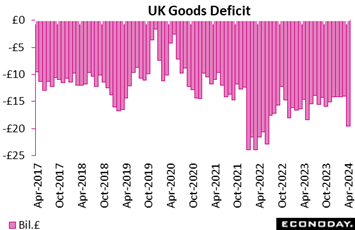

In sharp contrast to Italy’s surplus, the UK’s trade deficit deepened surprisingly sharply in April. At £19.61 billion, the shortfall was up from March's £13.97 billion for the most red ink since June 2022. The marked deterioration was partially attributable to weaker exports which fell 2.4 percent, their third straight drop, but mainly to stronger imports which surged fully 11.0 percent. The jump in the latter was largely on the back of a hefty increase in demand for machinery and transport equipment and fuels. In sharp contrast to Italy’s surplus, the UK’s trade deficit deepened surprisingly sharply in April. At £19.61 billion, the shortfall was up from March's £13.97 billion for the most red ink since June 2022. The marked deterioration was partially attributable to weaker exports which fell 2.4 percent, their third straight drop, but mainly to stronger imports which surged fully 11.0 percent. The jump in the latter was largely on the back of a hefty increase in demand for machinery and transport equipment and fuels.

The deficit with the EU increased from £10.16 billion to £12.32 billion as exports fell 0.9 percent and imports gained 8.1 percent. However, most of the damage was done by the rest of the world where the deficit widened from £3.81 billion to £7.29 billion, the largest since August 2022. Exports here slumped 3.7 percent while imports were up some 14.7 percent.

The April report undermines what had been a modestly improving trend in the goods balance. Both sides of the balance sheet continue to be very erratic but the ongoing slide in exports, which now stand at their weakest level since January 2022, is ominous.

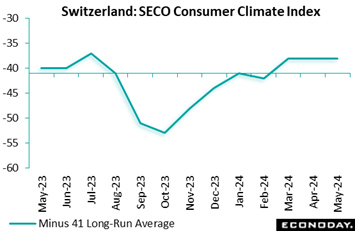

Swiss household sentiment was again unchanged in May. At minus 38, the unadjusted headline index matched both its March and April readings but was 2 points higher than a year ago and 3 points stronger than its long-run average. That said, the mid-quarter outturn was slightly weaker than the market consensus. Swiss household sentiment was again unchanged in May. At minus 38, the unadjusted headline index matched both its March and April readings but was 2 points higher than a year ago and 3 points stronger than its long-run average. That said, the mid-quarter outturn was slightly weaker than the market consensus.

Most of the components were broadly stable on the month although a jump in the year ahead inflation outlook (104 after 96) to a 4-month high might raise a few eyebrows at the Swiss National Bank. The increase here contrasted with buying intentions (minus 63 after minus 60) which fell to a 3-month low.

Overall, the results suggest that the previously improving trend in consumer sentiment has run out of steam. However, current levels of the composite index are firm enough to point to modest growth of spending over coming months.

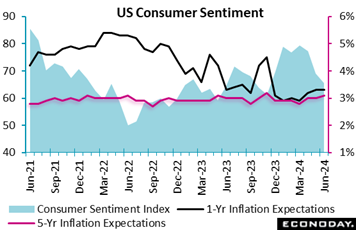

The preliminary University of Michigan consumer sentiment index for June fell to 65.6 after a final 69.1 in May. This is its lowest level since 61.3 in November 2023 and well below the consensus of 73.0 in Econoday’s survey of forecasters. Most of this month’s decline is reflected in perceptions of current conditions, while expectations for about six months from now, though subdued, haven’t changed that much from the prior month. The preliminary University of Michigan consumer sentiment index for June fell to 65.6 after a final 69.1 in May. This is its lowest level since 61.3 in November 2023 and well below the consensus of 73.0 in Econoday’s survey of forecasters. Most of this month’s decline is reflected in perceptions of current conditions, while expectations for about six months from now, though subdued, haven’t changed that much from the prior month.

The current conditions index is down to 62.5 in June from 69.6 in May for its lowest since 59.4 in December 2022. Consumers are clearly more concerned about inflation again and disappointed that the outlook for lower interest rates puts the possibility at a greater distance. Consumers are also likely facing heightened awareness of the election cycle and an intensification of an already ugly political climate during the various campaigns at local, state, and federal levels.

The expectations index fell to 67.6 in June after 68.8 in May. This is its lowest since 67.4 in December 2023. Consumers are a little more worried about the geopolitical situation and the performance of the US economy, but on the whole the solid labor market is keeping worries in check.

Although it should be said that inflation expectations on the part of consumers have not become unanchored, these are a little more elevated and point to anticipation of a longer fight to get inflation under control than thought just a few months ago. Preliminary 1-year inflation expectations are unchanged at 3.3 percent from May while the preliminary 5-year reading is up a tenth to 3.1 percent. Both are the highest since 3.2 percent in November 2023.

Global economic data are coming in just below Econoday’s consensus medians, at minus 12 for the overall Relative Performance Index (RPI) and at minus 11 less prices (RPI-P). These readings have been little changed for the past month suggesting that the marginal bias to Econoday’s global policy rate, currently at a weighted average of 4.3 percent for major central banks, is to the downside.

Ahead of Thursday’s Bank of England announcement, UK economic data have begun to struggle to keep up with market forecasts. Even so, at minus 6 and minus 7 respectively, the RPI and RPI-P show only a limited degree of underperformance. Moreover, since the May MPC meeting, both measures have averaged just above zero suggesting no additional pressure to cut Bank Rate.

In Switzerland, the RPI (minus 7) masks a real economy that is running somewhat hotter than expected – the RPI-P stands at 15. The gap means that recent inflation data have surprised on the downside, leaving the door open to another cut for the Swiss National Bank’s policy rate on Thursday. Forecasters are split on whether or not the bank will in fact deliver a second successive ease (see Looking Ahead for details).

Canadian underperformance, at minus 13 overall, is extending to a third straight month, helping to explain the prior week’s rate cut by the Bank of Canada. Likewise the Eurozone, at minus 19 overall and a lowly minus 33 when excluding prices, likewise explains the ECB’s move.

Japan is performing in line with expectations, at plus 6 overall and minus 5 ex-prices both of which indicate that the country’s data, on net, are posting within Econoday’s consensus ranges. And China right now is performing exactly at Econoday’s median forecasts, at zero for the RPI and at zero for the RPI-P as well. No changes are expected for the country’s loan prime rates on Thursday.

Though inflation in the US is only moderating to a limited degree, price data have nevertheless been coming in below estimates. This is reflected in the separation between the country’s overall score at minus 27 which improves sharply to minus 10 when excluding weaker-than-expected inflation results.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, Olajide Oyadeyi, and Theresa Sheehan

A run of Chinese monthly data open the week on Monday amid expectations for steady, unspectacular results. But it will be central bank announcements that will be the week’s key focus beginning with the Reserve Bank of Australia on Tuesday followed on Thursday by China’s loan prime rates then the Swiss National Bank and finally the Bank of England. No rate changes are expected with the exception of the SNB where forecasts range from no change to rate cuts of either 12.5 or 25 basis points. Note that Wednesday’s consumer price report from the UK could have a bearing on future expectations for BoE action with moderation to a benign 2.1 percent Econoday’s CPI consensus.

Retail sales on Tuesday will be the most watched US report; forecasters are looking for no more than modest gains across key readings. Japanese data will open with machinery orders on Monday, merchandise trade on Tuesday, and will be capped by May consumer prices on Friday where higher costs for renewable energy are expected to heat up the headline print. The week will close with Friday’s run of June PMI flashes where incremental improvement is the general consensus.

Japanese Machinery Orders for April (Mon 0850 JST; Sun 2350 GMT; Sun 1950 EDT)

Consensus Forecast, Month over Month: -2.3%

Consensus Forecast, Year over Year: 0.4%

Despite strong demand for computers, machinery orders are expected to fall back 2.3 percent in April for year-over-year growth of 0.4 percent. Orders in March rose a surprising 2.7 percent on the month and were up 2.7 percent on the year.

Chinese Fixed Asset Investment for May (Mon 1000 CST; Mon 0200 GMT; Sun 2200 EDT)

Consensus Forecast, Year-to-Date on Y/Y Basis: 4.2%

Fixed asset investment for the year-to-date to April is expected to hold at 4.2 percent growth. March’s 4.2 percent rate missed expectations for 4.7 percent.

Chinese Industrial Production for May (Mon 1000 CST; Mon 0200 GMT; Sun 2200 EDT)

Consensus Forecast, Year over Year: 6.2%

Year-over-year growth in industrial production rose a stronger-than-expected 6.7 percent in April after 4.5 percent growth in March. Expectations for May is 6.2 percent growth.

Chinese Retail Sales for May (Mon 1000 CST; Mon 0200 GMT; Fri 2200 EDT)

Consensus Forecast, Year over Year: 3.0%

After much lower-than-expected growth of 2.3 percent in April, year-over-year sales in May are expected to rise by 3.0 percent.

Canadian Housing Starts for May (Mon 0815 EDT; Mon 1215 GMT)

Consensus Forecast, Annual Rate: 240,000

Housing starts are expected to hold steady at 240,000 in May versus 240,000 and 242,000 in the two prior months.

Reserve Bank of Australia Announcement (Tue 1430 AEST; Tue 0430 GMT; Tue 0030 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 4.35%

The Reserve Bank of Australia kept its policy rate steady at 4.35 percent at its May meeting, warning that inflation was “declining more slowly than expected” and once again citing strength in the labour market. No change is expected for the June meeting.

Germany: ZEW Survey for June (Tue 1100 CEST; Tue 0900 GMT; Tue 0500 EDT)

Consensus Forecast, Current Conditions: -67.0

Consensus Forecast, Economic Sentiment: 50.0

Current conditions are expected to improve in June to minus 67.0 versus May’s minus 72.3 which, though weak, easily beat the consensus. The report’s expectations component (economic sentiment) is seen rising to 50.0 from May’s 47.1 which, for the ninth month in a row, was also above the consensus.

US Retail Sales for May (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Ex-Vehicles - M/M: 0.3%

Consensus Forecast, Ex-Vehicles, Ex-Gas - M/M: 0.3%

May sales are expected to rise a modest 0.3 percent versus no change in April which was weaker than expected. April’s ex-auto sales increased 0.2 percent with May expected at a 0.3 percent increase as is the ex-auto ex-gas reading.

US Industrial Production for May (Tue 1315 GMT; Tue 0915 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Manufacturing Output - M/M: 0.2%

Consensus Forecast, Capacity Utilization Rate: 78.6%

After no change in April, industrial production is expected to rise 0.3 percent in May. Manufacturing output is expected to rise 0.2 percent after slipping 0.3 percent. Capacity utilization is expected at 78.6 percent following 78.4 percent in April.

Japanese Merchandise Trade for May (Wed 0850 JST; Tue 2350 GMT; Tue 1950 EDT)

Consensus Forecast: ¥ -1,260 billion

Consensus Forecast, Imports Y/Y: 11.4%

Consensus Forecast, Exports Y/Y: 16.1%

A deficit of ¥1,260 billion is the consensus for May’s trade balance versus a deficit of ¥465.6 billion in April that was wider than expected but masked a strong 8.3 percent rise in exports. Exports for May, expected to benefit from strong demand for automobiles, semiconductors, and chip-making equipment, are seen rising 16.1 percent.

UK CPI for May (Wed 0700 BST; Wed 0600 GMT; Wed 0200 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 2.1%

At 2.3 percent in April versus 3.2 percent in March, consumer prices in April fell sharply but slightly less than expected. May’s consensus is 2.1 percent.

New Zealand First-Quarter GDP (Thu 1045 NZDT; Wed 2245 GMT; Wed 1845 EDT)

Consensus Forecast, Quarter over Quarter: 0.1%

Consensus Forecast, Year over Year: 0.2%

Consensus for first-quarter GDP is marginal quarter-over-quarter expansion of 0.1 percent versus contraction of 0.1 percent in the fourth quarter. The year-over-year rate is seen at plus 0.2 percent versus minus 0.3 percent previously.

China Loan Prime Rates (Thu 0915 CST; Thu 0115 GMT; Wed 2115 EDT)

Consensus Change: 1-Year Rate: 0 basis points

Consensus Level: 3.45%

Consensus Change: 5-Year Rate: 0 basis points

Consensus Level: 3.95%

Officials are expected to hold rates unchanged at June’s announcement: at 3.45 percent for the 1-year rate and 3.95 percent for the 5-year. The last time either of these rates were changed was in February with a 25-basis-point cut for the 5-year.

German PPI for May (Thu 0800 CEST; Thu 0600 GMT; Thu 0200 EDT)

Consensus Forecast, Month over Month: -0.1%

Consensus Forecast, Year over Year: -2.1%

After rising 0.2 percent on the month in April, May’s PPI is seen slipping 0.1 percent. Year-over-year, the PPI is expected to contract 2.1 percent versus April’s contraction of 3.3 percent.

Swiss National Bank Monetary Policy Assessment (Thu 0930 CEST; Thu 0730 GMT; Thu 0330 EDT)

Consensus Forecast, Change: -12.5 basis points

Consensus Forecast, Level: 1.375%

After surprising the markets with a 25-basis-point cut in March, forecasters are uncertain what to expect for June’s meeting, from no change to rate cuts of 12.5 or 25 basis points with the former Econoday’s median estimate. At 1.4 percent, consumer inflation is low in Switzerland while the Swiss franc, which had been weak, has recently firmed.

Bank of England Announcement (Thu 1200 BST; Thu 1100 GMT; Thu 0700 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 5.25%

With wages stubbornly robust and the economy having moved out of recession, no action is expected for June’s MPC meeting. Barring major weakness in Wednesday’s CPI report, the first rate cut is generally expected to be deferred until no sooner than September which is the first meeting after August’s summer break.

Eurozone: EC Consumer Confidence Flash for June (Thu 1600 CEST; Thu 1400 GMT; Thu 1100 EDT)

Consensus Forecast: -13.7

Consumer confidence in June is expected to rise slightly to minus 13.7 versus May’s minus 14.3. This index has been improving but only slowly.

Japanese CPI for May (Fri 0830 JST; Thu 2330 GMT; Thu 1930 EDT)

Consensus Forecast, Year over Year: 2.9%

Consensus Forecast, Ex-Fresh Food; Y/Y: 2.6%

Consensus Forecast, Ex-Fresh Food Ex-Energy; Y/Y: 2.2%

Consumer inflation in May is expected to accelerate from 2.5 percent in April to 2.9 percent in May as the government raised renewable energy charges. Excluding fresh food, the rate is seen rising to 2.6 percent versus 2.2 percent. But when also excluding energy, the latter rate is seen falling to 2.2 percent from April’s 2.4 percent.

UK Retail Sales for May (Fri 0700 BST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, Month over Month: 1.6%

Consensus Forecast, Year over Year: -1.3%

Sales were much weaker than expected in April, falling 2.3 percent on the month and 2.7 percent on the year. Forecasters see a rebound for May, calling for a monthly 1.6 percent rise that would trim annual contraction to 1.3 percent.

German PMI Flashes for June (Fri 0930 CEST; Fri 0730 GMT; Fri 0330 EDT)

Consensus Forecast, Composite: 52.7

Consensus Forecast, Manufacturing: 46.4

Consensus Forecast, Services: 54.4

Manufacturing in May, which remained deeply depressed at 45.4, is expected to add a point to a less depressed 46.4 in June. Services, which in May firmed further to 54.2, are seen at 54.4. Consensus for June’s composite is 52.7 following May’s 52.4.

Eurozone PMI Flashes for June (Fri 1000 CEST; Fri 0800 GMT; Fri 0400 EDT)

Consensus Forecast, Composite: 52.4

Consensus Forecast, Manufacturing: 48.0

Consensus Forecast, Services: 53.7

The composite is expected to edge higher to 52.4 in June versus 52.2 in May and 51.7 in April. Manufacturing in June is expected to rise to 48.0 versus May’s improved reading at 47.3 with services also expected to increase to 53.7 from May’s steady 53.2.

UK PMI Flashes for June (Fri 0930 BST; Fri 0830 GMT; Fri 0430 EDT)

Consensus Forecast, Composite: 53.3

Consensus Forecast, Manufacturing: 51.3

Consensus Forecast, Services: 53.2

Manufacturing climbed more than 2 points in May and into the plus-50 expansion zone at 51.2 with June seen steady at 51.3. Services, by contrast, slowed more than 3 points in May to 52.9 with June’s consensus at 53.2. The composite is expected to rise 3 tenths to 53.0.

Canadian Retail Sales for April (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Month over Month: 0.7%

Retail sales were once again weaker than expected in March, falling 0.2 percent after February’s 0.1 percent decline. Sales in April are expected to rebound a sharp 0.7 percent on the month.

|