|

Employment, however disparaged as a lagging indicator, is showing new bounce in both the US and Europe and is posing unexpected resistance to the global trend toward lower policy rates. The strength of US payroll growth, which is back over 200,000, helps offset this year's bumpy run and will help restore confidence that the US economy, slowing global trade or not, continues to perform well. What this means for Jerome Powell is an easing of rate-cut assumptions as he faces lawmakers in the coming week. But not all the week's news is benign, as German manufacturing is showing new cracks at the same time that Chinese manufacturing stagnates. And though building momentum for rate cuts isn't really the week's theme, that's where we'll begin.

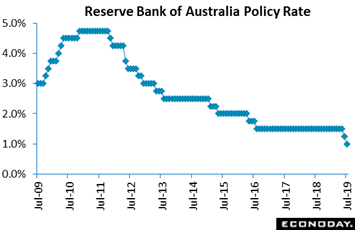

In line with expectations, the Reserve Bank of Australia cut its main policy rate by 25 basis points from 1.25 percent to 1.00 percent and a record low. This follows a similar 25 basis point rate cut at the RBA's previous meeting in June. The statement said the outlook for the global economy remains "reasonable" but cautioned that risks are tilted to the downside, citing uncertainty caused by global trade and disputes over technology. Officials' outlook was little changed, with their central scenario still for the economy to expand close to its trend rate but with prospects for household consumption again cited as the main domestic uncertainty. Comments from officials have made it clear that their assessment of the labor market is central to their policy bias, that low wage growth points to spare capacity and that the economy can sustain lower rates of unemployment. Turning to inflation, officials noted pressures remain subdued and they retained their forecast for underlying inflation to be 1.75 percent this year, 2.00 percent in 2020 and a little higher after that. Officials argue that another cut in policy rates will help to make inroads into spare capacity and "achieve more assured progress" toward the 2 to 3 percent inflation target. In line with expectations, the Reserve Bank of Australia cut its main policy rate by 25 basis points from 1.25 percent to 1.00 percent and a record low. This follows a similar 25 basis point rate cut at the RBA's previous meeting in June. The statement said the outlook for the global economy remains "reasonable" but cautioned that risks are tilted to the downside, citing uncertainty caused by global trade and disputes over technology. Officials' outlook was little changed, with their central scenario still for the economy to expand close to its trend rate but with prospects for household consumption again cited as the main domestic uncertainty. Comments from officials have made it clear that their assessment of the labor market is central to their policy bias, that low wage growth points to spare capacity and that the economy can sustain lower rates of unemployment. Turning to inflation, officials noted pressures remain subdued and they retained their forecast for underlying inflation to be 1.75 percent this year, 2.00 percent in 2020 and a little higher after that. Officials argue that another cut in policy rates will help to make inroads into spare capacity and "achieve more assured progress" toward the 2 to 3 percent inflation target.

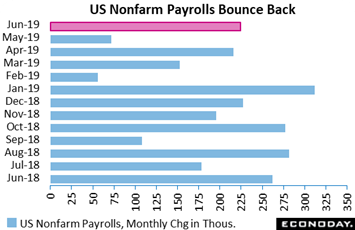

The Federal Reserve is not emphasizing that lack of wage growth points to underlying spare capacity, but they could. Wages in fact proved soft but were not the headlines in what was a very favorable June employment report. Nonfarm payrolls shot 224,000 higher and well beyond Econoday's consensus range where the high forecast was 205,000. There were no flukes in this report, one punctuated by a 17,000 jump for what has been an uneven manufacturing sector that the Fed is watching with concern. Payrolls at professional & business services jumped 51,000 as employers turn to contractors to meet demand. Government payrolls, up 33,000, were also a large contributor to June's growth. The unemployment rate edged higher to 3.7 percent but reflected not weakening but strengthening as new comers entered the labor force looking for jobs. The participation rate rose 1 tenth to 62.9 percent to also beat out expectations while the pool of available workers rose nearly 400,000 to what is still, however, an historically thin 11.3 million that, despite June's gains, isn't really pointing to much spare capacity. The Federal Reserve is not emphasizing that lack of wage growth points to underlying spare capacity, but they could. Wages in fact proved soft but were not the headlines in what was a very favorable June employment report. Nonfarm payrolls shot 224,000 higher and well beyond Econoday's consensus range where the high forecast was 205,000. There were no flukes in this report, one punctuated by a 17,000 jump for what has been an uneven manufacturing sector that the Fed is watching with concern. Payrolls at professional & business services jumped 51,000 as employers turn to contractors to meet demand. Government payrolls, up 33,000, were also a large contributor to June's growth. The unemployment rate edged higher to 3.7 percent but reflected not weakening but strengthening as new comers entered the labor force looking for jobs. The participation rate rose 1 tenth to 62.9 percent to also beat out expectations while the pool of available workers rose nearly 400,000 to what is still, however, an historically thin 11.3 million that, despite June's gains, isn't really pointing to much spare capacity.

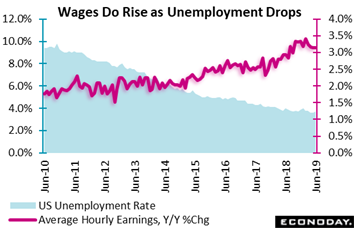

The strength of payroll growth should ease any sense of urgency at the Fed that the economy was on the brink of a pivot lower. Had wages also accelerated noticeably in June, the chances of a rate cut at the Fed's month-end policy meeting would have all but evaporated. But like Australia and other global economies, wage growth in the US remains subdued, up only 0.2 percent in June for a year-on-year rate of 3.1 percent that has been sagging from a 3.4 percent peak in February. This won't be helping to lift core inflation back to the Fed's 2 percent target. Yet the long trend of wage growth, as tracked in the red line of the graph, has in fact been climbing, and at the same time that the unemployment rate, at 3.7 percent, has been trending lower. Though perhaps in slow-motion form, the laws of supply of demand remain intact: declining unemployment is indeed consistent with rising wages. The strength of payroll growth should ease any sense of urgency at the Fed that the economy was on the brink of a pivot lower. Had wages also accelerated noticeably in June, the chances of a rate cut at the Fed's month-end policy meeting would have all but evaporated. But like Australia and other global economies, wage growth in the US remains subdued, up only 0.2 percent in June for a year-on-year rate of 3.1 percent that has been sagging from a 3.4 percent peak in February. This won't be helping to lift core inflation back to the Fed's 2 percent target. Yet the long trend of wage growth, as tracked in the red line of the graph, has in fact been climbing, and at the same time that the unemployment rate, at 3.7 percent, has been trending lower. Though perhaps in slow-motion form, the laws of supply of demand remain intact: declining unemployment is indeed consistent with rising wages.

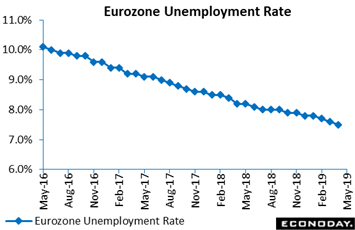

Like the US, confidence in the direction of the economy has been shaky in the Eurozone yet here too positive jobs data, this time for May, are calming nerves. Following a 72,000 drop in April unemployment, the number of people out of work in the Eurozone fell an impressive 103,000 to 12.3 million in May. This reduced the jobless rate by a tick to 7.5 percent for the best reading since July 2008. At a national level, the dip largely reflected stronger labor markets in Italy, down 2 tenths to 9.9 percent, and Spain also down 2 tenths to 13.6 percent. France at 8.6 percent and Germany at 3.1 percent were unchanged. Despite sluggish economic growth, the Eurozone labor market continues to provide positive surprises. Like the US, confidence in the direction of the economy has been shaky in the Eurozone yet here too positive jobs data, this time for May, are calming nerves. Following a 72,000 drop in April unemployment, the number of people out of work in the Eurozone fell an impressive 103,000 to 12.3 million in May. This reduced the jobless rate by a tick to 7.5 percent for the best reading since July 2008. At a national level, the dip largely reflected stronger labor markets in Italy, down 2 tenths to 9.9 percent, and Spain also down 2 tenths to 13.6 percent. France at 8.6 percent and Germany at 3.1 percent were unchanged. Despite sluggish economic growth, the Eurozone labor market continues to provide positive surprises.

The sharp rise in manufacturing payrolls during June is the best news in months for a US factory sector that is coping with reduced global trade not to mention risks of emerging Boeing 737 effects. But in Germany the latest news, unfortunately, is definitely not positive. Manufacturers' orders were much weaker than expected in May, tumbling 2.2 percent on the month. Annual growth nosedived from minus 4.9 percent to minus 8.7 percent, its worst reading in almost a decade. The only good news was that domestic orders finally gained some ground, up 0.7 percent for the first monthly increase of the year. It was the overseas market that was weak, contracting 4.3 percent on the month with the Eurozone at minus 1.7 percent. Consumer goods orders saw a 0.7 percent decrease while intermediates were down 1.5 percent and capital goods, a steep 2.8 percent. The May report leaves average total orders 1.6 percent below their first-quarter mean. Without any revisions, June will need a monthly jump of more than 6 percent just to keep the second quarter flat. Clearly, this does not bode well for goods production in the current quarter and must also add to doubts about the sustainability of the ongoing upswing in services. The sharp rise in manufacturing payrolls during June is the best news in months for a US factory sector that is coping with reduced global trade not to mention risks of emerging Boeing 737 effects. But in Germany the latest news, unfortunately, is definitely not positive. Manufacturers' orders were much weaker than expected in May, tumbling 2.2 percent on the month. Annual growth nosedived from minus 4.9 percent to minus 8.7 percent, its worst reading in almost a decade. The only good news was that domestic orders finally gained some ground, up 0.7 percent for the first monthly increase of the year. It was the overseas market that was weak, contracting 4.3 percent on the month with the Eurozone at minus 1.7 percent. Consumer goods orders saw a 0.7 percent decrease while intermediates were down 1.5 percent and capital goods, a steep 2.8 percent. The May report leaves average total orders 1.6 percent below their first-quarter mean. Without any revisions, June will need a monthly jump of more than 6 percent just to keep the second quarter flat. Clearly, this does not bode well for goods production in the current quarter and must also add to doubts about the sustainability of the ongoing upswing in services.

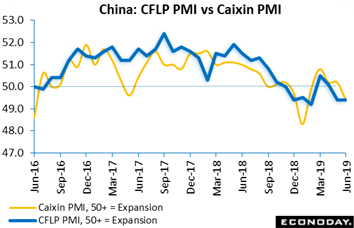

Like Germany, China is at the very front line of global trade and the news here is also not getting any better. China's official CFLP manufacturing PMI was in contraction for a second month in a row during June, unchanged and below expectations at 49.4. The rival Caixin manufacturing PMI fell from 50.2 in May and is also now at 49.4. The drop in the Caixin headline reflected slight declines for output, new orders, and new export orders. Payrolls in the sample were cut for the third month in a row and the survey's measure of business confidence is now at its lowest level since the series was introduced in 2012. June's results indicate that US-China trade tensions are pulling down activity and sentiment, and they add incremental pressure on government officials to provide additional support to the domestic economy. Like Germany, China is at the very front line of global trade and the news here is also not getting any better. China's official CFLP manufacturing PMI was in contraction for a second month in a row during June, unchanged and below expectations at 49.4. The rival Caixin manufacturing PMI fell from 50.2 in May and is also now at 49.4. The drop in the Caixin headline reflected slight declines for output, new orders, and new export orders. Payrolls in the sample were cut for the third month in a row and the survey's measure of business confidence is now at its lowest level since the series was introduced in 2012. June's results indicate that US-China trade tensions are pulling down activity and sentiment, and they add incremental pressure on government officials to provide additional support to the domestic economy.

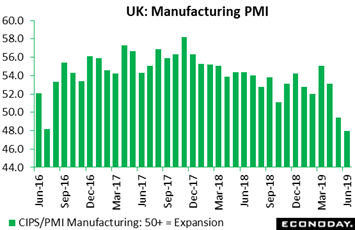

Another economy in the cross-border cross-hairs is the UK and manufacturers here, no thanks to the Brexit saga, had a poor end to the second quarter. At a weaker than expected 48.0, the sector PMI was down 1.4 points from May and at a 6-1/2 year low. This is the first back-to-back sub-50 performance since early 2013. Output in June contracted at the fastest pace in seven years as did, ominously, new orders as well. Efforts to unwind inventories accumulated ahead of what was supposed to be Brexit day in March again had a significant impact. Employment fell for a third straight month while backlogs decreased in what is another 6-1/2 year lowlight. Not surprisingly, business optimism dipped to its third-lowest level on record. Impacted perhaps even more than manufacturing by Brexit may be UK construction where this PMI came in at a much lower than expected 43.1, down from 48.6 in May for its fourth sub-50 reading in the last five months and a 10-year low. Inevitably, Brexit uncertainty, and the subsequent delays to project starts, was widely cited as a major factor. Another economy in the cross-border cross-hairs is the UK and manufacturers here, no thanks to the Brexit saga, had a poor end to the second quarter. At a weaker than expected 48.0, the sector PMI was down 1.4 points from May and at a 6-1/2 year low. This is the first back-to-back sub-50 performance since early 2013. Output in June contracted at the fastest pace in seven years as did, ominously, new orders as well. Efforts to unwind inventories accumulated ahead of what was supposed to be Brexit day in March again had a significant impact. Employment fell for a third straight month while backlogs decreased in what is another 6-1/2 year lowlight. Not surprisingly, business optimism dipped to its third-lowest level on record. Impacted perhaps even more than manufacturing by Brexit may be UK construction where this PMI came in at a much lower than expected 43.1, down from 48.6 in May for its fourth sub-50 reading in the last five months and a 10-year low. Inevitably, Brexit uncertainty, and the subsequent delays to project starts, was widely cited as a major factor.

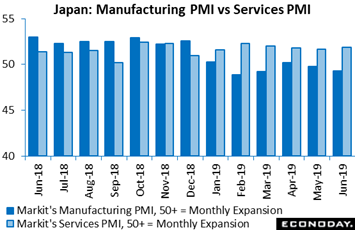

Like the rest, the manufacturing PMI out of Japan is also struggling at the 50 line. This index ended June down 5 tenths at 49.3 in June to indicate contraction for the fourth time in five months. US-China trade tensions were once again widely cited as the main factor weighing on activity and sentiment. Output fell for the sixth month in a row, the longest streak since 2012-13, while new orders and new export orders also declined amid complaints that Chinese demand is particularly weak. Payrolls rose at the slowest pace since November 2016 with input costs flat and selling prices coming down. Japan's services PMI, as in other nations, continues to do much better than manufacturing though there's nothing to be excited about, at 51.9 in June for a small gain. Respondents reported stronger new orders and steady confidence about the 12-month outlook but a bigger fall in new export orders and slower growth in employment compared with May. How long services can continue to resist the drag from manufacturing and push ahead is a question not only for Japan, but for China, Europe and the US as well. Like the rest, the manufacturing PMI out of Japan is also struggling at the 50 line. This index ended June down 5 tenths at 49.3 in June to indicate contraction for the fourth time in five months. US-China trade tensions were once again widely cited as the main factor weighing on activity and sentiment. Output fell for the sixth month in a row, the longest streak since 2012-13, while new orders and new export orders also declined amid complaints that Chinese demand is particularly weak. Payrolls rose at the slowest pace since November 2016 with input costs flat and selling prices coming down. Japan's services PMI, as in other nations, continues to do much better than manufacturing though there's nothing to be excited about, at 51.9 in June for a small gain. Respondents reported stronger new orders and steady confidence about the 12-month outlook but a bigger fall in new export orders and slower growth in employment compared with May. How long services can continue to resist the drag from manufacturing and push ahead is a question not only for Japan, but for China, Europe and the US as well.

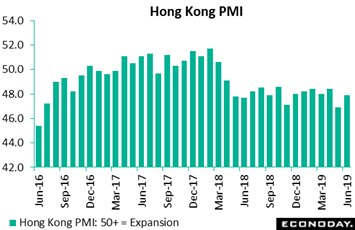

The smaller economies in Asia are perhaps the most exposed of all to unfolding trade issues. The PMI for Hong Kong, where civil unrest is also an issue, managed to show improvement in June though still at a contractionary 47.9 but still 1 point better than May. Ongoing weakness in business conditions was again widely attributed by respondents to US-China trade tensions, with some also citing the impact of the large-scale protests. Output and new orders again fell in June, with orders from mainland China falling at the steepest pace in more than three years. Confidence for the 12-month outlook also remains low. Input costs were reported to have increased at a below-average rate and selling prices increased only marginally, a price theme repeated again and again in the country surveys. The smaller economies in Asia are perhaps the most exposed of all to unfolding trade issues. The PMI for Hong Kong, where civil unrest is also an issue, managed to show improvement in June though still at a contractionary 47.9 but still 1 point better than May. Ongoing weakness in business conditions was again widely attributed by respondents to US-China trade tensions, with some also citing the impact of the large-scale protests. Output and new orders again fell in June, with orders from mainland China falling at the steepest pace in more than three years. Confidence for the 12-month outlook also remains low. Input costs were reported to have increased at a below-average rate and selling prices increased only marginally, a price theme repeated again and again in the country surveys.

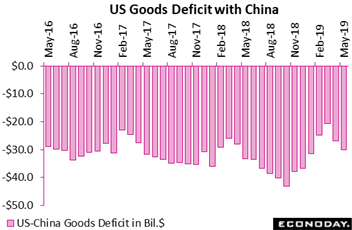

The very front trench of the trade war is of course between the US and China where new trouble for the US is appearing. New deepening in the US deficit with China was enough to make for a wider-than-expected US trade deficit of $55.5 billion in May. Country data in this report are not seasonally adjusted but the results are clear as May's deficit with China came in at $30.2 billion vs $26.9 billion in April and a long-term low of $20.8 billion in March. May included increases in US tariff duties on $200 billion of Chinese goods, raising prices but not curbing demand and contributing to the deepening in the bilateral deficit. Whether this deficit remains wide or begins to shrink again in coming months will be key to net exports and their impact on GDP. Foods, which are one of the hot spots of the tension, were steady in May, whether exports or imports. For the second quarter, net exports after May's report look to be a negative for US GDP. The very front trench of the trade war is of course between the US and China where new trouble for the US is appearing. New deepening in the US deficit with China was enough to make for a wider-than-expected US trade deficit of $55.5 billion in May. Country data in this report are not seasonally adjusted but the results are clear as May's deficit with China came in at $30.2 billion vs $26.9 billion in April and a long-term low of $20.8 billion in March. May included increases in US tariff duties on $200 billion of Chinese goods, raising prices but not curbing demand and contributing to the deepening in the bilateral deficit. Whether this deficit remains wide or begins to shrink again in coming months will be key to net exports and their impact on GDP. Foods, which are one of the hot spots of the tension, were steady in May, whether exports or imports. For the second quarter, net exports after May's report look to be a negative for US GDP.

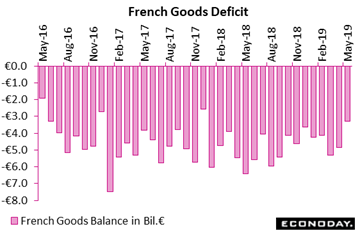

The bounce higher for US imports of Chinese goods may be just temporary but more and more trade reports, which were sinking noticeably in the spring, are showing increased flows. France posted a seasonally adjusted trade deficit of €3.28 billion deficit in May, a marked improvement on April's €4.87 billion and the least red ink since December 2017. The headline reduction reflected a 4.6 percent monthly jump in exports to a record €44.3 billion, easily eclipsing a 1.4 percent rise in imports to €47.5 billion. Overall net exports subtracted 0.3 percentage points from first-quarter GDP growth but May's report probably paves the way for at least a small contribution to the second quarter. The bounce higher for US imports of Chinese goods may be just temporary but more and more trade reports, which were sinking noticeably in the spring, are showing increased flows. France posted a seasonally adjusted trade deficit of €3.28 billion deficit in May, a marked improvement on April's €4.87 billion and the least red ink since December 2017. The headline reduction reflected a 4.6 percent monthly jump in exports to a record €44.3 billion, easily eclipsing a 1.4 percent rise in imports to €47.5 billion. Overall net exports subtracted 0.3 percentage points from first-quarter GDP growth but May's report probably paves the way for at least a small contribution to the second quarter.

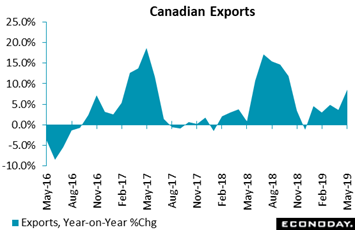

One country that never did show any trade troubles is Canada. At C$0.8 billion, Canada in May posted its largest trade surplus in two years. Exports jumped a monthly 4.6 percent in a rise, however, tied in part to the restarting of vehicle production after plant shutdowns in April. Imports rose 1.0 percent in May. Canada, like China, is another country posting a big surplus with the US, at C$5.9 billion versus April's C$4.4 billion for the best showing in nearly 11 years. One country that never did show any trade troubles is Canada. At C$0.8 billion, Canada in May posted its largest trade surplus in two years. Exports jumped a monthly 4.6 percent in a rise, however, tied in part to the restarting of vehicle production after plant shutdowns in April. Imports rose 1.0 percent in May. Canada, like China, is another country posting a big surplus with the US, at C$5.9 billion versus April's C$4.4 billion for the best showing in nearly 11 years.

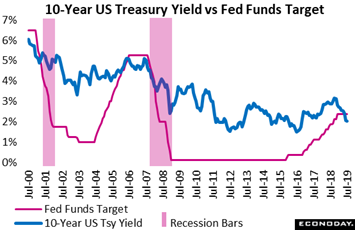

One signal that the Fed may have gone too far too fast with prior rate hikes is the deepening inversion of the 2.375 percent Fed funds rate and the 10-year US Treasury yield, a benchmark yield for the US economy that ended the week at 2.05 percent. Recessions subsequently followed the last two times this pair broke into inversion in what, for you optimists, may be nothing more than a coincidence. But Powell is certain to take abundant heat on the Fed's monetary flip-flop, raising rates as recently as December and now having to consider the immediate prospect of a rate cut. Yet the labor market refuses to give in, continuing to generate sizable growth that helps to ensure what Powell underscored at his June press conference – that consumer spending is the foremost strength of the US economy. It was only last week that the financial markets were over-anticipating assurances from Powell that a rate cut at the July policy meeting was assured, and this only a week after June's policy meeting and with no additional economic data in hand. Now Powell has that data and they point not to the need for immediate stimulus but for the possibility of continued "patience", a word just retired but that may quickly be coming off the bench. One signal that the Fed may have gone too far too fast with prior rate hikes is the deepening inversion of the 2.375 percent Fed funds rate and the 10-year US Treasury yield, a benchmark yield for the US economy that ended the week at 2.05 percent. Recessions subsequently followed the last two times this pair broke into inversion in what, for you optimists, may be nothing more than a coincidence. But Powell is certain to take abundant heat on the Fed's monetary flip-flop, raising rates as recently as December and now having to consider the immediate prospect of a rate cut. Yet the labor market refuses to give in, continuing to generate sizable growth that helps to ensure what Powell underscored at his June press conference – that consumer spending is the foremost strength of the US economy. It was only last week that the financial markets were over-anticipating assurances from Powell that a rate cut at the July policy meeting was assured, and this only a week after June's policy meeting and with no additional economic data in hand. Now Powell has that data and they point not to the need for immediate stimulus but for the possibility of continued "patience", a word just retired but that may quickly be coming off the bench.

The week's news moslty came in against trend. Growth in the labor market, the foundation of the global economy, remains solidly intact and will help to give central bankers some policy space, slowing down what seemed to be a rush to rate cuts. Whether policy insurance is needed against the risks of slowing global trade is only one side of the problem for monetary policy. The other side is whether there's enough spare capacity in the labor market to absorb new stimulus without over heating. What the Fed thinks about labor capacity is still being articulated, unlike the Reserve Bank of Australia which, for one, thinks there's capacity aplenty.

**Jeremy Hawkins and Brian Jackson contributed to this article

For economic data, the week's biggest releases will be Chinese consumer prices at midweek and US consumer prices on Thursday. But the most market-moving events in the week aren't likely to be data at all but monetary policy updates, most immediately by Jerome Powell who, amid market expectations for a month-end rate cut, will be speaking to Washington lawmakers on both Tuesday and Wednesday. The Bank of Canada, not facing any pressure or need for a rate cut, will be issuing an announcement on Wednesday. Minutes from last month's meeting of the ECB, where new stimulus may well be on the table, will be posted on Thursday. And supporting the dovish central bank sentiment is likely to be the Chinese CPI and the US CPI, neither of which are expected to show much pressure. Japanese machine orders and German industrial production will kickoff the week's calendar on Monday. Industrial production reports from France and Italy will follow on Wednesday with the latest Chinese data on trade set for Friday.

Japanese Machine Orders for May (Sun 19:50 EDT; Sun 23:50 GMT; Mon 08:50 JST)

Consensus Forecast, Month-to-Month: -3.0%

At a month-to-month decline of 3.0 percent, forecasters see Japanese machine orders in May reversing nearly half of April's unexpectedly strong 5.2 percent monthly rise. The manufacturing component rebounded strongly in April.

German Industrial Production for May (Mon 02:00 EDT; Mon 06:00 GMT; Mon 08:00 CEST)

Consensus Forecast, Month-to-Month: 0.4%

Consensus Forecast, Year-over-Year: -3.2%

Production slumped more severely than expected in April, down 1.9 percent on the month, but forecasters see a bounce back to an increase of 0.4 percent for May. Yet year-on-year, the weakness is expected to continue at a consensus minus 3.2 percent versus April's minus 1.8 percent.

Chinese CPI for June (Tue 21:30 EDT; Wed 01:30 GMT; Wed 09:30 CEST)

Consensus Forecast, Year-over-Year: 2.7%

Consumer prices are expected to hold steady and match May's 2.7 percent rise in June. Up from April's 2.5 percent, May was the third consecutive increase for headline inflation and lifted it to its highest level since February 2018.

French Industrial Production for May (Wed 02:45 EDT; Wed 06:45 GMT; Wed 08:45 CEST)

Consensus Forecast, Month-to-Month: 0.4%

Consensus Forecast, Year-over-Year: 1.6%

Industrial production in May is expected to rise a month-to-month 0.4 percent vs an as-expected April rise of 0.4 percent. Manufacturing, which posted no change, held down April's report. Year-on-year, production is expected to rise 5 tenths in May to 1.6 percent.

Italian Industrial Production for May (Wed 04:00 EDT; Wed 08:00 GMT; Wed 10:00 CEST)

Consensus Forecast, Month-to-Month: 0.2%

After falling a steep 0.7 percent in April, industrial production in May is expected to recover only slightly with a 0.2 percent gain. Energy was an isolated positive in the April report.

Canadian Housing Starts for June (Wed 08:15 EDT; Wed 12:15 GMT)

Consensus Forecast: 207,500

Housing starts fell sharply but still beat expectations in May at a 202,337 annual rate, down from a 233,410 rate in April that was the strongest month since June last year. For June this year, the consensus is looking for a 207,500 rate.

Bank of Canada Announcement (Wed 10:00 EDT; Wed 14:00 GMT)

Consensus Forecast, Change: 0 bp

Consensus Forecast, Level: 1.75%

The Bank of Canada kept rates steady in their last meeting in May though they did note that the slowdown during late last year and early this year appears to have been temporary and that ongoing strength in the jobs market suggests that businesses also see the slowdown as temporary. No change is expected for July's meeting where the overnight target rate is expected to hold at 1.75 percent.

US Consumer Price Index for June (Thu 08:30 EDT; Thu 12:30 GMT)

Consensus Forecast, Month-to-Month Change: 0.0%

Consensus Range: -0.1% to 0.2%

Consumer Price Index

Consensus Forecast, Year-on-Year Change: 1.6%

Consensus Range: 1.6% to 2.1%

CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Range: 0.1% to 0.3%

CPI Core, Less Food & Energy

Consensus Forecast, Year-on-Year Change: 2.0%

Consensus Range: 1.9% to 2.1%

US consumer prices have been subdued and forecasters see only an incremental increase in core pressure for June, at a consensus 0.2 percent rise versus 0.1 percent in May. For the overall CPI, no change is the call. Year-on-year rates are expected to hold steady for the core at 2.0 percent and fall 2 tenths to 1.6 percent overall.

Chinese Merchandise Trade Balance for June (Friday: Release Time Not Set)

Consensus Forecast: $28.5 billion

Consensus Range: -$6.2 billion to $33.0 billion

Exports, Year-on-Year

Consensus Forecast: -3.9%

Consensus Range: -8.0% to 4.0%

Imports, Year-on-Year

Consensus Forecast: -2.3%

Consensus Range: -10.2% to 11.4%

The June consensus for the merchandise trade balance is a surplus of US$28.5 billion following a $41.65 billion surplus in May that benefited from an improvement in exports to the US and a rise in exports to Japan. But overall trade is expected to continue to contract, at a year-on-year 3.9 percent for exports with imports expected to dip 2.3 percent.

Eurozone Industrial Production for May (Fri 05:00 EDT; Fri 09:00 GMT; Fri 11:00 CEST)

Consensus Forecast, Month-to-Month: 0.2%

Consensus Forecast, Year-over-Year: -1.5%

Eurozone industrial production has been stuck in contraction, a trend that does not sit well with an ECB that is concerned about the weakness of manufacturing. For May, forecasters see production improving with a 0.2 percent month-to-month gain but still falling 1.5 percent year-on-year.

|