|

The push toward lower global interest rates appears to be reaching a pivotal phase of heavyweights. The European Central Bank meets on Thursday and is widely expected to signal stimulus at their next meeting in August while the Federal Reserve, in the following week, is widely expected to cut rates for the first time in 11 years. For the Fed, however, the cut would follow an unexpected run of very strong data that belies the need to cut rates. And there's more strength than weakness in the latest batch of data that begins with June activity in China and ends with second-quarter expectations for US GDP.

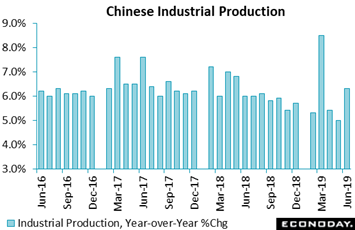

The week started fast, first thing on Monday as China released its June batch of big data where a 2 tenths decline in second-quarter GDP to 6.2 percent upstaged two very strong reports. Chinese industrial production advanced 6.3 percent on the year in June, strengthening from 5.0 percent in May and well above the 5.2 percent consensus. Outside of March at 8.5 percent, this is the best showing since May last year. On the month, industrial production rose 0.68 percent after increasing 0.38 percent in May. Importantly, June's growth was largely driven by a pick-up in manufacturing output from 5.0 percent annually to 6.2 percent. Auto production fell to a lesser extent, down 15.2 percent on the year in June after falling 21.5 percent in May, while year-on-year growth in steel products picked up from 11.5 percent to 12.6 percent. Utilities output also strengthened, up 6.6 percent on the year after increasing 5.9 percent previously, while year-on-year growth in mining output accelerated from 3.9 percent to 7.3 percent. The week started fast, first thing on Monday as China released its June batch of big data where a 2 tenths decline in second-quarter GDP to 6.2 percent upstaged two very strong reports. Chinese industrial production advanced 6.3 percent on the year in June, strengthening from 5.0 percent in May and well above the 5.2 percent consensus. Outside of March at 8.5 percent, this is the best showing since May last year. On the month, industrial production rose 0.68 percent after increasing 0.38 percent in May. Importantly, June's growth was largely driven by a pick-up in manufacturing output from 5.0 percent annually to 6.2 percent. Auto production fell to a lesser extent, down 15.2 percent on the year in June after falling 21.5 percent in May, while year-on-year growth in steel products picked up from 11.5 percent to 12.6 percent. Utilities output also strengthened, up 6.6 percent on the year after increasing 5.9 percent previously, while year-on-year growth in mining output accelerated from 3.9 percent to 7.3 percent.

Chinese retail sales rose 9.8 percent on the year in June, picking up from 8.6 percent in May and well above the consensus forecast of 8.3 percent. This is the second strong gain in a row and (in an echo of industrial production) is the best showing since March last year. On the month, retail sales advanced 0.96 percent after increasing 0.75 percent in May. The increase in headline retail sales growth in June was broad-based, with stronger growth posted in ten of thirteen spending categories. Auto sales were particularly strong, up 17.2 percent on the year and perhaps pointing to further improvement for Chinese auto production. Sales of household non-durables grew 12.3 percent on the year, up from growth of 11.4 percent previously, while year-on-year growth in sales of home appliances picked up from 5.8 percent to 7.7 percent. Year-on-year growth in rural retail sales increased from 9.0 percent to 10.1 percent, while urban retail sales growth picked up from 8.5 percent to 9.8 percent. Chinese retail sales rose 9.8 percent on the year in June, picking up from 8.6 percent in May and well above the consensus forecast of 8.3 percent. This is the second strong gain in a row and (in an echo of industrial production) is the best showing since March last year. On the month, retail sales advanced 0.96 percent after increasing 0.75 percent in May. The increase in headline retail sales growth in June was broad-based, with stronger growth posted in ten of thirteen spending categories. Auto sales were particularly strong, up 17.2 percent on the year and perhaps pointing to further improvement for Chinese auto production. Sales of household non-durables grew 12.3 percent on the year, up from growth of 11.4 percent previously, while year-on-year growth in sales of home appliances picked up from 5.8 percent to 7.7 percent. Year-on-year growth in rural retail sales increased from 9.0 percent to 10.1 percent, while urban retail sales growth picked up from 8.5 percent to 9.8 percent.

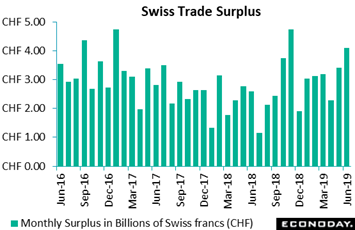

A central reason why global central banks have shifted to defense is the contraction underway in global trade, contraction that doesn't always mean smaller surpluses or deepening deficits. On the contrary, declines for exports are sometimes being offset in the account books by greater declines for imports in a mix that leads to improved trade numbers. Switzerland's trade surplus in May rose from CHF3.40 billion to CHF4.10 billion in June, its strongest showing since last November. Yet the improvement masks a contraction on both sides of the balance sheet as exports fell 0.7 percent on the year while imports slumped 9.0 percent. Even so, for the second quarter as a whole Switzerland's trade balance deteriorated from the first quarter as export volumes declined 1.0 percent while imports climbed 0.8 percent. This means that net merchandise exports subtracted from second quarter real GDP. A central reason why global central banks have shifted to defense is the contraction underway in global trade, contraction that doesn't always mean smaller surpluses or deepening deficits. On the contrary, declines for exports are sometimes being offset in the account books by greater declines for imports in a mix that leads to improved trade numbers. Switzerland's trade surplus in May rose from CHF3.40 billion to CHF4.10 billion in June, its strongest showing since last November. Yet the improvement masks a contraction on both sides of the balance sheet as exports fell 0.7 percent on the year while imports slumped 9.0 percent. Even so, for the second quarter as a whole Switzerland's trade balance deteriorated from the first quarter as export volumes declined 1.0 percent while imports climbed 0.8 percent. This means that net merchandise exports subtracted from second quarter real GDP.

Japan posted a larger than expected ¥968.3 billion trade surplus in June despite sharp contraction in exports which fell 6.7 percent on the year in June after dropping 7.8 percent in May. Japan's export weakness was broadly in line with previously released data out of China and Singapore also indicating subdued trade flows in June, though there is some variation among major trading partners. Japanese exports to China fell 10.1 percent on the year in June after dropping 9.7 percent in May, year-on-year growth in exports to the US picked up from 3.3 percent to 4.8 percent, and exports to the European Union fell 6.7 percent on the year after falling 7.1 percent previously. Exports to most other Asian economies fell in June. On the import side of the report, petroleum, food, manufactured products, electrical machinery, machinery, and transport equipment all recorded year-on-year declines. Japan posted a larger than expected ¥968.3 billion trade surplus in June despite sharp contraction in exports which fell 6.7 percent on the year in June after dropping 7.8 percent in May. Japan's export weakness was broadly in line with previously released data out of China and Singapore also indicating subdued trade flows in June, though there is some variation among major trading partners. Japanese exports to China fell 10.1 percent on the year in June after dropping 9.7 percent in May, year-on-year growth in exports to the US picked up from 3.3 percent to 4.8 percent, and exports to the European Union fell 6.7 percent on the year after falling 7.1 percent previously. Exports to most other Asian economies fell in June. On the import side of the report, petroleum, food, manufactured products, electrical machinery, machinery, and transport equipment all recorded year-on-year declines.

India's June trade balance posted a deficit of $15.28 billion, barely changed from May's $15.36 billion but a $1.32 billion improvement from a year ago. This was the first year-on-year reduction in the red ink in three months. Yet, in keeping with the theme, the latest headline masked significantly weaker exports where annual growth dropped from 3.9 percent to minus 9.7 percent, the worst result since January 2016. The negative impact here was more than offset by a nosedive in imports where growth declined from 4.3 percent to minus 9.1 percent. Recent domestic measures in India to stimulate demand look to give imports a boost at the same time, however, that exports may be held down by increasing global trade tensions, an outcome that could well deepen the country's deficit in the coming months and quarters. India's June trade balance posted a deficit of $15.28 billion, barely changed from May's $15.36 billion but a $1.32 billion improvement from a year ago. This was the first year-on-year reduction in the red ink in three months. Yet, in keeping with the theme, the latest headline masked significantly weaker exports where annual growth dropped from 3.9 percent to minus 9.7 percent, the worst result since January 2016. The negative impact here was more than offset by a nosedive in imports where growth declined from 4.3 percent to minus 9.1 percent. Recent domestic measures in India to stimulate demand look to give imports a boost at the same time, however, that exports may be held down by increasing global trade tensions, an outcome that could well deepen the country's deficit in the coming months and quarters.

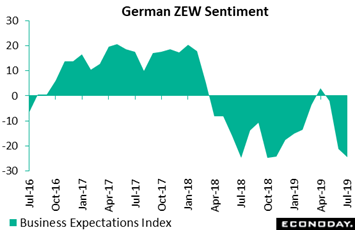

Confidence measures are increasingly fashionable among central bankers and the latest readings, especially outside of the consumer, aren't always positive. Analysts became notably more pessimistic about the state of the German economy in July and ZEW's survey results were on the soft side of consensus. Expectations fell a further 3.4 points in July's report to minus 24.5, their third straight fall and their worst showing since October last year. The current conditions gauge dropped nearly 9 points to minus 1.1 for their first sub-zero result since June 2010. July's ominously poor findings reflect a still negative trend in incoming orders alongside the rise in Gulf tensions, the ongoing trade dispute between the US and China and, not to forget, the lack of any obvious progress on Brexit. Confidence measures are increasingly fashionable among central bankers and the latest readings, especially outside of the consumer, aren't always positive. Analysts became notably more pessimistic about the state of the German economy in July and ZEW's survey results were on the soft side of consensus. Expectations fell a further 3.4 points in July's report to minus 24.5, their third straight fall and their worst showing since October last year. The current conditions gauge dropped nearly 9 points to minus 1.1 for their first sub-zero result since June 2010. July's ominously poor findings reflect a still negative trend in incoming orders alongside the rise in Gulf tensions, the ongoing trade dispute between the US and China and, not to forget, the lack of any obvious progress on Brexit.

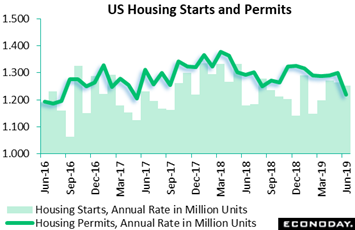

One area of the US economy that has been surprisingly less than strong is the US housing sector which really hasn't benefited much from this year's 50 basis point drop in mortgage rates. This time the disappointment in this up-and-down year is an unexpected 6.1 percent drop in June building permits to a 1.220 million annual rate. This is the lowest rate in more than two years. Permits are down 6.6 percent from this time last year with weakness in the latest month centered in multi-family units which fell sharply to a 407,000 annual rate. Year-on-year, multi-family permits are down 10.2 percent. Single-family homes are the more important of the two subcomponents and despite a respectable 0.4 percent monthly rise in June to an 813,000 rate are down 4.7 percent on the year. But good news, especially for second-quarter residential investment, does come from starts on the single-family side, up a very strong 3.5 percent on the month to an 847,000 rate. Yet here too single-family units are down on the year, at minus 0.8 percent. Nevertheless, total starts did pick up compared to the first quarter and residential investment, after five straight quarters of pulling down GDP, may yet prove to be a positive for the second quarter (the first estimate of second-quarter GDP will be posted Friday). One area of the US economy that has been surprisingly less than strong is the US housing sector which really hasn't benefited much from this year's 50 basis point drop in mortgage rates. This time the disappointment in this up-and-down year is an unexpected 6.1 percent drop in June building permits to a 1.220 million annual rate. This is the lowest rate in more than two years. Permits are down 6.6 percent from this time last year with weakness in the latest month centered in multi-family units which fell sharply to a 407,000 annual rate. Year-on-year, multi-family permits are down 10.2 percent. Single-family homes are the more important of the two subcomponents and despite a respectable 0.4 percent monthly rise in June to an 813,000 rate are down 4.7 percent on the year. But good news, especially for second-quarter residential investment, does come from starts on the single-family side, up a very strong 3.5 percent on the month to an 847,000 rate. Yet here too single-family units are down on the year, at minus 0.8 percent. Nevertheless, total starts did pick up compared to the first quarter and residential investment, after five straight quarters of pulling down GDP, may yet prove to be a positive for the second quarter (the first estimate of second-quarter GDP will be posted Friday).

A surprise of the latest week was the labour market report out of the UK where wage pressures unexpectedly firmed in a rise that, for traditionalists at least, evokes the iron laws of the Phillips curve. Annual average earnings growth in the three months to May weighed in at 3.4 percent, well above the market consensus and the strongest reading since December-February. Moreover, excluding bonuses, the rate was up at 3.6 percent, 0.2 percentage points higher than last time and an 11-year high. Unemployment data in the report were mixed with claimant count joblessness up a sizeable 38,000 in June following a 24,500 gain in May. This was enough to nudge the jobless rate a tick higher to 3.2 percent, in line with market expectations. ILO statistics showed unemployment falling 11,000 in the three months to May versus the three months ending in April to keep this unemployment rate steady at 3.8 percent and also matching the consensus. A surprise of the latest week was the labour market report out of the UK where wage pressures unexpectedly firmed in a rise that, for traditionalists at least, evokes the iron laws of the Phillips curve. Annual average earnings growth in the three months to May weighed in at 3.4 percent, well above the market consensus and the strongest reading since December-February. Moreover, excluding bonuses, the rate was up at 3.6 percent, 0.2 percentage points higher than last time and an 11-year high. Unemployment data in the report were mixed with claimant count joblessness up a sizeable 38,000 in June following a 24,500 gain in May. This was enough to nudge the jobless rate a tick higher to 3.2 percent, in line with market expectations. ILO statistics showed unemployment falling 11,000 in the three months to May versus the three months ending in April to keep this unemployment rate steady at 3.8 percent and also matching the consensus.

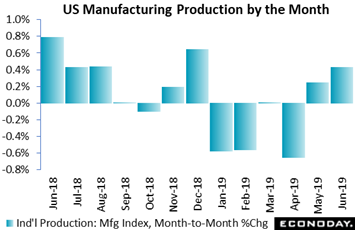

Another surprise in the week was US manufacturing which the Fed has singled out for special caution. And the surprise was of strength not weakness. The manufacturing component of June's industrial production report hit the top end of Econoday's consensus range with a solid 0.4 percent gain for the best showing so far this year. Manufacturing is by far the report's largest component and June's results are uniformly strong, led by a 2.9 percent monthly rise for motor vehicle production and a 0.7 percent rise for selected hi-tech. Business equipment production posted a second strong increase at 0.5 percent that follows May's 0.4 percent rise in gains that should ease the Fed's concerns over business investment. Construction supplies are yet another strength, up 0.5 percent and 0.6 percent the last two reports in what are positive signals for construction demand. The immediate look at manufacturing may not be justifying any rate cuts but, in defense of the doves, the longer term view is still soft, with manufacturing output up only 0.4 percent year-on-year. Another surprise in the week was US manufacturing which the Fed has singled out for special caution. And the surprise was of strength not weakness. The manufacturing component of June's industrial production report hit the top end of Econoday's consensus range with a solid 0.4 percent gain for the best showing so far this year. Manufacturing is by far the report's largest component and June's results are uniformly strong, led by a 2.9 percent monthly rise for motor vehicle production and a 0.7 percent rise for selected hi-tech. Business equipment production posted a second strong increase at 0.5 percent that follows May's 0.4 percent rise in gains that should ease the Fed's concerns over business investment. Construction supplies are yet another strength, up 0.5 percent and 0.6 percent the last two reports in what are positive signals for construction demand. The immediate look at manufacturing may not be justifying any rate cuts but, in defense of the doves, the longer term view is still soft, with manufacturing output up only 0.4 percent year-on-year.

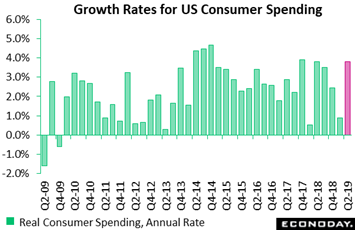

The results for US manufacturing, which have been under the microscope, suggest that business investment could sustain its long contribution to GDP in the second quarter. And June's gain for production follows the growing string of monthly acceleration in US data: the 224,000 surge in nonfarm payrolls, the 0.3 percent rise in core consumer prices, and perhaps most spectacularly the 0.7 percent jump in control group retail sales (an input into GDP). The rise in June control sales had forecasters scrambling to lift their estimates for second-quarter personal consumption expenditures which is the centerpiece of the GDP report. Econoday's consensus, as highlighted by the red column at the right of the accompanying graph, is a 3.9 percent annual rate which would mark sharp acceleration from the first quarter's tepid 0.9 percent. It's net exports and inventories that are expected to hold back second-quarter GDP to thankfully mask, for a Fed about to cut rates, the substantial and fundamental strength of the economy. If the Fed is indeed led by incoming data, their reasoning behind the approaching rate cut is likely to take an end run around the host of current data. The results for US manufacturing, which have been under the microscope, suggest that business investment could sustain its long contribution to GDP in the second quarter. And June's gain for production follows the growing string of monthly acceleration in US data: the 224,000 surge in nonfarm payrolls, the 0.3 percent rise in core consumer prices, and perhaps most spectacularly the 0.7 percent jump in control group retail sales (an input into GDP). The rise in June control sales had forecasters scrambling to lift their estimates for second-quarter personal consumption expenditures which is the centerpiece of the GDP report. Econoday's consensus, as highlighted by the red column at the right of the accompanying graph, is a 3.9 percent annual rate which would mark sharp acceleration from the first quarter's tepid 0.9 percent. It's net exports and inventories that are expected to hold back second-quarter GDP to thankfully mask, for a Fed about to cut rates, the substantial and fundamental strength of the economy. If the Fed is indeed led by incoming data, their reasoning behind the approaching rate cut is likely to take an end run around the host of current data.

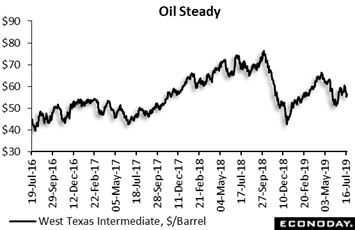

News late in the week that Iran has seized a British oil tanker underscores the possibility that the Middle East may be an increasing factor for the policy mix. Yet prior troubles on the oil production side, whether the blacklisting of Iran or Venezuela, have yet to lead to much volatility for oil prices. Oil has been holding in the mid to high $50 range in the US the past two months with a decline from the mid $60s to low $50s in the early spring still playing out negatively in the inflation data. Lack of pressure for oil prices will give central bankers further cover in cutting rates, that is if prices stay lower. But the Middle East is one of those places that trouble can flare up at any moment, and any sudden spike could not only make the Strait of Hormuz a topic of immediate discussion but central bank rate cuts all that less appealing. Stock markets were steady in the week with the Shanghai Composite down a slight 0.2 percent, Germany's Dax down 0.5 percent, and the Dow down 0.7 percent. News late in the week that Iran has seized a British oil tanker underscores the possibility that the Middle East may be an increasing factor for the policy mix. Yet prior troubles on the oil production side, whether the blacklisting of Iran or Venezuela, have yet to lead to much volatility for oil prices. Oil has been holding in the mid to high $50 range in the US the past two months with a decline from the mid $60s to low $50s in the early spring still playing out negatively in the inflation data. Lack of pressure for oil prices will give central bankers further cover in cutting rates, that is if prices stay lower. But the Middle East is one of those places that trouble can flare up at any moment, and any sudden spike could not only make the Strait of Hormuz a topic of immediate discussion but central bank rate cuts all that less appealing. Stock markets were steady in the week with the Shanghai Composite down a slight 0.2 percent, Germany's Dax down 0.5 percent, and the Dow down 0.7 percent.

Incoming data have been pivoting higher from what, however, was a clear slump through much of the first-half of the year. Yet with the global economy now perhaps moving back up, central bankers may well have to sound increasingly dismissive of what has been in the past their favorite resource: the latest economic data. Exceptions, long-term trends, and awkward explanations are likely to be the central-banking themes in the weeks ahead, all to shift the emphasis away from improving growth.

**Jeremy Hawkins and Brian Jackson contributed to this article

A dovish announcement on Thursday from the European Central Bank is expected, one that will lean into concrete actions at their next meeting in September. The week's crescendo is on Friday when US GDP is expected to slow, only however, at the headline level. Consumer spending, the economy's backbone, is expected to accelerate sharply in what would add yet one more contradiction to the expected month-end rate cut by the Federal Reserve. Worldwide PMI flashes for July will fill Wednesday's calendar amid general expectations for continued weakness in manufacturing components and emerging weakness in service components. Home sales, both new and existing, will be posted in the US at midweek as will consumer confidence from the Eurozone and business confidence out of France and Germany.

Eurozone: EC Consumer Confidence Flash (Tue 10:00 EDT; Tue 14:00 GMT; Tue 16:00 CEST)

Consensus Forecast: -7.2%

The European Commission's consumer confidence flash is expected to come in unchanged at minus 7.2 percent. This report has been broadly flat.

US Existing Home Sales for June (Tue 10:00 EDT; Tue 14:00 GMT)

Consensus Forecast, Annualized Rate: 5.340 million

Consensus Range: 5.150 to 5.450 million

Existing home sales have been uneven this year but have still been moving forward with price data moving higher in the May report and supply coming into the market. Existing home sales in June are expected to hold unchanged at a 5.340 million rate.

French Business Climate Indicator for July (Wed 02:45 EDT; Wed 06:45 GMT; Wed 08:45 CEST)

Consensus Forecast: 102

Falling to a 3-year low, manufacturing sentiment slipped 2 points in June to 102. For July the consensus is also 102.

French PMI Composite Flash for July (Wed 03:15 EDT; Wed 07:15 GMT; Wed 09:15 CEST)

Manufacturing Consensus: 51.6

Services Consensus: 52.8

The PMI flash for July is expected to slip 3 tenths from June to 51.6 with services seen at 52.8 in what would be a 1 tenth decline.

German PMI Composite Flash for July (Wed 03:30 EDT; Wed 07:30 GMT; Wed 09:30 CEST)

Manufacturing Consensus: 45.2

Services Consensus: 55.2

Well under 50, the manufacturing PMI for Germany has been sending a convincing signal all year of global trade weakness. The flash index for July is expected to come in little changed at 45.2 versus a final 45.0 in June and a June flash of 45.4. The services flash is seen at 55.2 which would be a 6 tenths decline from final June.

Eurozone PMI Composite Flash for July (Wed 04:00 EDT; Wed 08:00 GMT; Wed 10:00 CEST)

Composite Consensus: 52.1

Manufacturing Consensus: 47.7

Services Consensus: 55.2

Forecasters see July's PMI composite flash for the Eurozone holding steady at 52.1 versus a 52.2 final in June (June flash was 52.1). June's pace was modest but still the best since November last year. The consensus for the manufacturing flash is 47.7 with the consensus for services at a contrasting 55.2.

US Composite PMI Flash for July (Wed 09:45 EDT; Wed 13:45 GMT)

Composite Consensus: 51.2

Manufacturing Consensus: 50.8

Services Consensus: 51.4

Slow growth for manufacturing and nearly as slow growth for services has been the message from the PMIs. The consensus for July's flash PMI composite is split between a services consensus at 51.4 and a manufacturing consensus at 50.8, both of which would be little changed from June.

US New Home Sales for June (Wed 10:00 EDT; Wed 14:00 GMT)

Consensus Forecast, Annualized Rate: 655,000

Consensus Range: 630,000 to 676,000

At only 626,000, new home sales in May proved unexpectedly weak in a report that also showed a sharp decline in prices. Yet year-to-date sales were still up substantially and a move back higher to a 655,000 annual rate is Econoday's consensus for June.

German Ifo Survey for July (Thu 04:00 EDT; Thu 08:00 GMT; Thu 10:00 CEST)

Consensus Forecast: 97.0

Economic sentiment in July is expected to slip to 97.0 versus 97.4 in June which was its third decline in as many months and its weakest reading since November 2014. Details showed services remaining relatively buoyant but manufacturing continuing to weaken.

European Central Bank Announcement (Thu 07:45 EDT; Thu 11:45 GMT; Thu 13:45 CEST)

Consensus Forecast: No change

The European Central Bank is expected to keeps its refi rate unchanged at zero but is expected to signal accommodative action at its following meeting in September.

US Durable Goods Orders for June (Thu 08:30 EDT; Thu 12:30 GMT)

Consensus Forecast, Month-to-Month Change: 0.7%

Consensus Range: -1.5% to 2.2%

Durable Goods Orders, Ex-Transportation

Consensus Forecast: 0.2%

Consensus Range: 0.0% to 0.5%

Core Capital Goods Orders (Nondefense Ex-Aircraft)

Consensus Forecast: 0.2%

Consensus Range: 0.0% to 0.3%

Forecasters see durable goods orders in June rising 0.7 percent following a mixed May report that was headlined by a 1.3 percent overall decline. But core capital goods orders rose a better-than-expected 0.5 percent in May (revised from 0.4 percent) with an increase of 0.2 percent expected for June. Ex-transportation orders are also seen up 0.2 percent after May's 0.4 percent gain (revised from an initial 0.3 percent).

US International Trade In Goods for June (Thu 08:30 EDT; Thu 12:30 GMT)

Consensus Forecast, Month-to-Month Change: -$72.5 billion

Consensus Range: -$74.1 billion to -$72.0 billion

Forecasters see narrowing for the June goods trade gap, at a consensus $72.5 billion vs $75.1 billion in May (revised from an initial $74.6 billion). Exports of goods posted a strong rebound in May though imports rose even more sharply.

US GDP: 2nd Quarter, 1st Estimate, Q/Q SAAR (Fri 08:30 EDT; Fri 12:30 GMT)

Consensus Forecast: 1.9%

Consensus Range: 1.6% to 2.2%

Real Personal Consumption Expenditures

Consensus Forecast: 3.9%

Consensus Range: 2.3% to 4.1%

GDP Price Index

Consensus Forecast: 1.9%

Consensus Range: 1.3% to 2.2%

GDP Core Price Index

Consensus Forecast: 1.7%

Consensus Range: 1.6% to 2.0%

Consensus for the first estimate of second-quarter GDP is 1.9 percent, a rate held down by expected corrections for net exports and inventories both of which contributed strongly to the first quarter. The fundamental strength of second-quarter GDP is expected to lie in consumer spending as personal consumption expenditures are expected to post a 3.9 percent growth rate that would be well up from 0.9 percent in the first quarter. The GDP price index is seen at 1.9 percent with the core price index at 1.7 percent.

|