|

Global monetary policy remains on hold as are global interest rates, at an average of 4.35 percent on Econoday’s global policy measure that tracks benchmarks in 12 major economies. The European Central Bank is expected to begin cutting rates next month but otherwise the general outlook is steady as she goes as long as inflation in most economies remains elevated. China is of course an exception as price pressures here are dormant and real economic growth subpar.

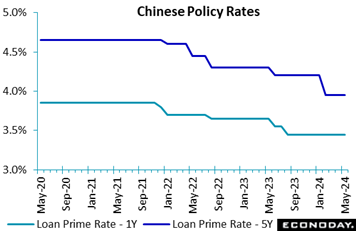

The People's Bank of China left the one-year loan prime rate unchanged at 3.45 percent at its monthly review, in line with the consensus forecast. This rate has been left unchanged since August 2023. The equivalent five-year rate was also left on hold at 3.95 percent for the third consecutive month after it was cut by 25 basis points in February. The People's Bank of China left the one-year loan prime rate unchanged at 3.45 percent at its monthly review, in line with the consensus forecast. This rate has been left unchanged since August 2023. The equivalent five-year rate was also left on hold at 3.95 percent for the third consecutive month after it was cut by 25 basis points in February.

Officials characterized monthly data published last week as showing that "the national economy was generally stable and continued to rebound and progress well". Although they acknowledged growth in some indicators moderated, they attributed this to the impact of lunar new year holidays and base effects. Officials also warned, however, that "the external environment is becoming more complex, severe and uncertain" and that the domestic economy still faces "multiple difficulties and challenges". They said they will seek to "frontload and effectively implement" macroeconomic policies that have already been introduced. This assessment along with the no-action decision suggest that they do not yet see a case for a major shift in policy settings.

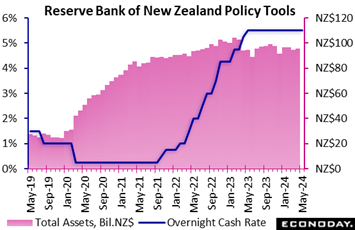

The Reserve Bank of New Zealand's Monetary Policy Committee left its official cash rate unchanged at 5.50 percent for the seventh consecutive meeting, in line with the consensus forecast. Prior to this pause, officials had increased policy rates by a cumulative 525 basis points as part of efforts to return inflation to their target range of one percent to three percent. The Reserve Bank of New Zealand's Monetary Policy Committee left its official cash rate unchanged at 5.50 percent for the seventh consecutive meeting, in line with the consensus forecast. Prior to this pause, officials had increased policy rates by a cumulative 525 basis points as part of efforts to return inflation to their target range of one percent to three percent.

Headline CPI inflation fell to 4.0 percent in the three months to March from 4.7 percent in the three months to December, with core inflation falling from 4.4 percent to 4.1 percent. In their accompanying statement, officials advised that they still expect inflation to fall to within their target range by the end of this year, noting that capacity pressures and conditions in the labour market have eased.

Despite this optimism, officials cautioned that price pressures remain strong in parts of the economy and noted that the impact of upcoming fiscal policy announcements would need to be assessed. Reflecting this assessment, officials again concluded that "monetary policy needs to remain restrictive to ensure inflation returns to target within a reasonable timeframe".

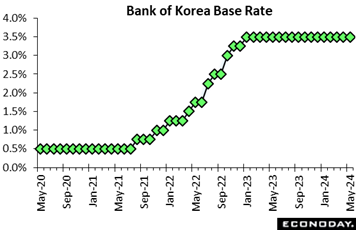

The Bank of Korea left its main policy rate unchanged at 3.50 percent in line with the consensus forecast. Officials have left this rate on hold since the start of 2023 after tightening policy aggressively over 2022 as part of efforts to return headline inflation to their two percent target. The Bank of Korea left its main policy rate unchanged at 3.50 percent in line with the consensus forecast. Officials have left this rate on hold since the start of 2023 after tightening policy aggressively over 2022 as part of efforts to return headline inflation to their two percent target.

Since the previous BoK meeting mid-April, data have shown a small decline in core inflation from 2.42 percent in March to 2.24 percent in April. In their statement, officials noted that "upward pressures on prices could increase due to an improvement in economic growth" but retained their forecast for core inflation to average 2.2 percent this year. Officials also noted that the stronger-than-expected improvement in economic conditions seen in recent months had prompted them to revise their forecast for GDP growth this year up from 2.1 percent to 2.5 percent.

Officials reaffirmed that their priority is "to conduct monetary policy in order to stabilize consumer price inflation at the target level over the medium-term horizon". Nevertheless, they again warned that "it is premature to be confident that inflation will converge on the target level", concluding that this warrants maintaining a restrictive monetary policy stance "until such confidence is established". This suggests that officials' bias will remain in favour of keeping rates on hold in upcoming meetings.

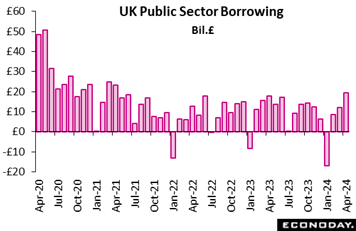

Public sector finances in the UK began the new fiscal year with a sizeable and larger than expected deficit. Overall net borrowing (PSNB) was £19.59 billion following an upwardly revised £12.14 billion in March and £18.06 billion a year ago. Excluding public sector banks (PSNB-X), the red ink stood at £20.51 billion following the previous month's larger revised £13.06 billion and £18.98 billion in April 2023. Public sector finances in the UK began the new fiscal year with a sizeable and larger than expected deficit. Overall net borrowing (PSNB) was £19.59 billion following an upwardly revised £12.14 billion in March and £18.06 billion a year ago. Excluding public sector banks (PSNB-X), the red ink stood at £20.51 billion following the previous month's larger revised £13.06 billion and £18.98 billion in April 2023.

Total public sector spending rose £3.1 billion versus April 2023 with gains in spending on public services and benefits partially offset by reductions in central government interest payable and in subsidy payments resulting from the closure of energy support schemes. Receipts were up £1.6 billion. Net debt was 97.9 percent of GDP, down from 98.3 percent in March but broadly in line with the levels last seen in the early 1960s.

The April shortfall was £1.2 billion more than forecast by the Office for Budget Responsibility (OBR) and so underlines the government's limited room for any additional tax cuts ahead of July’s surprise election. To this end, any such giveaways would not go down well in the gilt market.

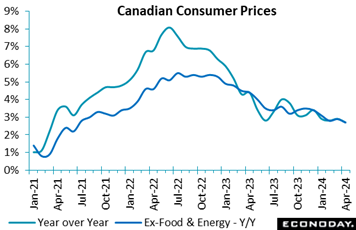

Consumer prices in Canada rose an unadjusted 0.5 percent in April, bringing down the 12-month rate to 2.7 percent from 2.9 percent, the lowest reading since 2.2 percent in March 2021, as expected by forecasters in an Econoday survey. Excluding food and energy, the consumer price index was up 0.3 percent on the month and 2.7 percent year-over-year. Consumer prices in Canada rose an unadjusted 0.5 percent in April, bringing down the 12-month rate to 2.7 percent from 2.9 percent, the lowest reading since 2.2 percent in March 2021, as expected by forecasters in an Econoday survey. Excluding food and energy, the consumer price index was up 0.3 percent on the month and 2.7 percent year-over-year.

The central bank projects inflation to average 2.9 percent in the second quarter, and April's report puts inflation on the right track to meet this projection. In remarks to the Senate Banking Committee at the beginning of May, BoC Governor Tiff Macklem said the data since January have increased the central bank’s confidence that inflation will continue to come down gradually despite projected stronger activity. April's readings support this view. Econoday's Relative Performance Index is now consistent with limited easing risk (see Bottom Line for details).

The Bank of Canada's own core measures of inflation came down to 2.7 percent year-over-year on average from 3.0 percent in March, with all three of these measures now below 3.0 percent.

Much of the monthly gain was led by a 7.9 percent increase in gasoline prices from March. Excluding gasoline, the CPI was up 0.2 percent on the month and 2.5 percent on the year. Energy prices rose 5.1 percent on the month and 4.5 percent on the year, while food prices retreated 0.2 percent from March, for a 12-month advance of 2.3 percent.

The second largest upward contributor to the monthly CPI gain, after gasoline, was mortgage interest cost, up 1.2 percent. Rents, up 0.5 percent, were the fourth largest contributor. Mortgage interest cost and rents were the first and second largest contributors to the 12-month CPI advance, with gains of 24.5 percent and 8.2 percent, respectively.

Overall, shelter prices were up 0.5 percent on the month and 6.4 percent from a year earlier. Except for food and recreation, education and reading, all other major categories recorded higher monthly prices. On a 12-month basis, six of the main categories increased, while prices for household operations, furnishings and equipment were down 2.1 percent and clothing and footwear declined 2.6 percent.

Goods prices rose 0.8 percent on the month and 1.0 percent year-over-year, and services were up 0.2 percent and 4.2 percent, respectively.

On a seasonally adjusted basis, the headline CPI was up 0.2 percent on the month and the core index, excluding food and energy, edged up 0.1 percent. Both came down from March.

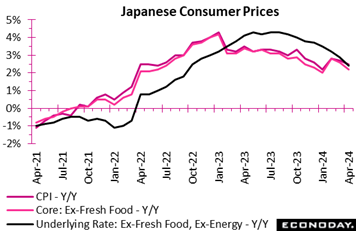

Consumer inflation in Japan moderated in all three key measures in April in light of easing food and durable goods supplier markups, offsetting the slight upward pressure from the first rise in energy costs in many months after the base effect of utility subsidies had waned earlier this year. Consumer inflation in Japan moderated in all three key measures in April in light of easing food and durable goods supplier markups, offsetting the slight upward pressure from the first rise in energy costs in many months after the base effect of utility subsidies had waned earlier this year.

The core CPI (excluding fresh food prices), closely watched by the Bank of Japan for its policy stance, rose at the slowest pace in three months, up an as-expected 2.2 percent on the year, after a 2.6 percent gain in March. The year-over-year increase in the total CPI continued easing to 2.5 percent from 2.7 percent despite faster fresh food price rises, coming in just above the median forecast of a 2.4 percent rise.

Underlying inflation measured by the core-core CPI (excluding fresh food and energy) decelerated to a 19-month low of 2.4 percent from 2.9 percent, also above the median forecast of a 2.5 percent rise. The annual rate for this narrow indicator had been at or above 3.0 percent from December 2022 until February 2024.

Consumer inflation in Tokyo, in previously released data, decelerated much faster than expected in April as completely free high school education took effect in the Tokyo Metropolitan area in the month, but its impact on the national CPI was limited. Tokyo prices for the month of May will be posted in the coming week with an uptick expected (see Looking Ahead for details).

Service costs have seen gradual upward pressures as many firms are offering higher wages to secure workers amid widespread labor shortages. Service prices excluding owners' equivalent rent rose 2.5 percent on the year in April, pushing up the total CPI by 0.79 percentage point, following increases of 2.9 percent (plus 0.94 point) in March and 3.1 percent in February. Goods prices excluding fresh food gained 2.6 percent (plus 1.28 points), after a 3.1 percent increase (plus 1.50 point) and down from the 3.4 percent gain in February.

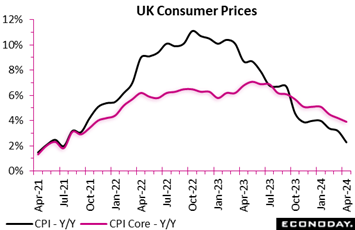

UK consumer inflation fell sharply but by slightly less than expected in April. Prices increased a monthly 0.3 percent, a tick more than the market consensus, and with base effects from the energy sector strongly negative, reduced the annual inflation rate from 3.2 percent to 2.3 percent. This is its lowest mark since July 2021 and just 0.3 percentage points above its 2 percent medium-term target. UK consumer inflation fell sharply but by slightly less than expected in April. Prices increased a monthly 0.3 percent, a tick more than the market consensus, and with base effects from the energy sector strongly negative, reduced the annual inflation rate from 3.2 percent to 2.3 percent. This is its lowest mark since July 2021 and just 0.3 percentage points above its 2 percent medium-term target.

Weaker energy inflation did much of the work, falling from minus 18.2 percent to minus 27.1 percent following the sector regulator's 12 percent cut in the cap on unit prices. However, the core rate also eased as a 0.9 percent monthly advance in the index trimmed its yearly change from 4.2 percent to 3.9 percent. This is its lowest print since October 2021 but also above expectations. Declining rates were seen in food and alcohol (2.9 percent after 4.0 percent), clothing and footwear (3.7 percent after 4.0 percent), recreation and culture (4.4 percent after 5.3 percent). Even so, while overall goods inflation tumbled from 0.8 percent to a lowly minus 0.8 percent, its services counterpart dipped just a tick to a still very robust 5.9 percent.

April's update should go down well enough at the BoE but it will come as little surprise. Importantly, the bank still expects headline inflation to re-accelerate over the second half of the year, moving up to close to 3 percent by December. In particular, there will still be concerns about inflation in services where the rate remains almost three times the target. For now, a June cut in Bank Rate looks possible but unlikely. That said, another soft CPI report on June 19, the day before the next MPC announcement, combined with a more pronounced drop in wage growth (June 11) might just be enough to tip the majority of MPC members in favour of a 25 basis points.

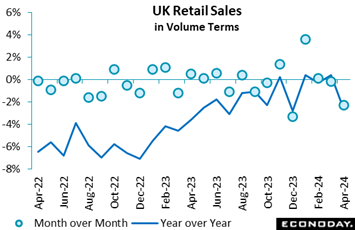

Retail sales in the UK were much weaker than expected at the start of the quarter. Following a revised 0.2 percent monthly fall in March, volumes declined a sharp 2.3 percent, more than 2 percentage points more than the market consensus and their worst performance since last December. Annual growth slumped from 0.4 percent to minus 2.7 percent and sales now stand at a 4-month low. Excluding auto fuel, the picture was much the same with purchases down 2.0 percent versus March and 3.0 percent weaker on the year. Retail sales in the UK were much weaker than expected at the start of the quarter. Following a revised 0.2 percent monthly fall in March, volumes declined a sharp 2.3 percent, more than 2 percentage points more than the market consensus and their worst performance since last December. Annual growth slumped from 0.4 percent to minus 2.7 percent and sales now stand at a 4-month low. Excluding auto fuel, the picture was much the same with purchases down 2.0 percent versus March and 3.0 percent weaker on the year.

April's monthly drop reflected broad-based losses. Food decreased 0.8 percent and non-food (ex-auto fuel) was down fully 4.1 percent. Within the latter, there were sizeable falls in all of the main categories, notably household goods at minus 5.4 percent, with the only exception being non-specialised stores (up 0.4 percent). Elsewhere, non-store retailing also advanced 1.1 percent but auto fuel was off 4.9 percent.

The latest data were probably biased downward by very wet weather but the underlying position still looks weak. Even so, earlier strength means that the 3-monthly change remains positive at 0.7 percent. The April data probably slightly boost the likelihood of a June rate cut by the Th but the MPC's focus on inflation still suggests otherwise.

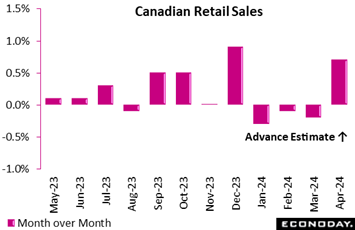

Retail sales in Canada were once again lower than expected as they contracted 0.2 percent in March, while the consensus forecast had centered on a 0.1 percent decline. Volumes were even weaker, as they dropped 0.4 percent on the month. Sales were up 1.9 percent year-over-year. For the first quarter as a whole, sales fell 0.2 percent though volumes managed to increase 0.3 percent. The advance estimate for April sales, however, points to strong opening to the second quarter with a 0.7 percent rebound. Retail sales in Canada were once again lower than expected as they contracted 0.2 percent in March, while the consensus forecast had centered on a 0.1 percent decline. Volumes were even weaker, as they dropped 0.4 percent on the month. Sales were up 1.9 percent year-over-year. For the first quarter as a whole, sales fell 0.2 percent though volumes managed to increase 0.3 percent. The advance estimate for April sales, however, points to strong opening to the second quarter with a 0.7 percent rebound.

In March, when consumer prices appreciated 2.9 percent year-over-year, retail sales declines were broad based across seven of nine subsectors and six provinces led by Ontario.

Furniture, home furnishings, electronics and appliances, down 1.6 percent, led the monthly contraction, while the other housing-related category, building material and garden equipment and supplies, stood out with a 1.3 percent expansion. Motor vehicles and parts, up 1.0 percent on the month, were the only other core sector to expand. Excluding the latter sector, sales were down 0.6 percent. Core sales, which also exclude gasoline and fuel, fell 0.6 percent as well. Gasoline stations and fuel vendors receipts were down 0.7 percent.

The Bank of Canada expects the contribution of housing and consumption to GDP growth to increase in the first quarter from the fourth quarter of 2023 before diminishing in the second quarter while remaining positive. The central bank expects population growth to drive consumer spending in the first half of the year, while per capital growth consumption should remain negative.

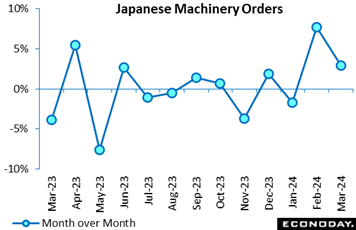

Japanese core machinery orders, beat most expectations to post a second straight monthly rise, up 2.9 percent in March following a much stronger-than-expected 7.7 percent gain to a 13-month high in February, prompting the government to upgrade its view for the first time in two years saying orders are now “showing signs of a pickup”. Orders from manufacturers surged 19.4 percent on the month, led by demand for engines and computers. Those from non-manufacturers posted the first drop in three months, slumping 11.3 percent after a 9.1 percent rise and a 6.5 percent gain in the two prior months, hit by lower orders for construction equipment and despite continued solid demand for computers. Japanese core machinery orders, beat most expectations to post a second straight monthly rise, up 2.9 percent in March following a much stronger-than-expected 7.7 percent gain to a 13-month high in February, prompting the government to upgrade its view for the first time in two years saying orders are now “showing signs of a pickup”. Orders from manufacturers surged 19.4 percent on the month, led by demand for engines and computers. Those from non-manufacturers posted the first drop in three months, slumping 11.3 percent after a 9.1 percent rise and a 6.5 percent gain in the two prior months, hit by lower orders for construction equipment and despite continued solid demand for computers.

Year-over-year, orders posted their first rise in 13 months, up 2.7 percent following a 1.8 percent dip in the prior month. On the quarter, orders rose a solid 4.4 percent in the January-March period but failed to match the official forecast of a 4.9 percent rebound provided in February. The Cabinet Office forecast that core orders are likely to slip back 1.6 percent in the April-June quarter for the first drop in two quarters, which are expected to be pulled down by both the manufacturing and non-manufacturing sectors.

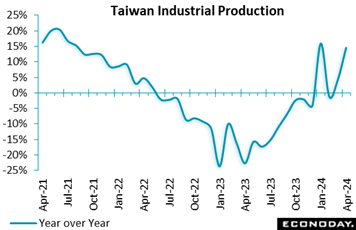

Taiwan's industrial production index rose 14.61 percent on the year in April, accelerating sharply from an increase of 4.2 percent in March. Output in the manufacturing sector rose 14.9 percent on the year after a previous increase of 4.01 percent, with April’s data also showing a year-over-year increase in output in the electricity and gas sector but contraction in the mining sector. PMI survey data showed conditions stabilized in the manufacturing sector in April after two years of contraction. Taiwan's industrial production index rose 14.61 percent on the year in April, accelerating sharply from an increase of 4.2 percent in March. Output in the manufacturing sector rose 14.9 percent on the year after a previous increase of 4.01 percent, with April’s data also showing a year-over-year increase in output in the electricity and gas sector but contraction in the mining sector. PMI survey data showed conditions stabilized in the manufacturing sector in April after two years of contraction.

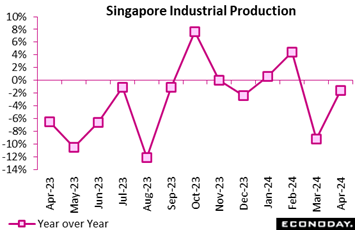

Singapore industrial production rebounded sharply in April, with output increasing 7.1 percent on the month after falling 16.0 percent in March. Previously published trade data also showed a rebound in exports in April, while PMI survey data showed slower growth in the aggregate economy. Singapore industrial production rebounded sharply in April, with output increasing 7.1 percent on the month after falling 16.0 percent in March. Previously published trade data also showed a rebound in exports in April, while PMI survey data showed slower growth in the aggregate economy.

In year-over-year terms, industrial production fell 1.6 percent in April after dropping 9.2 percent in March. This smaller decline was largely driven by the electronics industry, which accounts for nearly half of the sector, with output there down 1.1 percent on the year after falling 11.3 percent previously. In the biomedical industry, where conditions are often volatile, output fell 29.1 percent after a previous decline of 34.8 percent. Output growth was mixed in other parts of the sector. Excluding the biomedical industry, output rose 1.7 percent on the year in April after falling 5.7 percent in March.

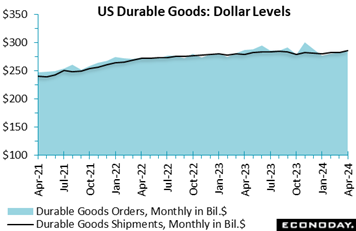

Defense aircraft and motor vehicles gave a lift to April's durable goods orders, up 0.7 percent, but gains were also posted outside transportation with this reading up 0.4 percent. Core capital goods also had a respectable month with a 0.3 percent gain. All these results easily beat Econoday's consensus estimates, especially for the headline which was expected to fall 0.5 percent. Yet an offset to April's strength is revisions to March which, part of a 12-year benchmarking, was marked significantly lower but still shows a 0.8 percent overall gain. Defense aircraft and motor vehicles gave a lift to April's durable goods orders, up 0.7 percent, but gains were also posted outside transportation with this reading up 0.4 percent. Core capital goods also had a respectable month with a 0.3 percent gain. All these results easily beat Econoday's consensus estimates, especially for the headline which was expected to fall 0.5 percent. Yet an offset to April's strength is revisions to March which, part of a 12-year benchmarking, was marked significantly lower but still shows a 0.8 percent overall gain.

Defense aircraft rose 2.5 percent in April though this follows a mid-teen gain and a mid-teen decline in the two prior months. Motor vehicles are less volatile than aircraft, rising 1.5 percent following gains of 2.8 and 1.2 percent in the two prior months, gains that underscore the strength of consumer demand. Commercial aircraft fell 8.0 percent in April but follow two prior gains of 7.7 and 17.7 percent. By the way, those blips higher in the blue area of the graph are monthly jumps in commercial aircraft (nondefense aircraft and parts). The graph tracks shipments and new orders in seasonally adjusted dollar terms, at $285.7 billion for the month of April for shipments and $284.1 billion for March.

Computers along with communications equipment both posted solid gains, up 3.9 and 3.3 percent, as did electrical equipment (0.9 percent) and also primary metals (1.3 percent). Machinery rose 0.4 percent with all contributing to the capital goods gain.

Unfilled orders rose a modest but still useful 0.2 percent with inventories up 0.1 percent. Shipments proved very strong, up 1.2 percent.

This report, despite the downgrade for March, is solidly positive. Manufacturing appears to be pulling out the doldrums which, for a sector considered to be a bellwether of overall change, is good news for the US economy.

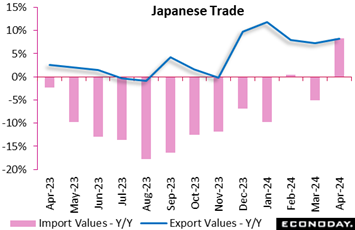

Japanese export values rose 8.3 percent on year in April for the fifth straight increase, led by solid global demand for automobiles and Asian purchases of semiconductors. The pace of increase was slower than the consensus forecast of a 11.1 percent gain but accelerated from the 7.3 percent rise in March. Import values rebounded 8.3 percent after falling 5.1 percent in March. April’s rise was led by higher prices and volumes of crude oil as well as purchases of aircraft and computers. The trade balance recorded a ¥462.5 billion deficit after a ¥387.0 billion surplus in March and a ¥383.0 billion deficit in February. Japanese export values rose 8.3 percent on year in April for the fifth straight increase, led by solid global demand for automobiles and Asian purchases of semiconductors. The pace of increase was slower than the consensus forecast of a 11.1 percent gain but accelerated from the 7.3 percent rise in March. Import values rebounded 8.3 percent after falling 5.1 percent in March. April’s rise was led by higher prices and volumes of crude oil as well as purchases of aircraft and computers. The trade balance recorded a ¥462.5 billion deficit after a ¥387.0 billion surplus in March and a ¥383.0 billion deficit in February.

Shipments to China, a key export market for Japanese goods, posted their fifth straight increase after a year-long decline through November last year amid a gradual recovery in the world's second-largest economy. Japanese exports to the European Union posted the first drop in five months but exports to the US remained robust, up for the 31st straight month.

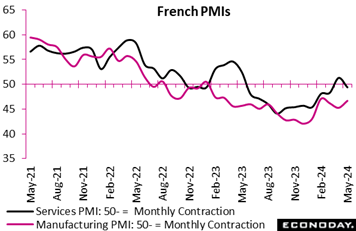

Private sector business activity went into reverse in May. At 49.1, France’s flash composite output index slipped back below the 50-expansion threshold and also fell short of the market consensus. This month's deterioration was attributable to services where the PMI fell to 49.4, well short of April's final 51.3 albeit only a 2-month low. The manufacturing counterpart edged to 46.8 from 46.7 to remain well in contraction territory. Private sector business activity went into reverse in May. At 49.1, France’s flash composite output index slipped back below the 50-expansion threshold and also fell short of the market consensus. This month's deterioration was attributable to services where the PMI fell to 49.4, well short of April's final 51.3 albeit only a 2-month low. The manufacturing counterpart edged to 46.8 from 46.7 to remain well in contraction territory.

More optimistically, aggregate new orders increased for the first time in more than a year despite another decline in exports and, courtesy of services, this prompted a fourth successive addition to headcount. Even so, falling backlogs continued to support output while year-ahead business confidence eased to its lowest level in four months.

Input cost inflation was slightly higher and hit a 6-month peak but output price inflation declined to its lowest mark in more than three years.

In sum, the May results are disappointing and suggest that the economy was close to stagnating in mid-quarter. Combined with decelerating output prices, the data will further underpin expectations for a 25 basis point cut in ECB interest rates next month.

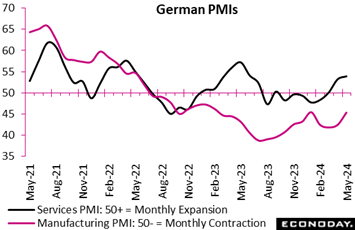

Germany’s flash composite output index was again stronger than expected in May and points to only the second increase in business activity in 11 months. At 52.2, the latest reading was up from April's final 50.6 and a full point above the market consensus. It was also a 12-month high. Germany’s flash composite output index was again stronger than expected in May and points to only the second increase in business activity in 11 months. At 52.2, the latest reading was up from April's final 50.6 and a full point above the market consensus. It was also a 12-month high.

Growth remains wholly attributable to services where the flash sector PMI weighed in at a solid 53.9, up from April's final 53.2 and an 11-month peak. Manufacturing remains in the doldrums but a flash PMI of 45.4 was at least nearly 3 points above April's final 42.5 and a 4-month high. Manufacturing output (48.9) saw its smallest fall in 13 months.

Aggregate new orders increased for the first time in more than 12 months due to stronger demand for services but backlogs fell in both sectors. Overall employment also expanded further despite another decline in manufacturing and business expectations about the year ahead saw a broad-based improvement to claim their best level since February 2022.

Meantime, overall input cost inflation eased to a 6-month low while the output price rate posted its weakest outturn in more than three years and slipped below its long-run average.

The May update provides a surprisingly optimistic picture of the German economy. Services are doing fine and manufacturing looks to be on the mend. Second quarter GDP would seem to be shaping up well and declining inflation pressures will put a smile on the ECB's face.

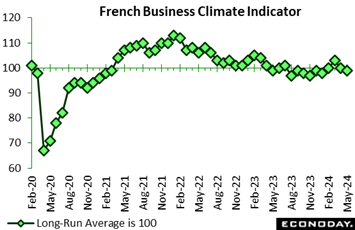

Sentiment in manufacturing unexpectedly deteriorated again in May. At 99, the headline index was a point below both the market consensus and its unrevised April level. It also dipped below its 100 long-run average for the first time since January. Sentiment in manufacturing unexpectedly deteriorated again in May. At 99, the headline index was a point below both the market consensus and its unrevised April level. It also dipped below its 100 long-run average for the first time since January.

Past production (minus 2 percent after 1 percent) declined marginally and despite a small improvement in order books (minus 17 percent after minus 19 percent), both general production expectations (minus 9 percent after minus 7 percent) and personal production expectations (1 percent after 8 percent) worsened. Expected selling prices (minus 1 percent after 3 percent) also decreased.

Elsewhere, sentiment was more mixed with an improvement in services (101 after 100) contrasting with no change in construction (also 101) and falls in both retail trade (99 after 102) and wholesale trade (94 after 95). As a result, the economy-wide gauge held steady at 99, a point short of its historic norm.

May's surprisingly soft results are in keeping with the month’s disappointing flash PMI data. France’s economy is probably keeping its head above water but still lacks any real momentum.

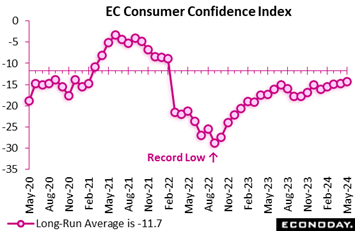

Consumer confidence in Europe improved again in May but, in line with April, not by very much and by less than expected. At minus 14.3, the EU Commission's provisional index stood just 0.4 points above its final April print and 0.3 points below the market consensus. This marked its fourth straight gain and made for the strongest reading since February 2022 but the gauge remains some way short of its minus 11.7 long-run average. May's modest advance leaves intact a slowly improving trend in sentiment but current levels still suggest no significant near-term bounce in household spending. Consumer confidence in Europe improved again in May but, in line with April, not by very much and by less than expected. At minus 14.3, the EU Commission's provisional index stood just 0.4 points above its final April print and 0.3 points below the market consensus. This marked its fourth straight gain and made for the strongest reading since February 2022 but the gauge remains some way short of its minus 11.7 long-run average. May's modest advance leaves intact a slowly improving trend in sentiment but current levels still suggest no significant near-term bounce in household spending.

Global economic data continue on net to come in very near expectations, at minus 3 for the Relative Performance Index and at minus 5 less prices (RPI-P). These readings suggest no jolts for Econoday’s Global Policy Rate which stands at 4.35 percent in a reading that tracks central-bank benchmarks from 12 major economies.

Economic activity in the Eurozone continues to run well ahead of market forecasts. The RPI ended the week at a respectable 29 and the RPI-P at a solid 38. In the absence of a major upside surprise in Friday’s flash HICP report for May, the ECB should still lower key interest rates next week but, if sustained, such outperformance may dampen the bank’s enthusiasm for another ease as soon as July.

In the UK, slightly softer than expected business activity in May and a surprise slump in April retail sales helped to reduce the RPI to minus 16. However, the sub-zero reading here masks an upside shock on inflation last month – the RPI-P now stands at minus 31. Accordingly, a June cut in Bank Rate remains a possibility but, in light of the inflation update, for now the odds are still against.

Note too that PM Rishi Sunak’s surprising decision to call the next general election for 4 July could have interesting implications for how upcoming economic data are interpreted. Strong economic news will probably be seen as potentially reducing the size of a widely forecast Conservative defeat and so increase the risk of a hung parliament, which would probably be about the worst case for UK financial markets and the pound.

In Japan, a mixed week for economic data left the RPI and the RPI-P at 2 and 4 respectively, implying that overall activity is essentially matching expectations and leaving a weak yen and investors still contemplating a possible June BoJ tightening.

Canada ended the week at minus 6 overall and minus 7 less prices, both within consensus ranges and suggesting limited easing risk for the Bank of Canada. The US ended the week at minus 11 for both the RPI and RPI-P as the country continues to climb out of the negative zone where it dropped to at the outset of the month following the limited strength in the April employment report.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

The week’s inflation news will start with Australia on Wednesday where no meaningful improvement is expected at 3.4 percent for April. Wednesday’s consumer price data from Germany are expected to accelerate but remain with quiet looking 2 percent handles. Eurozone HICP flashes for May are also expected to look normal, at 2.5 percent overall and 2.7 percent for the narrow core. Tokyo consumer prices are expected to firm in May following a jolt lower in April on special factors.

Other Japanese data will include industrial production and retail sales, both on Friday. China’s CFLP PMIs on Friday are expected to hold steady in data for May. Monthly GDP from Canada is expected to stall in March though the first quarter as a whole is seen posting respectable growth of 2.3 percent.

German Ifo for May (Mon 1000 CEST; Mon 0900 GMT; Mon 0400 EDT)

Consensus Forecast, Business Climate: 90.3

Consensus Forecast, Current Conditions: 89.9

Consensus Forecast, Business Expectations: 90.5

The business climate index improved more quickly than expected in April, rising 1.5 points to 89.4. May’s consensus is a nearly 1 point further gain to 90.3.

Australian Retail Sales for April (Tue 1130 AEST; Tue 0130 GMT; Mon 2130 EDT)

Consensus Forecast, Month over Month: 0.3%

Retail sales in April are expected to increase 0.3 percent on the month after March’s 0.4 percent decline.

US Consumer Confidence Index for May (Tue 1000 EDT; Tue 1400 GMT)

Consensus Forecast: 95.3

The consumer confidence index is expected to fall back in May, to a consensus 95.3 versus 97.0 in April which compared with expectations for 104.0 and March’s downward revised 103.1. Consumer confidence has missed Econoday’s consensus the past three reports.

Australian April CPI (Wed 1130 AEST; Wed 0130 GMT; Tue 2130 EDT)

Consensus Forecast, Year over Year: 3.4%

Consumer prices in April are expected to edge back to 3.4 percent versus 3.5 percent in March and 3.4 percent in February.

Germany: GfK Consumer Climate for June (Wed 0800 CEST; Wed 0600 GMT; Wed 0200 EDT)

Consensus Forecast: -23.0

May’s consumer climate index rose a surprisingly strong 3.1 points to, however, a still historically weak minus 24.2. June’s expectations are further improvement to minus 23.0.

Eurozone M3 Money Supply for April (Wed 1000 CEST; Wed 0800 GMT; Wed 0400 EST)

Consensus Forecast, Year-over-Year: 1.5%

The 3-month moving average is expected to climb 1.5 percent in April following March’s as-expected 0.4 percent increase that extended a trend of gains.

German CPI, Preliminary May (Wed 1400 CEST; Wed 1200 GMT; Wed 0800 EDT)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 2.4%

HICP, Preliminary May

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 2.8%

May’s consensus is a year-over-year 2.4 percent versus 2.2 percent in both April and March. The consensus for the HICP is 2.8 percent versus 2.4 percent in both April and March.

Australian First-Quarter Capital Expenditures (Thu 1130 AEST; Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Quarter over Quarter: 0.7%

Capital Expenditures for the first quarter are expected to rise 0.7 percent on the quarter versus 0.8 percent growth in the fourth quarter which doubled expectations for 0.4 percent.

Swiss First-Quarter GDP (Thu 0900 CEST; Thu 0700 GMT; Tue 0300 EDT)

Consensus Forecast, Quarter over Quarter: 0.3%

First-quarter GDP is expected to rise a quarterly 0.3 percent that would match 0.3 percent expansion in the fourth quarter.

Eurozone: EC Economic Sentiment for May (Thu 1100 CEST; Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast: 96.0

Consensus Forecast, Industry Sentiment: -9.8

Consensus Forecast, Consumer Sentiment: -14.3

Economic sentiment in May is expected to rise to 96.0 from April’s 95.6 which remained well short of the 100 long-run average.

Eurozone Unemployment Rate for April (Thu 1100 CEST; Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast: 6.5%

Consensus for April's unemployment rate is no change at 6.5 percent. Unemployment in the Eurozone has been running at record lows.

US International Trade in Goods (Advance) for April (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Balance: -$92.5 billion

The US goods deficit (Census basis) is expected to deepen by $1.5 billion to $ billion in April after deepening by $1.0 billion in March to $91.0 billion.

Tokyo Consumer Price Index for May (Fri 0830 JST; Thu 2330 GMT; Thu 1930 EDT)

Consensus Forecast, Year over Year: 2.1%

Ex-Fresh Food, Consensus Forecast: 1.9%

Ex-Fresh Food & Energy, Consensus Forecast: 1.7%

Overall inflation in Tokyo is expected to increase 2.1 percent in May following April’s 1.8 percent that was much lower than expected and reflected subsidized schooling and easing for processed foods and hotel fees. Underlying rates are expected at 1.8 percent for the ex-fresh food core versus April’s 1.6 percent and at 1.7 percent for the ex-fresh food ex-energy core-core versus 1.8 percent.

Japanese Industrial Production for April (Fri 0850 JST; Thu 2350 GMT; Thu 1950 EDT)

Consensus Forecast, Month over Month: 1.6%

Consensus Forecast, Year over Year: -1.2%

Industrial production on the month in April is expected to rise a further 1.6 percent following a 3.8 percent rebound in March. On a year-over-year basis, April’s growth is expected to fall 1.2 percent versus 6.7 percent contraction in March. The government maintained its assessment in the March report, saying the industrial sector had "weakened while taking one step forward and one step back."

Japanese Retail Sales for April (Fri 0850 JST; Thu 2350 GMT; Thu 1950 EDT)

Consensus Forecast, Month over Month: 0.7%

Consensus Forecast, Year over Year: 1.5%

Retail sales are expected to rise 1.5 percent on the year in April versus a weaker-than-expected 1.2 percent decline in March. The government maintained its assessment in the March report that retail sales were “taking one step forward and one step back”.

China: CFLP PMIs for May (Fri 0930 CST; Fri 0130 GMT; Thu 2130 EDT)

Manufacturing PMI, Consensus Forecast: 50.4

Non-manufacturing PMI, Consensus Forecast: 51.3

The CFLP manufacturing PMI is expected to hold steady at 50.4 in May. The non-manufacturing PMI is expected at 51.3 versus April’s 51.2 which was nearly 2 points below March and a full point below the consensus.

German Retail Sales for April (Fri 0800 CEST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, Month over Month: -0.4%

Sales volumes are expected to fall 0.4 percent on the month in April versus March’s much better-than-expected and much needed monthly pickup of 1.8 percent.

Eurozone HICP Flash for May (Fri 1100 CEST; Fri 0900 GMT; Fri 0500 EDT)

Consensus Forecast, Year over Year: 2.5%

Narrow Core

Consensus Forecast, Year over Year: 2.7%

Consensus for May’s HICP flash is 2.5 percent and 2.7 percent for the narrow core. These would compare respectively with April’s 2.4 and 2.7 percent, the former unchanged from March’s 2.4 percent and the latter down from 2.9 percent.

US Personal Income for April (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Month over Month: 0.3%

US Consumption Expenditures

Consensus Forecast, Month over Month: 0.3%

US PCE Price Index

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 2.7%

US Core PCE Price Index

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 2.8%

Personal income as well as consumption expenditures are both expected to increase 0.3 percent. These would compare with March’s 0.5 percent increase in income and stronger-than-expected 0.8 percent increase in consumption. Inflation readings for April are expected at monthly increases of 0.3 percent overall and a modest 0.2 percent for the core (versus 0.3 percent for both in March). Annual rates are expected at 2.7 percent overall and 2.8 percent for the core (matching March’s 2.7 and 2.8 percent both of which were slightly higher than expected).

Canadian Monthly GDP for March (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Month over Month: 0.0%

After rising a monthly 0.2 percent in February, no change is expected for March.

Canadian First-Quarter GDP (Fri 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Annualized: 2.3%

A 2.3 percent annualized growth rate is the consensus for Canadian first-quarter GDP versus 1.0 percent expansion in the fourth quarter.

|