|

Global Economics is taking the next week off. The next article will be dated June 14.

A busy week saw a slight downgrade to first-quarter US GDP on Thursday, to 1.3 percent annualized growth versus an initial 1.6 percent estimate. Fed policymakers have been anticipating moderation in GDP gains for some time and, as part of their fight against inflation, are anticipating a period of growth below their longer-run growth forecast of 1.8 percent. However, very early GDP Nowcasts for the second quarter point to growth above 2 percent. At present, the US economy is continuing to expand despite restrictive monetary policy and despite little prospect of any near-term rate cuts. As long as there’s little sign of a recession and inflation remains stubbornly above the two percent target, the Fed will be reluctant to risk overheating the economy.

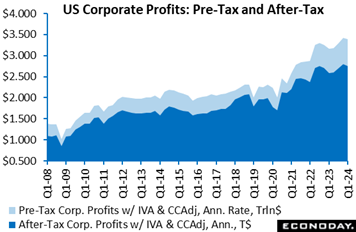

A clear sign of US economic strength is the climb underway in corporate profits. At an annualized rate of $3.195 trillion, US year-over-year after-tax corporate profits rose a very sizable 10.9 percent in the first quarter compared to last year's first quarter. When including inventory valuation and consumption adjustments, after-tax profits of $2.755 trillion in the first quarter were up 6.4 percent on the year. Taxes on corporate income, at a hefty $638.6 billion annual rate (the space between the light and dark blue areas of the graph) were up a year-over-year 10.8 percent. For comparison, the Dow right now is up nearly 16 percent from this time last year. A clear sign of US economic strength is the climb underway in corporate profits. At an annualized rate of $3.195 trillion, US year-over-year after-tax corporate profits rose a very sizable 10.9 percent in the first quarter compared to last year's first quarter. When including inventory valuation and consumption adjustments, after-tax profits of $2.755 trillion in the first quarter were up 6.4 percent on the year. Taxes on corporate income, at a hefty $638.6 billion annual rate (the space between the light and dark blue areas of the graph) were up a year-over-year 10.8 percent. For comparison, the Dow right now is up nearly 16 percent from this time last year.

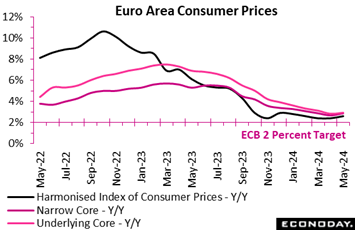

More big news came on Friday with inflation data from the Eurozone that are also pointing to underlying strength in activity. In the first acceleration this year, a 0.2 percent monthly rise in the flash HICP put May’s annual rate at 2.6 percent, up from April's final 2.4 percent and a tick above Econoday’s consensus. The latest reading matches its highest mark since January and means that inflation is now 0.6 percentage points above its medium-term target. More big news came on Friday with inflation data from the Eurozone that are also pointing to underlying strength in activity. In the first acceleration this year, a 0.2 percent monthly rise in the flash HICP put May’s annual rate at 2.6 percent, up from April's final 2.4 percent and a tick above Econoday’s consensus. The latest reading matches its highest mark since January and means that inflation is now 0.6 percentage points above its medium-term target.

The underlying gauges also edged firmer. The narrowest measure was similarly up 0.2 percentage points at 2.9 percent, a couple of ticks above forecasts and its first increase since last June. Excluding just energy and unprocessed food, the rate was also 2.9 percent, up from 2.8 percent last time. Ominously, however, the latest gains were led by services where inflation jumped from 3.7 percent to 4.1 percent, its highest print since October 2023. By contrast, non-energy industrial goods dipped from 0.9 percent to 0.8 percent and food, alcohol and tobacco from 2.8 percent to 2.6 percent. Energy (0.3 percent after minus 0.6 percent) provided a small boost.

Regionally, headline inflation accelerated in most member states, including France (2.7 percent after 2.4 percent), Germany (2.8 percent after 2.4 percent) and Spain (3.8 percent after 3.4 percent). Italy (0.8 percent after 0.9 percent) posted a small fall.

The flash May data are unlikely to come a big surprise to the European Central Bank but the sharp jump in inflation in services will surely raise a few eyebrows. A cut in key interest rates in the coming week is still very likely but the probability of another ease in July has just fallen further.

Monthly CPI data show that headline inflation in Australia rose slightly to 3.6 percent in April from 3.5 percent in March, above the consensus forecast of 3.4 percent. This is the second consecutive small increase in headline inflation and takes the level further above the Reserve Bank of Australia's target range of two percent to three percent. Monthly CPI data show that headline inflation in Australia rose slightly to 3.6 percent in April from 3.5 percent in March, above the consensus forecast of 3.4 percent. This is the second consecutive small increase in headline inflation and takes the level further above the Reserve Bank of Australia's target range of two percent to three percent.

Steady headline inflation in April reflects offsetting moves across major categories. Food prices rose 3.8 percent on the year in April after advancing 3.5 percent in March, with communication prices also increasing at a faster pace. Showing moderation were housing costs, up 4.9 percent after a previous increase of 5.2 percent, while the year-over-year increase in fuel prices slowed from 8.1 percent to 7.4 percent.

The update shows little change in underlying price pressures. The measure of inflation that excludes volatile items – including fuel and holiday travel – was unchanged at 4.1 percent in April, while the monthly trimmed mean edged higher from 4.0 percent to 4.1 percent.

At the RBA's previous meeting, held earlier in the month, officials highlighted uncertainties impacting the inflation outlook and again reiterated that returning inflation to target remains their highest priority. This suggests that a cut in policy rates remains unlikely at upcoming meetings.

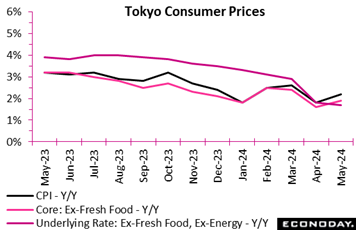

Consumer inflation in Tokyo, a leading indicator of the national average, picked up in May in two of three key measures, driven by higher utility costs due to reduced subsidies and the weak yen pushing up import prices. Consumer inflation in Tokyo, a leading indicator of the national average, picked up in May in two of three key measures, driven by higher utility costs due to reduced subsidies and the weak yen pushing up import prices.

The core CPI (excluding fresh food), closely watched by the Bank of Japan, posted an as-expected 1.9 percent increase. This rise followed a sharp deceleration to a 25-month low of 1.6 percent in April from 2.4 percent in March, influenced by the introduction of completely free high school education in the metropolitan area and the easing of gains in processed food and hotel fees.

Overall energy prices rose 5.9 percent after falling 2.9 percent in April while durable goods prices also showed a 4.1 percent gain after a 3.8 percent drop. Processed food prices rose 3.2 percent, the same rate as in the previous month, and hotel fee rose 14.7 percent versus 18.8 percent.

The total CPI annual rate accelerated to 2.2 percent, just above the consensus forecast of 2.1 percent, up from a three-month low of 1.8 percent. By contrast, the core-core CPI (excluding fresh food and energy) eased further to a 20-month low of 1.7 percent, matching expectations and down from 1.8 percent in April.

Services have led overall inflation until recently though, starting in April, the plunge in education costs have pushed down inflation. The prices of services excluding owners' equivalent rent gained 0.7 percent on year in May, down from a 1.0 percent rise in April. The annual rate of goods prices excluding fresh food accelerated to 3.6 percent from 2.5 percent the previous month.

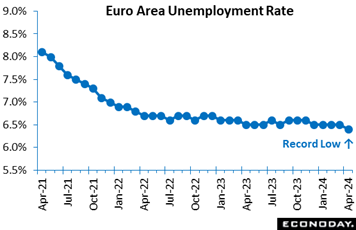

The Eurozone labour market remains very tight. Joblessness fell a further 100,000 in April following a larger revised 105,000 drop in March. Moreover, the latest decline was steep enough to reduce the unemployment rate by a tick to 6.4 percent, a new record low and beneath the market consensus. The Eurozone labour market remains very tight. Joblessness fell a further 100,000 in April following a larger revised 105,000 drop in March. Moreover, the latest decline was steep enough to reduce the unemployment rate by a tick to 6.4 percent, a new record low and beneath the market consensus.

The headline dip was mainly due to France, where the national rate fell from 7.4 percent to 7.3 percent, and Italy, where the rate dropped from 7.1 percent to 6.9 percent. The rates in both Germany (3.4 percent) and Spain (11.7 percent) were flat.

April's update will not prevent the ECB lowering key interest rates but it should leave Governing Council members all the more wary about another reduction in July.

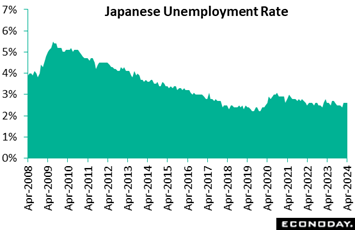

Japanese payrolls posted the 21st straight rise on year in April amid labor shortages at hotels, restaurants and telecoms while the unemployment rate was unchanged at an as-expected 2.6 percent for the second month in a row. Japanese payrolls posted the 21st straight rise on year in April amid labor shortages at hotels, restaurants and telecoms while the unemployment rate was unchanged at an as-expected 2.6 percent for the second month in a row.

Compared to the previous month, the number of people who lost their jobs or retired fell 4.3 percent in April for the first fall in three months after rising 4.5 percent in March. The number of those who quit to look for better positions also marked the first drop in three months, down 1.3 percent, after rising 2.6 percent. The number of those who began looking for work and thus were counted as being unemployed rose 2.0 percent after being flat and rising in the previous two months amid tight labor conditions and rising wages.

In its monthly economic report for May released in the prior week, the government maintained its overall assessment, saying the economy is recovering moderately backed by a high pace of wage hikes amid widespread labor shortages. It also repeated that employment conditions are "showing signs of improvement."

The latest unemployment rate is below the recent high of 3.1 percent in October 2020 but there is still some room for improvement toward the 2.2 percent seen in December 2019, just before the pandemic triggered a global economic slump.

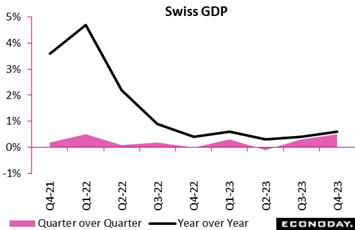

The Swiss economy began the year on a surprisingly firm footing. Following a 0.3 percent quarterly increase at the end of 2023, GDP expanded fully 0.5 percent, a couple of ticks above the consensus. Annual growth was 0.6 percent, up from 0.5 percent. The Swiss economy began the year on a surprisingly firm footing. Following a 0.3 percent quarterly increase at the end of 2023, GDP expanded fully 0.5 percent, a couple of ticks above the consensus. Annual growth was 0.6 percent, up from 0.5 percent.

Headline growth reflected a 0.4 percent quarterly advance in private consumption and a 0.5 percent rise in gross fixed capital formation. Within the latter, a 0.8 percent increase in equipment and software investment more than offset a 0.2 percent fall in construction. Government consumption was up 0.2 percent making for a 0.4 percent rise in final domestic demand, but by far and way the largest positive impact came from business inventories (and statistical discrepancies) which added some 2.1 percentage points.

Meantime, the trade balance subtracted 1.2 percentage points as a 3.2 percent increase in exports was easily eclipsed by a 5.9 percent spurt in imports, itself led by an 8.2 percent jump in purchases of goods.

Consequently, the underlying picture is rather softer than the headline data might suggest. Final domestic demand is expanding but at a modest pace and the sharp rise in inventories could dampen growth this quarter. The first quarter data will leave investors uncertain about what the Swiss National Bank will announce at its June 20 meeting.

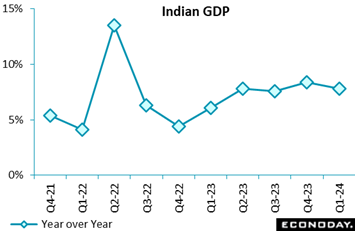

India's gross domestic product expanded 7.8 percent on the year in the three months to March, slowing from an increase of 8.4 percent in the three months to December. Monthly industrial production and PMI survey data showed solid growth over this period, with PMI survey data for May to be published in coming days. India's gross domestic product expanded 7.8 percent on the year in the three months to March, slowing from an increase of 8.4 percent in the three months to December. Monthly industrial production and PMI survey data showed solid growth over this period, with PMI survey data for May to be published in coming days.

At its most recent meeting earlier this month, the Reserve Bank of India's Monetary Policy Committee left the benchmark repurchase rate unchanged at 6.50 percent. Officials advised then that they expect growth to remain supported by investment demand and an improved outlook for consumer spending. They concluded that "monetary policy must continue to be actively disinflationary", suggesting that upside risks to the inflation outlook will likely remain their primary focus in upcoming meetings.

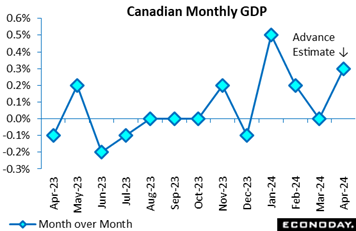

Canada's economy grew at an annualized 1.7 percent rate in the first quarter, rather weaker than the 2.3 percent consensus expectation and compared with the fourth quarter’s negligible 0.1 percent rate. On a quarter-over-quarter basis, GDP rose 0.4 percent after a revised flat showing in the fourth quarter, down from 0.2 percent initially reported. Canada's economy grew at an annualized 1.7 percent rate in the first quarter, rather weaker than the 2.3 percent consensus expectation and compared with the fourth quarter’s negligible 0.1 percent rate. On a quarter-over-quarter basis, GDP rose 0.4 percent after a revised flat showing in the fourth quarter, down from 0.2 percent initially reported.

Household spending rose 0.7 percent on a quarter-over-quarter basis in the first quarter, led by a 1.1 percent rise in services spending. This mostly reflected spending on telecom services, rent and air transport. Household goods spending rose by a modest 0.3 percent, paced by spending on motor vehicles.

A slower pace of business inventory accumulation subtracted from GDP in the first quarter. Most industries saw a slower rise in inventories: weakest were retail motor vehicles where inventories rose at half the pace of the fourth quarter.

On a monthly basis, GDP in March was flat following a 0.2 percent increase in February. The quarter-end fizzle along with the lower-than-expected quarterly results support arguments calling for a 25-basis-point cut at the coming week’s Bank of Canada meeting. However, in an offset, StatCan’s advance estimate for the month of April is a 0.3 percent rebound, one that would get the second quarter off to a respectable start. Going into the GDP data, forecasters appeared evenly split between calling for no change or a rate cut (see Looking Ahead for details).

Retail sales in Australia rose 0.1 percent on the month after falling 0.4 percent in March, with year-over-year growth picking up from 0.8 percent to 1.3 percent. Performance was mixed on a regional basis, with sales increasing in the most populous state, New South Wales, but falling in the two next most populous states, Victoria and Queensland. Sales were also mixed across major categories, with increases in sales of household goods and other retailing offset by declines in food and clothing sales. Retail sales in Australia rose 0.1 percent on the month after falling 0.4 percent in March, with year-over-year growth picking up from 0.8 percent to 1.3 percent. Performance was mixed on a regional basis, with sales increasing in the most populous state, New South Wales, but falling in the two next most populous states, Victoria and Queensland. Sales were also mixed across major categories, with increases in sales of household goods and other retailing offset by declines in food and clothing sales.

Excluding the impact of a series of Taylor Swift concerts earlier in the year, retail sales in Australia have been very weak in recent months, highlighting the impact of restrictive policy settings and cost of living pressures. At their most recent meeting earlier this month, officials at the Reserve Bank of Australia noted that "households have been curbing discretionary spending" and warned that "there is a risk that household consumption picks up more slowly than expected".

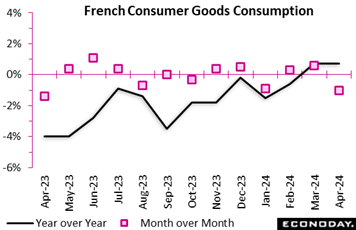

Household spending on manufactured products was surprisingly weak in April. After a stronger revised 0.8 percent monthly increase in March, purchases fell fully 1.0 percent. Sales now stand at their lowest level since January but, with base effects positive, annual growth was unchanged at 0.7 percent. Household spending on manufactured products was surprisingly weak in April. After a stronger revised 0.8 percent monthly increase in March, purchases fell fully 1.0 percent. Sales now stand at their lowest level since January but, with base effects positive, annual growth was unchanged at 0.7 percent.

April's monthly setback was largely due to a 2.0 percent slump in textiles and clothing compounded by a 0.1 percent fall in other engineered goods. With food declining some 2.7 percent but energy gaining 1.3 percent, total goods spending dropped 0.8 percent, more than reversing March's 0.5 percent advance.

The disappointing April data make for a poor start to the current quarter, leaving overall goods purchases 0.5 percent below their average level in the first quarter. Moreover, looking ahead, consumer confidence was only unchanged in May and so still well below its long-run average which, with buying intentions similarly very weak, suggests that the household sector will not provide much of a boost to GDP growth this quarter.

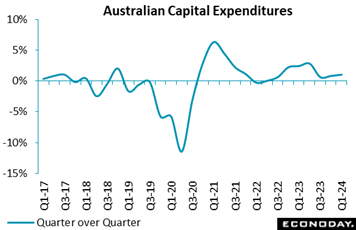

Private capital expenditures rose 1.0 percent on the quarter (volumes, seasonally adjusted) in the three months to March, picking up from an increase of 0.8 percent in the three months to December. Private capex rose 5.5 on the year in the three months to March after advancing 7.9 percent previously. Private capital expenditures rose 1.0 percent on the quarter (volumes, seasonally adjusted) in the three months to March, picking up from an increase of 0.8 percent in the three months to December. Private capex rose 5.5 on the year in the three months to March after advancing 7.9 percent previously.

The increase in headline capex growth reflects offsetting moves in the two major categories. Spending on equipment plant and machinery rose 3.3 percent on the quarter after a previous fall of 0.1 percent but spending on buildings and structures fell 0.9 percent after a previous increase of 1.5 percent. Conditions were again mixed on a sectoral basis, with capex falling by 4.7 percent on the quarter in the mining sector and increasing by 3.3 percent in the non-mining sector.

The first quarter update also includes the survey's revised forecast for private capex in the 2023-24 fiscal year (in value terms ending June 30). Officials now expect it to be A$180.6 billion, up 2.5 percent from the previous estimate made three months earlier of A$177.7 billion and also up from A$165.1 billion, the actual amount of spending in the 2022-23 fiscal year. Officials have also made revised their estimate for capex in the 2024-25 fiscal year to $155.4 billion, up 6.8 percent from their previous estimate of A$145.6 billion.

The capex survey covers around 60 percent of total business investment in Australia. More comprehensive information about the recent strength of investment will be published in the GDP report for this quarter, scheduled for release in the coming week (see Looking Ahead).

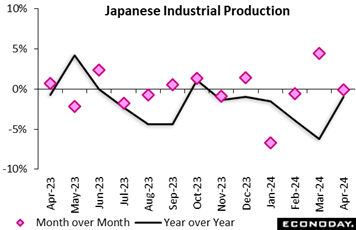

Japan's industrial production fell a seasonally adjusted 0.1 percent on the month in April after an upwardly revised 4.4 percent jump in March, as output of the transport industry excluding automobiles (aircraft engine parts) slumped in payback for a sharp gain in the previous month and vehicle output also slipped from a sharp rebound in March when production resumed after two months of suspension at Toyota group firms over a safety scandal. It was weaker than the median forecast of a 1.6 percent rise, with some forecasters having projected a slight drop. Of the 15 industries, seven posted increases from the previous month and eight marked decreases. Japan's industrial production fell a seasonally adjusted 0.1 percent on the month in April after an upwardly revised 4.4 percent jump in March, as output of the transport industry excluding automobiles (aircraft engine parts) slumped in payback for a sharp gain in the previous month and vehicle output also slipped from a sharp rebound in March when production resumed after two months of suspension at Toyota group firms over a safety scandal. It was weaker than the median forecast of a 1.6 percent rise, with some forecasters having projected a slight drop. Of the 15 industries, seven posted increases from the previous month and eight marked decreases.

From a year earlier, factory output posted a sixth straight drop, down 1.0 percent, slightly firmer than a consensus forecast of a 1.2 percent drop (some had expected a rebound), after an upwardly revised 6.2 percent slump in the prior month.

The Ministry of Economy, Trade and Industry's survey of producers indicated that output is expected to post a solid 2.3 percent rise in May before falling a sharp 5.6 percent in June. The ministry maintained its assessment that industrial output "has weakened while taking one step forward and one step back." The METI repeated that it will keep a close watch on the effects of global economic growth and resumed automobile production.

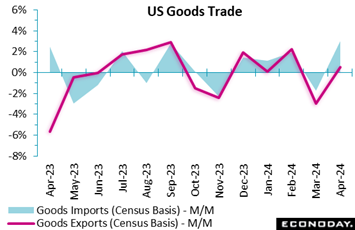

A big and broad jump in imports – which is a positive indication on domestic demand – greatly widened the US goods deficit. April's swollen $99.4 billion result was far outside Econoday's consensus range and compared with May's revised $92.3 billion. A big and broad jump in imports – which is a positive indication on domestic demand – greatly widened the US goods deficit. April's swollen $99.4 billion result was far outside Econoday's consensus range and compared with May's revised $92.3 billion.

Imports of vehicles surged a monthly 10.4 percent for annual growth of 12.0 percent in what speaks to strong sales expectations among car dealers. Capital goods imports jumped 3.5 percent for annual growth of 10.1 percent which points to strong business confidence and investment in new equipment. Imports of industrial supplies rose 2.1 percent in the month with "other" goods also contributing, up 5.6 percent.

Further good news came from exports where a healthy 0.5 percent monthly gain was dwarfed, however, by the import surge. Exports of consumer goods, usually a noticeable weakness for the US, rose 5.4 percent on the month for solid annual growth of 5.1 percent. Exports of vehicles, another US weakness, rose a monthly 3.6 percent with exports of capital goods, a great strength of the US, up 3.5 percent for annual growth of 7.4 percent.

Yet however positive these details sound, when calculating the net export component of GDP, April's giant deficit gets the second quarter off to a poor start. Not good news when the second estimate of first-quarter GDP got a downgrade to a modest 1.3 percent annualized growth rate. But strength in domestic spending, both from consumers and businesses as underscored in April's goods data, could more than offset trouble for net exports.

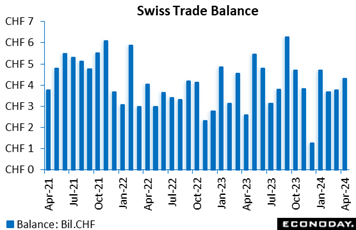

The merchandise trade balance was in a CHF4.32 billion surplus in April, up from a slightly larger revised CHF3.77 billion in March and CHF2.50 billion a year ago. The increase in the black ink reflected a 25.6 percent yearly rise in exports that easily more than offset an 18.7 percent gain in imports. However, this was the first time that imports have shown positive growth since February 2023. The merchandise trade balance was in a CHF4.32 billion surplus in April, up from a slightly larger revised CHF3.77 billion in March and CHF2.50 billion a year ago. The increase in the black ink reflected a 25.6 percent yearly rise in exports that easily more than offset an 18.7 percent gain in imports. However, this was the first time that imports have shown positive growth since February 2023.

Seasonally adjusted, the surplus stood at CHF3.91 billion, up from March's larger revised CHF3.06 billion and a 7-month high. Exports increased 9.1 percent on the month, their fourth straight gain and largely due to a 20.3 percent jump in chemicals and pharmaceuticals. Imports rose 5.9 percent following a 3.3 percent fall previously. There was also a marked improvement in the real trade balance as export volumes advanced 9.6 percent and imports only 3.2 percent. This leaves net exports on course to make a positive contribution to real GDP growth this quarter.

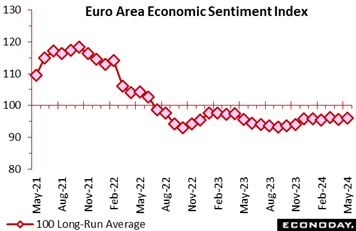

Economic sentiment improved slightly and in line with expectations this month. At 96.0, the headline gauge was up 0.4 points versus April, matching Econoday’s consensus but reversing only part of its previous 0.7 point decline. The measure now stands 4 points below its long-run average. Economic sentiment improved slightly and in line with expectations this month. At 96.0, the headline gauge was up 0.4 points versus April, matching Econoday’s consensus but reversing only part of its previous 0.7 point decline. The measure now stands 4 points below its long-run average.

May's improvement was due to rises in confidence in industry (minus 9.9 after minus 10.4), services (6.5 after 6.1) and in the household sector (minus 14.3 after minus 14.7). However, retail trade (minus 6.8) was only flat and construction (6.0 after minus 5.9) marginally weaker.

Regionally, national sentiment improved in France (97.3 after 95.8), Germany (92.4 after 91.6) and Italy (100.4 after 99.6) but worsened in Spain (101.1 after 104.3). Italy and Spain were the only two of the larger four economies to post above the common 100 historic mean.

Inflation expectations were mixed: expected selling prices in manufacturing rose from 5.6 to 6.4, a 13-month peak, but fell in services for a fourth straight month from 14.0 to 13.2, the lowest outturn since August 2021. Inflation expectations in the consumers sector (12.5 after 11.6) increased to a 3-month high.

May's update leaves Eurozone sentiment on an essentially flat trend and at a low enough level to signal only very modest growth. However, with inflation signals varied, the ECB is all the more likely to adopt a cautious approach to easing. A cut in key interest rates still seems a done deal but another in July remains unlikely.

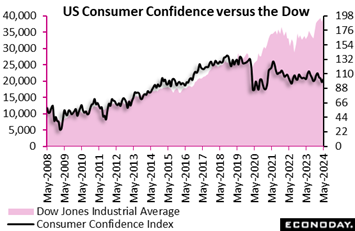

The Conference Board's consumer confidence index rose noticeably to 102.0 in May after a modest upward revision to 97.5 in April. The May reading was well above the consensus of 95.3 in the Econoday survey of forecasters. The Conference Board's consumer confidence index rose noticeably to 102.0 in May after a modest upward revision to 97.5 in April. The May reading was well above the consensus of 95.3 in the Econoday survey of forecasters.

The May index did not entirely retrace the decline in April from 103.1 in March, but it does suggest that consumers were reacting to negative news in April and have regained much of the lost ground in confidence. The components show consumers were significantly more optimistic about present employment conditions, although slightly less about present business conditions.

The index for the present situation rose to 143.1 in May after a small upward revision to 140.6 in April. The expectations index climbed to 74.6 from 68.8. The components for expected conditions show a switch to anticipating gains in personal income, a good labor market, and expansion in business six months from now.

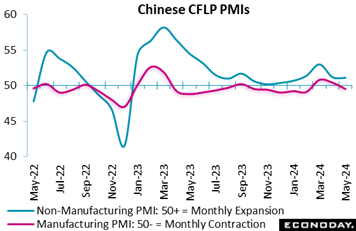

Official Chinese PMI survey data show conditions in China's aggregate economy deteriorated in May. The headline index for the CFLP manufacturing PMI fell from 50.4 in April to 49.5 in May, below the consensus forecast of 50.4 and indicating renewed contraction in the sector. The CFLP non-manufacturing PMI fell slightly from 51.2 to 51.1, also below the consensus forecast of 51.3. The composite index covering the entire economy fell from 51.7 in April to a three-month low of 51.0 in May. Official Chinese PMI survey data show conditions in China's aggregate economy deteriorated in May. The headline index for the CFLP manufacturing PMI fell from 50.4 in April to 49.5 in May, below the consensus forecast of 50.4 and indicating renewed contraction in the sector. The CFLP non-manufacturing PMI fell slightly from 51.2 to 51.1, also below the consensus forecast of 51.3. The composite index covering the entire economy fell from 51.7 in April to a three-month low of 51.0 in May.

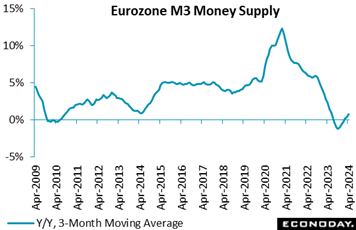

Broad money expanded again in the Eurozone. A 0.1 percent monthly increase in April lifted annual M3 growth from 0.9 percent to 1.3 percent, boosting the headline 3-monthly change from 0.4 percent to 0.8 percent. The data were just a little weaker than the market consensus. Broad money expanded again in the Eurozone. A 0.1 percent monthly increase in April lifted annual M3 growth from 0.9 percent to 1.3 percent, boosting the headline 3-monthly change from 0.4 percent to 0.8 percent. The data were just a little weaker than the market consensus.

The increase in April's annual rate was again largely attributable to narrow money M1 where the yearly rate of decline eased from 6.6 percent to 6.0 percent, its strongest reading since April 2023. Amongst the M3 counterparts, private sector loans were up 0.5 percent on the year after a 0.4 percent increase previously and, after adjustment for loan sales and securitisation as well for positions due to notable cash pooling services, 0.9 percent following a 0.8 percent gain. Within the latter, adjusted loans to households held steady at 0.2 percent while borrowing by non-financial corporations (0.3 percent after 0.4 percent) slowed marginally.

The April data remain in line with a gradual recovery in the Eurozone economy and, while hardly robust, will do nothing to prevent the ECB cutting key interest rates in the coming week.

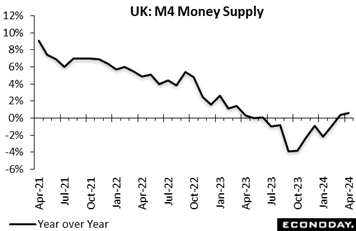

Broad money expanded just 0.1 percent on the month in April after an unrevised 0.7 percent increase in March. M4 has now grown in four of the last five months and, at 5.6 percent, the annualised quarterly rate is the highest since the period ending October 2022. M4 lending was also up a monthly 0.1 percent which, following a 0.9 percent bounce previously, similarly leaves a solid upward trend. Broad money expanded just 0.1 percent on the month in April after an unrevised 0.7 percent increase in March. M4 has now grown in four of the last five months and, at 5.6 percent, the annualised quarterly rate is the highest since the period ending October 2022. M4 lending was also up a monthly 0.1 percent which, following a 0.9 percent bounce previously, similarly leaves a solid upward trend.

Excluding intermediate other financial institutions, M4 rose a stronger 0.4 percent versus March but its lending counterpart only rose 0.1 percent, leaving a subdued minus 0.6 percent 3-month annualised rate. That said, the latter post was the strongest since January.

Elsewhere the financial data were again mixed. In the housing market, mortgage approvals slipped from 61,263 to a still firm 61,140 while mortgage lending jumped from £0.46 billion to £2.41 billion. However, overall consumer credit rose just £0.73 billion or around half the £1.42 billion seen March.

In sum, April's data remain consistent with a gradual recovery in economic activity and should have no significant implications for how the BoE MPC meeting votes in June.

The global Relative Performance Index (RPI) stands at minus 12 and at minus 21 less prices (RPI-P), the latter indicating that firmer-than-expected inflation reports are lifting the overall score.

The US score, sagging since April’s lower-than-expected employment report, had been on the rebound but was set back in the latest week by the downgrade for first-quarter GDP. At minus 20 overall and minus 21 less prices, the RPIs could sink further yet should the coming week’s May employment report also disappoint, a result that would reawaken rate-cut expectations.

For Canada where the both the RPI and RPI-P are near zero at plus 1, economic surprises won’t be a factor at the Bank of Canada’s June 5 policy meeting. The consensus for the meeting is split between no action and a rate cut, setting up what may be financial-market fireworks either way after Wednesday’s announcement.

In the Eurozone, surprisingly strong inflation in the key May report is unlikely to prevent the ECB easing this week but will dampen speculation about another in July . More generally, at 14 the region’s RPI shows overall economic activity running a little ahead of forecasts but, with the RPI-P at 3, recent real economy developments have largely conformed to expectations.

In the UK, economic news has been a little firmer than anticipated but not sufficiently so as to lift either the RPI (minus 9) or RPI-P (minus 31) back above zero. The economy has recently picked up momentum and a cut in Bank Rate at the June 20 BoE meeting is probably off the table, but activity in general is still lagging market forecasts.

In Switzerland, surprisingly robust first quarter GDP growth helped to the keep the RPI (9) in positive surprise territory. The RPI-P (2) also finally climbed above zero for the first time since mid-March, albeit only just. However, both gauges show recent economic activity in general largely meeting expectations and financial markets are still unsure about the outcome of this month’s SNB Monetary Policy Assessment (MPA).

In Japan, another mixed bag of data left the RPI (3) and RPI-P (minus 1) little changed on the week. Both measures still show economic activity essentially matching the consensus call, offering limited guidance to investors who remain uncertain about the timing of the next BoJ tightening. Still, with the yen so weak, action at the June 13 meeting is at least a possibility.

In China, early warning from the CFLP of a disappointingly soft economy in May pushed the RPI (minus 36) and RPI-P (minus 50) deeper into negative surprise territory. The IMF has just upgraded its forecast for Chinse growth but most investors have yet to be convinced that fiscal policy is loose enough.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

Despite some talk it might hold steady, the Bank of Canada is expected to begin cutting rates on Wednesday with an incremental 25-basis-point move. There is no uncertainty at all that the European Central Bank will begin cutting rates, also by an expected 25 basis points on Thursday. The Reserve Bank of India on Friday is expected to hold its policy rate steady.

Eurozone retail sales on Thursday are expected to show slowing monthly growth, while German manufacturing orders on Thursday and German industrial production on Friday are both expected to rebound modestly from prior declines.

Moderate growth is the call for both US and Canadian employment on Friday. US nonfarm payrolls are expected to rise 195,000 with average hourly earnings seen up 0.3 percent on the month for a steady annual rate of 3.9 percent.

China: S&P Manufacturing PMI for May (Mon 0945 CST; Mon 0145 GMT; Sun 2145 EDT)

Consensus Forecast: 51.6

After a slightly better-than-expected 51.4 in April, S&P's manufacturing PMI in May is expected to hold in plus-50 ground for a seventh straight month at 51.6.

US: ISM Manufacturing Index for May (Mon 1000 EDT; Mon 1400 GMT)

Consensus Forecast: 49.8

After falling back into contraction in April to a much lower-than-expected 49.2, the ISM manufacturing index in May is expected to recover but to no better than 49.8.

Korean CPI for May (Tue 0800 KST; Mon 2300 GMT; Mon 1900 EDT)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 2.8%

Consumer prices in May, which in April came in at 2.9 percent, are expected to edge lower to 2.8 percent.

German Unemployment Rate for May (Tue 0955 CEST; Tue 0755 GMT; Tue 0355 EDT)

Consensus Forecast: 5.9%

May’s unemployment rate is expected to hold steady at April’s 5.9 percent. Germany’s jobs market remains tight and continues to support wage growth.

Australian First-Quarter GDP (Wed 0130 GMT; Wed 1130 AEST; Tue 2130 EDT)

Consensus Forecast, Quarter over Quarter: 0.2%

Consensus Forecast, Year over Year: 1.3%

First-quarter GDP is expected to rise a quarterly 0.2 percent for year-over-year growth of 1.3 percent. Fourth-quarter respective results were 0.2 percent growth on the quarter and 1.5 percent on the year.

China: S&P PMI Composite for May (Wed 0945 CST; Wed 0145 GMT; Tue 2145 EDT)

Composite Index, Consensus Forecast: 52.7

Services Index, Consensus Forecast: 52.6

S&P's services PMI is expected to hold steady in May at 52.6 versus April’s 52.5 and March’s 52.7.

Eurozone PPI for April (Wed 1100 CEST; Wed 1000 GMT; Wed 0500 EDT)

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: -5.8%

Producer prices have shown sustained weakness and are expected to fall 5.8 percent on the year in April which would compare with 7.8 percent contraction in March. The monthly showing, at a consensus plus 0.1 percent in April, fell 0.4 percent in March which was the fifth straight decline.

US ADP Private Payrolls for May (Wed 0815 EDT; Wed 1215 GMT)

Consensus Forecast: 173,000

Forecasters see ADP's May employment number at 173,000. This would compare with April growth in private payrolls reported by the Bureau of Labor Statistics of 167,000. ADP’s number for April was 192,000.

Bank of Canada Announcement (Wed 0945 EDT; Wed 1345 GMT)

Consensus Forecast, Change: -25 basis points

Consensus Forecast, Level: 4.75%

After holding rates steady for six straight meetings despite slow economic growth, the Bank of Canada is expected to begin cutting rates by 25 basis points at its June meeting.

Australian International Trade in Goods for April (Thu 1130 AEST; Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Balance: A$5.8 billion

Consensus for international trade in goods in April is a surplus of A$5.8 billion versus March’s A$5.0 billion surplus that was lower than expected as exports extended their slump.

German Manufacturing Orders for April (Thu 0800 CEST; Thu 0600 GMT; Thu 0200 EDT)

Consensus Forecast, Month over Month: 0.5%

Manufacturing orders are expected to increase a monthly 0.5 percent in April to reverse March’s weaker-than-expected 0.4 percent decline.

Eurozone Retail Sales for April (Thu 1100 CEST; Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 0.8%

Retail sales volumes in April are expected to rise 0.3 percent on the month after March’s favorable 0.8 percent monthly rise.

European Central Bank Announcement (Thu 1215 GMT; Thu 1415 CEST; Thu 0815 EST)

Consensus Forecast, Change: -25 basis points

Consensus Forecast, Refi Rate: 4.25%

The ECB is widely expected to cut its key interest rates by 25 basis points putting the refi rate at 4.25 percent and the deposit rate at 3.75 percent. The question is what the bank will signal for its July meeting.

Canada Merchandise Trade Balance for April (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast: -C$1.5 billion

April’s trade balance is seen in deficit of C$1.5 billion versus March’s deficit of C$2.3 billion that was pulled lower by a sharp drop in exports.

Japanese Household Spending for April (Fri 0830 JST; Thu 2330 GMT; Thu 1930 EDT)

Consensus Forecast , Month over Month: 0.1%

Consensus Forecast , Year over Year: 0.5%

Real household spending in April is expected to slow to a 0.1 percent monthly rise following March’s better-than-expected 1.2 percent climb.

Chinese Merchandise Trade Balance for May (Estimated for Friday, release time not set)

Consensus Forecast: US$71.8 billion

China's trade surplus is expected to hold steady in May at US$71.8 billion versus a lower-than-expected surplus of US$72.35 billion in an April report that saw a greater rise in imports than exports.

Reserve Bank of India Announcement (Fri 0430 GMT; Fri 1000 IST; Fri 0030 EDT)

Consensus Change: 0 basis points

Consensus Level: 6.50%

Despite above-target inflation and robust economic growth, the Reserve Bank of India has left policy unchanged since February last year. Expectations for June’s meeting are no change.

German Industrial Production for April (Fri 0800 CEST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, Month over Month: 0.2%

Industrial production in April is expected to rise 0.2 percent on the month after falling 0.4 percent in March.

US Employment Situation for May (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast: Change in Nonfarm Payrolls: 195,000

Consensus Forecast: Unemployment Rate: 3.9%

Consensus Forecast: Average Hourly Earnings M/M: 0.3%

Consensus Forecast: Average Hourly Earnings Y/Y: 3.9%

A 195,000 rise is the call for nonfarm payroll growth in May versus a lower-than-expected 175,000 in April. Average hourly earnings in May are expected to rise 0.3 percent on the month for a year-over-year rate of 3.9 percent; these would compare with April’s rates of 0.2 and 3.9 percent, which were also lower than expected. May’s unemployment rate is expected to hold unchanged at April’s 3.9 percent which was less tight than expected.

Canadian Labour Force Survey for May (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast: Employment Change: 15,000

Consensus Forecast: Unemployment Rate: 6.2%

Employment in May is expected to rise 15,000 versus April’s 90,400 surge that followed, however, March’s 2,200 decline. May’s unemployment rate is expected to rise a tenth to 6.2 percent.

|