|

Global activity has been tracking on the soft side of forecasts for the last month. Econoday’s Relative Performance Index ended the week at minus 9 to indicate that global data, on net, are coming in at the low end of Econoday’s consensus ranges. This points to a bias for policy accommodation though many central banks continue to hold the line, that is keeping rates high in their slow but successful effort to bring inflation down. Yet the European Central Bank and Bank of Canada did cut rates this month and as did the Swiss National Bank in the latest week.

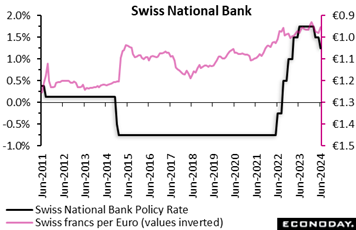

The Swiss National Bank reduced its main policy rate by 25 basis points from 1.50 percent to 1.25 percent at its quarterly Monetary Policy Assessment. This follows a rate cut of 25 basis points in March. Forecasters were divided on whether the SNB would leave rates on hold or cut by 25 basis points, resulting in a median forecast for a cut of 12.5 basis points. Officials also reiterated that they remain willing to be active in the foreign exchange market "as necessary". The Swiss National Bank reduced its main policy rate by 25 basis points from 1.50 percent to 1.25 percent at its quarterly Monetary Policy Assessment. This follows a rate cut of 25 basis points in March. Forecasters were divided on whether the SNB would leave rates on hold or cut by 25 basis points, resulting in a median forecast for a cut of 12.5 basis points. Officials also reiterated that they remain willing to be active in the foreign exchange market "as necessary".

Since the previous MPA in March, GDP data showed another quarter of subdued growth, with the economy expanding by 0.6 percent on the year in the three months to March after an increase of 0.5 percent in the three months to December. Price pressures, meanwhile, eased and then picked up slightly, with headline inflation falling from 1.2 percent in February to 1.0 percent in March before increasing to a still favourable 1.4 percent in both April and May.

The statement accompanying the bank’s decision noted that Swiss growth is likely to "remain moderate" in coming quarters before improving "gradually" over the medium-term. Officials forecast annual GDP growth of around 1.0 percent in 2024 and 1.5 percent in 2025 but warned of external risks to this outlook.

The bank also expects unemployment to rise slightly in the near-term and for capacity pressures to moderate. Based on an assumption that policy rates will remain unchanged over the forecast period, the SNB now forecasts annual inflation of 1.3 percent in 2024, 1.1 percent in 2025, and 1.0 percent in 2026.

Officials concluded that a further reduction in policy rates would allow them to "to maintain appropriate monetary conditions". Officials promised to "adjust our monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term" but they provided little indication of whether they believe additional rate cuts will be required in upcoming meetings.

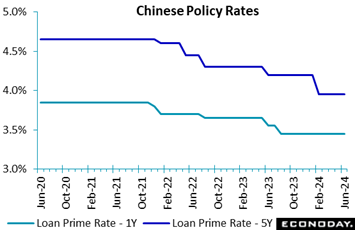

The People's Bank of China left its one-year loan prime rate unchanged at 3.45 percent at its monthly review, in line with the consensus forecast. This rate has been left unchanged since August 2023. The equivalent five-year rate was also left on hold at 3.95 percent for the fourth consecutive month after it was cut by 25 basis points in February. Officials characterized monthly data published during the week (which we will review later in this article) as showing "sustained” momentum and “stable growth" despite further weakness in the property market. The People's Bank of China left its one-year loan prime rate unchanged at 3.45 percent at its monthly review, in line with the consensus forecast. This rate has been left unchanged since August 2023. The equivalent five-year rate was also left on hold at 3.95 percent for the fourth consecutive month after it was cut by 25 basis points in February. Officials characterized monthly data published during the week (which we will review later in this article) as showing "sustained” momentum and “stable growth" despite further weakness in the property market.

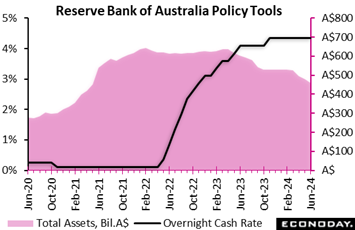

The Reserve Bank of Australia left its main policy rate, the cash rate, unchanged at 4.35 percent, in line with the consensus forecast. Officials increased this rate by 25 basis points in November 2023 but have since left it unchanged. Over this period, officials have expressed confidence that previous policy tightening will help return inflation to within their target range of two percent to three percent over the forecast period. The Reserve Bank of Australia left its main policy rate, the cash rate, unchanged at 4.35 percent, in line with the consensus forecast. Officials increased this rate by 25 basis points in November 2023 but have since left it unchanged. Over this period, officials have expressed confidence that previous policy tightening will help return inflation to within their target range of two percent to three percent over the forecast period.

In their statement, however, officials expressed concern about recent inflation data, with monthly CPI data showing an increase in headline inflation from 3.4 percent in February to 3.5 percent in March and 3.6 percent in April. Officials noted that inflation is falling more slowly than they had previously anticipated and they reiterated concerns about risks to the outlook. They again noted that conditions in the labour market remain strong and that the outlook for household consumption remains uncertain.

Although officials left policy on hold, they reiterated that returning inflation to target remains their highest priority. They again concluded that "the path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out". The RBA's next meeting is scheduled for early August.

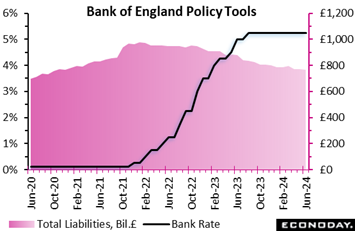

The Bank of England's Monetary Policy Committee left its main policy rate on hold at 5.25 percent, in line with the consensus forecast. The benchmark rate has been at this level, a 16-year high, since it was last raised by 25 basis points back in August last year. The Bank of England's Monetary Policy Committee left its main policy rate on hold at 5.25 percent, in line with the consensus forecast. The benchmark rate has been at this level, a 16-year high, since it was last raised by 25 basis points back in August last year.

Seven members, including Governor Andrew Bailey, voted for no change. Two members, Swati Dhingra and Dave Ramsden, voted to lower the rate by 25 basis points to 5.00 percent, as they did at the previous meeting.

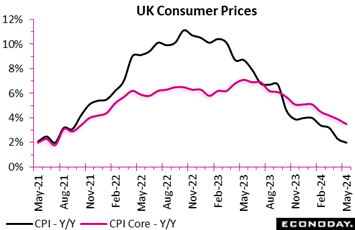

Data published in the week showed headline CPI inflation fell from 2.3 percent in April to 2.0 percent in May, hitting the BoE's target level. In the statement accompanying the bank’s decision, however, officials noted that they expect inflation to rise again later in the year and that key indicators of inflation persistence remain elevated.

Officials also noted that the current restrictive stance of monetary policy is weighing on activity and is loosening conditions in the labour market. Nevertheless, they stressed that their remit is always to aim to meet the inflation target while recognising that shocks and disturbances will cause inflation to depart from the two percent level.

Reflecting these considerations, the majority of MPC members concluded that rates should remain on hold, arguing that policy should remain restrictive for as long as it takes to ensure inflation returns to the target level "sustainably in the medium term". The accompanying minutes noted, however, that officials believe that the policy stance could remain restrictive even if the policy rate were to be reduced in upcoming meetings. Officials also stressed that updated forecasts in August would provide them with an opportunity to reconsider how long policy rates should remain at their current level.

Headline CPI rose 0.3 percent on the month in May, as it did in April, with the inflation rate slowing from 2.3 percent to 2.0 percent, in line with the Bank of England's target level and just below the consensus forecast of 2.1 percent. This is the lowest headline inflation rate since July 2021. Core CPI rose 0.5 percent after a previous increase of 0.9 percent, with this year-over-year increase decelerating from 3.9 percent to 3.5 percent, the smallest increase since October 2021 but still well above target. Headline CPI rose 0.3 percent on the month in May, as it did in April, with the inflation rate slowing from 2.3 percent to 2.0 percent, in line with the Bank of England's target level and just below the consensus forecast of 2.1 percent. This is the lowest headline inflation rate since July 2021. Core CPI rose 0.5 percent after a previous increase of 0.9 percent, with this year-over-year increase decelerating from 3.9 percent to 3.5 percent, the smallest increase since October 2021 but still well above target.

Most major categories recorded smaller year-over-year price increases in May, including food, clothing and footwear, and health. This was partly offset by stronger price increases for housing and household services, transport, and communication. Goods prices fell 1.3 percent on the year in May after falling 0.8 percent in April, while the year-over-year increase in services prices eased from 6.0 percent to 5.9 percent.

Although May’s data showed a further decline in consumer inflation, labour market data published in the prior week confirmed that wage growth has yet to slow enough to convince officials that the inflation can sustainably remain at target.

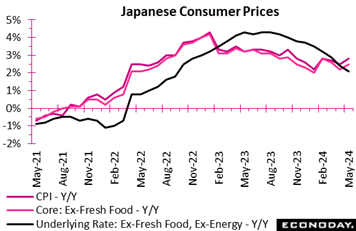

Consumer inflation in Japan accelerated in two of three key measures in May as the government raised the renewable energy charge that users pay for greener electricity but the largest contribution to the year-over-year increase in the CPI remains processed food prices. Consumer inflation in Japan accelerated in two of three key measures in May as the government raised the renewable energy charge that users pay for greener electricity but the largest contribution to the year-over-year increase in the CPI remains processed food prices.

The core CPI (excluding fresh food prices), closely watched by the Bank of Japan for its policy stance, rose 2.5 percent on year in May after rising 2.2 percent in April and 2.6 percent in March, coming in slightly below the consensus call of a 2.6 percent increase. The year-over-year increase in the total CPI rose to a three-month high of 2.8 percent after easing to 2.5 percent in April. It was also below the median forecast of a 2.9 percent rise.

Underlying inflation measured by the core-core CPI (excluding fresh food and energy) decelerated to a 20-month low of 2.1 percent from 2.4 percent, also just under the median forecast of a 2.2 percent rise. The annual rate for this narrow indicator had been at or above 3.0 percent from December 2022 until February 2024.

Goods prices excluding fresh food gained 3.5 percent, rising sharply from a 2.6 percent as utility costs showed a hefty increase in May after falling for months. Food prices excluding perishables continued to ease to a 3.2 percent increase from 3.5 percent but this category remains. Overall energy prices jumped 7.2 percent on year in May. Service prices excluding owners' equivalent rent moderated to 2.2 percent on the year in May following a 2.5 percent rise in April.

In coming months, the Bank of Japan is expected to "cautiously" raise the overnight interest rate target gradually. At its meeting earlier this month, the nine-member board decided in a unanimous vote to hold the overnight interest rate target steady in a range of 0 percent to 0.1 percent for the second straight meeting.

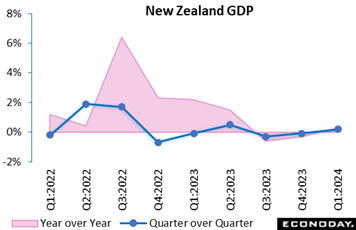

New Zealand's economy expanded modestly in the three months to March, after contracting in four of the previous five quarters. Conditions remain impacted by ongoing tight monetary policy put in place by the Reserve Bank of New Zealand, with officials committed to restricting demand as part of their efforts to lower inflation. New Zealand's economy expanded modestly in the three months to March, after contracting in four of the previous five quarters. Conditions remain impacted by ongoing tight monetary policy put in place by the Reserve Bank of New Zealand, with officials committed to restricting demand as part of their efforts to lower inflation.

GDP rose 0.2 percent on the quarter in the three months to March after contracting 0.1 percent in the three months to December, with the economy expanding 0.3 percent on the year after a previous decline of 0.2 percent. The small quarter-over-quarter increase largely reflected stronger growth in private consumption spending and a rebound in investment spending, offset by a negative contribution to growth by net exports. On a sectoral basis, however, conditions weakened across all major sectors, with the improvement in headline growth driven by the impact of unallocated taxes.

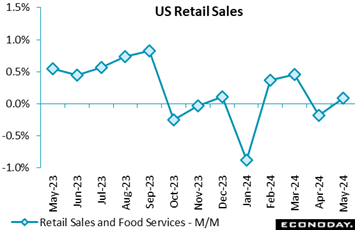

US retailers had a flat May though car dealers had a good month. Retail and food services sales managed only a 0.1 percent monthly gain that failed to reverse a 0.2 percent decline in April. Yet dealer sales of motor vehicles & parts jumped 0.8 percent to more than reverse April's 0.4 percent decline; with domestic shipments of vehicles jumping in April and imports of foreign makes surging, forecasters may well be expecting further strength for dealer sales in the months ahead. US retailers had a flat May though car dealers had a good month. Retail and food services sales managed only a 0.1 percent monthly gain that failed to reverse a 0.2 percent decline in April. Yet dealer sales of motor vehicles & parts jumped 0.8 percent to more than reverse April's 0.4 percent decline; with domestic shipments of vehicles jumping in April and imports of foreign makes surging, forecasters may well be expecting further strength for dealer sales in the months ahead.

Nonstore retailers, up 0.8 percent, also had a good May indicating strength for e-commerce though this followed a 1.8 percent April decline. Two other large categories, food & beverage stores and general merchandise stores, had flat months, down 0.2 and up 0.1 percent respectively. Notable losers were building materials & garden equipment dealers with a 0.8 percent decline and also furniture & home furnishing stores down 1.1 percent, both reflecting, at least in part, a flat housing market that's being tied down by high interest rates.

Jerome Powell described consumer spending as "solid" at the prior week’s FOMC press conference though May's data, motor vehicles aside, look sluggish at the very best. Retailers will have to have a strong June or personal consumption expenditures in the second quarter will slow from the first quarter's inflation-adjusted 2.0 percent growth pace.

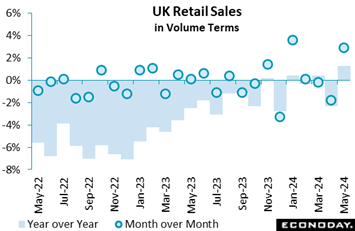

UK retail sales volumes rose 2.9 percent on the month in May, rebounding sharply after slumping 1.8 percent in April and recording close to zero growth in the previous two months. On the year, volumes rose 1.3 percent after a decline of 2.3 percent in April. Officials noted that year-over-year comparisons for May were impacted by an additional public holiday in May 2023 to mark the coronation of King Charles III. UK retail sales volumes rose 2.9 percent on the month in May, rebounding sharply after slumping 1.8 percent in April and recording close to zero growth in the previous two months. On the year, volumes rose 1.3 percent after a decline of 2.3 percent in April. Officials noted that year-over-year comparisons for May were impacted by an additional public holiday in May 2023 to mark the coronation of King Charles III.

Stronger volumes in May were largely driven by improved sales for clothing retailers and furniture stores. Non-store retailing also recorded strong growth on the month. Excluding fuel, sales rose 2.9 percent on the month.

The prior month’s sharp monthly drop in volumes was partly caused by unusually wet weather, a point noted in the week by officials at the Bank of England when they left rates on hold. Officials also noted an improvement in consumer confidence and evidence of a recent pick-up in consumer demand at their meeting, consistent with May's retail data.

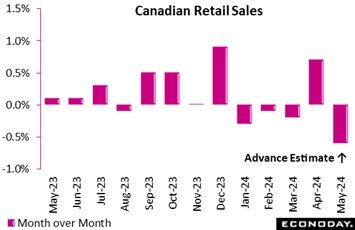

Retail sales in Canada rose by 0.7 percent in April, in line with Econoday’s consensus estimate. Volumes were up 0.5 percent on the month. The advance estimate for May was less encouraging, calling for a monthly sales decline of 0.6 percent. Retail sales in Canada rose by 0.7 percent in April, in line with Econoday’s consensus estimate. Volumes were up 0.5 percent on the month. The advance estimate for May was less encouraging, calling for a monthly sales decline of 0.6 percent.

In April, when consumer prices rose 2.7 percent year-over-year, retail sales increases were broad based in seven of nine subsectors. Best gains came at gasoline stations and fuel vendors, up 4.5 percent on the month, and food and beverage retailers, up 1.9 percent. Core sales, excluding gas stations and fuel vendors plus autos and parts, rose 1.4 percent in April from March and were up 1.5 percent from a year ago.

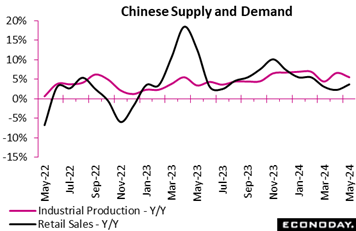

China releases its retail sales and industrial production reports together each month, and as seen in the accompanying graph May’s results were mixed. Retail sales beat expectations, rising 3.7 percent on the year versus a 3.0 percent consensus and picking up from growth of 2.3 percent in April. In month-over-month terms, retail sales rose 0.51 percent after barely advancing at all in April, only 0.03 percent. China releases its retail sales and industrial production reports together each month, and as seen in the accompanying graph May’s results were mixed. Retail sales beat expectations, rising 3.7 percent on the year versus a 3.0 percent consensus and picking up from growth of 2.3 percent in April. In month-over-month terms, retail sales rose 0.51 percent after barely advancing at all in April, only 0.03 percent.

Chinese industrial production did rise 5.6 percent on the year in May, but this was down from 6.7 percent in April and below expectations for 6.2 percent. In monthly terms, industrial production rose 0.30 percent in May after increasing 0.97 percent in April.

Within the industrial sector, manufacturing output rose 6.0 percent on the year after increasing 7.5 percent in April. Utilities output and mining output rose 4.3 percent and 3.6 percent on the year respectively after increasing 5.8 percent and 2.0 percent. Separate data on fixed asset investment rose 4.0 percent year-to-date in May, moderating from growth of 4.2 percent in April. In month-over-month terms, fixed asset investment fell 0.04 percent in May after dropping 0.03 percent in April.

Officials characterised May’s data as showing that the national economy "sustained the recovery momentum with stable growth" with "improvement in major indicators and rapid development of new growth drivers". Officials again warned, however, that "the external environment is complex and severe" and that the domestic economy still faces "multiple difficulties and challenges". They again noted that they will seek to "frontload and effectively implement" macroeconomic policies that have already been introduced, suggesting they do not yet see a case for a major shift in policy settings.

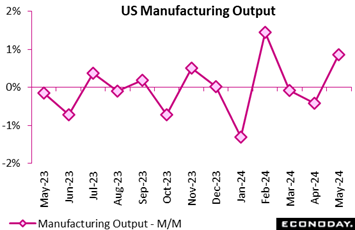

Durable goods orders in the US have posted solid gains so far this year and are beginning to be reflected in manufacturing volumes which surged a far higher-than-expected 0.9 percent in May. This supported overall industrial production which also rose 0.9 percent. Durable goods orders in the US have posted solid gains so far this year and are beginning to be reflected in manufacturing volumes which surged a far higher-than-expected 0.9 percent in May. This supported overall industrial production which also rose 0.9 percent.

The Federal Reserve, which publishes the industrial production report, described May's volume gains as "widespread" especially for consumer goods and defense & space equipment as well as machinery and computers. Materials were also strong.

Not strong, however, were furniture and related products where volumes dropped 2.6 percent in an echo of May’s retail sales report where furniture stores, like furniture manufacturers, had a bad May in what is very likely a reflection of a flat housing market.

Other readings in May's report included a 0.3 percent rise in mining volumes and a 1.6 percent monthly gain in utilities output. Total capacity utilization jumped 0.5 percentage points but was still 0.9 points below its historical average.

If China does increase stimulus it will be to help the property market where residential prices fell 3.9 percent on the year in May, worsening from a decline of 3.1 percent in April. This extends two years of weakness and represents a major drag on investment and consumer spending. If China does increase stimulus it will be to help the property market where residential prices fell 3.9 percent on the year in May, worsening from a decline of 3.1 percent in April. This extends two years of weakness and represents a major drag on investment and consumer spending.

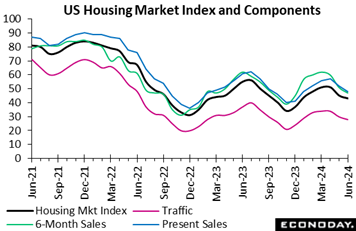

The US home builders housing market index slipped further in June to 43 from 45 in May and 51 in April. In spite of some modest improvement in mortgage interest rates in early June, homebuyers remain wary of taking on a mortgage while rates are close to 7 percent. The Freddie Mac monthly average rate has been just above or below 7.0 percent since April. Weekly measures of mortgage rates have fallen a bit in the last two or three weeks in anticipation of future rate cuts by the Federal Reserve, although rhetoric from FOMC members remains decidedly cautious. The US home builders housing market index slipped further in June to 43 from 45 in May and 51 in April. In spite of some modest improvement in mortgage interest rates in early June, homebuyers remain wary of taking on a mortgage while rates are close to 7 percent. The Freddie Mac monthly average rate has been just above or below 7.0 percent since April. Weekly measures of mortgage rates have fallen a bit in the last two or three weeks in anticipation of future rate cuts by the Federal Reserve, although rhetoric from FOMC members remains decidedly cautious.

The index for present home sales is down 4 points this month to 48 and the expected sales index is down 4 points to 47. The index for buyer traffic is down 2 points to 28.

The report noted that persistently high mortgage rates are keeping many prospective buyers on the sidelines, and that home builders are also struggling with higher financing rates for construction and development loans as well as chronic labor shortages and lack of buildable lots. The National Association of Home Builders, which produces this report, is calling for a more favorable interest rate environment for construction and development loans that it said would help bring down shelter costs and with that overall inflation as well.

In June, 29 percent of builders offered a price cut, up from 25 percent in May and the highest since 31 percent in January. However, the size of the price cut remained at 6 percent where it has been for 12 straight months. There is also an increase in the number of builders offering incentives to 61 percent in June after 59 percent in May and the highest since 62 percent in January.

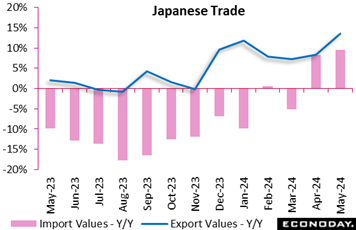

Japanese export values rose 13.5 percent on year in May for the sixth straight increase, led by solid global demand for automobiles and Asian purchases of semiconductors. The pace of increase was slower than the consensus forecast of a 16.1 percent gain but faster than the 8.3 percent rise in April. Import values rose 9.5 percent (consensus was an 11.4 percent rise) after rebounding 8.3 percent in April and falling 5.1 percent in March. The increase was led by continued solid demand for computers as well as crude oil and refined petroleum products whose import costs have been pushed up by the protracted weakness of the yen. Japanese export values rose 13.5 percent on year in May for the sixth straight increase, led by solid global demand for automobiles and Asian purchases of semiconductors. The pace of increase was slower than the consensus forecast of a 16.1 percent gain but faster than the 8.3 percent rise in April. Import values rose 9.5 percent (consensus was an 11.4 percent rise) after rebounding 8.3 percent in April and falling 5.1 percent in March. The increase was led by continued solid demand for computers as well as crude oil and refined petroleum products whose import costs have been pushed up by the protracted weakness of the yen.

The trade balance recorded a ¥1,221.3 billion deficit (versus the median forecast of a ¥1,298.5 billion deficit) after showing a revised ¥465.6 billion deficit in April and a ¥382.4 billion surplus in March.

Shipments to China, a key export market for Japanese goods, posted their sixth straight increase after a year-long decline through November last year amid a gradual recovery in the world's second-largest economy. Japanese exports to the European Union fell on year for the second straight month, hit by lower demand for automobiles and steel. Exports to the US remained robust, up for the 32nd straight month for autos.

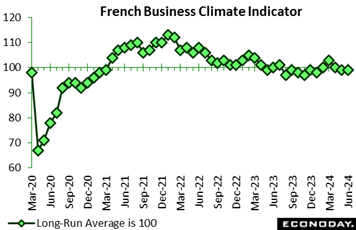

The overall business climate in France has held steady this month, mirroring the conditions seen in May and maintaining a value of 99, slightly below the long-term average of 100. The overall business climate in France has held steady this month, mirroring the conditions seen in May and maintaining a value of 99, slightly below the long-term average of 100.

The business climate in retail trade, including vehicle trade and repair, has slightly improved, rising from 99 to 100. A positive shift in ordering intentions drives this uptick. The manufacturing sector remains stable with an index of 99, unchanged from May, and continues to hover just below the long-term average. The services sector has experienced a minor decline, with the index dropping from 102 to 101. This decrease is attributed to a reduction in both past and expected activity levels as well perhaps to uncertainty ahead of snap legislative elections to be held on June 30 and July 7.

The business climate in building construction has worsened this month, falling from 102 to 100. This decline is due to decreased confidence in the sector's activity levels. The employment climate indicator has declined to 100, down by 2 points, aligning with its long-term average. This decline is primarily due to negative shifts in opinions about workforce changes, particularly in services excluding temporary work agencies.

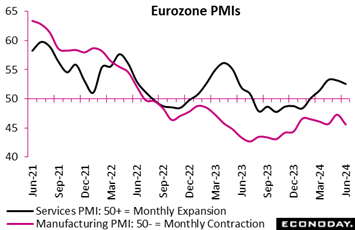

S&P’s flash PMI for the Eurozone suggests conditions have deteriorated across sectors in June. Headline indicators for both the manufacturing sector and the services sector have weakened and fell well short of consensus forecasts. S&P’s flash PMI for the Eurozone suggests conditions have deteriorated across sectors in June. Headline indicators for both the manufacturing sector and the services sector have weakened and fell well short of consensus forecasts.

The headline index for the manufacturing sector suggests sharper contraction in June, falling sharply to a six-month low of 45.6 from 47.3 in May. The business activity index for the services sector shows weaker expansion, falling to a three-month low of 52.6 from 53.2 in May.

Survey respondents reported a bigger fall in manufacturing output and weaker growth in service sector activity in June. The surveys show a small increase in new orders in the services sector but a bigger fall on the manufacturing side, while respondents reported solid payroll growth in the services sector and another decline for manufacturing. The surveys' measures of business confidence showed weaker sentiment in both sectors. Input costs were reported to have risen at a slower pace in the services sector and but to have risen in the manufacturing sector after a previous decline, while output prices rose at a slower pace in the services sector and fell at less pronounced pace in the manufacturing sector.

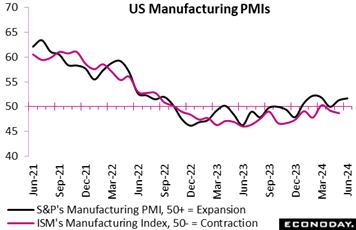

Forecasts for June’s ISM manufacturing index on July 1 will be getting a bit of a lift from S&P's US manufacturing flash which is up 4 tenths so far this month to a slightly better-than-expected 51.7. The closely watched ISM, at a disappointing 48.7 in May, has been struggling below breakeven 50 for much of the last two years, in some contrast to S&P's PMI which has been in the low 50s range all year. As we saw earlier in this article, manufacturing output as measured by the Federal Reserve showed life in May. Forecasts for June’s ISM manufacturing index on July 1 will be getting a bit of a lift from S&P's US manufacturing flash which is up 4 tenths so far this month to a slightly better-than-expected 51.7. The closely watched ISM, at a disappointing 48.7 in May, has been struggling below breakeven 50 for much of the last two years, in some contrast to S&P's PMI which has been in the low 50s range all year. As we saw earlier in this article, manufacturing output as measured by the Federal Reserve showed life in May.

Turning to services, forecasts for this ISM index on July 3 are also likely to get a boost from June's S&P flash which also rose 3 tenths to a very solid 55.1 that indicates moderate-to-strong growth in general activity compared to May. ISM's measure, at 53.8 in May, has been in the mid-to-low 50s since early last year.

New orders for S&P's manufacturing sample posted a third straight increase though gains were limited by weakness in export orders. Output for the manufacturing sample is growing at a slower pace this month. S&P's services sample reported the strongest rate of new orders in a year, a reading that hints perhaps at acceleration for US GDP.

Yet in an ominous note, optimism among manufacturers fell to a year-and-a-half low on lack of confidence over demand and to what the report vaguely attributes to uncertainty ahead of the presidential election. Sentiment for the services sample is strong.

Eurozone economic data are increasingly underperforming expectations, at a deeply negative minus 41 on Econoday’s Relative Performance Index (RPI) which if extended over the next several weeks would build chatter for a back-to-back rate cut at the ECB’s July 18 meeting, a cut that seemed improbable just a couple of weeks ago. June’s harmonised inflation flash on July 2 will be critical for rate expectations.

The three largest economies within the Eurozone are all underperforming: Germany at minus 21, France at minus 26, and Italy at minus 12. And all these scores are being propped up by as-expected inflation data excluding which the Eurozone’s RPI less prices (RPI-P) falls to minus 48 with Germany’s RPI-P at minus 32.

The UK is also underperforming at minus 25 on the RPI. Yet given the July 4 election and likely reforming of the government, the Bank of England, which next meets on August 1, isn’t likely to face any immediate rate-cut heat.

Other countries are performing within expectations, at scores between plus 10 and minus 10 to indicate that recent data, on net, are coming within Econoday’s consensus ranges. China’s mixed set of May data leaves this country’s score at plus 7 with Canada at plus 8 and Japan just marginally on the weak side at minus 11. And data from the US are virtually matching Econoday’s consensus medians, at minus 1 overall and also minus 1 when excluding prices.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, Olajide Oyadeyi, and Theresa Sheehan

The week’s inflation data open with Canada on Tuesday and Australia on Wednesday, the former expected to ease a tenth to 2.6 percent and the latter to rise 2 tenths to a noticeably overheated 3.8 percent. Friday will open with Tokyo consumer prices which are expected to hold steady with US PCE indexes to close the week amid expectations for marginal monthly gains and nearly benign looking 2.6 percent annual rates both overall and for the core.

Other data to watch are Japanese retail sales and US durable goods orders on Thursday, and Japanese industrial production on Friday. Germany will post retail sales and unemployment on Friday. A market-mover for Canada will be Friday’s monthly GDP report which is expected show a 0.3 percent bounce.

Singapore CPI for May (Mon 1300 SGT; Mon 0500 GMT; Mon 0100 EDT)

Consensus Forecast, Year over Year: 2.9%

Consumer inflation in May is expected to rise to 2.9 percent versus April’s as-expected 2.7 percent rate.

German Ifo for June (Mon 1000 CEST; Mon 0900 GMT; Mon 0400 EDT)

Consensus Forecast, Business Climate: 89.4

Consensus Forecast, Current Conditions: 88.5

Consensus Forecast, Business Expectations: 90.8

The business climate index held unchanged in May at 89.3 which was 1 point below the consensus but still matching its best reading since May last year. June’s consensus is a steady 89.4.

Canadian CPI for May (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 2.6%

After April’s as-expected 2.7 percent rate that was down from March’s 2.9 percent, consumer prices in May are expected to slow further to 2.6 percent.

Singapore Industrial Production for May (Wed 1300 SGT; Wed 0500 GMT; Wed 0100 EDT)

Consensus Forecast, Month over Month: 2.1%

Consensus Forecast, Year over Year: 2.1%

Industrial production in May is expected to increase a year-over-year 2.1 percent as is the monthly rate. These would compare with respective April rates of 7.1 and minus 1.6 percent.

Australian May CPI (Wed 1130 AEST; Wed 0130 GMT; Tue 2130 EDT)

Consensus Forecast, Year over Year: 3.8%

Consumer prices in May are expected to rise to 3.8 percent versus a higher-than-expected 3.6 percent in April and 3.5 percent in March.

Germany: GfK Consumer Climate for July (Wed 0800 CEST; Wed 0600 GMT; Wed 0200 EDT)

Consensus Forecast: -20.0

After June’s surprisingly sharp improvement to minus 20.9 from May’s minus 24.2, the consumer climate index is expected to improve slightly further in July to minus 20.0.

Japanese Retail Sales for May (Thu 0850 JST; Wed 2350 GMT; Wed 1950 EDT)

Consensus Forecast, Month over Month: 0.7%

Consensus Forecast, Year over Year: 2.0%

Retail sales in May are expected to match April’s 0.7 percent rise that followed, however, a 1.2 percent decline in March. The government maintained its assessment in the April report that retail sales were “taking one step forward and one step back”.

Eurozone M3 Money Supply for May (Thu 1000 CEST; Thu 0800 GMT; Thu 0400 EST)

Consensus Forecast, Year-over-Year: 1.6%

The 3-month moving average is expected to increase 1.6 percent in May following April’s 0.8 percent rise that extended an emerging trend of gains.

Eurozone: EC Economic Sentiment for June (Thu 1100 CEST; Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast: 96.4

Consensus Forecast, Industry Sentiment: -9.5

Consensus Forecast, Consumer Sentiment: -14.0

Economic sentiment in June is expected to rise to 96.4 from May’s 96.0 which extended a long flat trend short of the 100 long-run average.

US Durable Goods Orders for May (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast: Month over Month: 0.0%

Consensus Forecast: Ex-Transportation - M/M: 0.1%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.1%

Forecasters see durable goods orders unchanged in May following a solid 0.6 percent rise in April. Ex-transportation orders are seen up 0.1 percent as are core capital goods orders.

US International Trade in Goods (Advance) for May (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Balance: -$95.6 billion

The US goods deficit (Census basis) is expected to narrow by $2.4 billion to $95.6 billion in May after deepening by $5.7 billion in April to $98.0 billion.

Tokyo Consumer Price Index for June (Fri 0830 JST; Thu 2330 GMT; Thu 1930 EDT)

Consensus Forecast, Year over Year: 2.3%

Ex-Fresh Food, Consensus Forecast: 2.0%

Ex-Fresh Food & Energy, Consensus Forecast: 1.7%

Overall inflation in Tokyo is expected to increase 2.3 percent in June following May’s 2.2 percent rate that marked an increase from April’s 1.8 percent. Underlying rates are expected at 2.0 percent for the ex-fresh food core versus May’s 1.9 percent and at 1.7 percent for the ex-fresh food ex-energy core-core.

Japanese Industrial Production for May (Fri 0850 JST; Thu 2350 GMT; Thu 1950 EDT)

Consensus Forecast, Month over Month: 2.0%

Consensus Forecast, Year over Year: -0.1%

At a consensus 2.0 percent, industrial production on the month in May is expected to rebound following a much weaker-than-expected 0.9 percent decline in April. On a year-over-year basis, May’s contraction is expected at a marginal 0.1 percent versus 1.8 percent contraction in April.

German Retail Sales for May (Fri 0800 CEST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, Month over Month: -0.5%

Sales volumes are expected to fall 0.5 percent on the month in May on top of April’s unexpectedly steep 1.2 percent downturn.

German Unemployment Rate for June (Fri 0955 CEST; Fri 0755 GMT; Fri 0355 EDT)

Consensus Forecast: 5.9%

June’s unemployment rate is expected to hold steady at May’s 5.9 percent. Germany’s jobs market has been tight.

US Personal Income for May (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Month over Month: 0.4%

US Consumption Expenditures

Consensus Forecast, Month over Month: 0.3%

US PCE Price Index

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: 2.6%

US Core PCE Price Index

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: 2.6%

Personal income is expected to rise 0.4 percent in May with consumption expenditures expected to increase 0.3 percent. These would compare with April’s increases of 0.3 percent for income and 0.2 percent for consumption. Inflation readings for May are expected at monthly increases of only 0.1 percent both overall and for the core (versus 0.3 and 0.2 percent in April). Annual rates are expected at 2.6 percent for both (versus April’s 2.7 and 2.8 percent).

Canadian Monthly GDP for April (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Month over Month: 0.3%

After March’s as-expected no change, GDP in April is expected to rise 0.3 percent.

|