|

With rate cuts in the week from China and Canada, Econoday’s Global Policy Rate moved 3 basis points lower to 4.26 percent. This weighted average of major central banks looks to be moving consistently lower as national inflation rates settle toward the two percent line, and perhaps will be moving lower in the coming week should the Bank of England cut rates on Thursday. We’ll start the week’s article off with monetary policy and money supply, and then move to inflation and GDP reports, including the surprisingly strong second-quarter showing from the US.

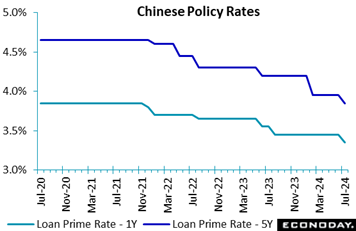

The People's Bank of China lowered the country’s one-year loan prime rate by 10 basis points to 3.35 percent at its monthly review, in contrast to the consensus forecast for no change. This rate had been left unchanged since August 2023. The equivalent five-year rate was also lowered by 10 basis points to 3.85 percent after it was cut by 25 basis points in February. The People's Bank of China lowered the country’s one-year loan prime rate by 10 basis points to 3.35 percent at its monthly review, in contrast to the consensus forecast for no change. This rate had been left unchanged since August 2023. The equivalent five-year rate was also lowered by 10 basis points to 3.85 percent after it was cut by 25 basis points in February.

Quarterly data released in the prior week showed weaker GDP growth in the three months to June, with monthly data also showing slower growth in key activity data and a sharper drop in house prices. Officials cautioned that "the external environment is intertwined and complex, the domestic effective demand remains insufficient and the foundation for sound economic recovery and growth still needs to be strengthened."

After noting in recent months that they will seek to "frontload and effectively implement" macroeconomic policies that have already been introduced, the statement accompanying last week's data did not contain this language, indicating that some adjustment to policy settings could be considered in the near-term. The reduction in the loan prime rate announced may provide some support to the property market, with many lenders basing their mortgage rates on the five-year rate.

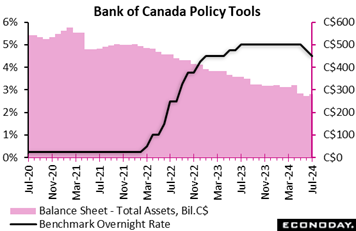

The Bank of Canada lowered its policy rate by another 25 basis points to 4.50 percent for a second straight meeting, as widely expected, to cushion the impact of prior credit tightening. The bank also decided to continue its policy of quantitative tightening to trim the bank's balance sheet to a normal level. This process is likely to end sometime next year when the bank will resume normal purchases of government bonds. The Bank of Canada lowered its policy rate by another 25 basis points to 4.50 percent for a second straight meeting, as widely expected, to cushion the impact of prior credit tightening. The bank also decided to continue its policy of quantitative tightening to trim the bank's balance sheet to a normal level. This process is likely to end sometime next year when the bank will resume normal purchases of government bonds.

"Ongoing excess supply is lowering inflationary pressures," the bank said in a statement. "At the same time, price pressures in some important parts of the economy -- notably shelter and some other services -- are holding inflation up.” The bank said it is carefully assessing these opposing forces on inflation.

Looking ahead, the bank said, "Monetary policy decisions will be guided by incoming information and our assessment of their implications for the inflation outlook."

In his opening remarks at a news conference, Governor Macklem said, "With the target in sight and more excess supply in the economy, the downside risks are taking on increased weight in our monetary policy deliberations."

"We need growth to pick up so inflation does not fall too much, even as we work to get inflation down to the two percent target," he said.

"If inflation continues to ease broadly in line with our forecast, it is reasonable to expect further cuts in our policy interest rate," the governor said, repeating his remarks made last month. The bank's policymakers "will be taking our monetary policy decisions one at a time."

Annual inflation eased back to 2.7 percent in June, mainly driven by lower gasoline prices, after unexpectedly rising to 2.9 percent in May from a three-year low of 2.7 percent hit in April. Employment fell 1,400 in June versus a consensus call of a 21,300 gain after rising 27,000 in May while the unemployment rate rose to 6.4 percent from 6.2 percent, up 1.3 percentage points since April 2023.

The latest policy decision follows the bank’s rate cut in June which was the first since March 2020 but still left monetary policy "restrictive" to economic activity.

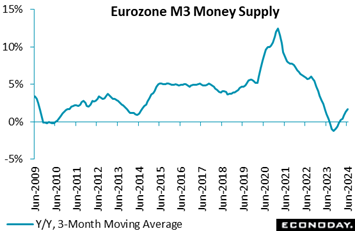

M3 growth continued to accelerate in June. An annual rate of 2.2 percent was up from 1.5 percent in May and the strongest since February 2023 and lifted the Eurozone’s headline 3-month moving average to 1.7 percent, a tick above Econoday’s consensus. Monthly growth was a solid 0.8 percent. M3 growth continued to accelerate in June. An annual rate of 2.2 percent was up from 1.5 percent in May and the strongest since February 2023 and lifted the Eurozone’s headline 3-month moving average to 1.7 percent, a tick above Econoday’s consensus. Monthly growth was a solid 0.8 percent.

Once again, the acceleration was dominated by narrow money M1, where the yearly rate of contraction eased from minus 5.0 percent to minus 3.4 percent. In terms of the main M3 counterparts, private sector loans were up 0.8 percent on the year after a 0.6 percent increase in May. Adjusted for the effects of transfers to and from MFI balance sheets as well as for notional cash pooling services, the rate increased from 0.8 percent to 1.1 percent. Within the latter, lending to households was flat at 0.3 percent but borrowing by non-financial corporations more than doubled from 0.3 percent to 0.7 percent.

The June update is consistent with a gradual recovery in the region's economic growth and should be much as the ECB expected. In particular, the central bank should be happy about the upturn in corporate lending. A cut in key interest rates in September remains a possibility but will need favourable July inflation data (flash report due on Wednesday).

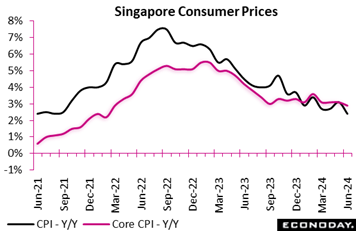

Singapore's headline consumer price index rose 2.4 percent on the year in June, slowing from 3.1 percent in May. The index fell 0.2 percent on the month after increasing 0.7 percent previously. The Monetary Authority of Singapore's preferred measure of core inflation, which excludes the cost of accommodation and private road transport, also moderated from 3.1 percent in May to 2.9 percent in June. This index was unchanged on the month after an increase of 0.1 percent previously. Singapore's headline consumer price index rose 2.4 percent on the year in June, slowing from 3.1 percent in May. The index fell 0.2 percent on the month after increasing 0.7 percent previously. The Monetary Authority of Singapore's preferred measure of core inflation, which excludes the cost of accommodation and private road transport, also moderated from 3.1 percent in May to 2.9 percent in June. This index was unchanged on the month after an increase of 0.1 percent previously.

May’s sharp increase in headline inflation was driven by a year-over-year increase in private transport prices; the fall in June reflects a reversal of that move. These prices fell 0.7 percent on the year after increasing 2.8 percent previously. The moderation in core inflation in June was largely driven by a smaller increase in prices for retail and other goods, up 0.5 percent on the year after a previous increase of 1.5 percent, with other major categories recording steady price increases.

Following Tuesday’s CPI report, the Monetary Authority of Singapore announced on Friday that it will retain current monetary policy settings. The MAS pursues its inflation and growth objectives by adjusting the direction, slope, width, and central level of an undisclosed "band" around its measure of Singapore's nominal effective exchange rate.

Officials remain confident about Singapore's growth prospects over the rest of the year, reflecting their expectation that global interest rates are set to decline and provide a boost to the export sector. They also expect core inflation to moderate later in the year and fall further to around 2 percent in 2025. Based on this assessment, officials concluded that "current monetary policy settings remain appropriate".

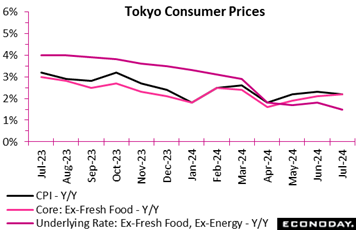

Core consumer inflation in Tokyo, the leading indicator of the national average, picked up only slightly in July after the government ended utility subsidies in June. The core CPI (excluding fresh food) posted a 2.2 percent increase on the year, as expected, versus 2.1 and 1.9 percent in the two prior months. The year-over-year rise in the total CPI decelerated to 2.2 percent, just below the median forecast of 2.3 percent. The core-core CPI (excluding fresh food and energy) stood at 1.5 percent (versus the consensus call of 1.6 percent), slowing from 1.8 percent in June. Core consumer inflation in Tokyo, the leading indicator of the national average, picked up only slightly in July after the government ended utility subsidies in June. The core CPI (excluding fresh food) posted a 2.2 percent increase on the year, as expected, versus 2.1 and 1.9 percent in the two prior months. The year-over-year rise in the total CPI decelerated to 2.2 percent, just below the median forecast of 2.3 percent. The core-core CPI (excluding fresh food and energy) stood at 1.5 percent (versus the consensus call of 1.6 percent), slowing from 1.8 percent in June.

Services costs have lost upward momentum in recent months as regulated wages for medical and welfare workers and education-support providers remain depressed. Prices of services excluding owners' equivalent rent rose just 0.6 percent on year in July, down from a 1.1 percent rise in May. The annual rate of goods prices excluding fresh food accelerated to 4.3 percent from 3.7 percent in June mainly due to higher utility costs.

Judging by the how tame the country’s CPI data have been, the Bank of Japan is likely to maintain its policy stance at its two-day meeting on July 30-31 and wait until the September 20-21 meeting before following up on its March hike by raising the overnight target to 0.25 percent from the current range of zero to 0.1 percent.

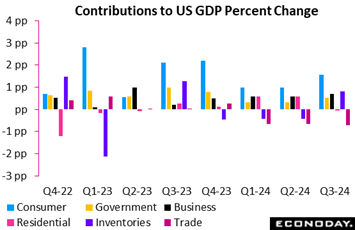

The first estimate of second quarter US GDP surprised to the upside with a gain of 2.8 percent to double the first quarter’s 1.4 percent rate. The consensus in the Econoday survey of forecasts was 2.0 percent growth within a range of 1.2 percent to 2.5 percent. The second quarter's increase was powered by a 2.3 percent rise in personal consumption expenditures with inflation-adjusted spending on durable goods up 4.7 percent, nondurables up 1.4 percent, and services up 2.2 percent. Government consumption expenditures rose 3.1 percent in the second quarter. Personal consumption was the largest contributor to GDP (1.57 percentage points). The first estimate of second quarter US GDP surprised to the upside with a gain of 2.8 percent to double the first quarter’s 1.4 percent rate. The consensus in the Econoday survey of forecasts was 2.0 percent growth within a range of 1.2 percent to 2.5 percent. The second quarter's increase was powered by a 2.3 percent rise in personal consumption expenditures with inflation-adjusted spending on durable goods up 4.7 percent, nondurables up 1.4 percent, and services up 2.2 percent. Government consumption expenditures rose 3.1 percent in the second quarter. Personal consumption was the largest contributor to GDP (1.57 percentage points).

Gross investment gained 8.4 percent in the second quarter with fixed investment up 3.6 percent. Within fixed investment, residential investment declined 1.4 percent, while nonresidential investment was up 5.2 percent.

The change in private inventories made a positive contribution (0.82 points), rising to $92.9 billion in the second quarter from $36.0 billion in the first quarter. Net exports made the only negative contribution among major components (minus 0.72) with the deficit widening to $894.4 billion from $834.9 in the prior quarter.

The quarterly price index for personal consumption rose 2.6 percent in the second quarter, down sharply from up 3.4 in the first quarter. The core price index for personal consumption increased 2.9 percent in the second quarter after up 3.7 percent in the prior quarter. These results offer more evidence that the process of disinflation has resumed.

The above-expectations performance of the second quarter adds to a picture of the US economy continuing to grow modestly despite high interest rates. The FOMC will take this into account. The strength won't likely bring forward a rate cut at the July 30-31 meeting, but neither should it encourage the FOMC to remain on hold at the September 17-18 meeting.

Advance estimates for South Korean GDP show the economy weakened in the second quarter. GDP contracted by 0.2 percent on the quarter, down sharply from growth of 1.3 percent in the three months to March, with year-over-year growth slowing from 3.3 percent to 2.3 percent. Advance estimates for South Korean GDP show the economy weakened in the second quarter. GDP contracted by 0.2 percent on the quarter, down sharply from growth of 1.3 percent in the three months to March, with year-over-year growth slowing from 3.3 percent to 2.3 percent.

Weaker headline GDP growth was driven by domestic demand. Private consumption fell 0.2 percent on the quarter, weakening from growth of 0.7 percent previously, while investment slowed sharply, down 1.3 percent after a previous increase of 1.1 percent. Government consumption also rose at a slightly slower pace. Net exports further contributed to weaker headline growth, with export growth slowing and imports rebounding on the quarter after a previous decline.

At their most recent policy meeting earlier this month, officials at the Bank of Korea left policy rates on hold at 3.50 percent, as they have since the start of 2023. This decision reflected officials' assessment that core inflation will "continue its slowing trend". Officials also expressed confidence in the growth outlook and retained their forecast for GDP to expand by 2.5 percent this year.

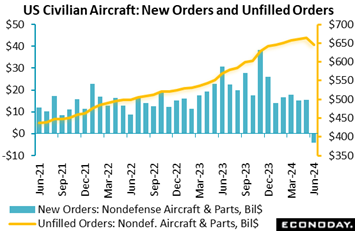

Order cancellations for commercial aircraft skewed US durable goods orders 6.6 percent lower in June, in an unexpected result compared to Econoday's consensus for a 0.3 percent rise. Excluding transportation equipment (which includes aircraft), orders actually rose 0.5 percent to easily exceed the consensus. Core capital goods, which have been on the retreat, shot up 1.0 percent to also beat the consensus though this only barely reversed a downward revised 0.9 percent decline in May (originally minus 0.6 percent). Order cancellations for commercial aircraft skewed US durable goods orders 6.6 percent lower in June, in an unexpected result compared to Econoday's consensus for a 0.3 percent rise. Excluding transportation equipment (which includes aircraft), orders actually rose 0.5 percent to easily exceed the consensus. Core capital goods, which have been on the retreat, shot up 1.0 percent to also beat the consensus though this only barely reversed a downward revised 0.9 percent decline in May (originally minus 0.6 percent).

New orders for nondefense aircraft and parts (commercial aircraft) fell to minus $4.2 billion versus $15.6 billion in orders for May. Orders for defense aircraft slowed to $4.6 billion from $5.1 billion to further pull down the transportation sector. Motor vehicles did likewise, down 0.1 percent to $64.4 billion.

Elsewhere, however, the news was very good led by machinery with a 1.6 percent gain and including computers and electronics at 0.8 percent. Communications equipment, a smaller category, rose 3.5 percent with electrical equipment up 1.3 percent. All these feed into the core capital goods group and point to a burst of pent-up investment.

The factory sector has been uneven as manifested in this very bumpy set of data. But aircraft orders are often very volatile which put the focus on the otherwise broad gains in this report. Other readings for June include a 1.2 percent jump in shipments, no change for inventories, and a sharp 1.3 percent fall in unfilled orders that were, as new orders were, pulled down by a 2.9 percent drop for commercial aircraft.

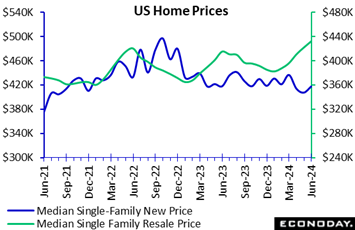

However much home sales have moderated in response to high interest rates, home prices have been holding their own. Sales of new single-family homes fell 0.6 percent in June to a 617,000 annual rate; year-over-year sales were down 7.4 percent. The June reading was well below the consensus of 640,000 in the Econoday survey of forecasters. However much home sales have moderated in response to high interest rates, home prices have been holding their own. Sales of new single-family homes fell 0.6 percent in June to a 617,000 annual rate; year-over-year sales were down 7.4 percent. The June reading was well below the consensus of 640,000 in the Econoday survey of forecasters.

The dip likely reflected both current prices and mortgage interest rates topping 7 percent in May and June. As of mid-July, mortgage rates moved consistently below 7 percent. This may have sparked greater home-buying, although the intense hot weather could have deterred buyer traffic.

The supply of new homes available for sale was at 9.3 months in June, up from 9.1 months in May and the highest since 9.7 in December 2022. Nevertheless, the median price of a new single-family home jumped 2.5 percent in June to $417,300 after $407,100 in May, but was essentially unchanged from $417,600 a year ago. The median price of an existing single-family home, in separately released data, is actually higher than a new home at 432,700 in June, up 2.4 percent on the month and up 4.1 percent on the year. Note that the lower price for new homes may be due to their size, that builders have responded to demand for entry-level units in the absence of existing inventory.

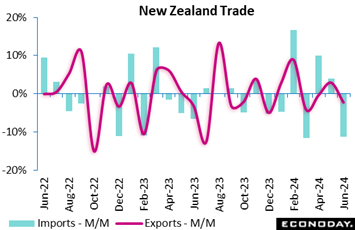

New Zealand's merchandise trade surplus widened from NZ$54 million in May to NZ$699 million in June. Imports and exports both fell sharply after previous increases. New Zealand's merchandise trade surplus widened from NZ$54 million in May to NZ$699 million in June. Imports and exports both fell sharply after previous increases.

Exports fell 2.3 percent on the month in June after advancing 2.9 percent in May and fell 0.1 percent on the year after a previous increase of 0.6 percent. Exports of meat and fruit recorded solid year-over-year increases, offset by declines in exports of dairy products and forestry products. Exports to Australia, Japan, and China fell on the year, outweighing increases in exports to the European Union and the US.

Imports fell 11.3 percent on the month in June, down sharply from an increase of 3.9 percent in May, and fell 13.0 percent on the year after a previous increase of 0.4 percent. Petroleum imports fell sharply on the year after increasing in each of the two previous months, accompanied by further weakness in imports of vehicles and mechanical machinery and equipment. Imports from the European Union and China rose on the year, offset by declines in imports from Australia, Japan, and the US.

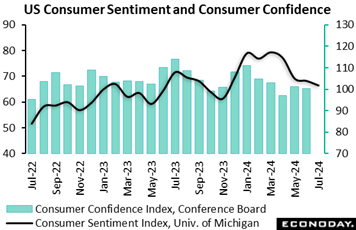

The avalanche of political events the last couple of weeks has had limited impact on US consumer sentiment, so far. Yet July's final index did rise 4 tenths to 66.4 from the mid-month flash to imply a nearly 67-point level in the last half of the month and perhaps a very marginal uptick. The avalanche of political events the last couple of weeks has had limited impact on US consumer sentiment, so far. Yet July's final index did rise 4 tenths to 66.4 from the mid-month flash to imply a nearly 67-point level in the last half of the month and perhaps a very marginal uptick.

Compared to June, however, the index is down nearly 2 points and remains depressed, which the report attributes to the effect of high costs especially on lower income households. As far as politics go, the report warns that upcoming readings may prove volatile as the November election approaches.

Though costs are high, inflation expectations are fully anchored and open a door to a Federal Reserve rate cut. Year-ahead expectations are at 2.9 percent which is down from June's 3.0 percent while 5-year expectations are steady at 3.0 percent where it has settled for the last four months in a row. Note that the green columns of the accompanying graph track the consumer confidence report which will be posted on Tuesday.

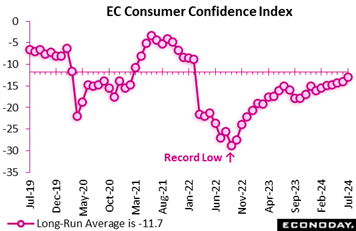

Consumer confidence improved further and by more than expected in July. At minus 13.0, the EU Commission's provisional index was a full point stronger than its June reading and 0.5 points above the market consensus. The latest increase extends the unbroken sequence of gains that began back in February and puts the headline index at its highest level mark since February 2022. The gauge now stands just 1.3 points short of its long-run average. Consumer confidence improved further and by more than expected in July. At minus 13.0, the EU Commission's provisional index was a full point stronger than its June reading and 0.5 points above the market consensus. The latest increase extends the unbroken sequence of gains that began back in February and puts the headline index at its highest level mark since February 2022. The gauge now stands just 1.3 points short of its long-run average.

So far, the ongoing improvement in household sentiment has had little impact on retail sales which, as of May, were just 0.5 percent above their level at the start of the year. However, with inflation having declined significantly and interest rates on the way down, prospects for spending in the third quarter should be rather stronger.

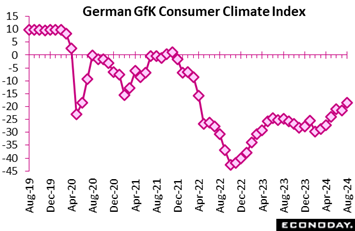

Germany’s consumer climate index highlights a positive shift driven by enhanced income prospects and a minor rise in purchasing power. Although the inclination to save remained unchanged, income expectations have surged by 11.5 points this month, reaching 19.7 for the highest since October 2021. This marks a substantial 25-point increase from last year. The improved income outlook stems from a marginal dip in June's inflation rate to 2.2 percent, combined with notable wage, salary, and pension hikes, leading to real income gains for many German households. Germany’s consumer climate index highlights a positive shift driven by enhanced income prospects and a minor rise in purchasing power. Although the inclination to save remained unchanged, income expectations have surged by 11.5 points this month, reaching 19.7 for the highest since October 2021. This marks a substantial 25-point increase from last year. The improved income outlook stems from a marginal dip in June's inflation rate to 2.2 percent, combined with notable wage, salary, and pension hikes, leading to real income gains for many German households.

Despite these positive income trends, Germans remain cautious about economic recovery over the next year. The economic expectations indicator rose by 7.3 points but only offset the previous month's decline, stabilizing at 9.8 points -- the same as in May 2024. As such, August's headline index, at minus 18.4 and up 2.2 points from July, was stronger than the consensus forecast of minus 21, signaling that while income optimism prevails, broader economic sentiment remains tempered by lingering recovery challenges.

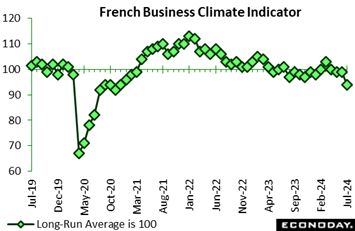

France’s business climate witnessed a pronounced decline in July, with the indicator dropping to 94, its lowest since February 2021, and well below the long-term average of 100. This downturn spans all market sectors. Wholesale trade fell to 92 from 95 in May due to a fall in past sales and a grim business outlook. The services sector experienced a sharp fall from 101 in June to 95 in July, due to lower-than-expected demand. Retail trade, including vehicle trade and repair, fell from 99 in the previous month to 94, reflective of reduced ordering intentions and an unfavourable business outlook. France’s business climate witnessed a pronounced decline in July, with the indicator dropping to 94, its lowest since February 2021, and well below the long-term average of 100. This downturn spans all market sectors. Wholesale trade fell to 92 from 95 in May due to a fall in past sales and a grim business outlook. The services sector experienced a sharp fall from 101 in June to 95 in July, due to lower-than-expected demand. Retail trade, including vehicle trade and repair, fell from 99 in the previous month to 94, reflective of reduced ordering intentions and an unfavourable business outlook.

Manufacturing faced significant challenges, particularly with a decline in foreign orders, falling from 99 in the previous month to 95 in July. The construction sector's business climate dipped slightly from 100 to 99. Additionally, the employment climate worsened, falling to 96 from 100, driven by anticipated reductions in workforce size, especially in temporary and non-temporary work agencies within the services sector.

Overall, the deteriorating business climate indicates a challenging period ahead for French businesses, requiring adaptive strategies and potential policy support to mitigate adverse impacts.

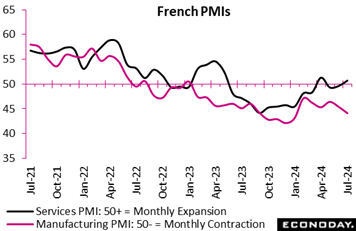

France's services PMI popped back into expansion, rising 1.1 points to 50.7 and a three-month high. However, the manufacturing PMI dropped to a six-month low of 44.1, indicating sharper contraction in factory production. This dichotomy resulted in a slight overall output decline. France's services PMI popped back into expansion, rising 1.1 points to 50.7 and a three-month high. However, the manufacturing PMI dropped to a six-month low of 44.1, indicating sharper contraction in factory production. This dichotomy resulted in a slight overall output decline.

The latest figures highlight persistent demand weakness for French goods and services, despite continued employment growth. Business confidence declined for the fourth consecutive month, reaching its lowest level this year, amid rising input costs and output prices.

Manufacturing faced its 26th consecutive monthly output fall, with the fastest contraction since January, attributed to weak sales and customer delays. Conversely, service sector activity rebounded, driven by the Olympic Games and post-election optimism.

Despite optimism for higher activity in the next 12 months, confidence waned due to concerns over the housing market and potential disruptions from the Olympic Games. This complex economic landscape underscores the challenges and cautious optimism in France's private sector.

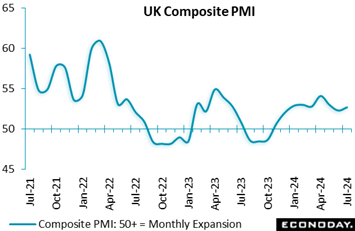

Overall business activity in the UK is performing much as expected this month. At 52.7, the flash composite output index was just 0.1 point above the market consensus and up 0.4 points versus its final print in June. The latest outturn was only a 2-month high but extended the unbroken sequence of positive growth readings to nine months. Overall business activity in the UK is performing much as expected this month. At 52.7, the flash composite output index was just 0.1 point above the market consensus and up 0.4 points versus its final print in June. The latest outturn was only a 2-month high but extended the unbroken sequence of positive growth readings to nine months.

The monthly headline gain reflected fresh progress in both manufacturing and services. For the former, the sector PMI weighed in at 51.8, up from June's final 50.9 and a 2-year peak. In large part, this was attributable to a jump in output (sub-index 54.1) which claimed a 29-month high. Its services counterpart made more limited ground, rising from 52.1 to 52.4.

Aggregate new orders increased by the most since April 2023 on the back of gains in both domestic and overseas demand. Employment growth was also the strongest in more than a year with headcount in manufacturing stabilising after 21 months of contraction. Following June's setback, business confidence posted its sharpest improvement in 15 months and was only slightly below the 2-year high seen in February.

Meantime, input costs climbed by the most in 15 months due to higher transport charges but the inflation rate was still among the softest seen since the beginning of 2021. Moreover, output price inflation slowed to its weakest rate since February 2021, driven by a smaller increase in services companies. That said, the rate of inflation was still above its long-run trend.

In sum, the July results suggest that the economy made a solid start to the current quarter, potentially easing pressure on the Bank of England to cut Bank Rate in August. To be sure, July’s flash increases the likelihood of another split vote in the coming week.

Economists are nailing their forecasts based on Econoday’s Relative Performance Index (RPI) which is sitting right at the zero line, at plus 2 to indicate only the most marginal outperformance relative to expectations. When excluding prices, the RPI-P is at plus 1 to indicate that global inflation forecasts are also dead on.

At 16 on the RPI, the US remains on a gradually rising trend of outperformance supported in the latest week by surprisingly strong GDP. Though the outperformance is still only modest in degree, the strength allows the Federal Reserve to remain patient and points to no action for Wednesday’s policy announcement.

In the Eurozone, recent economic data have largely matched market expectations, as reflected in an RPI of minus 5 and an RPI-P of minus 3. Still, since the start of June there has been a clear downside bias amidst signs that second quarter growth could disappoint (flash report due Tuesday). Some on the ECB’s Governing Council will almost certainly want to cut key interest rates again in September but for most, the coming week’s flash HICP report (due Wednesday) will be a more important determinant.

In the UK, forecasters have been overly optimistic to an even greater extent as the RPI and RPI-P ended last week little changed at minus 29 and minus 31 respectively. Ahead of Thursday’s BoE announcement, this plays into the hands of the MPC’s doves though high inflation in services remains an issue for many policymakers. Forecasters are expecting a rate cut, yet investors are quite evenly split.

In Japan, unexpectedly soft July inflation ensured that the RPI (minus 23) remained well below zero. With the RPI-P (minus 13) also showing some downside bias to the real economy surprises, recent data have done little to boost speculation about a possible BoJ interest rate hike in the coming week.

In China, cuts in a range of central bank interest rates over the last week or so confirmed that economic activity is not recovering as quickly as the authorities were hoping. To this end, although both the RPI (minus 7) and RPI-P (zero) currently show no major forecast errors, both measures have spent most of the last four months quite deep in negative surprise territory.

There were no significant data releases from Canada last week but mainly downside surprises over the last three months meant that the BoC’s 25 basis point cut on Wednesday was widely expected. Indeed, without some improvement, at currently minus 30 and minus 21 respectively, the national RPI and RPI-P warn of probable further monetary easing to come.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, Olajide Oyadeyi, and Theresa Sheehan

US focus in the July 29 week will be narrowly fixed on two times: 14:00 ET on Wednesday when the FOMC releases its policy announcement and 8:30 ET on Friday when the Bureau of Labor Statistics publishes the July employment numbers. Markets are anticipating that the FOMC statement will set the stage for a rate cut in the near future, presumably the September 17-18 meeting. For payrolls, healthy moderate growth of 180,000 is the call.

The Bank of England will announce what is expected to be a rate cut on Thursday, while the Bank of Japan is expected to hold rates steady on Wednesday but announce its reduction schedule for bond purchases. National CPI’s in Europe begin on Tuesday and will followed by Eurozone harmonised inflation data on Wednesday.

GDP’s unfold on Tuesday with first estimates for the second quarter to open with France then Germany followed by Italy and finally the Eurozone. Marginal to modest growth is generally expected.

Japanese industrial production on Wednesday is expected to fall steeply reflecting new safety test issues in the auto industry. A sleeper in the week but a report that should never be overlooked because of its policy implications is the quarterly US employment cost index on Wednesday. A sharp fall in this index, however unlikely, could raise talk for a rate cut at that afternoon’s FOMC announcement.

French Second-Quarter GDP, First Estimate (Tue 0730 CEST; Tue 0530 GMT; Tue 0130 EDT)

Consensus Forecast, Quarter over Quarter: 0.2%

Second-quarter GDP in France is expected to increase a quarterly 0.2 percent to match the first quarter’s modest pace.

German Second-Quarter GDP, First Estimate (Tue 1000 CEST; Tue 0800 GMT; Tue 0400 EDT)

Consensus Forecast, Quarter over Quarter: 0.1%

Consensus Forecast, Year over Year: 0.1%

The flash estimate for second-quarter GDP is marginal expansion of 0.1 percent both on the quarter and on the year. These would compare with quarterly growth of 0.2 percent in the first quarter and yearly contraction of 0.2 percent.

Italian Second-Quarter GDP, First Estimate (Tue 1000 CET; Tue 0800 GMT; Tue 0400 EDT)

Consensus Forecast, Year over Year: 0.9%

Second-quarter GDP is expected to expand 0.9 percent on the year versus 0.7 percent growth in the first quarter.

Eurozone: EC Economic Sentiment for July (Tue 1100 CEST; Tue 0900 GMT; Tue 0500 EDT)

Consensus Forecast: 96.0

Consensus Forecast, Industry Sentiment: -10.0

Consensus Forecast, Consumer Sentiment: -13.0

Economic sentiment in July is expected to hold steady and flat at 96.0 versus June’s 95.9 which was well short of the 100 long-run average.

Eurozone Second-Quarter GDP, First Estimate (Tue 1100 CEST; Tue 0900 GMT; Tue 0500 EDT)

Consensus Forecast: Quarter over Quarter: 0.2%

Consensus Forecast, Year over Year: 0.5%

Second-quarter Eurozone GDP is expected to expand a quarterly 0.2 percent for year-over-year growth of 0.5 percent. These would compare with first-quarter quarterly growth of 0.3 percent and annual growth of 0.4 percent.

German CPI, Preliminary July (Tue 1400 CEST; Tue 1200 GMT; Tue 0800 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 2.2%

July’s consensus is no change at June’s 2.2 percent. May’s rate was 2.4 percent.

US Consumer Confidence Index for July (Tue 1000 EDT; Tue 1400 GMT)

Consensus Forecast: 99.5

The consumer confidence index is expected to fall back again, to a consensus 99.5 versus 100.4 in June which compared with expectations for 100.0 and May’s 101.3.

Korean Industrial Production for June (Wed 0800 KST; Tue 2300 GMT; Tue 1900 EDT)

Consensus Forecast, Month over Month: -0.6%

Industrial production is expected to decrease another 0.6 percent on the month in June versus 1.2 percent contraction in May.

Japanese Industrial Production for June (Wed 0850 JST; Tue 2350 GMT; Tue 1950 EDT)

Consensus Forecast, Month over Month: -4.9%

Consensus Forecast, Year over Year: -7.6%

The result of new safety test issues in the auto industry, industrial production in June is expected fall a steep 4.9 percent to more than reverse May’s better-than-expected 3.6 percent gain. On a year-over-year basis, contraction of 7.6 percent is expected versus May growth of 0.3 percent.

Japanese Retail Sales for June (Wed 0850 JST; Tue 2350 GMT; Tue 1950 EDT)

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: 3.0%

Retail sales are expected to hold at 3.0 percent year-over-year growth in June despite what is expected to be sharp slowing in monthly growth to 0.1 percent from 1.6 percent. The government upgraded its assessment in the May report saying sales are “on a gradual uptrend”.

Australian June and Quarterly CPI (Wed 1130 AEST; Wed 0130 GMT; Tue 2130 EDT)

Consensus Forecast Monthly, Year over Year: 3.8%

Consensus Forecast Quarterly, Quarter over Quarter: 1.0%

Consensus Forecast Quarterly, Year over Year: 3.8%

Consumer prices in June are expected to slow to 3.8 percent year-over-year versus 4.0 percent in May which compared unfavourably with expectations for 3.8 percent and April’s 3.6 percent rate. Second-quarter consumer prices are expected to increase 1.0 percent on the quarter and 3.8 percent on the year. These would compare with first-quarter rates of 1.0 and 3.6 percent.

China: CFLP PMIs for July (Wed 0930 CST; Wed 0130 GMT; Tue 2130 EDT)

Manufacturing PMI, Consensus Forecast: 49.3

Non-manufacturing PMI, Consensus Forecast: 50.2

The CFLP manufacturing PMI is expected to edge lower to 49.3 in July from June’s 49.5 which was unchanged from May and the second straight under 50. The non-manufacturing PMI, expected at 50.2 versus June’s 50.5, has held above 50 for more than a year.

Australian Retail Sales for June (Wed 1130 AEST; Wed 0130 GMT; Tue 2130 EDT)

Consensus Forecast, Month over Month: 0.2%

Retail sales in June are expected to increase 0.2 percent on the month after May’s stronger-than-expected 0.6 percent increase.

Bank of Japan Announcement (Expected sometime between 11:30 and 12:00 JST on Wednesday, July 31)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.0 to 0.1%

The BoJ is expected to maintain its policy stance and wait perhaps until its next meeting in September before raising rates again. The bank is scheduled to decide at this meeting how fast it should reduce the size of its purchases of Japanese government bonds. It is expected to slow the monthly pace to about ¥3 billion to ¥4 billion from ¥6 trillion yen.

German Unemployment Rate for July (Wed 0955 CEST; Wed 0755 GMT; Wed 0355 EDT)

Consensus Forecast: 6.0%

July’s unemployment rate is expected to hold steady at June’s 6.0 percent. The Germany jobs market has remained tight.

Eurozone HICP Flash for July (Wed 1100 CEST; Wed 0900 GMT; Wed 0500 EDT)

Consensus Forecast, Year over Year: 2.4%

Narrow Core

Consensus Forecast, Year over Year: 2.8%

Consensus for July’s HICP flash is 2.4 percent and 2.8 percent for the narrow core. These would compare respectively with June’s 2.5 and 2.9 percent and with May’s 2.6 and 2.9 percent.

US ADP Private Payrolls for July (Wed 0815 EDT; Wed 1215 GMT)

Consensus Forecast: 154,000

Forecasters see ADP's July employment number at 154,000. This would compare with June growth in private payrolls reported by the Bureau of Labor Statistics of 136,000. ADP’s number for June was 150,000.

US Second-Quarter Employment Cost Index (Wed 0830 EDT; Wed 1230 GMT)

Consensus Forecast, Quarter over Quarter: 1.0%

After the first quarter's 1.2 percent increase, forecasters see employment costs easing to 1.0 percent in the second quarter.

Canadian Monthly GDP for May (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Month over Month: 0.1%

After rebounding 0.3 percent in April following no change in March, GDP in May is expected to rise 0.1 percent.

US Federal Reserve Announcement (Wed 1800 GMT; Wed 1400 EDT)

Consensus Forecast, Policy Rate Change: 0 basis points

Consensus Forecast, Target Range: 5.25% to 5.50%

With growth solid and inflation still above target, the Fed is once again expected to keep rates unchanged. Whether policymakers signal a pending rate for the September meeting is considered a possibility.

Australian International Trade in Goods for June (Thu 1130 AEST; Thu 0130 GMT; Wed 2130 EDT)

Consensus Forecast, Balance: A$5.0 billion

Consensus for international trade in goods in June is a surplus of A$5.0 billion versus May’s surplus of A$5.8 billion that was down from April’s $6.0 billion as imports rose more than exports.

China: S&P Manufacturing PMI for July (Thu 0945 CST; Thu 0145 GMT; Wed 2145 EDT)

Consensus Forecast: 51.5

After 51.8 in June, S&P's manufacturing PMI in July is expected to only ease slightly to 51.5. This index has held in plus-50 ground for nine straight months.

Indian PMI Manufacturing for July (Thu 1030 IST; Thu 0500 GMT; Thu 0100 EDT)

Consensus Forecast, Year over Year: 58.5

July’s manufacturing PMI is expected climb yet further to 58.5 versus June’s 58.3 and May’s 57.5.

Eurozone Unemployment Rate for June (Thu 1100 CEST; Thu 0900 GMT; Thu 0500 EDT)

Consensus Forecast: 6.5%

Consensus for June's unemployment rate is an incremental rise to 6.5 percent versus May and April’s record low, both at 6.4 percent. The Eurozone labour market has been very tight.

Bank of England Announcement (Thu 1200 BST; Thu 1100 GMT; Thu 0700 EDT)

Consensus Forecast, Change: -25 basis points

Consensus Forecast, Level: 5.00%

Services inflation might still be sticky but forecasters see the Bank of England cutting Bank Rate by 25 basis points to 5.00 percent.

US: ISM Manufacturing Index for July (Thu 1000 EDT; Thu 1400 GMT)

Consensus Forecast: 48.8

After edging 2 tenths lower in June to 48.5, the ISM manufacturing index, which has missed Econoday’s consensus the last three reports in a row, is expected to edge higher to a still subpar 48.8 in July.

Korean CPI for July (Fri 0800 KST; Thu 2300 GMT; Thu 1900 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 2.5%

Consumer prices in July, which in June slowed from May’s 2.7 to 2.4 percent, are expected to edge up to 2.5 percent.

US Employment Situation for July (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast: Change in Nonfarm Payrolls: 180,000

Consensus Forecast: Unemployment Rate: 4.1%

Consensus Forecast: Average Hourly Earnings M/M: 0.3%

A 180,000 rise is the call for nonfarm payroll growth in July versus 206,000 in a June report that included sharp downward revisions to prior months. Average hourly earnings in July are expected to rise 0.3 percent on the month to match June’s rise. July’s unemployment rate is expected to hold unchanged at June’s 4.1 percent which was up from May’s 4.0 percent.

|