|

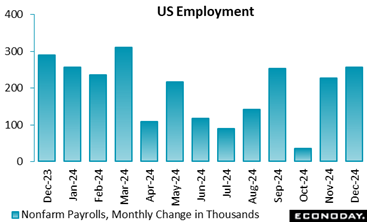

The December employment report surprised to the upside with a generous increase in nonfarm payrolls of 256,000 compared to the consensus of up 157,000. The prior two months were little revised at down 8,000. Overall, nonfarm payrolls have recovered nicely from short-term impacts from two major hurricanes and strike activity in September and October.

It should be noted that the monthly average for the fourth quarter 2024 is up 170,000 compared to up 267,000 in the first quarter, up 147,000 in the second quarter, and up 159,000 in the third quarter. The underlying trend for job gains is one consistent with a temperate labor market able to absorb those who have lost jobs and those who are new entrants.

Fed policymakers should be satisfied that the labor market has cooled from its heated pace of recent years to a sustainable level against the backdrop of modest expansion. An unemployment rate of 4.1 percent in December is in line with the trend in the second half of 2024 and one which the FOMC will find comfortable in terms of the maximum employment side of the dual mandate. As far as the labor market data go, policymakers will find no reason to lower rates to support job growth.

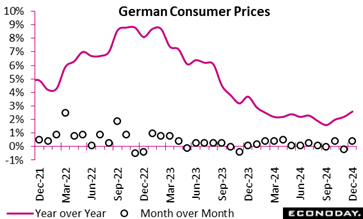

The CPI rose by 2.6 percent in December 2024 compared to the same month in the previous year, exceeding the annual average of 2.2 percent for 2024 and the consensus estimate of 2.4 percent. Month-over-month, consumer prices increased by 0.4 percent (0.1 percentage points above the consensus) signalling persistent short-term upward price trends. The CPI rose by 2.6 percent in December 2024 compared to the same month in the previous year, exceeding the annual average of 2.2 percent for 2024 and the consensus estimate of 2.4 percent. Month-over-month, consumer prices increased by 0.4 percent (0.1 percentage points above the consensus) signalling persistent short-term upward price trends.

Similarly, the harmonised index for consumer prices (HICP), which allows for EU-wide comparisons, recorded a higher annual increase of 2.8 percent and a notable 0.7 percent rise from November. With an annual average HICP inflation rate of 2.5 percent, these figures highlight a slightly more pronounced inflationary environment when harmonised standards are applied.

Core inflation, at 3.1 percent for December, exceeds both headline CPI and HICP rates. This suggests that inflationary pressures are entrenched in non-volatile sectors, such as services and durable goods, excluding food and energy.

Overall, the data reflects a complex inflation landscape where both volatile and core components contribute to rising costs.

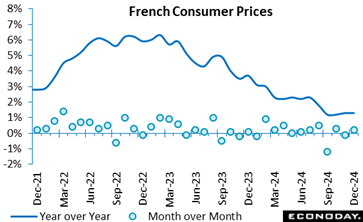

In December 2024, the CPI rose 1.3 percent year-over-year, mirroring November's figure. Energy prices rebounded slightly, counterbalanced by declining prices in manufactured goods and a slowdown in food price growth, leading to overall stability in these sectors. Tobacco and service prices maintain steady growth rates. In December 2024, the CPI rose 1.3 percent year-over-year, mirroring November's figure. Energy prices rebounded slightly, counterbalanced by declining prices in manufactured goods and a slowdown in food price growth, leading to overall stability in these sectors. Tobacco and service prices maintain steady growth rates.

Over the month, consumer prices rose by 0.2 percent, following a 0.1 percent fall in November. This uptick is attributed primarily to higher service prices, especially in transport, alongside a modest rise in energy prices, driven by petroleum products. In contrast, manufactured goods prices declined, while food and tobacco prices remained stable.

The harmonised index of consumer prices grew by 1.8 percent year-over-year in December, slightly up from November's 1.7 percent growth, with a 0.2 percent monthly increase. This modest inflation trend reflects a delicate balance between stabilising food and tobacco prices and sector-specific increases in energy and services. Overall, the data indicate restrained inflation, with sectoral variances influencing short-term price dynamics.

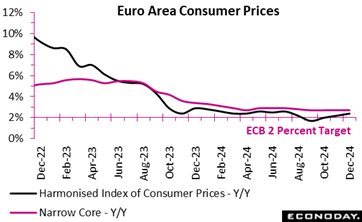

The Euro area annual inflation rose to 2.4 percent in December 2024, in line with the consensus and up from 2.2 percent in November, reflecting a modest uptick in price pressures. The Euro area annual inflation rose to 2.4 percent in December 2024, in line with the consensus and up from 2.2 percent in November, reflecting a modest uptick in price pressures.

Services led the inflation surge with an annual rate of 4.0 percent, slightly higher than November's 3.9 percent, highlighting persistent cost pressures in labour-intensive sectors. The core rates, as well as food, alcohol, and tobacco prices remained steady at 2.7 percent, maintaining their contribution to inflation. Non-energy industrial goods inflation softened marginally to 0.5 percent from 0.6 percent in November. Energy prices, however, reversed their deflationary trend, edging up by 0.1 percent in December after a minus 2.0 percent decline in November, signalling early signs of recovery in the energy sector.

Regionally, headline inflation rose only slightly in France (1.8 percent after 1.7 percent) but much more sharply in Spain (2.8 percent after 2.4 percent) and Germany (2.8 percent after 2.4 percent). However, inflation fell in Italy (1.4 percent after 1.5 percent).

In essence, while core inflation and food inflation remain elevated, the stabilisation of energy prices suggests easing cost pressures in some areas.

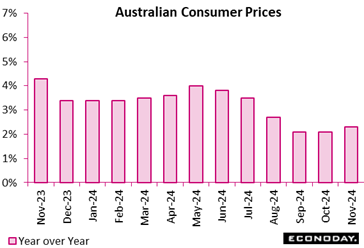

Monthly CPI data show headline inflation in Australia rose from 2.1 percent in October to 2.3 percent in December, just above the consensus forecast of 2.2 percent. Headline inflation has now been within the Reserve Bank of Australia's target range of two percent to three percent for four months after it had been above that range for nearly three years. This monthly indicator measures the year-over-year change in the CPI index compared with the same month twelve months earlier. Monthly CPI data show headline inflation in Australia rose from 2.1 percent in October to 2.3 percent in December, just above the consensus forecast of 2.2 percent. Headline inflation has now been within the Reserve Bank of Australia's target range of two percent to three percent for four months after it had been above that range for nearly three years. This monthly indicator measures the year-over-year change in the CPI index compared with the same month twelve months earlier.

Higher headline inflation in December smaller declines in energy prices. Automotive fuel prices fell 10.2 percent on the year after a previous decline of 11.5 percent while electricity prices dropped 21.5 percent on the year after a previous decline of 35.6 percent. This fall in electricity prices was mainly driven by government rebates. Other categories of spending recorded offsetting moves with food prices recording a weaker increase and communication prices up slightly on the year after a previous decline.

Consumer inflation in China eased further to a nine-month low of a mere 0.1 percent rise on the year in December after slowing to 0.2 percent in November from 0.3 percent in October, indicating demand remains sluggish despite the government's drive to lift the economy out of the pandemic slump. Consumer inflation in China eased further to a nine-month low of a mere 0.1 percent rise on the year in December after slowing to 0.2 percent in November from 0.3 percent in October, indicating demand remains sluggish despite the government's drive to lift the economy out of the pandemic slump.

The weakest figure since the 0.1 percent rise in March 2024 was mainly caused by a 2.2 percent drop in transportation and communications costs and a 0.7 percent dip in the prices for living goods and services as well as flat prices of food, tobacco and alcohol, offsetting a 4.9 percent jump in "other supplies and services" and a 1.2 percent gain in clothing.

On the month, the consumer price index was unchanged after slumping 0.6 percent in November, the largest drop in eight months, and falling 0.3 percent in October. For the whole of 2024, the CPI rose 0.2 percent from the previous year.

China's headline producer price index fell 2.3 percent on the year in December, moderating from a fall of 2.9 percent in November. Headline PPI inflation has been in negative territory since late 2022. The index fell 0.1 percent on the month, as it did previously. Consumer price data also published today showed a further moderation in headline inflation.

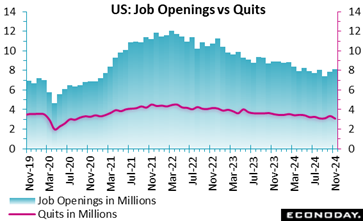

Job openings are up 259,000 in November to 8.098 million after an upward revision to 7.839 million in October. The November level is above the consensus of 7.650 million in the Econoday survey of forecasters. Job opening for private industry is up 256,000 in part on substantial gains of 114,000 in financial activities and 273,000 in professional and business services with sizeable declines of 83,000 in leisure and hospitality, 89,000 in information, and 56,000 in manufacturing. The job openings rate is 4.8 in November, the highest in six months. Job openings are up 259,000 in November to 8.098 million after an upward revision to 7.839 million in October. The November level is above the consensus of 7.650 million in the Econoday survey of forecasters. Job opening for private industry is up 256,000 in part on substantial gains of 114,000 in financial activities and 273,000 in professional and business services with sizeable declines of 83,000 in leisure and hospitality, 89,000 in information, and 56,000 in manufacturing. The job openings rate is 4.8 in November, the highest in six months.

The pace of hiring is down 125,000 to 5.269 million in November after 5.394 million in October. Hiring is down 114,000 for private industries with the largest declines at down 66,000 in professional and business services and 39,000 in manufacturing. Leisure and hospitality hiring is up 74,000 in November. Government hiring is down 11,000, mostly at the state and local level at down 10,000. The hiring rate is 3.3 in November, its lowest in six months.

Job separations are down 180,000 in November to 5.126 million after 5.306 million in October. Total private job separations are down 184,000 in November while government is up 4,000. The separations rate is down a tenth to 3.2 in November. Job quits – a subset of separations – is down 218,000 to 3.065 million with private industry quits down 223,000 and government up 4,000. Notable is that quits in leisure and hospitality are down 107,000, reflecting much less churn in that segment of the labor market. The quits rate is 1.9 in November after 2.1 in October. Layoffs and discharges – another subset of separations – is up 17,000 to 1.765 million in November with private layoffs up 19,000 and government down 1,000. Layoffs in leisure and hospitality are up 108,000, but widespread declines offset much of that increase. The layoff and discharges rate is unchanged at 1.1 for the past three months.

Overall, if hiring is slow for November, layoff activity remains low. With more jobs opening up in November, hiring could pick up again. Importantly, fewer workers are changing jobs at the moment which will mean less competition for at least some categories of workers, and therefore less upward pressure on employee compensation.

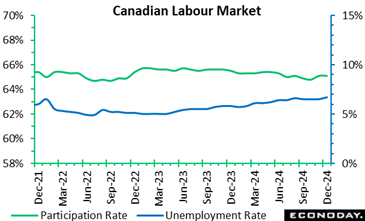

Canada's employment growth continued to rebound in December, rising by 91,000 or an encouraging 0.4 percent from November, above expectations for a 20,000 gain in Econoday's survey of forecasters. The unemployment rate dipped to 6.7 percent in December from 6.8 percent in November. Forecasters looked for unemployment to rise to 6.9 percent in December. Canada's employment growth continued to rebound in December, rising by 91,000 or an encouraging 0.4 percent from November, above expectations for a 20,000 gain in Econoday's survey of forecasters. The unemployment rate dipped to 6.7 percent in December from 6.8 percent in November. Forecasters looked for unemployment to rise to 6.9 percent in December.

The slight fall in the unemployment rate comes after it hit its highest level in November since January 2017 (not counting the COVID-impacted impacted 2020-2021 period), and interrupting its upward trend since April 2023. The unemployment rate is still up 0.9 percentage points compared to December 2023. The slight fall in the unemployment rate comes after it hit its highest level in November since January 2017 (not counting the COVID-impacted impacted 2020-2021 period), and interrupting its upward trend since April 2023. The unemployment rate is still up 0.9 percentage points compared to December 2023.

The participation rate was 65.1 percent in December, the same as in November and versus 64.8 percent in October.

Total hours worked rose 0.5 percent in December but are up 2.1 percent from a year ago. Average hourly wages increased at their slowest pace since May 2022, rising by 3.8 percent year-over-year after the annual growth rate was 4.1 percent in November, and up 4.9 percent in October.

For December, employment gains were mainly in full-time work, up 56,000 or 0.3 percent. This follows an increase of 51,000 in November, the third employment gain in the past four months.

Private sector jobs rose by 26,700 in December after a mere 6,300 rise in November and a 20,500 increase in October. Public sector employment rose by 40,400 following November's increase of 45,000, and after falling by 17,200 in October. Self-employment rebounded by 23,700, after a 700 downtick in November.

Nonfarm payrolls are up 256,000 in December after a small net downward revision of 8,000 in the prior two months. The December rise is well above the consensus of up 157,000 in the Econoday survey of forecasters. Private payrolls are up 223,000 in December and government jobs are up 33,000. Payroll growth remains strong overall, although with pockets of weakness. Nonfarm payrolls are up 256,000 in December after a small net downward revision of 8,000 in the prior two months. The December rise is well above the consensus of up 157,000 in the Econoday survey of forecasters. Private payrolls are up 223,000 in December and government jobs are up 33,000. Payroll growth remains strong overall, although with pockets of weakness.

Payrolls at private goods-producers are down 8,000 in December, with an increase of 8,000 in construction more than offset by declines of 3,000 in mining and logging and 13,000 in manufacturing. However, private service-providers' payrolls are up 231,000 in December with solid increases of 69,500 in health care and social assistance, 43,400 in retail, 43,000 in leisure and hospitality, and 28,000 in professional and business services. Payrolls at private goods-producers are down 8,000 in December, with an increase of 8,000 in construction more than offset by declines of 3,000 in mining and logging and 13,000 in manufacturing. However, private service-providers' payrolls are up 231,000 in December with solid increases of 69,500 in health care and social assistance, 43,400 in retail, 43,000 in leisure and hospitality, and 28,000 in professional and business services.

Some of the December increase can be attributed to a bounceback after weather impacts and strike activity affected payroll counts in October and November.

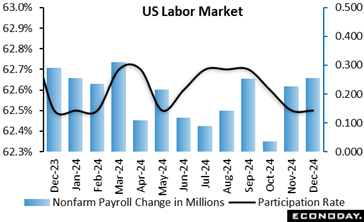

The average workweek is unchanged at 34.3 in December from November. Average hourly earnings gains moderated slightly in December from the pace in November but remain on the rise at up 0.3 percent month-over-month and up 3.9 percent year-over-year.

The unemployment rate dips one-tenth to 4.1 percent in December. The December rate is just below the consensus of 4.2 percent in the Econoday survey. The U-6 unemployment rate – the broadest measure of unemployment – is down two-tenths to 7.5 percent in December. The labor force participation rate is unchanged at 62.5 percent in December from November.

The unemployment rate was steady due to an increase of 243,000 in the labor force. The employment-to-population ratio is up two-tenths to 60.0 percent. The number of people working part-time for economic reasons in December is down 111,000 in December, job losers are down 143,000, and job leavers are up 93,000.

Fed policymakers will find ample evidence of ongoing strength in the labor market when they meet on January 28-29. At least on the maximum employment side of the dual mandate, there will be little reason to ease the fed funds target rate range from its current restrictive 4.25-4.50 percent. They also may have less reason to be concerned that the cooling in the labor market that they hoped to achieve has been accomplished without going too far.

The December employment report includes annual revisions to the Household Survey. The Establishment survey will be revised with the January data in the report set for release on Friday, February 7 at 8:30 ET.

Retail sales in Australia rose 0.8 percent on the month in November after an increase of 0.6 percent in October, with year-over-year growth moderating from 3.4 percent to 3.0 percent. Performance was mixed on a regional basis, with sales a little weaker than the national average in the most populous state, New South Wales, but stronger in the third most populous state, Queensland. Clothing retailers, department stores and cafe and restaurants recorded sales increases stronger than the headline increase, offset by weaker growth in sales of food by other retailers. Retail sales in Australia rose 0.8 percent on the month in November after an increase of 0.6 percent in October, with year-over-year growth moderating from 3.4 percent to 3.0 percent. Performance was mixed on a regional basis, with sales a little weaker than the national average in the most populous state, New South Wales, but stronger in the third most populous state, Queensland. Clothing retailers, department stores and cafe and restaurants recorded sales increases stronger than the headline increase, offset by weaker growth in sales of food by other retailers.

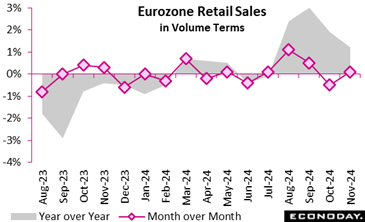

November 2024's retail landscape revealed a slight uptick of 0.1 percent in retail trade volume from October 2024, following a decline of 0.3 percent the previous month, suggesting a cautious stabilisation in consumer spending. November 2024's retail landscape revealed a slight uptick of 0.1 percent in retail trade volume from October 2024, following a decline of 0.3 percent the previous month, suggesting a cautious stabilisation in consumer spending.

Sector-specific analysis for November 2024 reveals contrasting trends: the volume of retail trade for food, drinks, and tobacco edged up by a modest 0.1 percent, while automotive fuel sales in specialized stores saw a more robust increase of 0.8 percent. This could indicate rising consumer mobility or a response to fluctuating fuel prices. Conversely, non-food products experienced a decrease of 0.6 percent, possibly reflecting shifting consumer priorities or greater sensitivity to non-essential spending amidst economic uncertainties.

Year-over-year, the comparison with November 2023 shows an overall healthier retail environment with a 1.2 percent increase in the retail sales index, 0.6 percentage points below the consensus. Each sector recorded growth, with non-food products leading at a 1.5 percent increase, suggesting a recovery or adaptation in consumer habits over the year. Food, drinks, and tobacco, as well as automotive fuel, also grew, though at a slower pace, marking a steady but cautious optimism in the market.

These patterns underscore a gradual but uneven recovery trajectory within the euro area's retail sector, with varying degrees of resilience across different market segments.

Industrial production in November 2024 showed promising recovery, with a 1.5 percent month-over-month increase, 0.8 percent more than expected and reversing the revised October dip of 0.4 percent. However, year-over-year comparisons reveal lingering challenges, as production was 2.8 percent lower than November 2023. Over the three months (September to November), output was down 1.1 percent, reflecting cautious momentum in recovery. Industrial production in November 2024 showed promising recovery, with a 1.5 percent month-over-month increase, 0.8 percent more than expected and reversing the revised October dip of 0.4 percent. However, year-over-year comparisons reveal lingering challenges, as production was 2.8 percent lower than November 2023. Over the three months (September to November), output was down 1.1 percent, reflecting cautious momentum in recovery.

Key sectors drove the positive results, with energy production surging 5.6 percent, construction growing by 2.1 percent, and other transport equipment (e.g., aircraft, ships, military vehicles) booming by 11.4 percent. Capital goods (1.4 percent), consumer goods (0.9 percent), and intermediate goods (0.5 percent) also contributed modestly.

Despite these gains, energy-intensive industries remain under pressure. While production rose 1.5 percent month-over-month, the three-month comparison shows a decline of 4.1 percent. Year-over-year, this segment was down 0.4 percent, underscoring sustained strain from high energy costs and input constraints.

The data reflects core manufacturing and construction resilience but highlights structural challenges, particularly in energy-dependent industries. Strategic measures to stabilise energy-intensive sectors may be pivotal in sustaining industrial growth through 2025.

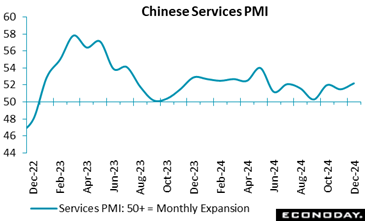

China's services sector posted its fastest growth in seven months in December as the Caixin purchasing managers index unexpectedly rose to 52.2 (vs. consensus 51.4) after dipping to 51.5 in November from 52.0 in October. The index indicated expansion for two years. New business gains offset the drag from weaker demand from overseas, which showed its first decline since August 2023. Higher costs led to the first increase in selling prices in six months. China's services sector posted its fastest growth in seven months in December as the Caixin purchasing managers index unexpectedly rose to 52.2 (vs. consensus 51.4) after dipping to 51.5 in November from 52.0 in October. The index indicated expansion for two years. New business gains offset the drag from weaker demand from overseas, which showed its first decline since August 2023. Higher costs led to the first increase in selling prices in six months.

Sentiment in the Chinese services sector remained positive but the level of business confidence eased to the second-lowest since March 2020, the December survey showed. Some businesses expressed concerns over rising competition and the negative effect outlook for international trade.

In light of slowing factory activity, the composite index covering the entire economy slipped to 51.4 (consensus 52.2) in December after rebounding to 52.3 in November from 51.9 in October but the index was still above the neural line of 50 for the 14th straight month.

In last week's data, China's manufacturing sector showed expansion for the third straight month in December but the pace of growth as indicated by the Caixin PMI unexpectedly slowed to 50.5 (vs. consensus 51.6) after rising to 51.5 in November from 50.3 in October. The slowdown was caused by lower growth in new orders and production while weak exports dampened sales.

The Chinese economy has been struggling to recover from the slump triggered by property market debt crisis, prompting Beijing to promise more fiscal and monetary stimulus measures amid heightened global uncertainty. U.S. President-elect Donald Trump has threatened to impose a 25 percent tariff on all goods from Mexico and Canada, and an additional 10 percent tariff on imports from China.

Monday, India’s consumer price index for December is estimated to increase 5.29 percent on the year from November’s 4.48 percent.

On Tuesday, the US producer price index final demand is expected to increase 0.3 percent in December on the month, with a year-on-year increase of 3.3 percent. Excluding food and energy, the PPI is forecast to be up 0.2 percent on the month and up 3.4 percent on the year.

Wednesday, the French annual consumer price index inflation is estimated up 1.3 percent in the final reading for December, unchanged from the preliminary report and unchanged from 1.3 percent in November. CPI is expected to go up 0.2 percent on the month, also unrevised from the preliminary result. For the HICP, the figures are seen unrevised at 1.8 percent on the year and up 0.2 percent on the month.

On the other hand, the US consumer price index is expected to go up 0.3 percent in December on the month with a year-on-year rise of 2.9 percent. For CPI excluding food and energy, the call is a more moderate 0.2 percent increase on the month and up 3.3 percent on the year. After four straight monthly core increases of 0.3 percent, a 0.2 percent December figure would be most welcome.

The Eurozone industrial production output is expected to go up 0.5 percent on the month in November after a flat showing in October. On the year, the consensus looks for a decline of 1.6 percent. The US Empire manufacturing index is expected to stay barely positive at 1.0 in January versus 0.2 in December, and way down from a bizarrely strong 31.2 in November.

Thursday, Japan’s producer inflation is forecast to creep up further to a 17-month high of 3.8 percent in December (the highest since 4.5 percent in June 2023) after accelerating to 3.7 percent in November from 3.6 percent in October. Energy costs have risen in Japan since the government ended a three-month utility subsidy program in October (bills paid later) and there has been a spike in farm produce costs caused by lingering domestic rice shortages.

Also on Thursday is the South Korean Bank of Korea Announcement. The Bank of Korea has its work cut out given political turmoil and other headwinds, including the threat of US tariffs. The consensus looks for another 25 basis point rate cut with more to come.

Friday, China’s GDP report is expected to show growth of 1.7 percent on the quarter and 5.0 percent on year.

India Consumer Price Index for December (Mon 1200 IST; Mon 0630 GMT; Mon 0130 EST)

Consensus Forecast, Y/Y: 5.29%

Consensus Range, Y/Y: 4.5% to 5.6%

Slower food price inflation is expected to help annual CPI slow to a 5.29 percent increase in December from 5.48 percent in November. That would tend to support the view that the Reserve Bank of India will cut rates in February.

US NFIB Small Business Optimism Index for December (Tue 0600 EST; Tue 1100 GMT)

Consensus Forecast, Index: 101.3

Consensus Range, Index: 99.0 to 102.0

Business confidence surged after Republicans swept to power in US elections in November. Forecasts call for a slight correction to 101.3 in December from 101.7 in November, which was up sharply from 93.7 in October.

US PPI-Final Demand for December (Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast, PPI-FD - M/M: 0.3%

Consensus Range, PPI-FD - M/M: 0.3% to 0.4%

Consensus Forecast, CPI - Y/Y: 3.3%

Consensus Range, CPI - Y/Y: 3.0% to 3.4%

Consensus Forecast, Ex-Food & Energy - M/M: 0.2%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.3%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.4%

Consensus Range, Ex-Food & Energy - Y/Y: 3.2% to 3.8%

The consensus sees PPI up 0.3 percent in December on the month, with a year on year increase of 3.3 percent. For PPI ex food & energy, the call is up 0.2 percent on the month and up 3.4 percent on the year.

India Wholesale Price Index for December (Wed 1200 IST; Wed 0630 GMT; Wed 0130 EST)

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 2.2% to 2.3%

The consensus looks for a 2.3 percent increase for wholesale prices on the year for December after a 1.89 percent rise in November.

France CPI for December (Wed 0845 CET; Wed 0745 GMT; Wed 0245 EST)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.2% to 0.2%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: 1.3% to 1.3%

Consensus Forecast, HICP - M/M: 0.2%

Consensus Range, HICP - M/M: 0.2% to 0.2%

Consensus Forecast, HICP - Y/Y: 1.8%

Consensus Range, HICP - Y/Y: 1.8% to 1.8%

French annual CPI inflation is seen at 1.3 percent in the final reading for December, unchanged from the preliminary report and unchanged from 1.3 percent in November. CPI is expected up 0.2 percent on the month, also unrevised from the preliminary result. For the HICP, the figures are seen unrevised at 1.8 percent on the year and up 0.2 percent on the month.

Eurozone Industrial Production for November (Wed 1100 CET; Wed 1000 GMT; Wed 0500 EST)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.5% to 0.5%

Consensus Forecast, Y/Y: -1.6%

Consensus Range, Y/Y: -1.9% to -1.5%

Industrial output is expected up 0.5 percent on the month in November after a flat showing in October. On the year, the consensus looks for a decline of 1.6 percent.

Canada Manufacturing Sales for November (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.5% to 0.5%

Forecasters uniformly agree with Statistics Canada’s preliminary estimate calling for a gain of 0.5 percent for November. That would follow a 2.1 percent gain in October, which was mainly due to rising sales of petroleum and coal products.

US CPI for December (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, CPI - M/M: 0.3%

Consensus Range, CPI - M/M: 0.2% to 0.4%

Consensus Forecast, CPI - Y/Y: 2.9%

Consensus Range, CPI - Y/Y: 2.9% to 2.9%

Consensus Forecast, Ex-Food & Energy - M/M: 0.2%

Consensus Range, Ex-Food & Energy - M/M: -0.1% to 0.3%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.3%

Consensus Range, Ex-Food & Energy - Y/Y: 3.3% to 3.3%

The consensus sees CPI up 0.3 percent in December on the month with a year on year rise of 2.9 percent. For CPI ex food & energy, the call is a more moderate 0.2 percent increase on the month and up 3.3 percent on the year. After four straight monthly core increases of 0.3 percent, a 0.2 percent December figure would be most welcome.

US Empire State Manufacturing Index for January (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, Index: 1.0

Consensus Range, Index: -2.0 to 5.0

The Empire manufacturing index is expected to stay barely positive at 1.0 in January versus 0.2 in December, and way down from a bizarrely strong 31.2 in November.

Japan PPI for December (Thu 0850 JST; Wed 2350 GMT; Wed 1850 EST)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.2% to 0.5%

Consensus Forecast, Y/Y: 3.8%

Consensus Range, Y/Y: 3.6% to 3.9%

Producer inflation in Japan is forecast to creep up further to a 17-month high of 3.8% in December (the highest since +4.5% in June 2023) after accelerating to 3.7% in November from 3.6% in October. Energy cost have risen since the government ended a three-month utility subsidy program in October (bills paid later) and there has been a spike in farm produce costs caused by lingering domestic rice shortages. The slight easing in the yen's general weakness might have provided only a limited impact on helping lower import costs.

On the month, the corporate goods price index is forecast to mark an 11th increase in 12 months, up 0.4%, after rising 0.3% the previous month.

South Korea Bank of Korea Announcement (Thu 1000 KST; Thu 0100 GMT; Wed 2000 EST)

Consensus Forecast, Change: -25 bps

Consensus Range, Change: -25 Bps to 0 bps

Consensus Forecast, Level: 2.75%

Consensus Range, Level: 2.75% to % 3.00%

The Bank of Korea has its work cut out given political turmoil and other headwinds, including the threat of US tariffs. The consensus looks for another 25 basis point rate cut with more to come.

Australia Labour Force Survey for December (Thu 1130 AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Unemployment Rate: 4.2%

Consensus Range, Unemployment Rate: 3.9% to 4.2%

Consensus Forecast, M/M: 20K

Consensus Range, M/M: 18K to 25K

Job growth in Australia in December is expected to show a modest 20,000 increase on the month as growth flagged headed into year end. The jobless rate is expected to tick up to 4.2 percent from 3.9 percent in November.

Germany CPI for December (Thu 0800 CET; Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.4% to 0.4%

Consensus Forecast, Y/Y: 2.6%

Consensus Range, Y/Y: 2.6% to 2.6%

Consensus Forecast, HICP - M/M: 0.7%

Consensus Range, HICP - M/M: 0.7% to 0.7%

Consensus Forecast, HICP - Y/Y: 2.8%

Consensus Range, HICP - Y/Y: 2.8% to 2.8%

German annual inflation is seen at 2.6 percent in the final reading for December, unchanged from the preliminary report. CPI is expected up 0.4 percent on the month, unrevised from the preliminary. For the HICP, the figures are seen unrevised at 2.8 percent on the year and up 0.7 percent on the month.

Canada Housing Starts for December (Thu 0815 EST; Thu 1315 GMT)

Consensus Forecast, Annual Rate: 260K

Consensus Range, Annual Rate: 240K to 270K

Starts are seen pretty steady at a 260,000 rate in December versus 262,000 in November.

US Jobless Claims (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Initial Claims - Level: 214K

Consensus Range, Initial Claims - Level: 207K to 230K

Claims are expected to bounce back to 214,000 in the latest week after surprising to the downside at 201,000 last week, a figure presumably depressed by the holidays.

US Retail Sales for December (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Retail Sales - M/M: 0.5%

Consensus Range, Retail Sales - M/M: 0.3% to 0.7%

Consensus Forecast, Ex-Vehicles - M/M: 0.4%

Consensus Range, Ex-Vehicles - M/M: 0.2% to 0.6%

Consensus Forecast, Ex-Vehicles & Gas - M/M: 0.4%

Consensus Range, Ex-Vehicles & Gas - M/M: 0.3% to 0.5%

Forecasters look for another good gain in retail sales with a boost from autos and recovery from storm damage in the Southeast. The unexpected strength in the job market is providing support. The consensus sees sales up 0.5 percent on the month with ex-autos up 0.4 percent and sales ex-autos and gasoline up 0.4 percent.

US Philadelphia Fed Manufacturing Index for January (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Index: -8.0

Consensus Range, Index: -10.1 to 0.0

Forecasters expect the Philly Fed index to remain in contraction at minus 8.0 in January but a bit better than minus 16.4 in December.

US Imports and Export Prices for December (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Import Prices - M/M: -0.1%

Consensus Range, Import Prices - M/M: -0.3% to 0.2%

Consensus Forecast, Export Prices - M/M: 0.1%

Consensus Range, Export Prices - M/M: -0.4% to 0.5%

Import prices are seen down 0.1 percent on the month and export prices up 0.1 percent.

US Business Inventories for November (Thu 1000 EST; Thu 1500 GMT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.6%

The consensus sees inventories up 0.1 percent on the month.

US Housing Market Index for January (Thu 1000 EST; Thu 1500 GMT)

Consensus Forecast, Index: 46.0

Consensus Range, Index: 45.0 to 47.0

The index is seen flat at 46 in January from 46 in December and not much changed from 44 a year ago.

China GDP for Fourth Quarter (Fri 1000 CST; Fri 0200 GMT; Thu 2100 EST)

Consensus Forecast, Q/Q: 1.7%

Consensus Range, Q/Q: 1.6% to 1.7%

Consensus Forecast, Y/Y: 5.0%

Consensus Range, Y/Y: 4.4% to 5.1%

GDP growth is seen at 1.7 percent on the quarter and 5.0 percent on year.

China Industrial Production for December (Fri 1000 CST; Fri 0200 GMT; Thu 2100 EST)

Consensus Forecast, Y/Y: 5.4%

Consensus Range, Y/Y: 5.2% to 5.5%

A 5.4 percent increase is expected on year.

China Retail Sales for December (Fri 1000 CST; Fri 0200 GMT; Thu 2100 EST)

Consensus Forecast, Y/Y: 3.5%

Consensus Range, Y/Y: 3.2% to 3.5%

The consensus looks for an increase of 3.5 percent on year.

Eurozone HICP for December (Fri 1100 CET; Fri 1000 GMT; Fri 0500 EST)

Consensus Forecast, HICP - Y/Y: 2.4%

Consensus Range, HICP - Y/Y: 2.4% to 2.4%

Consensus Forecast, Narrow Core - Y/Y: 2.8%

Consensus Range, Narrow Core - Y/Y: 2.7% to 2.8%

Forecasts call for HICP up 2.4 percent on year and narrow core up 2.8 percent.

US Housing Starts and Permits for December (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Starts - Annual Rate: 1.320 M

Consensus Range, Starts - Annual Rate: 1.301 M to 1.345 M

Consensus Forecast, Permits - Annual Rate: 1.458 M

Consensus Range, Permits - Annual Rate: 1.450 M to 1.500 M

The call for December looks for a 1.320 million unit rate, up a bit from a sluggish 1.289 million in November. Permits are seen at 1.45 million versus 1.505 million in November.

US Industrial Production for December (Fri 0915 EST; Fri 1415 GMT)

Consensus Forecast, Industrial Production - M/M: 0.3%

Consensus Range, Industrial Production - M/M: 0.1% to 0.5%

Consensus Forecast, Manufacturing Output - M/M: 0.4%

Consensus Range, Manufacturing Output - M/M: 0.2% to 0.4%

Consensus Forecast, Capacity Utilization Rate: 77.0%

Consensus Range, Capacity Utilization Rate: 76.9% to 77.6%

The consensus sees a modest bounce for industrial production, up 0.3 percent, with manufacturing up 0.4 percent, after a series of weak months. Capacity utilization is seen at 77.0 percent, up from a surprisingly low 76.8 percent in November.

|