|

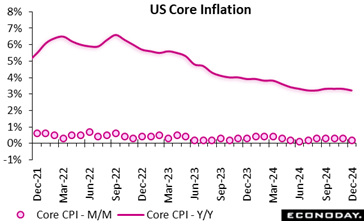

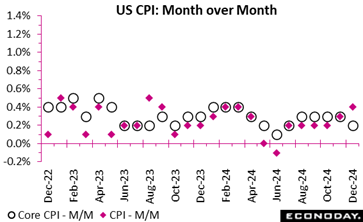

With the January 28-29 FOMC meeting on the near horizon, sorting out this week’s economic data is a challenge. Opinions seem to be divided as to how best to interpret the December CPI numbers. At the all-items level, the December CPI is up 2.9 percent year-over-year and rising for a second month in a row. On the other hand, the December core CPI is up 3.2 percent compared to a year ago, a one-tenth dip from up 3.3 percent in the prior three months. The FOMC is unlikely to overreact to a single month’s reading. What it will take into account is that the movement is small and will need a few more data points before anything can be usefully concluded. Importantly, if services prices are showing disinflationary progress, the assist from falling commodities costs is pretty much gone. Taken together, substantive improvements in overall upward price pressure may be harder to come by the closer inflation measures get to the Fed’s 2 percent objective.

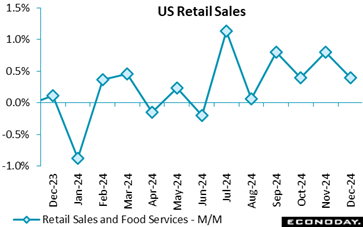

Total retail and food services sales rose 0.4 percent in December, capping off a solid fourth quarter 2024 for consumer spending. Although a good bit of the strength in retail sales in the last three months has been due to sales of motor vehicles, the underlying pace of retail activity is still consistent with modest expansion. However, some of the fourth quarter consumer spending was associated with getting ahead of potential price increases for imported goods in anticipation of threatened tariff hikes in 2025. Spending in the first quarter 2025 may not keep pace.

The Fed’s Beige Book for the period roughly from late November through early January was the first to show uniform expansion across the 12 districts since the spring of 2022. However, growth was widely described as slight or modest. A recession may not be on the near horizon and the outlook for the near future is a little more optimistic, but there are plenty of unknowns and risks that could hinder growth in 2025.

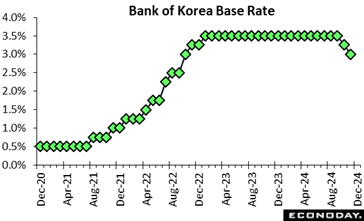

The Bank of Korea left its main policy rate unchanged at 3.00 percent at its policy meeting held today, contrary to the consensus forecast for a further cut of 25 basis points to 2.75 percent. This follows a cut of 25 basis points at each of their two previous meetings after officials had previously advised that a rate cut at upcoming meetings may be considered. Policy rates have been at restrictive levels since early 2023 as part of efforts to return headline inflation to their target level of 2.0 percent. The Bank of Korea left its main policy rate unchanged at 3.00 percent at its policy meeting held today, contrary to the consensus forecast for a further cut of 25 basis points to 2.75 percent. This follows a cut of 25 basis points at each of their two previous meetings after officials had previously advised that a rate cut at upcoming meetings may be considered. Policy rates have been at restrictive levels since early 2023 as part of efforts to return headline inflation to their target level of 2.0 percent.

Since the previous BoK meeting late November, data have shown increases in headline inflation from 1.3 percent in October to 1.5 percent in November and 1.9 percent in December, with core inflation steady over this period just below 2.0 percent. In the statement accompanying today's decision, officials expressed confidence that inflation will remain stable but advised that they are likely to revise down their growth forecasts in coming weeks.

Today's decision to leave rates on hold reflects uncertainties about the economic outlook but officials also noted recent exchange rate volatility in response to "unexpected political risks" and "the changing domestic political situation" following last month's short-lived period of martial law. These factors appear to have convinced officials that policy should stay on hold today, but they also signalled that further cuts will be considered in coming months to help mitigate downside risk to growth.

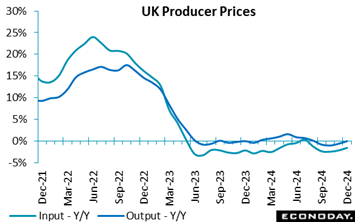

In December 2024, producer price dynamics highlighted a gradual easing of cost pressures across the supply chain. Input prices fell by 1.5 percent annually, softening from November's sharper 2.1 percent decline, while factory gate prices edged up by 0.1 percent, marking a shift from a 0.5 percent drop in the prior month. Monthly gains of 0.1 percent in both input and output prices suggest a slight rebound, driven by increased costs in parts, equipment, and refined petroleum products. In December 2024, producer price dynamics highlighted a gradual easing of cost pressures across the supply chain. Input prices fell by 1.5 percent annually, softening from November's sharper 2.1 percent decline, while factory gate prices edged up by 0.1 percent, marking a shift from a 0.5 percent drop in the prior month. Monthly gains of 0.1 percent in both input and output prices suggest a slight rebound, driven by increased costs in parts, equipment, and refined petroleum products.

Service producer prices, however, reflected broader sectoral moderation, rising by 2.9 percent annually in the fourth quarter, a deceleration from 3.7 percent in the third quarter. This indicates that inflationary pressures in services-often a sticky component-are beginning to cool, aligning with broader disinflationary trends.

The interplay between declining input costs and stabilising output prices could offer some relief to manufacturers, easing margin pressures. However, the upward contributions from specific sectors like petroleum products point to lingering cost volatility. Overall, the data suggests improving supply chain conditions, but persistent sector-specific pressures underline the importance of vigilance in monitoring inflation drivers.

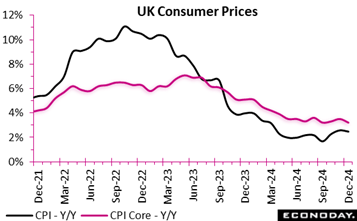

In December 2024, the annual CPI rose by 2.5 percent, slightly easing from November's 2.6 percent, while monthly growth rose to 0.3 percent. Transport costs drove upward pressures, offset by a decline in restaurant and hotel contributions. Core CPI remained a concern at 3.2 percent, albeit down from 3.5 percent in November, signalling persistent underlying price pressures despite improvements. In December 2024, the annual CPI rose by 2.5 percent, slightly easing from November's 2.6 percent, while monthly growth rose to 0.3 percent. Transport costs drove upward pressures, offset by a decline in restaurant and hotel contributions. Core CPI remained a concern at 3.2 percent, albeit down from 3.5 percent in November, signalling persistent underlying price pressures despite improvements.

The CPI goods annual rate increased to 0.7 percent, reflecting stronger goods inflation, while services inflation softened significantly from 5.0 percent to 4.4 percent, hinting at sectoral shifts in cost dynamics. Similarly, the broader CPIH remained steady at 3.5 percent annually, with monthly gains slowing to 0.3 percent. Core CPIH dipped to 4.2 percent, showing some relief but reflecting substantial inflationary pressures in services, where rates eased from 5.7 percent to 5.4 percent.

The cooling of headline and core measures suggests some progress in inflation control, though elevated transport and service costs may continue to challenge consumers. Overall, the data suggests a cautious, wait-and-see approach at the next policy meeting, focusing on consolidating gains in inflation control without undermining economic momentum.

The Consumer Price Index in December increased 0.4 percent, following a 0.3 percent increase in November, and after rising 0.2 percent in each of the previous 4 months. This compares to expectations for a 0.3 percent rise in the Econoday survey of forecasters. The Consumer Price Index in December increased 0.4 percent, following a 0.3 percent increase in November, and after rising 0.2 percent in each of the previous 4 months. This compares to expectations for a 0.3 percent rise in the Econoday survey of forecasters.

Over the last 12 months, consumer prices are up 2.9 percent, compared to a 2.7 percent year-over-year rise in November. Expectations were for a 2.9 percent increase. Over the last 12 months, consumer prices are up 2.9 percent, compared to a 2.7 percent year-over-year rise in November. Expectations were for a 2.9 percent increase.

Core CPI, excluding food and energy prices, rose 0.2 percent, slowing down after rising by 0.3 percent in each of the previous four months. Consumer prices less food and energy rose 3.2 percent from the December 2023, after rising by 3.3 percent on an annual basis in November.

The data eases concern that the Federal Reserve will need to reverse course and begin hiking rates once again to combat inflation. Instead, this provides the central bank with more reason to hit pause on rate cuts at its January meeting.

After rising by 0.3 percent in November, shelter costs rose by the same rate in December. Food prices increased by 0.3 percent, building on a 0.4 percent jump in November, as grocery prices and restaurant prices each rose by 0.3 percent. Energy costs jumped 2.6 percent over the month, after being up 0.2 percent in November.

Energy prices are down 0.5 percent year-over-year, following a 3.2 percent decline for the 12 months ending November. Food prices increased 2.5 percent over the last year, after rising by 2.4 percent in November.

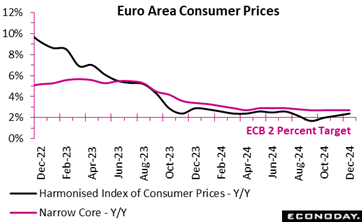

The euro area annual inflation rate edged up to 2.4 percent in December 2024 in line with the consensus and slightly higher than November's 2.2 percent but lower than 2.9 percent recorded in December 2023. This marks a deceleration in price growth compared to the previous year but indicates a modest increase in recent months. The euro area annual inflation rate edged up to 2.4 percent in December 2024 in line with the consensus and slightly higher than November's 2.2 percent but lower than 2.9 percent recorded in December 2023. This marks a deceleration in price growth compared to the previous year but indicates a modest increase in recent months.

Services played a dominant role in driving inflation, contributing 1.78 percentage points (pp) to the annual rate. This highlights the persistent price pressures in labour-intensive sectors, possibly reflecting rising wage costs or elevated demand. Food, alcohol, and tobacco also made a significant contribution of 0.51 pp, underscoring the impact of supply chain dynamics and seasonal demand, especially during the festive period. Non-energy industrial goods added 0.13 pp, a likely reflection of stable but restrained consumer demand for manufactured products. Notably, energy's contribution was minimal (0.01 pp), signalling a stabilisation in energy prices, which contrasts sharply with its earlier role as a major inflationary driver.

Regionally, headline inflation rose in France (1.8 percent after 1.7 percent), Spain (2.8 percent after 2.4 percent), and Germany (2.8 percent after 2.4 percent), but fell in Italy (1.4 after 1.5 percent). Inflation rates in France and Italy remain below the European Central Bank's target, while Germany and Spain exceed it.

Overall, December 2024's inflation figures reflect a shift from energy-driven pressures to service-sector dominance, with subdued contributions from other categories.

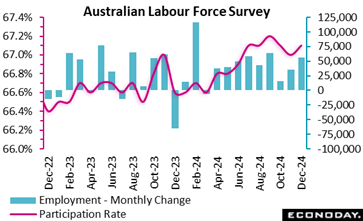

Labour market conditions in Australia gained further momentum in December, with employment increasing for the ninth consecutive month and at a faster pace and the unemployment and participation rates continuing to indicate very tight conditions. This will likely keep the focus of the Reserve Bank of Australia on risks to the inflation outlook. Labour market conditions in Australia gained further momentum in December, with employment increasing for the ninth consecutive month and at a faster pace and the unemployment and participation rates continuing to indicate very tight conditions. This will likely keep the focus of the Reserve Bank of Australia on risks to the inflation outlook.

The number of people employed in Australia rose by 56,300 in December, up sharply from 35,600 in November and well above the consensus forecast for an increase of 20,000. Full-time employment fell by 23,700 persons after a previous increase of 56,200 persons, but part-time employment rose by 80,000 persons after a previous decline of 17,000 persons. Hours rose 0.5 percent on the mopnth after no change previously.

Today's data also show the unemployment rate rose from 3.9 percent in November to 4.0 percent in December. The participation rate rose from 67.0 percent to 67.1 percent, matching its record high.

In November 2024, the UK economy showed a modest recovery with a 0.1 percent growth in monthly real GDP, driven by a service sector rebound. This followed a 0.1 percent contraction in October, marking a stabilisation in overall activity. However, the three months to November 2024 remained flat, indicating stagnation in broader economic growth. In November 2024, the UK economy showed a modest recovery with a 0.1 percent growth in monthly real GDP, driven by a service sector rebound. This followed a 0.1 percent contraction in October, marking a stabilisation in overall activity. However, the three months to November 2024 remained flat, indicating stagnation in broader economic growth.

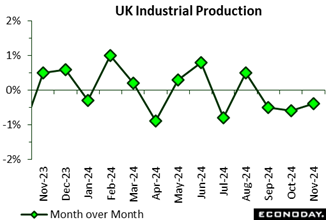

In contrast, the production sector faced ongoing challenges, with output declining by 0.4 percent in November and 0.7 percent over the three-month period, largely due to persistent weaknesses in manufacturing. Construction provided a bright spot, posting a 0.4 percent growth in November after a 0.3 percent decline in October. This sector also expanded by 0.2 percent over the three-month period, offering some resilience amid mixed economic signals.

Overall, while November's modest growth highlights recovery in key areas like services and construction, persistent declines in production and a stagnant quarterly performance underscore lingering economic headwinds.

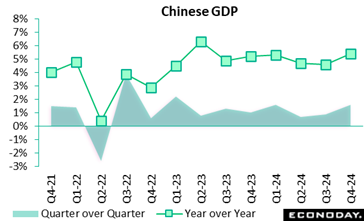

China's GDP rose 1.6 percent on the quarter in the three months to December, up from growth of 0.9 percent in the three months to September, with year-over-year growth picking up from 4.6 percent to 5.4 percent. Monthly activity data also published today showed stronger growth in key activity indicators but another substantial decline in house prices. China's GDP rose 1.6 percent on the quarter in the three months to December, up from growth of 0.9 percent in the three months to September, with year-over-year growth picking up from 4.6 percent to 5.4 percent. Monthly activity data also published today showed stronger growth in key activity indicators but another substantial decline in house prices.

Today's data follow a series of policy measures announced by Chinese officials in September and October in response to ongoing weakness in the property sector and sluggish growth in consumer spending and manufacturing output. Officials lowered the seven-day reverse repo rate, cut banks' reserve requirements, and brought forward planned government spending.

In their statement accompanying today's data, officials characterised the data as showing the economy is "generally stable with steady progress", judging that conditions have "recovered remarkably" in response to their "timely" policy measures. Officials, however, provided little guidance about whether additional changes to policy settings will be considered in the near-term.

Data published today were stronger than consensus expectations for year-over-year growth of 5.0 percent, but in line with the quarter-over-quarter growth forecast of 1.7 percent.

Retail and food services spending is up 0.4 percent in December after a small upward revision to up 0.8 percent in November. The increase is just below the consensus of up 0.5 percent in the Econoday survey of forecasters. As expected, spending was solid for motor vehicles and there was generally increased spending associated with the winter holidays in most other categories. Retail and food services spending is up 0.4 percent in December after a small upward revision to up 0.8 percent in November. The increase is just below the consensus of up 0.5 percent in the Econoday survey of forecasters. As expected, spending was solid for motor vehicles and there was generally increased spending associated with the winter holidays in most other categories.

Sales of motor vehicles and parts are up 0.7 percent in December after a 3.1 percent increase in the prior month. Excluding motor vehicles, total sales are up 0.4 percent in December. This matches the Econoday survey consensus. Sales at gasoline service stations are 1.5 percent higher in December and probably reflect holiday travel. Excluding motor vehicles and gasoline, total sales are up 0.3 percent higher, just below the consensus in the Econoday survey.

With sales increasing at year-end more-or-less on expectations, the retail numbers are in line with a good pace of consumer spending in the fourth quarter 2024.

Sales of motor vehicles account for 19.6 percent of the total in December. The next largest share of sales is 17.4 percent for nonstore retailers which include online etailers. The category is up 0.2 percent in December from the prior month after rising 1.7 percent in November from October.

Spending at food and beverage stores is up 0.8 percent in December and probably reflects both more shopping for food at home and higher prices for eggs and poultry. Spending at restaurants is down 0.3 percent in December, suggesting more entertaining at home during the holiday season. Spending on home furnishings is up 2.3 percent.

There are increases likely associated with gift-buying. Electronics and appliances are up 0.4 percent, clothing stores are up 1.5 percent, miscellaneous stores are up 4.3 percent, general merchandise is up 0.3 percent, and sporting goods, hobby, musical instruments, and bookstores are up 2.6 percent.

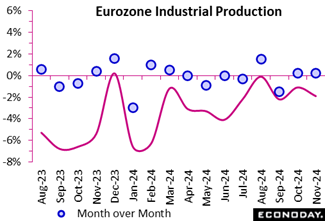

In November 2024, industrial production in the euro area showed modest monthly growth of 0.2 percent, consistent with October's revised figure, while the annual output contracted by 1.9 percent. Monthly growth was driven by strong gains in durable consumer goods (1.5 percent) and energy (1.1 percent), indicating resilience in consumer-driven and energy sectors. Intermediate goods and capital goods also posted 0.5 percent increases, signalling a moderate recovery in industrial inputs and investment-linked outputs. Non-durable consumer goods lagged, growing only 0.1 percent. In November 2024, industrial production in the euro area showed modest monthly growth of 0.2 percent, consistent with October's revised figure, while the annual output contracted by 1.9 percent. Monthly growth was driven by strong gains in durable consumer goods (1.5 percent) and energy (1.1 percent), indicating resilience in consumer-driven and energy sectors. Intermediate goods and capital goods also posted 0.5 percent increases, signalling a moderate recovery in industrial inputs and investment-linked outputs. Non-durable consumer goods lagged, growing only 0.1 percent.

On an annual basis, the decline was broad-based, with intermediate goods (minus 2.5 percent) and capital goods (minus 2.8 percent) suffering the largest contractions, reflecting challenges in industrial supply chains and investment activities. Energy (minus 1.3 percent) and durable consumer goods (minus 1.0 percent) also declined, while non-durable consumer goods remained stable, possibly buoyed by sustained consumer demand for essential goods.

Regionally, industrial production fell on an annual basis in Spain (minus 0.8 percent after 3.1 percent), France (minus 1.1 percent after minus 1.0 percent), Italy (minus 1.5 percent after minus 3.5 percent), and Germany (minus 3.3 percent after minus 4.5 percent). Revisions to October data highlight slight improvements, with the euro area's monthly growth adjusted to 0.2 percent and annual contraction to minus 1.1 percent, suggesting the industrial sector may be stabilising, albeit slowly.

These trends emphasise the industrial sector's short-term recovery, tempered by persistent annual declines.

Production output in the UK faced continued challenges in November 2024, declining by 0.4 percent, marking the third consecutive monthly fall and reaching its lowest level since May 2020. This downturn was driven by decreases across key sectors: manufacturing (minus 0.3 percent), mining and quarrying (minus 1.5 percent), and water supply and sewerage (minus 0.3 percent), partially offset by a modest increase in electricity and gas (0.2 percent). Production output in the UK faced continued challenges in November 2024, declining by 0.4 percent, marking the third consecutive monthly fall and reaching its lowest level since May 2020. This downturn was driven by decreases across key sectors: manufacturing (minus 0.3 percent), mining and quarrying (minus 1.5 percent), and water supply and sewerage (minus 0.3 percent), partially offset by a modest increase in electricity and gas (0.2 percent).

Manufacturing, the largest contributor to the decline, saw reductions in 7 of its 13 sub-sectors. Notable contractions came from other manufacturing and repair (minus 2.1 percent), basic pharmaceutical products (minus 1.9 percent), and transport equipment (minus 0.9 percent). These trends underline persistent headwinds in the industrial landscape.

The broader picture remains concerning, with production output for the three months to November 2024 down by 0.7 percent compared to the previous quarter. This represents the seventh consecutive quarterly fall, driven largely by a 1.0 percent decline in manufacturing. Although minor gains in electricity and gas (0.5 percent) and mining and quarrying (0.3 percent) offered some relief, they were insufficient to offset the broader downturn.

With sustained declines across multiple sectors, November's data highlights significant structural challenges in production, signalling the need for targeted interventions to stabilise industrial output.

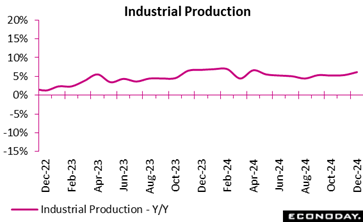

Chinese industrial production rose 6.2 percent on the year in December, picking up from growth of 5.4 percent in November. This is the strongest growth since April last year. Within the industrial sector, manufacturing output rose 6.1 percent on the year after increasing 6.0 percent previously. Utilities output and mining output rose 5.3 percent and 3.1 percent on the year respectively after previous increases of 1.6 percent and 4.2 percent respectively. In month-over-month terms, industrial production rose 0.64 percent after increasing 0.46 percent previously. Chinese industrial production rose 6.2 percent on the year in December, picking up from growth of 5.4 percent in November. This is the strongest growth since April last year. Within the industrial sector, manufacturing output rose 6.1 percent on the year after increasing 6.0 percent previously. Utilities output and mining output rose 5.3 percent and 3.1 percent on the year respectively after previous increases of 1.6 percent and 4.2 percent respectively. In month-over-month terms, industrial production rose 0.64 percent after increasing 0.46 percent previously.

Today's data follow a series of policy measures announced by Chinese officials in September and October in response to ongoing weakness in the property sector and sluggish growth in consumer spending and manufacturing output. Officials lowered the seven-day reverse repo rate, cut banks' reserve requirements, and brought forward planned government spending.

In their statement accompanying today's data, officials characterised the data as showing the economy is "generally stable with steady progress", judging that conditions have "recovered remarkably" in response to their "timely" policy measures. Officials, however, provided little guidance about whether additional changes to policy settings will be considered in the near-term.

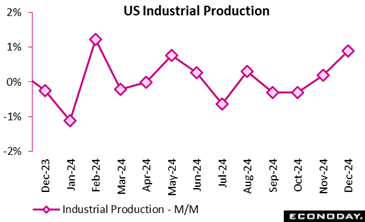

Industrial production is up 0.9 percent in December from November and revised higher to up 0.2 percent in November from October. The increase for December is above the consensus of up 0.3 percent in the Econoday survey of forecasters. In December, manufacturing got a boost at the strike at Boeing was settled. Mining rebounded in December in part on higher demand and higher prices. Utilities output increased in response to colder across the US. Industrial production is up 0.9 percent in December from November and revised higher to up 0.2 percent in November from October. The increase for December is above the consensus of up 0.3 percent in the Econoday survey of forecasters. In December, manufacturing got a boost at the strike at Boeing was settled. Mining rebounded in December in part on higher demand and higher prices. Utilities output increased in response to colder across the US.

Manufacturing is up 0.6 percent in December with durables production up 0.4 percent. Production of motor vehicles and parts eased back 0.6 percent in December following the rebound of up 3.4 percent in November. and nondurables up 0.7 percent. However, aerospace production jumps 6.3 percent in December. Excluding motor vehicles, manufacturing production is up 0.7 percent in December. Nondurables manufacturing is up 0.7 percent in December, in part on an increase of 1.6 percent in petroleum and coal products.

Mining output is up 1.8 percent in December on demand for energy products. Utilities output is up 2.1 percent in December with increases of 1.6 percent in electric and 6.2 percent in natural gas.

Capacity utilization is at 77.6 percent in December after 77.0 percent in November. December is above the consensus of 77.0 percent in the Econoday survey. Manufacturing capacity usage is at 76.6 percent, mining at 90.8 percent, and utilities at 71.1 percent. The average for capacity utilization for 1972-2023 is 79.7 percent.

Monday starts off with China’s loan prime rate for December. Forecasters estimate the policy rate to be flat at 3.10 percent for the 1-year lending rate and unchanged at 3.60 percent for the 5-year. Also on Monday is Germany’s producer price index which is expected to be up an impressive 1.0 percent on the year, following November’s 0.1 percent increase on the year. Forecasters also estimate a 0.4 percent increase on month.

On Tuesday, Canada’s total consumer price index is expected to fall 0.4 percent on the month and to rise 1.8 percent from a year ago versus 0.0 percent on the month and 1.9 percent on year in November. December’s monthly decline largely reflects the impact of a GST sales tax holiday that went into effect in December. The slower yearly CPI increase shows the impact of slower food price growth, which offsets an increase in energy inflation.

Wednesday, the United States leading index is expected to resume its downtrend with a decline of 0.1 percent in December after rising in November for the first time since February 2022.

Thursday, Japan’s merchandise trade balance is estimated to post a deficit of ¥50.0 billion for a sixth consecutive shortfall, narrowing from a revised ¥110.32 billion deficit in November and the ¥323.54 billion deficit in December 2023 and the record shortfall of ¥3,506.43 billion (¥3.51 trillion) in January 2023.Export values are expected to post a third straight year-on-year rise in December, up 3.0 percent while import values are expected to mark their ninth straight increase, up 4.4 percent.

The United States jobless claims is also out on Thursday. Claims are expected to be nearly flat at 218,000 after a larger than expected increase of 14,000 to 217,000 a week ago. That would compare with the four-week moving average of 212,750, however there is often volatility in this series around holiday periods like year end.

On Friday, Japan’s consumer price index is expected to accelerate in two of the three key measures in December, with the core reading (excluding fresh food) seen up 2.9 percent on year after rising to 2.7 percent in November from October's 2.3 percent. Three-month utility subsidies for peak time air conditioner use ended in November while processed food prices remained high in protracted rice shortages. The year-on-year increase in the total CPI is forecast at 3.4 percent, also up from 2.9 percent the previous month. The underlying inflation measured by the core-core CPI (excluding fresh food and energy) is seen at 2.4 percent after rising to 2.4 percent in November from 2.3 percent in October.

Also on Friday is Japan’s Bank of Japan announcement. The Bank of Japan's nine-member board is widely expected to decide in a majority vote to raise the policy interest rate by another 25 basis points to 0.5 percent at its meeting on Jan. 23-24 after leaving it steady at 0.25 percent in the last three meetings. The bank raised the key rate to the current level from a range of 0 percent to 0.1 percent in July and conducted its first rate hike in 17 years in March 2024, when it also ended its controversial seven-year-old yield curve control framework.

United States existing home sales for December is also out on Friday where it is expected to hold roughly steady at an annual rate of 4.16 million units in December versus 4.15 million in November despite rising mortgage rates in December.

China Loan Prime Rate for December (Mon 0915 CST; Mon 0115 GMT; Sun 2015 EST)

Consensus Forecast, 1-Year Rate - Change: 0 bp

Consensus Range, 1-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 1-Year Rate - Level: 3.10%

Consensus Range, 1-Year Rate - Level: 3.10% to 3.10%

Consensus Forecast, 5-Year Rate - Change: 0 bp

Consensus Range, 5-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 5-Year Rate - Level: 3.60%

Consensus Range, 5-Year Rate - Level: 3.60% to 3.60%

Forecasters see the policy rate flat at 3.10 percent for the 1-year lending rate and unchanged at 3.60 percent for the 5-year.

Germany PPI for December (Mon 0800 CET; Mon 0700 GMT; Mon 0200 EST)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.2% to 0.5%

Consensus Forecast, Y/Y: 1.0%

Consensus Range, Y/Y: 1.0% to 1.3%

German producer prices were up 0.1 percent on year in November, their first annual increase since June 2023. The consensus forecast for German PPI in December sees a more impressive increase of 1.0 percent on the year, so the period of wholesale price deflation appears to have ended. Forecasters also look for an increase of 0.4 percent month on month in December.

Germany ZEW Survey for January (Tue 1100 CET; Tue 1000 GMT; Tue 0500 EST)

Consensus Forecast, Current Conditions: -93.1

Consensus Range, Current Conditions: -94.0 to -93.0

Consensus Forecast, Economic Sentiment: 14.0

Consensus Range, Economic Sentiment: 10.0 to 15.4

Current conditions are expected flat at minus 93.1 in January from December. The economic sentiment index, reflecting economic expectations, is seen retreating to 14.0 from 15.7 in December after a remarkable rise from 7.4 in November.

Canada CPI for December (Tue 0830 EST; Tue 1330 GMT)

Consensus Forecast, M/M: -0.4%

Consensus Range, M/M: % -0.7% to 0.2%

Consensus Forecast, Y/Y: 1.8%

Consensus Range, Y/Y: 1.5% to 1.9%

Consensus Forecast, Core CPI - Y/Y: 1.6%

Consensus Range, Core CPI - Y/Y: 1.5% to 1.9%

Total CPI is expected to fall 0.4 percent on the month and to rise 1.8 percent from a year ago versus 0.0 percent on the month and 1.9 percent on year in November. December’s monthly decline largely reflects the impact of a GST sales tax holiday that went into effect in December. The slower yearly CPI increase shows the impact of slower food price growth, which offsets an increase in energy inflation.

New Zealand CPI for Fourth Quarter (Wed 1045 NZDT; Tue 2145 GMT; Tue 1645 EST)

Consensus Forecast, Q/Q: 0.5%

Consensus Range, Q/Q: 0.4% to 0.5%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 2.1% to 2.2%

The consensus looks for CPI up 0.5 percent in the fourth quarter with a 2.1 percent annual increase from a year ago. That compares with increases of 0.6 percent on quarter and 2.2 percent on year in Q3. A 2.1 percent outcome would square with the RBNZ’s most recent forecast. Meanwhile, core inflation looks to be moving back toward the 2 percent midpoint of the RBNZ target range.

United States Leading Indicators for December (Wed 1000 EST; Wed 1500 GMT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: % -0.2% to 0.1%

The leading index is expected to resume its downtrend with a decline of 0.1 percent in December after rising in November for the first time since February 2022.

Japan Merchandise Trade for December (Thu 0850 JST; Wed 2350 GMT; Wed 1850 EST)

Consensus Forecast, Balance: -50.0 B

Consensus Range, Balance: -450.2 B to 96.9 B

Consensus Forecast, Imports - Y/Y: 4.4%

Consensus Range, Imports - Y/Y: -0.5% to 5.9%

Consensus Forecast, Exports - Y/Y: 3.0%

Consensus Range, Exports - Y/Y: -1.2% to 4.0%

Japanese export values are forecast to post a third straight year-on-year rise in December, up 3.0 percent, led by solid demand for semiconductors, food and plastics. Shipments of automobiles are expected to show declines amid global uncertainties. Import values are expected to mark their ninth straight increase, up 4.4 percent, reflecting demand for non-ferrous metal ore, computers and non-ferrous metals. Purchases of semiconductors, semiconductors and smartphones are seen down on year.

The trade balance is forecast to post a deficit of ¥50.0 billion for a sixth consecutive shortfall, narrowing from a revised ¥110.32 billion deficit in November and the ¥323.54 billion deficit in December 2023 and the record shortfall of ¥3,506.43 billion (¥3.51 trillion) in January 2023.

South Korea GDP for Fourth Quarter (Thu 0800 KST; Wed 2300 GMT; Wed 1800 EST)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.2% to 0.5%

Consensus Forecast, Y/Y: 1.5%

Consensus Range, Y/Y: 1.2% to 1.5%

Forecasts look for GDP up 0.2 percent on the quarter and up 1.5 percent on the year in Q4 after a quarterly rise of 0.1 percent and an increase of 1.5 percent on year in Q3. Net exports made a positive contribution in the quarter, offsetting a weaker showing from consumption and the domestic economy. Consumption slowed at year end due to the national mourning period after the plane crash in late December.

Singapore CPI for December (Thu 1300 SGT; Thu 0500 GMT; Thu 0000 EST)

Consensus Forecast, Y/Y: 1.6%

Consensus Range, Y/Y: 1.5% to 1.7%

Annual CPI inflation is expected unchanged at 1.6 percent in December from November.

Canada Retail Sales for November (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: 0.0% to 0.2%

Forecasters agree with the StatsCan estimate looking for an unchanged reading on the month. Auto sales were up strongly along with gas station sales, reflecting higher prices, but those pluses were offset by weakness in core retail sales.

Eurozone EC Consumer Confidence Flash for January (Thu 1600 CET; Thu 1500 GMT; Thu 1000 EST)

Consensus Forecast, Index: -14.3

Consensus Range, Index: -14.7 to -14.0

The consensus looks for minus 14.3 in January versus minus 14.5 in December, not much change after a series of declines since October.

United States Jobless Claims (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Initial Claims - Level: 218K

Consensus Range, Initial Claims - Level: 190K to 220K

Claims are expected nearly flat at 218,000 after a bigger than expected increase of 14,000 to 217,000 a week ago. That would compare with the four-week moving average of 212,750. There is often volatility in this series around holiday periods like year end.

Japan CPI for December (Fri 0830 JST; Thu 2330 GMT; Thu 1830 EST)

Consensus Forecast, CPI - Y/Y: 3.4%

Consensus Range, CPI - Y/Y: 3.3% to 3.6%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.9%

Consensus Range, Ex-Fresh Food - Y/Y: 2.9% to 3.1%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y: 2.4%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 2.3% to 2.4%

Consumer inflation in Japan is expected to accelerate in two of the three key measures in December, with the core reading (excluding fresh food) seen up 2.9 percent on year after rising to 2.7 percent in November from October's 2.3 percent. Three-month utility subsidies for peak time air conditioner use ended in November while processed food prices remained high in protracted rice shortages.

The year-on-year increase in the total CPI is forecast at 3.4 percent, also up from 2.9 percent the previous month. The underlying inflation measured by the core-core CPI (excluding fresh food and energy) is seen at 2.4 percent after rising to 2.4 percent in November from 2.3 percent in October.

Japan Bank of Japan Announcement (Fri 1130 JST; Fri 0230 GMT; Thu 2130 EST)

Consensus Forecast, Change: 25 bp

Consensus Range, Change: 0 bp to 25 bp

Consensus Forecast, Level: 0.5%

Consensus Range, Level: 0.25% to 0.5%

The Bank of Japan's nine-member board is widely expected to decide in a majority vote to raise the policy interest rate by another 25 basis points to 0.5 percent at its meeting on Jan. 23-24 after leaving it steady at 0.25 percent in the last three meetings. The bank raised the key rate to the current level from a range of 0 percent to 0.1 percent in July and conducted its first rate hike in 17 years in March 2024, when it also ended its controversial seven-year-old yield curve control framework.

This is part of the bank's policy normalization process following a decade of large-scale monetary easing aimed at reflating the economy. It is expected to lift the overnight rate to around 1 percent by the end of 2025 or early 2026.

Singapore Industrial Production for December (Fri 1300 SGT; Fri 0500 GMT; Fri 0000 EST)

Consensus Forecast, M/M: -1.2%

Consensus Range, M/M: -1.2% to 2.3%

Consensus Forecast, Y/Y: 5.0%

Consensus Range, Y/Y: 5.0% to 7.0%

The consensus looks for output down 1.2 percent on the month and up 5.0 percent on the year.

Germany PMI Composite Flash for January (Fri 0930 CET; Fri 0830 GMT; Fri 0330 EST)

Consensus Forecast, Manufacturing Index: 42.4

Consensus Range, Manufacturing Index: 42.0 to 43.0

Consensus Forecast, Services Index: 51.0

Consensus Range, Services Index: 50.8 to 51.2

Not an inspiring start to the year. The consensus looks for manufacturing at 42.4 in the January flash versus 42.5 in December. Services are seen at 51.0 versus 51.2 in December.

Eurozone PMI Composite Flash for January (Fri 1000 CET; Fri 0900 GMT; Fri 0400 EST)

Consensus Forecast, Composite Index: 49.6

Consensus Range, Composite Index: 49.4 to 49.9

Consensus Forecast, Manufacturing Index: 45.3

Consensus Range, Manufacturing Index: 44.9 to 46.0

Consensus Forecast, Services Index: 51.5

Consensus Range, Services Index: 51.4 to 51.9

Manufacturing contraction continues in January while services stage a modest recovery. The manufacturing flash is expected at 45.3, services at 51.5 and composite at 49.6. That compares with manufacturing at 45.1, services at 51.6, and composite at the same 49.6 in December.

United Kingdom PMI Composite Flash for January (Fri 0930 GMT; Fri 0430 EST)

Consensus Forecast, Manufacturing Index: 47.0

Consensus Range, Manufacturing Index: 46.9 to 47.2

Consensus Forecast, Services Index: 51.0

Consensus Range, Services Index: 51.0 to 51.1

The manufacturing flash is expected at 47.0 and services at 51.0.

United States PMI Composite Flash for January (Fri 0945 EST; Fri 1445 GMT)

Consensus Forecast, Manufacturing Index: 48.9

Consensus Range, Manufacturing Index: 48.4 to 50.0

Consensus Forecast, Services Index: 56.7

Consensus Range, Services Index: 56.0 to 58.5

Notwithstanding the surprising recovery in the Philly Fed manufacturing index for January, forecasts look for another contractionary PMI manufacturing report, offset in the composite by rising strength in services. Forecasts call for PMI manufacturing down to 48.9 from 49.4 and services at 56.7 versus 56.8 in the December final.

United States Existing Home Sales for December (Fri 1000 EST; Fri 1500 GMT)

Consensus Forecast, Annual Rate: 4.16 M

Consensus Range, Annual Rate: 4.10 M to 4.22 M

Sales are seen holding roughly steady at an annual rate of 4.16 million units in December versus 4.15 million in November despite rising mortgage rates in December.

United States Consumer Sentiment for January (Fri 1000 EST; Fri 1500 GMT)

Consensus Forecast, Index: 73.2

Consensus Range, Index: 73.0 to 73.5

Sentiment is expected unchanged at 73.2 in the January final from the January preliminary report.

|