|

By Theresa Sheehan, Econoday Economist

After the release of the annual revisions and January payroll numbers on Friday, February 7, interest will shift to the price stability side of the Fed’s dual mandate. At the moment the labor market looks solid and an unemployment rate of 4.0 percent is consistent with maximum employment.

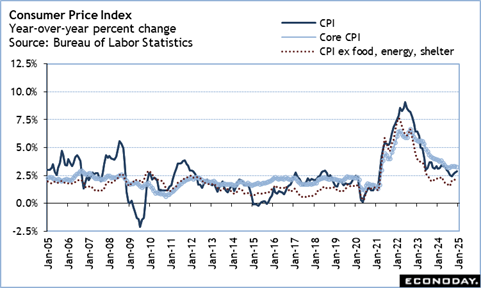

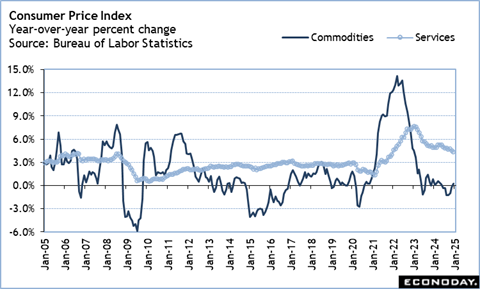

The BLS will release the annual revisions to the CPI along with the January report at 8:30 ET on Wednesday. The revisions typically go back five years. The revisions also typically reflect only small changes in any given month and do not alter the overall picture of changes in consumer prices. The question is if the pace of the year-over-year CPI reflects progress in disinflation at the all-items and core levels that is sufficient to get Fed policymakers thinking about a rate cut again.

This is unlikely in the near term with commodities costs rising and services prices falling only incrementally.

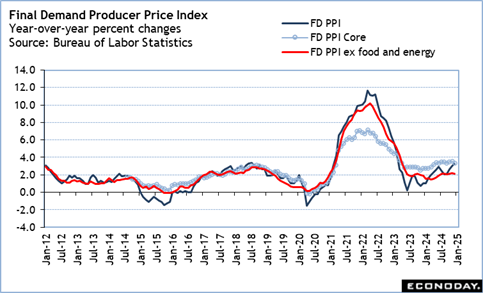

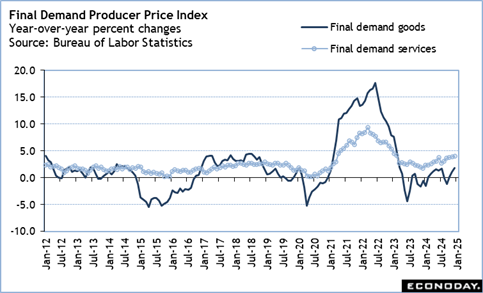

The BLS will release the annual revisions to the final-demand PPI on Thursday at 8:30 ET along with the January report. The report could show if producers are beginning to feel the pinch of higher input costs.

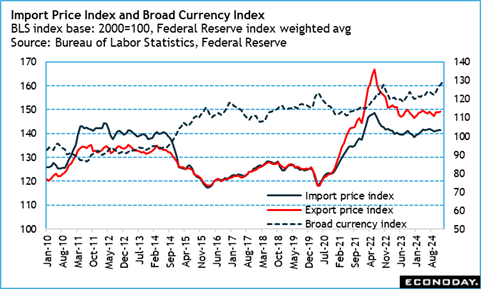

Finally, the report on import and export prices indexes for January is set for release at 8:30 ET on Friday. These indexes are unadjusted and therefore do not get annual revision. The firming in the value of the US dollar versus major currencies in the last few months means imports are going to be pricier and a contributing factor in upward price pressures.

By Marco Babic, Econoday Economist

The coming week in Europe is relatively quiet, and there aren’t likely to be any major shifts in the assessment of the economy.

Eurostat’s preliminary estimates show that the Eurozone economy stagnated in the fourth quarter, compared to the previous three months. The agency also estimates the currency bloc grew by a modest 0.7 percent last year. Thursday’s flash estimate, which includes more complete data, is unlikely to alter this assessment.

Germany will release final CPI figures on Thursday. Preliminary estimates indicate a 2.3 percent price increase in January from the previous year, while core inflation (excluding food and energy) climbed 2.9 percent.

As 2025 begins, trade data is moving to the forefront.

The United States escalated tensions by slapping tariffs on China while temporarily putting on hold those on Canada and Mexico. China countered.

Although the US hasn’t imposed tariffs on the European Union, there is a sense of inevitability. In what is fortuitous timing, after 25 years of negotiations, the European Union finalized a partnership agreement with Argentina, Brazil, Paraguay, and Uruguay. The EU and Switzerland also finalized a bilateral relations deal, set for signing in the spring. The opening moves have been made. Stay tuned.

China CPI for January (Mon 0930 CST; Mon 0130 GMT; Sun 2030 EST)

Consensus Forecast, Y/Y: 0.5%

Consensus Range, Y/Y: 0.4% to 0.5%

CPI is expected to pick up to show a year on year increase of 0.5 percent for January, propelled by Lunar New Year demand, after barely rising by 0.1 percent in December.

China PPI for January (Mon 0930 CST; Mon 0130 GMT; Sun 2030 EST)

Consensus Forecast, Y/Y: -2.4%

Consensus Range, Y/Y: -2.4% to -2.2%

Almost no change in the deflationary trend is seen with wholesale prices down 2.4 percent in January after a 2.3 percent decline in December. This would be the 28th consecutive decline.

United States NFIB Small Business Optimism Index for January (Tue 0600 EST; Tue 1100 GMT)

Consensus Forecast, Index: 104.7

Consensus Range, Index: 103.5 to 106.0

Optimism about the economy under Trump lifted the index by 3.4 points to 105.1 in December, its highest since October 2018. For January, the index is expected to correct slightly to a still upbeat 104.7, well above its long-time average of 98.0.

Italy Industrial Production for December (Wed 1000 CET; Wed 0900 GMT; Wed 1400 EST)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.3% to -0.1%

The consensus sees industrial production retracing by 0.2 percent on the month in December after rising by 0.3 percent in November.

India CPI for January (Wed 1600 IST; Wed 1030 GMT; Wed 0530 EST)

Consensus Forecast, Y/Y: 4.69%

Consensus Range, Y/Y: 4.4% to 4.9%

Headline inflation is expected at down again at 4.69 percent in January on the year as food prices continue to ease. CPI decreased to 5.22 percent in December from 5.48 percent in November.

India Industrial Production for December (Wed 1600 IST; Wed 1030 GMT; Wed 0530 EST)

Consensus Forecast, Y/Y: 3.9%

Consensus Range, Y/Y: 3.1% to 4.1%

Industrial production is expected up 3.9 percent on the year in December, down from 5.2 percent in November as the economy lost steam at year end.

United States CPI for January (Wed 0830 EST; Wed 1330 GMT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.2% to 0.4%

Consensus Forecast, Y/Y: 2.9%

Consensus Range, Y/Y: 2.9% to 2.9%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.3%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.2%

Consensus Range, Ex-Food & Energy - Y/Y: 3.1% to 3.2%

Headline and core are both expected up 0.3 percent on the month, not a pretty picture for an inflation-weary market. Food and energy prices have been rising, along with vehicles and shelter costs, the usual suspects. Total CPI is seen up 2.9 percent and core up 3.2 percent on year.

Hard for the Fed to contemplate rate cuts with numbers like these.

United States Treasury Statement for January (Wed 1400 EST; Wed 1900 GMT)

Consensus Forecast, Balance: -$47 B

Consensus Range, Balance: -$93 B to -$45.5 B

The consensus sees red ink of $47 billion in January versus a deficit of $22 billion in January a year ago.

Japan PPI for January (Thu 0850 JST; Wed 2350 GMT; Wed 1850 EST)

Consensus Forecast, M/M: %

Consensus Range, M/M: % to

Consensus Forecast, Y/Y: %

Consensus Range, Y/Y: % to %

Producer inflation in Japan is expected to accelerate further to 4.1% in January after being unchanged at 3.8% in December and staying at the highest pace since +4.5% in June 2023. Energy cost have risen since the government ended a three-month utility subsidy program late last year and there has been a spike in farm produce costs caused by relentless domestic rice shortages. On the month, the corporate goods price index is forecast to have risen 0.3% after rising 0.3% in the previous two months.

At its latest Jan. 23-24 meeting, the Bank of Japan's nine-member board, as widely expected, voted 8 to 1 to raise the policy interest rate by another 25 basis points (0.25 percentage point) to 0.5%. The BOJ is in the process of normalizing its policy by gradually lifting the rates from zero and slightly negative at every third or fourth meeting. The BOJ under Governor Ueda shifted gear in March 2024 with its first rate hike in 17 years and an end to the seven-year-old controversial yield curve control framework, following a decade of large monetary easing aimed at reflating the economy. The board stood pat in December, October and September after voting 7 to 2 in July to hike the rate to 0.25% from a range of 0% to 0.1%.

Germany CPI for January (Thu 0800 CET; Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.2% to -0.2

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 2.3% to 2.3%

Forecasters see no change in the final reading for January from the preliminary report at down 0.2 percent on the month and up 2.3 percent on year.

United Kingdom Monthly GDP for December (Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.1% to 0.2%

The consensus looks for monthly GDP up a marginal 0.1 percent again in December after the same 0.1 percent rise in November.

United Kingdom GDP for Fourth Quarter (Thu 0700 GMT; Thu 0200 EST)

Consensus Forecast, Q/Q: 0.0%

Consensus Range, Q/Q: -0.1% to 0.0%

Consensus Forecast, Y/Y: 1.1%

Consensus Range, Y/Y: 1.0% to 1.3%

The economy hit a wall in the second half. No growth is the call for Q4 from Q3, same as in Q3 from Q2. The forecast looks for a 1.1 percent rise from a year ago in Q4.

Eurozone Industrial Production for December (Thu 1100 CET; Thu 1000 GMT; Thu 0500 EST)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.5% to 0.0%

Consensus Forecast, Y/Y: -2.7%

Consensus Range, Y/Y: -3.0% to -0.5%

Weakness is expected to persist. Forecasters see industrial production down 0.2 percent in December after a 0.2 percent increase in November. Output is expected down 2.7 percent on year.

United States Jobless Claims for Week 2/8 (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Initial Claims - Level: 215K

Consensus Range, Initial Claims - Level: 215K to 221K

Claims are expected to fall back to 215,000 in the latest week after rising unexpectedly by 11,000 to 219,000 a week ago. The four-week moving average last week rose 4,000 to 216,750.

United States PPI-Final Demand for January (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, PPI-FD - M/M: 0.2%

Consensus Range, PPI-FD - M/M: 0.2% to 0.4%

Consensus Forecast, CPI - Y/Y: 3.2%

Consensus Range, CPI - Y/Y: 3.1% to 3.2%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.4%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.3%

Consensus Range, Ex-Food & Energy - Y/Y: 3.3% to 3.3%

More of the same for wholesale prices: the consensus sees PPI-FD up 0.2 percent on the month and up 3.2 percent on the year. Ex-food & energy, PPI-FD is seen up 0.3 percent and up 3.3 percent on the year.

India Wholesale Price Index for January (Fri 1200 IST; Fri 0630 GMT; Fri 0130 EST)

Consensus Forecast, Y/Y: 2.5%

Consensus Range, Y/Y: 2.5% to 2.5%

WPI is seen ticking up to. 2.5 percent on year in January from 2.37 percent in December.

Eurozone GDP Flash for Fourth Quarter (Fri 1100 CET; Fri 1000 GMT; Fri 0500 EST)

Consensus Forecast, Q/Q: 0.0%

Consensus Range, Q/Q: 0.0% to 0.0%

Consensus Forecast, Y/Y: 0.9%

Consensus Range, Y/Y: 0.9% to 0.9%

Forecasts call for no revision from the prior report with no change on quarter and 0.9 percent growth on year.

Canada Manufacturing Sales for December (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, M/M: 0.6%

Consensus Range, M/M: 0.6% to 0.6%

Forecasters agree with Stats Canada’s preliminary estimate calling for a decent 0.6 percent increase for December.

United States Retail Sales for January (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Retail Sales - M/M: 0.0%

Consensus Range, Retail Sales - M/M: -1.0% to 0.4%

Consensus Forecast, Ex-Vehicles - M/M: 0.3%

Consensus Range, Ex-Vehicles - M/M: -0.2% to 0.5%

Sales are off to a sluggish start in 2025 after strength in late 2024. Lower auto sales dampened the result along with nasty winter weather that hurt leisure spending. The consensus looks for an unusual flat reading on the month, with sales up 0.3 percent ex-autos.

United States Imports and Export Prices for January (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Import Prices - M/M: 0.4%

Consensus Range, Import Prices - M/M: 0.3% to 0.6%

Consensus Forecast, Export Prices - M/M: 0.3%

Consensus Range, Export Prices - M/M: 0.1% to 0.4%

Import prices are about to get a lot more interesting with the Trump tariffs. For now, expectations are benign with the consensus looking for imports up 0.4 percent on the month and exports up 0.3 percent.

United States Industrial Production for January (Fri 0915 EST; Fri 1415 GMT)

Consensus Forecast, Industrial Production - M/M: 0.3%

Consensus Range, Industrial Production - M/M: 0.1% to 0.4%

Consensus Forecast, Capacity Utilization Rate: 77.7%

Consensus Range, Capacity Utilization Rate: 77.6% to 77.9%

With the ISM purchasing managers index returning to modest growth at 50.9 in January, forecasters expect a moderate 0.3 percent rise in industrial production after a good gain of 0.9 percent in December. Capacity utilization is seen ticking up to 77.7 percent from 77.6 in December. That rate remains about 2 percentage points below average.

United States Business Inventories for December (Fri 1000 EST; Fri 1500 GMT)

Consensus Forecast, Industrial Production - M/M: 0.3%

Consensus Range, Industrial Production - M/M: 0.1% to 0.4%

Inventories are expected up another marginal 0.1 percent in December after rising 0.1 percent in November.

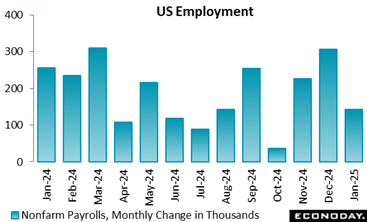

Looking at US Employment

By Theresa Sheehan, Econoday Economist

The monthly employment report for January shows moderate hiring consistent with the economy’s ability to absorb new entrants to the workforce and the currently unemployed to find jobs. January had a gain of 143,000 with a net revision higher of 100,000 for the prior two months. The average monthly increase in payrolls in the fourth quarter 2024 is 284,000. The unemployment rate of 4.0 percent in January is well within the context of achieving maximum unemployment for the Fed’s dual mandate. The January increase is not as robust as the gains of the fourth quarter 2024 but is a sustainable pace within a modestly expanding US economy. Payroll growth is skewed toward the service sector at the moment, but some of that might be attributed to extreme cold weather conditions and winter storms that disrupt transportation and prevent outdoor activities like housing starts.

The hot labor market of 2021 and 2022 has cooled considerably and upward pressure on compensation along with it. However, average hourly earnings are up 4.1 percent in January and remain in line with readings of the past six months. Competition for workers and churn in the labor market has settled as the labor supply/demand imbalance healed. Nonetheless, businesses have yet to see a return to pre-pandemic growth in wages.

The report included annual benchmark revisions.

Edited by Simi Fagbola, Econoday Economist

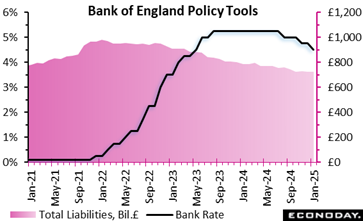

The Bank of England's Monetary Policy Committee (MPC) has initiated a cautious shift in monetary policy, reducing the Bank Rate to 4.5 percent-a move supported by a 7–2 majority. This measured cut reflects confidence in progress toward price stability while acknowledging persistent inflationary risks. The Bank of England's Monetary Policy Committee (MPC) has initiated a cautious shift in monetary policy, reducing the Bank Rate to 4.5 percent-a move supported by a 7–2 majority. This measured cut reflects confidence in progress toward price stability while acknowledging persistent inflationary risks.

Inflation has moderated significantly over the past two years, with CPI inflation at 2.5 percent in the fourth quarter of 2024. However, external pressures, including rising global energy costs and regulatory price changes, could push inflation to 3.7 percent by the third quarter of 2025 before it stabilises around the 2 percent target. Despite this, the MPC believes there is enough disinflationary momentum to justify a modest rate cut while maintaining a restrictive stance.

Economic growth remains subdued, with GDP underperforming earlier projections and business confidence softening. A gradual recovery is anticipated mid-year, but sluggish productivity growth and a constrained supply capacity pose challenges. The MPC remains vigilant, balancing the risks of inflation persistence against the fragility of demand.

While further rate reductions may be considered, policymakers emphasise a careful and gradual approach, ensuring that monetary easing does not reignite inflationary pressures. Future decisions will be guided by evolving economic conditions and inflation dynamics.

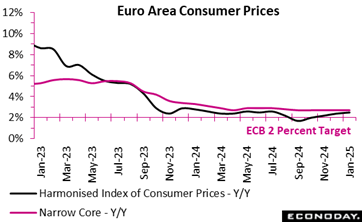

Euro area inflation in January 2025 edged up to 2.5 percent, in line with the consensus estimate for the month and slightly higher than December's 2.4 percent. While the overall increase appears modest, sectoral dynamics reveal a more complex picture of price movements. Euro area inflation in January 2025 edged up to 2.5 percent, in line with the consensus estimate for the month and slightly higher than December's 2.4 percent. While the overall increase appears modest, sectoral dynamics reveal a more complex picture of price movements.

Services inflation, the leading contributor, softened marginally to 3.9 percent from 4.0 percent, indicating a slow cooling in consumer-facing sectors. Food, alcohol, and tobacco inflation followed suit, dipping to 2.3 percent from 2.6 percent, suggesting some relief in household essentials. In contrast, energy prices surged to 1.8 percent from 0.1 percent, marking a significant shift likely driven by rising fuel and utility costs. Non-energy industrial goods inflation remained stable at 0.5 percent, reflecting subdued pricing pressures in manufacturing.

Regionally, headline inflation rose only slightly in Spain (2.9 percent after 2.8 percent) but more sharply in Italy (1.7 percent after 1.4 percent), while it remained stable in France (1.8 percent after 1.8 percent) and Germany (2.8 percent after 2.8 percent).

While easing pressures in services and food offer reassurance, the energy rebound may raise concerns with inflation still above the ECB's 2 percent target.

Nonfarm payrolls are up 143,000 in January after a net upward revision of 100,000 in the prior two months. The increase in January is below the consensus of up 168,000 in the Econoday survey of forecasters. The increase is consistent with moderate hiring at a pace able to absorb new entrants to the labor market as well as workers already there and looking for work. Nonfarm payrolls are up 143,000 in January after a net upward revision of 100,000 in the prior two months. The increase in January is below the consensus of up 168,000 in the Econoday survey of forecasters. The increase is consistent with moderate hiring at a pace able to absorb new entrants to the labor market as well as workers already there and looking for work.

The January report includes annual benchmark revisions. The preliminary benchmark revision published in March 2024 was for a decrease of 818,000. Nonetheless, the present job market is healthy and showing little sign of deterioration. The January report includes annual benchmark revisions. The preliminary benchmark revision published in March 2024 was for a decrease of 818,000. Nonetheless, the present job market is healthy and showing little sign of deterioration.

Private payrolls are up 111,000 in January with flat payroll growth in the goods-producing sector and increase entirely among service-providers. Most of January's payroll growth is attributable to gains of 34,300 in retail trade and 43,700 in health care. Government payrolls are up 32,000 with increases of 3,000 in state government excluding education and 21,000 in local government.

Average hourly earnings rose 0.5 percent in January from December and may include some mandated raises in minimum wages. Average hourly earnings are up 4.1 percent compared to January 2024 and in line with the pace of increases seen in the last six months. Overall, while upward pressure on wages has eased, it remains above pre-pandemic levels.

The unemployment rate is down a tenth to 4.0 percent in January. The U6 unemployment rate – the broadest measure of unemployment – is unchanged at 7.5 percent in January. The number of employed persons rose 2.234 million to 163.895 million, while the number of unemployed is down 37,000 to 6.849 million. However, the number of persons working part-time for economic reasons is up 119,000 to 4.477 million.

The labor force participation rate is up a tenth to 62.6 percent in January. The increase is not particularly meaning full as the rate has been stuck within a tenth or two of that percentage for nearly two years.

Fed policymakers will find little in this report to suggest that the labor market is anything but solid at the moment, although there are significant uncertainties on the near horizon due to changes in government policies. As far as the dual mandate is concerned, the US economy continues to meet the standard of maximum employment against the demand of maintaining price stability.

The industrial sector closed 2024 on a downward trajectory, with December's production dropping 2.4 percent month-over-month, 1.4 percentage points below the consensus and marking the lowest level since May 2020. On an annual basis, output declined by 3.1 percent, 1.0 percentage points below the forecast estimates and reinforcing the sustained contraction seen throughout the year. The industrial sector closed 2024 on a downward trajectory, with December's production dropping 2.4 percent month-over-month, 1.4 percentage points below the consensus and marking the lowest level since May 2020. On an annual basis, output declined by 3.1 percent, 1.0 percentage points below the forecast estimates and reinforcing the sustained contraction seen throughout the year.

The automotive industry bore the brunt of the decline, plunging 10.0 percent, alongside machine maintenance and assembly (minus 10.5 percent). Capital goods production fell 4.7 percent, reflecting weak investment appetite. However, pharmaceutical production surged 11.6 percent, acting as a rare bright spot.

Despite the overall slowdown, energy-intensive industries stabilised (0.6 percent), a modest improvement after steep declines in previous years. Interestingly, other transport equipment (for example, aircraft, ships, military vehicles) saw a 6.5 percent uptick, benefiting from large-scale orders.

With persistent structural weaknesses in key sectors, 2025's outlook hinges on global demand recovery, investment incentives, and stability in energy markets to reignite industrial momentum.

U.S. manufacturing activity sprang back to life in January, ending 26 months of contraction (nine months in the previous data series) as inventories had fallen to levels that triggered a steady increase in new orders on export and capital goods demand and pulled factory output out of the doldrums, the latest monthly data from the Institute for Supply Management showed. U.S. manufacturing activity sprang back to life in January, ending 26 months of contraction (nine months in the previous data series) as inventories had fallen to levels that triggered a steady increase in new orders on export and capital goods demand and pulled factory output out of the doldrums, the latest monthly data from the Institute for Supply Management showed.

Despite the growing uncertainties ahead of a trade war that has just erupted between Washington and Ottawa, the sector index compiled by the Institute for Supply Management popped above the make-or-break line of 50, rising a more than expected 1.7 points to 50.9 in January after edging closer to growth territory at 49.2 in December from 48.4 (recent figures have been revised in an annual update on seasonal adjustments). The index easily beat the consensus call of 49.5.

"Demand and production improved; and employment expanded," Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee, said in a statement. "However, staff reductions continued with many companies, but at weaker rates." Fiore had predicted that the ISM headline index would rise above 50 in the first quarter, in January or February, on signs of a pickup toward the end of 2024.

"Prices growth was moderate, indicating that further growth will put additional pressure on prices," he said. "As predicted, maintaining a slower rate of price increases as demand returns will be a major challenge for 2025."

|