|

By Brian Jackson, Econoday Economist

Regional PMI surveys for February will be the main focus of the Asia-Pacific data calendar in the coming week. With the exception of India, these surveys showed subdued conditions in January, but survey responses were impacted to some extent by the timing of lunar new year holidays. Having survey data for both January and February will provide a clearer indication of how economies across the region have started in 2025.

South Korea will also report inflation, industrial production and retail sales data, while Taiwan will report inflation and trade data. Chinese inflation data will be published over the coming weekend and will likely show that price pressures remain subdued.

The Australia data calendar is also busy, with GDP, retail sales and trade data scheduled for release, while the Reserve Bank of Australia will publish the minutes of its meeting two weeks ago at which officials cut policy rates for the first time since 2020. The statement accompanying that decision noted uncertainty about the outlook for household spending, so next week’s retail sales data for January will likely be a particular focus after sales fell slightly on the month in December.

By Marco Babic, Econoday Economist

Last week’s data in Europe did little, if anything, to dispel the notion that the Eurozone economy remains weak. The European Central Bank announces its decision in interest rates on Thursday and it would be a surprise if they didn’t lower rates further, having left the door open following its

meeting in January.

The major indicators coming out next week begin with Flash HICP for the Eurozone. While still above 2 percent, the 2.5 and 2.7 percent respective HICP and narrow core readings are not likely to deter the ECB from further cuts. The governing council is amenable to 25 basis point reductions in the Deposit Rate, with Christine Lagarde saying 50 basis points was not on the table at the prior meeting.

Eurozone producer prices are slated for Wednesday. Prices in the pipeline are not going to raise any alarm bells in Frankfurt, with PPI flat on a yearly comparison basis in December.

Germany reports manufacturing orders on Friday ahead of industrial production the following Monday. Like an overcaffeinated cheetah’s EKG, the monthly chart is volatile and unlikely to make any convincing argument about the German economy one way or the other.

PMI readings for February will be finalized Monday but generally don’t digress much from their flash readings. Friday’s US employment report, when the whole world becomes an economist, is another highlight of the European week, and the first of Donald Trump’s in office.

By Teresa Sheehan, Econoday Economist

The economic data in the March 3 week will have to contend with political developments that could mean it is less timely and informative than usual. In particular, the data regarding the job market hasn’t had much time to catch up with events. The situation regarding cuts in government jobs is fluid and it isn’t clear how many people have actually become unemployed or are taking buyouts. The effects haven’t yet lifted the numbers for initial jobless claims, and any cascade into the private sector is probably limited as yet. As such, signs of rising unemployment rates could be small while new hiring is going to be cautious until the outlook is less uncertain.

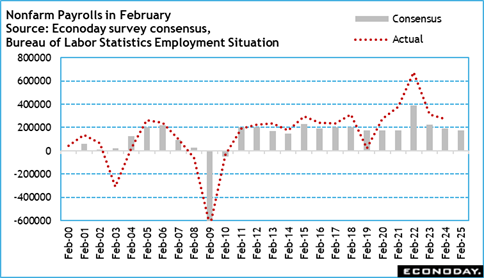

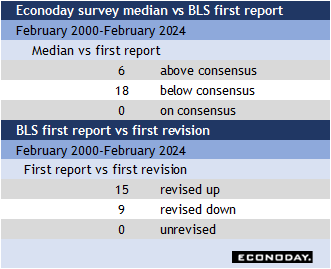

The monthly employment data from the BLS at 8:30 ET on Friday is for February, a short month. The survey reference period ended around February 15, and not all job cuts in the federal government will be visible in the numbers. Also, the unemployment rate is based on how households describe their employment status. Some workers will not be officially unemployed due to the terms of their separation. In any case, there is room for a downside surprise in the level of employment in February and a hint of spreading unemployment, but it is more likely that the numbers will rebound after the bitterly cold weather in January put a chill on some hiring. The early forecasts for payroll increases are around 150,000-200,000, a solid performance. However, February does have a strong tendency to come in below the consensus and then subsequently be revised higher in the March report.

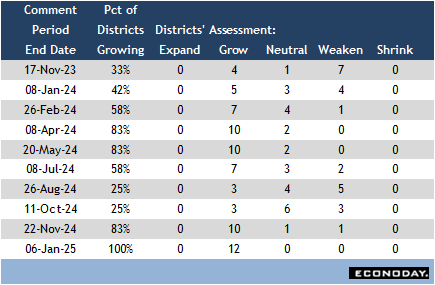

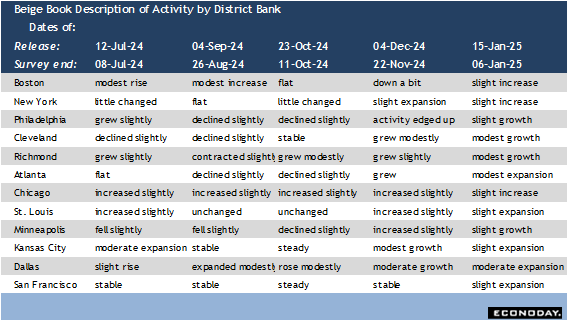

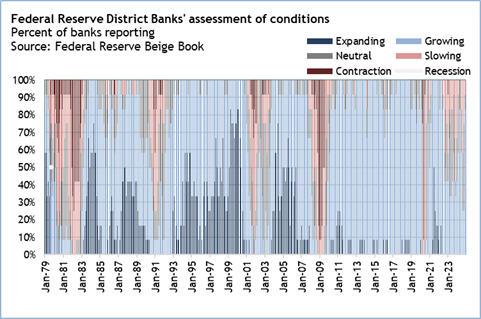

The Fed’s Beige Book is a compilation of anecdotal evidence about the US economy. The next Beige Book will cover the period roughly between early January and mid-February when the report is released at 14:00 ET on Wednesday. The report released on January 15 was the first to show at least some growth for all 12 Fed districts since November 2023. High levels of uncertainty on the part of businesses and consumers may tip some of the districts back from slight expansion toward the end of 2024 and back into neutral or even weakening conditions. In any case, the FOMC will carefully parse the contents of the report to see how it lines up with the dual mandate of price stability and maximum employment in advance of the March 18-19 FOMC meeting.

China PMI Manufacturing for February (Mon 0945 CST; Mon 0145 GMT; Sun 2045 EST)

Consensus Forecast, Index: 50.4

Consensus Range, Index: 50.3 to 50.8

Forecasters look for the index to edge up to 50.4 in February from 50.1 in January as a tentative recovery continues.

Germany PMI Manufacturing Final for February (Mon 0955 CET; Mon 0855 GMT; Mon 0355 EST)

Consensus Forecast, Index: 46.1

Consensus Range, Index: 45.0 to 46.1

Ongoing contraction is seen in Germany’s industrial sector with the final index unrevised from 46.1 in the flash.

Eurozone PMI Manufacturing Final for January (Mon 1000 CET; Mon 0900 GMT; Mon 0400 EST)

Consensus Forecast, Index: 47.3

Consensus Range, Index: 47.3 to 47.3

Forecasters see no change in the final from the flash at 47.3.

United Kingdom PMI Manufacturing Final for February (Mon 0930 GMT; Mon 0430 EST)

Consensus Forecast, Level: 46.4

Consensus Range, Level: 46.4 to 46.4

No revision is the call from 46.4 in the flash, and down from 48.3 in January, not a pretty picture.

Eurozone HICP Flash for February (Mon 1100 CET; Mon 1000 GMT; Mon 0500 EST)

Consensus Forecast, HICP - Y/Y: 2.3%

Consensus Range, HICP - Y/Y: 2.3% to 2.6%

Consensus Forecast, Narrow Core - Y/Y: 2.6%

Consensus Range, Narrow Core - Y/Y: 2.5% to 2.7%

The consensus looks for a 2.3 percent increase on year for HICP and 2.6 percent for narrow core.

United States PMI Manufacturing Final for February (Mon 0945 EST; Mon 1445 GMT)

Consensus Forecast, Index: 51.6

Consensus Range, Index: 51.6 to 51.6

Forecasters expect no revision from the flash at 51.6.

United States ISM Manufacturing Index for February (Mon 1000 EST; Mon 1500 GMT)

Consensus Forecast, Index: 50.5

Consensus Range, Index: 50.0 to 52.0

Slight erosion from January is seen with the index down to 50.5 from 50.9 but remaining barely in expansion. Markets see a sluggish, uncertain start to manufacturing in 2025 with vulnerability ahead from tariffs.

United States Construction Spending for January (Mon 1000 EST; Mon 1500 GMT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.3% to 0.3%

Construction flags with no change expected in January after rising 0.5 percent in December.

United States Motor Vehicle Sales for February

Consensus Forecast, Total Vehicle Sales - Annual Rate: 15.9 M

Consensus Range, Total Vehicle Sales - Annual Rate: 15.7 M to 16.3 M

Sales expected to improve to a 15.9 million unit rate from 15.6 million in January.

South Korea Industrial Production for January (Tue 0800 KST; Mon 2300 GMT; Mon 1800 EST)

Consensus Forecast, M/M: -3.1%

Consensus Range, M/M: -3.1% to -2.3

Consensus Forecast, Y/Y: -2.1%

Consensus Range, Y/Y: -2.3% to -2.0%

Output is seen falling back by 3.1 percent on the month and by 2.1 percent on year after rising 4.6 percent on the month and 5.2 percent on year in December.

Japan Unemployment Rate for January (Tue 0830 JST; Mon 2330 GMT; Mon 1830 EST)

Consensus Forecast, Rate: 2.4%

Consensus Range, Rate: 2.4% to 2.4%

Japanese payrolls are expected to post their 30th straight rise on year in January amid widespread labor shortages. The unemployment rate is forecast at 2.4% after improving slightly to 2.4% in December from 2.5% in November and October. September’s 2.4% was an eight-month low. The government continues to describe employment conditions as "showing signs of improvement” in its latest monthly economic report.

Australia Retail Sales for January (Tue 1130 AET; Tue 0030 GMT; Mon 1930 EST)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: -0.8% to 0.6%

Credit card data and a decent sales momentum into year end suggest sales rebounded by 0.4 percent in January after slipping by 0.1 percent in December.

Eurozone Unemployment Rate for January (Tue 1100 CET; Tue 1000 GMT; Tue 0500 EST)

Consensus Forecast, Rate: 6.3%

Consensus Range, Rate: 6.3% to 6.3%

No change at 6.3 percent is the call.

South Korea GDP for Fourth Quarter (Wed 0800 KST; Tue 2300 GMT; Tue 1800 EST)

Consensus Forecast, Y/Y: 1.2%

Consensus Range, Y/Y: 1.2% to 1.2%

Forecasters expect the same modest 1.2 percent growth on year in Q4 as in Q3 as the Bank of Korea looks to boost the economy at the start of 2025.

Australia GDP for Fourth Quarter (Wed 1130 AET; Wed 0030 GMT; Tue 1930 EST)

Consensus Forecast, Q/Q: 0.5%

Consensus Range, Q/Q: 0.3% to 1.0%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: 1.2% to 1.3%

Forecasters think the economy picked up at year end and expect a 0.5 percent rise on the quarter and 1.3 percent growth on year compared with 0.3 percent and 0.8 percent in Q3.

China PMI Composite for February (Wed 0945 CST; Wed 0145 GMT; Tue 2045 EST)

Consensus Forecast, Services Index: 50.8

Consensus Range, Services Index: 50.8 to 51.2

The index is seen pretty flat at 50.8 versus 51.0 in January.

Germany PMI Composite Final for February (Wed 0955 CET; Wed 0855 GMT; Wed 0355 EST)

Consensus Forecast, Composite Index: 51.0

Consensus Range, Composite Index: 51.0 to 52.5

Consensus Forecast, Services Index: 52.2

Consensus Range, Services Index: 50.5 to 52.2

Forecasters see no revision from the flash at 51.0 for the composite and at 52.2 for services.

Eurozone PMI Composite Final for March (Wed 1000 CET; Wed 0900 GMT; Wed 0400 EST)

Consensus Forecast, Composite Index: 50.2

Consensus Range, Composite Index: 50.2 to 50.2

Consensus Forecast, Services Index: 50.7

Consensus Range, Services Index: 50.7 to 51.3

No revision from the flash is the call with the composite at 50.2 and services steady at 50.7.

United Kingdom PMI Composite Final for February (Wed 0930 GMT; Wed 0430 EST)

Consensus Forecast, Composite Index: 50.5

Consensus Range, Composite Index: 50.5 to 50.5

Consensus Forecast, Services Index: 51.1

Consensus Range, Services Index: 51.1 to 51.1

Forecasters see no revision from the flash at 50.5 for the composite and at 51.1 for services.

United States ADP Employment Report for February (Wed 0815 EST; Wed 1315 GMT)

Consensus Forecast, Private Payrolls - M/M: 162,000

Consensus Range, Private Payrolls - M/M: 140,000 to 300,000

The consensus looks for ADP private payrolls up 162,000 on the month, not too shabby.

United States PMI Composite Final for February (Wed 0945 EST; Wed 1445 GMT)

Consensus Forecast, Composite Index: 50.4

Consensus Range, Composite Index: 50.4 to 50.4

Consensus Forecast, Services Index: 49.7

Consensus Range, Services Index: 49.7 to 49.7

No revision from the flash is expected for the composite at 50.4 and services at 49.7.

United States Factory Orders for January (Wed 1000 EST; Wed 1500 GMT)

Consensus Forecast, M/M: 1.4%

Consensus Range, M/M: -0.2% to 1.7%

A big 3.1 percent jump in durable goods orders, fueled by aircraft, translates to a 1.4 percent rise expected in factory orders in January.

United States ISM Services Index for February (Wed 1000 EST; Wed 1500 GMT)

Consensus Forecast, Index: 53.0

Consensus Range, Index: 51.3 to 53.2

Another decent month of expansion is seen for services with the ISM index at 53.0 in February, steady from 52.8 in January.

South Korea CPI for February (Thu 0800 KST; Wed 2300 GMT; Wed 1800 EST)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.2% to 0.3%

Consensus Forecast, Y/Y: 1.9%

Consensus Range, Y/Y: 1.8% to 2.0%

The consensus sees CPI up 0.3 percent on the month and 1.9 percent on year.

Australia International Trade in Goods for January (Thu 1130 AET; Thu 0030 GMT; Wed 1930 EST)

Consensus Forecast, Balance: 5.469 B

Consensus Range, Balance: 4.9 B to 6.3 B

The goods trade balance is seen at A$5.469 billion in January versus A$5.085 billion in December.

Switzerland Unemployment Rate for February (Thu 0745 CET; Wed 0645 GMT; Wed 0145 EST)

Consensus Forecast, Adjusted: 2.7%

Consensus Range, Adjusted: 2.7% to 2.7%

No change seen at 2.7 percent.

Eurozone ECB Announcement (Thu 1415 CET; Thu 1315 GMT; Thu 0815 EST)

Consensus Forecast, Refi Rate Change: -25 bp

Consensus Range, Refi Rate Change: -25 bp to -25 bp

Consensus Forecast, Refi Rate Level: 2.65%

Consensus Range, Refi Rate Level: 2.65% to 2.65%

Consensus Forecast, Deposit Rate Change: -25 bp

Consensus Range, Deposit Rate Change: -25 bp to -25 bp

Consensus Forecast, Deposit Rate Level: 2.50%

Consensus Range, Deposit Rate Level: 2.50% to 2.50%

Markets and forecasters uniformly expect 25 basis point cuts in both policy rates.

Canada International Trade in Goods for January (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Balance: C$1.2 B

Consensus Range, Balance: -C$0.3 B to C$1.3 B

The trade balance is expected to show a surplus of C$1.2 billion for January. US trade figures showed significant front-running of imports in January ahead of expected US tariffs. Will Canadian export figures reflect this? These trade figures may soon get a lot more interesting.

United States International Trade in Goods and Services for January (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Balance: -$123.0 B

Consensus Range, Balance: -$130.0 B to -$96.4 B

The goods trade deficit widened dramatically to a record $153.3 billion in January as importers rushed to get things into the country before tariffs kick in. Forecasters see the deficit with goods and services together at $123.0 billion, way up from $98.4 billion in December.

United States Jobless Claims Week 3/1 (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Initial Claims - Level: 244K

Consensus Range, Initial Claims - Level: 235K to 250K

Claims are expected to rise to 244K in the latest week after surging by 22K to 242K last week.

United States Productivity and Costs for Fourth Quarter (Thu 0830 EST; Thu 1330 GMT)

Consensus Forecast, Nonfarm Productivity - Annual Rate: 1.2%

Consensus Range, Nonfarm Productivity - Annual Rate: 1.2% to 1.2%

Consensus Forecast, Unit Labor Costs - Annual Rate: 3.0%

Consensus Range, Unit Labor Costs - Annual Rate: 3.0% to 3.0%

No revision is expected with annual growth in productivity at 1.2 percent and unit labor costs at 3.0 percent in the latest update for Q4.

Germany Manufacturing Orders for January (Fri 0800 CET; Fri 0700 GMT; Fri 0200 EST)

Consensus Forecast, M/M: -0.9%

Consensus Range, M/M: -3.0% to 0.5%

Orders expected to fall back by 0.9 percent after rising 6.9 percent in December.

Canada Labour Force Survey for February (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Employment - M/M: 15,000

Consensus Range, Employment - M/M: 10,000 to 15,000

Consensus Forecast, Unemployment Rate: 6.7%

Consensus Range, Unemployment Rate: 6.6% to 6.7%

The consensus looks for a marginal 15,000 rise in employment and an uptick to 6.7 percent in the jobless rate from 6.6 percent a month ago.

United States Employment Situation for February (Fri 0830 EST; Fri 1330 GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 160,000

Consensus Range, Nonfarm Payrolls - M/M: 130,000 to 300,000

Consensus Forecast, Unemployment Rate: 4.0%

Consensus Range, Unemployment Rate: 3.9% to 4.1%

Consensus Forecast, Private Payrolls - M/M: 143,000

Consensus Range, Private Payrolls - M/M: 108,000 to 190,000

Consensus Forecast, Manufacturing Payrolls - M/M: 5,000

Consensus Range, Manufacturing Payrolls - M/M: 5,000 to 6,000

Consensus Forecast, Average Hourly Earnings - M/M: 0.3%

Consensus Range, Average Hourly Earnings - M/M: 0.2% to 0.4%

Consensus Forecast, Average Workweek: 34.2

Consensus Range, Average Workweek: 34.2 to 34.2

The consensus looks for a moderate 160,000 rise in payrolls and no change in unemployment. Presumably, March will be when the employment picture reflects federal government layoffs and related effects.

United States Consumer Credit for January (Fri 1500 EST; Fri 2000 GMT)

Consensus Forecast, M/M: $5.5 B

Consensus Range, M/M: -$3.0 B to $16.0 B

Forecasters look for consumer credit up a small $5.5 billion.

|