|

By Brian Jackson, Econoday Economist

The Asia-Pacific data calendar is relatively light after Chinese inflation reports are released over the weekend. Indian inflation and industrial production will not show any immediate impact from the cut in policy rates announced by the Reserve Bank of India in early February, but they may provide information about the chances of additional policy easing in upcoming meetings. Consumer and business confidence data for Australia, however, may show some effect from the reduction in policy rates announced by the Reserve Bank of Australia last month, though this may be tempered by the advice from officials that further rate cuts still depend heavily on the inflation outlook.

Apart from the data calendar, a key focus in the coming week will be whether Chinese officials announce immediate change in policy settings in response to the decisions made about economic targets and policies at the annual meeting of the National People’s Congress. Officials at that meeting retained a GDP growth target of “around five percent”, as they have for the past two years, but lowered their inflation target from three percent to two percent in response to persistently subdued price pressures. Officials also announced a shift in the monetary policy stance from “prudent” to “moderately loose,” indicating that measures such as reductions in reserve requirements and borrowing rates may soon be announced.

By Marco Babic, Econoday Economist

There are not many releases scheduled for Europe for the coming week, but the data will provide a first glimpse into how the year started off.

On Monday, Germany reports on the output of its factories and other sectors. The report comes on the heels of Friday’s manufacturing orders which saw an unexpected decline of seven percent. Europe’s largest economy has been in a prolonged slump with no indication things are on the cusp of improving.

At the same time, Germany reports on its balance of trade for January. In December both imports and exports rose on a monthly basis, but with an underperforming industrial sector, it remains to be seen if exports continue to provide some economic support.

In recent days, there have been proposals for Germany and some European countries ramping up spending on defense to support Ukraine and to pick up the defense burden from the US generally. Increased spending on military hardware and resulting production increases would give a boost to industry. It will certainly take some time for increased production to show up in the numbers, but if increased spending comes to pass, that could lift industrial sentiment.

Italy reports producer prices for February which will give some first hints on pipeline inflation.

Later in the week, Eurostat reports January industrial production for the Eurozone. In December it fell 1.1 percent on the month and 2.0 percent from a year ago.

With the European Central Bank cutting rates again, last Thursday, it’s clear they are more concerned about a moribund European economy than inflation.

By Teresa Sheehan, Econoday Economist

February data on payrolls and the unemployment rate suggest the US labor market is losing ground with hiring stalled in many industries and layoffs rising. The risks are heightened that the US is heading into a self-inflicted recession. Normally this would call for easier monetary policy from the FOMC, but the policy outlook is hazy. However, Fed Chair Powell indicated Friday that at this time of uncertainty, with the economy in a “good place” right now, the FOMC can proceed slowly.

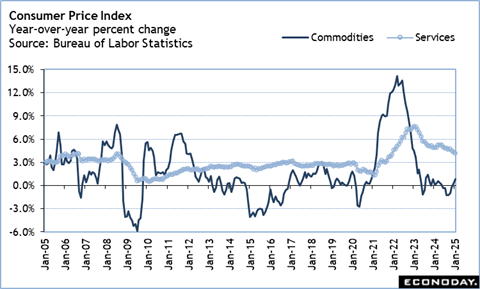

The economic data in the March 10 week include the February CPI and Final-Demand PPI reports at 8:30 ET on Wednesday and Thursday, respectively. There is little sign of moderation in the current pace of upward price pressures. In the context of the upcoming FOMC meeting on March 18-19, policymakers will still deem inflation “elevated” and too soon to for another rate cut. Even if prices on services show further improvement, those for commodities will be inching up again on things like food and insurance prices.

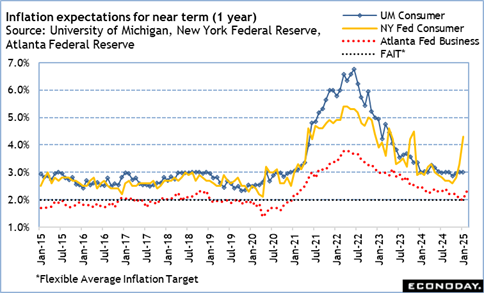

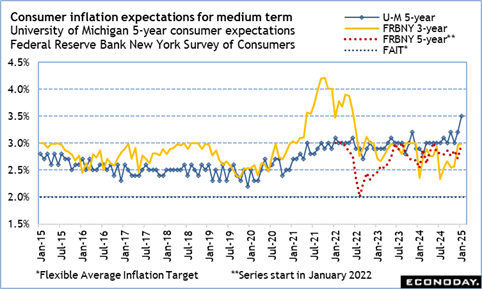

On Friday at 10:00 ET, the University of Michigan survey of consumers will include readings for inflation expectations in early March. In February, the 1-year inflation expectations measure jumped a full point to 4.3 percent while the 5-year inflation measure was up three-tenths to 3.5 percent. Rising inflation expectations will be one reason for the FOMC to maintain the current fed funds target rate at 4.25-4.50 percent at the next meeting. The Fed needs to keep it credibility as an inflation fighter and make sure that inflation expectations remain anchored. At present the increases can be said to be a reaction to a lot of unknowns piling up in a short period of time. But the FOMC will want to ensure that it reinforces the message that taming inflation is its priority at the moment.

The February numbers on retail sales should get some support from improved sales of motor vehicles. There could be a rebound after the weakness in January as demand for essentials reasserts itself and some consumers have tax refunds to spend. But elsewhere consumers may be cutting back on discretionary spending in a more uncertain economy with greater concerns about job security.

China CPI for February (Mon 0930 CST; Mon 0130 GMT; Sun 2130 EDT)

Consensus Forecast, Y/Y: -0.4%

Consensus Range, Y/Y: -0.4% to -0.2%

CPI is expected to retreat by 0.4 percent on year in February after rising 0.5 percent in January.

China PPI for February (Mon 0930 CST; Mon 0130 GMT; Sun 2130 EDT)

Consensus Forecast, Y/Y: -2.1%

Consensus Range, Y/Y: -2.1% to -2.0%

Forecasters expect a decline of 2.1 percent on year for February after falling 2.3 percent in January.

Germany Industrial Production for January (Mon 0800 CET; Mon 0700 GMT; Mon 0300 EDT)

Consensus Forecast, M/M: 1.5%

Consensus Range, M/M: 1.0% to 1.5%

Consensus Forecast, Y/Y: -2.8%

Consensus Range, Y/Y: -3.0% to -2.8%

Germany’s factory sector continues its seesaw pattern with increases followed by declines amid persistent weakness and sluggish global demand. Expectations call for a 1.5 percent increase on the month and a 2.8 percent decrease on year after a 2.4 percent drop on the month and 3.1 percent drop on year in December.

Germany Merchandise Trade for January (Mon 0800 CET; Mon 0700 GMT; Mon 0300 EDT)

Consensus Forecast, Balance: E 21.0 B

Consensus Range, Balance: E 21.0 B to E21.5 B

The surplus is seen nearly flat at E21.0 billion in January versus E20.7 billion in December.

Japan Household Spending for January (Tue 0830 JST; Mon 2330 GMT; Mon 1930 EDT)

Consensus Forecast, M/M: -1.5%

Consensus Range, M/M: -2.4% to -0.2%

Consensus Forecast, Y/Y: 4.0%

Consensus Range, Y/Y: 2.5% to 5.6%

Japan's real household spending is forecast to post a second straight rise in January, up a sharp 4.0% on year, led by strong demand for winter clothing, heaters and other seasonal goods amid record snowfall in many regions. It is also expected to be underpinned by a rebound in auto sales compared to a year earlier when Toyota Motor suspended production and shipments of some models over safety inspection scandals.

The year-on-year increase is seen accelerating from an unexpected 2.7% jump and the first rise in five months in December, when consumers rushed to donate to prefectures that offer generous free goods and services in return by the Dec. 31 tax year deadline.

On the month, real average expenditures by households with two or more people are expected to slip back 1.5% amid depressed real wages after soaring 2.3% in December, edging up 0.4% in November and surging 2.9% in October.

Japan GDP for Fourth Quarter (Tue 0850 JST; Mon 2350 GMT; Mon 1950 EDT)

Consensus Forecast, M/M: 0.7%

Consensus Range, M/M: 0.5% to 0.8%

Consensus Forecast, Annual Rate: 2.8%

Consensus Range, Annual Rate: 2.2% to 3.0%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: 1.1% to 1.4%

Japan's economic growth picked up to 0.7% on quarter, or an annualized 2.8%, in the October-December period from +0.4% q/q (+1.7% annualized) in July-September is forecast to show no or only a limited revision in the second reading. The preliminary Q4 GDP data released last month showed the much stronger-than-expected growth was largely due to a technical rebound in net exports, up 0.7 percentage point (after four quarters of drops), that was caused by a sharper-than-expected slump in imports and masks weak exports. Domestic demand trimmed total domestic output by 0.1 point in Q4 after boosting the Q3 GDP by 0.5 point, underscoring the wobbly recovery.

From a year earlier, Japan's GDP posted a second straight increase in the final quarter of 2024, up 1.2%, after rising 0.6% in Q3 and falling 0.8% in Q2. It is expected to be revised up slightly to a 1.3% rise.

United States NFIB Small Business Optimism Index for February (Tue 0600 EDT; Tue 1000 GMT)

Consensus Forecast, Index: 101.0

Consensus Range, Index: 100.9 to 102.0

No recovery in small business sentiment with the index at 101.0 in February, down from 102.8 in January and 105.1 in December. Enthusiasm over expected pro-business policies of the Trump administration has faded a bit.

United States JOLTS for January (Tue 1000 EDT; Tue 1400 GMT)

Consensus Forecast, Job Openings: 7.5 M

Consensus Range, Job Openings: 7.4 M to 7.9 M

Job openings dropped unexpectedly to 7.6 million in December from 8.16 million in November and the consensus looks for another decline to 7.5 million in January as the labor market cools.

Japan PPI for February (Wed 0850 JST; Tue 2350 GMT; Tue 1950 EDT)

Consensus Forecast, M/M: -0.1%

Consensus Range, M/M: -0.2% to 0.0%

Consensus Forecast, Y/Y: 3.9%

Consensus Range, Y/Y: 3.8% to 4.1%

Producer inflation in Japan is expected to decelerate to 3.9% on year in February after rising to 4.2% in January from 3.9% in December amid globally softer prices for iron/steel, nickel and resins but the recent gains are the highest since +4.5% in June 2023, thanks to elevated processed food prices and the weak that has kept import costs high. The year-on-year rise in energy costs eased slightly after the government revived utility subsidies for three months which are reflected in bill payments from February to April. Food prices remain elevated in the aftermath of a spike in farm produce costs caused by domestic rice shortages.

On the month, the corporate goods price index is forecast to have slipped 0.1% after rising 0.3% in the previous two months.

India CPI for February (Wed 1600 IST; Wed 1030 GMT; Wed 0630 EDT)

Consensus Forecast, Y/Y: 4.0%

Consensus Range, Y/Y: 4.0% to 4.2%

Forecasters expect CPI up 4.0 percent on year in February after a 4.31 percent increase in January. Declining food prices have helped inflation trend lower.

India Industrial Production for January (Wed 1600 IST; Wed 1030 GMT; Wed 0630 EDT)

Consensus Forecast, Y/Y: 3.5%

Consensus Range, Y/Y: 3.4% to 3.5%

Output slowed sharply to a 3.2 percent year on year rise in December from 5.2 percent in November, dragged down by weak manufacturing. The consensus looks for output up 3.5 percent in January.

Canada Bank of Canada Policy Rate Announcement (Wed 0945 EDT; Wed 1345 GMT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: -25 bp to -25 bp

Consensus Forecast, Level: 2.75%

Consensus Range, Level: 2.75% to 2.75%

With tariffs hitting the Canadian economy, all the BOC can do is cut rates. The consensus looks for a succession of 25 bp rate cuts including March 12.

United States CPI for February (Wed 0830 EDT; Wed 1230 GMT)

Consensus Forecast, CPI - M/M: 0.3%

Consensus Range, CPI - M/M: 0.2% to 0.4%

Consensus Forecast, CPI - Y/Y: 2.9%

Consensus Range, CPI - Y/Y: 2.9% to 3.2%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.3% to 0.4%

Consensus Forecast, Ex-Food & Energy - Y/Y: 3.2%

Consensus Range, Ex-Food & Energy - Y/Y: 2.9% to 3.2%

Forecasters look for another 0.3 percent print for total and core CPI, suggesting no real change in the inflation picture. Food and energy prices continue to exert upward pressure. Meanwhile, business surveys suggest some companies are raising prices in anticipation of higher costs from tariffs.

Eurozone Industrial Production for January (Thu 1100 CET; Thu 1000 GMT; Thu 0600 EDT)

Consensus Forecast, M/M: 1.0%

Consensus Range, M/M: 0.5% to 1.0%

Consensus Forecast, Y/Y: -0.5%

Consensus Range, Y/Y: -1.7% to -0.3%

Output is seen up 1.0 percent on the month and down 0.5 percent on year in January.

United States Jobless Claims for Week 3/8 (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 230K

Consensus Range, Initial Claims - Level: 223K to 230K

Claims are expected to rebound to 230K in the latest week after dropping by 21,000 to 221K a week ago.

United States PPI-Final Demand for February (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, PPI-FD - M/M: 0.3%

Consensus Range, PPI-FD - M/M: 0.2% to 0.4%

Consensus Forecast, PPI - Y/Y: 3.4%

Consensus Range, PPI - Y/Y: 3.2% to 3.4%

Consensus Forecast, Ex-Food & Energy - M/M: 0.3%

Consensus Range, Ex-Food & Energy - M/M: 0.2% to 0.4%

The consensus looks for headline PPI to ease off slightly after an. ugly January report. The consensus looks for PPI up 0.3 percent on month and up 3.4 percent on year in February after rising 0.4 percent and 3.5 percent in January. PPI ex-food & energy is seen up 0.3 percent on the month in February after rising 0.3 percent in January.

Germany CPI for February (Fri 0800 CET; Fri 1000 GMT; Fri 0600 EDT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: -0.2% to 0.4%

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 2.3% to 2.3%

Consensus Forecast, HICP - M/M: 0.6%

Consensus Range, HICP - M/M: 0.6% to 0.6%

Consensus Forecast, HICP - Y/Y: 2.8%

Consensus Range, HICP - Y/Y: 2.8% to 2.8%

Forecasters see no revision in the final from the flash with CPI up 0.4 percent on month and 2.3 percent on year.

Canada Manufacturing Sales for January (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, M/M: 2.0%

Consensus Range, M/M: 2.0% to 2.0%

Manufacturing sales are seen up 2.0 percent in January, in line with the Stats Canada preliminary estimate, paced by accelerating sales of autos ahead of imposition of US import tariffs.

United States Consumer Sentiment Index for March (Fri 1000 EDT; Fri 1400 GMT)

Consensus Forecast, Index: 64.0

Consensus Range, Index: 62.0 to 69.0

Consumer sentiment fell by 10 percent to 64.7 in February from 71.7 in January as consumers fear tariffs, economic turmoil and inflation. The consensus sees the index remaining depressed at 64.0 in the preliminary March report.

|