|

By Marco Babic, Econoday Economist

A great deal of ink has been spilled over the United States imposing tariffs on its Canadian and Mexican neighbors, plus China. During that time, Europe remained relatively quiet, hoping to avoid a similar fate. No longer.

On Wednesday Europe announced retaliatory tariffs on iconic American products such as Kentucky bourbon and Harley-Davidson motorcycles starting April 1. Symbolic? Perhaps. It gets more serious in the middle of the month when tariffs on industrial and farm products come into effect.

The week of March 17 sees trade reports from Italy and the Eurozone for January, while the Swiss report February results. It’s too soon to glean any direction from these reports on the implications of tariffs, so it will be instructive to look at sentiment indicators.

On Tuesday, ZEW reports German investor sentiment for March, and which rose to its highest level in two years in February. With the US position on supporting Ukraine shifting seemingly by the day, it has forced Europe to fill the void.

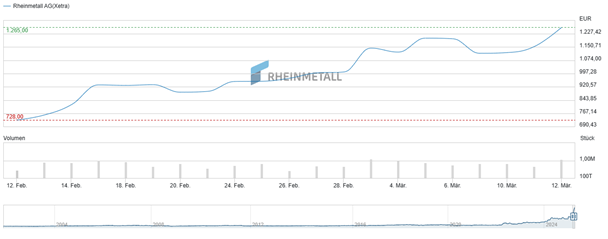

One beneficiary of that is Germany’s Rheinmetall, Europe’s largest munitions producer which has seen its share price rise sharply in the past month. While only one company, it illustrates that increased defense spending could help industrial production and also investor sentiment.

Source: Rheinmetall

Next week also provides a gauge on how consumers in the Eurozone are viewing the economy, with March consumer confidence on Friday. Sentiment remained negative in February and it remains to be seen if they see an improvement in price pressures and geopolitical uncertainty.

Swiss National Bank in the Spotlight

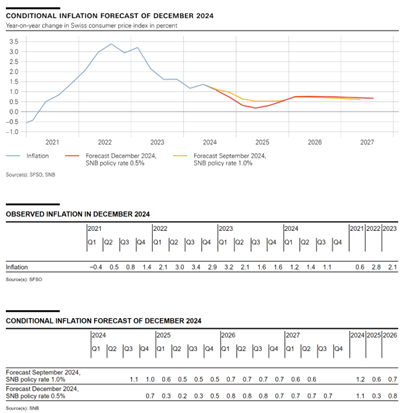

One of the main events next week is the Swiss National Bank’s Monetary Policy Assessment on Thursday. At its December meeting, it lowered its policy rate to 0.5 percent, noting that inflationary pressure decreased on the quarter and was lower than expected.

That led the SNB to lower its inflation forecast for 2025 from 0.6 to 0.3 percent annually

The language on the Swiss franc was rather terse at the SNB’s last meeting, saying only that “We also remain willing to be active in the foreign exchange market as necessary.”

With ongoing uncertainty and investors likely looking for stability, they could be looking to Switzerland. In the past, the SNB has been willing to intervene in the markets to keep the franc from appreciating too drastically. Markets generally expect another 25 basis point rate cut from the SNB.

By Teresa Sheehan, Econoday Economist

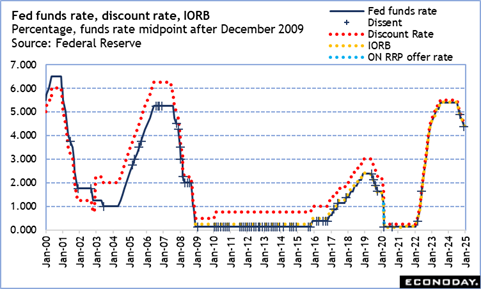

The March 18-19 FOMC meeting is the center of attention in the March 17 week. Fed Chair Jerome Powell’s comments on March 7 were calibrated to keep markets calm and set expectations for the meeting based on the current economic data, not the unknowns generated by the flood of changes happening in federal policy and government.

Powell kept the focus on a labor market that continues to see moderate hiring and relatively few layoffs outside of technology and government. He said the US economy is in a “good place” and that monetary policy is well positioned to keep it there. He emphasized that the FOMC is paying close attention to the economic data and being careful not to overreact to any one data point including month-to-month shifts in the inflation indicators. The current situation is one in which the FOMC can be patient in setting policy and adjusting the current fed funds target range of 4.25-4.50 percent where it has been since December 2024.

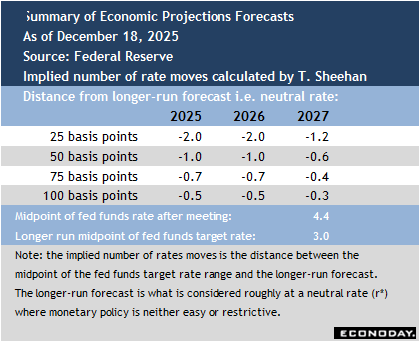

Powell’s remarks gave markets no reason to expect a rate move to be announced at 14:00 ET on Wednesday when the FOMC statement is set for release. However, the quarterly summary of economic projections (SEP) will also be released at that time. The update to the FOMC’s collective forecasts will be carefully parsed to determine if any slowdown in GDP growth is expected in 2025, if unemployment is anticipated to rise, and where inflation is headed. Will a forecast deterioration in the labor market mean that rates are likelier to be cut sooner? Or will still elevated inflation and higher inflation expectations keep monetary policy meaningfully restrictive for a longer period?

Powell’s press briefing at 14:30 ET on Wednesday will probably include questions about just how much of policy talk out of the White House – which would be difficult to quantify in its impact – has had an impact on forecasts.

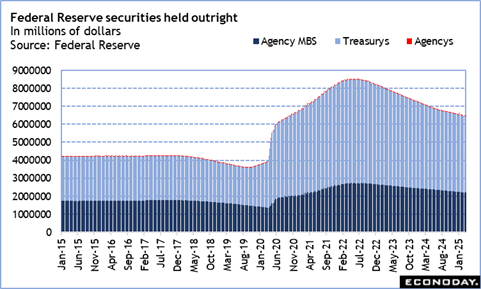

There has been some thought about when the FOMC would determine it is time to end the program that began in June 2022 of reducing reserve holdings of US treasuries and agency mortgage-backed securities. The size of the balance sheet is now down over $2 trillion from their peak of $8.5 trillion in May 2022. It is probable that the current holding of about $6.5 trillion could be now deemed closer to the “ample” reserve conditions desired by Fed policymakers from the “abundant” reserves that characterized the latest round of large-scale asset purchases associated with the pandemic response.

China Fixed Asset Investment for February (Mon 1000 CST; Mon 0200 GMT; Sun 2200 EDT)

Consensus Forecast, Year to Date on Y/Y Basis: 3.4%

Consensus Range, Year to Date on Y/Y Basis: 3.2% to 3.8%

Growth in fixed asset investment has hovered around 3.4 percent for years and forecasters see another 3.4 percent reading for February versus 3.2 percent in January.

China Industrial Production for February (Mon 1000 CST; Mon 0200 GMT; Sun 2200 EDT)

Consensus Forecast, Y/Y: 5.3%

Consensus Range, Y/Y: 5.2% to 5.5%

Growth in industrial production is seen at 5.3 percent on year in February versus 6.2 percent in January.

China Retail Sales for February (Mon 1000 CST; Mon 0200 GMT; Sun 2200 EDT)

Consensus Forecast, Y/Y: 3.8%

Consensus Range, Y/Y: 3.5% to 4.0%

Sales growth has been sluggish with growth on year seen at 3.8 percent in February versus a softer 3.7 percent in January.

Canada Housing Starts for February (Mon 0815 EDT; Mon 1215 GMT)

Consensus Forecast, Annual Rate: 247,000

Consensus Range, Annual Rate: 222,000 to 250,000

Starts continue trending sideways. They are expected to improve somewhat to a 247,000 annual in February from 240,000 in January, based on housing permits data, but the improvement was limited by severe winter weather.

United States Retail Sales for February (Mon 0830 EDT; Mon 1230 GMT)

Consensus Forecast, Retail Sales - M/M: 0.7%

Consensus Range, Retail Sales - M/M: 0.4% to 1.0%

Consensus Forecast, Ex-Vehicles - M/M: 0.4%

Consensus Range, Ex-Vehicles - M/M: 0.1% to 0.9%

Consensus Forecast, Ex-Vehicles & Gas - M/M: 0.5%

Consensus Range, Ex-Vehicles & Gas - M/M: 0.2% to 1.0%

Forecasters see retail sales rebounding by 0.7 percent in February after dropping by 0.9 percent in January, with a lift from auto and gas station sales.

United States Empire State Manufacturing Index for March (Mon 0830 EDT; Mon 1230 GMT)

Consensus Forecast, Index: 0.2

Consensus Range, Index: -2.0 to 6.0

The index is expected to fade to an uninspiring 0.2 in March from 5.7 in February and minus 12.6 in January.

United States business Inventories for January (Mon 1000 EDT; Mon 1400 GMT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.2% to 0.5%

Data already released point to a 0.3 percent increase for January.

United States Housing Market Index for March (Mon 1000 EDT; Mon 1400 GMT)

Consensus Forecast, Index: 42.0

Consensus Range, Index: 42.0 to 44.0

Builder sentiment remains on the gloomy side with the housing market index expected flat at 42 in March after declining to 42 in February from 47 in January.

Germany ZEW Survey for March (Tue 1100 CET; Tue 1000 GMT; Tue 0600 EDT)

Consensus Forecast, Economic Sentiment: 35

Consensus Range, Economic Sentiment: 30 to 50

Economic sentiment is seen up to 35 in March from 26 in February.

Canada CPI for February (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, M/M: 0.6%

Consensus Range, M/M: 0.3% to 0.9%

Consensus Forecast, Y/Y: 2.2%

Consensus Range, Y/Y: 1.9% to 2.5%

The consensus sees CPI up 0.6 percent on the month and up 2.2 percent on year in February versus gains of 0.1 percent and 1.9 percent in January. The GST sales tax holiday that depressed consumer prices in December and January ended in February.

United States Housing Starts and Permits for February (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, Starts - Annual Rate: 1.383 M

Consensus Range, Starts - Annual Rate: 1.301 M to 1.415 M

Consensus Forecast, Permits - Annual Rate: 1.45 M

Consensus Range, Permits - Annual Rate: 1.375 M to 1.475 M

The call for February is a 1.383 million unit rate, up slightly from 1.366 million in January. Permits are seen at 1.45 million units in February versus 1.483 million in January. High prices and high mortgage rates are holding back residential construction.

United States Import and Export for February (Tue 0830 EDT; Tue 1230 GMT)

Consensus Forecast, Import Prices - M/M: -0.1%

Consensus Range, Import Prices - M/M: -0.3% to -0.1%

Consensus Forecast, Export Prices - M/M: -0.2%

Consensus Range, Export Prices - M/M: -0.4% to 0.4%

In the calm before the tariff storm, imports are expected down 0.1 percent on the month and exports down 0.2 percent on the month in February after rising 0.3 percent and 1.3 percent in January. Lots of attention on this number in March.

United States Industrial Production for February (Tue 0915 EDT; Tue 1315 GMT)

Consensus Forecast, Industrial Production - M/M: 0.2%

Consensus Range, Industrial Production - M/M: 0.0% to 0.4%

Consensus Forecast, Manufacturing Output - M/M: 0.1%

Consensus Range, Manufacturing Output - M/M: 0.0% to 0.5%

Consensus Forecast, Capacity Utilization Rate: 77.8%

Consensus Range, Capacity Utilization Rate: 77.6% to 78.0%

Higher manufacturing hours are seen lifting output a modest 0.2 percent in February.

Japan Merchandise Trade for February (Wed 0850 JST; Tue 2350 GMT; Tue 1950 EDT)

Consensus Forecast, Balance: ¥814.5B

Consensus Range, Balance: ¥691.1B to ¥950.0B

Consensus Forecast, Imports - Y/Y: -1.0%

Consensus Range, Imports - Y/Y: -2.9% to 4.0%

Consensus Forecast, Exports - Y/Y: 13.9%

Consensus Range, Exports - Y/Y: 10.4% to 19.4%

Japanese export values are forecast to post a fifth straight year-on-year rise in February, up a sharp 13.9%, after rising a revised 7.3% in January. The increase is expected to be led by continued solid demand for automobiles, semiconductor-producing equipment and computer chips. There might have been some rush exports to the key U.S. market in the face of the threat of stiff tariffs on imports of steel and aluminum among other goods.

Import values are expected to mark their first drop in three months, down 1.0%, following a revised 16.5% rise the previous month. A drop in coal imports is seen offsetting higher purchases of automobiles, drugs and smartphones. Both exports and imports tend to show irregular patterns around the lunar new year holidays in some Asian countries, which began on Jan. 29 this year.

The trade balance is forecast to post a surplus of ¥814.5 billion following a revised ¥2,736.6 billion (¥2.74 trillion) deficit in January. It would compare to a 382.98 billion deficit in February 2024 and the record shortfall of ¥3,506.43 billion (¥3.51 trillion) in Jan 2023.

Japan Machinery Orders for January (Wed 0850 JST; Tue 2350 GMT; Tue 1950 EDT)

Consensus Forecast, M/M: -0.8%

Consensus Range, M/M: -2.7% to 2.1%

Consensus Forecast, Y/Y: 7.4%

Consensus Range, Y/Y: 4.4% to 11.8%

Japanese core machinery orders, the key leading indicator of business investment in equipment, are forecast to post a second straight monthly drop in January, down 0.8% (range: -2.7% to +2.1%), after slipping back 1.2% in December to mark their first drop in three months.

From a year earlier, core orders, which track the private sector and exclude volatile orders from electric utilities and for ships, are expected to show fourth consecutive gain, up 7.4% after rising 4.3% previously.

Japan Bank of Japan Announcement (Wed 1130 JST; Wed 0230 GMT; Thu 2230 EDT)

Consensus Forecast, Change: 0bp

Consensus Range, Change: 0bp to 0bp

Consensus Forecast, Level: 0.5%

Consensus Range, Level: 0.5% to 0.5%

The Bank of Japan's nine-member board is widely expected to stand pat for now to monitor the effects of its last rate hike conducted in January when it voted 8 to 1 to raise the policy interest rate by another 25 basis points to 0.5% in a third rate hike during the current normalization process begun in March 2024. Members are also closely watching whether expected high wage increases by major firms will spread to smaller firms in fiscal 2025 starting on April 1.

The board expects inflation to be anchored around its 2% target by early 2026. It is on course for two more 25 basis point rate hikes that would take the overnight interest rate target to 1% by late 2025 or early 2026 as part of its gradual normalization process after more than a decade of large-scale easing. The BOJ is in the process of normalizing its policy by gradually lifting the rates from zero and slightly negative. The BOJ under Governor Ueda, who took office in April 2023, shifted gear in March 2024 with its first rate hike in 17 years and an end to the seven-year-old yield curve control framework, following a decade of large monetary easing aimed at reflating the economy. The board stood pat in December, October and September after voting 7 to 2 in July to hike the rate to 0.25% from a range of 0% to 0.1%.

Eurozone HICP for February (Tue 1100 CET; Tue 1000 GMT; Wed 0600 EDT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.5% to 0.5%

Consensus Forecast, Y/Y: 2.4%

Consensus Range, Y/Y: 2.4% to 2.4%

Forecasters see no revision from the flash in headline HICP at up 0.5 percent on the month and up 2.4 percent on year.

United States FOMC Announcement (Wed 1400 EDT; Thu 1800 GMT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Federal Funds Rate Target: 4.375%

Consensus Range, Federal Funds Rate Target: 4.375% to 4.375%

The Fed is expected to wait for the dust to settle on the impact of tariffs and other policy changes, so no change in rates this time, even as expectations grow for a rate cut in June.

New Zealand GDP for Fourth Quarter (Thu 1045 NZDT; Wed 2145 GMT; Wed 1745 EDT)

Consensus Forecast, Q/Q: 0.4%

Consensus Range, Q/Q: 0.3% to 0.5%

Consensus Forecast, Y/Y: -1.4%

Consensus Range, Y/Y: -1.4% to -1.4%

The economy is expected to bounce back by 0.4 percent in Q4 from Q3 after declining by 1.0 percent on quarter in Q3. On year, forecasts look for a 1.4 percent decrease in Q4.

Australia Labour Force Survey for January (Thu 1130 AEDT; Thu 0030 GMT; Wed 2030 EDT)

Consensus Forecast, Employment - M/M: 28,000

Consensus Range, Employment - M/M: 15,000 to 60,000

Consensus Forecast, Unemployment Rate: 4.1%

Consensus Range, Unemployment Rate: 4.0% to 4.2%

The consensus looks for jobs up a modest 28,000 on the month. The jobless rate is expected unchanged at 4.1 percent from 4.1 percent in January and up from 4.0 percent in December.

China Loan Prime Rate for March (Thu 0900 CST; Thu 0100 GMT; Wed 2100 EDT)

Consensus Forecast, 1-Year Rate - Change: 0 bp

Consensus Range, 1-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 1-Year Rate - Level: 3.10%

Consensus Range, 1-Year Rate - Level: 3.10% to 3.10%

Consensus Forecast, 5-Year Rate - Change: 0 bp

Consensus Range, 5-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 5-Year Rate - Level: 3.60%

Consensus Range, 5-Year Rate - Level: 3.60% to 3.60%

Forecasters see no change in the LPR at the 1-year or 5-year tenors.

United Kingdom Labour Market Report for February (Thu 0700 GMT; Tue 0300 EDT)

Consensus Forecast, ILO Unemployment Rate: 4.4%

Consensus Range, ILO Unemployment Rate: 4.4% to 4.4%

The ILO jobless rate is expected steady at 4.4 percent in February from January.

Germany PPI for February (Thu 0800 CET; Thu 0700 GMT; Thu 0300 EDT)

Consensus Forecast, Y/Y: 1.0%

Consensus Range, Y/Y: 1.0% to 1.3%

Wholesale prices are expected up 1.0 percent in February on the year.

Switzerland SNB Monetary Policy Assessment (Thu 0930 CET; Thu 0830 GMT; Thu 0430 EDT)

Consensus Forecast, Change: -25 bp

Consensus Range, Change: 0 bp to -25 bp

Consensus Forecast, Level: 0.25%

Consensus Range, Level: 0.25% to 0.5%

With inflation falling, the consensus looks for a 25 basis point cut to follow up the surprising super-sized 50 bp cut in December.

United Kingdom BoE Announcement & Minutes (Thu 1200 GMT; Thu 0800 EDT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 4.50%

Consensus Range, Level: 4.50% to 4.50%

No one looks for the majority to back a rate cut this time so soon after cutting in February, but attention will focus on how many doves vote for a move at this week’s meeting.

United States Jobless Claims for Week 3/15 (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 225 K

Consensus Range, Initial Claims - Level: 210 K to 230 K

Claims are expected to edge up to 225K in the latest week after an unexpected downtick to 220K from 222K last week and from 242K the week before that. Suggests a relatively stable labor market.

United States Philadelphia Fed Manufacturing Index for March (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Index: 12.0

Consensus Range, Index: 9.0 to 17.2

The consensus looks for continued moderate expansion with the index at 12.0, down from 18.0 in February. As an early read on March, lots of attention on this one.

United States Existing Home Sales for February (Thu 1000 EDT; Thu 1400 GMT)

Consensus Forecast, Annual Rate: 3.95 M

Consensus Range, Annual Rate: 3.87 M to 4.10 M

Sales are seen at an annual 3.95 million unit rate in February, down from 4.08 million in January, suggesting a weakening market with consumers increasingly cautious.

United States Leading Indicators for February (Thu 1000 EDT; Thu 1400 GMT)

Consensus Forecast, M/M: -0.2%

Consensus Range, M/M: -0.3% to -0.1%

Another sluggish showing expected at minus 0.2 percent.

Japan CPI for February (Fri 0830 JST; Fri 0730 GMT; Fri 0330 EDT)

Consensus Forecast, CPI - Y/Y: 3.5%

Consensus Range, CPI - Y/Y: 3.5% to 3.6%

Consensus Forecast, Ex-Fresh Food - Y/Y: 2.9%

Consensus Range, Ex-Fresh Food - Y/Y: 2.9% to 3.0%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y: 2.6%

Consensus Range, Ex-Fresh Food & Energy - Y/Y: 2.5% to 2.7%

Consumer inflation in Japan is expected to ease a few notches in two of the three key readings in February as the government has revived temporary utility subsidies to help lower electricity and natural gas bills during the peak winter heating season from January to March (bills paid from February to April). However, processed food prices remain elevated in the aftermath of protracted domestic rice supply shortages and high import costs caused by the weak yen.

The core reading (excluding fresh food) is forecast to post a 2.9% increase on year, easing from January’s 3.2% gain, which was the fastest pace in 21 months. The year-on-year rise in the total CPI is also expected to decelerate to 3.5% after surging to a two-year high of 4.0%

the previous month. The underlying inflation measured by the core-core CPI (excluding fresh food and energy) is estimated at 2.6% vs. 2.5% previously.

Canada Retail Sales for January (Fri 0830 CET; Fri 0730 GMT; Fri 0330 EDT)

Consensus Forecast, M/M: -0.4%

Consensus Range, M/M: -0.5% to -0.4%

Forecasters agree with the preliminary estimate from Statistics Canada calling for sales down 0.4 percent on month in January after a robust 2.5 percent jump in December.

Eurozone EC Consumer Confidence Flash for March (Fri 1600 CET; Fri 1500 GMT; Fri 1100 EDT)

Consensus Forecast, Index: -12.8

Consensus Range, Index: -13.0 to -12.6

The index is expected at minus -12.8 in March versus minus 13.6 in February.

|