|

By Brian Jackson, Econoday Economist

The Reserve Bank of Australia’s policy is the main focus in the Asia-Pacific region in the week ahead. At the previous meeting mid-February, officials lowered the main policy rate by 25 basis points from 4.35 percent to 4.10 percent. This is the first reduction in the rate since 2020. Officials noted at the time, however, that are “cautious on prospects for further policy easing” and also warned that “if monetary policy is eased too much too soon, disinflation could stall.” This, and subsequent public comments suggest that there is little appetite at present for another rate cut, with officials still wary of upside risks to underlying inflation. Australian retail sales & trade data are also scheduled for release next week.

The other big focus will be the March round of purchasing managers surveys for the Asia-Pacific region. Activity data for the first two months of the year is typically impacted by the timing of lunar new year holidays, but these surveys will provide the first major indication of economic conditions in the region for March. February PMI surveys generally showed subdued conditions, with many respondents citing concerns about global trade tensions. Next week’s surveys will be closely watched to see if activity and sentiment have improved in recent weeks.

By Marco Babic, Econoday Economist

The week ahead brings us April Fool’s Day, but recent headlines are no laughing matter for the global economy. President Trump announced punishing tariffs on cars and auto parts, which raised the hackles of Canada and the EU.

Interestingly, Trump said that if Canada worked with the EU “to do economic harm to the US,” additional large-scale tariffs would be planned. It seems that what is good for the goose in this case, is not something for the gander.

To be sure, tariffs have been an on-again off-again scenario and leaders are trying to cut last-minute deals and promise investment in the United States. But Canada and the EU are digging in their heels and we are on the verge of a full-scale global tariff war.

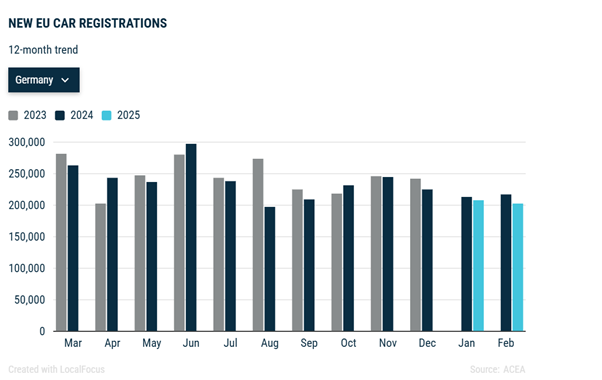

One of the hardest hit industries in Europe will obviously be the auto industry. Germany’s automakers are already facing headwinds. With Europe’s largest economy already stagnant, a faltering auto industry could push it into a deep recession.

Source: ACEA

Oh yes. And there is economic data out in the week ahead as well.

Apropos Germany, manufacturing orders, which fell 7 percent on a monthly basis in January, are scheduled for release on Friday. While they won’t reflect the current lay of the land, continued contraction is not a good starting point for the coming months should tariffs become a fixed reality.

Germany is reporting retail sales figures for February on Monday, having risen 0.2 percent from the previous month and 2.9 percent from a year ago. Consumer sentiment for April was largely stable, but a concerning sign is an increased propensity to save among consumers.

Italy and Germany report preliminary inflation data for March on Monday, with the flash Eurozone reading coming on Tuesday. Inflation has been within tolerable bounds for the ECB, but with inflationary effects of tariffs concerns about stagflation could arise.

Over the course of the week, final manufacturing and composite PMIs are reported, although as usual won’t likely deviate much, it at all, from preliminary results.

The data still need to catch up with current events which could be the calm before the storm.

By Teresa Sheehan, Econoday Economist

With the major inflation data for February out of the way, the focus in the March 31 week shifts back to the labor market. The next FOMC meeting on May 6-7 will have another month’s worth of reports to consider in setting monetary policy. At present, getting back to the 2 percent objective for price stability looks to be stalled and remains the more pressing side in the dual mandate. The maximum employment side of the mandate is not yet needing attention in terms of a significant slowing in the labor market. The reports in the coming week should not change that outlook as yet.

The ongoing health in the labor market reflects the rebalancing over the past year or so that has brought labor demand into better alignment with labor supply. If hiring has slowed, job losses have not increased outside of a few narrow sectors. Fed policymakers are watching for signs of layoffs spreading and/or accelerating. The January reports could offer a few warning signs.

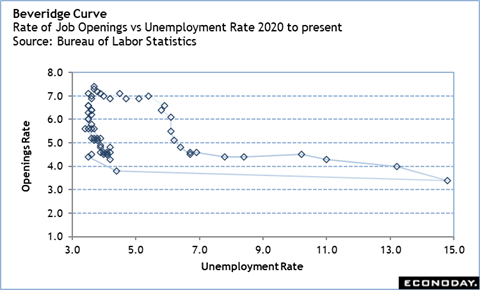

The data on job openings and labor turnover (JOLTS) in February at 10:00 ET on Tuesday lags some of the other reports. It should confirm the anecdotal evidence for fewer job openings and hires, fewer workers voluntarily leaving jobs, and some increasing layoff activity. The largest share will likely fall in the government and technology sectors, but cuts in federal contracts and replacing workers with AI are going to have secondary impacts that will show up soon. The Beveridge Curve – which compares the rate of job openings to the unemployment rate still shows normal, healthy conditions prevail for the labor market.

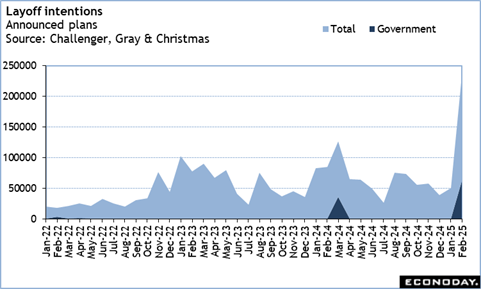

More current will be the March numbers in the Challenger report on layoff intentions at 7:30 ET on Thursday. Layoff intentions took a big jump higher to 172,017 in February, up 245.5 percent from January, but over a third of that was 62,242 in government. Nonetheless, excluding planned government layoffs, job cut plans more than doubled to 109,775 in February from 49,671 in January. Layoff intentions may not lead to actual job losses as some of these can mean elimination of unfilled positions. Also, intentions are not necessarily for the immediate future but are cuts in future staffing plans over weeks or months. Nonetheless, even if these are not actual layoffs, it means the labor market is contracting.

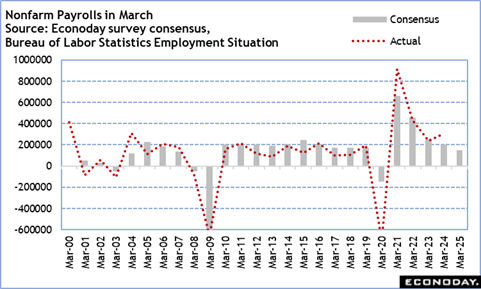

The monthly employment report on Friday at 8:30 ET is widely anticipated to show nonfarm payrolls are rising steadily at a level able to absorb the newly unemployed and new entrants to the labor force. What it may not show is if the workers leaving federal government employment are simply retiring and exiting the job market, looking for new jobs, or waiting out the weeks or months until their separation agreements expire before being counted as unemployed again.

Fed policymakers are going to have challenges in discerning what is going on behind the numbers. There remain high levels of uncertainty about the US economy and the impacts of rapidly changing and inconsistent policy out of the White House.

South Korea Industrial Production February (Mon 0800 KST; Sun 2300 GMT; Sun 1900 EDT)

Consensus Forecast, M/M: 0.0%

Consensus Range, M/M: -0.8% to 0.7%

Output is seen flat on the month in February after dropping 2.3 percent in January, not impressive.

Japan Industrial Production February (Mon 0850 JST; Sun 2350 GMT; Sun 1950 EDT)

Consensus Forecast, M/M: 3.2%

Consensus Range, M/M: 1.1% to 3.5%

Consensus Forecast, Y/Y: 1.3%

Consensus Range, Y/Y: -1.0% to 2.6%

Japan’s industrial production is forecast to post its first rise in four months on the month in February, up 3.2%, driven by solid export demand for vehicles from the United States as well as semiconductor-producing equipment and computer chips from Asia minus China whose economy is still dragging its feet. The index tends to rebound after a decline or two and production activity in January might have slowed ahead of the lunar new year holidays in some Asian countries that began late that month.

The monthly survey by the Ministry of Economy, Trade and Industry released last month indicated that output would rebound a solid 2.3% in February, led by output of semiconductor-producing equipment and computer chips, before slipping back 2.0% in March, when vehicle and general machinery productions is seen falling.

From a year earlier, factory output is expected to mark the second straight gain, up 1.3%, after rebounding a partial 2.2% (revised down from 2.6%) on the 6.7% plunged in January 2024 that was triggered by suspension of all domestic production by Toyota Motor group firm Daihatsu over a vehicle safety scandal from late December until mid-February, which had a widespread impact beyond the auto industry.

Japan Retail Sales for February (Mon 0850 JST; Sun 2350 GMT; Sun 1950 EDT)

Consensus Forecast, M/M: 1.1%

Consensus Range, M/M: 0.3% to 1.5%

Consensus Forecast, Y/Y: 1.5%

Consensus Range, Y/Y: -1.0% to 2.3%

Japanese retail sales are forecast to have slowed to a sluggish 1.5% rise on year in February, down from +4.4% (revised up from +3.9%) in January, as the severe winter weather chilled demand for spring clothing, prompting department store sales to post their first y/y dip in four months (-2.3% vs. +5.2% previously). The expected setback is also due to the calendar factor of a shorter shopping day compared to February 2023, when the leap-year effect led to a 4.7% jump in sales. Overall, elevated costs for food, energy and other necessities are keeping consumption sluggish.

The widely projected three-year y/y increase streak in sales values (official data don’t have volumes) is seen underpinned by a continued rebound in auto sales, lingering demand for winter clothing and heaters amid record snowfall in many regions as well as higher retail gasoline prices in light of reduced government subsidies. In the January-March quarter of 2024, the economy slumped an 0.5%, or an annualized 2.1%, for the first contraction in two quarters, hit by suspended output at Toyota group factories over a safety test scandal that had a widespread impact beyond the auto industry.

On the month, retail sales are expected to post a 1.1% gain after rebounding 1.2% (revised up from +0.5%) in January, slipping 0.2% in December and rising 1.4% in November.

China CFLP Composite PMI for March (Mon 0930 CST; Mon 0130 GMT; Mon 2130 EDT)

Consensus Forecast, Manufacturing Index: 50.3

Consensus Range, Manufacturing Index: 50.2 to 50.5

Consensus Forecast, Non-Manufacturing Index: 50.6

Consensus Range, Non-Manufacturing Index: 50.3 to 50.6

Manufacturing is expected to edge up to 50.3 in March from 50.2 in February and services is seen at 50.6 versus 50.4 in February.

Germany Retail Sales for February (Mon 0800 CET; Mon 0700 GMT; Mon 0300 EDT)

Consensus Forecast, M/M: 0.1%

Consensus Range, M/M: 0.0% to 0.3%

The consensus looks for another muted rise of 0.1 percent for February after an uptick of 0.2 percent in January.

Germany CPI for March (Mon 1400 CET; Mon 1300 GMT; Mon 0900 EDT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.4% to 0.4%

Consensus Forecast, Y/Y: 2.3%

Consensus Range, Y/Y: 2.2% to 2.4%

CPI is seen up 0.4 percent on the month and up 2.3 percent on year.

United States Chicago PMI for March (Mon 0945 EDT; Mon 1345 GMT)

Consensus Forecast, Index: 44.1

Consensus Range, Index: 43.0 to 45.5

The index is expected down at 44.1 in March from 45.5 in February, another dismal showing.

Japan Unemployment Rate for February (Tue 0830 JST; Mon 2330 GMT; Mon 1930 EDT)

Consensus Forecast, Rate: 2.5%

Consensus Range, Rate: 2.4% to 2.5%

Japanese payrolls are expected to post their 31st straight rise on year in February amid lingering labor shortages. The seasonally adjusted unemployment rate is forecast at 2.5% after being unchanged at 2.5% for the third consecutive month and edging up from 2.4% in September, which was the lowest in more than four years (since 2.4% in February 2020).

The government continues to describe employment conditions as "showing signs of improvement” in its latest monthly economic report. Major firms have matched or exceeded union demands for base wage hikes for the fiscal year that starts on April 1 but elevated costs of living have pushed the real wage y/y change into a drop, squeezing many households.

Japan Tankan for First Quarter (Tue 0850 JST; Mon 2350 GMT; Mon 1950 EDT)

Consensus Forecast, Large Manufacturer Sentiment Index: 12

Consensus Range, Large Manufacturer Sentiment Index: 12 to 13

Consensus Forecast, Large Non-Manufacturer Sentiment Index: 34

Consensus Range, Large Non-Manufacturer Sentiment Index: 32 to 35

Consensus Forecast, Small Manufacturer Sentiment Index: -1

Consensus Range, Small Manufacturer Sentiment Index: -1 to 1

Consensus Forecast, Small Non-Manufacturer Sentiment Index: 16

Consensus Range, Small Non-Manufacturer Sentiment Index: 14 to 17

FY Current 2024

Consensus Forecast, Large Firms Capital Expenditure Plans: 9.1%

Consensus Range, Large Firms Capital Expenditure Plans: 8.5% to 10.0%

Consensus Forecast, Small Firms Capital Expenditure Plans: 4.7%

Consensus Range, Small Firms Capital Expenditure Plans: 0.9% to 5.2%

FY Started 2025

Consensus Forecast, Large Firms Capex Plans - FY Started: 2.9

Consensus Range, Large Firms Capex Plans - FY Started: 2.1 to 4.4

Consensus Forecast, Small Firms Capex Plans - FY Started: -3.9

Consensus Range, Small Firms Capex Plans - FY Started: -12.7 to 1.7

The Bank of Japan’s quarterly Tankan business survey is forecast to show confidence among manufacturers slipped in the March quarter in the face of stiff tariffs on U.S. imports of metals and vehicles as well as President Trump’s plans to slap “reciprocal tariffs” on imports from global trading partners. China’s struggling recovery from its property market problems is also seen putting a damper on corporate sentiment. Sentiment among non-manufacturers appears to have edged up or being flat. The tourism industry is benefiting from an influx of foreign visitors amid the weak yen while rising costs of living are hurting consumer spending.

The Tankan diffusion index showing sentiment among major manufacturers is forecast at 12, down from 14 in December. The index measuring sentiment among major non-manufacturers is seen at 34, easing from 33 in the previous poll. The index for smaller manufacturers is forecast to dip to -1 from +1 while that for their non-manufacturers is seen unchanged at 16.

Major firms are expected to project their plans for business investment in equipment would rise a combined 9.1% on the year in fiscal 2024 ending in March 2025, down from +11.3% in the December survey and indicating firms are becoming more cautious in the face of a global trade war. Capex plans are generally supported by demand for automation amid labor shortages as well as government-led digital transformation and emission control. Smaller firms are expected to maintain their combined capital spending plans at a 4.7% increase after lifting it to +4.0% in December from +2.6% in September. Smaller firms tend to have conservative plans at the start of each fiscal year and revise them up later.

Looking ahead, major firms are forecast by economists to present a combined 2.6% rise in capex for fiscal 2025 ending in March 2026 (their first estimate) while smaller firms are expected to start their plans for the incoming fiscal year with a 3.9% drop.

South Korea External Trade for March (Tue 0900 KST; Tue 0000 GMT; Mon 2000 EDT)

Consensus Forecast, Balance: $5.6 B

Consensus Range, Balance: $4.4 B to $7.0 B

The surplus is seen at $5.6 billion in March versus $4.3 billion in February.

Australia Retail Sales for February (Tue 1130 KST; Tue 0030 GMT; Mon 2030 EDT)

Consensus Forecast, M/M: 0.3%

Consensus Range, M/M: 0.2% to 0.4%

Another moderate gain of 0.3 percent is expected after a 0.3 percent rise in January.

China PMI Manufacturing for March (Tue 0945 CST; Tue 0145 GMT; Mon 2130 EDT)

Consensus Forecast, Index: 50.6

Consensus Range, Index: 50.6 to 51.2

The index is expected to edge down to 50.6 in March from 50.8 in February as slow expansion continues.

Australia RBA Announcement (Tue 1430 AEDT; Tue 0330 GMT; Mon 2330 EDT)

Consensus Forecast, Change: 0 bp

Consensus Range, Change: 0 bp to 0 bp

Consensus Forecast, Level: 4.10%

Consensus Range, Level: 4.10% to 4.10%

The market looks for no change in rates from the RBA this time as services inflation stays sticky despite a slowing economy. Like the Fed, RBA on hold, data dependent.

Germany PMI Manufacturing Final for March (Tue 0955 CEST; Tue 0755 GMT; Tue 0355 EDT)

Consensus Forecast, Index: 48.3

Consensus Range, Index: 48.3 to 48.3

No revision is expected from the flash at 48.3 in the final March report.

Eurozone PMI Manufacturing Final for March (Tue 1000 CEST; Tue 0800 GMT; Tue 0400 EDT)

Consensus Forecast, Index: 48.7

Consensus Range, Index: 48.7 to 49.0

No revision is expected from the flash at 48.7 in the final March report.

Eurozone HICP Flash for March (Tue 1100 CEST; Tue 0900 GMT; Tue 0500 EDT)

Consensus Forecast, HICP - Y/Y: 2.2%

Consensus Range, HICP - Y/Y: 2.1% to 2.3%

Consensus Forecast, Narrow Core - Y/Y: 2.6%

Consensus Range, Narrow Core - Y/Y: 2.5% to 2.6%

The consensus sees HICP up 2.2 percent for March versus 2.3 percent in February. Narrow core is seen at 2.6 percent versus 2.6 percent.

Eurozone Unemployment Rate for February (Tue 1100 CEST; Tue 0900 GMT; Tue 0500 EDT)

Consensus Forecast, Rate: 6.2%

Consensus Range, Rate: 6.2% to 6.3%

No change from 6.2 percent is the call for February.

United States PMI Manufacturing Final for March (Tue 0945 EDT; Tue 1345 GMT)

Consensus Forecast, Index: 49.8

Consensus Range, Index: 49.8 to 49.8

Forecasters expect the March final unchanged from 49.8 in the flash, and down from 52.7 in February.

United States ISM Manufacturing Index for March (Tue 1000 EDT; Tue 1400 GMT)

Consensus Forecast, Index: 49.6

Consensus Range, Index: 48.5 to 50.3

The consensus looks for a return to slight contraction at 49.6 in March versus 50.3 in February as manufacturing reacts to the start of tariffs.

United States Construction Spending for February (Tue 1000 EDT; Tue 1400 GMT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.1% to 0.5%

Expected up 0.4 percent in February after declining by 0.2 percent in January.

United States JOLTS for February (Tue 1000 EDT; Tue 1400 GMT)

Consensus Forecast, Job Openings: 7.60

Consensus Range, Job Openings: 7.50 to 7.71

Openings are seen correcting down to a rate of 7.60 million in February after rising to 7.740 million in January from 7.508 million in December.

United States Motor Vehicle Sales for March (ANYTIME)

Consensus Forecast, Total Vehicle Sales - Annual Rate: 16.0 M

Consensus Range, Total Vehicle Sales - Annual Rate: 15.6 M to 16.3 M

Seen unchanged at an annual 16.0 million unit rate in March versus 16.0 million in February.

South Korea CPI for March (Wed 0800 KST; Tue 2300 GMT; Tue 1900 EDT)

Consensus Forecast, M/M: 0.2%

Consensus Range, M/M: 0.0% to 0.2%

Consensus Forecast, Y/Y: 2.1%

Consensus Range, Y/Y: 1.9% to 2.4%

CPI expected up 0.2 percent in March from February and up 2.1 percent on year.

United States ADP Employment Report for March (Wed 0815 EDT; Wed 1215 GMT)

Consensus Forecast, Private Payrolls - M/M: 120K

Consensus Range, Private Payrolls - M/M: 60K to 125K

Private payrolls are expected up a decent 120,000 in March after rising a sluggish 77,000 in February.

United States Factory Orders for February (Wed 1000 EDT; Wed 1400 GMT)

Consensus Forecast, M/M: 0.5%

Consensus Range, M/M: 0.1% to 1.2%

After a big 1.7 percent jump in January, orders are seen up 0.5 percent in February.

Australia International Trade in Goods for February (Thu 1130 AEDT; Thu 0030 GMT; Wed 2030 EDT)

Consensus Forecast, Balance: A$5.4 B

Consensus Range, Balance: A$4.3 B to A$6.25 B

The consensus sees the surplus narrowing marginally to A$5.4 billion in February from A$5.62 in January as freight volumes point to slightly lower exports after a strong showing in January.

China PMI Composite for March (Thu 0945 CST; Thu 0145 GMT; Wed 2145 EDT)

Consensus Forecast, Services Index: 51.6

Consensus Range, Services Index: 51.3 to 51.7

Forecasters expect the PMI services at 51.6 in March versus 51.4 in February.

Germany PMI Composite Final for March (Thu 0955 CEST; Thu 0755 GMT; Wed 0355 EDT)

Consensus Forecast, Services Index: 50.2

Consensus Range, Services Index: 50.2 to 50.2

No revision is expected for services from the flash at 50.2.

Eurozone PMI Composite Final for March (Thu 1000 CEST; Thu 0800 GMT; Wed 0400 EDT)

Consensus Forecast, Composite Index: 50.4

Consensus Range, Composite Index: 50.2 to 50.4

Consensus Forecast, Services Index: 50.4

Consensus Range, Services Index: 50.4 to 50.4

No revision is expected for the composite from the flash at 50.4. Services is seen unrevised at 50.4.

Canada International Merchandise Trade for February (Thu 0830 EDT; Wed 1230 GMT)

Consensus Forecast, Balance: C$2.2 B

Consensus Range, Balance: -C$1.0 B to C$3.4 B

The trade balance is seen in surplus by C$2.2 billion as exports boom ahead of US tariffs.

United States International trade in Goods and Services for February (Thu 0830 EDT; Wed 1230 GMT)

Consensus Forecast, Balance: -$122.7 B

Consensus Range, Balance: -$132 B to -$110 B

Forecasters look for goods & services trade gap at $122.7 billion in February versus $131.4 billion in January.

United States Jobless Claims for Week 3/29 (Thu 0830 EDT; Wed 1230 GMT)

Consensus Forecast, Initial Claims - Level: 226K

Consensus Range, Initial Claims - Level: 224K to 235K

Claims have been holding surprisingly steady around 225K and are expected at 226K in the latest week.

United States PMI Composite Final for March (Thu 0945 EDT; Thu 1345 GMT)

Consensus Forecast, Services Index: 54.3

Consensus Range, Services Index: 54.3 to 54.3

The services index is seen unrevised from 54.3 in the flash.

United States ISM Services for March (Thu 1000 EDT; Thu 1400 GMT)

Consensus Forecast, Index: 53.0

Consensus Range, Index: 51.0 to 53.8

Another decent month of expansion seen in March with the index at 53.0 versus 53.5 in February.

Japan Household Spending for February (Fri 0830 JST; Thu 2330 GMT; Thu 1930 EDT)

Consensus Forecast, M/M: -0.5%

Consensus Range, M/M: -1.4% to 0.9%

Consensus Forecast, Y/Y: -3.4%

Consensus Range, Y/Y: -4.6% to -0.5%

Japan's real household spending is forecast to post a seventh drop in 12 months in February, down 3.4% on year, after the rate of increase slowed to 0.8% in January from a 2.7% jump as consumers slashed purchases of vegetables and fruits amid rising costs and shied away from buying appliances that were not in an urgent need for replacement. Real wage growth is falling behind inflation again, keeping households cautious.

On the month, real average expenditures by households with two or more people are expected to dip a seasonally adjusted 0.5% after slumping 4.5% the previous month.

Germany Manufacturing Orders for February (Fri 0800 CEST; Fri 0600 GMT; Fri 0200 EDT)

Consensus Forecast, M/M: 3.9%

Consensus Range, M/M: 3.0% to 5.0%

Forecasters see orders rebounding by 3.9 percent on the month in March after a remarkable 7.0 percent drop on the month in February.

United States Employment Situation for March (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast, Nonfarm Payrolls - M/M: 131K

Consensus Range, Nonfarm Payrolls - M/M: 80k to 165K

Consensus Forecast, Unemployment Rate: 4.2%

Consensus Range, Unemployment Rate: 4.0% to 4.2%

Consensus Forecast, Private Payrolls - M/M: 115K

Consensus Range, Private Payrolls - M/M: 95K to 143K

Consensus Forecast, Manufacturing Payrolls - M/M: 3k

Consensus Range, Manufacturing Payrolls - M/M: -5K to 5K

Consensus Forecast, Average Hourly Earnings - M/M: 0.3%

Consensus Range, Average Hourly Earnings - M/M: 0.3% to 0.3%

Consensus Forecast, Average Hourly Earnings - Y/Y: 4.0%

Consensus Range, Average Hourly Earnings - Y/Y: 3.9% to 4.0%

Consensus Forecast, Average Workweek: 34.2

Consensus Range, Average Workweek: 34.2 to 34.3

Payrolls are seen up by a somewhat muted 131,000 with the jobless rate rising to 4.2 percent from 4.1 percent in February. Private payrolls are expected up 115,000.

Canada Employment for March (Fri 0830 EDT; Fri 1230 GMT)

Consensus Forecast: Employment- M/M: 20K

Consensus Range, Employment - M/M: -10K to 25K

Consensus Forecast: Unemployment Rate: 6.7%

Consensus Range, Employment: 6.7% to 6.7%

Another modest employment gain of 20,000 is the call, not enough to keep the unemployment rate from rising to 6.7 percent from 6.6 percent in February.

|