|

By Teresa Sheehan, Econoday Economist

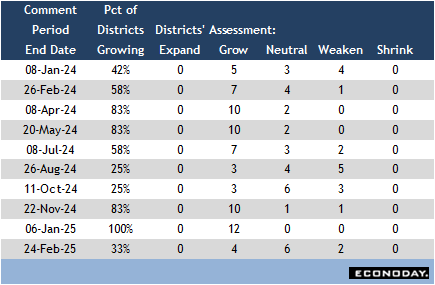

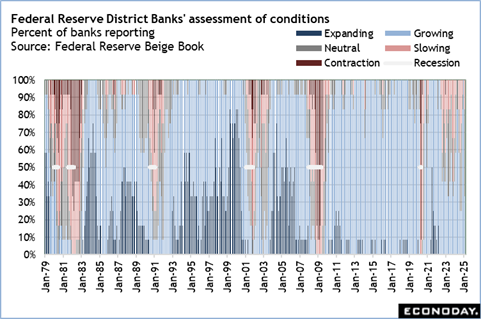

The highlight of the April 21 week could well be the Fed's

Beige Book at 14:00 ET on Wednesday. The next report will reflect conditions

across the 12 districts roughly from the end of February through mid-April. The

prior report released in early March showed a steep and abrupt turn to only 4

districts reporting expansion - that was mostly characterized as slight to

moderate - after all districts seeing economic growth at the end of 2024. This

is the sort of change that can presage a recession. If conditions continue with

under 2/3 of the districts reporting no or slowing activity, it will be clear

that the US economy is suffering an economic shock from the actions coming out

of the White House in its campaign to remake the federal government and alter

fiscal policy at top speed.

Fed Chair Jerome Powell has recently said that if you want

to know what is happening in the US economy, "you should read the Beige Book".

It is anecdotal evidence, but it is compiled from business contacts across the

12 districts and is more current than many of the hard numbers. It provides

important context for the current economy. If conditions remain weak, the FOMC

will have to consider heightened recession risks when setting policy at the May

6-7 meeting.

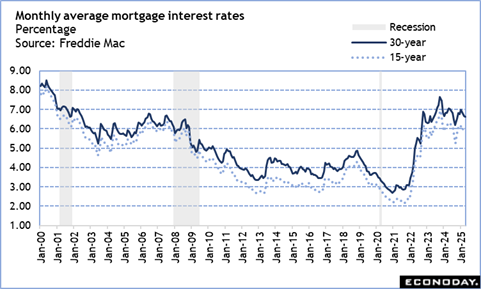

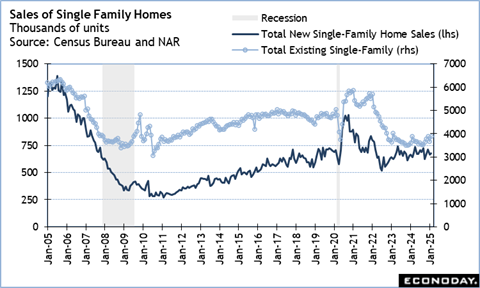

Also in the upcoming week are data on sales of new

single-family homes at 10:00 ET on Wednesday and existing homes at 10:00 ET on

Thursday. Sales of homes are likely to pick up in March as the moderation in

mortgage rates from the January peaks will improve home affordability while

price increases are also moderating with greater supply on the market. However,

rates are on the rise again starting in mid-April and could cool future sales

at a time when consumers are highly uncertain about the economic outlook,

inflation, and job security.

By Marco Babic, Econoday Economist

Although it's a shortened week in Europe due to the Easter holiday

on Monday, the scheduled indicators will provide some of the first concrete

data for assessing the economic landscape, notably Germany's closely-watched

Ifo index on Thursday.

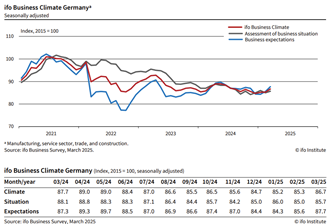

In March, business expectations for Germany increased as did

current conditions, putting the overall index at 86.7 after 85.3 in February.

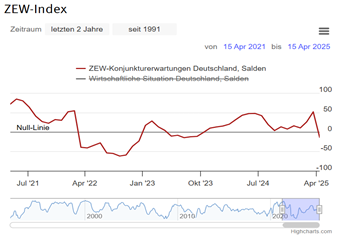

With last week's release of the ZEW index for April, all bets are off.

The ZEW report, which measures professional investor

sentiment, saw the expectations index plunge to minus 14 from 51.6 in March,

the biggest decline since Russia's invasion of Ukraine. This significant

decline was attributed directly to the erratic upheaval in the US trade policy.

It's more than reasonable to expect a similar decline for

the Ifo expectations index. In March of 2022, the index fell to 83.2 from 98.1,

and continued to decline, mirroring the ZEW results.

Purchasing Manager's reports for France, Germany, the UK, and Eurozone are

reported Wednesday. Currently France is the only one of the economies with a

composite index reading below 50 (48), the point above which marks expansion.

The other three economies' readings are all above 50, bolstered by their

service sectors. All four have manufacturing levels below 50, so even a modest

pullback in services could push the composite results into contraction.

On Monday, consumer confidence for the Eurozone will be

released for April. In March, consumers were more negative than the previous

month, with the index falling to minus 14.5 from minus 13.6. Nothing has

transpired in the past month that is likely to have bolstered buyers' views.

Another piece of the puzzle is French business sentiment on Friday. In March,

the business climate index fell to 96 from 97 the previous month, indicating a

fragile environment as the readings remain below their historical average of

100.

By Brian Jackson, Econoday Economist

The Asia-Pacific data calendar is relatively quiet next

week. Australia and New Zealand have public holidays at the end and the start

of the week and most indicators scheduled for publication are still pre-dating

the escalation of global trade tensions and market volatility seen in recent

weeks. The exception is the flash estimate for the India PMI survey, which will

provide the first indication of conditions in April.

Singapore will publish inflation and industrial production data for March and

South Korea will publish GDP data for the first quarter of the year. Chinese

authorities are also scheduled to announce the monthly update for the loan

prime rate, with no change expected after the publication of monthly activity

data last week showing improved conditions in March.

China Loan Prime Rate for April (Mon 0900 CST; Mon 0100

GMT; Sun 2100 EDT)

Consensus Forecast, 1-Year Rate - Change: 0 bp

Consensus Range, 1-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 1-Year Rate - Level: 3.10%

Consensus Range, 1-Year Rate - Level: 3.10% to 3.10%

Consensus Forecast, 5-Year Rate - Change: 0 bp

Consensus Range, 5-Year Rate - Change: 0 bp to 0 bp

Consensus Forecast, 5-Year Rate - Level: 3.60%

Consensus Range, 5-Year Rate - Level: 3.60% to 3.60%

Forecasters see no change in the LPR at the 1-year at 3.10

percent or 5-year tenor at 3.60%.

United States Leading Indicators for March (Mon 1000

EDT; Mon 1400 GMT)

Consensus Forecast, M/M: -0.5%

Consensus Range, M/M: -0.7% to -0.3%

LEI expected to weaken to minus 0.5 percent in March after a

decline of 0.3 percent in February. The US outlook appears increasingly gloomy

as tariff uncertainty weighs heavily.

Eurozone EC Consumer Confidence Flash for April (Tue

1600 CEST; Tue 1400 GMT; Tue 1000 EDT)

Consensus Forecast, Index: -15.1

Consensus Range, Index: -16.0 to -15.0

Consumer confidence continues to trend down since US

elections in November. Now the impact of Trump's "liberation day" tariff

announcement on April 2 will start to show up. Forecasters see the index

falling again to minus 15.1 in the April flash from minus 14.5 in March.

United States Richmond Fed Manufacturing Index for April (Tue

1000 EDT; Tue 1400 GMT)

Consensus Forecast, Index: -5.0

Consensus Range, Index: -7.0 to -4.0

The Richmond Fed manufacturing index is expected to show

slightly faster contraction in April. After the big miss on the Philly Fed

index at minus 26.4 in April versus the expected positive 6.7, risk is to the

downside.

Singapore CPI for March (Wed 1300 SGT; Wed 0500 GMT; Wed

0100 EDT)

Consensus Forecast, Y/Y: 1.1%

Consensus Range, Y/Y: 1.0% to 1.1%

CPI is expected to rise 1.1 percent from a year ago versus

0.9 percent last month.

Germany PMI Composite Flash for April (Wed 0930 CET; Wed

0830 GMT; Wed 0430 EDT)

Consensus Forecast, Composite Index: 50.8

Consensus Range, Composite Index: 48.2 to 51.0

Consensus Forecast, Manufacturing Index: 48.0

Consensus Range, Manufacturing Index: 45.0 to 49.0

Consensus Forecast, Services Index: 50.3

Consensus Range, Services Index: 49.0 to 50.7

The composite is expected marginally positive but weaker at 50.8

in the April flash, down from 51.3 in the March final. Manufacturing is seen at

48.0, down from 48.3, and services at 50.3, down from 50.9. More declines are

likely, reflecting the trade shock.

Eurozone PMI Composite Flash for April (Wed 1000 CEST;

Wed 0800 GMT; Wed 0400 EDT)

Consensus Forecast, Composite Index: 50.4

Consensus Range, Composite Index: 45.9 to 50.6

Consensus Forecast, Manufacturing Index: 47.5

Consensus Range, Manufacturing Index: 45.9 to 49.0

Consensus Forecast, Services Index: 50.5

Consensus Range, Services Index: 49.0 to 50.7

With the tariff shock starting to be felt, the composite

flash is expected at 50.4 versus 50.9 in the March final. Manufacturing is

expected down at 47.5 versus 48.6. Services is seen at 50.5 versus 51.0.

United Kingdom PMI Composite Flash for April (Wed

0830 BST; Wed 0930 GMT; Wed 0330 EST)

Consensus Forecast, Composite Index: 50.5

Consensus Range, Composite Index: 50.2 to 50.9

Consensus Forecast, Manufacturing Index: 44.0

Consensus Range, Manufacturing Index: 44.0 to 44.3

Consensus Forecast, Services Index: 51.8

Consensus Range, Services Index: 51.0 to 52.0

The consensus sees the composite at 50.5 in the April flash

versus 51.5 in the March final. Manufacturing is expected at a very

contractionary 44.0 versus 44.9, and services at 51.8, down from 52.5.

United States PMI Composite Flash for April (Wed 0945

EDT; Wed 1345 GMT)

Consensus Forecast, Manufacturing Index: 49.4

Consensus Range, Manufacturing Index: 48.5 to 49.5

Consensus Forecast, Services Index: 52.5

Consensus Range, Services Index: 51.0 to 53.5

Trade worries are hitting now with the PMI manufacturing

expected to contract at 49.4 in the April flash, down from 50.2 in the March

final. Services is expected to continue expanding at 52.5 versus 54.4 in March.

United States New Home Sales for March (Wed 1000 EDT;

Wed 1400 GMT)

Consensus Forecast, Annual Rate: 682K

Consensus Range, Annual Rate: 650K to 700K

Home sales are seen improving again to a 682,000 annual rate

in March after rising to 676K in February.

South Korea GDP for First Quarter (Thu 0800 KST; Wed 2300

GMT; Wed 1900 EDT)

Consensus Forecast, Q/Q: 0.2%

Consensus Range, Q/Q: 0.1% to 0.6%

Consensus Forecast, Y/Y: 0.1%

Consensus Range, Y/Y: 0.0% to 0.8%

Growth on year is seen at a marginal 0.1 percent in Q1, down

from 1.2 percent in Q4. The trade war, exchange rate volatility, and political

turmoil are being felt.

Germany Ifo Survey for April (Thu 1000 CEST; Thu 0800

GMT; Thu 0400 EDT)

Consensus Forecast, Business Climate: 85.4

Consensus Range, Business Climate: 84.5 to 86.0

Consensus Forecast, Current Conditions: 85.9

Consensus Range, Current Conditions: 85.5 to 86.0

Consensus Forecast, Business Expectations: 85.5

Consensus Range, Business Expectations: 85.0 to 86.4

After the shocking drop in the ZEW investor sentiment index

in April, a weak reading is expected for Ifo. The consensus looks for the Ifo

business climate index to erode to 85.4 in April from 86.7 in March, and

presumably the risk is for a softer number given trade war effects.

United States Durable Goods Orders for March (Thu 0830

EDT; Thu 1230 GMT)

Consensus Forecast, New Orders - M/M: 1.4%

Consensus Range, New Orders - M/M: 0.0% to 2.8%

Consensus Forecast, Ex-Transportation - M/M: 0.3%

Consensus Range, Ex-Transportation - M/M: -0.1% to 0.4%

Consensus Forecast, Core Capital Goods - M/M: 0.3%

Consensus Range, Core Capital Goods - M/M: 0.0% to 0.4%

More strong orders for Boeing aircraft should lift the

overall number by 1.4 percent. The ex-transportation figure has been supported

by front-running tariffs.

United States Jobless Claims (Thu 0830 EDT; Thu 1230 GMT)

Consensus Forecast, Initial Claims - Level: 220K

Consensus Range, Initial Claims - Level: 214K to 225K

Claims expected to bounce back to 220K, the rough 4-week

moving average, after a surprising 9K drop to 215K a week earlier. Suggests a

relatively stable labor market.

United States Existing Home Sales Index for March (Thu

1000 EDT; Thu 1400 GMT)

Consensus Forecast, Annual Rate: 4.12 M

Consensus Range, Annual Rate: 4.0 M to 4.35 M

Home sales are contending with elevated mortgage rates and

falling consumer sentiment. The consensus sees sales down at a 4.12 million

unit rate from 4.26 million in February.

Japan Tokyo CPI for April (Fri 0830 JST; Thu 2330 GMT;

Thu 130 EDT)

Consensus Forecast, CPI - Y/Y: 3.5%

Consensus Range, CPI - Y/Y: 3.0% to 3.6%

Consensus Forecast, Ex-Fresh Food - Y/Y: 3.2%

Consensus Range, Ex-Fresh Food - Y/Y: 2.6% to 3.2%

Consensus Forecast, Ex-Fresh Food & Energy - Y/Y:

2.8%

Consensus Range, Ex-Fresh Food & Energy - Y/Y:

2.3% to 3.0%

Consumer inflation in Tokyo, the leading indicator of the

national average, is expected to soar in April as the price-cutting base-year

effect of free high school education in the capital has waned and after the

government halved its wintertime utility subsidies in March, the last of the

three-month period (bills are paid from February to April). Many firms also

tend to their retail prices at the April 1 start of the fiscal year, more so

this year amid high wage hikes, while processed food costs remain elevated on

the lingering effects of rice shortages.

The core reading (excluding fresh food) is forecast to surge

to a 23-month high of a 3.2% rise on year after accelerating slightly to 2.4%

in March from 2.2% in February. The year-on-year rise in the total CPI is

expected to jump to a 25-month high of 3.4% after inching up to 2.9% from 2.8%.

The annual rate for the core-core CPI (excluding fresh food and energy) is

estimated at a 14-month high of 2.8%, also up sharply from 2.2% the previous

month.

In April 2024, consumer inflation in central Tokyo's 23

wards decelerated much faster than expected (the core CPI annual rate slowed to

1.6% from 2.4% in March) as completely free high school education took effect

in the Tokyo metropolitan area, pushing down the CPI by 0.51 percentage points.

The national government had been providing subsidies to slash high school

tuition fees but the Tokyo prefectural government added its own financial

support, removing the upper limit on household income from eligibility

conditions and effectively making all public and private tuition free for grade

10 to 12 students.

Singapore Industrial Production for March (Fri 1300

SGT; Fri 0500 GMT; Fri 0100 EDT)

Consensus Forecast, M/M: 0.4%

Consensus Range, M/M: 0.4% to 1.1%

Consensus Forecast, Y/Y: 7.8%

Consensus Range, Y/Y: 6.8% to 7.8%

Output is seen recovering by 0.4 percent on the month and

7.8 percent on year in March after dropping by 7.5 percent on the month and 1.3

percent on year in February.

United Kingdom Retail Sales for March (Fri 0700 BST; Fri

0600 GMT; Fri 0200 EDT)

Consensus Forecast, M/M: -0.4%

Consensus Range, M/M: -0.6% to -0.3%

Consensus Forecast, Y/Y: 2.0%

Consensus Range, Y/Y: 1.7% to 2.4%

Sales expected to recede by 0.4 percent on the month in

March after jumping by 1.0 percent in February. The consensus looks for a 2.0

percent rise on year versus 2.2 percent in February.

Canada Retail Sales for February (Fri 1230 GMT; Fri 0830

EDT)

Consensus Forecast, M/M: -0.4%

Consensus Range, M/M: -0.5% to -0.4%

Forecasters agree with the Statistics Canada estimate

calling for a decline of 0.4 percent in February after a 0.6 percent decrease

in January.

United States Consumer Sentiment for April (Fri 1000

EDT; Fri 1400 GMT)

Consensus Forecast, Index: 50.5

Consensus Range, Index: 47.0 to 50.8

Consensus Forecast, Year-ahead Inflation Expectations:

6.7%

Consensus Range, Year-ahead Inflation Expectations: 6.7%

to 6.7%

After an unexpectedly nasty 11 percent drop in the

preliminary April reading to 50.8 from 57.0 in March, forecasters see the index

relatively steady at 50.5 in the final April report. One-year inflation

expectations are seen unrevised at a shocking 6.7 percent from the preliminary

April report. That is up from 5.0 percent in March, 4.3 percent in February,

3.3 percent in January and 2.8 percent in December, all reflecting tariff

effects.

|